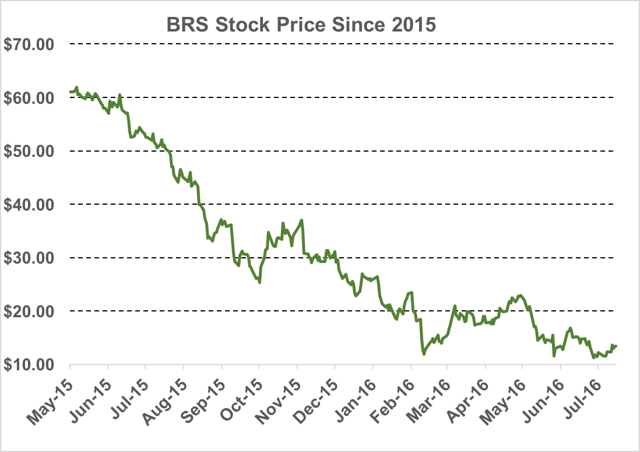

- Bristow is down by 80% since mid 2015 as bankruptcy fears continue to slowly play out. The moderate recovery in oil prices has been unable to help Bristow recover.

- Bristow has just suffered a massive impact due to excess unhedged currency exposure to the British Pound (quite bad) and the imploding Nigerian Naira (even worse).

- Accelerating resignations from various management and board members. Key replacement director notably has highlighted specific expertise in bankruptcy.

- In a best case, BRS delivers very outsized losses going forward. In a worst case, BRS violates debt covenants and faces default.

- Recent statements by management are blatantly at odds with previous SEC disclosure. SEC inquiries into the use of offshore tax havens may have a separate impact on the stock.

This article is the opinion of the author. Nothing herein comprises a recommendation to buy or sell any security. The author is short BRS. The author may choose to transact in securities of one or more companies mentioned within this article within the next 72 hours. The author has relied upon publicly available information gathered from sources, which are believed to be reliable and has included links to various sources of information within this article. However, while the author believes these sources to be reliable, the author provides no guarantee either expressly or implied.

This report is divided into three sections.

SECTION I details a string of recent critical problems hitting Bristow just ahead of earnings. Numerous issues do not appear to have been disseminated to or digested by the investing public at all. The fact is that Bristow has massive unhedged currency exposures to both the British Pound (down by nearly 15% in 3 weeks) and the Nigerian Naira (down by 40% in 3 weeks). However, numerous other issues are detailed, including concerns over UK Search and Rescue. In just 9 trading days, Bristow is set to host its quarterly earnings call and will be forced to disclose these impacts. I expect a nearer term decline of 40-50% on the stock (share price down to around $6-8). However, as with its recently bankrupted competitors, the prospects for an actual default within 9-12 months remains moderate to high (share price to below $1). This is precisely what we have seen with Erickson Air Crane (NASDAQ:EAC), CHC (HELIQ) and other helicopter operators, which imploded by 99% as their credit situations unraveled.

SECTION II primarily focuses on a line of SEC inquiries into Bristow. In early 2015, (when Bristow was still profitable and supposed to pay taxes) the SEC began inquiring into certain offshore tax strategies being used by Bristow. Bristow first attempted to give limited, partial responses, but the SEC persisted with further inquires and demanded details of Cayman Islands and other offshore entities. It was eventually revealed that these entities accounted for nearly half of pre-tax net income. In the midst of the inquiry, Bristow’s then-CFO John Briscoe abruptly resigned prior to completing the response to the SEC. The company stated that he was looking to “pursue other business opportunities”, however he never ended up moving elsewhere. He simply quit. The CFO spot was then filled by an internal appointment, Don Miller, who had previously been in charge of Bristow’s M&A. Presumably Mr. Miller would have had little exposure to Bristow’s offshore tax operations. However, within just 9 business days, Miller then completed the final response to the SEC. Prior to running M&A at Bristow, Miller had spent 9 years with Enron North America. Prior to Enron, Miller had advised Enron from his prior position at Citigroup.

Shorting a stock based on expectations for an SEC action can take great patience. So instead, my focus of interest is how formerly utilized tax strategies may have allowed Bristow to underbid on projects such as the UK Search and Rescue operations. Even prior to any SEC action, to the extent that Bristow is unable to maintain such a competitive advantage, it would have a further negative impact on profitability for things such as UK Search and Rescue (among others). As of now, UK Search and Rescue, while only 11% of revenues, remains the one bright spot for Bristow, amidst sharply declining revenues elsewhere. Details of UK Search and Rescue are included in Section I. With nearly 50% of pre-tax income being parked in offshore tax havens, there is also the possibility that Bristow will have to repay substantial back tax liabilities at a time when it can no longer afford to do so. The actual prospect for an outright SEC action remains as a “put option” on the price of the stock.

SECTION III highlights the consistent failures of sell side research in covering Bristow. Recent reports by Cowen, Barclays and Credit Suisse have consistently downplayed or disregarded the recent negative developments and maintained lofty share price targets. In each instance, sell side analysts ignore obvious problems and simply echo the hyped up optimism of management. These reports have served to drive money into the stock, visibly propping up the share price. The sell side has consistently pumped the stock since it was trading at $60, and continues to pump it all the way down. Not surprisingly, these analysts generally come from the banks who have run Bristow’s past debt and occasional equity offerings over the years. Given Bristow’s constrained finances, the company is now a high priority investment banking client as it needs to raise money in the near term. More importantly, a number of the banks have served as lenders to Bristow. As a result, they are virtually certain to NOT issue anything that looks like concern over solvency.

In Section III below, I highlight the repeated examples from their research reports where they have ignored obvious problems which then quickly materialized and pummeled the share price. I also show how despite the ongoing implosion in the share price, these banks continued to pump the stock by simply quoting and echoing incorrect statements from Bristow management.

Section I – Bristow Group headed for a 45% decline

When I look for compelling shorts, I generally look for stocks which have at least 30-50% downside. And that is what I usually predict when I write about them in public.

But I have consistently found that these troubled stocks end up falling much more than 50% once their problems are exposed. Many of the stocks I have exposed quickly fell by 75-99%.

Examples include: Revance Therapeutics (NASDAQ:RVNC), SunCoke (NYSE:SXC), ForceField Energy (NASDAQ:FNRG), Regulus (NASDAQ:RGLS), Aemetis (NASDAQ:AMTX), Biolase (NASDAQ:BIOL), TearLab (NASDAQ:TEAR), CytRx (NASDAQ:CYTR),, Galena (NASDAQ:GALE), Northwest Bio (NASDAQ:NWBO), Ignite Restaurants (NASDAQ:IRG), among others.

The mot important factor with each of those stocks above was to identify a near term catalyst.

In particular, readers should refer to my article on helicopter operator Erickson Air Crane which subsequently declined by 98%, now trading at around 60 cents down from $25. According to the subsequent lawsuits, the concerns I highlighted were the precise primary cause for the collapse in the share price.

As with Erickson, Bristow Group (NYSE:BRS) is set for a very substantial decline and there is also a near term catalyst.

To paraphrase an old joke:

Q: What’s the best way to become a millionaire ?

A: Start with a BILLION and run helicopter company.

I can’t decide whether I think that management at Bristow are truly bad actors (dishonest) or whether they are just incompetent bunglers. In reality, it doesn’t much matter because the effect has been the same. Yes, I get it, times have been tough for anyone servicing the oil and gas industry. The offshore helicopter industry has been hit particularly hard, as evidenced by multiple recent bankruptcies.

But the point is that management has continuously and repeatedly given dramatically incorrect reassurances to shareholders about Bristow’s performance and prospects. These guys have repeatedly demonstrated that they will say ANYTHING in an attempt to keep the stock up.

With each quarter comes a new set of excuses for the past, as well as promises for the future. But in each case, when the actual results do come out, management is somehow “surprised” by new negative factors. I will demonstrate this in great detail below.

