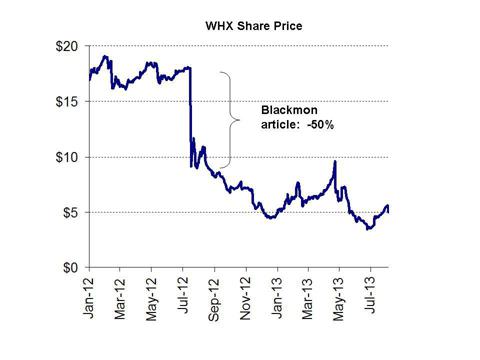

In July 2012, the Whiting USA Trust (WHX) was trading at $18.00 and had just paid one of its highest ever dividends. Whiting had long been subject to heavy criticism due to the unsustainable nature of its dividends which were based on finite oil and gas reserves. Each time a negative article surfaced, the retail investor base shrugged it off or refuted the concerns of the critics. It was notable that institutions and insiders refused to own Whiting. It was almost entirely held by mom and pop retail investors for its dividend yield of at least 10%.

On July 17th, 2012, Seeking Alpha author Shane Blackmon published an article entitled

“You’ll Lose 50% Of Your Money If You Hold This Trust For The Next 3 Years”

In fact, it did not take 3 years for the stock to fall 50%. By the end of that very day, the shares closed down by 50%.

The majority of investors had already been made aware that the dividend at Whiting was fundamentally unsustainable in various articles and comments. However, each person was individually certain that they could keep collecting the dividend for the short term, and then exit before the price imploded.

On July 17th, 2012, they found out the hard way that it is impossible to time the implosion of an unsustainable dividend scheme.

Shares of Whiting never recovered, and are now down by more than 70% from their pre-article price. Whiting now trades for below $5.00.

StoneMor Partners (STON) is in a different business than Whiting, but in many respects the problems are identical to those of Whiting.

The stock is often not particularly liquid, however there are very cheap call and put options listed at very frequent strike prices.

Investors should be particularly concerned that institutions and insiders absolutely refuse to own StoneMor, just as they did with Whiting.

Investors should also be concerned about the steady stream of warnings that StoneMor’s dividend is an unsustainable “Ponzi dividend”.

Ultimately we will see that current investors in StoneMor are set to lose around 30-50% relative to the current price. The only catalyst that is necessary is when others decide to sell. This could happen either before the dividend is cut or after.

The reason for this is that the dividend is in no way sustainable. As with Whiting, some investors are already aware of this, but choose to keep collecting the dividend in hopes they can get out before the big drop in the share price.

With Whiting, there was no fundamental change or announcement that led to the 50% drop. Instead it was just that on that day investors chose to stop bearing the risk of the dividend cut and get out. Ultimately the dividend was cut well after the drop in the price of Whiting.

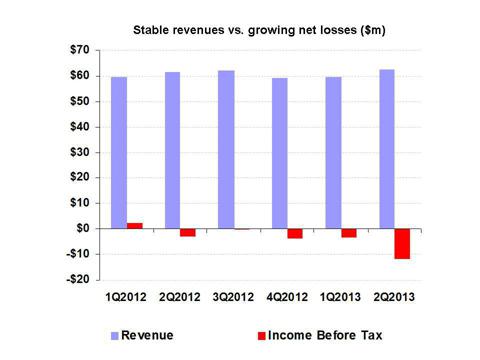

On the surface, StoneMor has all the hallmarks of an ideal retirement portfolio dividend stock. Revenues are stable. The industry is set for continued growth due to the aging of the US population. Gross margins are stable, even though the company does continue to lose money every quarter at the bottom line.

But the biggest attraction of StoneMor is clearly its large and stable dividend of 8-10%. It is the dividend that has made StoneMor a darling among retail investors. Hunger for this dividend has pushed the shares up to over $26, its highest levels since 2011. Many retail investors now seem to regard it as almost a fixed income investment due to these characteristics.

But that is where the good news ends.

The problem with StoneMor is that the “principal” here is far from protected and the yield is far from guaranteed. Despite the low volatility in recent months, regarding this equity as a fixed income security is a dangerous mistake.

Even a cursory analysis reveals significant problems at StoneMor, which indicate that this dividend (and thus the equity price) should be at significant risk. Because the valuation of StoneMor’s equity is entirely dependent upon the dividend, any reduction in that dividend will quickly send the stock down by 30-50%.

We can see that StoneMor has been panned by insiders, institutions, equity analysts and debt analysts. This leaves just passive retail owning more than 90% of the stock.

Now that StoneMor has gone ex-dividend (August 1st), the best move for holders of StoneMor is to take the dividend and run, selling the units.

There has been an abundance of articles which continue to praise StoneMor as an attractive dividend investment. These articles are typically very brief and perform no analysis other than citing the cosmetically attractive dividend along with the attractive fundamentals of the industry. These articles do nothing to assess whether or not StoneMor can actually keep paying this dividend. They also do nothing to explain why this stock continues to have a dividend yield that is several hundred percent above its peers.

