Not long ago, ZM Funds was in a serious pickle. It was the largest holder of $120 million in second lien debt from a deeply distressed helicopter operator called Evergreen Helicopter. Evergreen has received a going concern letter from their auditor. It was in default on its debt. It was not even paying its accounts payable to such an extent that suppliers began withholding parts and Evergreen was unable to maintain its aircraft. At present only 50% of its aircraft are even being used and the company is the defendant in multiple lawsuits and legal proceedings with its creditors, suppliers and customers demanding immediate payment. But in fact, the situation was set to get far worse for struggling Evergreen, given that over 60% of its revenues come from DOD contracts in Afghanistan. The US has already announced that the pullout from Afghanistan is set to accelerate and troop levels will be further reduced by 50% in the next year.

In short, it was clear that ZM would not get repaid on this very large subordinated and distressed debt holding.

Fortunately for ZM Funds, an elegant solution was found. ZM is the controlling shareholder of Erickson Air-Crane (EAC) and holds two board seats. Following its recent equity offering, Erickson has a market cap of around $350 million. ZM simply had Erickson, the company that it controls, borrow $400 million in debtand a $100 million credit facility to buy the crippled and indebted Evergreen. Prior to the borrowing, Erickson was down to just $1 million in cash and already had $100 million in debt, so this represents a very substantial levering-up.

In exchange for its deeply distressed debt of Evergreen, ZM received millions of shares of Erickson, which had been rising strongly. As we will see below, as soon as the questionable acquisition was completed, ZM quickly began liquidating its shares in Erickson and has just filed to sell 100% of its entire stake in Erickson.

Apparently this is all fine and legal, simply because Erickson had disclosedthat it is controlled by ZM. It notes that ZM may take certain actions and approve certain transactions which are not in the interests of other shareholders and which other shareholders would not approve. That is certainly putting it mildly.

That acquisition of Evergreen took place just a few weeks ago. The company has put a positive spin on the deal, noting that it will increase revenues, along with “adjusted EBITDA”.

Despite the enthusiasm and urgency of Erickson and ZM, the transaction is far from intuitive. In fact, in makes no sense whatsoever. Rather than help Erickson, this acquisition is more likely to sink the entire ship for Erickson.

Portland based Erickson has traditionally derived the majority of its revenues from firefighting and timber operations in North America, not far flung Afghanistan. With respect to the distressed Evergreen acquisition, Erickson disclosed the following:

- lack of experience in these business segments

- lack of experience with these types of aircraft

- lack of experience in these geographic regions (Middle East, South America and Africa)

- NO experience with Department of Defense customers and projects

For obvious reasons, ZM is clearly eager to get out of its holdings of this now debt-saddled company as fast as possible. As soon as it was completed, ZM quickly sold millions in stock. And now, 2 days ago, a massive S3 registration statement was filed in which ZM will sell 100% of its remaining shares even as the ink on the deal is still drying. The S3 notes that after the offering, ZM will hold zero shares. In addition, Erickson will be offering 4 million new shares.

Astute investors will note that the 9 million plus shares in the S3 filing equates to 100% of the company’s current outstanding share count!

It also equates to over 45 days trading volume. Based on the sheer enormity of this offering, the share price should be expected to automatically correct by at least 50% to around $13.00.

After that, the share price will be a function of how well the debt saddled company can turn around the struggling Afghan helicopter operations of the deeply distressed Evergreen. Unless a drastic turnaround can be made with struggling Evergreen and its Afghan operations, Erickson should easily see the single digits very soon. But by that time, ZM will already be long gone.

Despite these troubling facts, shares sold short represents just 2% of shares outstanding and only 1.5 days trading volume. Large short interest can often support a stock on the way down, preventing it from falling as shorts become buyers. But with Erickson, this is clearly not the case.

This could turn out to be a genius trade of epic proportions for ZM. First, they get their very distressed debt repaid in full. But even better, their repayment came in the form of deeply discounted shares which they now sell at a price which is a triple at current prices. Even if they get out at $13.00, ZM’s trade will represent a spectacular homerun.

Aside from ZM Funds, the stock has few major mutual fund holders. Only two mutual funds own more than 1% of the company. Aside from ZM there are only two 5% holders. As a result, this abusive transaction has gone largely unnoticed. But with the majority owner planning on selling 100% of its shares, and with Erickson now saddled by debt and maintenance requirements of a huge distressed acquisition, it is hard to see how these smaller funds will wait around to be left holding the bag as ZM sells. It is also hard to see how anyone else will buy shares of Erickson as ZM liquidates in the face of the massive acquisition.

Looking further back, Erickson Air-Crane came public just over 1 year ago in a very difficult IPO. At the time, the Oregon company had historically been engaged primarily in providing helicopter services for firefighting and to the timber industry in North America. After being repeatedly delayed for 2 years, the IPO had originally been slated to be priced at $14.00, but weak demand caused the offering price to be cut and the size to be reduced.

The company ended up coming public at $8.00, 43% below expectations. The share price then quickly traded down to as low as $5.35, another 33% below the lowered IPO price.

Even home-team Oregon newspapers were not kind to the company’s prospects, stating

Erickson isn’t gearing up for rapid growth, however. It’s a 40-year-old business just trying to pay down $130 million in debt.

Erickson had been positioning itself for an IPO for nearly two years and repeatedly failed to find buyers for its stock.