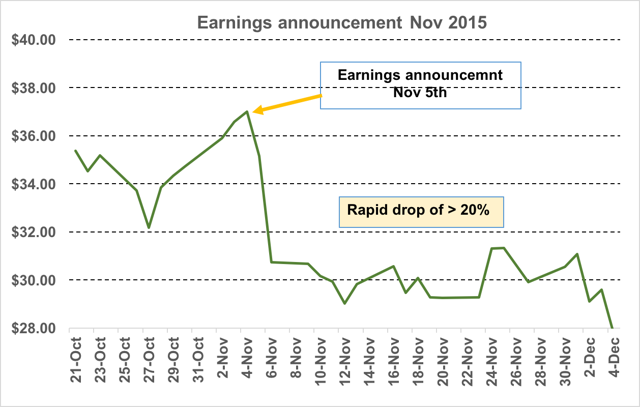

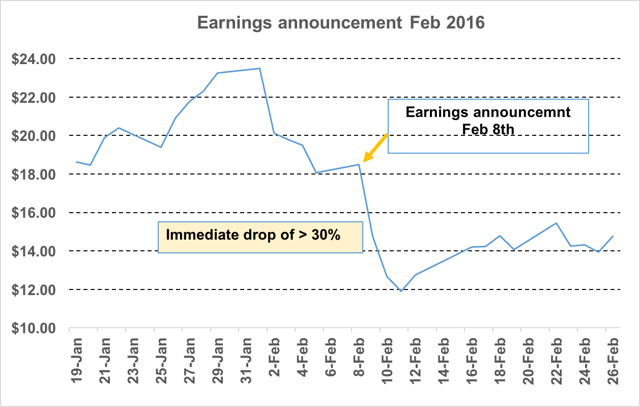

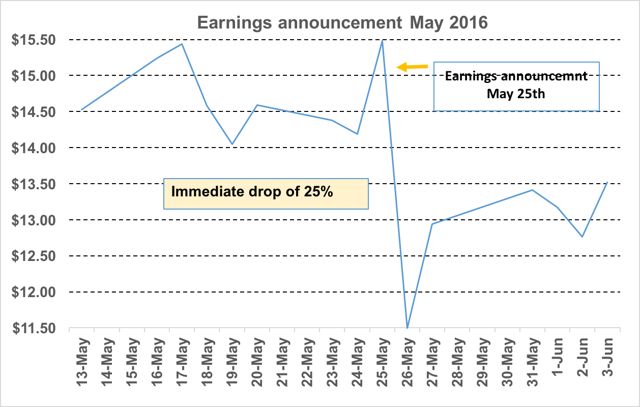

In each of the past 3 quarters, the share price quickly fell by at least 20-30%following management’s earnings call due to disappointing “surprises” from management.

The upcoming quarter, to be announced in 9 trading days is going to contain some shocking new disclosures for investors. The share price will once again take a significant dive.

As we have seen repeatedly in the past, currency “headwinds” (historically from less significant regions for Bristow such as Asia and Brazil) have been a consistent theme in Bristow’s large miscalculations, leading to significant losses and drops in the share price.

In fact, the impact of massive unhedged currency exposures is about to get much worse.

But doesn’t Bristow hedge its currency exposure ? (No, they don’t)

I find it downright bizarre that a company with such tremendous currency exposure around the world does not even bother to hedge its exposure with futures or other contracts.

But this is indeed the case. Bristow does not hedge its currency exposure.

On page 21 of the 10K, Bristow notes that:

Generally, we do not enter into hedging transactions to protect against foreign exchange risks related to our revenue or operating expense.

In a subsequent presentation, Bristow addressed the question by stating that they simply “naturally hedge our currency exposure through client contracts when possible“. But this has clearly and consistently not worked at all, as demonstrated in recent quarters.

In the previous year, currency moves were not nearly as extreme as recent moves, yet “surprise” currency moves saw Bristow operating revenue decline by $98.6 million year-over-year. The hit to net income was $30 million. And again, these were not drastic currency moves.

In order to avoid breaching loan covenants, Bristow has been forced to cut its dividend by 80%, slash cap ex and eliminate cash bonuses for employees. The loan covenants were renegotiated in May. But in fact, all of this was BEFORE the new and negative currency developments occurred.

As we will see, due to recent extreme currency moves, things are about to get quite substantially worse for Bristow and so far management has clearly failed to disclose the full impact to investors.

Currency impact mostly affects revenues and earnings (as opposed to balance sheet)

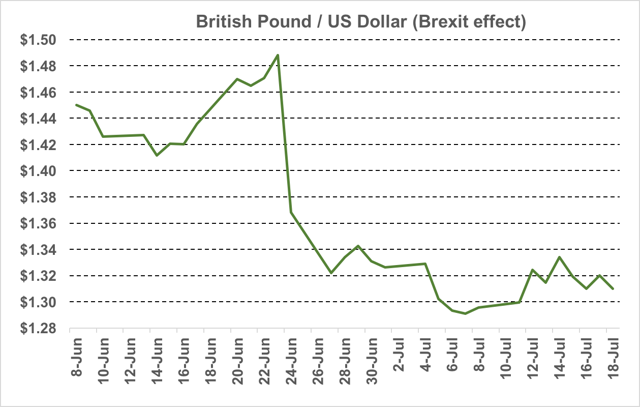

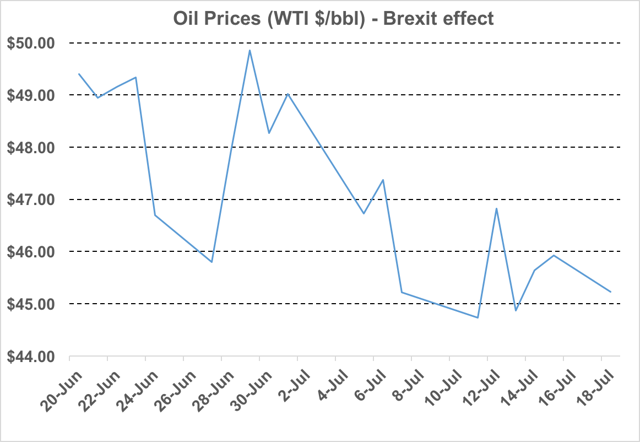

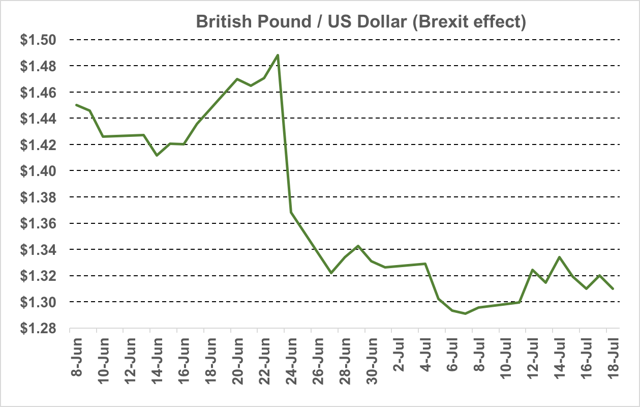

Over just the past few weeks, Bristow has clearly been heavily impacted by due to the 15% fall in the British Pound (approaching 20% decline since last year). European (primarily North Sea) revenues comprise fully 50% of Bristow’s total.

I am primarily focused on the significant revenue / net income impact of the currency plunge. But given that Bristow has historically kept nearly half of its earnings “indefinitely reinvested abroad”, there could also be a negative balance sheet impact it the tens of millions of dollars.

Nigerian revenues are around 15% of total, which doesn’t seem overly large. But in June, the Nigerian Naira dropped by a massive 40% when the government stopped defending its historical peg to the dollar. Bristow had previously disclosed the potential for very substantial exposure to moves in the Naira. But because the currency has historically been pegged, no one has paid much attention to this. Following the move in the Naira, Bristow has disclosed nothing to the general public.

Note that I expect very little near term impact on the balance sheet from the Naira. In fact, Bristow may even be slightly net short the Naira (with more Naira liabilities than assets), however this likely amounts to less than $1 million. So the balance sheet impact is likely immaterial in either direction. Instead, the main impact from the Naira will be a plunge in revenues and sharp increase in Bristow’s ongoing losses.

Disclosure shortcomings – past and present

Just prior to Brexit, management insisted in SEC filings that it had absolutely no material exposure to any fall in the Pound. This limited the damage to the share price during the Brexit days. But shortly after Brexit,management quietly admitted that the exposure could in fact equate to tens of millions vs. 2016 operating income. In fact, I now think it could be much more.

Following the collapse of the Naira, management has made no disclosure of the actual impact. On its Nigerian operations. But as we will see below, at a minimum it is likely to equate to 22% of Bristow’s entire 2016 global operating income. This will soon need to be disclosed in the upcoming earnings call. And, as with the Pound, I suspect that the actual number could be much greater.

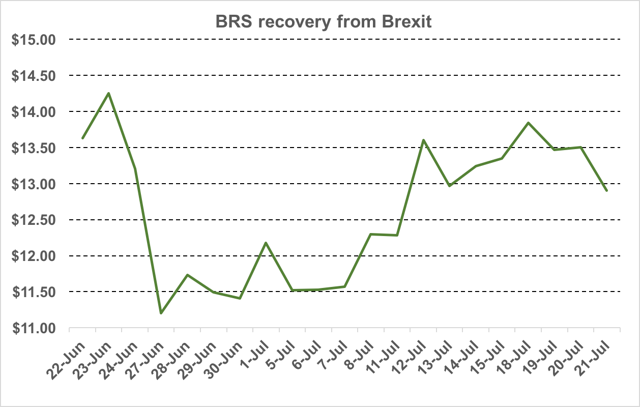

Despite the enormity of its impact, the crashing Naira has not even been noticed by Bristow investors or reflected in the share price. The share price did dip briefly on Brexit, but has since recovered much of those losses.

As it has repeatedly done in the past, Bristow management has continued to publicly put on a positive spin to support the weak share price. As expected, sell side analysts simply echo the positive statements from management.

These statements will be dissected in detail below.

When times were good, Bristow refused to issue much stock at share prices over $60 and instead continued to lever up substantially with debt. The share price has since fallen to as low as $10.80. Debt load now exceeds $1.1 billion vs. a market cap of around $450 million. Multiple competitors have recently already gone bankrupt but are still operating. They are undercutting Bristow and price and flooding the market with used helicopters, eliminating Bristow’s ability to monetize their own.

