My last short article discussed Farmer Brothers Coffee (FARM) and since that time, the stock has come off by nearly 20% without much of a bounce. Prior to that, I discussed Unilife (UNIS), which is now down by 15-20% for largely the reasons I predicted. Before that, I highlighted unacknowledged and low-priced product competition for Organovo Holdings (ONVO). At the time, the stock had been trading around $13.00, and now it has fallen to $9.00. Prior to that, my earnings call on Ignite Restaurant Group (IRG) correctly predicted a fall of around 30% in that stock.

But for today, I am focused on an even better near-term short opportunity in MiMedx Group (MDXG).

MiMedx – Investment thesis

Shares of MiMedx are likely to see a decline of 30-40% in the near term. The stock represents an ideal short candidate due to its tremendous free float of nearly 100 million shares combined with a negligible short interest of just 5.8 million shares. There are also liquid options which trade on the stock.Institutional ownership is negligible and the CEO is the only insider with any meaningful ownership of stock.

Yet, these are not the real problems. The real reasons for the sell thesis are as follows:

1. A deeply flawed FDA clinical “study” which was irreparably skewed, providing stellar (but arguably misleading) results for the EpiFix product

2. Heavy marketing of that same study (by MiMedx and its banker/analysts) despite superior trials by competing products

3. A complete mis-presentation of the implications of recent Medicare reimbursement changes

4. Substantial changes in the competitive landscape for skin substitute products

5. Heavy selling by CEO Pete Petit (the largest shareholder) of over $1.2 million

6. Indications that the largest outside shareholder ADEC is liquidating (just sold below the stealth non-disclosure point of 4.99%)

7. The onset of analyst downgrades, with Northland seeing around 20% declines from current levels

This report is divided into three sections.

SECTION ONE – Background information provides detailed background information on the evolving situation at MiMedx, along with several reasons NOT to sell the stock. Presenting this information first will allow readers to better evaluate the real risks and the reasons why MiMedx is likely to be facing steep declines in the near future.

SECTION TWO – the red flags illustrates that there are more than ample warning signs which should presage the upcoming declines. The upcoming declines should come as no surprise to anyone.

SECTION THREE – the black swans details the much deeper negative catalyst events – which the mostly retail investor base has almost entirely ignored. Section three is clearly the most important part of this article. So for those who wish to “skip to the point” – section three contains the most price-relevant details.

SECTION ONE: Background information

With over 100 million shares outstanding, MiMedx currently has a market cap of nearly $800 million. Yet, with nearly 20 million additional (deep in the money) warrants and options outstanding, this market cap swells to over $1 billion. Many of these options have strike prices well below $1.00 and are set to expire in 2014, implying substantial near-term dilution.

MiMedx generated $40 million in sales over the first 9 months of 2013, resulting in a net loss of $2.7 million. The company has never generated a profit. The share price has recently been trading in the $7-8 range and the company currently has just 40 cents per share in cash (following a $39 million capital raise in December).

MiMedx Products

MiMedx Group describes itself as “an integrated developer, manufacturer and marketer of regenerative biomaterial products processed from human amniotic membrane.” What the company does is to collect donated human placentas from hospitals via C-Section births. These placentas would otherwise be discarded as medical waste. MiMedx then uses/processes these placentas into a type of healing application for burns and wounds.

The company’s two main products are EpiFix and AmnioFix. EpiFix can basically be viewed as an enhanced skin patch for use on external burns, wounds and ulcers. AmnioFix serves a similar function but is for internal use in sports medicine and surgeries, including spinals and tennis elbow.

On October 1st, the company announced that it had signed a distribution agreement with Medtronic to provide its allografts for distribution via Medtronic’s SpinalGraft Technologies (“SGT”) subsidiary. Terms were not disclosed.

These products are not FDA-approved via clinical trials, but instead have been governed under HCT/P regulations (“Human Cells, Tissues, and Cellular and Tissue-Based Products”) which allow marketing of products which have been minimally manipulated (among other criteria). These products are regulated under Section 361 of the PHS Act.

