Summary

- Nymox withheld the data that Phase 3 trials of its only drug had failed for 6-12 months after management knew of the failure.

- During this time, Nymox issued bullish press releases while management continued to aggressively dump stock without timely SEC disclosure.

- Offshore anonymous Panamanian finance deals; auditor, legal counsel, bankers ALL closely tied to regulatory violations, stock promotions and/or outright frauds.

- Nymox moved its domicile from Canada to the Bahamas to limit transparency and legal liability. No institutional ownership or research coverage by anyone.

- Nymox is down to $800,000 in cash and has just $41,000 in quarterly revenues. Bogus misleading press releases have caused the stock to recently soar.

This article is the opinion of the author. Nothing herein comprises a recommendation to buy or sell any security. The author is short NYMX. The author may choose to transact in securities of one or more companies mentioned within this article within the next 72 hours. The author has relied upon publicly available information gathered from sources, which are believed to be reliable and has included links to various sources of information within this article. However, while the author believes these sources to be reliable, the author provides no guarantee either expressly or implied.

Authors note: Prior to publication, the author filed a formal written whistle-blower complaint with the United States Securities and Exchange Commission (“SEC”), including details from the article below.

Investment summary – catalysts for a decline to true zero.

The key points I will make in this article are as follows:

- Nymox management has consistently and repeatedly misled shareholders about its prospects in a material way – and then dumped stock at inflated prices without making timely SEC disclosures. The stock price then crashes.

- Following the ensuing fraud lawsuits, Canadian Nymox reincorporated in the Bahamas to limit disclosure and legal liability. It then quickly resumed its promotional activities from the Bahamas.

- Nymox has a history of using anonymous offshore Panamanian financiers who then fail to disclose share ownership or their unregistered offshore dumping of stock.

- Unremedied material weakness in internal controls, a “going concern” warning and a highly problematic penny stock auditor of past stock promotions. Auditor Thayer O’Neal is simply a renamed “spin off” from previous auditor who was dissolved by the PCAOB for gross audit deficiencies.

- Nymox’s legal counsel has recently been charged by the SEC with stock fraud, engaging in pump and dumps and market manipulation. He has a long history of such activities.

- Nymox’s banker has a long history of involvement with penny stock promotions and blatant SEC violations when raising money for microcaps. Significant history of their troubled clients going to zero after raising money from investors.

- The doctor who was quoted in the recent bullish Nymox press release failed to disclose his direct funding from Nymox as well as ownership of shares.

- More details on repeated small purchases by new board member James Robinson

Nymox Pharma (NASDAQ:NYMX) is a “no-brainer” short which I expect to go to true zero. The company bears many striking similarities to Forcefield Energy (NASDAQ:FNRG) which quickly collapsed by 99% within a few days following my exposé of that company.

Multiple parties behind Nymox have been behind other stock promotions which have declined by at least 99%.

Shares of Nymox Pharma had nearly doubled this year as a result of several grossly misleading press releases issued by the company. The shares are now up by nearly 10x from their 2015 lows.

Nymox has been around for over 30 years but has failed to ever have a commercial success. In November of 2014, the company announced that its only clinical drug (NX-1207) had failed both Phase 3 clinical trials it was in, sending its stock to as low as 39 cents. However, Nymox management had in its possession the information that the trials had failed for as long as 6-12 months prior to releasing the news to the public.

During that time (well after the drug had failed), Nymox management continued to put out bullish press releases while dumping millions in stock without making timely SEC disclosures of the sales. During this time, Nymox also raised millions more for the company by placing unregistered stock with an anonymous offshore Panamanian shell company. The Panamanian shell has never disclosed its ownership and has never disclosed its sales of stock.

On the legal side, Nymox is represented by Zouvas & Associates LLP. Luke Zouvas was previously a partner with Luis Carrillo in the firm Carrillo Huettel & Zouvas, LLP. That firm imploded when Carrillo was charged by the SEC in a wide range of small cap pump and dump fraud schemes involving Canadian stock promoters and Bahamas based brokers.

(Note that Nasdaq listed Nymox was originally a Canadian company. In order to avoid legal scrutiny and liability, Nymox recently (July 2015) re-domiciled itself to the Bahamas.)

Zouvas himself can now be tied to numerous small cap pump and dump stock promotions and was just recently (April 2016) charged by the SEC for outright stock fraud using offshore companies, undisclosed ownershipand sales of stock, as well as false and misleading press releases issued by the company.

Past Zouvas stock promotions (which all imploded) bear striking similarities to Nymox.

Nymox has quarterly revenues of less than $50,000 and is down to less than $1 million in cash. The company has had unremedied material weaknesses in internal controls for over two years and has a going concern warning.

Nymox’s auditor, Thayer O’Neal was created as a direct spinoff of LL Bradford, when that firm was recently shut down by the PCAOB for multiple gross audit deficiencies. The new “spin off” auditor simply changed its name and picked up LL Bradford’s troubled clients, all of which (aside from Nymox) have imploded to just pennies.

Nymox’s banker is Chardan Capital markets. Chardan and its founders have a lengthy history of run ins with regulators, including cases of market manipulation, numerous imploded reverse merger frauds and charges of defrauding the Small Business Administration.

Similar to Forcefield Energy , Nymox “appears” to have just 1% institutional holdings with the rest “supposedly” being scattered among small retail holders. Nymox has zero research coverage. Following my exposure of Forcefield, the share price plunged 60% within 3 days. The Chairman was then quickly arrested by the FBI for manipulating the worthless stock. After being halted, Forcefield quickly fell to zero. I believe that with Forcefield there were large holdings of stock being held by undisclosed offshore holders. These holders were well aware that the company was a sham and were the first to dump shares at any price as soon as I exposed the promotion. There was simply no value in the company and no bottom in the share price.

In the last section below, I will also provide more information on recent share purchases by an 81 year old Hollywood film director (James Robinson) who was appointed to the board of Nymox in 2015.

Background

Over the past few years, I have exposed a wide variety of deeply troubled companies. I have highlighted these companies as attractive targets for short selling opportunities. Following exposure, many of these companies quickly plunged by 80% or more. Examples of my “targets” which subsequently plunged by at least 80% include:

Biolase (NASDAQ:BIOL), CleanTech Solutions (NASDAQ:CLNT), CytRx (NASDAQ:CYTR), Erickson AirCrane (NASDAQ:EAC), Forcefield Energy Galena (NASDAQ:GALE), Sungy Mobile (NASDAQ:GOMO), Ignite Restaurant Group (NASDAQ:IRG), NeoNode (NASDAQ:NEON), Neptune Technologies (NASDAQ:NEPT), Northwest Bio (NASDAQ:NWBO), Ohr Pharma (NASDAQ:OHRP), Regulus (NASDAQ:RGLS), SunCoke (NYSE:SXC) and TearLab (NASDAQ:TEAR), Tokai Pharma (NASDAQ:TKAI).

These were the absolute homerun short trades.

But in fact, I have also exposed dozens of others which also quickly fell by at least 50%. This can be seen by looking at a list of my prior articles. While not the epic homeruns, I would also consider drops of 50% or more to be very successful short trades.

In my earlier career years, I spent nearly a decade as an investment banker for a major firm on Wall Street, with a primary focus on healthcare companies, biotechs in particular. I performed due diligence on more companies than I can count and helped successful biotechs raise billions of dollars. I learned quite a bit about what separates “real” biotechs from the “wanna be’s”.

It is now many years later, and I have parlayed that experience into investing for my own account. I continue to focus heavily on biotechs and (as my regular readers know) I often focus on short selling opportunities, betting on declines in the share prices of biotechs which have underlying problems.

Examples of my past biotech exposés include CytRx , Galena , Ziopharm (NASDAQ:ZIOP), Revance Therapeutics (NASDAQ:RVNC), Regulus , Keryx Biopharm (NASDAQ:KERX), Ohr Pharma . Each of these stocks quickly fell by at least 60-90% as their problems unfolded.

And now I get to tout my most recent successful short prediction.

About 2 weeks ago, Shares of Tokai Pharma plunged by 80% in a single day when its prostate cancer drug (Galeterone) failed Phase 3 trials. This is yet another stock which I had warned investors about in late 2015. When I wrote about Tokai, the stock had been trading at around $10. I showed that Tokai was engaged in “after-the-fact cherry picking” of data and highlighted heavy insider selling. I described Tokai as a “no brainer short“.

