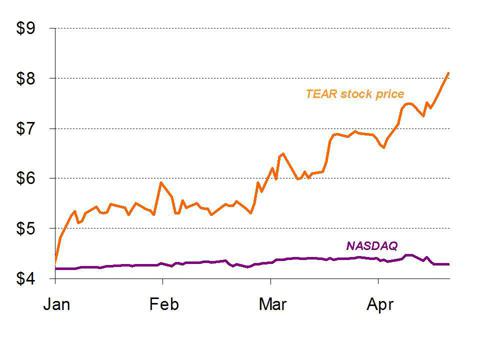

Shares of TearLab (TEAR) have nearly doubled in 2013, buoyed by a stream of analyst upgrades from small, retail oriented brokerages. However, it now looks as if a near term equity offering will likely take the shares lower.

Investment thesis

Despite the recent bullish analyst reports, financial performance at TearLab has been consistently very poor. The company’s balance sheet continues to be weak and the company has lost money every year in its history. The company will clearly need to issue a sizeable amount of equity at a price of around $6.00 or below.

The bullish upgrades from sell-side analysts suggest that the equity offering could be expected very soon. The upgrades have so far been based on very dated information from the 1990s which has now been repeated.

In addition, there are fundamental problems with TearLab’s product offering, which will severely limit its ultimate adoption by eye doctors. Although the test works well, it is ultimately not a necessary diagnostic for eye doctors. Finally, the total market size for dry eye disease is far less than what has been forecast.

TearLab’s financial performance

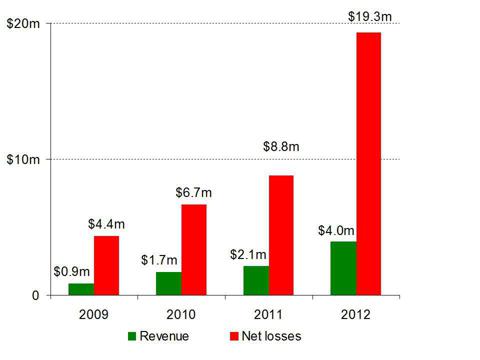

TearLab has continued to post slight increases in revenues, but only via larger increases in marketing expenditures. The net result was a net loss that widened to $19 million in 2012. Over the course of its 10 year life, TearLab has never once made a profit.

In contrast to the bullish sentiment expressed by analysts, TearLab’s latest 10K filing discloses quite clearly that

Our limited working capital and history of losses have resulted in doubts as to whether we will be able to continue as a going concern.

As of December 2012, TearLab had $15 million in cash, but lost $19 million for the year on a mere $3.9 million in sales. This puts the company on a Price to Sales ratio of more than 50x.

The company indicated on its last conference call that it hopes to more than double revenues to $9 million in 2013. But once again, the revenue growth will only be made possible by spending “a couple of million more” than that $9 million on marketing expenditures. So once again, TearLab will post an ongoing net loss.

Will TearLab issue equity soon?

TearLab has been a serial dilution machine, offering equity inevery single one of the past 10 years. In many cases the company has offered equity multiple times each year. In numerous cases the deals required heavily dilutive warrant coverage.

During the past 2 fiscal years alone, TearLab has issued equity 7 times raising nearly $40 million. The average price for issuing equity was just $2.35 – roughly 70% below the current level.

| Date | Shares | Proceeds | Share price | Warrants |

| Jan 2010 | 3.2m | $3.0 m | $0.93 | |

| Mar 2010 | 1.5m | $5.0 m | $3.22 | 621,000 |

| Jun 2011 | 1.6m | $2.1 m | $1.60 | 109,375 |

| Jun 2011 | 3.8m | $7.0 m | $1.82 | 3,846,154 |

| Apr 2012 | 3.5m | $12.4 m | $3.60 | |

| Jul 2012 | 2.5m | $7.9 m | $3.17 | |

| Sep 2012 | 0.3m | $1.2 m | $3.72 | |

| Total | 16.4m | $38.6 m | 4,576,529 | |

| Avg | $2.35 |

It is clear that TearLab needs to issue equity again, likely in the next few weeks. The recent bullish report and $8.50 share price target from Craig Hallum came with a disclosure that:

Craig Hallum expects to receive or intends to seek compensation for investment banking services from the subject company in the next three months.

