This report is the opinion of the author. See disclosures and disclaimers.

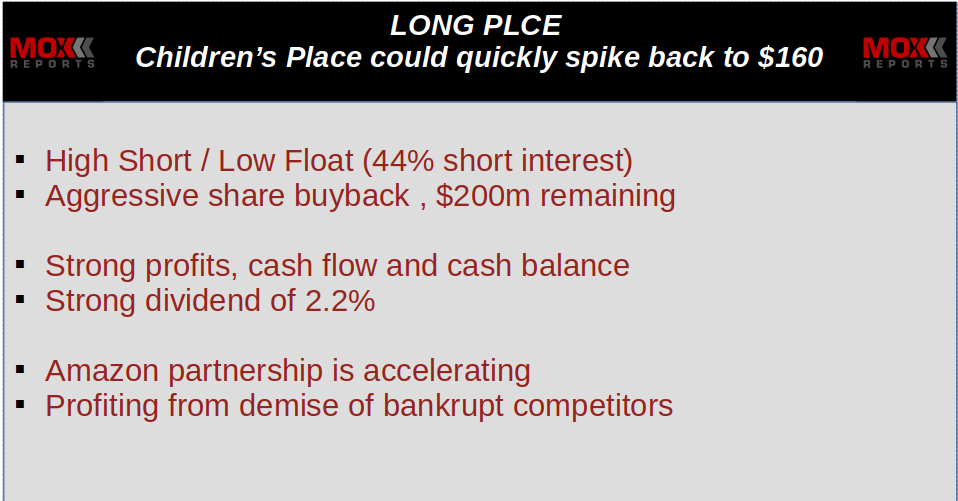

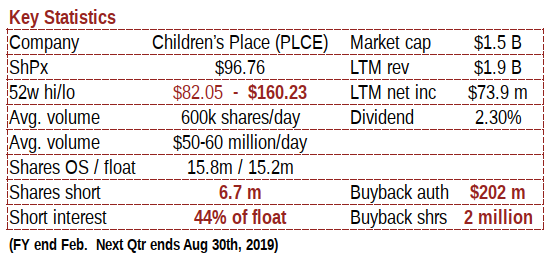

1. The formula of (High Short / Low Float) + (Company Buybacks) + (Flawed Thesis). In June 2019, I published a very contrarian long thesis on Dillard’s when the share price was at $60.26. Within 20 trading days, the share price was already up by as much as 47% and is currently still up by 30%. The trade similarities between Dillard’s (DDS) and Children’s Place (PLCE) should be immediately obvious. I am long both of these stocks and I expect that Children’s Place could quickly rebound to $160 or higher. See disclosures and disclaimers.

2. Even a modest revision from peak bearishness could see Children’s Place rebound to $160 or above. Extreme bearish sentiment has caused short interest in Children’s Place to hit all time highs at 44% of float. But the short thesis is missing some very important details. Weak earnings from Children’s Place along with the bankruptcy of competitor Gymboree saw Children’s Place fall by nearly 50% from its highs above $160. Aside from causing negative sentiment, bankrupt competitors were liquidating inventory, putting real pressure on quarterly earnings for Children’s Place, creating a natural drag on the share price. But competitor liquidations have now largely passed. In addition, Children’s Place has been able to capitalize on competitor weakness, buying up assets and IP at distressed prices, and often becoming the only remaining local competitor in the space. This local consolidation by Children’s Place also benefits from the accelerating partnership with Amazon.