Following my article, Tokai’s share price ground down to around $5.00 – an initial decline of 50%. Failure of its drug was all but guaranteed. Following the announcement of the failure, the stock now trades for around $1.00.

Today I am exposing very deep problems at Nymox Pharmaceutical . There are obvious similarities between Nymox and my past homerun short trades, especially Tokai Pharma and Forcefield Energy.

Nymox is another “no brainier short” which will soon go to true zero. Yes, zero. This is a company with no value and basically no assets which has simply been pumped up on promotional hype.

Nymox – recent developments

In late 2014, shares of Nymox Pharma had just rallied by 25% to over $5.00 as anticipation was building for the results of its two Phase 3 trials for its NX-1207. The trials had been evaluating NX-1207 for use in treating Benign Prostatic Hyperplasia (“BPH”), otherwise known as an enlarged prostate.

Much of the share price strength had been due to a stream of positive press releases from Nymox touting the strong prospects for NX-1207. Examples of these press releases are shown below.

Then on November 3rd, 2014, Nymox announced that both trials had both failed to meet their primary endpoints. The stock immediately plunged by 85% to just 75 cents. It continued to decline to as low as 39 cents in the subsequent weeks.

(Note: as I will demonstrate throughout this article, management was already aware that NX-1207 had failed Phase 3 trials as far back as 6-12 months earlier. Instead of making timely disclosure of the failure, management continued to put out bullish press releases touting the drug’s prospects. During this time Nymox CEO Paul Averback aggressively sold millions of dollars worth of stock at inflated prices, while Nymox the company raised over $5 million from equity offerings. No SEC disclosures of the sales were made at the time).

Since the implosion in November of 2014, the shares have now recovered much of those losses, now trading at around $3.20 In other words, the stock is now up by nearly 10x since its post-failure lows !

The key driver of the stock price rebound has once again been a series of NEW favorable press releases under which the company seems to suddenly indicate that (contrary to previous disclosure) the company’s only drug once again has bright prospects.

As I will demonstrate clearly below, the information in these press releases is deeply misleading. Nymox’s only drug continues to be just as worthless as it was when the stock was trading at 39 cents.

With just 1% institutional holdings and zero research coverage, there has been almost no analysis of the faulty information being disseminated by Nymox.

Investors should run (not walk) from this dubious biotech which has a long and sordid history of deeply misleading shareholders as management dumps shares.

Company Overview

Nymox Pharma was founded in 1985 (yes, over 30 years ago) by CEO Dr. Paul Averback. During the past 30 years, the company has pursued multiple business paths including various diagnostic tests as well as several initial attempts at therapeutic drugs. It has never generated meaningful commercial revenues. The company does generate a miniscule amount of revenue (less than $50,000 per quarter) from sales of two diagnostic tests which test for the presence of nicotine in saliva or urine.

Looking at Nymox’s financials, it may appear that the company has generated a decent amount of revenues over the past 5 years. However, this is absolutely, positively not the case.

Back in 2010, Nymox signed a licensing agreement with Italy’s Recordati Pharma. Recordati paid an upfront licensing fee of $13 million for European rights to Nymox’s only drug, NX-1207. Over the years, Nymox has disclosed working on several different drug compounds, but NX-1207 is the only one that ever made it into any clinical trials. At the time of the Recordati agreement, NX-1207 drug had just entered Phase 3 trials.

It is important to note that the $13 million in cash from Recordati is long since gone and Nymox now has less than $1 million in cash. However, for accounting purposes the Recordati revenues were recognized pro-rata over the subsequent 5 years. This gives the appearance that Nymox had generated around $2-3 million per year in revenues. But again, this is for accounting purposes only. Nymox generates less than $50,000 per quarter in revenue and now has less than $1 million in cash. Nymox has never generated meaningful revenues from commercial sales of any product.

Following the 2014 failure of both Phase 3 trials, Recordati immediately terminated all development and commercialization activities related to NX-1207.

As of 2016, we can see that Nymox is no longer recognizing these revenues for accounting purposes. In Q1 of 2016, Nymox revenues amounted to just $41,501.

As for cash, Nymox’s situation is dire. As of December 31, 2015, the company was down to just $653,000 in cash. The company did raise $2.1 million in a series of small private offerings in February. But by March 2016, it was again down to just $831,000 in cash. Last year the company burned $3.7 million in cash from operations.

Given its shaky financials and limited prospects, it is not surprising that there is virtually no institutional investment in the company. Institutional ownershipstands at just 1% of shares outstanding. There is no research coverage of Nymox. Share price moves are entirely driven by retail day traders who play the latest headlines and press releases on the stock.

Nymox has a long history of misleading investors – and then dumping stock at inflated prices

My regular readers will remember that I have exposed multiple biotech stock promotions at companies such as CytRx , Galena , Ziopharm , Northwest Bio and Tokai Pharma . These promotions shared many similarities to what we now see at Nymox. This will be illustrated below.

Each of these companies was dominated by the participation of retail investors and each of them had completed seemingly “promising” Phase 2 clinical trials. Many small investors relied heavily upon numerous bullish press releases which appeared to presage almost certain success of their drugs.

What many retail investors do not understand is that drugs do not “pass” Phase 2 and then proceed on to Phase 3. The progression from Phase 2 to Phase 3 is simply a DECISION made by the company. For companies running stock promotions, they will ALWAYS proceed to Phase 3, even when they know that their drug doesn’t work. This is because having a drug in Phase 3 typically results in a share price bump and allows the company to raise larger sums of money. We saw this exact phenomenon in each of CytRx, Galena, Ziopham, Northwest Bio and Tokai. And we are now seeing it again with Nymox.

In each case, management aggressively touted the “compelling results” in Phase 2 in order to boost the share price. When the share price bumped up, the companies could then raise more money and enter partnerships with larger drug companies. Insiders would often sell stock.

Yet in each case, the Phase 2 trials were largely a sham. In each of may articles, I showed with a high degree of certainty that each of these dugs stood almost no chance in Phase 3 trials. Yet management chose to proceed to Phase 3 anyway. When Phase 3 results were released, they were a dismal failure in each and every case. The share prices quickly plummeted by 60-80% in a single day.

Sadly, such misleading behavior is very common with small cap biotechs.

With no institutional investment and no research coverage, there is simply no mechanism to keep Nymox honest. The day-to-day share price action is strictly dominated by retail day traders who play the headlines and press releases of the company along with following “technical analysis” on places like Twitter.

Nymox (in particular CEO and founder Paul Averback) has a history of grossly misleading investors and then dumping shares at inflated prices.

During its 30 year history, past business descriptions detailed the company’s primary pursuit of Alzheimer’s related projects. This included a diagnostic testfor Alzheimer’s as well as several anti-Alzheimer’s drugs. Many years ago, Nymox had also done very preliminary work on developing several anti-infective drugs. But these never went anywhere.

Even in the distant past, Nymox and CEO Averback have always been very aggressive in promotion.

With the Alzheimer’s test, Averback had once run an aggressive public ad stating that “Alzheimer’s–Now you can rule it out“. An article in Bloomberg quickly described Averback’s ad as “misleading”, “unproven” and “unsupported”.

According to Bloomberg:

Dr. Norman R. Relkin, an Alzheimer’s specialist who directs a memory-disorders program at New York Hospital-Cornell Medical Center, says hawking the test to the public is “reprehensible.” The Alzheimer’s Assn. derides Nymox’ “highly objectionable” sales efforts and advises against use of the test

Following such public criticism of his marketing tactics on the ineffective test, Avervack then switched to using “scientific meetings” to spread use of the test, funding studies conducted in hospitals which it said were supportive.

Bloomberg concluded that:

In its rush to market, Nymox seems more interested in cashing in on the data it has rather than learning more.

However, the effect of the public promotion by Averback had a strong effect and Nymox’s stock soared from $2.45 to as high as $13.50, before ultimately crashing back to the $2’s.

The issue here was that the Alzheimer’s test proved to be highly problematic.

Nymox’ test had demonstrated a disturbing rate of false positives of 11%. At the time, Harvard Medical School neurologist Peter Lansbury noted: “A false positive for Alzheimer’s is a nightmare.” It would end up preventing diagnosis for various other types of impairment, which could have otherwise been treated if properly diagnosed.

