Note: At least 13 recent articles covering CytRx have been removed from circulation at Seeking Alpha, the Wall Street Cheat Sheet, Motley Fool and Forbes. Many were removed in just the past two days. A list of these removed articles is shown at the bottom of this article. The author has preserved PDF copies of these articles at Moxreports.com.

In total, more than 100 articles tied to The Dream Team have now been removed from circulation in just the past two days.

Overview

A few weeks ago I received a surprising email asking me to be a paid stock tout for IR firm “The Dream Team Group”. I was asked to write paid promotional articles on Galena Biopharma (GALE) and CytRx Corp (CYTR), without disclosing payment. Rather than refuse outright, I decided to investigate. I began submitting dummy articles to the Dream Team rep (with no intention of ever publishing them). My goal was to determine how involved management from these two companies were in this undisclosed paid promotion scheme. Below I will provide detailed documentation (emails and attachments) which indicate that management from both Galena and CytRx were intimately involved in reviewing and editing the paid articles on their own stock at precisely the time they were looking to sell / issue shares.

Management will have a very difficult time convincing investors that “we didn’t know”. The articles were provided from Dream Team directly to CytRx and Galena. Management then edited and approved the articles and would have seen the lack of disclosure. When they appeared in final publication there was again no disclosure. And it seems no coincidence that there appears to have been great urgency to get these articles in almost exact proximity to sales / issuances of stock by insiders and the companies at both Galena and CytRx.

Many investors are aware that Galena was previously a subsidiary of CytRx and that the CEO of CytRx also sits on the board of Galena.

The promotional articles and the paid retention of the Dream Team Group were coordinated with the release of news and data from the companies such that they coincided with the share prices of both stocks rising dramatically. News events included items like the completion of Phase 2 trials, the inception of new trials and the receipt of an SPA from the FDA. Clearly these would all normally be expected to have a positive effect on their own. Yet management used coordinated articles in the media to interpret and amplify the effect of the news which it had released.

The promotional campaigns by Dream Team extended to various web sites including Forbes, TheStreet.com, Motley Fool, Wall Street Cheat Sheet and Seeking Alpha. Multiple aliases were used, some of which pretended to be hedge fund managers. At least 13 articles on Cytrx alone have now been removed, most during the past two days alone.

The undisclosed media promotions coordinated with the release of news and data saw both of these stocks rise from around $2.00 in November to around $8.00 by January. The fact that these recent news releases were concurrent with undisclosed stock promotions casts significant doubt on many of the fundamental statements made by these companies regarding their drug prospects.

Below I include a review of Federal Securities Laws Section 17b (regarding touting) and Section 10b(5) (the anti-fraud provision). Given that the recent equity offering from CytRx occurred on the back of this undisclosed promotion, it creates the potential that the proceeds from the offering may be at significant legal risk. Investors who bought into the offering at $6.50 are already well underwater. They may find these promotions to have been very disturbing in the context of their flagging investment.

Broader awareness of these issues could see the share prices of both CytRx and Galena trade to well below $2.00, back where they were when the promotions began.

Preliminary notes

Note #1: Shortly prior to publishing this article, the author notified the United States Securities and Exchange Commission about the details described herein. Portions of this content were also shared with media outlets including Seeking Alpha, the Wall Street Cheat Sheet and TheStreet.com which had previously published articles by Dream Team writers.

Note #2: Prior to publication, the author contacted CytRx Corp, Galena Biopharma, and Michael McCarthy of Dream Team Group. Their responses are noted in Appendix II.

Note #3: During the course of this investigation I have exchanged dozens of emails with individuals who admit to promoting CytRx, Galena and other companies in exchange for undisclosed payments. I have included copies of some of these emails as links below. These should be read from bottom to top so as to be read in chronological order. In some cases, certain personal information including email addresses and phone numbers have been redacted and are displayed as XXXXX in red font. The author also has numerous additional emails which he is still processing and which have not been included in this article.

Note #4: Before I undertook any of this, I first sent an email to a neutral 3rd party and to my attorney letting them know about this experiment and putting into advance writing the fact that at no time would I ever publish any of these articles nor would I accept any compensation. This was for my own protection. I strongly discourage readers from engaging in this type of research on their own.

Note #5: Dream Team also operates via a sub-brand called Mission IR. I have used Mission and DTG interchangeably throughout this article. Mission IR is a frequent poster of messages at Investors Hub. Their page on Investors Hubprovides a list of companies for which they have recently been engaged. (It also includes several obvious decoys such as Facebook and Twitter).