Earlier in 2016, bottom feeding “value hunters” might have been tempted to think that Bristow trades at a discount to book value.

But in terms of “asset recovery” in a bankruptcy situation, Bristow’s helicopter assets are now worth far less than the book value stated on the balance sheet. Just in May2016, following the bankruptcy of competitor CHC, Oil and Gas People noted that:

With the market conditions for helicopters so poor there is a lot of idle aircraft around, if CHC have 100 or so that they want to get rid of, then how many do the other big players in the market have? The leasing companies of course won’t want these aircraft back but under Chapter 11, they have no choice. With regards to buy back, the market is flooded with unused helicopters with supply far outstripping demand. The leasing companies have a couple of choices, receive the airframes back under chapter 11 and receive no payment at all or sell the airframe at a discounted market value price and get shot of it?

A search in the 10K for the word “impair” turns up 175 hits.

For 2016, Bristow already recorded a loss on impairment of $55 million and an additional loss on disposal of assets of $30 million.

Because the assets are so heavily impaired, and because of the heavy debt load, the downside in the share price remains quite large.

The point of this article will be that when details of massive exposures incurred in recent weeks becomes public, the stock will quickly fall by 40-50%. It may take more than one day, but I expect it to settle at around $6-8.

We have seen this repeatedly in the past. In each of the past 3 quarters, the share price quickly plunged by at least 20-30% due to new surprises disclosed at the last minute by management.

Anyone foolish enough to see this information and still hold through another disastrous upcoming earnings call certainly deserves the losses they have coming.

Yet despite an almost inevitable plunge in the Bristow share price going forward,short interestin Bristow Group remains below 10% of the float and the borrow is cheap at around 1%.

Company overview and investment summary

Headquartered in Houston Texas, Bristow Group is an operator of helicopter services in various locations around the world. The majority of its consolidated operating revenues (76% of total) come from providing flight services to oil the offshore oil and gas industry, with heavy exposure to the North Sea (Britain and Norway). Operating income is also heavily exposed to operations run in Nigeria. The firm also provides Search and Rescue services as an adjunct to various governments as well as running a helicopter training school in Florida. However, both of these segments account for much smaller portions of revenue.

Bristow has plunged by 80% since mid 2015, largely due to the plunging price of oil. The stock was hit again on the Brexit vote in June due to Bristow’s heavy exposure to the UK, but since the stock has regained much of the brief Brexit losses.

Bristow Group has been around in one form or another for decades. Like other helicopter operators, the company has massive cap ex requirements and also needs to make use of massive leverage (debt).

Over the past 3-4 years, the company has been forced to spend $2.5 billionon cap ex. This was achievable when markets were strong. Now, it is not.

Bristow could have easily issued tremendous amounts of stock at prices in the $60’s in previous years (when its market cap was close to $3 billion), but instead the company largely chose to lever up and continue raising debt. It now sits under a pile of $1.1 billion in debt with a market cap of only $450 million.

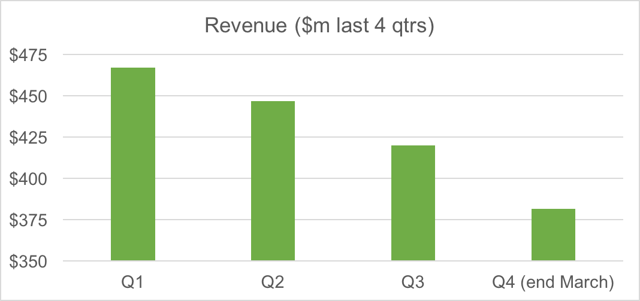

Over the past year, operating cash flow was just $116 million, which was not nearly enough to support the $372 million in required cap ex. To investors, Bristow continues to state that it has “liquidity” of $360 million. But in fact it only has cash of $104 million, down from $130 million last quarter.

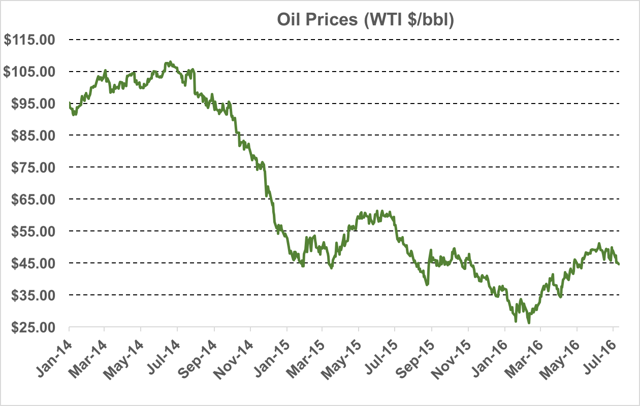

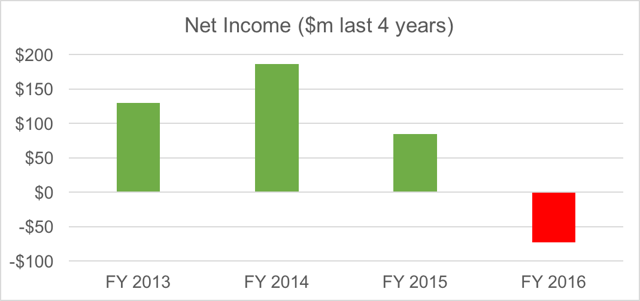

When times were good (think oil at $100), Bristow was actually able to turn a decent profit. But as the price of oil plunged, revenues have fallen. Margins have been hit hard. Multiple competitors have filed for bankruptcy such that they are flooding the market with their unused equipment and lower priced services.

The effect on Bristow’s financials has been dire.

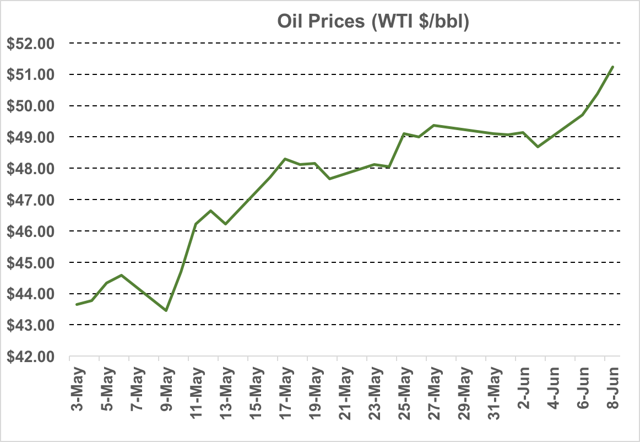

Things did appear to have bottomed starting in May/early June when several things happened at once. These factors had tempted a number of investors back into the stock, preventing it from collapsing altogether.

First. The price of oil rebounded sharply from lows of around $25 per barrel in February to as high as $52 per barrel in June.

Second, management was able to renegotiate covenants on its debt agreements with banks, to avoid otherwise going into default.

Third, in June (when oil peaked at $52) several members of management made a few purchases of stock near its multi decade lows. However, total purchases amounted to just $464,000, the majority of which came from the CEO. But in general, it was starting to appear that things might get better for Bristow.

But late June was extremely unkind to Bristow.

The surprise Brexit vote caused the British Pound to plunge by nearly 15% from its recent levels. That takes the decline to well over 20% since mid 2015.

Like many stocks, Bristow’s share price took a hit on Brexit. It fell to a new multi decade low of $10.80 (intraday). But then, along with the rest of the market, Bristow stock rebounded, returning to current levels.

Contradictions vs. SEC disclosures – a quick “about face”

(Note: information in this section is separate from the information in Section II, which details the SEC’s inquiry into offshore tax havens.)

Part of the rebound in Bristow’s shares price was likely due to the fact that in original disclosures (from the 10K in May), Bristow has disclosed that its exposure to the Pound was “not meaningful”. At the time of the disclosure, the Pound was at $1.55-1.58.

Investors were clearly soothed by management’s existing disclosure.

Yet two weeks AFTER the Brexit vote and the Pound collapse to around $1.30, management gave a presentation in London (Evercore) where it quietlyestimated that each 10% drop in the Pound would end up equating to a $10-12 million drop in operating income. So we should likely expect the real impact to be at $20 million or more (up from a previous statement of zero in the 10K).

So within just a few weeks, their estimate of currency exposure went from zero to potentially over $20 million.

This alone equates to a 50% increase vs. the operating loss just reported. From this, it quickly becomes clear that management has zero clue what is going on with its currency exposures.

In fact, if past earnings calls are any guide, we should expect the impact to be even bigger.

The situation in Nigeria looks like it could ultimately have a far greater impact. Yet (true to historical form) management has so far publicly disclosed nothing about the impact of the Naira.

Nearly all of Bristow’s African revenues come from the oil producing country of Nigeria. For the past year these African revenues comprised fully $255 million of total revenues.

Little noticed disclosure previously noted that Bristow’s exposure to the Naira was significantly greater than exposure to the Pound. Based on their original forecasts, a 10% change in the Nigerian Naira would equate to a 5.6% drop in operating income. So the estimated impact was already for a 22% drop in operating income (or rather a further 22% increase in operating loss).

