Long $OSTK – Overstock headed sharply higher (despite obvious problems)

- As of December, short interest in OSTK hit 42%. Latest data will be released after market close today. Given recent activity, I expect short interest to hit 50-60%.

- The key to the rising share price is understanding what is happening behind the ICO. The “optimal” size for OSTK share price is actually far less than $500 million.

- Current investors in Overstock have obvious incentives to make moderate buys in the ICO, even moderate success will sharply boost value of their equity holdings.

- Yet some investors reportedly unable to get confirmed to buy. Ask yourself why ? Token will then trade with limited liquidity on closed system via sole BD.

- Engineering token price higher is simple and would leave OSTK with potential apparent value of multiple billions. The stock price will react accordingly.

This article is the opinion of the author. The author is long OSTK.

At the risk of stating the obvious: keep in mind that a slew of increasingly negative public analysis from a range of very smart short sellers has so far failed produce even the slightest dent in the trajectory of Overstock’s share price.

Below is my analysis of why I see the share price of Overstock headed sharply higher in the near term (yes, even despite it very obvious problems).

Background

When I publish my stock ideas at Moxreports.com, it is often the case that my long ideas actually originate from would-be short ideas. After first realizing that an idea is just a “bad short” I then occasionally realize that some of these are actually great longs – even despite the obvious fundamental problems which had first caught my attention on the short side.

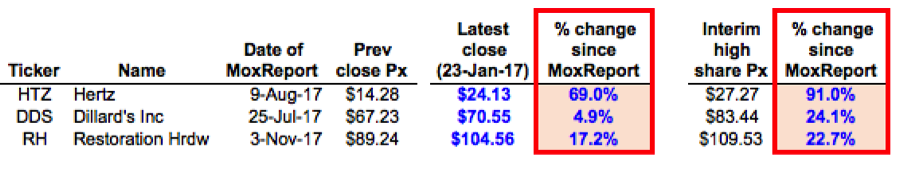

Last year I wrote contrarian long ideas on three stocks which had been heavily shorted following wide circulation of very detailed short theses. With each of these stocks, there were very clear and visible fundamental problems that were easily understood by anyone who conducted even moderate analysis. As shown in each of those articles, I actually fully agreed with much of the short theses (but again, only on a fundamental basis).

The problem (from a short perspective) was that with each of these ideas there were external factors which were set to drive the stocks substantially higher. These external factors had nothing to do with the underlying business or fundamentals. As a result, short investors who only focused on the visibly poor fundamentals would very soon end up on the receiving end of a very nasty surprise which they would find hard to reconcile.

This pain for short positions then ended up being greatly magnified further by the heavy short interest which fueled an even greater share price rise. In fact, with short interests of 40-60% on these stocks, most shorts should have known better in advance had they been paying closer attention.

Important: These articles were not hit and run squeezes simply due to a high short interest at the time. I wrote each of these articles 2-5 months ago such that they have had plenty of time to find their own level. Each of these stocks is now well above where it was at the time I published.

MoxArticles: Hertz, Dillard’s Restoration Hardware,

Why Overstock.com is headed sharply higher

I am fully aware of the very detailed short thesis on Overstock. Short sellers have not been shy about publishing their views on Overstock and I have pored over everything that has come out. In addition, I have several of my own unique viewpoints about the fundamentals which I have not yet seen anyone else address.

As was the case with my previous long ideas above, I actually agree with many of the points raised by those who are short Overstock (on a fundamental basis).

But I am long Overstock because I see the stock headed sharply higher from current levels in a way that has very little to do with any of its fundamentals.

Ask yourself this: do you really think you can pick the top (as well as its timing) on the chart below ? (Especially now that the string of vocal short sellers have already fired their ammunition).

And now it gets even more interesting.