Background

A few weeks ago I received an email and subsequent phone calls asking me to be a paid stock tout for an IR firm called The Dream Team Group (“DTG”). The sender first informed me about an article he wanted on CytRx Corp. , and later asked for additional articles on Galena Biopharma , among others.

This was a notably odd invitation for me to receive given that I generally write very negative articles focused on inappropriate (and sometimes what I view as illegal) behavior by US listed companies and their promoters. It was clear that the individual contacting me had not even bothered to read what I have written in the past. He clearly had no idea what he had just stumbled into by contacting me of all people.

The individual ultimately revealed his name to be Tom Meyer. He later informed me that the IR firm he works for was the Dream Team and that he worked closely with the head of Dream Team, Michael McCarthy. In his initial emails and in subsequent phone discussions, I was offered $300 per article, but was also told that there were two conditions. First, management of the companies would have to sign off (and edit) the articles. Second, I would not be allowed to disclose that I was getting paid.

Hi Rick, Thanks for getting back to me so soon. I work for an IR firm and I have a team that I manage. So when the firm has a new client, they will ask me to start getting some articles published on various sites. And then my team will get started on it. We typically cover biotech companies but occasionally will have some others as well. When I give you an assignment, you will type up the draft and then send back to me so I can get the company’s approval. I will send you back the edited version and then you can publish. Once published, I will pay you $300. We send checks to our guys every 2 weeks. Let me know if that is of interest to you. Thanks a lot, Tom

I was told to not worry about posting on Yahoo message boards, because DTG has a full team which handles the posting of numerous bullish messages on places like Yahoo Finance.

I felt that there was a lot of information to be uncovered if I dug deeper. So rather than immediately make my findings public, I chose to fly to Chicago to meet Mr. Meyer in person and then submit a series of “dummy articles” to him to see what response I could get.

At minus 20 degrees, Chicago was actually 100 degrees colder than Los Angeles during my visit !

My goal in submitting dummy articles to DTG was to determine the level of involvement of management of these companies in reviewing and editing articles. To me, this was of far greater significance than the (already troubling) non-disclosure by various authors and IR firms who might be getting paid. As a result, I submitted dummy articles to Tom / Dream Team on both CytRx and Galena as well as a few others.

With CytRx I was able to receive fully edited copies of the dummy articles which bore the electronic signature of the VP of Business Development (David Haen) as well as by the Assistant to the CEO (Lauren Terrado).

The conclusion I reached is obvious: management at CytRx was intimately involved in editing these documents extensively.

With Galena, I was told that the company suddenly changed its mind and cancelled the article on February 10th, almost immediately prior to an exposé article by Adam Feuerstein at TheStreet. Based on this, I am under the assumption that Galena backed out from wanting an article from me as a result of Mr. Feuerstein calling them just before publishing his article. In any event, the offer of payment still stood from Tom / DTG as compensation for my time.

The writers and their aliases

Throughout the course of our discussions, Mr. Meyer discussed with me an additional writer who writes for him on CytRx and Galena. His name is John Mylant. Mr. Mylant writes for both Seeking Alpha and for TheStreet.com and has published 3 articles on CytRx and 1 on Galena. Note: these articles on CytRx and Galena have since been removed from Seeking Alpha.

Via email and phone I was able to confirm with Mr. Mylant that he was paid by DTG to publish articles on CytRx and GALE and that management had signed off on them because that is what they are paying for. In addition, confirming the involvement of Mr. Mylant should not prove to be too difficult given that DTG does require its writers to fill out a form W9 for tax purposes. Mr. Mylant’s only complaint seems to be that DTG only pays him $300 which is well below his standard rate for the other IR firms he works for which pay $525 per article.

From Mr. Mylant on February 21st:

Dream Team people do only pay $300. I actually stopped working with them. The work I did for [XXXXX] was through another company wasn’t with them. I am not sure who you talk to their work with Dream Team, but some of the articles that I saw were very second rate articles and really can work trying to get people to buy into the company. Very poorly written. Dream Team were the only ones that paid that low to me. When I told people I charge $525, they didn’t blink. I only wrote for Tom you times because he just didn’t pay enough and I thought the company was very shady.

Note: information regarding other companies which could not be verified has been redacted until 3rd party verification can be obtained.

The links to the emails above make it clear that Mr. Mylant had been working for Dream Team and had published on both Galena and CytRx for Dream Team.