But again, given that management grossly underestimated its exposure to the Pound, I believe that Bristow could actually be far more exposed to the Nigerian Naira.

Because of the long standing fixed peg 200:1, most would have assumed that there would be no need (and no ability) to effectively hedge the Naira.

But in late June, the Naira was unexpectedly unpegged from the dollar and it immediatelyplunged by 40%. It has remained at these new levels.

On June 20, the Wall Street Journal noted that:

Nigeria’s currency plummeted more than 40% against the dollar on Monday, the latest sign that low crude-oil prices continue to disrupt the economies of some major oil-producing nations.

Anyone with exposure to Nigeria (ie. Bristow in particular) should have seen this coming for some time. Even back in February, US News reported that:

…Money changers sit idle, with no dollars or euros to sell.

“We’ve run out of foreign exchange,” says Shehu Mahmud, the acting chairman of an association of money changers in the capital Abuja…. Already, the currency [Naira] has lost more than 50 percent of its value on the black market.

As we have seen in Venezuela, the plunge in oil prices has led to dramatically lower production as well as increased political unrest. The 40% plunge in the Naira is certainly going to contribute to further instability in Nigeria.

There are two realities that need to be faced with respect to this $255 million in historical Nigerian revenues.

First, even if revenue were to remain unchanged in Africa, profitability on these revenues will now drop to near zero because much of the cost basis (including fuel, offshore pilot and mechanic costs etc.) will be in dollars while the revenues coming in will be denominated in now-devalued Naira.

But based on this, the second reality is that it will likely make very little business sense to continue operating in Nigeria with the now devalued currency. As a result, up to $255 million in historical revenues is now likely now in question.

You don’t need to take my word for it, just ask the Nigerians.

Just on July 12th, one Nigerian Naira news service noted that:

There is double-digit inflation, a lack of dollars (which prevents investors easily repatriating profits) and domestic terrorism, including bombing of oil pipelines, putting a further dent in government coffers.

“The naira is going to sink further, and it’s a formula for a disaster,” says Steve Hanke, professor of applied economics at The Johns Hopkins University. “Capital flight will accelerate so disrupting foreign direct investment.”

The weak currency, which looks set to get even weaker, will likely scare new investors away and current investors will be increasingly likely to pull their money out of the country. And the country’s growth will slow without the investment dollars.

As we will see below, losses from the Naira implosion could well have significant implications for Bristow’s massive debt situation and new covenants.

But what about UK Search and Rescue

While in London, and while ignoring the problems in Nigeria, management clearly attempted to over-emphasize its one bright spot: that UK Search and Rescue operations would see little impact from Brexit. Yes, this stability would be a mild positive. However, such revenues accounted for just 11% of revenues in 2016 vs. 76% for oil and gas operations.

To put this in perspective, revenues from Nigeria were 40% more than revenues from Search and Rescue.

In fact, Bristow won this contract way back in 2013 on a competitive bid vs. now bankrupted CHC Helicopter Group. At the time, Bristow was a $3.5 billion company with a $70 stock price and could afford to take chances on the bid. At the time, CHC was also very healthy and was preparing for a $530 million IPO which would value CHC at over $3 billion. Yet even then CHC refused to bid anywhere near as low as Bristow.

CHC’s COO Peter Barlotta leaked an email to the press about the low ball bidthat Bristow used to win the contract.

In the email, Bartolotta also reveals that one of the other bidders has tendered a bid some 20% lower than that of CHC’s, adding: “We don’t have insight to the financial or other motivations of competitors. But we know that the economics at a price 20 percent lower than our interim bid simply aren’t right for CHC.”

The winner of the contract in 2013 turned out to be Bristow.

Despite undercutting CHC by 20%, to a level which apparently makes no economic sense, Bristow still described its Search and Rescue operations as being among its most profitable. It is entirely unclear to me how this could be the case.

However, as mentioned above, in 2015, the SEC began inquiring about Bristow’s use of offshore tax havens to minimize taxes paid on overseas income. Specifically, the use of Cayman Islands entities was a point of focus.

The SEC and tax angles here are an entirely different component of the short thesis. As a result, I have included a detailed Section II which lays out this information. There are two key points: First, to the extent that Bristow was using an unsustainable tax advantage to compete on UK SAR, the end of this advantage will soon hit profits. Second, to the extent that Bristow improperly evaded US taxes, it would need to repay those taxes NOW – at a time when it certainly cannot afford to do so. The information is well worth reading and has likely not been read by most investors in Bristow, so I would strongly encourage readers to go through it.

The revenue value of the 10 year Search and Rescue contract , which began in 2015, was originally disclosed specifically as £1.6 billion (Pounds) when the exchange rate was close to 1.6 GBP/USD. That would have equated to around USD$2.5 billion, or roughly $250 million per year in revenues.

Yet despite the 20% drop in the British Pound since then, management continues to use the original translated value of the contract in presentations, including the presentation in London. As always, despite past experiences, Bristow describes the Search and Rescue revenues as being “naturally hedged“, rather than actually hedging the revenues financially. In other words, Bristow continues to not hedge currency exposure.

Management’s discrepancy here amounts to nearly $500 million over the life of the 10 year contract.

In any event, even assuming the highest possible estimated contract value over 10 years, Search and Rescue revenues remain small, amounting to less revenue than Africa (or even Asia for that matter).

And keep in mind that competitor CHC had its own Search and Rescueoperations, which also accounted for around 10% of revenues. Shortly before filing for bankruptcy, CHC’s CEO had a conference call with analysts and investors to stress the “stability” provided by these Search and Rescue revenues.

But again, somehow Search and Rescue is where management chooses to direct our attention ahead of the upcoming earnings call. It is really the only positive factor than can be discussed, amongst many larger negatives.

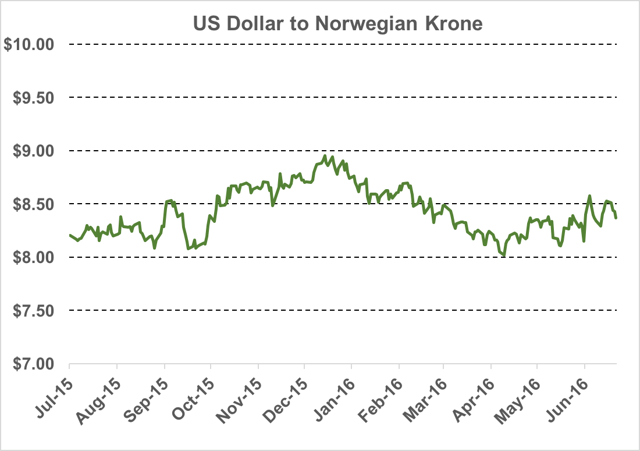

As an aside, little impact expected from Norwegian Krone

It should be noted that previous disclosures also indicated a heavy exposure to the Norwegian Krone. However, the Krone has not been particularly volatile. I expect little impact from anything relating to the Krone.

Insiders are already fleeing the sinking ship, as management continues to publicly reassure

In a June 8K filing, Bristow announced that it was terminating cash bonuses for employees. It did note that it was handing out a few million shares in bonuses to top management, but these are most likely not highly prized by employees who have seen their existing equity awards plunge by 80% in the past year. The value of their past bonuses has quite literally evaporated, such that getting new shares of the rapidly plunging stock likely means little.

We are already seeing multiple recent management departures, including Chief Admin Officer Hillary Ware, as well as Jeremy Akel (Chief Operating Officer), Mike Imlach (VP of Global Ops), and Mike Sim (VP of Business Development)

On June 13th, two directors resigned after being with Bristow for over a decade. The director who replaced them is notably known to have specific expertise in bankruptcy.

On June 27th (just after the Brexit vote), Bristow appointed William Higgins as a new director. The Heli Hub industry journal was notably focused on Mr. Higgins past bankruptcy experience with Leslie controls in a headline:

Bristow Group adds new Board director with particular experience

Heli Hub noted that:

We are not clear on why Mr Higgins’ skills in bankruptcy protection have been noted, whether that is something Bristow feel they might need, or whether it is an SEC requirement to provide those details in this sort of statement.

Getting a clearer picture of default risk

I have previously expressed my concerns about helicopter operator Erickson Air Crane, which then declined from $25 to just 60 cents. But that company never formally filed for bankruptcy.

But anyone involved in the helicopter industry should be very familiar with bankruptcy.

In the 1980s and 1990’s, Bristow was fully owned by British and Commonwealth Holdings, which went bankrupt during that time.

Bristow was then acquired by Offshore Logistics, which itself had gone bustduring the prior oil price downturn.

When competitor CHC filed for bankruptcy in May of 2016, it seemed that the last straw was a fatal flight accident that grounded much of its fleet. Likewise, in June of 2016, Bristow announced that it was grounding most of its Airbus EC225 helicopters following that crash.

This follows two serious helicopter crashes by Bristow itself near Lagos, Nigeria. In the first crash, 6 of the 12 passengers were killed.

An article from Bloomberg is now raising the issue that the most recent crash in Norway “has sparked a debate over whether the industry’s deepest cost cuts in 15 years are imperiling safety.”