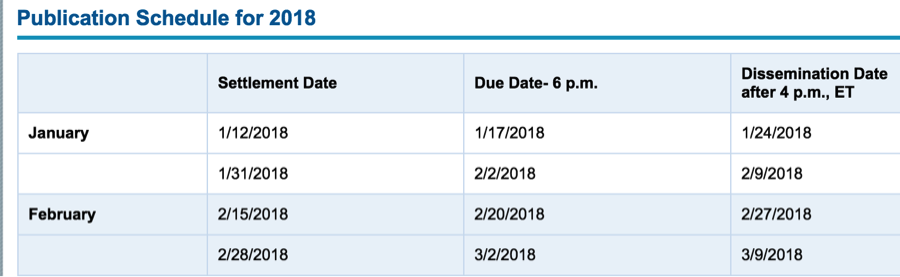

When the latest short interest data for Overstock is released tonight (yes, tonight…), I expect that we will see the new reported short interest rise from 42% of float as of December 29th to somewhere between 50-60%, largely as a result of a 25% rise in the share price in January and the proliferation of negative commentary which has continued to attract more and more short sellers. (In fact, even at levels of 40% or more, the short interest is already problematic for anyone who is short the stock.)

Below are the short interest publication dates for each of the various settlement dates listed, along with a Bloomberg table showing the recent rise in short interest to over 40% of float in Overstock.

Much of the short thesis on Overstock is predicated on the ICO raising less than $500 million or less than $250 million or whatever. In fact, as far as the share price of OSTK is concerned, the “optimal” amount for the ICO is actually a bit smaller. I am expecting around $100-150 million.

Existing investors in Overstock have an overwhelming incentive to put in moderate buys into this ICO. As the price of the tZero token rises in the aftermarket, the apparent value of further tokens held or issuable by Overstock will have massive (apparent) value which should be expected to boost the stock accordingly. For any sizeable equity holder, a small investment to support the ICO will have a disproportionately positive impact on their equity holdings.

Queston #1: How can we be so certain that the price of the tZero token will rise in the aftermarket following the ICO ?

Question #2: Are you kidding ?!