In July of 2005, an FDA advisory panel voted 5 to 2 to block use of Nymox’s Alzhemer’s test. The FDA ruled that the test was “non-approvable“.

By this time, the stock had declined back into the $2’s and Nymox’s cash balance was down to just $151,000. Nymox was broke.

With its Alzheimer’s test a failure, Nymox needed a new investment thesis to boost the stock price. Nymox also desperately needed cash.

Keep in mind that Averback had already been running the company for 20 years and had so far failed to ever generate more than a few hundred thousand in total annual revenues. Even these meager revenues were simply the result of a 2000 acquisition of Serex, which marketed two diagnostic tests for detecting nicotine in urine or saliva samples. At the bottom line, the company was losing $3.5 million per year.

What was Averback supposed to do after 20 years, go out and get a real job ?!? No chance.

On the product side, Nymox soon began emphasizing a new direction for the company. Historical filings had all emphasized Nymox’s focus on Alzheimer’s, but in 2006 the company began to emphasize its new focus on BPH (enlarged prostate).

Nymox had originally been developing a whole series of compounds for Alzheimer’s, including NXD-5150, NXD-9062, NXD- 1191 and NXD-3109. But none of these ever made it into clinical trials.

Instead, Nymox began pursuing NX-1207 for enlarged prostate (BPH). NX-1207 had inexplicably been developed directly from its work on entirely unrelated the Alzhemier’s drugs, none of which showed enough promise to enter clinical trials.

To address the cash shortage, Nymox began relying more heavily on an offshore financing agreement conducted via obscure Panamanian shell company, raising over $3 million by issuing stock at discounted prices.

(Note: In the past, it has been my experience that the involvement of anonymous offshore shell companies in holdings shares has typically been for the purpose of concealing true ownership of the shares as well as concealing the offshore dumping of these shares. Such dumping often presages massive plunges in the share price. This topic merits its own discussion and is addressed in the section below. But for now, we could see that Nymox had temporarily solved its near term liquidity crisis via its new Panamanian connection.)

Despite its curious beginnings as an unrelated Alzheimer’s drug, Nymox took NX-1207 through multiple clinical trials for BPH.

Throughout 2007 and 2008, Nymox began releasing a stream of positive press releases touting strong results from Phase 2 clinical trials. Throughout 2008, the share price began to rise to over $5.00.

Based on strong Phase 2 results (according to Nymox), Nymox then took NX-1207 into Phase 3 trials. And in 2010, Nymox announced a licensing deal with Italian pharma group Recordati.

The Pharma Times put out an article noting:

Italian drugmaker Recordati is shelling out 10 million euros [US$13 million] for access to US group Nymox Pharmaceutical’s experimental enlarged prostate drug NX-1207 in Europe, causing the latter’s shares to rocket more than 60%.

Misleading investors while secretly dumping stock

During this time, Nymox continued to put forth very aggressive and positive press releases. (A list of these is provided below). Because of the Recordati investment and the positive PR, Nymox’s share price had soared back to almost $10 by 2011.

As the stream of hyper bullish press releases continued, CEO Averback was quietly selling millions of shares without ever filing any SEC forms to disclose the sales. From SEC filings, the only way that anyone would know that Averback had sold would be to compare each annual form 20F to the previous year’s 20F and then do the math. This is further complicated by the fact that Averback has often awarded himself additional shares, which obscures the impact of his share sales.

Looking back, we can see that as of March 2011, CEO Averback owned 13.1 million shares. But by March of 2013, this number had declined to 12.2 million shares. Averback had therefore disposed of nearly a million shares when the share price was ranging from $7 to nearly $10, netting him at least $6-8 million in proceeds. As shown below, while he was selling, Nymox had put out more than a dozen bullish press releases on NX-1207.

As described in a subsequent lawsuit, in November 2013, Nymox completed enrollment for its first Phase 3 trial of NX-1207. Nymox did not make any disclosure of the results.(Note: as with most securities lawsuits, the suit was ultimately dismissed.)

Even prior to the failure, biotech journalist Adam Feuerstein from TheStreet.com was the first to highlight when these trials had already been completed as well as the fact that the results were well overdue. Investors refused to listen.

Investors had no idea, but as early as November 2013 (and certainly by May of 2014), Averback would have been fully informed that the first trial of NX-1207 had failed.

Rather than disclose this information to the public, Averback continued selling his shares of Nymox at inflated prices. Again, there was no direct SEC disclosure at the time of the share sales to US investors. Even though Averback knew that the trial had failed, he continued to have Nymox issue positive press releases on NX-1207.

By March of 2014, Averback’s share ownership was down to 11.4 million shares. CEO Averback had therefore sold over 800,000 additional shares at prices of $5-8, again netting him millions of dollars in additional personal proceeds. And again we saw numerous bullish press releases touting NX-1207 at the exact time Averback was dumping his stock.

By May 2014, Nymox’s second Phase 3 trial was completed. It was a failureand Averback would have been fully informed of this. Again, Averback refused to disclose the failure of the Phase 3 trial to investors until 6 months later, during which time he continued selling shares.

By March of 2015, Averback’s holdings were down to 10.9 million shares. He had therefore sold another 500,00 shares. But since there is no SEC disclosure of dates, we cannot prove how many of this last 500,000 shares were sold prior to disclosing the failure of the Phase 3 trials. Given that he knew of the drugs complete failure, and given his past behavior, I am assuming he sold his shares before disclosing the failure to the public.

But wait, it gets worse.

Averback wasn’t just focused on lining his own pockets. Instead, he had the company start aggressively issuing new shares to raise money that it would badly need once the trial failure became public. The shares were issued to an anonymous offshore Panamanian buyer, which would then sell them into the market. Again, no disclosure of any such sales were made at the time.

From the subsequent 20F filing (released a year later), we can see a list of the share issuances which started in December 2013. We can see that the share sales aggressively continued even after the second trial failure in May of 2014. Clearly the sale prices were (obviously) significantly above the sub-$1 levels where the stock ended up once the trails failures were disclosed.

– December 18, 2013, 48,544 common shares were issued at a price of $6.18 per share.

– January 14, 2014, 69,686 common shares were issued at a price of $5.74 per share.

– February 4, 2014, 61,533 common shares were issued at a price of $5.69 per share.

– February 28, 2014, 62,297 common shares were issued at a price of $5.62 per share.

– March 25, 2014, 65,408 common shares were issued at a price of $5.35 per share.

– April 11, 2014, 28,468 common shares were issued at a price of $5.27 per share.

– April 25, 2014, 29,487 common shares were issued at a price of $5.09 per share.

– May 7, 2014, 63,573 common shares were issued at a price of $4.72 per share.

– May 16, 2014, 59,595 common shares were issued at a price of $5.03 per share.

– May 28, 2014, 29,132 common shares were issued at a price of $5.15 per share.

– June 10, 2014, 31,062 common shares were issued at a price of $4.83 per share.

– June 23, 2014, 31,302 common shares were issued at a price of $4.79 per share.

– July 3, 2014, 21,501 common shares were issued at a price of $4.65 per share.

– July 8, 2014, 52,312 common shares were issued at a price of $4.78 per share.

– July 24, 2014, 31,672 common shares were issued at a price of $4.74 per share.

– August 5, 2014, 31,179 common shares were issued at a price of $4.81 per share.

– August 8, 2014, 60,926 common shares were issued at a price of $4.92 per share.

– August 27, 2014, 60,048 common shares were issued at a price of $5.00 per share.

– September 9, 2014, 61,703 common shares were issued at a price of $4.86 per share.

– September 15, 2014, 31,049 common shares were issued at a price of $4.83 per share.

– September 30, 2014, 37,406 common shares were issued at a price of $4.01 per share.

– October 9, 2014, 33,791 common shares were issued at a price of $4.44 per share.

– October 24, 2014, 50,040 common shares were issued at a price of $5.00 per share.

Under those drawings, Nymox received over $5 million in proceeds. The majority of these drawings occurred at a time when Averback knew with 100% certainty that the trials had failed.

As soon as the Phase 3 failures were announced, the share price plunged. But Nymox had already raised $5 million for its own use and Averback had personally pocketed at least $15 million for himself.

