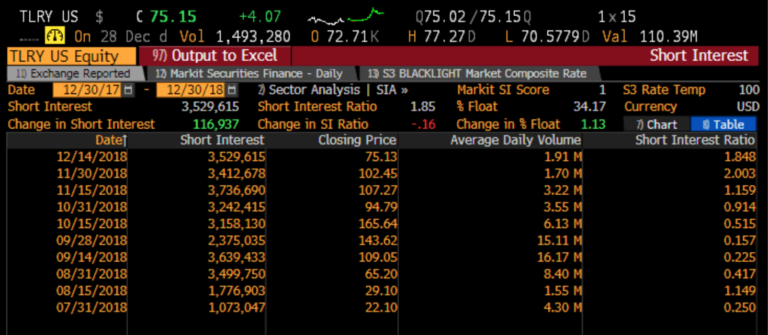

The Tilray squeeze.Tilray inc. (TLRY) is a Canada based producer and processor of marijuana. In July of 2018, Tilray came public on the NASDAQ raising $153 million in an IPO priced at $17.00. Tilray’s IPO market cap of $1.5 billion was large enough to leave many people skeptical that it could sustain such a high share price. As a result, in the first few weeks, short interest quickly rose to around 17% of the float. Within two months of its IPO, shares of cannabis stock Tilray (TLRY) had skyrocketed by nearly 18x on the back of an epic low float short squeeze. Looking at the sharp spike in the cost of stock borrow for Tilray largely telegraphed in advance the biggest part of this squeeze.

When the squeeze kicked in. By early September 2018, Tilray had already began squeezing to above $100 per share. With its market cap approaching $8 billion, Tilray was now considered a “no brainer” short. At prices above $100, Tilray’s individual market cap was almost double the size of the entire US cannabis market !

However the late-comer short sellers who flooded in in hopes of catching a sharp leg down actually ended up exacerbating the ongoing squeeze quite sharply. By September 19th Tilray had tripled again, from $100 to as high $300. This was nearly 18x vs. its IPO price from just two months earlier, and Tilray was now valued at over $20 billion.

Over the longer term, the short sellers would be proven right. Over the longer term short sellers usually are. There was certainly no way that Tilray could sustain a triple digit share price based on those fundamentals as they sat at at the time. But in the short run, the sharp and painful squeeze from $100 to $300 should not have come entirely as a surprise.

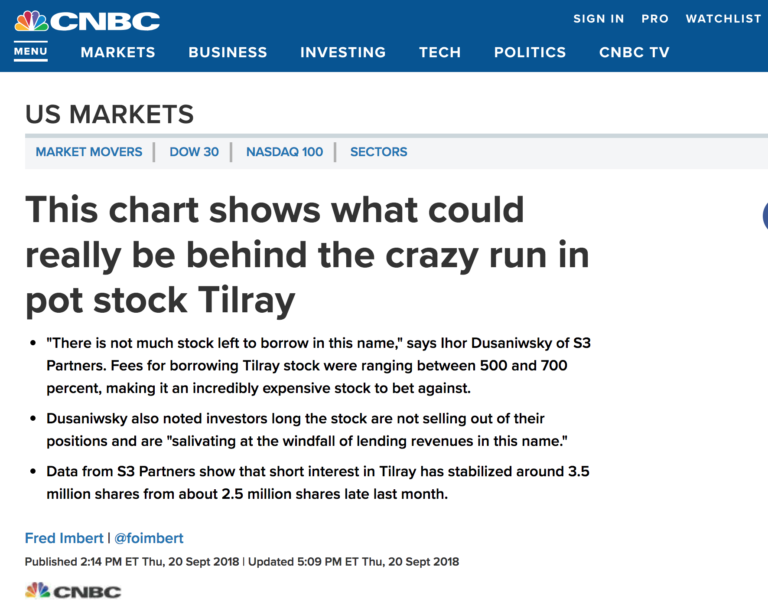

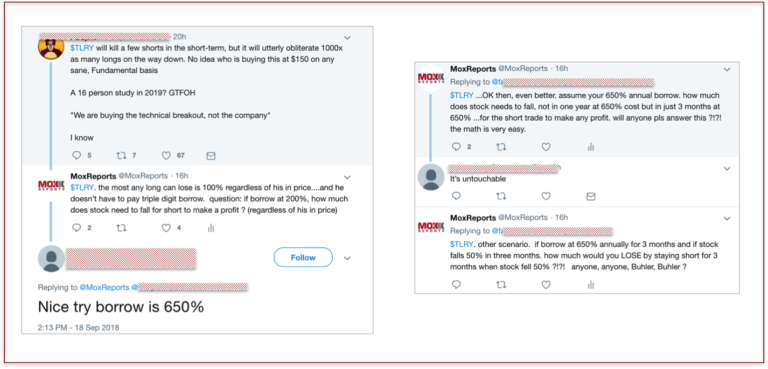

Here is why the Tilray squeeze was predictable. As the squeeze entered its final stages, the cost to borrow shares spiked to between 200-650%. Tilray was already absurdly overvalued at $50, and even more so as it hit $100, $200 and then $300. But when someone makes the decision to pay 650% to short any stock, regardless of how absurdly valued, it means that this person clearly does not understand the economics of what he is doing. Simply due to the excessive borrow cost, this short seller will end up losing money in nearly all probable circumstances. And even in the best case scenario, their potential winnings will be tiny. It is just a bad bet plain and simple, regardless of how absurd the valuation of any stock may be.

