Investment thesis

TearLab Corp (TEAR) has so far managed to drive moderate increases in revenue over the past year, but only by spending a disproportionate amount on marketing. The result has been ballooning losses in every quarter. The company has never earned a profit. Following dozens of recent calls to the offices of eye doctors, it has become apparent that the adoption of the TearLab product tends to be fleeting and driven primarily by the marketing spend. As a result, the temporary boost in revenues resulting from this marketing tends to be short lived and must be constantly replaced with new doctors who will give the product a trial. Investors should be concerned that TearLab now gives away its desktop reader for free in order to encourage doctors to make a trial of the product.

TearLab recently laid out a large seven figure pay package (roughly in line with a full quarter’s revenue) to hire Seph Jensen from Alcon Labs. His start date was scheduled to begin just prior to the upcoming earnings release. This expensive hire should also signal the company’s desire to telegraph a much needed turnaround to stem ballooning losses. The timing was likely urgent in order to have a visible solution in place prior to announcing disappointing earnings. TearLab is likely to report a much larger loss on revenues which are flat to down. The result is expected to be a share price decline of at least 25% to around $8.50 or below. The hiring of Mr. Jensen will be positioned as a means of addressing these problems going forward. On the earnings call he will certainly announce the company’s plans for reducing the ballooning losses.

Background information

Lately I have done quite well on several trades by aggregating information from non-market sources ahead of earnings releases and placing my bets accordingly. There is nothing illegal about this. Information which can be obtained by customers, suppliers and competitors is all fair game as long as it is not supplied by company insiders. As described below, Tesla (TSLA) follower Craig Froehle recently conducted similar analysis right ahead of the $25 plunge at that company.

In August, I wrote an article just before the release of earnings at Francesca Holdings (FRAN) which predicted that an earnings miss would lead to a 30% drop in the share price. A few days later, Francesca disappointed as predicted and the share price quickly fell from $25.00 to less than $18.00. Analysts had continued to maintain price targets as high as $38.00, so they were wrong by about 90%.

More recently, I predicted a similar 30% drop upon the release of earnings by Ignite Restaurant Group (IRG). Analysts had predicted that earnings might decline a bit, but continued to maintain price targets of around $17-18. Following the release of earnings this week, Ignite quickly traded down to below $11.99, also a nearly 30% decline from the time of my article a few days earlier.

To me, both of these trades were painfully obvious. Rather than rely upon the bullish views of sell side analysts, I turned off my computer and left my desk to conduct my own research in person. With Francesca, I visited numerous stores in various cities over the span of several months. I then called dozens more and scoured the internet for evidence of discounting. In its prior earnings call, Francesca had noted that its practice of deep discounting was coming to an end and margins would rebound accordingly. Analysts believed and repeated this view almost verbatim. But my months of research showed that the discounts were actually accelerating rather than declining. A steep earnings miss was all but guaranteed. When it was reported, the stock quickly plunged as it should.

Prior to writing about IRG, I visited and called numerous restaurants across multiple states and interviewed employees on each occasion. I also aggregated information on the availability of discounts. It was clear that the company’s turnaround strategy was failing and that traffic was falling despite heavy discounting. The combination of much lower traffic along with deep discounts meant that IRG was all but guaranteed to report a loss rather than the analyst-predicted profit for the quarter. As expected, the share price dropped to below $11.99, closing in on a new 52 week low.

This type of analysis is now becoming more widely used by a wider array of investors. Investors have come to realize that the reports and targets of sell side analysts are typically useless or downright dangerous. They are often little more than gratuitous quotes from management along with lofty share price targets which get re-raised every time the share prices rise.

Just prior to the release of Q3 earnings by Tesla, Seeking Alpha author Paulo Santos wrote an article highlighting Craig Froehle’s use of VIN number tracking to get an estimate of vehicle production and sales at Tesla Motors . Mr. Santos states that

The VIN data continues to be consistent with U.S. demand for the Model S having peaked, and indeed, it’s now consistent with that demand having already weakened substantially.

One day later, seemingly bullet proof Tesla began a plunge of more than $30. The point is that this type of grass roots analysis is becoming far more useful in predicting share prices and earnings than the reports of ever bullish sell side analysts.

