On Wednesday August 7th, Biolase Inc (BIOL) announced Q2 results. The company missed analyst estimates by 2 cents and updated investors with guidance at the lower end of previously given ranges.

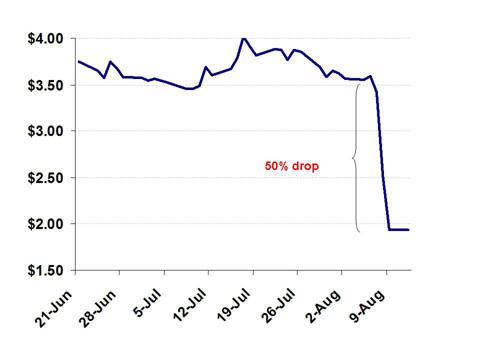

Missing earnings is never a good thing. But as earnings misses go, this one was certainly not catastrophic. Despite the moderate nature of the miss, shares of Biolase began to plunge in the days that followed. The shares have now fallen by 50% in the week since earnings. The shares have not traded up on a single day since earnings. Clearly something bigger is going on.

As shown below, further steep declines in Biolase are highly likely in the next few days due to the need to issue a large amount of equity, regardless of the price.

The company’s $30 million S3 registration statement should be effective within days, at which time the offering can proceed. Biolase is in a position where it simply must complete an offering, such that even if the price falls to $1.00 or below, the offering must still proceed.

What has happened is that details given in the 10Q and the earnings call have revealed that Biolase is now in the middle of a near term solvency crisis. Yesterday, as the stock was hitting $1.80 (down 50% since earnings), Biolase put out a brief press release, repeating what it had already stated in the recent 10Q, that Comerica Bank had waived Biolase’s non-compliance until September. But, as expected, the stock price was not cheered and continued to fall 7% further that day. Following the press release, Biolase closed at $1.81, a new low for the year.

As confirmed in the press release, Biolase is now in violation of its bank covenants. It has around 19 more trading days in which to rectify this situation before the Comerica deadline. Biolase has already given weak guidance for the remainder of the year such that any turnaround in financial performance will not be able to repair the situation with Comerica.

The only way for Biolase to repair the situation with its lender will be to issue a substantial amount of stock at whatever price the market will bear within the next 19 trading days. Biolase knew that this situation was coming, so they filed a $30 million S3 registration statement just a few days before earnings. Had the S3 been effective, Biolase would presumably have already issued stock immediately.

On the conference call Biolase specifically highlighted the filing of the S3 as its source of liquidity when discussing its low cash balance and the situation with its credit facility. As a result, there should be very little uncertainty with respect to the company’s intentions about issuing stock.

The $30 million S3 was filed on July 26th. Yesterday (after the close) Biolase filed the amended S3 which included reference to the latest 10Q and the latest share price. It confirmed a maximum size of $30 million. There were no other changes of substance. As a result, the S3 should be effective within a matter of days.

At that time Biolase will need to issue stock almost immediately. The biggest threat to Biolase is now that the stock will continue to fall before the offering can be completed. Either way, once the S3 is effective, we can expect a very quick offering by Biolase which will likely come with a discount of at least 20%. Given the distressed nature of the company at present, the offering will likely require additional issuance of warrants.

The market has already figured this out. This is the reason for the continuing plunge in the share price.

It doesn’t matter where the stock appears to stabilize, investors always become aware that a further drop is guaranteed because of the need to issue stock at any price. Hence, the selling continues.

Biolase has not risen on a single day since releasing earnings.

Certainly Brecken Capital saw this coming. The fund had previously owned around 9% of Biolase but began selling down its holdings following disappointing Q1 results. As soon as the S3 was filed, Brecken reduced its stake to exactly 4.99% which allows it to sell further without making any disclosures. Had Brecken attempted to dump larger amounts of stock earlier, the reported sales would have spooked other investors making additional sales difficult for Brecken. Instead, Brecken conducted a very smart stealth exit from Biolase.

Everyone knows that an offering is coming. Everyone also knows that the discount on the offering will be very large due to Biolase’s distressed financial condition. This has created a viscous circle of selling.

Now there is the additional problem that as Biolase’s share price continues to fall, the market cap is now getting dangerously low. There becomes the very real risk that Biolase will be forced to issue substantial amounts of stock at prices below $1.00. But at those prices, Biolase would struggle to raise a sufficient amount of money to satisfy the bank while continuing to run its business.

On its recent conference call, Biolase management disclosed that revenues were 7-10% lower than internal goals for the quarter. Gross margin fell from 55% to 39%. The net loss grew to $2.6 million. Cash balance has now fallen to just $2 million and management disclosed that the company will not generate cash flow for the year.

Total stockholders equity has now fallen to just $8 million. Meanwhile Biolase owes at least $6 million to Comerica.

According to the credit agreements, Comerica has the right to declare all amount outstanding to be immediately repayable in the event of a default. Biolase is now in default due to its failure to maintain $500,000 of EBITDA. But clearly Biolase does not have the money to repay Comerica.