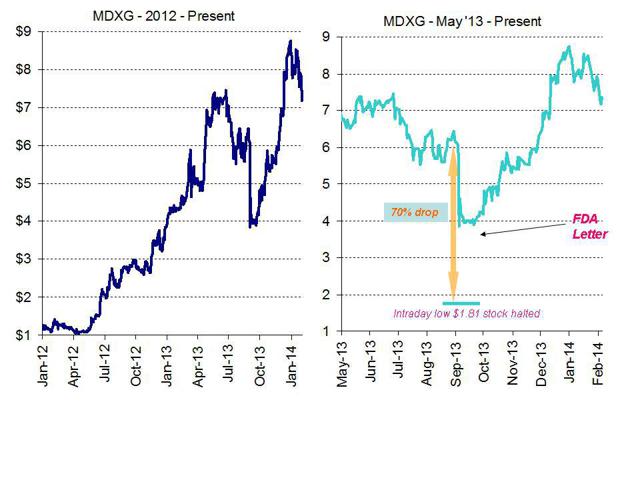

MiMedx Share Price Performance

Over the past two years, share price performance at MiMedx has been stellar. At their recent peak, the shares had risen from just over a $1.00 to just shy of $9.00. However, there is a very high likelihood of a 30-40% decline in MiMedx in the near future, to a price of around $4-5. Yet, the market has almost entirely missed the real reasons why.

Two possible “red herrings” – NOT the reasons to sell

Again, for clarity, the following two issues are quite well-known and have been absorbed by the market. They are just presented for completeness.

During the end of 2013, a number of headline concerns caused the stock to exhibit substantial volatility. In September, panic over an FDA “untitled letter” following an inspection at the company’s Marietta, Georgia plant sent the stock plunging to as low as $1.81 in intra-day trading and the stock was halted several times during the day. The FDA letter stated the MiMedx had violated the Public Health Service Act by improperly manufacturing and marketing drugs that are also a biological product, but without a valid biologics license. The good news is that the products (currently) in question only comprise 15% of MiMedx’s revenues. The bad news is twofold: First, the company will now likely have to pursue an expensive FDA approval process and obtain a BLA. Second, even a minor hit to the financials may have a disproportionate impact on the share price due to the extremely high price-to-sales multiple and the historical lack of profitability.

So far, MiMedx has said that it does not agree with the FDA and is currently in discussions on how to proceed. For the time being, this issue has been digested by the market and does not appear to be a primary concern for investors.

A separate issue is the SEC investigation of potential insider trading violations by CEO Pete Petit in connection with information allegedly shared regarding his company Matria Healthcare prior to the sale of that company. The headline in the Atlanta Business Chronicle was short and scary, noting that “SEC Sues Pete Petit, Alleges Fraud“.

But the reality is that despite any previous violations, this investigation is unlikely to impact the specific financials at MiMedx. The downside scenario would be limited to the potential loss of Mr. Petit’s management involvement if he were forced to step down, and some possible pressure on the share price simply due to more negative headlines. As with the FDA impact above, this issue is not a primary reason to sell the stock, but the impact could be disproportionately large simply due to the very lofty multiple upon which MiMedx trades.

SECTION TWO: The red flags and warnings

One major problem at MiMedx is that as these (mostly retail) investors have gotten comfortable (desensitized) with the scary headlines, they have also overlooked a number of very real problems.

In November and December, MiMedx released a series of very bullish press releases which helped to bolster the stock. These items were then amplified by sell-side analysts (who happen to be the investment bankers for MiMedx).

The share price continued to skyrocket on the back of their analysis and steep price upgrades. Within the space of a few weeks, Canaccord repeatedly boosted their target on the stock. In early November, when the stock was in the $5s, Canaccord told us it was a $6.50 stock. But as the much anticipated equity offering drew nearer, Canaccord nearly doubled the target to $12.00 in December. The basis for such a dramatic hike seems unclear. This increase implies an increase in market cap of nearly $600 million for MiMedx even though Canaccord only increased its 2014 revenue estimates for MiMedx by a mere $27 million. But as would be expected, the share price soared as shown above.

Not surprisingly, Canaccord was appointed bookrunner on MiMedx’s $39 million equity offering in December. Canaccord reaped millions in fees. Small cap investment bank Craig Hallum only had a $9 target on the stock, so they were only awarded joint lead status on the offering, making perhaps under $1 million in fees. But certainly, their $9.00 target did imply a 50% rise in the share price vs. its then prevailing level of around $6.00.

But wait. It gets better.