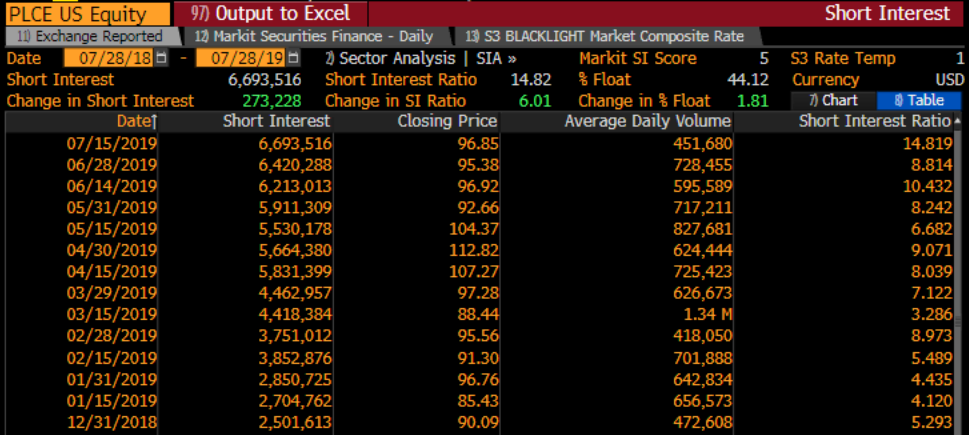

3. Short interest has spiked sharply…. even as share buybacks continue to shrink the float. Since January, short interest in Children’s Place is up sharply from 2.5 million shares to 6.7 million shares. Like Dillard’s, this rising short interest is being acutely compounded by an ongoing share buyback which is shrinking the share count. Children’s Place has consistently bought back 1-2 million shares per year using internally generated funds, including in 2018 at prices north of $150. Last year, share count at Children’s Place shrunk by 9% to just 15 million shares remaining, down from 22 million just a few years ago. Children’s Place has continued its share buyback into 2019, it has authorization to repurchase over 2 million more shares, and it has ample cash and cash flow to continue.

Important. After the plunge to the $80s, the share price has been steadily rising even against increasing pressure from short sales . Someone is clearly accumulating shares at a meaningful rate, more than offsetting the short sales (and in direct contradiction to the bear thesis). To the extent that the company buyback has been accelerating at lower prices, there is the possibility that the short interest is considerably higher against the smaller remaining share count.

4. Rising stock borrow volatility = rising short seller nervousness. Float dynamics can often predict eventual share price direction, but it is stock borrow spikes that predict the actual timing of price spikes. Stock borrow volatility takes most investors by surprise. For example, borrow on Dillard’s went from 2% to 30% in a short number of day days. It then quickly spiked from 30% to 60%. This unexpected spike in borrow cost directly preceded a one-day spike in the share price from the $60s to the $80s. In recent weeks, Children’s Place borrow has become visibly more volatile, identical to what was seen ahead of past spikes in Beyond Meat (BYND), Tilray (TLRY) and Dillard’s. (See graph of stock borrow volatility below).

5. Children’s Place is actively benefiting from the demise of its competitors. The market is beginning to realize that “mall-mageddon” is not a sector-wide extinction, instead it is a shakeout of the weak. Retailers such a Target are successfully capitalizing on the demise of competitors who were over-levered and under-nimble. Children’s Place has maintained low leverage and was an early mover into ecommerce, including partnering with Amazon. The bankruptcies of over-levered competitors has resulted in the closure of more than 1,000 competitor doors in this space. As many as 70% of these stores had previously been in the same malls as Children’s Place. In many cases, Children’s Place is now the only competitor left standing in those malls, leaving consumers with few local alternatives.

Bankruptcy liquidations from failing competitors caused some short term pricing pressure in the overall space, including on Children’s Place quarterly results. However, Children’s Place has taken advantage of this weakness to actively buy up competitor assets and brand rights at distressed prices, locking in consumers who now have few alternatives. Children’s place is effectively winning the war of attrition.

6. Partnership with Amazon is accelerating faster than expected and provides three ways to win. Children’s Place first announced its partnership with Amazon in 2014, long before its now-bankrupt competitors understood the need for such “co-opetition”. First, the near term benefits from the relationship have allowed Children’s Place to generate and sustain stronger revenues on higher margins, which is why it was able to outlast its now-bankrupt competitors. Second, ecommerce revenues have more than quadrupled from $120 million to $543 million, and now comprise nearly 1/3 of total revenues. This creates the potential for the share price to enjoy multiple expansion as the market increasingly treats its as a ecommerce play valued on P/S rather than a bricks and mortar retailer valued on P/E. Finally, it is not hyperbolic to view Children’s Place as a highly likely acquisition target for Amazon. The current partnership has been a testing of the waters which has clearly been going well for both sides over a five year period. Children’s Place precisely fits Amazon’s mold of a) acquiring recognized brand leaders who are b) in very specialty niche markets such as groceries, shoes, fabrics and education materials. And even prior to any potential acquisition, the partnership continues to deliver positive financial results for Children’s Place (and for Amazon).