As a result, Comerica had no choice but to waive the default for Biolase for several weeks. As an initial move, Comerica did begin curtailing credit to Biolase to restrict any future borrowing. The credit facility has just beenreduced from $10 million to $7.5 million.

Often times there are creative ways for distressed companies to gain some additional traction with their lenders during hard times. Unfortunately, Biolase appears to have already exhausted all of these extreme measures.

The receivables have already been placed in a “lock box“, such that Biolase cannot touch any of the proceeds from these sales until Comerica first receives the money and services the debt.

Next, substantially all of the assets of Biolase have been pledged. This is not just assets which are presently owned, but also against any assets which may be acquired in the future.

As disclosed by Biolase

Lockbox arrangements under the revolving bank facilities provide that substantially all of the income generated is deposited directly into lockbox accounts and then swept into cash management accounts for the benefit of Comerica Bank. Cash is disbursed from Comerica Bank to the Company only after payment of the applicable debt service and principal. At June 30, 2013 and December 31, 2012, there were no restricted cash amounts. The Company’s obligations are generally secured by substantially all of the Company’s assets now owned or hereinafter acquired.

Also disclosed was that Biolase issued 80,000 warrants to Comerica with a strike price of $2.00. This warrant would have been an incentive payment from Biolase to Comerica. The warrant was issued in 2012 and was fully exercised by Comerica in 1Q2013. The issuance of stock warrants to maintain a lending relationship with a bank is a very unique occurrence. But the issue is that stock and warrants are the only currency that Biolase can currently make use of.

What we can see is that anything resembling an asset has already been given to the bank as security. There is nothing left to give. When assets ran out, Biolase began giving the bank warrants on its stock. But with the share price is a tailspin below $2.00, there is little value left to be given to the bank.

As a result, Biolase has no choice but to issue equity at any price, regardless of how low.

How did we get here ?

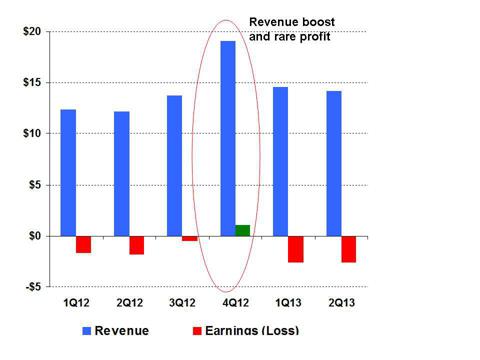

Biolase has been in business for nearly 20 years but has consistently failed to generate profits.

After years of consistent losses, investors and analysts were cheered in March, when Biolase released Q4 results. In Q4 Biolase reported a rise in revenue and a very rare profit. The hope was that after decades, Biolase might finally be turning the corner. The shares rose to a multi year high of over $6.00, up from just $1.50 last year.

This hope was darkened when a disappointing Q1 was reported (including a resumption of net losses and a dangerous drop in cash). The shares quickly fell to below $4.00.

Q2 results the smashed all hopes completely. It was another money losing quarter along with discouraging guidance. Within days the stock was trading below $2.00 again.

The ongoing net losses have been a notable drain on cash. Biolase has not shown any positive cash flow from operations in the past 4 years. The only source of cash which has carried Biolase through up until now has been the proceeds of its $18 million equity offering competed two years ago.

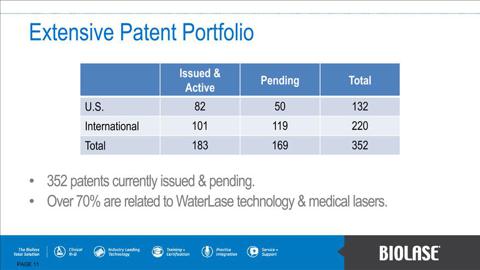

Over the course of the past year, there have been numerous headlines detailing Biolase’s progress with various patent and partnership initiatives. This lasers for Ear, Nose and Throat (“ENT”), eye conditions such asGlaucoma, and the NewTom oral imaging product.

It may be the case that over coming years, one or more of these products might start to become a meaningful contributor to recurring revenue. However investors have largely learned to tune out these announcements until they produce real results.

As shown in its recent presentation, Biolase already has 352 patents on various new products issued and pending. Over 70% of these are related to WaterLase technology. Yet despite the progress on hundreds of patents over the past few years, there has been very little translation into recurring revenues. This is why investors have largely tuned out the similar announcements during 2013.

Biolase has already put out guidance that it hopes to achieve approximately $68 million in revenues for 2013. This is the low end of what had previously been announced. This would be an improvement over 2012, but would still only put Biolase back on track with the revenues it had achieved in 2006. Biolase has not given guidance for when we would expect to see quarterly profits instead of quarterly losses.