Shortly after the company sold $39 million in stock, CEO Pete Petit sold over$1.2 million in stock from his personal holdings. MiMedx’s largest shareholder (ADEC Private Equity) then reduced their holding to just below 4.99% of the company – allowing further sales (including a complete liquidation) to go without any need to report the sales. This is a very standard “stealth liquidation” technique.

And just as all of this was happening, we started to get the first analyst downgrades on the stock from Northland Securities with a $6.00 target. It should come as no surprise to anyone that the only bank to have the guts to downgrade the stock is the one who wasn’t being paid investment banking fees.

Despite the lofty targets from the research analysts (a.k.a. bankers), the company, the management and the largest holder were all suddenly eager to sell. But why?

From the Northland report:

Key Points

- Our downgrade is a valuation call. Irrespective of how Q4 numbers shape up or how aggressive fiscal 2014 guidance is provided, we cannot reconcile current valuation with the ground fundamentals.

- In our opinion, we are entering a vicious cycle of CMS constantly squeezing out the marginal dollar from skin substitute reimbursement. For Mimedx, the current payment levels for Q-code reimbursement for EpiFix are “temporary” in nature. Once bundled rates come into effect, the playing field will be leveled. While EpiFix has favorable MAC coverage policies, that seems to be baked into the stock.

- … However, our general impression of the tissue space has always been that most products are undifferentiated and suffer from a lack of rigorous randomized trials. Hence, aggressive marketing plays a stronger role than true clinical advantages or disadvantages….

At the bottom of this report, I will illustrate the transparent flaws in the research reports provided by the other (and far more bullish) sell side analysts who have provided investment banking services to MiMedx.

SECTION THREE: The black swans

Clearly, there are several issues which at one time spooked the investors in MiMedx, quickly sending the stock to as low as $1.81 in intraday trading. But even with the various warning signs that have been presented above, investors are continuing to award MiMedx a market cap of nearly $800 million to $1 billion.

The issues presented here in Section Three are the real issues which could well see the stock decline by 30-40%. It appears that very few investors are aware of these issues. Again, MiMedx is a stock which has minimal institutional holdings. The largest institution reduced its stake below 4.99% in January, such that we do not know if they still are even holding any shares.

A deeply flawed clinical “study”

The details behind MiMedx’s recently published “clinical study” are far more dangerous to the company’s near-term future than are the FDA letter or the insider trading investigation.

In 2013, the International Wound Journal published a study entitled “A prospective randomised comparative parallel study of amniotic membrane wound graft in the management of diabetic foot ulcers“. This study had been initiated on the FDA’s ClinicalTrials.gov in 2012 and was sponsored by MiMedx.

The purpose of the sponsored study was to see how EpiFix (an amniotic membrane wound graft) compared to “standard of care” in treating Diabetic Foot Ulcers. These ulcers often affect the feet of obese diabetic patients. Healing can be impacted by factors such as age, weight (i.e. pressure on the wound) as well as the size of the wound.

The study concluded that

Patients treated with EpiFix achieved superior healing rates over standard treatment alone. These results show that using EpiFix in addition to standard care is efficacious for wound healing.

It also cited an overall healing rate of 92% at 6 weeks.

Not surprisingly, the truly spectacular results from this sponsored studyhave been widely repeated and quoted by sell-side analysts/bankers (to investors) and by management (presumably to doctors and prospective patients).

For example, Lake Street Capital quotes this study and management saying (almost verbatim)

EpiFix, the company’s lead product, heals diabetic foot ulcers (DFUs)twice as fast and three times better than competing alternatives at a lower cost,

Clearly, Lake Street didn’t bother to read the fine print contained within the study, or they may have expressed less of such unbridled optimism.

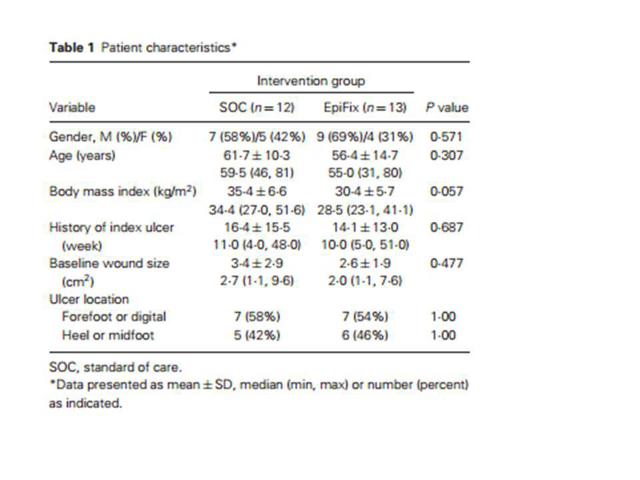

As part of the journal article, there was included a table which illustrated the demographic details of the clinical study for EpiFix. This table is reproduced in identical form as follows:

Anyone who understands clinical trial design (or even just plain statistics) is likely now hitting the “sell” button on MiMedx before reading any further.