This was also the case with Whiting before its collapse. Brief articles noted a high dividend, but failed to test whether or not the dividend could be sustained.

There are numerous red flags which show that the dividend and the unit price are at significant risk with StoneMor. Many of these red flags should be too obvious to ignore.

Each of these red flags is a separate way of noting that the market is telling us it expects a dividend cut. These are the clues from which we can predict the 30-50% downside move.

Red Flag #1: Institutions refuse to own StoneMor

Retail is not the only one who loves dividends. Institutions are big fans of stable dividends as well. Yet total institutional ownership stands at just 9%.

As with Whiting, the institutions are well aware of the unsustainable nature of the dividend at StoneMor. They are also aware that purchasing StoneMor simply for the dividend is a devil’s bargain. As soon as the dividend level is reduced (or as soon as confidence fades in advance), the equity price will fall by far more than the amount of any hoped for dividends.

Red Flag #2: Company insiders refuse to own StoneMor

If the industry is growing and the company is thriving, one would presume that insiders would be eager to lock in an 8-10% dividend as well. Yet the combined total of insider ownership between a dozen different individuals stands at just 3%.

As with institutions, the insiders are well aware that the 8-10% dividend policy is unsustainable. As with Whiting, insider ownership is negligible.

Red Flag #3: Rating agencies have ranked StoneMor as a junk credit

StoneMor equity is not a fixed income security. Neither the dividend payments nor the principal amount invested come with any guarantee. But by looking at the actual debt of StoneMor (which does come with a guaranteed payment of principal and interest), we can see just how risky the equity proposition is.

Despite the stable industry characteristics and the consistent revenues, bothMoodys and S&P rate StoneMor as a junk credit. The current rating of B- is just one notch above being a near uninvestable CCC credit.

S&P had noted an expected recovery value rating of 4, indicating that in an event of default only 30-50% of principal would be recovered.

Both rating agencies express concern that StoneMor is so highly leveraged.

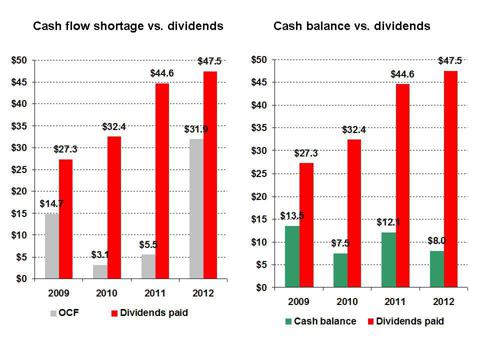

Reasons for rating StoneMor so poorly are explicitly due to the fact that during its entire life StoneMor has never generated enough cash flow to pay its dividend. StoneMor is either borrowing new money or issuing equity to pay these dividends.

The agencies describe this as “negative discretionary cash flow”.

This is the definition of “Ponzi finance”. StoneMor is paying an attractive current return to entice current investors. But the only source of this return comes from the new investment by future investors. Without a constant supply of new investors, StoneMor has no possible way of paying this dividend.

This is a practice which everyone should recognize is dangerous and unsustainable. It always comes to an end. And when it ends, it always ends badly.

S&P previously noted this concern explicitly when putting a junk rating on StoneMor by saying,”Our ratings primarily reflect our opinion that StoneMor’s business model,growth strategies, and ownership structure will result in negative discretionary cash flow that will require ongoing external funding.” S&P added, “In our view, the company’s financial risk profile is ‘highly leveraged’ (as defined in our criteria), primarily reflecting slim operating cash flow.”

But in expressing their opinions, Moody’s and S&P are talking about the risks to debt holders, not to equity holders. The risk to the equity holders is clearly far greater than that of the debt holders, particularly the risk of near term price declines.

Red Flag #4: Clear financial warnings from equity analysts

Surveys such as Valueline and Morningstar continue to highlight warnings on StoneMor.

Valueline continues to rank StoneMor at near its lowest ratings for financial strength, safety and timeliness.

Morningstar continues to rank StoneMor as a “D” for Growth and as an “F” for profitability.

Yet despite these unpromising financial conditions, StoneMor continues to pay out a huge and unsustainable dividend which it finances using new investors.

Red Flag #5: An uninterrupted history of losses

Over the past 5 years, StoneMor has posted roughly 5% annual growth in revenues. But this has largely been the result of increasing acquisitions. These acquisitions and the accompanying revenue growth have not translated into any profitability whatsoever. Over the past 4 years, annual losses have ranged from $6-14 million.

This is clearly why Morningstar ranks StoneMor an “F’ for profitability.

The cumulative loss so far in 2013 is now over $13 million for the first 6 months.

StoneMor bulls attribute these losses to the nuances of death care accounting, by which revenues are not fully recognized until the services are used (ie. the customer is buried).

But we have now had 9 years since the IPO in 2004 for any of this revenue recognition delay to start catching up. Instead, despite new acquisitions (including in 2012 and 2013), the losses have continued.