After pocketing the $15 million, and with the share price in tatters, Averback then announced that he would be “forfeiting” his $290,000 salary to help the company preserve cash. But he then also awarded himself 3 million new sharesupfront. This happens to be roughly the amount he had sold before disclosing the Phase 3 failures. So basically, after selling the 3 million shares for $15 million, he then got all of those shares back – for free.

Next, he then also set the company up to issue him an additional 250,000 shares per month for up to 7 years !! The justification for this massive award was that he was forgoing his $290,000 salary. But keep in mind that this would total a whopping 21 million shares ! Even at the distressed prices at the time of the award, the company valued these awards at $21.2 million. At current prices, they would be valued at over $60 million. This is how Averback compensated himself for forfeiting his mere $290,000 salary.

So Averback has already cashed out of at least $15 million personally. Due to the recent share price rise, his current holdings are now worth an additional $60-70 million. And with the additional shares he receives each month, he is set to receive up to $80 million more.

No bad for a company which has never even generated meaningful revenues over its 30 year history.

Included is a list of the press releases that Averback was putting out in the time that he was dumping his shares. Notice that a good number of these bullish releases occurred AFTER he was well aware that NX-1207 had failed Phase 3 trials.

Nymox disclosure – going from “very bad” to “completely preposterous”

As stock promotions go, Averback had turned Nymox from a complete failure into quite a success. He managed to personally pocket at least $15 millionhimself simply by selling stock at inflated prices before disclosing the drug failures. This alone was more than the total cumulative revenues of Nymox in its entire 30 year history !

But Averback wasn’t done. In fact, he was just beginning. Now that he was awarding himself millions of additional shares, he now had a massive incentive to get the share price back up.

And in fact, with nearly $100 million worth of stock at prevailing low prices, the real incentive is to simply get the VOLUME up just so he could sell more stock even at the low prices.

But there were already a series of lawsuits brewing against the company following the share price implosion.

The first thing he did was to re-domicile the company to the Bahama’s in 2015. Now he would continue to benefit from the minimal disclosure requirements, but Nymox would also be largely insulated from the legal consequences of his stock promotion.

Subsequent to changing its domicile, the next 20F noted the company no longer had any stated business purpose or any restrictions on what business it may choose to carry out:

our articles of incorporation are on file with the Acting Registrar General of the Commonwealth of The Bahamas under Corporation Number 175894 (NYSE:B). Our articles of incorporation do not include a stated purpose and do not place any restrictions on the business that the Corporation may carry on.

Nymox has institutional holdings of just 1%. The majority of outside shares appear to be simply owned in small lots by scattered retail investors. Yet somehow the vote garnered the support of 94% of these scattered shareholders.

Such a move to an offshore secrecy haven would clearly disadvantage shareholders. That Nymox could somehow garner such strong support for such a detrimental motion seems like a stretch. In fact, even getting a 94% turnout for such a retail-only stock should be nearly impossible. Locating thousands of small investors and getting them to actually vote would have been quite a challenge.

But as we will see, Nymox’s offshore Panama connection may mean that there are concentrated pockets of ownership which are not reflected in any company disclosure. This would easily explain how Nymox could obtain overwhelming approval for such a detrimental motion.

This is just my observation and opinion, it remains to be proven. In fact, this could be the single most interesting part of the Nymox promotion story, so keep this aspect in mind as we proceed.

Re-igniting the promotion from the Bahamas

As soon Averback got the company re-domiciled to the Bahamas in 2015, the immediate next step was to re-ignite the stock promotion.

What Nymox did next was to “re-evaluate” the failed Phase 3 data in what it referred to as a “prospective extension study”. It was just 8 months after the dismal failure of its two Phase 3 trials. But this simplified “new look” at the data ended now ended up pointing to an overwhelming success with NX-1207 showing dramatic benefit vs. placebo. Just 8 months earlier, NX-1207 had showed little to no benefit vs. placebo.

To be clear, this was not a new study. It was simply “data mining” using data from the existing failed Phase 3 studies. The failed data and various subsets can simply be mined and re-analyzed over and over again until a something resembling a positive result is finally obtained.

In any event, this “prospective extension study” of existing data allowed the now-Bahamian Nymox to put out an explosive press release which single handedly dove the share price up by 125%.

Fierce Biotech cautioned that:

Additional new blinded protocol data from the same pivotal studies is being prospectively captured in order to assess long-term results in patients up to 5 years after a single injection of NX-1207 2.5 mg vs placebo,” said CEO Paul Averback at the time….

There’s no word on what the FDA’s position will be on “prospectively captured” data like this.

In that explosive press release Nymox promised that:

The Company now intends to meet with authorities and to proceed to file where possible in due course for regulatory approvals for fexapotide triflutate in various jurisdictions and territories.

The chances that the FDA allows Nymox a “do-over” on two Phase 3 trials due to after-the-fact data mining are basically zero.

Fierce Biotech had noted specifically that:

The general rule of thumb in biotech is that an unblinded Phase III failure is hard to get around. You can mount a new study or give up.

Quite obviously Nymox does not have the cash to mount a new study, which is why it simply sat and “re-analyzed” the old data until it found a subset that looked positive.

But the press release was a quick and easy way for Nymox to rally retail day traders and get the share price moving again. The ruse clearly worked due to the all retail nature of the investor base and the notable lack of analyst coverage to interpret the findings.

In reality, NX-1207 for BPH is dead. It failed both of its Phase 3 trials and no amount of after-the-fact “prospective data capture” is going to change that.

Case in point, a full year has now passed and there has not been a single update as to any progress on NX-1207 for BPH or any supposed discussion with the FDA. Not even a single new press release on BPH.

Instead, Nymox has shifted the focus to using NX-1207 for a totally different application. This time it is as an actual treatment for prostate cancer. Towards the end of 2015, Nymox began putting out preliminary early announcements of results in its Phase 2 trials for NX-1207 in treating prostate cancer.

As was the case in years past with the Phase 2 trials for BPH, the press releases were emphatically glowing about the strong prospects for NX-1207 in treating prostate cancer.

On February 9th, Nymox announced the results of the Phase 2 trial. Not surprisingly, the results were stated in a way that was overwhelmingly positive.

It was clear from the press release that “The trial commenced in February 2012” and that “The study lasted 40 months overall from the first patient randomized to the last patient 18 month endpoints.”

So you do the math. This means that Nymox already had the result of this study for 8 months before releasing the data.

This is funny because just a few days BEFORE releasing the data, Nymox conducted another financing whereby it issued $2.1 million of new shares to what it described as “long-term Nymox shareholders”.

At the time, Nymox did not disclose the names of the investors nor did it disclose the price at which the investment was made.

The point is this: Nymox already knew the results of the Phase 2 study for 8 months and it chose to sell $2.1 million of new shares at some unspecified discount to unnamed existing investors just days before releasing the positive press release. It was a true sweetheart deal. It was literally like handing the unnamed investor a pile of free money.

As expected, the share price immediately soared on 10x normal volume due to the glowing press release.

But the gains were not going to last.

Shortly after the glowing press release, independent websites focused on prostate cancer began to see the claims being made by Nymox. And this is where the latest problems began.

Website Prostate Cancer Info Link focuses exclusively on prostate cancer issues. The site is sophisticated and features detailed articles, video presentations, a daily blog and an interactive mentoring service. The site found immediate problems with Nymox’s press release.

Referencing Nymox’s Phase 2 protocol, the site noted that:

Now, as we have indicated all along, there are very serious questionsabout whether any of these patients actually needed treatment at allat the time that they were initially entered into this study, so it is difficult to ascertain exactly what the real benefit is (or is not) from this form of treatment.

You take a group of men who show no indication that they need treatment. You treat many of them (although it is unclear from the media release or the study summary on ClinicalTrials.gov whether the patients were randomized to one or other of the three study arms or how many patients were enrolled in each of the three arms), and then you claim success without providing any data on the numbers of patients who are said not to need surgery or radiation therapy … and all this with a drug that has no side effects.

Now if these were results in men with even favorable, intermediate-risk prostate cancer (i.e., clinical stage T1c or T2a, PSA ≤ 10, a Gleason score of 3 + 4 = 7), then one might be able to see what the fuss was about, but the patients enrolled in this trial were so low risk that giving them the drug might have had nothing to do with the actual outcomesdescribed!