7. Why the market is missing this. These data points should be easily findable for motivated analysts, and the extreme bullish tilt for the share price should be immediately obvious. But just as we saw with Dillard’s, both companies have only very limited sell side coverage and by analysts who have little incentive to swing for the fences on deeply out-of-favor retail stocks. Likewise, buy side analysts have largely taken a shotgun approach (“mall-mageddon”) towards the entire bricks-and-mortar sector, frequently missing significant rifle shot opportunities among the wider carnage.

1. In a raging bull market, contrarian stock picks become the only good picks. We are now 10 years into a raging bull market. Simply searching for “good stocks” will only turn up stocks that are already over-priced, often by a very wide margin. As a result, when looking at longs, I look for stocks where market consensus is draconian, but wrong, and which may also benefit from some dominating technical advantage on the trading side. Sifting through the grim sentiment of “mall-mageddon” has been a great place to find a small number of outlier trades hiding within the broader wreckage.

- Here’s A List Of 68 Bankruptcies In The Retail Apocalypse And Why They Failed (CBInsights.com, March 12, 2019)

Over-levered and under-nimble. The elephant’s grave yard of used-to-be-leading retail chains includes Sears, JC Penney, Toy R Us, the Limited, Payless Shoes, Gymboree, Diesel and Brookstone, among many others. There is nothing surprising about their demise and few of them stand much chance at regaining their former glory.

The danger of staying too late in draconian “consensus trades”. When a stock is priced for extinction, the price can rebound very sharply by doing nothing more than “not going bankrupt”. And if a full business turnaround begins to unfold, then the price rises can become dramatic. These nuances within mall-mageddon are becoming more clear in 2019 than they were in 2017 when it started to take hold, as shown in these two contrasting articles.

2017: Will the death of US retail be the next big short? (Financial Times, July 2017)

2019: How Short Sellers Lost $7.6 Billion On 12 Bad Retail Bets (Investopedia, March 2019)

Winning the war of attrition. Mall-mageddon is not an extinction. It is a shakeout of retailers who are over-levered and under-nimble. Players such as Target (TGT) are already proving that by transitioning into ecommerce they can share the success of Amazon, rather than succumb to it. By simply “not going bust” the winners are seeing their shares rebound from multi year lows, and these rebounds can be sharply amplified if low share prices coincide with overly high short interest. Examples are numerous:

- The terminal thesis on Amazon saw it trade below $1.00 in the 1990s, but it eventually rose to over $2,000.

- In 2017, shares of RH had fallen from $25 from earlier levels of $100, but by 2018 was already hitting $160, a rise of more than 6x

2. Children’s Place drop from the $160s may quickly reverse. Between 2016 and 2018, Children’s Place quickly tripled from $50 to $150, as the business was firing on all cylinders. Out-performance was driven by the company’s early moves into ecommerce, including a successful partnership with Amazon, as well as shareholder-friendly actions such as share buybacks and chunky dividend payments. Many expected the price to continue to north of $200. But starting in November 2018, a series of events saw the share price quickly cut in half, falling into the $80s.

Why the share price fell 50%. First, two top executives left the company. Next, a series of weak earnings announcements hit Children’s Place at the same times as its major peers. Finally, in December, direct competitor Gymboree announced that it would be shuttering all of its 900 stores and filing for bankruptcy, such that inventory liquidations would continue to pressure the entire space. Given those competitor liquidations, the short term pressure on quarterly earnings at Children’s Place should not have been a surprise to anyone.

Drivers for a rebound to $160. Since those Q1 lows, the stock has been volatile, bouncing in a range between $80 to $120 as the market figures out that the “problems” at Children’s Place are smaller, shorter term and more fixable than previously assumed. Emerging drivers for a full rebound are starting to become apparent.

- The competitor liquidations put natural pressure on quarterly earnings, but those liquidations are now largely over. (In fact, Children’s Place was a big buyer of competitor assets and IP during those liquidations)

- But overall, the recent pressure on net margins was due to increased SG&A, not due to weaker selling prices. And the reason for this was a rise in fulfillment costs in order to meet increased demand from ecommerce. This is a good thing not a bad thing, and the short term increase in fulfillment cost is short term.