The implications of this table should be quite obvious.

On average, patients in the EpiFix trial group were 5 years younger. Their wounds were 25% smaller. Their body mass (i.e. obesity) was around 15% less.

In fact, as shown in the table above, the deviations from the mean are even more significant than the means. With EpiFix, the youngest patient was 15 years younger than in the SOC group. The lowest body mass was 20% lower. The SOC group had a maximum wound size that was 20% larger than for the EpiFix group.

With such a skewed patient population, it would have been truly stunning if the EpiFix trial did not produce a spectacular improvement vs. “standard of care” in the older and fatter people with larger wounds.

It should also be noted that much more reliable results could have been obtained with a proper trial. The original trial was slated to encompass 80 patients. This is already quite small, but ultimately the study only included 25 patients, with a mere 13 patients treated with EpiFix grafts. They then compared the results to a mere 12 patients who happened to be older, fatter and had larger wounds.

The point is that as studies go, this one should not be viewed as being even remotely conclusive. It delivered results that should have been 100% expected – and in a population size that was too small to even matter.

What investors need to understand is this:

As noted above, these amnio products are treated as HCT/P products and as such do not require clinical trials. So what was the point of this study if it was not to pursue a clinical trial? The trial design was so faulty that it clearly would not have passed muster if it were to eventually be used for legitimate clinical trials.

Clearly, it served more of a marketing purpose than a regulatory purpose. The study and a follow-up has been published and has then been subsequently publicized by MiMedx. In November, MiMedx stated that

A competitor recently announced that the clinical study of their products showed that only 52% of their patients both healed in 12 weeks and remained healed at the subsequent 12 week follow-up. An optimal treatment for DFU would be one that supports both rapid and long-term healing. With 94.4% of DFUs remaining healed approximately one year after treatment, we believe our EpiFix® allograft is a clinically effective and economic solution to these needs.

In January, skin substitute competitor Organogenesis (maker of Alpigraf)announced that it had acquired the other major competing product (Dermagraft) from Shire Pharmaceuticals. Together, these two products dominate the market for skin substitutes.

So how do their products compare in terms of clinical data ?

For Dermagraft, we can see the that the pivotal study was far larger and more rigorous. It involved 314 patients in multiple centers (as opposed to the 25 patients in one center for EpiFix).

The study also noted that

If the study ulcer had not decreased in size by more than 50% during the next 2 weeks and the patient met all other inclusion and exclusion criteria, the patient was randomized into the study.

In other words, this competing study took the approach of only attemptingto test on patients who had very persistent and resistant diabetic foot ulcers. They deliberately selected the most challenging patients in an attempt to genuinely see if the treatment would provide a meaningful benefit. This is as opposed to trying to find the patients who would quite obviously be healed as quickly as possible. The result is that the blatant “marketing benefit” is naturally less spectacular.

Likewise, the study for Apligraf included 208 patients, and it is noted that it deliberately “excluded patients who exhibited rapid healing“.

MiMedx management has repeatedly made reference to the “published studies” which tout its product. Yet, it should be clear from the demographics of the 13 patients who were treated in a single site that these studies possess predictable marketing value to a much greater extent than they do scientific rigor.

One might wonder what sort of doctor/scientist would put his name on such a tiny and skewed study. The name of the lead author was Charles Zelen, and it turns out that he was the lead author on three of the six “clinical publications” that are listed on MiMedx’s website. The other three were co-authored by Donald E. Fetterolf, who happens to be chief medical officer at MiMedx. These six studies are the only “clinical publications” listed on the MiMedx website.

The point is that it is very easy to write a “study” and submit it to a specialized journal such as the “International Wound Journal” or the “Journal of Wound Care”. The study will, of course, be published. And then companies such as MiMedx get to make simple statements touting their publication in these journals. It is easy and guaranteed marketing material, even when it lacks the scientific rigor of legitimate FDA trials.