Together, Mr. Meyer and Mr. Mylant have published 13 articles on CytRx since November, some of which had a very dramatic impact on the share price. In addition to doing much writing, Mr. Meyer also appears to have served as the go-between for Michael McCarthy (head of DTG) when coordinating the writing of other authors such as Mr. Mylant when he wrote on Galena.

On February 6th, I asked Mr. Meyer the following:

on GALE, I thought that John Mylant did a great piece this week, but he did not address the short attack. did the company approve his piece ?

To which Mr. Meyer responded:

John wrote his article before the short piece came out. It was published after but written before. The company just took a long time to approve it. Wouldn’t have been fair to make him go back and add something else.

He’s been working for me 4 months or so. He’s pretty good, gets things written pretty quick.

GALE is just slow my friend. I chatted with Michael last night and they’re still pending. I can’t make them approve when I say, it’s up to them unfortunately.

Mr. Meyer writes under many aliases, some of whom purport to be hedge fund managers. For example, at Wall Street Cheat Sheet, his bio for “Christine Andrews” states that:

Christine is an analyst and fund manager with almost 20 years of investment experience. She covers a variety of industries, with a special focus on technology, and likes to write about value stocks, poorly understood or under-followed situations, and contrarian perspectives.

The fictitious Ms. Andrews also has had a bio and one article at TheStreet.com.Note: The article posted by the fictitious Ms. Andrews at TheStreet has since been removed from circulation.

Mr. Meyer’s also uses the Wall Street Cheat Sheet where he uses the aliases James Ratz (also a supposed LA hedge fund manager), Christine Andrews(shown above) and John Rivers. He also uses his real name there under Tom Meyer to write articles about CytRx.

Note: Wall Street Cheat Sheet’s contributor program was a beta program with just 12 contributors. The site has now removed all articles that it has linked to Dream Team writers, including on CytRx and Galena.

Mr.Meyer also has accounts at the Motley Fool under “James Johnson” as well as “Ted Mayer“. Note: All of his past articles under both of these aliases have since been removed from circulation by Motley Fool.

At Forbes he uses his real name, Tom Meyer, but the picture doesn’t look anything like the individual I met in person in Chicago. In December, an article at Forbes sent CytRx soaring by nearly 50%, from the mid $4s to almost $7.00.Note: Meyer’s articles at Forbes have since been removed from circulation.

Finally, on Seeking Alpha he has written under the four names of Wonderful Wizard, Equity Options Guru, Kingmaker and Expected Growth. Note: All articles linked to Mr. Meyer or Mr. Mylant on CytRx and Galena, along with a number of others, have since been removed by Seeking Alpha.

In Appendix I, I have included the links to the 13 articles (on CytRx alone) that have been recently published by Meyer and Mylant, along with the stated name (ie. alias) of the author where applicable. These are the links as they appear in Yahoo Finance. Clicking on them simply reveals that they have been pulled from circulation. But it at least allows us to see when the articles were written along with the promotional titles and the (stated) name of the author.

For those who are interested in reading the actual articles which have been removed, I have spent the past 6 weeks archiving as many articles as possible on CytRx and other companies and I have made the originals for CytRx available atMoxreports.com. I plan on posting additional archived files going forward.

Promoting the promotion – one step further

An additional feature of interest is that once these articles were published, Dream Team / Mission IR would then tout the publication of these “independent” articles on its own website, further pretending that they had been written by independent sources.

For example, on its website Mission IR notes that:

CytRx Corp.’s Aldoxorubicin Demonstrates Blockbuster Potential, Says Motley Fool Contributor

It was actually an article written by Mr. Meyer under the alias of James Johnson.

A separate post on the Mission IR blog site quotes the “LA hedge fund manager” James Ratz for his article on Wall Street Cheat Sheet.

Once again, the real underlying author was the same Tom Meyer, who was being paid by Dream Team / Mission IR but without providing disclosure.

Nearly every article written by a Dream Team author gets quoted on the Mission blog posts as if they were written by independent authors.

CytRx management was heavily involved in editing the articles

Mr. Meyer sent one of my dummy articles to Galena management, but before they got a chance to send me their revisions, Adam Feuerstein from TheStreet.com wrote an exposé highlighting the Dream Team and its paid promotion campaign with Galena. Right at that time (likely while Mr. Feuerstein was calling Galena), Mr. Meyer suddenly informed me that he would no longer need an article for Galena. The fact that management had enough control toprevent publication shows that they knew they were paying for these articles.