So earlier this month, it resorted to cutting its share price and reducing the number of shares offered. “

The debt being paid down was actually being held by Erickson’s the ZM private equity fund. In addition, ZM had been hoping to liquidate shares. Getting this deal done was therefore even more crucial for ZM.

As a result it was reported that:

Discounted shares were evidently still insufficient to attract investors. So Erickson’s owner, the investment firm ZM Private Equity, stepped in and agreed to buy at least 750,000 of the IPO stock itself, and perhaps as many as 1.25 million shares.

ZM, which is also an Erickson creditor, had planned to reduce its stake in Erickson to around 50 percent through the IPO. If it buys the full 1.25 million shares, it will retain a 63 percent interest in Erickson.

ZM ended up having to purchase 1.05 million shares (one quarter of the IPO) in order to keep the IPO from failing and get its debt holdings repaid.

Now, with the acquisition of Evergreen, Erickson has levered up massively. Once again, the reason is so that it can bail out ZM Funds from another distressed debt holding.

Yet the market has clearly missed these important nuances. Since those $5.00 lows, the stock has been a rocket ship and is now closing in on $30.00. Including the effect of its recently issued shares, the company now sports a market cap of nearly $350 million.

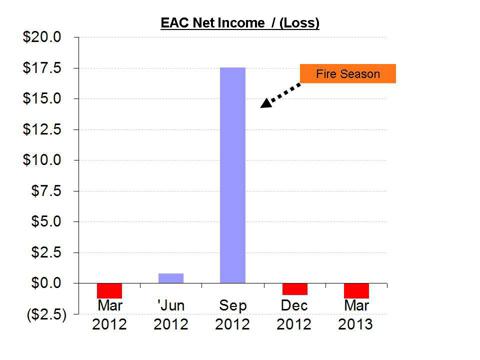

The reason for the rise is that the stock benefited greatly from a strong fire season in late 2012. As a result, the company actually turned a meaningful profit in one quarter out of the past five. The result of this single strong quarter is that Erickson posted a positive net income for full year FY 2012.

Erickson has always preferred to avoid any focus on its negative EPS and instead touts its strong “adjusted EBITDA”. And yet even this has received an artificial boost. The company recently changed its methodology for calculating EBITDA, resulting in an immediate boost of 30% without any change in the business. Investors in the stock have largely ignored the fact that the company continues to lose money and was down to just $1.3 million in cash at the end of Q1.

It should be viewed as intuitive that Erickson’s non-GAAP “adjusted EBITDA” numbers will give optimistic results. When a debt laden and capital intensive company simply ignores all of its depreciation, interest and taxes, the strained results are naturally going to be seen as just fine.

In mortgaging the farm to make these purchases, Erickson may have just committed a colossal blunder which solely benefits its controlling shareholder and board member.

The situation at Evergreen is indeed very, very bad. Evergreen’s situation was specifically described as “distressed” in the recent 8K filing. It was unable to make good on its payables, to the extent that its suppliers were withholding parts. It is noted that Evergreen

has been unable to adequately maintain certain of its aircraft

It has also been disclosed that

a number of EHI’s aircraft are not air-worthy, causing dissatisfaction among certain of its customers

At the end of 2012, target Evergreen was down to just $174,000 in cash. Only 50% of its aircraft were even being utilized. The company is now subject to lawsuits and legal proceedings from its suppliers, customers and creditors who are demanding immediate payment.

Despite the deep financial distress, Evergreen does continue to generate substantial revenue of nearly $200 million. It’s just that these revenues do not translate into any ability to generate a meaningful profit or accumulate cash to pay its massive debts or its suppliers.

Erickson is also in the process of completing second acquisition, which is also with a somewhat related party. Air Amazonia is the helicopter subsidiary of one of Erickson’s former customers in Brazil. The acquisition is set to close in Q3 for a price of $65-75 million, yet the company has just 14 aircraft. Like Evergreen, the aircraft utilization sits at just 50%.

With both targets only showing 50% utilization, Erickson has communicated the view that the glass is half full rather than half empty. With such low utilization, they hope that there will be room for improvement. Again, this is a substantial understatement. Yet the company has clearly paid a tremendous price for two companies which are sitting at half idle. In addition, Erickson’s Central Point Oregon manufacturing facility also sits at just 50% of capacity.

Conclusion

With few major holders and very limited research coverage, the rise in Erickson has gone largely unnoticed. The massive related party acquisition of the distressed Evergreen has also gone largely without any analysis by either longs or shorts.

Given that Erickson lacks any relevant experience in acquiring such a company, and given that the Afghan pullout will greatly curtail its revenues, it appears that the only real purpose of the Evergreen deal was to bail ZM Funds out of a 100% loss on a very large position in the $120 million second lien debt. With ZM firmly in control of the votes and the board at Erickson, this was an easy transaction to push through.

Now that this has been done, Erickson is saddled with half a billion in debt and is stuck with a deeply distressed target to manage in a far flung corner of the world.

Although Erickson has made positive statements about the acquisition and the use of “adjusted EBITDA”, it is clear that interest alone on the massive debt will preclude a profit for years to come. In the meantime, Evergreen’s fortunes are tied to Afghanistan.

It is not surprising that ZM is now selling 100% of its holdings in Erickson. Even if it continues to sell at prices which are 50% below the current level, ZM will lock in a tremendous gain and will have recovered all of its exposure to Evergreen’s deeply distressed debt.

The only thing that remains to be seen is if the many smaller holders of Erickson will wait to be left holding the bag as ZM sells.

Disclosure: The author is short EAC