Why should investors care?

The reason to care is that the FDA has already demonstrated that it is cracking down substantially on inappropriate marketing and other practices by those in the skin substitute market. We saw this with the FDA untitled letter for MiMedx in September. But (not by coincidence) we saw the same thing at Osiris (OSIR) for its own skin substitute. An FDA untitled letter was issued to Osiris in October, just one month after MiMedx.

Investors can decide for themselves if the claims being made by MiMedx are well-substantiated given the tiny trial size and the skewed demographics of the participants. They can also decide for themselves what will be the impact of any decision by the FDA to require more rigorous and perhaps fully formal trials.

Understanding the new world of Medicare reimbursement

On November 29th, MiMedx put out a press release to announce that “the Company applauds the Centers for Medicare and Medicaid Services’ (CMS) new methodology for the reimbursement of skin substitutes” which had been released two days earlier.

There are really only two components of the CMS announcement that need to be understood.

The first component is the fact that for the remainder of 2014, EpiFix will retain its Pass Through Status for its third and final year. In effect, the new reimbursement policies will not affect reimbursement at all for the duration of 2014. EpiFix already had Pass Through Status for the past two years, and three years is the maximum allowable. This continuation is indeed moderately favorable for EpiFix, but the duration of only 1 year means that its impact will naturally be limited. But the market has basically priced in the scenario that MiMedx is going to have a permanent cost and reimbursement advantage over its competitors. This has led to inflated expectations for revenues.

In addition, MiMedx was not the only one to receive Pass Through Status. The market seems to have ignored this as well. Osiris was actually granted an additional two years of Pass Through Status, even though its product is widely regarded as among the most inferior of the products on the market. (One key takeaway from this observation is that Pass Through Status is basically being awarded to products that are simply “new” as opposed to being actually “better”.)

The second component is more complicated – and more important. CMS will now be introducing a two-tiered reimbursement system, which will dramatically alter the competitive landscape.

Anyone who is contemplating a long or short investment in MiMedx needs to understand the full details of this new policy adjustment. The text of the November 27th announcement can be found here at the CMS.gov newsroom and the fuller versions here.

Under the “old” system, reimbursement was calculated as average selling price (“ASP”) +6%. Under the “new” system, reimbursement will be split among two types: high cost and low cost.

The old system of ASP+6% basically incentivized the market leaders (such as Shire and Organogenesis) to manufacture one-size-fits-all sheets of skin substitute. As a result, they produced sheets in standardized sizes (ie. cheaper to manufacture) and in sizes that were too big (i.e. reimbursed at cost plus, so maximizing revenues). The predictable result was massive amounts of waste when 40 sq cm of standardized substitute had to be purchased just to treat a wound that was 2-3 sq cm in size.

Many may find it galling to know that such a system of perverse incentives was in place and running. These manufacturers were clearly incentivized to only produce their products in a size that guaranteed substantial overcharging and waste. But we should also be happy that the once-flawed system has been analyzed and tweaked to reduce product waste and economic waste. At least the supervisory feedback function has had the desired effect.

Under the new system, “high-cost products” are those with an ASP of $32/sq cm or higher. These will be reimbursed at $1,371.19 for up to 100 sq cm of product. Wounds over 100 sq cm will be reimbursed at a maximum rate of $2,260.

“Low-cost products” are those with an ASP below $32 per sq cm. They will be reimbursed at a rate of up to a maximum of $409.41 per 100 sq cm of product.

Understanding the competitive response to the CMS changes

Just after the CMS announcement (and – of course – just prior to the equity offering), small cap investment bank Craig Hallum put out a “quick note” to explain the implications of these massive changes on MiMedx. The note was just one-page long and noted the following:

The two market leading products, Apligraf® and Dermagraft®, are not offered in a size-appropriate graft which is the chief reason for $100M in annual wastage prompting this decision by CMS. Prior to this new regulation, all reimbursement was set at ASP +6% which is why the competition was able to establish market share in the first place.

While the final rule paints a slightly better picture for MDXG’s competitors, they will still have to cut prices substantially or file PMA supplements in order to remain a competitive force in the years ahead. With this new rule, we believe MDXG could garner an incremental $50M in revenues over the next several years as the Company establishes a dominant position in the wound care marketplace.

This justification was used to state a $9.00 target (50% above the prevailing price at the time).