Hang tight for a bit on those articles. We’re going to let this GALE storm clear the air for a bit and so we’re going to take a break from writing on all symbols for at least a little while. AF killed DreamTeam in the article and I think Galena may have fired DreamTeam (not sure on that yet). We’re going to pay you for your Galena research though ($300) once I get your

W9. We will pay you for CYTR and [XXXXX] once we get back to biz and get them published.

This hasn’t happened before and is really the fault of GALE management who basically dumped their shares at the high point. They’re idiots and who knows what will happen to them later on. Sorry for the trouble, just need to let this sh*tstorm pass.

Note: Again, references to other tickers within these emails should not be interpreted to conclusively indicate that these companies had knowledge or involvement in these promotions.

For CytRx, on the other hand, he was very eager to get an article published. And this happened to be in the few days leading up to their equity offering.

CytRx management received my articles and then quickly provided feedback, emailed via Mr. Meyer. This was presumably done to maintain the appearance that management was not an active participant and that the process was being entirely orchestrated by Dream Team.

Changes would be run through Michael McCarthy who runs Dream Team. Mr. Meyer let me know that CytRx typically provides heavy changes in these paid articles and that I should not take it personally that their changes to my dummy article were so extensive. Mr. Meyer told me that it would be VP of Business Development David Haen who made most of the changes.

On January 29th, I said in an email:

man oh man….those were extensive changes. he basically re-wrote about 25% of the article.

To which Mr. Meyer replied:

Every once in a while a company will be really picky. CYTR is one of them. Our other companies aren’t nearly as bad.

Let me know when you submit.

Thx

In fact, it was easy to confirm who made the actual edits by simply using the “Track Changes” feature in Microsoft Word. As can be seen in the pdf files below, the changes were made by David Haen, VP of Business Development and a minor change by Lauren Terrado, Executive Assistant to the CEO. Changes marked “xx” are changes between the two versions of the documents I submitted. One was before the equity offering was announced, one was after.

I include 4 links here which I strongly encourage readers open and read.

Readers should keep in mind that the original document was one that was provided to CytRx only by me via Mr. Meyer. This can be seen by looking at the term “CYTR_RP” (my initials) within the filenames at the top of page 2 on the track changes files.

#1 – Entire article with edits made by David Haen

#2 – e signatures for individual edits by Haen

#3 – Entire article with edits made by Lauren Terrado

#4 – e signatures for individual edits made by Terrado

Note: The date listed on the cover page of the PDFs is February 12th, 2014. This is simply the date on which I printed these files as PDFs. As shown inside, Mr. Haen’s edits were provided on January 29th. Ms. Terrado’s were provided on February 3rd. On February 5th, CytRx announced the closing of the equity offering for a total of $86 million in proceeds.

The conclusions should be obvious.

CytRx management was well aware that these articles are being published. They also knew that these have been articles via Dream Team / Mission IR. They were also actively participating in the editing of the articles. Management also should have been well aware that no disclosure was being made about the fact the CytRx management was paying Dream Team and the writers for these articles, or about the editing of them.

During the time of the offering (in early February), Tom Meyer published two bullish articles on CytRx. To the extent that CytRx management provided edits and paid for this promotion, it raises the risk that investors in this deal and the investment bank involved will feel duped with respect to the exercise of the greenshoe during the offering. This potentially creates the risk that CytRx may not be able keep the proceeds raised in the offering due to potential legal consequences.

CytRx’s connections with Galena

Readers should keep in mind that Galena was originally a subsidiary of CytRx and was later spun out of the company. CytRx CEO Steven Kriegsman is also a director of Galena and recently took in nearly $3 million from selling Galena stock in January, before the recent plunge.

On February 12th, TheStreet.com published an article entitled “Galena Biopharma Pays For Stock-Touting Campaign While Insiders Cash Out Millions“. The crux of the piece was that two articles on Galena had recently been removed from Seeking Alpha because they were both posted by one individual using the multiple aliases of Kingmaker and Wonderful Wizard. TheStreet noted that:

The articles were part of a broader, coordinated “brand awareness campaign” designed to boost Galena’s stock price, according to a document obtained by TheStreet

TheStreet identified the Dream Team Group as being behind the promotion, pointing to a $50,000 payment which had (at one time) been disclosed on DTG’s website. The disclosure of this payment has since been removed from DTG’s website.

Since that time, a series of lawsuits against Galena have been announced and the stock is now down by around 40% from where it was before the Feuerstein article. Prior to the Feuerstein article, Galena had been trading as high as $5.46 and it is now trading at around $3.20. Also like CytRx, Galena had hit a high of around $8.00 in January.