We should be clear that, at this time, there is no randomized Phase III clinical trial in progress or scheduled to test the effectiveness and safety of NX-1207 in prostate cancer.

In other words, these findings basically invalidated the entire glowing press release from Nymox as being nearly irrelevant. It was a sham (just like the Phase 2 BPH trials from years past).

From February 2016 until June 2016, the share price stayed range bound in the range of $2-3. There was simply no news to drive the stock.

Then on June 22nd, Nymox put out yet another explosive press release detailing the results from another “prospective study” of the failed Phase 3 BPH data.

Of all the recent press releases, this press release was the worst. It was the least substantiated and the least rigorous. Yet the language in it was by far the most extreme.

The press release simply noted that:

These results are astonishingly good

Nymox went on to point out that “The expected rate of new prostate cancer in the U.S. general male population in this age group is in the 5-20% range after 7 year”. It then stated that the observed rate for those who had received NX-1207 was just 1.3%.

This simplified high level summary is what caused the share price to soar.

But in fact, this latest press release contained pure hyperbole and virtually no data with which to back it up. First off, it seems clear that many retail traders misinterpreted the release as if it were clinical trial results, which it is not. Again, this is a simply a rehash of old data from the failed Phase 3 BPH studies from 2014. Nymox didn’t even include the most basic of information from this “prospective study”, such as what age range was used or even basic statistical information such as means, medians, p values or baseline characteristics.

And in fact, it was noted that:

All men were thoroughly evaluated to exclude any prostate cancer prior to qualifying for enrollment in the studies.

So the fact that the incidence of prostate cancer in this group was very low should have been EXPECTED, and not a surprise.

But after years of using the same playbook, such an aggressive press release from Nymox should have come as expected. Here is an example of a previous glowing Phase 2 press release on the soon-to-fail NX-1207 for BPH.

Here is the worst part:

Like the most recent press releases, it offers strong assurances and praise for NX-1207 from different expert urologists who seem to assure us of NX-1207’s promising future.

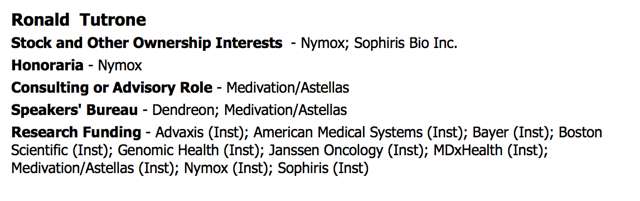

One of these doctors who has regularly touted Nyomx is Dr. Ronald Tutrone.

Dr. Tutrone is the one who was responsible for the comment stating that “These results are astonishingly good”. His credentials appear to be quite strong and the quote was very forceful. This is likely what sent the stock soaring.

Given that Averback owns millions of shares of Nymox, his own bias and self interest should be obvious to any investor.

However, Tutrone appears to be just an outside doctor who is “astonished’ by the great results for NX-1207. In the press release, there is no disclosure of stock ownership or funding by Nymox to Tutrone.

Yet for those who are willing to dig deep enough, we can see that as part of a totally separate ASCO abstract, Dr. Tutrone had been required to disclose his stock ownerships and funding relationships with various companies.

Not only has Dr. Tutrone previously disclosed that he received direct funding, but he also disclosed personally owning Nymox shares. Again, no mention of these conflicts was made in the recent aggressive press releases which sent Nymox soaring.

This disclosure was not easy to find. I am a professional researcher who specializes in biotech stocks and I knew exactly what I was looking for. Yet it still took me days to find this disclosure from Tutrone. There is simply no way that small retail investors could be expected to find such disclosure.

The Panama connection – why you should be concerned

Over the years I have learned to pay particular attention to the presence of anonymous offshore shell companies when they appear as shareholders in dubious small cap companies. Sometimes it takes a bit of extra effort to identify these entities, but it is certainly well worth the effort.

In past cases, it was the presence of these hidden offshore entities that presaged the rapid implosion of the share price. This is because these are often anonymous offshore entities who don’t disclose how much stock they own or when they are selling. Once they start dumping stock, the share price simply implodes. Bystander investors are left wondering what happened. In most cases they will never know.

Note that there is no way to prove this until well after the fact, so for now it remains just my opinion based on past experience.

I saw this to dramatic effect when I exposed fraudulent Forcefield Energy , which had been trading at around $7.50. Following my article, that stock imploded by 60% in 3 days before being halted. When it reopened, it immediately traded down to just pennies. The reason why was clearly the dumping of shares held by anonymous offshore entities in Belize. More details are provided on this below.

With Nymox, the company disclosed the involvement of an offshore Panamanian shell company named Lorros-Greyse Investments to provide financing to the financially strapped company. The earliest reference to Lorros-Greyse appears in 2003, which is the inception of Nymox’s agreement with Lorros.

Initially the arrangement called for Lorros to purchase up to $5 million of new shares from Nymox at discounted prices. That agreement was quickly superseded by a new agreement for up to an additional $12 million in stock. Then there was a subsequent agreement for up to an additional $13 million. Then another $15 million.

We can see from the formation documents that Lorros-Greyse was actually formed within just days of the beginning of this arrangement with Nymox. We can also see that over the past 13 years there are no other references online or in SEC documents. With Lorros-Greyse, there has been no other activity and no involvement with any other company other than Nymox. EVER.

The point is that Lorros-Greyse is simply an anonymous offshore sell company which was set up specifically to run the Nymox transactions and for no other purpose. It has been my observation that such anonymous shell companies are used to hide three things: the identity of the ultimate share holder, the size of their position, and the actual selling activity.

As an offshore entity, all sales to Lorros-Greyse were made pursuant to AN EXEMPTION FROM SEC REGISTRATION. Likewise, any sales by Lorros-Greyse would be unregistered offshore sales as well. They would be invisible to US shareholders, even though they would certainly impact the share price of Nymox stock in the marketplace.

Lorros-Greyse has no purpose other than acquiring and disposing of shares in Nymox. There has never been any other activity or reference to Lorros-Greyse. But by tracking down the nominee directors of Lorros-Greyse we can identify their activities in other similar companies.

It should come as no surprise that the other companies which w can tie to Lorros-Greyse have imploded to the pennies.

Note that the named directors are nominee directors only. They are NOT the beneficial owners who control the stock. The real owners are hidden.

For example, Viewpoint Investment Corp is another anonymous offshore Panamanian shell company. We can see from its formation documents that it has nearly identical directors as Lorros-Greyse.

With additional subscribers:

· DIANETH ISABEL MATOS DE OSPINO

Like Lorros-Greyse, Viewpoint appears to have been solely formed for the purpose of acquiring and disposing of millions of shares of a single company called 3Power Energy (OTCPK:PSPW). The shares would be acquired at a deep discount and then sold offshore using exemptions form US securities laws. At the time of its reverse merger, 3Power was trading at $2.48. Since that time it has collapsed to just 8 cents. Despite owning nearly 20 million shares, Viewpoint never disclosed owning these shares in any SEC filings. It also never disclosed when it sold (dumped) these shares. Anyone still holding onto shares of 3Power is simply left wondering what the heck happened to cause such an implosion.

Dianeth M. De Ospino is listed as a director of both Lorros and Viewpoint. She is also a director for another Panamanian entity called Opunosa Investment, whose sole purpose was to acquire and dispose of millions of shares in a company called World Gaming. Opunosa has not disclosed any sales of shares in World Gaming, however the share price has now imploded to just factions of one penny. Again, uninformed investors in World Gaming get to simply wonder what happened.

THE POINT IS THIS:

Lorros-Greyse is Viewpoint and is also Opunosa. It is all the same exact thing. They even use the same Panamanian law firm, Morgan & Morgan.

Morgan & Morgan received a “dishonorable mention” from The Economist in an article entitled “Who’s Next ?”. The focus of the article was on “incorporation mills” in Panama. Such firms received heavy attention this year upon release of “The Panama Papers” which detailed how many international politicians were using Panamanian entities to hide ill gotten assets and conduct illegal activities.

The Economist noted:

other incorporation mills face more scrutiny too, among them Panama’s other big law firms, such as Morgan & Morgan, and OIL, part of Hong-Kong-based Vistra, which caters primarily to Chinese customers. Like Mossack, these are wholesalers. They sell shell companies in blocks to law firms and banks, which sell them on to the end client, sometimes via other retailers.