Basically, what Hallum is saying is that the competitors will simply to continue to offer wrong-sized products at non-competitive prices despite new and different incentives to offer smaller products at rational prices. Ergo: the Craig Hallum banking client should be expected to rise by 50% (just in time for the company to raise $39 million in an equity offering).

This assumption is pure and unadulterated nonsense, and we will soon see that it will not play out in reality. It was nothing more than an excuse to justify a high share price target ahead of an equity offering in which Hallum hoped to be well-paid. The competitors will certainly change their product offerings in order to provide an economically rational (i.e. size-appropriate) product which will be reimbursed at proper rates accordingly.

Craig Hallum does include a minor mention of these competitors who would enjoy a “slightly better picture” in its one-page report. But it notes that “Dermagraft” by Shire and “Apligraft” by Organogenesis are nearly 2-3x as expensive as EpiFix, while they are to be reimbursed at the same rate.

Craig Hallum ultimately was selected as a lead manager on the equity offering alongside bookrunner Canacord and pulled in substantial fees a few weeks later, just as the share price was soaring on the back of upgrades like this.

Looking at past examples – history is repeating itself

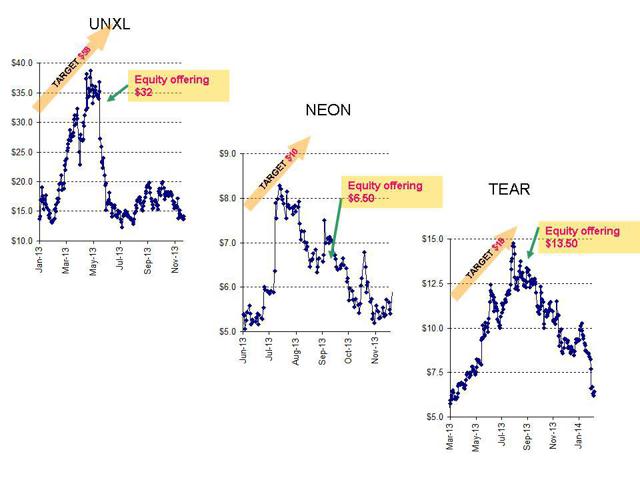

Readers who have followed my articles over the past year may remember that I have repeatedly called out similar research nonsense from Craig Hallum during 2013. Each of my articles said the same exact thing: over-bullish research calls were preceding investment banking deals by Hallum clients. The stocks soared, the equity was issued. Craig Hallum got paid their fees. Then the stocks tumbled.

Past Hallum examples (which I wrote about) included TearLab (TEAR), Neonode (NEON) and Uni-Pixel (UNXL). Readers will also remember that I was proven right about each one of these stocks within either a few days or a few weeks at most.

From the time I wrote about each of these Hallum stocks, each is now down by at least 20-30% – despite predictions of double-triple digit gains by Craig Hallum.

In each case, these Hallum bull calls came just in time for Hallum to help them issue stock. Hallum made millions in total fees. In each case, the bullish predictions came unraveled not long after the equity offering was completed.

Following the equity offerings, these banks tend to provide a few weeks of bullish support for their banking clients, helping to support the stock. If they did not do so, they would certainly aggravate their hedge fund clients who bought into the deals.

But we can see that reality is typically quick to set in, and the share price cannot sustain itself forever once real revenues fail to materialize as predicted in the bullish (pre-financing) research reports.

Perhaps a few examples would help to illustrate.

Prior to recent earnings, Hallum had an $18 target on TearLab. As with MiMedx, this was apparently based on the supposedly stellar growth prospects. What about Canaccord? Canaccord had a $19 target. Even though the growth prospects were challenged and the valuation was already excessive, TearLab’s investment bankers, by coincidence Hallum and Canaccord, raised $35 million for TearLab, making several million in fees. The offering price was $13.50. Since that time, insiders have been steady sellersof shares at prices around 40-50% below the banker targets.

On November 8th, I published an article entitled “Earnings Miss Will Send TearLab Sharply Lower“, which showed that my own research (including phone calls to dozens of eye doctors who were supposedly TearLab customers) indicated a very high likelihood of

a share price decline of at least 25% to around $8.50 or below.