- Unlike struggling competitors, Children’s Place is still very profitable, both at the gross level and the net level.

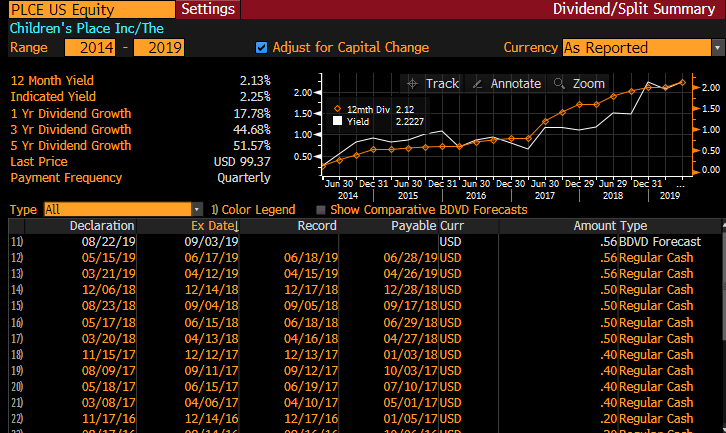

- The company has bought back shares every year for the last five years and has also increased the dividend payment every year. Total share buybacks already exceed $1 billion and in the last year the company was buying shares at north of $150.

- The company continues to generate over $100 million in free cash flow and has ample cash and credit. Continued dividend payments and share buybacks can continue with little or no strain.

Against all of this, rises in the short interest at Children’s Place appear to have occurred mostly in line with rising short interest against the broader bricks-and-mortar space.

3. Short interest has spiked sharply….even as share buybacks continue to shrink the float. Since January, short interest in Children’s Place has risen very sharply, from 2.5 million shares to 6.7 million shares. Short interest now amounts to 44% of float. Any time we start approaching half of the float being sold short, it should be considered an extremely high short interest. But despite the added pressure from short sales, the share price has been steadily rising, not falling. Someone is clearly accumulating shares at a meaningful rate, more than offsetting pressure from short sales. (See more below).

As a sector bet, “mall-mageddon” may continue to be an attractive overall short trade. But it is quite clear that there are individual stocks which should be very strong, yet are being dragged down by the “mall-mageddon” sector trade.

“Someone” has been buying Children’s Place. Even as short interest has been increasing, Children’s Place has been reducing the float by buying back shares. The company has bought back more than 7 million shares over the past five years, shrinking the share count to just 15 million shares remaining. In addition, the company still has current authorization to repurchase an additional 2 million shares and has the cash and cash flow to do so. The company is not highly levered and has ample borrowing capacity should it wish to accelerate share purchases while the stock price hovers below $100. In the past, the company has been an aggressive buyer of shares at prices north of $150.

During periods of share price weakness, Children’s Place has historically accelerated its share buyback quite sharply. In the quarter ended November 30, 2018, the company bought back 192,646 shares, paying as high as $138.63. But when the share price fell into the $80s and $90s in December the amount bought back nearly doubled as the company bought back 372,968 shares in just two months.

Given the recent resilience in the share price, it is distinctly possible that Children’s is in the market buying back shares. If so, it would mean that short interest could be significantly higher than the current reported 44%. We will find out the amount of the buyback in September when the company announces results for the August quarter.

The combined effect of shrinking share count against rising short interest has resulted in an ultra-high short interest of 44%, even as few people saw this spike developing over time. Except in cases of fraud or bankruptcy, short interest greater than 40% generally reverses itself very quickly once a stock starts to rise.

Even if short interest simply stays constant, this further buyback alone would take the short interest to almost 50% of float, which is seldom sustainable. The unwinding of excessive short sales often ends up sharply amplifying rebounds in share prices when the thesis turns from negative to neutral or negative to positive.

4. Stock borrow volatility as a barometer of rising short seller nervousness. Lately there has been a very visible rise in the volatility in the cost to borrow shares of Children’s Place. This is almost identical to what we saw ahead of large price spikes in other heavily shorted names such as Tilray and Dillard’s.

In late 2018, it took less than one month for Tilray to quadruple from $75 to $300. Much of this move was quite predictable in advance just by watching the stock loan market, when availability plunged and cost to borrow soared.