As the lawsuits against Galena have multiplied, the share price has steadily weakened. Some of this weakness has crossed over into shares of CytRx, as a result of the close links between these companies.

At CytRx alone, Mr. Kriegsman has paid himself over $5 million over the past 3 years ($2.8 million in 2013 alone). Most recently, last week he increased his base salary from $700,000 to $850,000 and (oddly) paid himself a spot “retention bonus” of $300,000. So even before his bonus in 2014 he will have already made well over $1 million in up front pay. This is certainly eye popping for a pre-revenue biotech.

Following the heavy media attention on Galena, the Dream Team has removed from its website disclosure on both CytRx and Galena. But the cached pages from search engines still show that the amount paid by CytRx to Dream Team was $65,000. The fact that Dream Team is now removing its own disclosures on CytRx and Galena is telling in and of itself. It is cause for substantial concern.

And as of now, a growing number of articles covering Galena and now CytRx have been removed from the media sites listed above. I expect that the legal fallout from this undisclosed promotion campaign is just beginning.

Looking at the securities laws

For those who are not familiar with US Federal Securities Law, I have included reference to Section 17b, which deals with paid touting of stocks and the required legal disclosure. I have also included reference to Section 10b(5), also known as the “anti-fraud provision”. To the extent that management was paying for and editing these articles by supposedly independent authors, it raises the possibility that these articles can now be considered to be statements issued by management themselves. This creates the potential that management could therefore be on the hook for any exaggerated or inaccurate statements made by these small time paid writers who were aggressively looking to boost the share prices.

Note: I am not a lawyer nor am I a securities regulator. But I am an individual with a strong background in the securities industry and I have spoken about these issues with several securities law attorneys. Based on this information I have reached a number of my own conclusions in terms of the legal implications of these activities. Readers should come to their own conclusions. Readers who wish to obtain formal legal advice or opinions should consult with an attorney of their own who specializes in securities law.

Those who are interested in background information on these types of situations can refer to this article which details an SEC crackdown on internet stock touting and the laws that were violated. It is a forceful read and I strongly encourage readers to at least give it a quick browse.

The article quotes the SEC Director of Enforcement describing actions against 44 individuals and companies as saying:

In all of these cases, the Internet promoters gave ostensibly independent opinions about Microcap companies that in reality were bought and paid for.

The article includes the following definition of Section 17b.

It shall be unlawful for any person, by the use of any means or instruments of transportation or communication in interstate commerce or by the use of the mails, to publish, give publicity to, or circulate any notice, circular, advertisement, newspaper, article, letter, investment service, or communication which, though not purporting to offer a security for sale, describes such security for a consideration received or to be received,directly or indirectly, from an issuer, underwriter, or dealer, without fully disclosing the receipt, whether past or prospective, of such consideration and the amount thereof.” (15 U.S.C. § 77q(B).)

The key point to note is that this Section applies to both direct and indirect payments which come from an issuer, underwriter or dealer in connection with the promotion of their stock.

As per their (now removed) disclosure, Dream Team was receiving payments from CytRx and Galena (the issuers). The writers indirectly received this via Dream Team. From the documents above it seems clear that the issuer was then well involved in the process via the editing and oversight.

But this also raises another, much thornier issue. Public companies must generally be very careful about what they say about themselves in order to avoid violating the anti-fraud provisions of the securities code. This is section10b(5) which states that:

Rule 10b-5: Employment of Manipulative and Deceptive Practices

It shall be unlawful for any person, directly or indirectly, by the use of any means or instrumentality of interstate commerce, or of the mails or of any facility of any national securities exchange,

(A) To employ any device, scheme, or artifice to defraud,

(B) To make any untrue statement of a material fact or to omit to state a material fact necessary in order to make the statements made, in the light of the circumstances under which they were made, not misleading, or

(C) To engage in any act, practice, or course of business which operates or would operate as a fraud or deceit upon any person in connection with the purchase or sale of any security.”

Wikipedia is often a source that should be approached with some caution. However, its content on 10b(5) is useful.

Here is the problem:

Because CytRx was paying for articles to be written, and because CytRx was signing off on (and editing) them, it raises the prospect that ALL of the statements within these articles will be viewed (for legal purposes) as having been issued by CytRx itself. After all, they did pay to have these statement made to the public and they did oversee the editing of the articles.