Bristow continues to struggle under over $1.1 billion in debt and must meet heavy cap ex requirements if it wishes to stay business. In London, Bristow now noted that it would be attempting to defer capex in order to preserve cash.

The effect of the currency implosions is that Bristow will now likely be running up against its loan covenants AGAIN, just a few weeks after revising them with banks.

Again, it is important to remember that the currency implosions above have occurred just within the past few weeks, and subsequent to the prior loan negotiations which just took place.

Making matters worse, Bristow’s ability to generate cash from asset sales and returns now appears to be under pressure as well.

In the 10K, Bristow had as a risk factor that:

In May 2015, a global competitor filed for Chapter 11 bankruptcy protection and announced its intention to reject leases resulting in the return of approximately 90 leased helicopters to lessors. This significant return of aircraft into an already oversupplied market could undermine our ability to dispose of our aircraft and could have a material adverse effect on our business, financial condition and results of operations.

Keep in mind that this was one year before the additional bankruptcy of Bristow’s largest competitor, CHC.

From bankruptcy, CHC had noted that:

The reorganization is expected to strengthen CHC’s financial position by reducing long-term debt and enhancing financial flexibility while allowing the Company to manage and operate its fleet of aircraft. CHC expects day-to-day operations to continue without interruption throughout the court-supervised restructuring process.

Under the bankruptcy, CHC is flooding the market with excess, unused helicopters as well as potentially undercutting Bristow on price. This should be obvious, CHC will now be free of much of its long term debt obligations, but will certainly need to cut price in order to attract customers during its bankruptcy.

Such cost cutting and emphasis on low pricing was significant enough to be disclosed as a separate risk factor in the recent 10K.

A focus by our clients on cost-saving measures rather than quality of service, which is how we differentiate ourselves from competition, could reduce the demand for our services.

The bankruptcy filing from CHC just happened in May, such that we have only begun to see the impact of the increased pressures on Bristow.

Yet, as described below, various sell side analysts seem to suggest that bankruptcy means that CHC will no longer even be in business or competing with Bristow. These sell side analysts are merely echoing inaccurate statements from Bristow management.

Are Bristow bankruptcy concerns overblown ?

When defaults happen, they often happen in a various abrupt stages.

CHC Group filed for bankruptcy in May, but it had “decided not to make” an interest payment as early as April 15th.

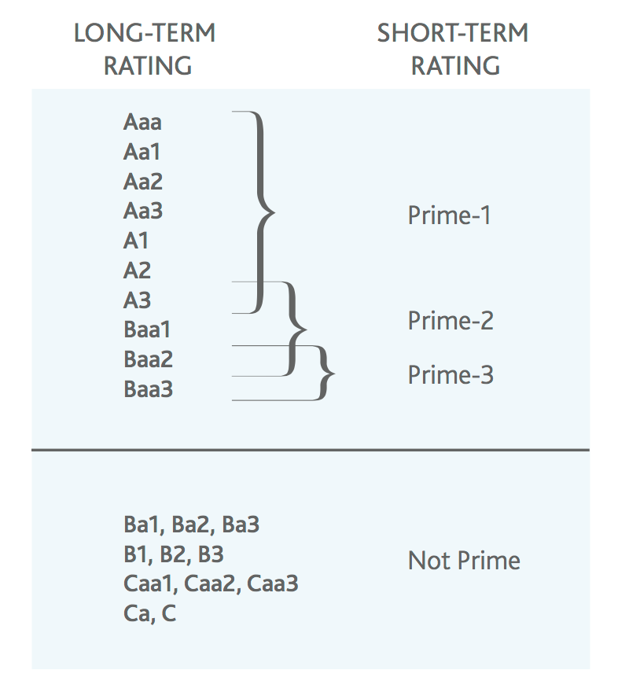

But keep in mind that just 3 weeks before the default, Moody’s had still been rating CHC Group as a B2 credit.

Just 3 weeks later, when the bond payment was missed, Moody’s suddenly downgraded CHC by 5 notches to “D” (for Default). It was very abrupt.

Bristow currently has over $1.1 billion of debt and just $104 million in cash. Cap ex requirements still greatly exceed operating cash flow. And Bristow’s market cap is down to less than $500 million.

As of its most recent review. Moody’s was rating Bristow as Ba3, just 1 notch above where it was rating CHC immediately before its default. But this was well before the recent currency implosions.

But wait, it gets better.

A few weeks before defaulting on its debt and filing for bankruptcy, CHC had put out a press release touting its Q1 financial results.

The results appear surprisingly similar to what we see from Bristow.

CHC noted the following:

· Improvements in cash flow

· decrease in aircraft related capital expenditures

· cost control initiatives progressing according to plan

But the biggest item was that CHC noted that

We exited the fiscal 2016 third quarter with liquidity of $377 million and we are focused on strengthening and increasing the quality of our liquidity.

Despite the assurances, within just a few weeks, CHC Group had defaulted on its debt payments and filed for bankruptcy.

We should remember that Bristow also boasts of having recent “liquidity” of $360 million. But also remember that only $104 million of this is cash. The remaining $256 is just more debt. Even though cash had actually fallen by $28 million, the company stated that “liquidity had increased by 20%”. And again, these figures are all prior to the recent currency implosions.

The relentless “optimism” of Bristow management

The point of this section is as follows:

As the share price was plunging to multi decade lows, management gave a presentation in London which then boosted the stock price by 10% that day. The presentation was typical for Bristow and outlined how everything was going great and that bankruptcy was not a risk. Yet statements in the presentation clearly contradict recent SEC disclosures.

Investors should note that management has been delivering the same optimistic pitch over and over again since mid 2015, during which time financial results have continuously plunged and the stock has dropped by 80%.

Management will (and does) say just about anything, even when it is downright silly.

Following the sequential resignations of multiple members of senior management in recent months, Bristow tried to spin these departures as a positive with a press release entitled.

Bristow Group Strengthens Operational and Leadership Structure

Prior to the release of earnings for the September quarter (released in November), Bristow’s share price sat at $37 (already cut nearly in half since January). Management’s positive spin on earnings consisted of its usual delusional optimism.

I am proud of our team’s progress during the quarter in implementing our economic restructuring initiatives designed to enhance Bristow’s leading competitive position and financial strength,” said Jonathan Baliff, President and Chief Executive Officer of Bristow Group. “We have been successful in reinforcing our financial flexibility through an expected deferral of approximately $100 million of capital expenditures out of fiscal 2016 with further deferrals expected over the next five years. We also are announcing a new two year $200 million term loan which will provide additional liquidity in light of this downturn.

In particular, management simply blamed the effect of a strong dollar for additional losses of $22 million. But if we could just ignore that….then things would look great.

Our results for the September 2015 quarter included a number of negative items, including the impact of the strong U.S. dollar, which detracted from our underlying performance where our regional operations delivered respectable results led by Europe Caspian and Asia Pacific. Excluding the impact of the foreign exchange losses, we would have reportedadjusted EBITDAR of $122.7 million, in line with the prior year quarter with an improved adjusted EBITDAR margin of 28.9%.

And with the stock in the $30’s management disclosed that it had even approved a $150 million stock buyback program. (With cash getting more and more scarce for Bristow, this ruse clearly has had little effect on the share price. )

Management noted that it was lowering guidance for the full fiscal year(ending March 2016) from $3.10 – $3.75 to an EPS of $1.80 to $2.40.

So management’s original estimate was initially wrong by around 40%. (Hint: it then gets worse).

THE POINT IS THIS:

INVESTORS HATE SURPRISES.

THE STOCK BRIEFLY ROSE BY 15% PRIOR TO THE EARNINGS RELEASE IN NOVEMBER.

FOLLOWING THE RELEASE OF EARNINGS AND THE CONFERENCE CALL IN NOVEMBER, BRISTOW’S STOCK QUICKLY DROPPED BY 20% (TO BELOW $30), HITTING NEW LOWS FOR THE YEAR.

So then in February, Bristow released earnings for the December quarter. By this time the share price had now fallen to $20-25 (prior to earnings).

Not only did Bristow reaffirm guidance of positive EPS for the year of $1.80 to $2.40, but the press release was again filled with reassuring language:

Our third quarter results demonstrate the success of our diversified business development and economic restructuring efforts in the face of unprecedented challenges for our oil and gas clients. These initiatives demonstrably improved our third quarter margins while improving our competitive position and financial flexibility,” said Jonathan Baliff, President and Chief Executive Officer of Bristow Group

The company went on to tout:

- Search and rescue strength

- Cap ex cuts

- “Improved liquidity”

- More loans

- Financial flexibility

Sound familiar ?

But the reality was that (surprise) revenues had declined by 21.2%. (Surprise) Currency exposure hit revenues by $14.9 million. (Surprise) Bristow’s dividend was cut by 80%. (Surprise) a steep drop in the Aussie Dollar caused additional losses.

THE POINT IS THIS (ONCE AGAIN):

INVESTORS HATE SURPRISES.