The presence of anonymous offshore shell companies is a screaming red flag – DANGER !

A while back I exposed problems at Forcefield Energy . Forcefield plunged by more than 30% on the day of my article and management quickly issued a forceful response against me. Forcefield claimed that it had requested that I be investigated by regulators and stated that:

“We are not going to stand by and allow our Company, officers and directors, employees and shareholders to continue to suffer through what appears to be an orchestrated short selling attack based on misinformation”.

In putting out this press release, management was simply telling the latest in a string of lies that it had told to shareholders.

Forcefield promised to give shareholders a full business update on the company on the following Monday. In the meantime, the share price continued to plunge on massive volume and was quickly down by 60%. But when Monday rolled around, the only update the company could give was that the Chairman of Forcefield had been arrested by the FBI at Miami International Airport, as he was trying to flee the country, following my article.

Again, this all happened within 3 days of my article exposing the fraud at ForceField. For those who have time, I recommended re-reading that article, as it provides some good hints on how to spot impending frauds.

An early tipoff that Forcefield likely had major problems was the existence of numerous transactions and arrangements in offshore havens such as Panama, Belize and Costa Rica.

Just like Nymox, Forcefield appeared to have institutional investment of just 1% of outstanding shares. It appeared that 99% of the stock was spread out in the hands of retail investors. But we can see from the subsequent implosion that this was not the case at all.

According to the Justice Department complaint:

St. Julien [The Chairman] did not disclose his ownership and control of the shares purchased through nominees and used offshore banks, including in Belize, to pay the nominees to conceal his ownership and control. St. Julien coordinated the purchases by telephone and text messages…. Through his scheme, St. Julien and his co-conspirators deceived the investing public by creating the appearance of genuine trading volume and interest in ForceField’s stock

The FBI ended up indicting nine individuals in a $131 million fraud scheme which involved payoffs using brown bags filled with cash as well as disposable cell phones and content-expiring messaging applications in an attempt to avoid tracing,

The indictment noted that:

They took a company with essentially no business operations and little revenue and deceived the market and their clients into believing it was worth hundreds of millions of dollars through a dizzying round of unauthorized trades and deceptive promotions.

(Hint: In my opinion, this sounds quite a bit like Nymox).

Within just a few trading days of my article, Forcefield had collapsed by nearly 100%. The only explanation for this is that the ownership of Forcefield stock was far more concentrated than the supposed “1% institutional interest” would indicate. When these undisclosed holders chose to sell, they dumped massive amounts of stock, crushing the share price. These large, undisclosed, offshore holders were invisible to the rest of us. But they knew more than anyone that the company had no cash and no business prospects. Even after the share price had plunged by 50%, these holders were still willing to sell at any price, because they knew that the stock was ultimately worthless.

Based on my experience with Forcefield, I think I have every reason to have similar concerns about Nymox and its use of anonymous offshore Panamanian entities to conduct its financings. Given that the transactions are unregistered, we have no idea who is behind Lorros, how many shares they may still hold, when they are selling or how much.

The recent “sweetheart” financing deal in February to another anonymous investor only adds to my concern.

A history of using troubled auditors favored by pump and dumps and stock promotions

Many years ago, Nymox had all the appearances of a legitimate company. It had a single drug in two Phase 3 trials, it had accumulated a decent cash balance via its licensing deal with Recordati and it was audited by Big 4 auditor KPMG.

But as soon as the truth came out regarding the failed Phase 3 trials of NX-1207, everything changed. Fast.

We already saw that the share price imploded by more than 80% to just pennies. Almost immediately thereafter, two long term board members (Roger Guy and Jack Gemmell) resigned.

The cash had long since run out. Nymox was down to around $600,000 is cash and had a working capital deficit of $580,000. Over the prior year it had burned over $5 million in cash.

KPMG then found material weaknesses in Nymox’s internal controls. As of 2016, these material weaknesses have still not been remedied.

Thayer O’Neal and the revolving door of troubled auditors

Nymox was then forced to find a new auditor. Nymox initially settled with little known Cutler & Co. But following Cutler’s deregistering with the PCAOB, Nymox ended up with the audit firm of Thayer O’Neal.

Thayer O’Neal is basically an auditor for failed penny stock promotions. Both John Thayer and Thomas “Mickey” O’Neal had been partners at a firm called LL Bradford. LL Bradford had just merged with another little deeply troubled auditor called RBSM. The PCAOB had conducted a detailed inspection of RBSM in 2014, finding numerous deep auditing deficiencies. That report was not released until 2015, at which time the troubled RBSM simply merged with troubled LL Bradford.

LL Bradford itself was then shut down 7 months ago when the PCAOB censured the firm and revoked its registration, stating:

the Firm [LL Bradford] repeatedly violated PCAOB rules, auditing standards, and quality control standards and, in connection with several of those audits, also violated Section 10A(g) and Section 10A(j) of the Securities Exchange Act of 1934 (“Exchange Act”) and Exchange Act Rule 10A-2 concerning auditor independence.

These are very serious violations and as a result, LL Bradford was shut down completely.

Partners Thayer and O’Neal then simply started a new firm, changed the name and picked up LL Bradford/RBSM’s troubled former clients. As a result, the “new firm” quickly assembled a roster of failed penny stock promotions.

From his LinkedIn page, partner Thomas “Mickey” O’Neal clearly describes his “new” firm as just a “spin off” of the defunct LL Bradford and RBSM.

In other words, this is just a revolving door of faulty audit practices. When the PCAOB shuts one down, the partners just put a new name on the door and keep performing the same poor audits for the same troubled clients.

Aside from Nymox, this is who the “new firm” Thayer O’Neal audits. It is simply a collection of failed stock promotions which were previously audited by LL Bradford / RBSM and which trade for just pennies.

| Company | Ticker | Market Cap | Share Price | Auditor |

| Can Cal Resources | CCRE | $2.9 m | $0.07 | LL Bradford / Thayer O’Neal |

| Joey New York | JOEY | $1.2 m | $0.02 | LL Bradford / Thayer O’Neal |

| 3D MakerJet Inc | MRJT | $2.2 m | $0.01 | RBSM / Thayer O’Neal |

| AI Document Services | AIDC | $13 m | $0.15 | RBSM / Thayer O’Neal |

| Momentous Entertainment | MMEG | $2.8 m | $0.03 | RBSM / Thayer O’Neal |

| Indoor Harvest | INQD | $6.6 m | $0.55 | RBSM / Thayer O’Neal |

| Abco Energy | ABCE | $1.0 m | $0.02 | RBSM / Thayer O’Neal |

| CEN Biotech | FITX | $6.0 m | $0.01 | RBSM / Thayer O’Neal |

THE POINT IS THIS:

Nymox has basically picked an auditor who’s past history shows that it is among the worst of the worst. The partners and their clients have a history of massive audit deficiencies and the predecessors were simply shut down by the PCAOB.

Thayer O’Neal simply adopted a new name and continued to audit the same companies.

This existing client list shows that Thayer O’Neal is the auditor of choice for failed penny stock promotions which trade for just a few cents and with no meaningful market value. Nymox appears to be the ONLY EXCEPTION to this pattern – for now.

Nymox’s legal counsel charged with running other stock frauds

From the recent equity prospectus in February 2016, we can see that Nymox is being represented by Zouvas & Associates LLP.

We are being represented by Zouvas & Associates LLP; the validity of the securities being offered by this prospectus and legal matters relating to applicable laws will be passed upon for us by Zouvas & Associates LLP.

Zouvas’ name also appears in previous Nymox SEC filings.

Anyone who is familiar with this name will immediately start hitting the “sell” button before reading any further.

Just a few months ago (April 2016), Luke Zouvas was charged by the SEC in a massive fraud case involving a “sham IPO” and “subsequent pump and dump” with Crown Dynamics Corp (OTC:CDYY). That company has since been renamed Airware Labs (OTCPK:AIRW). Promotion had driven the stock to nearly $3.00. It now trades for just 9 cents.

A read of the SEC charges reveals striking similarities to what we see going on at Nymox.

The history of Nymox’s attorney Zouvas’ in orchestrating stock fraud / promotion is extensive.

Zouvas had previously been a partner in the firm Carrillo Huettel & Zouvas Llp. Luis Carrillo was then busted by the SEC for running an international pump and dump scheme using Canadian stock promoters and Bahamas based brokers.