The share price had been sitting at around $11.00 at the time and the earnings were (as expected) the catalyst for a quick and sustained sell-off. Shares of TearLab now trade for around $6-7 – down by around 40% since my report, but around 66% below the targets put forth by Hallum and Cannacord, which still sit at $18-19.

On Uni-Pixel, I also called out the Craig Hallum client as being the subject ofirrational and unsubstantiated promotion. At the time, the share price was around $15. As with MiMedx (and TearLab), Hallum repeatedly raised their share price targets on Uni-Pixel (ultimately to $58, up from a share price of $10). This caused the share price to trade to over $40. Of course, this was just in time for Uni-Pixel to complete an equity offering of over $30 million with Craig Hallum an investment banker. Then, of course, the company failed to live up to the sky-high projections put forth in the (pre-financing) Hallum research. After the equity offering was complete, the stock quickly began to plunge and now sits at around $9.00. Hallum has since (i.e. after collecting its investment banking fees) reduced its price target on Uni-Pixel to just $9.00 from $58.00 – certainly a significant (post-investment banking) target revision.

But wait… I’m not done.

In September, I published a warning about Hallum client Neonode . Despite losing the majority of its revenues and its largest client, Hallum saw fit to upgrade $5.00 Neonode to a $10.00 target price. The stock soared (even though Neonode had just delivered a painful earnings miss). What followed was quite predictable. A Craig Hallum-led equity offering in which management were the largest sellers. As with MiMedx, Neonode management was very eager to sell their personal holdings at current prices even though Craig Hallum was telling outside investors that the stock will continue to soar by double-digit percentages. When I wrote about Neonode, the stock had been sitting at around $7.50. The stock since fallen to around $5.50-5.70 (a decline of around 25% – and a shortfall of 50% vs. the latest Craig Hallum target.)

But let’s not forget about Canaccord’s involvement here.

As we look at the ratings on MiMedx by Canaccord and Hallum, we can see that Canaccord started at $6.00 in October but doubled this to $12 by December, the month of the equity offering. Hallum started in March at $7.00 and then raised to $9.00.

The charts tell the story best. Here are the charts of the research-driven run-ups before the predictable equity offerings. The charts also show thepredictable plunges once the hyper-optimism for these high-priced “growth stocks” fails to result in concrete results.

The pattern, for those who might have missed it, is that a money-losing company (who happens to need to raise money) is bestowed with a series of sky-high share price targets. When the share price rises, the target is simply raised higher.

Then the company issues a large amount of stock (paying its banker/research provider millions in fees).

The stock is typically strong for a while, which is clearly good for the hedge fund clients who bought the deal.

But then when the excessive optimism fails to translate into reality, the hedge funds disappear and the stock inevitably falls back to where it began.

Readers should please keep in mind that the examples above were not cherry-picked for the convenience of this article. These examples were given because they were all stocks which I wrote about in 2013 and where I warned about this exact sequence of events well before they materialized.

MiMedx is the exact same example. There are overly bullish forecasts being put forth despite commonsense evidence to the contrary which is patently obvious. Now that MiMedx has already raised its $39 million in proceeds, and now that the CEO and the largest outside shareholder have begun selling stock, there is every reason to expect substantially more downside to come in the next few weeks.

Conclusion – what is MiMedx worth?

As with TearLab, Neonode and Uni-Pixel (among others), MiMedx has achieved a spectacular valuation of 10-20x sales based on hyper-bullish projections for future growth which will supposedly be driven by some tremendous recent catalysts.

But the analysts providing these numbers also happen to be the investment bankers to the company and stand to make millions in fees if the company selects them to underwrite the offerings.

By contrast, investment banks (as well as research analysts) have no method of monetizing any level of accuracy in their stock picks.

These analysts have blatantly ignored the flaws in MiMedx’s “clinical study” and have turned a blind eye toward the very obvious competitive reaction that will occur following CMS reimbursement changes.

These same banks were among the ones who made identical leaps of faith in projecting triple-digit rises in the shares of TearLab, Neonode and Uni-Pixel (among many others).

Best-case scenario is that MiMedx continues to execute and that the valuation finds a sustainable level. This probably puts MiMedx at around $4-5.

But worst-case scenario is that there is fallout from the FDA in terms of regulating one or more products and that the competitive response from the well-funded competitors is in line with what should be expected.

If this is the case, then MiMedx will not be profitable at any time in the near future and the share price is more likely to stabilize at around $3.00.

Disclosure: The author is short MDXG