That means that any mistake or exaggeration by any of these small time authors could potentially constitute fraud by CytRx management to the extent that the statements were speculative, promotional or incorrect.

The fact that these promotions then culminated in the sale of securities by CytRx in the recent capital raise (ie. an offering of securities) only serves to heighten these concerns.

To me the issues seem quite obvious. But again, I emphasize that I am not a securities attorney or a regulator, so I encourage readers to evaluate the facts and the laws and arrive at their own understanding in order to best handicap the odds and magnitude of any fallout from the items presented above. To the extent that there arise class action lawsuits against CytRx, those suits will likely do a more thorough job of spelling out the specific legal issues.

But what about the cash?

In February, CytRx closed its offering of $86 million (inclusive of greenshoe) worth of new shares at a price of $6.50. This may appear to give CytRx a decent cushion of safety vs. its market cap of around $250 million at present.

But to the extent that it is determined that the offering was conducted on the back of an undisclosed paid promotion, it could create significant legal uncertainty about the company’s ability to keep this newly raised money. If the share price drops sharply, investors in this deal could potentially file claim that they were defrauded into buying shares of CytRx near a 4 year high. In fact, the share price has already dropped to well below the $6.50 offering price and even further below the recent high share price of $8.35.

As a result, I view this “cushion” of around $2.00 per share to be at risk, creating the potential for the stock to trade well below any perceived “cash floor” of $2.00.

Looking at the share price of CytRx

CytRx is a pre-revenue biotech with multiple compounds in the hopper. It is expected that results from Phase 3 clinical trials will become known in 3-4 years (2017-2018). But the problem is that if the company had such stellar prospects, then why would it choose to conduct a highly inappropriate paid promotion campaign just so that it could raise $86 million in a stock sale?

I take the view that the blatant paid stock promotion itself casts doubt on every other statement the management has made, including those regarding the prospects for any of its drug candidates. But readers should make their own decision as to whether or not the non-disclosure of payments and editing of promotional articles is reason to doubt other promotional statements.

The most urgent concern is the fallout which can be expected from the SEC and the NASDAQ in connection with this promotional campaign.

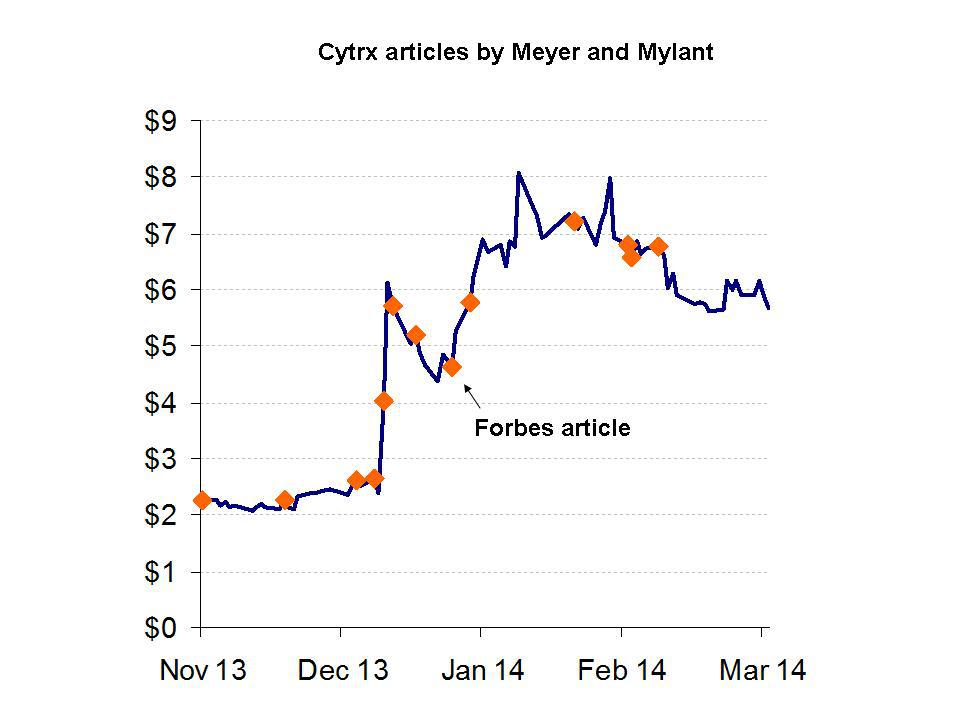

Following the release of Phase 2 data in December, CytRx’s share price jumped from as low as $2.19 to as high as $6.79. But the initial move in the stock was only around 80%. Yet (as shown below) this was accompanied by 3 positive articles in a row by Mr. Meyer and Mr. Mylant and the stock continued to soar post-announcement, tripling in 3 days.