(Hint: Once again, this sounds a lot like Nymox)

But in reality, Carrillo and his cohorts used a variety of offshore locations (in addition to the Bahamas) to run stock promotions. Carrillo was also featured in a very informative article entitled:

$500 MILLION BELIZE PENNY STOCK MANIPULATION RING SHUT DOWN

(For those who wish to understand the mechanics of offshore stock promotion, I highly recommend reading that article.)

Nymox’s attorney Zouvas separated from Carrillo to found his own firm, which also focused on stock promotions. His brother Mark is an accountant who often runs the books. Up until the recent SEC charges, it had been a great recipe for stock promotion success.

Examples include the now bankrupt Reostar Energy. The ensuing lawsuitnoted that:

An alleged under-the-table deal between former CEO Mark Zouvas and several investors to sell the company’s credit line at a low ball price was approved after the board of directors was misled… the deal designed to skim millions of dollars to Zouvas.

Other past Zouvas promotions include Bold Energy (Pending:BOLD) which eventually became the stock Lot78 (OTCPK:LOTE). Nymox’s attorney Luke Zouvas acted as the attorney in the deal.

Similar to Nymox, Lot78 was a low priced penny stock which soared to over $4.00 due to stock promotion and bullish press releases. Just like Nymox, Lot78 had minimal revenues, was largely out of cash and had virtually no institutional investment. Yet the share price rose on retail hype alone.

An article on Seeking Alpha came out, exposing the promotion, entitled:

Lot78 Inc: Why This $240 Million Company Could Drop By 75% Or More

In fact, this was a dramatic understatement. Zouvas’Lot78 has since plunged to just fractions of one penny. It is effectively a zero.

Nymox’s attorney Zouvas was also subpoenaed regarding USA Graphite (OTC:USGT), which has also plunged from over $4.00 to just fractions of one penny.

So the list of Zouvas promotions is long, and in each and every case the stocks end up imploding:

| Company | Result |

| Cuba Beverage (OTCPK:CUBV) | Imploded to less than 1 penny |

| Definitive Rest Mattress(OTCPK:DRMC) | Imploded to less than 1 penny, previously valued at over $100 million. Exposed by Seeking Alpha |

| Appiphany Technologies(OTCPK:APHD) | Imploded to 1 penny. |

| Lot78 (OTCPK:LOTE) | Imploded from over $4.00 to less than 1 penny. |

| ReoStar Energy | Bankrupt. Fraud claims against Zouvas. |

| 3DX Industries (OTCQB:DDDX) | High of $2.75. Imploded to just 3 cents. |

| Airware Labs | Imploded from $3.00 to 9 cents. |

| Enterra Corp (OTCPK:ETER) | Trades for 5 cents. |

| Lustrous Inc (OTCPK:LSTS) | Imploded from $2.50 to less than 1 cent. |

| Mix 1 Life (OTCQB:MIXX) | Imploded from $6.00 to 75 cents |

| Noho Inc (OTCPK:DRNK) | Imploded from $3.24 to less than 1 penny. |

| Petron Energy II (OTCPK:PEII) | Following promotion, imploded to fractions of 1 penny. |

| USA Graphite | Imploded from $4.00 to 1 penny. |

THE KEY POINT:

EACH OF THE STOCKS ABOVE HAS IMPLODED TO JUST PENNIES. BUT AS WE ARE NOW SEEING WITH NYMOX, THERE HAVE BEEN PAST PROMOTIONSWHICH DROVE THE STOCKS SUBSTANTIALLY HIGHER.

IN ADDITION TO THE INVOLVEMENT ON ZOUVAS, THE OBVIOUS COMMON THEMES HERE ARE

- · LACK OF MATERIAL REVENUES

- · LACK OF CASH

- · LACK MEANINGFUL INSTITUTIONAL INVESTMENT.

- · A STREAM OF BULLISH PRESS RELEASES

(IN OTHER WORDS, EACH OF THE ABOVE ZOUVAS PROMOTIONS ARE JUST LIKE NYMOX.)

The explosive rise in Nymox following several dubious press releases is no coincidence. Here are past examples of Zouvas promotions:

Petron Energy, 2013:

The stock of Petron Energy II (OTCBB:PEII) added a mind blowing 733% to its price in just 2 sessions relying on a promotional campaign in the end of July

USA Graphite, 2013

USA Graphite Inc. has been in the top ladder of OTC Markets activity statistics for the last couple of weeks. Just as we speak, the company has already turned over more than $1.6 million worth of shares and this is just the first half of today’s trading session. At the same time USGT stock has hit $0.87 per share which is nearly double its value from one month ago.

Mix 1 Life, 2015

Mix 1 Life, which makes nutritional shakes now carried in the health-foods sections of some large Arizona supermarkets, recently embarked on a local TV ad campaign. The Scottsdale company still hasn’t posted a profit, but recent sales have ramped up. Mix 1 Life is worth $30 million, at a recent share price of $2.30.

Lot78, 2013

After shares traded for less than $1.50 on Wednesday, they ended the week at more than $6. There was no news to justify the price soaring.

Nymox’s banker of choice – Chardan Capital Markets

History has shown us that when Chardan says “BUY” the wisest move is to quickly hit “SELL“.

In February, Nymox filed a 424B5 prospectus with the SEC hoping to raise up to $12 million by issuing new shares. This is the most recent document naming Zouvas at Nymox’s attorney. It also named Chardan Capital Markets as Nymox’s banker.

The timing of the prospectus also happened to coincide with Nymox issuing a new bullish press release. Nymox clearly wanted to be prepared to issue more stock if the share price soared.

Chardan was originally founded by Dr. Richard Propper, later getting his son Kerry Proper involved.

Chardan and its founders have a very long, long list of securities law violations going back decades and yet somehow the firm stays in business. Even a cursory Google search reveals multiple SEC and FINRA disclosure events / violations. Here is one recent detailed example on market manipulation of 4 US based small cap companies.

In the 1990’s, Richard Propper resigned as the managing general partner at Montgomery Medical Ventures, a venture-capital firm controlled by Montgomery Securities, amid reports that he inadvertently disclosed to a family member inside information about a Montgomery-related transaction (SEC investigation).

A few years later, he settled with the SEC over allegations that, as a general partner of two Montgomery funds, he failed to disclose holdings and transactionsin several public companies.

In 2005 and 2007, both Proppers were sued for defrauding the Small Business Association (“SBA”) out of $35 million.

It was at about this time that the Proppers and their Chardan Capital discovered the gold mine that was Chinese reverse mergers and SPACs (Special Purpose Acquisition Cos).

The implosion of Chinese reverse merger frauds is where Chardan became truly egregious. But this is where the firm also ended up making a fortune.

GeoInvesting (AKA The GeoTeam), highlighted no less than 17 different examples of Chardan Chinese reverse mergers / SPACs, the majority of which completely imploded following exposure of or allegations of fraud.

To highlight just a few examples:

Chardan formed the SPAC that housed Chinese A Power, which was then halted and delisted. It no longer trades.

Chardan formed the SPAC which also housed CABL, which voluntarily delisted from the NASDAQ.

Chardan was also involved in the $30 million capital raise for Liwa International (NASDAQ:LIWA) which imploded due to exposed fraud.

Chardan received substantial negative attention for an imploded fraud called Huiheng Medical, which was supposedly involved in treating brain cancer.

This attention went mainstream against Chardan and the Proppers in a USA Today article.

The USA today article details obvious and egregious supposed “oversights” by Chardan and the Proppers. A reporter who traveled to China revealed that Huiheng was in fact just an empty building with a tiny parking lot and little activity going on.

The USA today article also details numerous additional imploded frauds where Chardan and the Proppers were involved, making millions as investors lost everything.

Eventually it became clear that the market was no longer dumb enough to buy Chinese reverse merger frauds. But the Proppers still had an unused empty shell company which they wanted to monetize.

The empty shell had originally been intended for another China target and was (at the time) aptly named “Chardan 2008 China Acquisition Corp“.

By 2010, Chinese reverse mergers were imploding in a wave of outright frauds and Chardan and the Proppers were already getting heat for it. Anything with “China” in the name was toxic and no longer marketable to naïve investors. But Chardan and the Proppers had clearly spent millions of dollars setting up this empty shell acquisition company.