FOLLOWING THE RELEASE OF EARNINGS AND THE CONFERENCE CALL IN FEBRUARY THE STOCK IMMEDIATELY DROPPED BY 30%, HITTING NEW MULTI DECADE LOWS OF $11.90.

That takes us to May.

By the time full year earnings were released in May, the stock had slowly recovered to around $15 again, supported largely by a 60% rise in oil prices off of the February lows.

Then, (surprise) rather than a $2.00 PROFIT (as announced in both November and February), management announced a LOSS of $2.12. So once again, even the revised-lower numbers were off by a very long shot.

In May, management’s new spin now turned to soothing investor fears over looming bankruptcy.

CEO Baliff highlighted “the success of our cost reduction and diversification efforts” and emphasized a “20% increase in liquidity“.

In fact, in reality, cash had DECLINED by $30 million since December. All Bristow had really done was increased its borrowing ability by altering loan covenants. Surprise !

Once again, Bristow was unpleasantly surprised by the impact of foreign exchange on its results and had not given investors any warning. Surprise !

Additionally, changes in foreign exchange rates during fiscal year 2016 decreased operating revenue by $14.7 million and $98.6 million quarter-over-quarter and year-over-year, respectively.

THE POINT IS THIS (FOR A THIRD TIME):

INVESTORS HATE SURPRISES.

FOLLOWING THE RELEASE OF EARNINGS AND THE CONFERENCE CALL IN MAY THE STOCK IMMEDIATELY DROPPED AGAIN BY 25%, FROM $15.50 to $11.50, AGAIN TESTING MULTI DECADE LOWS.

As Bristow’s stock was fighting further declines, it was supported by a 20% spike in oil prices. Oil prices quickly jumped from $43 to almost $52.

But in fact, this was all BEFORE the Brexit crash, the Pound slump and the surprise Naira implosion.

In May, the situation was looking grim for Bristow. Hence the new multi decade lows for the share price.

But since that time, things have actually gotten much, much worse.

The Pound has dropped 15%, exposing Bristow to tens of millions in further losses.

The Naira has imploded, affecting $255 million in African revenues, and (supposedly) equating to “only” a 22% further increase in net operating losses. (Again, given the sheer size of the devaluation, I suspect the impact could be much greater).

Likewise, the price of oil has now declined by 10-15% from June highs.

This has all happened in just a few weeks.

Yet rather than showing further decline, the share price has now stabilized at around $13.

Management’s Evercore presentation in London on July 12th caused the stock to rally 10% in a single day. However, it is notable that volume was light.

THE POINT is that we have seen repeatedly seen this game from Bristow management in the past.

Once again, Bristow management has failed to disclose the massive impact of recent currency swings and attempts to divert attention to things like the tiny Search and Rescue business and its bogus “increased liquidity” from simply adding more debt capacity in the face of dwindling cash.

All of this calamity has happened just a few weeks after Bristow renegotiated its loan covenants with lenders as part of its $1.1 billion in outstanding debt.

The near term catalyst will be the new disclosures (surprises) raised on the upcoming conference call. Bristow will then yet again set new multi decade lows, which I expect at around $6-8.

Helicopter operators – past experience

A while back, I highlighted my concerns about helicopter operator Erickson Air Crane , including the fact that insiders and board members were set to dump large amounts of stock. The stock immediately plunged by 30%. A number of analysts and bloggers were quick to defend the stock even in the face of the inevitable. Jim Cramer even touted the stock on Mad Money. But as investors looked more deeply into the equity and credit fundamentals, the ongoing deterioration became clear and the stock continued its descent.

Erickson had been trading at around $25 at the time I wrote about it. It now trades for 60 cents.

My article was explicit and clear. There should have been little doubt about what to expect. Yet articles quickly surfaced from those determined to catch the falling knife.

Positive articles that came out AFTER my analysis included the following:

– Erickson Air-Crane Set Up Nicely For Short Squeeze

– Erickson Air-Crane: Big Risk, Big Reward

– Erickson Air-Crane: Acquisitions Will Reward Patient Shareholders

– Erickson Inc – The Fall And New Potential

A separate helicopter operator, CHC Group (OTCQX:HELIF), came public in 2014, only to go bankrupt in 2016. As before, we can see that “bargain hunters” failed to spot the obvious on the way down.

– CHC Group Is A Value Investment

– CHC Group: More Than Just A Contrarian Play On Oil

– CHC now trades for just 40 cents (even adjusted for its reveres split) following bankruptcy.CHC had just field for bankruptcy earlier this year and the Wall Street Journal noted that:

CHC is now asking the U.S. Bankruptcy Court in Dallas, to let it drop at least 90 aircraft from its fleet of about 230 helicopters, most of which are leased, as part of a broader restructuring that will target more than $2 billion in debt. The Canadian company said it can “no longer bear the weight” of its burdensome debt structure and expensive fleet amid declining oil prices and the resulting drop in demand for its services…. CHC is one of two global companies alongside Houston-basedBristow GroupInc. that dominate the business of ferrying workers and cargo offshore for energy companies and have been forced to shrink and cut costs.

The hype on Bristow

As with Erickson and CHC, there has been no shortage of “value hunters” being burned on the way down during Bristow’s straight-line descent from $60 to as low as $10.80.

– Market’s Overreaction Has Undervalued Bristow

– Bristow Group Inc. – Strong Insider Action Lifts Helicopter Stock

– Bristow Group Has Become Too Cheap To Ignore

– Bristow Group’s Overlooked Strength

– Bristow Group Is Worth Accumulating

– Brisow Group: This Former Highflier Is Too Cheap To Ignore At Just $14

Section II – details of the 2015 SEC inquires into offshore tax jurisdictions

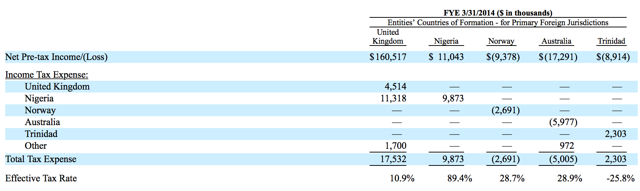

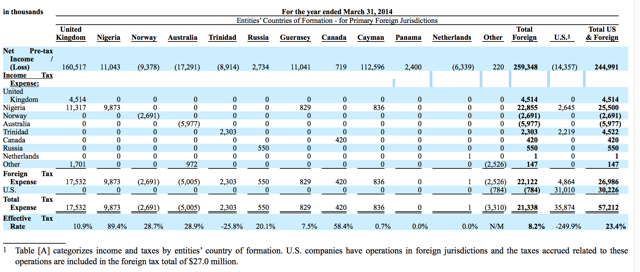

On March 2nd, 2015, when Bristow was still profitable and supposed to be paying taxes, the company received a letter from the SEC inquiring into “foreign jurisdictions, the effective tax rates in those jurisdictions, and the amount of pre- tax profit in those jurisdictions”. The SEC also wanted to know more about “Foreign earnings indefinitely reinvested abroad” – which is a corporate code name for earnings on which the company hopes it will never have to pay US taxes at all.

In the prior year, Bristow had reported paying a US effective corporate tax rateof 23.4%. However, this was actually the result of a number of special one time items. Without the benefit of those items, Bristow’s effective tax rate in the US was reported as just 13.7%.

Bristow’s CFO (at the time) John Briscoe, compiled the information and responded to the SEC on March 13th, 2015, including the following table:

There are a few things to notice in Briscoe’s response:

1. In March, CFO Briscoe only responded to the SEC with 5 overseas jurisdictions: The UK, Nigeria, Norway, Australia and Trinidad.

2. The overwhelming amount of pre-tax net income comes from the UK, then Nigeria. The other areas showed net losses (not net income).

3. For the UK, Bristow reported a tax rate of just 10.9%.

4. For Nigeria, the tax rate was reported as 89.4%. But this was explained as follows: “For example, in Nigeria, we accrue and pay taxes based on our gross income by applying a deemed profit margin of 20%. Therefore, a year of poor financial performance resulting in low or negative pre-tax earnings does not translate to significant tax expense reduction in Nigeria.”

On May 4th, 2015, the SEC wrote another letter to Bristow in which it made clear that Bristow had not responded fully to the previous letter, and in fact had omittedoverseas jurisdictions amounting to 48% of its pre-tax income, which should amount to to $259 million.

Among other various items, the SEC stated that:

you have detailed the pre-tax income for your primary foreign jurisdictions, which represents 52% of total net pre-tax foreign income… Please explain to us the nature of the remaining amount of pre-tax income from foreign jurisdictionsthat are not included in your response to prior comment 2 of $259.3 million

The SEC also requested that Bristow identify the foreign subs whose earnings were indefinitely reinvested.

The SEC had instructed Bristow to respond to this request within 10 business days. However, Bristow responded back that it needed until June 1st to get the required information.

