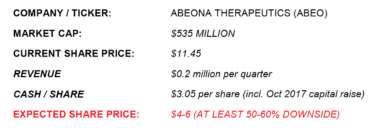

Reports about: ABEO

Short ABEO. Short Abeona on Manipulated Trial Data

February 15, 2018

Summary In Oct 2017, shares of ABEO hit a new high of $19.55 following the release of seemingly positive data in its clinical trial for MPS-III. ABEO quickly used that...