Rather than let it go to waste, Chardan simply changed the name and purpose of the shell and had it buy a US based law which specialized in processing mortgage foreclosures. Such foreclosures were booming in the wake of the 2008/2009 financial crisis in the US.

Once again, Chardan and the Proppers were the subject of widespread unwanted attention. The New York Times featured an article entitled, “Bet on Foreclosure Boom Turns Sour for Investors“.

As with the USA Today article, the NY Times details the lengthy history of regulatory violations from Proppers.

Here is the summary:

Chardan had its defunct “China” SPAC purchase the US based law firm of David J. Stern, which focused on processing housing foreclosures. As a result, the private company then became publicly tradable and was named “DJSP Enterprises”

Aside from making millions in fees, as the owner of the SPAC, Chardan retained a significant amount of ownership in the newly public company, receiving millions of shares for just pennies a piece. And then Dr. Propper was paid additional fees to act as a “consultant” to the company.

Shares of the company quickly soared to as high as $14 and Mr. Stern ended up cashing out a whopping $60 million.

But then the Florida Attorney General’s Office began investigating DSJP for falsifying documents to speed up foreclosures. The firm quickly lost its biggest clients. Its executives quit and the firm quickly fired 80% of its staff. In addition to the issues with regulators, the firm faced new lawsuits from both investors and employees.

DJSP now trades for just 13 cents.

Even with a US target, it turns out that Chardan’s renamed China SPAC ended up no better off than the previous generations of reverse merger frauds pursued in China.

The typical Chardan deal is heavily followed by retail investors who simply buy into the hype of a sexy story and a few bullish press releases. But when Chardan helps these companies raise money, it does need to get institutions to pony up a millions of dollars at a time.

QUESTION: If Chardan’s history of regulatory violations and stock implosions is so widely documented and well known, then how have they gotten new investors to buy into their deals ?

ANSWER: Give away FREE MONEY !

Here is how the technique works.

First, give some “friendly” investors a heads up that a company needs to raise money.

Second, those companies get SHORT the shares of the subject company, in advance of the financing deal.

Third, one or more banks announces that the company wishes to raise money at a discount. The share price falls.

Fourth, the “friendly” investor then buys the new shares at a considerable discount, covering its short position at a nice profit.

This is a great trade for all of the inside players involved. Everybody wins.

The bank involved makes a fat fee for running the offering.

The “friendly” investor makes a tidy profit with literally zero risk.

The company raises a few million dollars and then puts out a press release which leads smaller (naïve) investors to believe that some institution has enough confidence in the company to commit millions in capital to it.

The only ones who get suckered are the retail investors. Because in reality, this investor merely covered their short position and in no way wants to commit any capital whatsoever to this company or this deal. They know it is likely going down, not up.

No, this is not a hypothetical. And no, I am not making this up.

Here are the SEC charges which describe that exact sequence of events when Chardan was helping AutoChina raise money. Investor Charles Langston, who controlled CRL Management, LLC and Guarantee Reinsurance, LTD, got the heads up from Chardan and quickly began selling shares at $41.75. That very same afternoon, the deal was announced and Langston was able to cover his short at $35, making a near instant and riskless 17% profit.

Chardan’s defense to this is that it had sent Mr. Langston a “confidentiality” agreement and told him not to trade on it.

However, we can see from the SEC case that this was actually the 4th time that Mr. Langston has performed the exact same trade. Each time, he would short in advance and cover on the deal.

It becomes quite clear why someone like Mr. Langston would not want to hold Chardan’s AutoChina.

Chardan’s AutoChina was subsequently exposed as a complete fraud and imploded to zero.

By now, the mechanics of the fraud should start to sound familiar. This includes the use of offshore brokers and undisclosed holdings. The parties would make fraudulent trades between their own accounts to generate the appearance of legitimate trading volume and interest in the stock.

For those who wish to read more about Chardan implosions, here is a very partial list. Note that these are all recent deals on US listed small caps.

Northwest Bio

Chardan recently announced that it would be helping Northwest Bio raise a few million dollars. I had previously exposed a well orchestrated pump on Northwest Bio entitled:

Behind The Promotion Of Northwest Bio

This promotion had driven the worthless stock up to $7.50. Like the others, it was supposedly a promising biotech with a new treatment for cancer. (sound familiar?) The stock has since imploded to just 43 cents.

Live Deal / Live Ventures (NASDAQ:LIVE)

Another orchestrated stock promotion sent shares of microcap LiveDeal (now known as Live Ventures) up by 500%. As with the others, there was virtually no revenue and no business activity.

The promotion was exposed by Bleecker Street Research, which also detailed Chardan’s involvement in helping the company raise money at around $9.00 per share. The stock has since imploded by 80%.

Spherix (NASDAQ:SPEX)

Chardan also helped troubled Spherix raise millions of dollars. Spherix has since imploded by 90%, with the entire company now worth just $4 million.

22nd Century Group (NYSEMKT:XXII)

XXII was exposed by the GeoTeam as a stock promotion, which included details of insider’s past involvement in stock manipulation and excessive compensation of insiders bleeding the company dry.

Geo details Chardan’s lengthy history in financing the company, including the fact that it has received shares in XXII as compensation. Chardan had been aggressively touting the company, releasing a research report with a $9.00 target.

XXII has since imploded to just $1.00.

So again, Nymox recently filed a prospectus using Chardan as its banker and Zouvas as its lawyer. Nymox is again looking to sell millions of shares, following its hyper bullish (but unsubstantiated) press releases.

You do the math. This history of these parties should speak for themselves in terms of where the share price is headed.

In my experienced opinion, it quickly plunges to true zero. (Just like past Zouvas / Chardan deals)

Behind the purchases of James Robinson

In July 2015, right after Nymox re-domiciled to the Bahamas, Nymox appointedJames G. Robinson to the board of directors.

James Robinson is a big time Hollywood film producer He is the CEO and co-founder of Morgan Creek productions, which has produced dozens of well known hit movies, including the Ace Ventura Series, Young Guns, The Last of the Mohicans, Robin Hood: Prince of Thieves, The Major League series, Get Carter, Heist, and many others.

Robinson is now 81 years old and his net worth has been estimated at over half a billion dollars.

But please keep in mind that he has never shown any experience in biotech or in investing in small cap stocks.

In the initial press release, Nymox announced that:

Jim has been a long-term supporter of the Company in the past and this is great news for our shareholders

It is unclear what Nymox meant by “long-term supporter”. But in any event, we can see that Robinsons first SEC filing disclosing ownership of Nymox did not occur until 2 weeks AFTER that press release.

A that time, Robinson disclosed owning 2.1 million shares of Nymox.

Since that time, the 81 year old film director has continued to acquire small amounts of stock every few weeks or months. This is never more than a few thousand shares at a time, amounting to typically $10,000 or $20,000.

Yet each time he makes another small purchase, the news wires flag another “insider purchase by a director”. This (along with the bullish press releases from Nymox) is enough to lure in a few more retail investors and helps to keep the stock afloat.

I have already demonstrated above that so far EVERYONE with any involvement in Nymox has a lengthy history of imploded stock promotions, regulatory violations and / or outright fraud. This includes management at Nymox, their auditor, their legal counsel and their banker.

So far, I don’t believe that this is the case with Robinson. He has far too much money and far too big of a reputation to be caught up in a penny stock promotion to make just a few million dollars.

The reality is that I don’t know what attracted the 81 year old film producer to Nymox in the first place. But again, Robinson has never demonstrated any expertise with biotech or with small cap stocks.

What I do know is that I have seen this exact “movie” before and it always ends badly.

Robinson will lose a few million dollars on his investment in Nymox. He can certainly afford this small loss. In fact, with such a substantial net worth, I have no doubt that this will just be a tax write off at the end of the year against various other capital gains he may have. The financial impact of this will not be a big deal for Robinson.

A much bigger deal will be the damage to his reputation when his involvement hits the financial press and the Hollywood tabloids, which I am quite certain it will.

Here is what you need to know about the purchases by Robinson:

Recruiting a prestigious outsider is a standard play out of the penny stock promotion handbook I have seen it many times before and I will (of course) provide multiple examples.

In order to gain some credibility with retail investors, penny stock promotions try very hard to lure in any outside investor, manager or director who has some combination of wealth, fame or status.