An earnings miss at TearLab should now be obvious

Just one year ago, TearLab was trading at below $4. The stock has since risen as high as $15 – almost a quadruple. At its peak, TearLab hit just over half a billion in market cap.

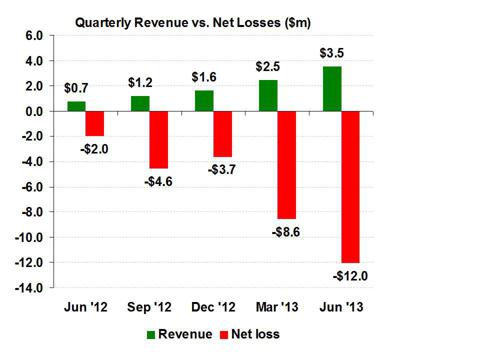

The driver for the rise in the share price over the past year has been analyst enthusiasm over revenue growth. On a percentage basis, the revenue growth has in fact been quite large, in the range of triple digit percentages. But this is simply due to the fact that it is growing off of a very small base of just over $1 million. The rise from a $4 share price to a $15 share price has occurred even though revenues have risen from around $1 million to just around $3.5 million. Yet the quarterly loss has increased from $2 million to over $12 million.

Recently the stock has been trending down towards $10 in advance of the upcoming earnings release. The reason should become apparent.

TearLab most recently reported revenues of just $3.5 million, up by $1 million from the previous quarter. But its net loss ballooned from $8 million to $12 million in a single quarter. The problem is clear. In order to increase revenues by just $1 million, TearLab must incur a massively disproportionate increase in its net loss.

Over the past few quarters, this revenue trend has looked as follows:

Analysts have been operating under the theory that at some point TearLab will end up generating enough revenue to break through the losses. But it should be kept in mind that the TearLab product has been on the market for over 5 years and significant sales have yet to materialize. The recent growth of $1-2 million in sales has been largely the result of a sharp increase in marketing spend. The result of the heavy spending has been the steep surge in losses.

This might be an acceptable strategy if it was one that led to a sustained increase in revenues in the long run. But with TearLab, it appears that the marketing spend is often successful only in getting doctors to agree to an initial test of the system for a limited period of time. When they fail to continue using it, it means that the marketing spend is largely wasted and the revenues evaporate. TearLab then continues with its marketing spend in an attempt to get more new doctors to conduct an initial rest of the system.

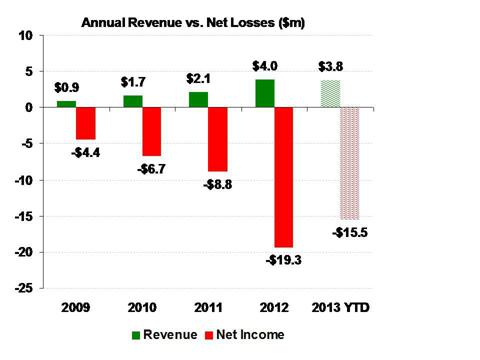

TearLab’s most recent earnings call was very brief. The company reported record revenues of over $3 million in a quarter, but the company lost over $12 million for the quarter. As a result, the company has already lost more in 1H 2013 than it did for full year 2012, its previous worst year ever.

The revenue vs. net loss for TearLab over the past 4 years is as follows. (The last column on the right is YTD 2013).

Instead of discussing the earnings miss directly, the majority of the earnings call was spent hearing a panel of hand selected experts offer their praise for the TearLab system. Of the 4 individuals, 3 were eye doctors while 1 was the CEO of the OCLI eye practice.

At the risk of stating the obvious, it should come as no surprise that the panel of 4 which were hand selected by TearLab had very positive things to say about the product. Among the doctors, some of them had been long term TearLab supporters going back for multiple years. For example, Dr. Marguerite MacDonald is featured in TearLab’s investor presentation and has served as a TearLab promoter for several years (as seen here on YouTube in 2011). Her support for TearLab has been unwavering, but it sheds little light upon the adoption of the product by newer doctors who are not dry eye aficionados.

A much more instructive approach is to contact a wider assortment of doctors’ offices who are familiar with the product and get their review. In order to achieve this, one can simply call the numbers listed on TearLab’s website under “Find a Doctor“. When prompted for location, simply click “view all locations“. A convenient list of all TearLab customers (along with their phone numbers) then appears.