More recently, we saw the same thing with shares of Dillard’s (DDS) after I wrote about it in June at a price of $60. The cost to borrow shares started at around 2% at that time. But around July 15, the cost to borrow shares became much more volatile. And on July 19, the shares spiked as high as $81 on significant volume, rising to as high as $87 the following week. Dillard’s currently sits at $77,which is still almost 30% above where it was in June.

- Tilray: How pricey stock borrow can predict short squeezes (Moxreports)

- Dillard’s (DDS) could quickly double on “upside perfect storm” (Moxreports)

Even with heavily shorted stocks, the cost to borrow shares can stay stable for long periods and then rise dramatically without much warning. With Dillard’s the borrow cost rose from 2% to 60% in just three weeks and the earlier spikes were an accurate predictor of the share price spikes that would take the stock up by as much as 45%.

As shown in the graph below, the cost to borrow shares of Children’s Place has gone from very stable to very erratic, just as the short interest is simultaneously approaching 50% of shares outstanding.

5. Benefiting from the demise of its competitors. In May 2019, Joan Verdon at Forbes.com published a breakdown of the most recent earnings call, the company’s results and its outlook.

Here are a few bullets:

- Approximately 40% of U.S. children’s apparel revenue is generated by market share donors – retailers that are giving up market share primarily due to closing stores or business failures.

- The donors, she said, have given up about $600 million a year in revenue over the last three years to a stronger group of market share takers.

- Most of the market share donors are located in malls, while most of the market share takers are located off-mall.

- The Children’s Place has a 60 percent overlap with mall-based market share donors – competitors such as the Gap, J.C. Penney and Justice, who have announced store closings – and only 28 percent overlap with market share takers.

- The Children’s Place has improved its mall portfolio, closing stores in dying malls. Nearly 90 percent of its mall stores are now in A and B malls. The company has closed 213 stores since 2013.

- The company is staying in quality malls and is reducing its exposure in the dying malls. In the 52 dying malls where it still has a store, the average lease term is less than one year.

- The Children’s Place Says Malls Are Where They Will Take Market Share (Forbes.com, May 2019)

- The Retail Apocalypse And Mall Die-Off Goes From ‘Big Short’ To Contrarian Buy (Forbes.com, November 2017)

When Gymboree and Crazy 8 shut down, Children’s Place didn’t just buy inventory, they also bought the IP rights to the competitor brands, and is offering additional Gymboree branded products via its own stores. As many as 70% of the now-defunct competitors were in the same malls as Children’s Place, such that consumers now have few alternatives to Children’s Place in their area.

A recent research note from Wedbush observed the following:

Fundamentally Better Off. The future for The Children’s Place now shines brighter than before,

given what we see as a fundamentally more favorable competitive landscape following the (now

almost complete) permanent closure of 800 competitor doors, from which The Children’s Place is

inexpensively acquiring customer data, real estate, as well as other assets and IP including rights to

the Gymboree and Crazy 8 brands, effectively preventing the threat of a competitor resurgence,

and leveraging the fiercely loyal customer base in margin accretive channels.

In the future, The Children’s Place will be the sole mass retailer of Children’s apparel in mall fronts across the US, with increasing digital penetration and a promising start to its partnership with Amazon, leveraging existing and newly acquired infrastructure across channels to extract as much of the estimated $600 MM left on the table from the Gymboree and Crazy 8 as possible.

6. Partnership with Amazon is accelerating faster than expected. Children’s Place was an early mover into ecommerce, long before others saw the need to do so. When CEO Jane Elfers joined Children’s Place in 2010, only 9% of the company’s sale were online. By Q1 of 2019, that share was now approaching one third, largely as a result of the company’s partnership with Amazon which she consummated in 2014. When the Amazon partnership began, the company only had 300 SKU’s on Amazon, but this has since risen to around 4,000 SKUs.

- Why I Just Bought More Children’s Place Stock (Motley Fool, November 2019)

- Co-opetition with Amazon works for The Children’s Place (Retailwire.com, May 2019)

- The Children’s Place Says Malls Are Where They Will Take Market Share (Forbes.com, May 2019)

This partnership with Amazon is accelerating faster than expected and provides three ways to win. Children’s Place first announced its partnership with Amazon in 2014, long before its now-bankrupt competitors understood the need for such “co-opetition”. This has now created three different ways which shareholders can win with Children’s Place.