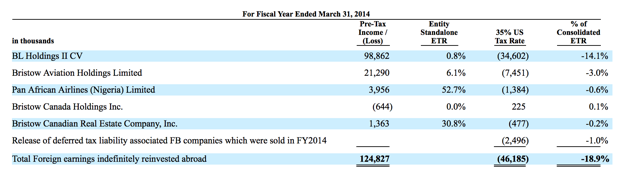

On June 1st, Bristow responded, including the two tables below.(click to enlarge) The key points to notice from the 1st table above are as follows:

The key points to notice from the 1st table above are as follows:

1. In the new response, Bristow now included 11 jurisdictions rather than just 5. The newly included jurisdictions suddenly includes offshore tax havens such as Guernsey, Panama, Cayman Islands and the Netherlands, which Bristow had previously omitted.

2. Suddenly we see the Cayman Islands account for $112 million in Pre-tax income, second only to the UK.

3. Of course, the Cayman’s have a tax rate of just 0.7%. That is to be expected.

4. But we now see that US pre-tax income has been fixed at negative$14.5 million.

The key points to notice from the 2nd table above are as follows:

1. The largest foreign sub is BL Holdings II CV, which is based in the Netherlandsand is responsible for just under $100 million in Pre-tax income (roughly 40% of pre-tax income for the year).

2. For the Netherlands, the tax rate is just 0.8%

3. Including the other foreign subsidiaries amounts to a total of $124 million in pre-tax income, nearly one half of total pre-tax income for the year being “indefinitely” re-invested abroad

4. Bristow did NOT disclose conducting substantial operations in the Netherlands

The SEC once again responded with further questions on July 31st, again asking for a response within 10 business days.

Once again, Bristow replied that it needed more time to address these issues, and stated that it would reply by August 28th 2015.

Just two weeks later, and prior to responding to the SEC, CFO John Briscoe abruptly resigned from Bristow at the age of 57.

In a press release put out by Bristow, the company noted that:

John Briscoe, who will be leaving his current position as Chief Financial Officer to pursue other business opportunities.

In fact, it is now almost 1 year later. According to Bloomberg, he former CFO has not been employed elsewhere. According to LinkedIn, the former CFO lists himself as being “retired” and offers his services as an energy consultant.

In other words, CFO Briscoe simply quit Bristow with no other job lined up and so far has not found any other employment. Contrary to the company press release, he was certainly not “pursuing other business opportunities”.

This seems quite unusual. Bristow’s choice of a replacement was equally unusual.

Bristow appointed Don Miller as the new CFO. It is noteworthy prior to his time at Bristow, Miller had spent 9 years at Enron North America. Prior to his time at Enron, Miller was one of Enron’s bankers. Miller had spent 12 years as a an energy corporate banker at Citicorp. Most will remember that Citigroup had a very intimate relationship with Enron during its spectacular rise, and ultimately paid over $1.6 billion to settled claims that Citi helped Enron defraud investors. The New York Times reported that:

Citigroup Resolves Claims That It Helped Enron Deceive Investors

Within just 9 business days, new CFO Miller was up to speed and had a complete response to the SEC.

The SEC responded with its standard boilerplate letter stating that it had no more questions.

Here is a screenshot of the final letter.

I understand that many (perhaps most) investors do not read SEC correspondence at all. As a result, many investors may interpret the letter above to be an “all clear” from the SEC. This is clearly not the case.

Just to demonstrate this, I am including an identical boilerplate letter received by MDC Partners (NASDAQ:MDCA) following its own correspondence with the SEC.

The SEC had been inquiring into a wide variety of accounting issues at MDC for a number of months. As with Bristow, there were multiple rounds of correspondence back and forth. The correspondence ended with the following letter, which is (quite obviously) identical, verbatim to the one received by Bristow.

After receiving the above letter from the SEC, MDC subsequently disclosed that it had then received a subpoena from the SEC regarding the exact issues which had been addressed in the correspondence. The share price immediately plunged by 33% and the CEO was forced to resign.

At the time, I had been preparing a lengthy bearish article on MDC, but the subpoena came out first and the share price tanked before I could publish.

THE POINT:

My point is that investors simply don’t read SEC correspondence. And even when they do, they seldom understand what they are reading.

How are the SEC inquiries related to the current situation at Bristow ?

When oil prices were higher and Bristow was reporting profits, it was doing so while reporting a very low corporate tax rate. During the SEC inquiries, Bristow previously reported a rate which appeared to be 23%. But excluding special items, this rate was just 13.7%.

However, it remains the case that various divisions within Bristow are taxed independently of the corporate parent due to use of offshore jurisdictions. So even when the parent appears to be losing money, various divisions SHOULD likely be subject to taxes. The most obvious candidate for this would be the UK Search and Rescue operations. Although UK Search and Rescue comprises just 11% of revenues and is relatively fixed (not growing), Bristow management continues to highlight them due to their supposed stability and profitability.

Yet we saw above that somehow Bristow was able to undercut competitor CHC by at least 20% on this contract, to a point where CHC said it did not make sense financially.

We have also seen from SEC disclosure that Bristow’s UK’s corporate tax rate is less than half of the listed corporate tax rate for that year.

We also saw from the SEC disclosure that nearly half of Bristow’s pre-tax net income was being posted in offshore tax jurisdictions, mostly in domiciles where it conducted no operations, and mostly in jurisdictions where it paid virtually no taxes.

There are two potential scenarios here. We could end up seeing one, both or neither of them, depending on how the SEC shakes out.

First, as it applies to current financials, to the extent that Bristow is found to be inappropriately evading taxes via offshore entities, it could still have a financial impact on current financials – even when the corporate parent appears to be losing money and not liable for taxes. This would presumably happen at the division level.

Second, to the extent that there have been taxes avoiding in past years, when Bristow was profitable, it would create a large tax liability payable now – when Bristow can least afford it.

Section III – Sell side coverage of Bristow has been consistently misleading and flawed

As my regular readers know, I frequently watch for sell side BUY recommendations and take the opposite side of the trade when such recommendations are deeply flawed. A few weeks ago, several sell side shops were busy hyping shares of OraSure Technologies (NASDAQ:OSUR). The hype was that OraSure was set to continue with a lucrative contract with drug giant AbbVie (NYSE:ABBV). The result of the sell side hype was that OraSure was rising sharply on strong volume.

When I wrote about OraSure, I performed far deeper research than the shallow analysis of the sell side. I demonstrated that (contrary to sell side research) OraSure was “virtually guaranteed” to lose this contract, which would cost the company $40 million straight to the bottom line. OraSure shares quickly tanked by as much as 20%.

Within 24 hours, OraSure announced that it had indeed lost the lucrative AbbVie contract.

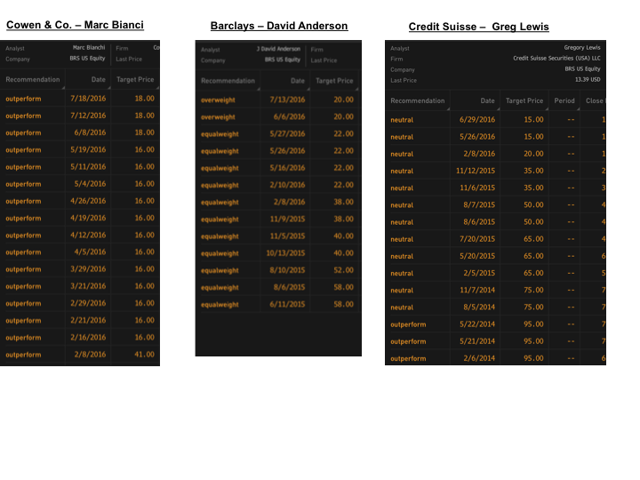

With Bristow, the key movers of the stock include Cowen & Co, Barclays and Credit Suisse, as shown below. A closer look reveals that all of them have touted or supported the stock, and all of them have been 100% wrong in every instance going back well into 2015. Yet they persist in touting and supporting the stock even now. (Hint: Bristow is in deep need of raising money and is therefore a high priority investment banking client).

The graphic below shows the dismal ratings history for each of these three investment banks.

Cowen & Co. Research

One of my favorite sell side shops to get short on is Cowen & Co. It seems that whenever a company is in obvious need of raising large amounts of money, investment banker Cowen is there with an “Outperform” rating and a lofty share price target. As a result, I have often gotten short Cowen research names.

Most recently, when I wrote about Revance Therapeutics (RVNC) the stock had just soared 50% to over $40 based on hype from Cowen that the company was likely to be a “buyout target”. Cowen placed a $55 target on Revance. The evidence was transparently obvious that Revance’s data was deeply flawed. Not only would there be no buyout, but I predicted that Revance’s share price would be cut in half. Revance’s data was indeed highly problematic and the stock has since plunged to just $13. Despite the obvious problems, Cowen simply maintains a $55 target on the stock.

With Bristow, Cowen’s July 18th outperform rating saw the shares climb by nearly 7% on substantial volume for the day. Within 2 days, nearly all of those gains had already faded.

Be it equity or debt, Bristow is an obvious investment banking client because the company is in dire need of money to offset falling revenues and service its $1.1 billion in debt. Cowen has a far weaker investment baking franchise than some of the “bigger boys” on Wall Street. As a result, the firm appears to have consistently higher share price targets which curries favor with investment banking clients. This is why I end up doing so well shorting Cowen research names.