This makes the timing of the analyst attention very fortuitous. Yet it is quite likely that the offering will occur far sooner that 3 months. It is likely that the timing will be in the proximity of its next earnings release date, which is expected in about 2 weeks.

At what price will TearLab issue equity?

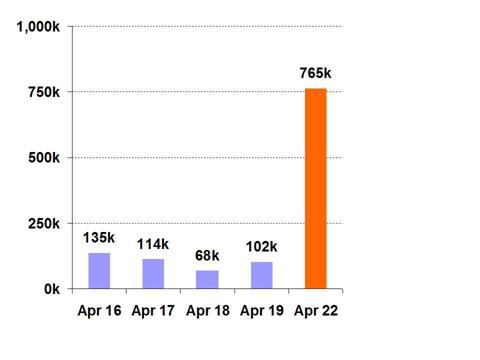

The analyst upgrades have been very effective in getting the share price up to all time high prices. Of equal importance, the upgrades have also generated significant spikes in volume.

The low trading volume is a problem for TearLab and is one of the reasons why the company has been forced to issue heavily dilutive warrants in the past.

On Monday April 22nd, brokerage Craig Hallum upgraded the stock based on brief comments which had been made at an ophthalmology conference. Hallum was exceedingly bullish and their remarks had a predictable effect on trading volume.

The volume is very important here because TearLab will need to raise at least $20 million in proceeds. With pre-upgrade volume hovering at around 100,000 shares per day, such a deal would require nearly 6 weeks’ worth of trading volume to be issued in a single day. A deal of that size would likely be accompanied by heavy warrant coverage or a discount to the share price of roughly 20%.

Unfortunately, the volume effect of these analyst upgrades is short lived. We saw similar volume spikes to as high as 900,000 shares per day on previous analyst upgrades. In each case the volume subsides once the upgrade becomes old news.

As a reference point, last week Craig Hallum ran an equity offering for Unipixel, which has a market cap of $350 million. That deal came with a 20% discount due to its low float. The share price immediately traded down 20% to the stock offering price, as expected. The equity offering came very shortly after Hallum had raised its share price on Unipixel by almost 100% to $58.00. The share price fell to $32.00 on the offering.

For TearLab, this would imply that the offering price (and thus the share price) would be headed to around $5.75-6.25.

What is the basis for the upgrades?

Craig Hallum released 3 very brief paragraphs to justify how TearLab has suddenly become an $8.50 (target price) stock.

Our observations at this year’s ASCRS meeting (which kicked off in San Francisco this past weekend) made a strong case that physician acceptance of the TearLab System as the gold standard for testing of Dry Eye Disease has reached a tipping point and that near term mainstream adoption is likely.

A paper posted on the website for the National Institute of Health (“NIH”), and also posted on TearLab’s own website, is entitled “Tear Osmolarity – A New Gold Standard“.

Unfortunately, the “gold standard” paper was dated from 1994 – almost 20 years ago. Yet this transition to “gold standard” in the 1990s has not resulted in commercial success for TearLab’s osmolarity product in these 20 years.

Had they not been so heavily highlighted again by Hallum, these comments would certainly not have moved the stock.

Justifying the share price target

Craig Hallum is the odds-on favorite to be the investment banker for a TearLab equity offering. Within Craig Hallum’s coverage universe, 74% of companies are rated “BUY” while 25% are rated “HOLD”. Just 1% of the companies are rated at “SELL”.

The firm’s recent upgrade and $8.50 target resulted in a very noticeable boost to both the share price and the volume. The share price now sits just a few percent below this target, which is at a lifetime high for the stock. It is also roughly double where the stock began this year.

In order to justify this stratospheric target, Hallum predicts that after years of struggling to break above $1 million per quarter, TearLab will suddenly catapult to $40 million in annual sales during 2014. This will be a particularly steep trajectory following another year of wide losses in 2013.

Yet the financial model in the Hallum report indicates that in 2014 TearLab will still be losing money even if revenues hit $40 million. It also indicates that TearLab will not issue any equity (even though it is undeniably needed) in either 2013 or 2014.