Over the past few weeks, I have contacted dozens of these doctors to ask about their recommendations for conducting a dry eye exam. I did not discuss any interest in TearLab as an investment.

As would be expected, there are a large number of doctors from TearLab’s list who do recommend a tear test. What does come as a surprise though, is that there are also a large number of doctors who have received the test over the course of the past year but no longer offer it, citing lack of need, inaccuracy or difficulty in getting reimbursed.

The doctors who do not recommend TearLab’s test end up recommending the more standard Schirmer test which has been used for many years along with a simple verbal assessment.

In fact, this should not come as a surprise. After more than 5 years, use of TearLab’s test is still the vast exception to the rule. Healthcare sites such as theMayo Clinic do not mention TearLab’s tear osmolarity test at all. Instead they recommend the Schirmer test or simple verbal assessment.

The list of doctors on TearLab’s website can be somewhat difficult to track. During the course of my research, there were a number of additions to the list, representing new doctors who appear to have been added in recent weeks. But there were also some deletions representing doctors who must have either returned or abandoned the test.

TearLab had previously noted that less than 5% of doctors have ever returned a test to TearLab. However this does not account for the units which have simply been discontinued in the practices of eye doctors nor does it account for doctors who have a test unit but see no reason to use it over verbal assessment which is easier and free and is not time consuming for the busy doctors.

The point from this is that the effect of TearLab’s marketing spend often appears to be only in getting some doctors to try the test for an initial and limited period. This clearly leads to a short term rise in revenue, but also a disproportionately large increase in marketing expense. When the revenue is only short lived, this becomes highly problematic. This is likely what we have been seeing over the past 5 quarters and it explains the slight rises in revenues along with much larger increases in the net loss at TearLab. TearLab appears to be constantly in search of new doctors to replace the ones who will not adopt the test after using it.

Looking at TearLab’s product

A heavy marketing budget can drive sales of virtually any product for short periods of time. But ultimately a product will need to justify itself if it is going to sell on its own.

The biggest problem with TearLab’s product is that is just isn’t necessary for the majority of eye doctors. It is certainly true that the product is well liked by specific dry eye specialists (such as those on TearLab’s last earnings call).

The TearLab test allows doctors to quantify tear levels with a numerical score. This is why the true dry eye only specialist practitioners like it. But for the regular eye practitioner, this level of information is simply superfluous and is certainly not worth paying for or taking the extra time from other waiting patients.

In most cases, doctors will simply ask their patients to describe their symptoms and then prescribe corrective measures accordingly. This is not only faster, but it is also free. It also addresses the problem to the satisfaction of the patient.

In some cases, doctors will use the industry standard Schirmer test.

The TearLab test does not offer the majority of practitioners any useable new information. Either a patient has a condition worthy of treatment, or they do not. This is primarily based on level of discomfort. The numeric score does not really add much additional value in a practical setting.

In addition, because the test costs less that $30, there is very little revenue potential for the eye doctor. As a result there is neither an overwhelming financial or medical incentive to use this test. It simply consumes time from office visits along with space on the desk for the TearLab unit.

This is why the test which has been around for more than 5 years still only shows a few million dollars in sales and why these sales only tend to increase when accompanied by a disproportionate marketing spend.

TearLab’s method of dry eye testing has been described as the “new gold standard” for dry eye testing since the early 1990’s – nearly 20 years. It is by no means a new technology waiting for widespread adoption.

In addition, TearLab continues to cite a whopping $1.5 billion market potentialfor the product based on hoped for sales to an estimated 50,000 eye doctors in the US. This massive market potential claim has been consistent for years. Yet after all of this time, new product sales continue to measure in just the hundreds of units for the entire year. The device simply doesn’t sell even after 5 years of marketing.

By this measure, use of TearLab’s test accounts for roughly 2% of applicable dry eye tests per year. And it should be remembered that even this low level is only the result of a very heavy marketing spend.

In effect, the heavy marketing spend has resulted in a small number of doctors trying the test for limited periods of time. But over the past 5 years, there has been no consistent adoption of the test at a meaningful level. While marketing spend may get doctors to try the test, it does not get them to continue using it. As a result, TearLab is on a never ending search for more new trial doctors.