However, by December 26th, the share price had fallen back to $4.62.

On December 27th, Tom Meyer published an article in Forbes entitled “The Race To Develop A Brain Cancer Treatment Takes An Interesting Turn“. He then quickly published another article on Seeking Alpha (under the alias Equity Options Guru) entitled “CytRx Corporation Poised For Success In 2014“. Within days the stock had risen to a new 52 week high at $6.90, another increase of nearly 50%.

Note: Both of those articles have since been removed from circulation.

The point is that these various articles demonstrably had an enormous effect on the share price.

The following graph shows the CytRx share price since November along with orange dots to show when the 13 articles were published by Meyer or Mylant.

Looking at the fundamentals at CytRx

So far I have deliberately refrained from providing any analysis of the fundamentals at CytRx including the prospects for their compounds in FDA trials. Based on the facts presented above, it is the stock market promotion that has dominated the share price action, bringing the stock to multi-year highs.

CytRx is held just 26% by institutions, implying a high ownership by retail investors. The promotions (via at least 13 paid articles) were well underway prior to the release of Phase 2 data in December, such that the release of that data likely had a greatly exaggerated effect on the share price.

Readers should keep in mind that drugs do not “pass” Phase 2 trials. It is the decision of the sponsor (ie. CytRx) whether or not to proceed to Phase 3. The FDA would certainly halt a study if it was deemed to be dangerous to the patients enrolled. But the FDA would not otherwise rule on effectiveness or stop a trial at Phase 2.

Aldox was recently given Special Protocol Assessment. However, this is simply the FDA’s way of saying that the study design is rigorous enough that the trial will not be rejected based on study design alone. It is categorically NOT an expression of confidence in any expected results themselves and it is NOT an expression of confidence in the drug itself.

The point I am trying to make is that these findings should not be viewed either as strong positives or strong negatives for CytRx. Yet a review of the various paid promotional articles shows that they have portrayed the “passing” of Phase 2 and the SPA designation as being very strong positives which supposedly make ultimate success much more likely. This is wrong.

Adam Feuerstein speaks and Tom Meyer rebuts

On December 16th, it was once again Adam Feuerstein who wrote an article entitled “CytRx Directors Are $3M Richer With Well-Timed Stock Option Grants“. He made two main points.

First, CytRx directors had approved option grants for themselves almost immediately before the release of the Phase 2 data which sent the stock price soaring. As a result, they netted millions of dollars in gains within days.

Second, the actual underlying data beneath this Phase 2 trial was far less compelling than it appeared on the surface. For some reason patients in this trial had a 0% response rate for tumor shrinkage with the legacy drug doxorubicin. This is unusual in that dox is considered the standard treatment for sarcoma patients. A 0% response in this control arm provided a very strong (apparent) boost for CytRx’s aldox.

Feuerstein also notes that more than 60% of the patients enrolled in CytRx’s aldox study were in India, Romania, Russia and the Ukraine, implying that accuracy may not be as high as for a study which had been done primarily in the US and/or Western Europe.

Mr. Meyer responded in a rebuttal article on Wall Street Cheat Sheet (using his own name, but not disclosing payment or editing from CytRx) in an article entitled “Inaccurate Article Sends CytRx Shares Lower“.

Mr. Meyer noted that:

Unfortunately, an inaccurate report was published on Monday, December 16, by The Street’s Adam Feuerstein. The report contained several inaccuracies, which caused shares of CytRx to sell off by more than 10 percent.

Mr. Meyer makes the point that the board had previously met in December 2012 with no spikes in the share price at that time. He also notes that 30% of the trial participants were from the US. Mr. Feuerstein apparently included participants from Hungary into his Eastern Europe calculations. This should only total 58% from those countries, not 60%. Mr. Meyer also includes a very detailed analysis of the underlying statistics which would appear to have required a PhD in biology and clinical statistics for anyone to have written.

Note: the rebuttal article by Mr. Meyer has been removed from circulation but I have stored a saved PDF copy of it here.

As always, Mission IR then posted on its website a highlight of these corrections to the described inaccurate Feuerstein article, quoting Mr. Meyer, but not disclosing that he was being paid or if the content within was coming from CytRx management.

So Mission basically quoted someone who was quoting someone who was paying them to quote them.

