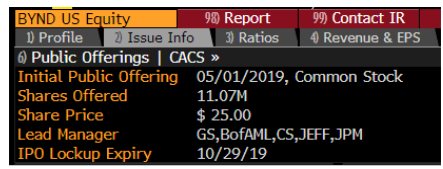

NASDAQ listed Beyond Meat (BYND) is a good example of a seemingly “obvious” short trade which I have very deliberately avoided for more than 200 points now. The stock is now up 10x since May 1st, when it IPO’d on the NASDAQ at $25.

It’s not that I am not shorting stocks anymore. I am simply being more selective. I now avoid short trades which either don’t work or which involve too much painful friction, such as valuation shorts…and regulatory shorts, and crowded shorts, and illiquid shorts, and low float shorts, and IPO shorts, and biotech shorts, and FANG shorts, and China shorts, and microcap shorts, among others.

El Segundo based Beyond Meat is a purveyor of supposedly-meat-like “veggie burgers” which is expected to generate revenues of over $200 million for FY 2019. Within 10 days of its IPO at $25, the stock was already in the $70s and was instantly perceived by many as being a “good short”. At $70, the company’s market cap was over $4 billion, or roughly 20x its expected 2019 revenues.

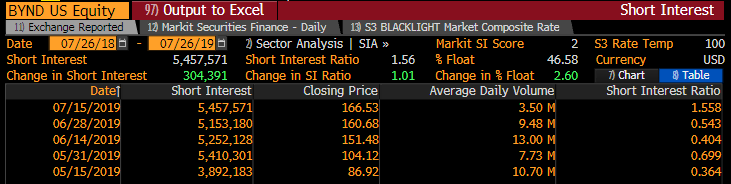

But because of the high short interest vs. a low public float (and then a sudden spike in borrow costs), it only took a few weeks for the stock to go from overvalued at $70 to overvalued at $170. It closed yesterday at $222 and shows little sign of slowing its rise, even though its market cap now sits at over $13 billion.

Comparison to Tilray. Given the level of frothiness, the ongoing squeeze in Beyond Meat is now rightfully being compared to the squeeze in 2018 which sent pot stock Tilray (TLRY) up 18x within two months of its IPO. Tilray came public at $17 in July 2018 and peaked out at $300 in September 2018. This comparison may not be perfect in some respects, but overall it is actually quite fair.