As I mentioned this on Twitter, few people seemed to understand my point. I asked people to think through the economics of shorting Tilray (or any other stock for that matter) when the stock borrow cost 200% and 650%. I did not get a single answer at the time. People were so caught up in the very true fact of the absurd overvaluation that they were ignoring the real math underlying the short trade itself.

So here is the point. By the time a stock starts commanding borrow rates of more than 200%, we know for certain that this stock has become grossly over-shorted by the exact type of investor that will likely be forced to cover as the stock rises. Even if the stock had been a very “smart short” at lower prices and before the borrow price spiked, it has now been spoiled by the over-crowding from the late comers.

Below is a list of articles that had appeared on SeekingAlpha in the three weeks prior to September 19th, when Tilray hit $300. Starting at prices as low as $51, there began a dozen articles insisting that Tilray was a great short. Yes it was grossly overvalued. But no, it was not a great short by any means.

| Date | Prev close | Title | Source |

| 19-Sep-18 | $154.98 | Cannabis Is A Short: Tilray Has 73% Downside To My $40 Price Target | SeekingAlpha |

| 18-Sep-18 | $120.19 | The Cannabis Hallucination | SeekingAlpha |

| 17-Sep-18 | $109.05 | The Tilray Bubble Is Bound To Burst | SeekingAlpha |

| 14-Sep-18 | $119.76 | Tilray: Selling Can Quickly Accelerate | SeekingAlpha |

| 14-Sep-18 | $119.76 | Avoid Tilray And Buy Literally Anything Else Instead | SeekingAlpha |

| 11-Sep-18 | $84.50 | A Warning On Canadian Pot Stocks | SeekingAlpha |

| 07-Sep-18 | $80.10 | Tilray’s Market Cap Will Soon Be Larger Than Aphria And Aurora Cannabis Combined | SeekingAlpha |

| 06-Sep-18 | $89.86 | Tilray Flying Too High | SeekingAlpha |

| 02-Sep-18 | $65.20 | Once In Your Lifetime, If You’re Lucky, You Find A Short Like Tilray | SeekingAlpha |

| 29-Aug-18 | $51.50 | Tilray: Sell The Pot Madness | SeekingAlpha |

| 29-Aug-18 | $51.50 | Tilray In 2 Words; Sell It. It Is Trading At 156x Forward Sales | SeekingAlpha |

| 28-Aug-18 | $53.44 | Tilray’s Share Price Is Unsustainable | SeekingAlpha |

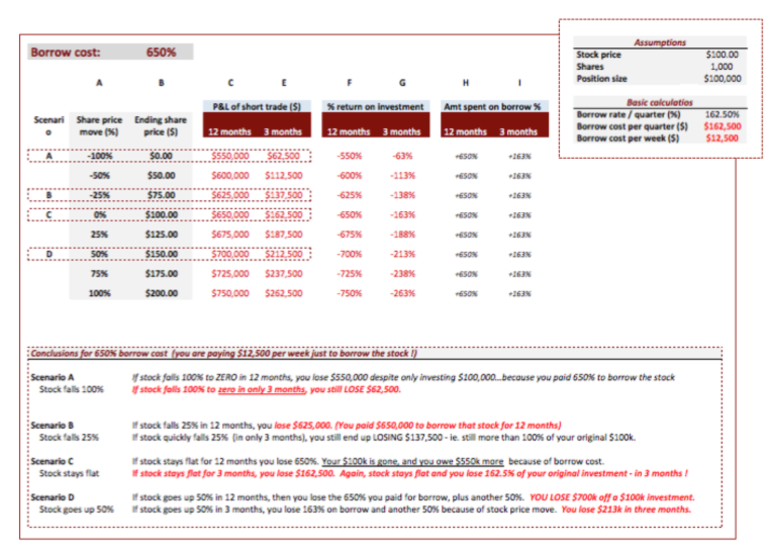

Trade economics of expensive borrow. The spreadsheet below shows the economics of the trade over time assuming a borrow cost of 650%. It is very bad. For example, if you short a stock at $100 and pay 650% borrow for just three months, you will still LOSE 62.5% of your money….EVEN IF THAT STOCK FALLS TO ZERO IN JUST THREE MONTHS ! And obviously for smaller moves or longer time frames, those numbers become absurdly worse.

Naked call sellers made things even worse. Because the borrow was so expensive, many people chose to sell naked in-the-money call options. They missed the point entirely. The fact that the borrow was commanding a price of 650% meant that this trade was already grossly overcrowded, and that many of the people crowding it were certainly less sophisticated. By shorting naked call options, all these investors were doing was further crowding an already over-crowded trade. Many of the call sellers also risked having their calls exercised against them, meaning that they would likely be bought in by their broker within 1-3 days (because there was no borrow to give them when the calls were exercised).

Conclusion. So Here is the point. Expensive stock borrow does not cause stocks to squeeze. But it does tell us quite a bit about who else is in the trade and how crowded it is.

- Why Canadian Marijuana Firm Tilray Is Valued At $1.4 Billion Ahead Of Its Thursday IPO

- Staggering 800% run since IPO propels Tilray to most valuable marijuana company

- Tilray IPO is ‘validation’ for pot companies, CEO says

- Tilray IPO: Five things to know about the first pot company to go public on Nasdaq

Conventions for the trade economics table. I deliberately used the following conventions in order to keep the math very intuitive.

- Stock price = $100

- Periods = 52 weeks / year ( I did not use individual day counts)

- Simple interest. (I did not use daily compounding)

- Borrow cost is fixed at issue (in reality it could go up or down depending on rebate and on share price trajectory).