When explaining the difficult Q2 results, Biolase offered a laundry list ofexcuses, including:

– disappointments in Germany

– delivery delays from Europe

– flooding in Canada

– non approval from Health Canada of Epic 10

– generic problems with Obama care

– rising interest rates

Basically, anything that could possibly go badly did go badly. But this has been consistent for years now. This was not an unusual quarter for Biolase.

In reality, management used incredibly poor judgment in waiting to issue equity. In Q1 the cash balance was already down to $1 million, such that the need for an offering should have been very clear. The share price had traded as high as $6.00, meaning that over $20 million could have been raised at a very attractive price. This would have given Biolase complete freedom to run its business for the next year or two without any cash constraints.

Instead, management waited until the cash was desperately needed. This has created a self fulfilling prophecy of a plunging share price and created significant uncertainty as to whether or not Biolase can raise enough money to satisfy the bank and keep funding operating expenses.

Near term investment thesis

In the near term, solvency concerns and the need to issue stock will entirely control Biolase’s share price. Biolase will be forced to issue up to $20 million of stock. If the stock price can hold up for a few more days then Biolase may be able to issue stock at around $1.40-1.50. But if the stock continues to fall then the offering price could start to approach $1.00. This is an urgent financing for Biolase and therefore the offering should be expected as soon as the S3 becomes effective. This could easily occur within the next few days.

Company background and investment considerations

The corporate predecessor of Biolase was Societe Endo Technic, SA an endodontic and laser product company founded in 1984 in Marseilles, France. In 1994 the company changed its name to Biolase and in 1998 the company adopted the focus it maintains today, developing, manufacturing, and marketing lasers for applications primarily in dentistry as well as dental imaging equipment.

The most important segment of the company’s business is its lasers. Biolase has two categories of lasers, Waterlase, its flagship product, and Diode. Using patented technology, Waterlase combines water and laser energy to perform procedures that would otherwise require dental drills, scalpels, and other traditional cutting instruments. Diode is used to perform less invasive procedures such as pain therapy and teeth whitening. Biolase has 160 issued and 150 pending patents for its laser technologies.

As the company’s flagship product, Waterlase is the most important part of Biolase’s strategy. The key selling points of Waterlase are that compared to traditional methods it reduces pain while improving the safety of dental procedures. Biolase also claims that Waterlase has an advantage because it may be used on both hard (anything involving teeth and/or bone) and soft tissue, something that is not available in other technologies.

Biolase cites the 2007 American Dental Association Survey of Dental Services Rendered ( the “ADA Study”) indicating that more than 200 million hard tissue dental procedures are performed annually in the United States alone. The existing technologies that are currently being used for the vast majority of these procedures are high speed drills for hard tissue (preparing cavities for filling, root canals) and cutting instruments for soft tissue (reshaping gum lines and related procedures).

High speed drills can be problematic because their forces may damage the patient’s dental structure, potentially even causing the patient to need another procedure. Also, drills obviously require anesthesia, and because it is not recommended to anesthetize more than half of the mouth at once, a patient may have to return for multiple procedures if drilling is required in many different parts of the mouth. Finally, the tools used in these procedures can potentially pose risk of infection to patients. According to Biolase, 15 % of dental burs carry “pathogenic microorganisms” which may infect a patient. Cutting tools used on soft tissue don’t appear to be nearly as problematic, but Biolase claims that the discomfort and bleeding are problematic compared to the reduced difficulties that result from use of its lasers. As stated above, Waterlase precisely cut hard and soft tissue with “little or no” damage to surrounding tissue.

While reduced discomfort and tissue damage is obviously a key benefit for patients, the benefits for dentists are at least as important as they are the decision makers.

The company believes that dentists benefit from using its products because of the additional procedures that may be performed using Waterlase that would not be available to dentists with traditional tools. This gives the dentist an opportunity to increase his or her revenue. Biolase also believes that the reduced discomfort provided by its lasers may increase the patient base for dentists who use them, and that the reduced number of post-operative complications that result from reduced surrounding tissue damage will be an important benefit as well.

The company admits that currently only a small percentage of dentists use lasers, and that they are more expensive than traditional tools. Biolase is clearly hoping that its products are in fact superior to the degree it believes, and that as a result its lackluster sales growth thus far will be replaced by more impressive performance. With all this in mind, Biolase is optimistic on the market demand for flagship Waterlase as well as Diode and its other products. However, its important to note that these products have already received FDA approval and have therefore already been exposed significantly to the market, meaning that much of the growth is already factored in with current market acceptance.

Of secondary importance in the company’s product line is dental imaging equipment. Biolase also has three main products in this category, the DaVinci Imaging, Cefla NewTom, and Trios intra-oral CAD/CAM. These systems provide an advantage over traditional technology because they are capable of providing three dimensional images as well as color and higher quality. They also have no time delay. Similarly to the lasers, these provide an advantage to dentists because they may increase the range of possible procedures as images that provide more information due to their more detailed and three dimensional nature may detect problems that would otherwise go undetected for longer periods of time.

Disclosure: I am short BIOL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.