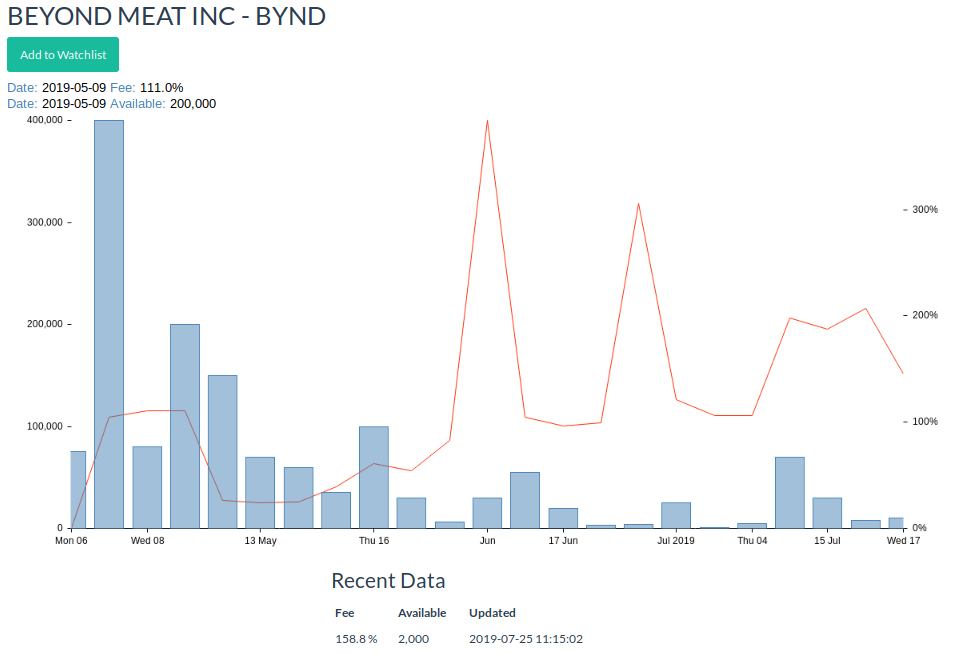

Both Tilray and Beyond Meat became heavily shorted immediately after their IPOs because their valuations were already visibly stretched relative to their fundamentals and relative to any realistic near term prospects. Yet because both companies offered only a small number of shares to the public, much of their market cap was never in public hands in the first place. In other words, they were “low float, momo business IPOs” and the low float meant that the lofty market caps were more theoretical than real for some period of time. Not surprisingly, available shares to short quickly ran out. Also not surprisingly, the cost to borrow shares quickly jumped to more than 30% for each of these companies, before then spiking sharply higher.

The graph below is from iBorrowDesk.com, which shows price and availability of Beyond Meat stock borrow from Interactive Brokers. This is not meant to be comprehensive, but it is generally useful as an overall barometer. The bars indicate availability (which has been steadily falling) and the orange line indicates cost to borrow (which has been steadily spiking). After initially rising to 30-40%, borrow cost for Beyond Meat quickly spiked to as high as 400% and now sits at around 160%. An overly simplified way to think of this is that even if the stock falls to the $130s by November 1st, the short seller will still only break even on his trade during this three month period.

Overvalued does not equate to a “good short”. With each of Beyond Meat and Tilray, Early shorts were often squeezed out, only to be replaced be later shorts who were even more certain about their short because they were now in at much higher prices. But each time new people shorted shares, they would be forced out yet again at even higher levels. Ross Gerber (Gerber Kawasaki) is based a few miles from me in Los Angeles, but our views often differ. Like many people, Gerber viewed Beyond Meat as a good short when it was trading “up here” in the $70s.

- Beyond Meat’s massive run may be getting young investors into some bad stock market habits (June 19, 2019)

- Beyond Meat’s surging stock has left short sellers with $150 million of losses since its IPO (Business Insider, May 30, 2019)

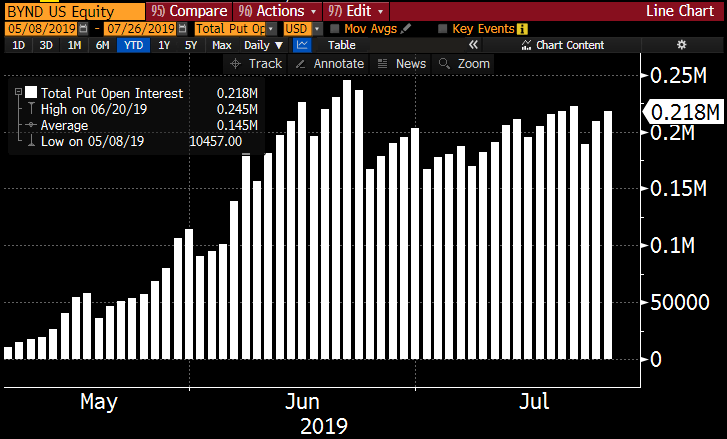

Option activity. Here is what people are missing. Because there is/was little or no available borrow on these two stocks, many investors resorted to using options to get short, thinking that “it was worth it” because the valuations were increasingly absurd. With Tilray it was the selling of uncovered calls which exacerbated the squeeze. With Beyond Meat, it is now heavy put buying that is fueling the squeeze. But in both cases, the common denominator is that when a low float stock becomes difficult and expensive to borrow, heavy bearish options activity will generally fuel a squeeze, not much different than if people were simply shorting huge amounts of additional shares.

Uncovered call selling on Tilray. Tilray forced many investors to learn a painful lesson about selling uncovered calls. Tilray only had a tiny 10 million shares in the float and thus there was a natural and finite limit to how many shares could be naturally shorted. As that number of shares short exceeded 40% (in between bi-weekly reporting periods), Tilray quickly became a very dangerous short trade. And then call selling made it much, much worse. There is no natural limit to how many calls can be sold. Option market makers are delighted to take the opposite side of the trade for any sellers. They know that the calls will be exercised almost immediately, leaving the call seller short a huge number of common shares. But that with no available borrow, the call seller will be forcibly bought in within three days. Through the selling of uncovered calls, it is very easy for short sellers in aggregate to sell more shares than exist in their entire real float. When they are forced to cover, the squeeze is explosive. This is roughly what likely happened with Tilray and is similar to what happened with the Volkswagen “infinity squeeze” in 2008.