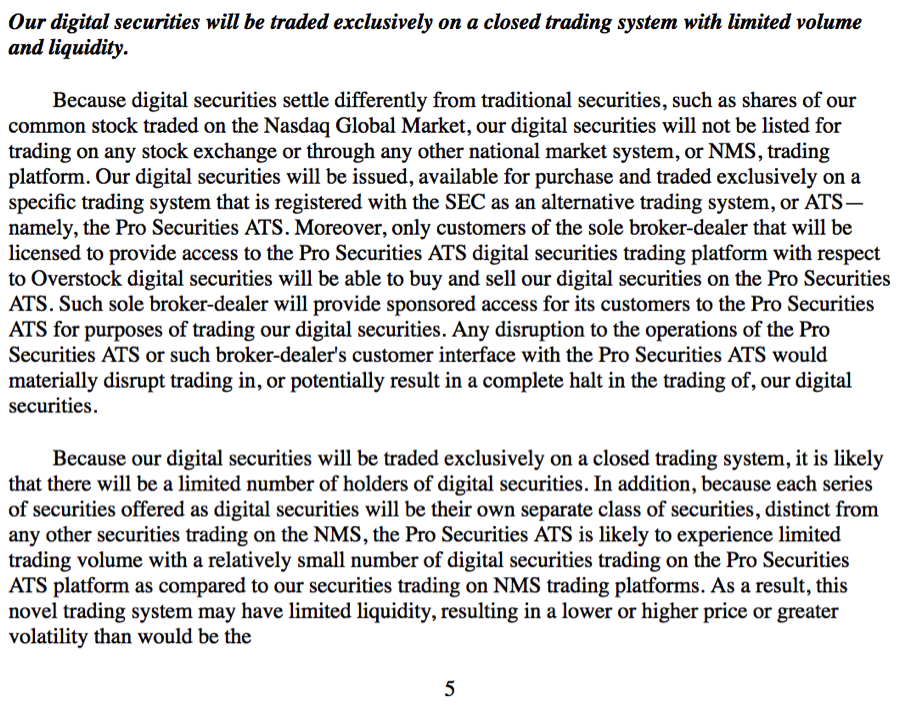

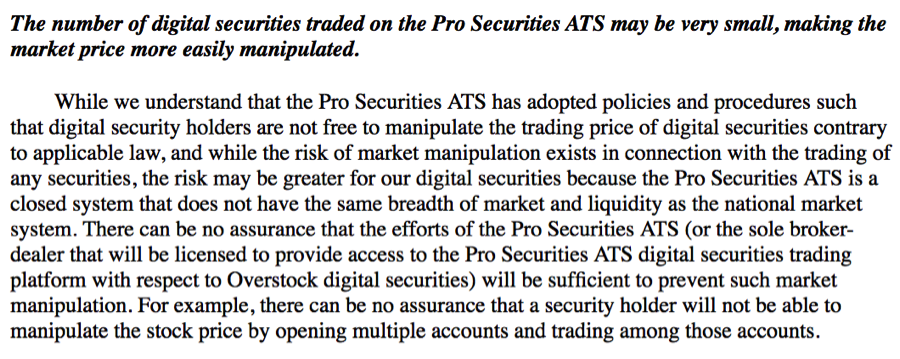

Even Overstock itself has specifically disclosed the easy potential for the outright manipulation of such “digital securities” as a result of their limited liquidity and the fact that they will trade on a “closed system” via just a single broker dealer.

Clearly this is why I say that a smaller offering ends of delivering much more potential benefit to the OSTK share price as opposed to a larger offering.

Consider this: last week an article in Techcrunch found that a single trader had been able to drive the price of Bitcoin from $150 to $1,000. And that is for the largest and most liquid crypto currency in existence. By comparison, moving up a single illiquid crypto currency (such as tZero) on a closed system would be almost effortless.

Article: Researchers find that one person likely drove Bitcoin from $150 to $1,000

Over the past few years, I have watched as various stock operators and promoters manipulate upwards the value of micro cap reverse merger equities by hundreds (or even thousands) of percent. In comparison to that, influencing a crypto currency in which the float is limited and largely controlled, is genuinely child’s play for any interested 3rd party. Even better (for the person looking to influence), SEC rules applying to crypto are still so vague that the consequences of any perceived “manipulation” would arguably be far less (if any) relative to similar activities in the world of small cap stocks.

The point is this: I expect to see an ICO that is much smaller than many have anticipated, coming in at about $100-150 million. And in fact this would prove to be a larger positive for the share price. As a result, it may even be the case that outside investors who would otherwise want to get in might find themselves unable to buy into the ICO. This would keep the public float of the tokens smaller, while simultaneously reserving some pent up demand for the aftermarket which would presumably push up the price after the ICO is completed. Perhaps you should ask around to a few investors and see what you hear.

Conclusion

When I look at Overstock now, what I see is a very similar setup to Restoration Hardware in late 2017. So please bear with me on this.

When I published my long thesis on Restoration Hardware in November, the stock was hitting multi year highs at around $89. It had more than tripled since the beginning of the year. Many investors viewed it as a short simply due to the share price spike. It is now substantially higher.

I was well and truly aware of the many fundamental problems facing RH. But I stated quite clearly in my article that on November 16th the company had scheduled its first investor call in more than two years. It just seemed like common sense that the highly incentivized CEO might just do something that was a) simple b) obvious and c) completely in line with his massive incentives.

In fact, the RH CEO jumped the gun by about 12 hours. Late in the day on November 15th, all it took was a few words of breath from the CEO to spike the stock by over 30% to a new all time high of $109. Surprise surprise, apparently the outlook for RH was suddenly better than previously expected.

Likewise, there are a number of levers which can be easily pulled by Overstock or other involved parties which would have an immediate and outsized effect on the share price. The most impactful will be anything related to the ICO, and this is what I expect. But also keep in mind that just a few public words from the CEO or other relevant participants could also result in a steep and immediate jump. And this type of development could occur on any day and at any time. Any potential upside is greatly magnified by the heavy short interest which already stood at 42% on the most recent reporting date and which is likely to be revealed at north of 50% tonight.

For those who are determined to pick their shorts based “on principle” rather than based on economics, there are any number of tobacco and “defense” (weapons) stocks which would likely prove far less expensive than shorting Overstock.