First, the near term benefits from the relationship have allowed Children’s Place to generate and sustain stronger revenues on higher margins, which is why it was able to outlast its now-bankrupt competitors. Many of those competitors are now completely out of the game and Children’s Place has bought their assets and IP. As a result, the economic benefits of the Amazon partnership are now accelerating.

Second, ecommerce revenues have risen from $120 million to $543 million, and now comprise nearly one third of total revenues. This creates the potential for the share price to enjoy multiple expansion as the market increasingly treats it as a P/S ecommerce play rather than a P/E bricks and mortar retailer.

Finally, it is not hyperbolic to view Children’s Place as a highly likely acquisition target for Amazon. The current partnership has been a testing of the waters which has clearly been going well for both sides over a five year period. Children’s Place precisely fits Amazon’s mold of a) acquiring recognized brand leaders who are b) in very specialty niche markets. And even prior to any potential acquisition, the partnership continues to deliver positive financial results for Children’s Place (and for Amazon).

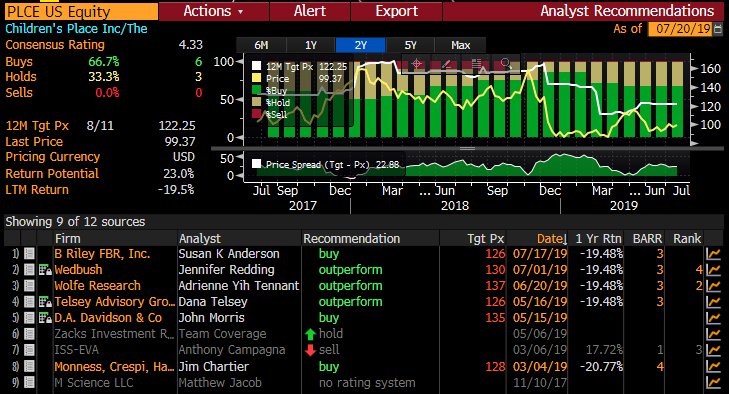

7. Why the market is missing this. Similar to Dillard’s Children’s Place is not covered on the sell side by any of the bulge bracket or even second tier major brokerages. There are a few smaller analysts who do cover the stock, all of whom have targets in the $120s and $130s (for now). Regardless of how anyone might feel towards the coverage or the targets, it is clear that the lack of mainstream coverage of Children’s Place means that it has very little visibility in front of institutional investors.

The data points on Dillard’s were all easily discover-able for many weeks and clearly indicated a sharp upward bias for the shares. No one should have been surprised by the 44% spike which quickly materialized. Yet even major media was taken by complete surprise. After weeks of very flat-ish trading, on July 19, Dillard’s suddenly by jumped by 22% just in the last 60 minutes of trading and financial media had no idea why. For the day, the stock was up by as much as 27%. With these contrarian stock trades, everything stays quiet until suddenly it isn’t.

- Here’s what’s behind Dillard’s big move (CNBC, July 19, 2019)

Conclusion. Even after a 50% drop in the share price, it is not surprising that shareholders remain confident in CEO Jane Elfers. Elfers realized early the need to partner with Amazon while simultaneous keeping leverage low. As a result, as its competitors face bankruptcy, Children’s Place is the one buying their assets and IP out of liquidation. Under her tenure, online sales have more than quadrupled and now comprise nearly 1/3 of sales. The bankruptcy of its competitors now leaves Children’s Place as the sole player in many malls across the country. And as the portion of online sales continues to increase, the stock will likely benefit from a “multiple expansion”, trading as a P/S valued ecommerce play instead of as a P/E valued bricks and mortar play. The partnership with Amazon has been beneficial to both sides for five years now. And with 4,000 SKUs offered via Amazon, it is not outlandish to think that Amazon would acquire Children’s Place at a premium to its current valuation. Children’s Place fits very nicely into Amazon’s strategy of buying a) brand name leaders in b) well defined market niches, which has been seen in its acquisition of premium / niche chains such as Whole Foods, Zappos, TenMarks Education and ComiXology.

In the meantime, Elfers has been an extremely shareholder friendly. The dividend yield has increased every year since it was initiated in 2014 and the company continues to buy back 1-2 million shares per year using internally generated funds.