Just as Bristow’s earnings were announced in November (as highlighted in Section I above), Cowen came out with a research note in which it made a number of supportive statements, all of which echoed the statements of Bristow management. Despite the obvious disappointments and the plunge in the share price, Cowen noted:

We believe Bristow’s business diversification (UK SAR, fixed wing, leverage to offshore production) translates to relative earnings stability during the downturn.

Clearly this was preposterous. Cowen went on to parrot management’sassertions on CapEx deferrals, cost savings and the strength of UK SAR.

The firm maintained a huge $41 target on the stock even when the share price plunged to $30 and below.

Then, as we saw above, earnings in February were a disaster that should have been easily predictable. Even as the business environment deteriorated substantially, Cowen maintained its Outperform rating and $41 target into February even as oil was approaching new lows of $25.

In fact, Cowen even reiterated this rating immediately before earnings were announced on February 8th. As we saw, results were an absolute disaster and the share price plunged to new multi decade lows of around $11.

So the next week, Cowen did cut its target from $41 all the way down to $16. But it has continued to maintain its “Outperform” rating ever since.

As part of its report, Cowen described an “attractive risk / reward” and noted that “we see concerns over covenants in the credit facility to be overdone”. As we know, the stock continued to decline and Bristow was forced to renegotiatecovenants – just a few weeks later.

Back in June, Cowen actually re-upped its target price to $18 based on rising oil prices and the newly revised covenants. But since that time, oil prices have resumed their decline, currency “headwinds” have created very obvious near term problems and the CHC bankruptcy is flooding the market with cheap helicopters and underpriced competition.

Barclays Research

Barclays has been covering Bristow since the middle of 2015. Barclays has consistently rated the stock an “Equal Weight” (NYSEARCA:HOLD), and simply lowers its target price each time the stock plunges.

When the stock was in the $50s, Barclays told us it was worth $58.

When the stock was in the $30s, Barclays told us it was worth $40.

When the stock was in the $20s, Barclays told us it was worth $38.

And now that the stock is in the teens, Barclays tells us it is worth $20-22.

When the stock (soon) gets into the single digits, I expect that Barclays will once again downgrade the stock to around $10.

Barclays has been a member of Bristow’s banking syndicate, such that despite the continuously falling share price, Barclays has consistently told investors to continue holding the stock. And in June, they even upgraded the stock to an “Overweight”.

Most recently, Barclay’s noted:

We believe BRS’s first order of business, before any need to tap the capital markets, is to pursue sale leasebacks of up to $340 million of UK SAR aircraft, which may prove attractive sale leaseback candidates despite our cautious view of the leasing market, as well as asset-based financingfor up to $125 million of UK SAR bases and infrastructure,

Quite obviously this simply ignores the impact of the CHC bankruptcy under which we are now seeing the market floodedwith unused helicopters. It is an obvious point that no serious analyst should miss.

The recent reports from Barclays seem to quote management almost verbatim in touting the importance of UK Search and Rescue, Capex deferrals and the “advantages” of the CHC bankruptcy for Bristow. (See above on the impact on pricing).

Credit Suisse Research

Like Barclays, Credit Suisse has continuously told investors to keep holding Bristow (a “Neutral’ rating), despite a relentless 80% decline in the share price. And just like Barclays, each time the share price plunges, Credit Suisse waits until AFTER the fact to lower its share price targets.

As the share price declined since last year, Credit Suisse went from a target of $65 to $50 to $35 to $20 and now most recently to just $15. At no time has Credit Suisse ever called Bristow a sell. Like Barclays, Credit Suisse is also one of Bristow’s lenders, so this should be expected.

So Credit Suisse has been telling us to hold the stock all throughout this 80% decline. But lately, this recommendation gets even harder to understand.

The most recent report from CS describes the “industry in a tail spin” as customers are doing more with less. CS then lowered its estimates, forecasting ongoing losses into FY17/18, with below consensus estimates. CS describes the market as being “oversupplied”. Regarding the recently grounded H225’s, CS notes that “we could see a scenario where demand from the O&G business for the H225 never returns to its previous level”.

But in order to justify not moving to a sell recommendation, CS describes Bristow as being “net short” the Naira but sees virtually no impact on the income statement. The implosion of the British Pound was not even addressed.

In the same report, CS discloses that 90% of its recommendations are for Buy or Hold, while only 10% of its global ratings are listed as “Sell”.

From current prices, CS sees just 12% upside in the share price.

Conclusion

There are so many problems with Bristow that it is difficult to know where to start. However, I can safely say that I expect a steep plunge to $6-8 following new “surprise” disclosures on the upcoming conference call.

Further declines and ultimate bankruptcy risk are harder to handicap. But as with Erickson and CHC, there could be significantly greater downside over the next 9-12 months.

What investors DO KNOW is this:

Bristow’s shares have already declined by 80% over the past year, as its financial condition has deteriorated drastically. Cash balance has fallen. The dividend has been cut by 80% (so far). Revenues continue to drop and losses continue to mount. Multiple competitors have recently gone bankrupt and are now flooding the market with unused helicopters and underpriced competition. This heavily affects Bristow’s asset values as well as its revenue and income (losses).

Management and board members are resigning, and management specifically recruited a replacement board member with notable experience in bankruptcy

Bristow is sitting on over $1.1 billion in debt, and was forced to renegotiate debt covenants in May. At the time, the banks were most likely encouraged by a recent doubling of the price of oil off of its February lows, from $25 to over $50. However, its credit rating has already been downgraded to Ba3.

But with subsequent developments the banks are now likely sweating bullets.

What investors DO NOT KNOW is this:

There have been major negative developments for Bristow, many occurring in jut the past few weeks. Investors are totally in the dark.

Very shortly AFTER the new covenants were agreed, Bristow was hit hard by the 15% fall in the pound and the massive 40% drop in the Nigerian Naira. (At the same time, oil fell by 10-15% from its February highs.)

These huge impacts are the result of huge massive unhedged currency exposures.

Despite having tremendous exposures to various global currencies, Bristow does NOT engage in financial hedging.

As recently as May, management was saying that it had zero exposure to any move in the British Pound. Yet we are now finding out (just a few weeks later, post Brexit) that its real exposure could be in the tens of millions of dollars.

But the bigger surprise will be Nigeria. So far management has said nothing about the 40% drop in the Nigerian Naira, even though previous disclosures would indicate that operating income should plunge by 22% on this alone. African (mostly Nigerian) revenues amounted to $255 million in 2016. However, due to the plunge in the Naira, these revenues are most likely going to disappear due to the simple economics of the depreciated Naira.

(It should be noted that the soon-to-disappear Nigerian revenues are actually larger than all Search and Rescue revenues.)

In addition, we are also likely to hear about significant pressure being placed on asset values, revenues, profits (losses) and margins as a result of CHC filing for bankruptcy in May. CHC is now operating at a distinct advantage to Bristow. It can undercut Bristow on price and is flooding the market with unused helicopters.

The SEC inquiry

The full impact of the past SEC inquiries has yet to be determined. But there is no good outcome that can be expected from it. The SEC was specifically asking about Bristow’s use of offshore tax havens to protect nearly 50% of its pre-tax income from US taxes. Prior to completing a response to the SEC, the then-CFO resigned despite having no new employment lined up. Bristow then oddly replaced him with an M&A executive whose past experience was in working for and advising Enron for decades.

The impact of an SEC action (if any) could affect both current and future financials by eliminating offshore tax advantages for Bristow. This problem could arise at the division level, even when the parent is losing money for the time being. This would simply make ongoing losses even larger. Even worse, an SEC action (if any) could potentially result in the payment of back taxes owed, at a time when Bristow can least afford it.

As we clearly saw with MDC Partners, the conclusion of a detailed dialogue with the SEC is by no means an “all clear”. Following the similar conclusion of its dialogue, MDC disclosed an SEC subpoena. Its stock fell 33% and the CEO was forced to resign.

The catalyst for a 40-50% drop in the share price is the upcoming earnings call, with a number of new “surprise” disclosures.

Management has made its predicament far worse by repeatedly hitting investors with unexpected surprises, resulting in much larger losses than were originally expected.

Management repeatedly tries to focus investors attention on any minor positive development, while attempting to downplay major negative events. But in each case, the truth comes out at the end of each quarter.

In each of the past 3 earnings calls, we have seen the share price quickly drop by at least 20-30%.

We have seen nearly identical situations before with helicopter operator Erickson Air Crane, and we saw it before with direct competitor CHC Helicopter. Both of these companies were originally trading in the $20’s.

As they declined by more than 50% to the single digits, “value hunters” thought they could time the bottom in the stock. In each case they appeared to be “too cheap to ignore”. But with declining fundamentals and a heavy debt load, there simply was not bottom to be found. Both Erickson and CHC now trade for just pennies on the dollar.

The sell side research on Bristow is in fact worse than most. The various analysts have continually told investors to Hold or Buy the stock even as it plunges with each and every new earnings report or corporate development. It appears that the majority of the content from these reports consists of near-verbatim quotes from management, expressing their usual relentless optimism, while largely ignoring points of obvious concern. As is often the case, the majority of sell side analysts happen to have been involved as Bristow’s investment bankers and lenders.