On page 5 of the recent report, Hallum includes a valuation comps table which puts TearLab at a 12.2x multiple of EV/Sales.

| Ticker | Company | Price | CY’13 EPS | EV/’13 Sales |

| CPHD | CEPHEID | $38.06 | $0.01 | 6.4x |

| CPTS | CONCEPTUS | $25.56 | $0.23 | 5.0x |

| CYBX | CYBERONICS | $44.80 | $1.83 | 4.1x |

| DXCM | DEXCOM | $15.50 | ($0.54) | 8.1x |

| EW | EDWARDS L.S. | $83.12 | $3.27 | 4.3x |

| ELGX | ENDOLOGIX | $14.14 | ($0.14) | 6.4x |

| GNMK | GENMARK DIAG | $14.71 | ($0.80) | 12.2x |

| ISRG | INTUITIVE SURG | $484.75 | $17.64 | 6.4x |

| MDXG.PK | MIMEDX GROUP | $5.00 | $0.00 | 7.8x |

| NEOG | NEOGEN | $49.85 | $1.23 | 5.1x |

| PODD | INSULET | $26.23 | ($0.59) | 5.8x |

| SRDX | SURMODICS | $26.75 | $0.87 | 6.1x |

| SPNC | SPECTRANETICS | $19.51 | $0.01 | 4.2x |

| Median | 6.1x | |||

| Average | 6.3x | |||

| TEAR | TEARLAB | $7.34 | ($0.42) | 12.2x |

This makes it a tie for the single most expensive stock within the medical technology comp group. It also makes it double the average multiple within that group. Yet the “BUY” rating persists.

Why won’t eye doctors make use of TearLab’s osmolarity system?

TearLab’s osmolarity system faces fundamental obstacles which continue to limit its adoption by eye doctors.

TearLab officially launched its product in 2008 and began commercialization and marketing of the product in 2009. Yet 4 years later, the company is still only attaining around $1 million in quarterly sales.

The point is that this is a product that has been well recognized and understood, and has been heavily marketed for years. Yet it continues to face dismal adoption rates by eye doctors.

The system works quite well and dry eye specialist doctors love it. However, for the other 50,000 eye doctors in the U.S. (i.e. TearLab’s intended target market), there are fundamental issues with the system that virtually preclude its wide spread adoption.

TearLab’s osmolarity system has three components. There is a microchip tear collector, a pen device for administering and a desktop unit for analyzing the tear. The output from this process is a numerical score which quantifies the patient’s condition within a dry eye score range.

TearLab (and the analysts) have correctly noted that the products come with a roughly 50% margin for the doctors who sell and administer it. This would seemingly make it attractive to eye doctors within their practices.

Yet the reality is that TearLab sells the diagnostic chip for just $10-15 while doctors get reimbursed at a rate of $22.71. So what we’re really looking at is an opportunity for a doctor to only make an extra $10 or so.

In order to make the extra $10, the doctor must acquire and make use of the desktop system and train his employees in its use.

The reimbursement requires a CLIA waiver and each doctor’s office must receive their own specific FDA waiver. Some states (such as New York and Nevada) do not even allow optometrists to receive waivers at all, precluding the use of these tests in point of care settings entirely.

In addition, many insurance providers do not reimburse for these tests which further reduces their use. In the event that reimbursement is able to be provided, pre-authorization by the insurance company is required.

Given that these tests are typically conducted as part of routine visits, the pre-authorization means that patients would be required to make a second visit in order to receive this test.

This is a fair amount of time and hassle to go through for a doctor. The extra $10 may not justify the extra time that taking such a test entails vs. the time it takes away from other patients.

But is the test necessary or useful ?

If the test were necessary or useful, then its low price point would likely not be an issue for eye doctors.

But the reality is that in the vast majority of cases, non-specialist eye doctors continue to use a simple verbal assessment from the patient to determine if the patient has a dry eye condition.

Once again, we can basically see that this has been the case due to the minimal sales generated by TearLab after 4 years on the market.

A dry eye study from the NIH noted that an overwhelming 82.8%of dry eye cases were diagnosed by doctors using simple “symptom assessment” alone. What this means is that eye doctors are less concerned about the numerical score revealed by a tear osmolarity test than they are about simply hearing the patient describe their symptoms. Even though TearLab’s product can be described as accurate, it is also largely unnecessary.