The hiring of Seph Jensen

On October 1st, TearLab announced the hiring of Seph Jensen from Alcon Labs where he had previously served as Head of Surgical Marketing. The announcement quickly sent the stock soaring to as high as $12.33. Since that time, the stock has now retreated by around 15%, giving up most of its gains.

The reason for the quick jump in the share price was obvious. At Alcon Mr. Jensen oversaw $1.4 billion in sales. If tiny TearLab with just a few million in sales could attract this type of talent, then the company must be really headed in the right direction.

Unfortunately there also appears to be a very different explanation for the timing of this hire.

Mr. Jensen was set to start with TearLab on October 31st, just two weeks before earnings are to be announced. It is very likely that the company will report a large earnings miss. Hiring Mr. Jensen will not help to explain the miss which just happened. However, it will allow the company to show shareholders that it is attempting to do something to slow the ever increasing losses.

This view is supported by the fact that Mr. Jensen’s compensation package wasastronomical for such a small company with minimal revenues and ongoing losses. Mr. Jensen will receive a base salary of $370,000 which is moderate. But he will also receive up to an additional 50% of this amount as an annual bonus. He also gets a signing bonus of $250,000. So the initial payments amount to just under $1 million. However, he was also granted 300,000 shares worth of options with a staggering 10 year maturity. The value of these options alone is worth well over $2-3 million alone. For reference, even short dated 1 year at-the-money options on TearLab are worth around $2.50 per share at present.

All in all, the pay package awarded to Mr. Jensen is worth somewhere between $2-4 million at minimum, which is in line with a full quarter’s entire revenue for the entire company. For reference, the entire SG&A expense for Q1 was only $3.9 million. Yet a similar amount is now being awarded to a single executive. The point is that Mr. Jensen should be viewed as an extremely expensive hire for TearLab.

The timing of this very expensive hire coming just before earnings suggests that TearLab is looking to provide investors with some level of comfort in the face of another quarter of ballooning losses. In any event, there is nothing out there to suggest that there has been any change leading into this quarter which will stem the pace of the accelerating consecutive losses from past quarters.

Conclusion

In recent cases, aggregating non-market information helped me accurately predict a significant earnings miss which presaged a quick share price decline of around 30% in several stocks.

Prior to the release of earnings for Francesca and Ignite Restaurant Group, I came to the conclusion that an earnings miss was highly likely in each case. I came to this conclusion based on dozens of phone calls and in person visits which revealed that business was not going to live up to the highly bullish expectations of analysts who cover the stock. The on the ground information I obtained was far more useful that the reports from analysts which simply repeated the views of management.

Making dozens of visits and phone calls is far from a scientific approach, but it has proven to be consistently useful to me.

With TearLab, I have called dozens of eye doctors to ask about their use of the TearLab product. I specifically called the doctors who are currently (or were previously) listed on the TearLab web site as carrying the TearLab test.

While there are naturally a large number of doctors who do carry this test, there are also a surprisingly large number of doctors who had previously used the test but who no longer recommend it to prospective patients. Even among the doctors who do carry it, they do not necessarily state that it is part of their standard dry eye exam. The Schirmer test and verbal assessment tend to remain the standard even among many TearLab customers.

The conclusion from this is that the revenue gains from TearLab’s expensive marketing efforts in some cases end up being very short lived. In many cases the doctors noted that there were several options for evaluating dry eye conditions. But in only a few cases did the doctors immediately tell me that the TearLab solution was a must.

The conclusion I have reached is that TearLab is likely to once again show a very large increase in marketing spend which will be accompanied by revenues which are either flat to down. This is simply due to a relatively underwhelming adoption of the tear test despite the heavy marketing spend. The result will be a loss which is larger than last quarter and which is moderately to significantly larger than expected by the street.

Mr. Jensen will then be given the stage to explain how things are about to change in coming quarters.

I am expecting TearLab to fall to around $8.00-$8.50 following earnings, with potential for further downside in the weeks that follow.

In the meantime, TearLab is a company which sports a $350 million market cap despite cumulative revenues of just $15 million over the past 5 years running. During this time, cumulative losses are now approaching $50 million without a single profit, with losses continuing to grow each quarter.

Disclosure: I am short TEAR. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.