- Hedge funds lose $30 billion on VW infinity squeeze (Moxreports.com)

Standard put buying on Beyond Meat. After learning some very painful and expensive lessons, many investors figured out that selling calls on low float, squeezy stocks is a “bad idea”. But now many are inadvertently repeating what is effectively the same mistake with their heavy purchases of put options. High short interest and expensive borrow can simply be viewed as friction in the system which cannot be avoided simply by going to the options market. As of now, open interest on Beyond Meat put options stands at 218,000 contracts – equivalent to 21.8 million shares.

The sky-high cost of borrow is always going to be reflected in the premium that must be paid for the options. This is options 101. This means that hard to borrow stocks are always more expensive, and their rate of time decay is extra fast. But even as value of these puts erode very quickly, the ultra high short interest means that any hoped for share price declines will be also slowed considerably because the share price is constantly being buoyed by sporadic short covering.

Even worse, the hedging activity of the options makers can exacerbate the squeeze. In other words, by buying puts on these low float hard to short stocks, the put buyer may be forcing the shares higher. The market maker who sold the puts is exposed to now exposed to downside moves in the stock. So he hedges this by shorting common stock. There is no borrow in public markets, but market makers are allowed to get naked short for their hedges. So now an additional source of elevated short interest has been created, like a backlog behind what the public market is already clamoring for. Either way, the effect is the same. Heavy put buying means that short interest is elevated well beyond where is would it be if the market were only shorting the finite number of common shares that exist in the float.

- Short Selling Beyond Meat Stock Is Beyond Expensive (Barron’s, June 3, 2019)

- Beyond Meat Stock Could Burn Shareholders (Barron’s May 31, 2019)

Possible upcoming catalysts for Beyond Meat to head lower

Q2 Earnings date on Monday, July 29. Upcoming earnings are getting lots of airtime but there no reason why the earnings release should be a truly big driver for the stock. The entire market knows that a $200+ share price is wildly out of proportion to the underlying fundamentals, and a slight miss or beat likely doesn’t change that. However, if management did manage to drum up a true surprise at the top or bottom line, then it could potentially give investors some presumed justification to run the stock even higher for a bit.

- Beyond Meat skyrockets as expectations for the company’s second-quarter earnings mount (Business Insider, Jul 22, 2019)

- Beyond Meat Stock Could Spike After Earnings. Here’s How to Play It. (Barron’s, Jul 18, 2019)

Lockup expiration. The terms of Beyond Meat’s IPO included a standard 180 day lockup, which expires on 10/29/2019. After the lockup expires, the float should loosen up and the cost to borrow shares will fall considerably. But until then, it is likely to remain a difficult short. If the overall market crashes, then that might bring down high fliers like Beyond Meat. But anyone wishing to make such a bet would be far better off shorting index futures or ETFs which are liquid and inexpensive to short. As a trade, Beyond Meat becomes a much better short after October 29.

(Note that lockups are granted to the underwriters as a way of protecting their clients, the buyers of the IPO shares. The underwriters have the ability to waive the lockup early if they want. This is typically done because the company wants to raise additional money sooner than day 180 and pay the underwriter even more fees. Presumably this only done when the stock is already at much higher levels, so it is not seen as being adverse to the IPO investors.)

Likely financing. Given the 10x rise in the share price, I will be greatly surprised if Beyond Meat does not raise money via an equity or convertible offering, possibly even before the lockup expiry date on October 29. After Tilray soared 17x from its IPO price, the company was quick to raise $450 million via a convertible bond offering. This was triple the amount raised in its IPO just four months earlier. When companies do this, it definitely moves the goal posts and anyone who wishes to get or stay short therefore needs to adjust their downside expectations accordingly. The initial offering can be expected to send the stock down from its highs, but the added cash on the balance sheet means that the “cash floor” for the company is now much higher. The ability to raise large sums at very high share prices creates a big incentive for companies to conduct contrained float IPOs.

- Tilray Inc. Upsizes and Prices Offering of US$450 Million Convertible Senior Notes

- Fallibility, Reflexivity, and the Human Uncertainty Principle (GeorgeSoros.com)

- Physics of Cow Tipping (Ignoring Friction, Dec 18, 2008)

Disclosure: No positions in any stocks mentioned. This post is the opinion of the author.