Think of it this way: if a doctor had to go through a significant amount of time and hassle to provide a flu patient with a numerical score to quantify his flu symptoms, he would most likely not do so. The chance to make an extra $10 would likely not add any additional encouragement either. Instead, the doctor would continue to simply ask the patient his about his or her symptoms and offer treatment based on the diagnosis.

In short, this explains why the test has not been adopted after years on the market: it is a largely unnecessary test which also provides almost no economic benefit to the practices of eye doctors.

So who is currently making use of the test?

There are a small number of doctors, as quoted by Craig Hallum, who are very enthusiastic about tear osmolarity. These are doctors such as Dr. Christopher Starr, Dr. Marguerite McDonald, Dr. Stephen Lane, and Dr. Eric Donnenfeld.

These are doctors who have made a specialty of dry eye disease. Their names appear frequently on sites such as “TheDryEyeReview.com“. They have also appeared in very positive comments and articles on TearLab’s website. They have been vocal supporters. As specialists, the ability to generate a numerical score to quantify the effects of dry eye is clearly something of professional interest.

But within the larger market of 50,000 eye doctors in the US, they have proven (for 4 years running) that they are less interested in seeing an academic, numerical score than they are in simply delivering treatments to their patients who they can already tell are suffering from dry eye.

These are the same doctors who have been vocal supporters on TearLab’s website since 2009. This makes it odd that Craig Hallum would extrapolate so heavily from their continued support again in 2013.

The REAL market size for dry eye is far smaller than TearLab estimates

TearLab management has indicated that there is a $1.8 billion market for their product. This is a huge number and is what has kept management trying to succeed. It is also what has kept investors willing to hold the stock despite the ongoing losses.

Yet from management’s presentation, we can see that this description of “market size” is far too expansive.

It is based upon an assumption that:

a) all 50,000 U.S. eye doctors (ophthalmologists + optometrists) will

b) see 6 dry eye patients every single day

c) they will do so on all 250 business days per year

d) they will be tested a cost of $12.00 per eye ($24 per patient).

This equates to 75 million patients every year. Again, this is a huge number and it is one that those who specialize in dry eye would certainly like to see.

Yet on page 9 of the same presentation, we can see that the total number of actual dry eye cases in the U.S. is only estimated at 30 million.

What this means is that there is capacity to treat 75 million cases of dry eye, but far less actual demand for dry eye tests and treatments. These numbers are according to managements own data.

Yet even management’s current estimate of total dry eye cases appears to be significantly too high compared to objective observations. The 30 million estimate comes from two studies that date back to the 1990’s (see footnotes 7 and 14).

According to a more recent study posted at the National Institute of Health entitled “Prevalence of dry eye disease among U.S. men“,

The age-standardized prevalence of DED was 4.34%, or 1.68 million men 50 years and older, and is expected to affect more than 2.79 million U.S. men by 2030.

Page 9 of TearLab’s own presentation also confirms that dry eye is mostly prevalent in older segments of the population, and even TearLab includes no data for those under 45.

Using the NIH data, and assuming that women are equally at risk of dry eye, yields around 6 million total dry eye cases per year, which is far below the 30 million estimate still used by TearLab management.

In short, this explains why TearLab’s revenues have so far been struggling to break roughly $1 million per quarter, despite being on the market for its 4th year.

Conclusion

The low price point and limited market need for tear osmolarity tests means that the only way for TearLab to continue generating sales is to continue with a heavy marketing spend. This need almost entirely precludes TearLab from generating a profit in coming years. The company has already disclosed that it will continue to incur heavy losses again in 2013 and even bullish brokerages predict continuing losses for years to come.

Recent NIH estimates indicate that there are only around 6 million applicable patients in the U.S.

If TearLab tests were used on 100% of all patients in the US then total revenues would be just $120 million. TearLab’s current market cap is double the entire market size.

The stock has nearly doubled in 2013 due to analyst upgrades from brokerages who are eager for investment banking roles.

The catalyst for a decline in the stock will be its next equity offering which will likely need to occur at a price of around $6.00 or below due to the poor liquidity of the stock.

Once the offering is out of the way and the analyst upgrades fade, it is unclear what will support this stock at $6.00 given that there is no prospect for profitability over the next few years.