Again, I take the view that the fallout from the promotion will dominate the equation in determining the share price of CytRx. This is because phase 3 trials are unlikely to be completed before 2017-2018 and the current cash balance following the $86 million equity offering may be in jeopardy due to the paid and edited stock promotion.

As a result of these factors, it is difficult to determine just how low the stock will trade. But due to the risk on the cash, there is the possibility that the stock trades back below $2.00.

Asked about the timing of articles coming out in conjunction with a stock offering by CytRx, Mr. Meyer had this to say:

I had a long conversation with Michael about it. I don’t like the fact that the company wanted your article out before the offering. I explained him to that it would make the writers look bad and he agreed. He had a conversation with the company about it.

When asked about this, Michael McCarthy (head of Dream Team) declined to comment.

Appendix I -articles on CytRx from Meyer and Mylant

The following is a list of 13 recent articles (as shown on Yahoo Finance) touting CytRx which appeared on Yahoo Finance and the Motley Fool. All of these were written by either Meyer or Mylant while they were getting paid by Dream Team. These are the original links, however many of the articles have now been removed from circulation.

Aldoxorubicin: The Drug CytRx Investors Should Be Watching at Motley Fool (Mon Feb 10)

James Johnson (Tom Meyer)

3 Newsworthy Biotech Stocks: BioDelivery, CytRx, TG Therapeutics at Wall St. Cheat Sheet (Mon, Feb 3)

James Ratz (Tom Meyer)

CytRx Is Heading to a Pivotal Trial at Wall St. Cheat Sheet (Tue, Feb 4)

John Rivers (Tom Meyer)

CytRx Corp. Is a High-Flying Stock at Wall St. Cheat Sheet (Wed, Jan 22)

James Ratz (Tom Meyer)

CytRx Corporation Poised For Success In 2014 at Seeking Alpha (Tue, Dec 31)

Equity Options Guru (Tom Meyer)

The Race To Develop A Brain Cancer Treatment Takes An Interesting Turn at Forbes (Fri, Dec 27)

Tom Meyer

Inaccurate Article Sends CytRx Shares Lower at Wall St. Cheat Sheet (Wed, Dec 18)

Tom Meyer

Is CytRx Corporation the Next Pharmacyclics? at Wall St. Cheat Sheet (Fri, Dec 13)

James Ratz (Tom Meyer)

CytRx Surges As Aldoxorubicin Dominates Doxorubicin In Phase IIB Tests at Seeking Alpha (Thu, Dec 12)

John Mylant

CytRx Corporation Soars on Positive Phase 2b Sarcoma Data at Wall St. Cheat Sheet (Wed, Dec 11)

Tom Meyer

CytRx Corporation Offers Hope for Brain Cancer Patients at Wall St. Cheat Sheet (Thu, Dec 5)

Tom Meyer

Aldoxorubicin Continues To Prove Itself As A Viable Cancer Treatment at Seeking Alpha (Tue, Nov 19)

John Mylant

CytRx Surges Ahead With Positive Drug Data at Seeking Alpha (Fri, Nov 1)

Equity Options Guru (Tom Meyer)

Appendix II – responses from McCarthy, CytRx, and Galena

I did speak with Michael McCarthy by phone and asked about his relationship with Mr. Meyer, Galena and Cytrx. I also asked about the payments to authors and the editing by Galena and CytRx. His only response to a series of questions was “I am unable to comment on that at this time”. He repeated that answer verbatim to each question asked.

I also spoke to David Haen who provided the edits to the dummy article I sent. He initially stated that CytRx had stopped using the Dream Team several months ago, “when the stock was a $2.00 stock”. (Note: that would be back in November, which is when the campaign appears to have begun, not when it ended). When I pressed further he stated that it might have been “earlier this year”. As I discussed the editing of documents with him, he noted that CytRx may have provided “some new or original content” to writers but that he felt most of it was for editing for accuracy. Readers can refer to my attached edited dummy article and to the comments which came from Tom Meyer’s emails to make their own determination about the extensiveness of Mr. Haen’s changes. I did inform Mr. Haen that I would be writing an article on this topic and gave him the opportunity to provide comment.

I did receive a call back from Galena management. However, they notified me that due to the ongoing class action lawsuits they would not be able to provide any responses to anything in connection with the Dream Team promotion.

This article is the opinion of the author. Nothing herein comprises a recommendation to buy or sell any security. The author is short CYTR. The author may choose to transact in securities of one or more companies mentioned within this article within the next 72 hours.