Pre-tax losses in 2012 did narrow to $4.8 million from $13.7 million in the previous year. However that trend looks to be short lived. The pre-tax loss in 1Q2013 has already come in at over $3 million for the single quarter. One time items in 2Q 2013 resulted in a loss of $11 million for the quarter.

This means that in the first 6 months of 2013, StoneMor has already lost more than it did for full year 2012.

Red Flag #6: StoneMor is close to breaching debt covenants

As of the latest 10Q from just a few days ago, there is a new risk of breeching covenants on StoneMor’s debt.

StoneMor’s debt covenants require that it not exceed a maximum consolidated leverage ratio of 4.0. As of Q2 that level hit 3.97, so it will take almost nothing further to violate this covenant.

StoneMor is also required to maintain a minimum consolidated debt service coverage ratio of 2.50. The current ratio is 3.22, such that if there is just a1% decline in EBITDA, StoneMor will be in violation of its covenants.

Breeching debt covenants will further restrict StoneMor’s ability to pay the dividend.

From latest 10-Q:

We have two primary debt covenants that are dependent upon our financial results, the consolidated leverage ratio and the consolidated debt service coverage ratio. The consolidated leverage ratio relates to the ratio of Consolidated Funded Indebtedness to Consolidated EBITDA. Our consolidated leverage ratio was 3.97 at June 30, 2013 compared to a maximum allowed ratio of 4.00. The consolidated debt service coverage ratio relates to the ratio of Consolidated EBITDA to Consolidated Debt Service. Our consolidated debt service coverage ratio was 3.22 at June 30, 2013 compared to a minimum allowed ratio of 2.50.

Valuation implications

By looking at comparable death care companies, we can see that StoneMor is drastically overvalued relative to any fundamentals. The sole reason for this overvaluation is hunger for the (unsustainable) dividend by retail investors. Were it not for the dividend, StoneMor would quite obviously be trading at roughly half of the current price.

StoneMor has three publicly traded comparable companies, Service Corporation International (SCI), Stewart Enterprises, Inc. (STEI), and Carriage Services, Inc. (CSV). Due to Service Corporation’s pending acquisition of Stewart Enterprises, it’s best to compare StoneMor to only Service Corporation and Carriage Services.

| STON | SCI | CSV | |

| Market Cap. | 559.9 Million | 4.0 Billion | 322.3 Million |

| P/Sales | 2.3 | 1.63 | 1.55 |

| TTM P/E | N/A | 25.8 | 27.7 |

| EV/EBITDA | 25.2 | 9.3 | 11.7 |

| Net Debt/Ebitda | 7.4 | 2.8 | 5.3 |

| Credit rating | B- | BB | BB |

| Dividend Yield | 9.2% | 1.5% | 0.7% |

Profitability: StoneMor is the only one of these peers that loses money, the other two are actually profitable companies.

Debt (leverage): StoneMor is also far more leveraged than its peers, with a very high Debt/Ebitda ratio of 7.4. This is the leverage concern that was expressed by the rating agencies.

Credit rating: StoneMor is rated 4 notches below its peers by the rating agencies – just one notch above a CCC credit. It two comparables are both rated BB, just 2 notches below investment grade.

Valuation: Despite these drawbacks, StoneMor trades at a substantial pricepremium to its peers. StoneMor’s Price/Sales ratio is roughly 50% higherthan its peers. EV/Ebitda is more than double its peers.

It is quite obvious that the only reason for this drastic valuation discrepancy is the massive difference in dividend yields. While the comps pay out 0.7-1.5% annual dividend yields, StoneMor pays a stunning yield of over 9%.

This is also how we can come to the conclusion that any meaningful cut in the dividend is likely to see the price of StoneMor fall by at least 30-50%.

A closer look at the unsustainable dividend

As shown in the charts below, StoneMor’s dividend has been climbing steadily, even though it has not generated enough cash to pay these dividends in any of the past 4 years. In any given year the shortfall ranges from $14-40 million.

So far in 2013, StoneMor has again paid out nearly $25 million in dividends, despite bringing in only $16 million in OCF.

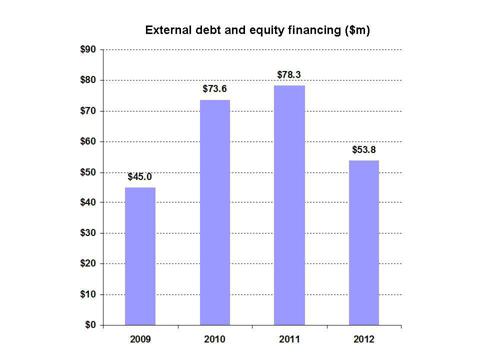

As a result, in each year, StoneMor has tapped the debt and equity markets. In effect, this means that StoneMor is simply raising money from new investors in order to pay off the existing investors.

So far in 2013, StoneMor has again already raised around $20 million from new investors, net of its debt repurchase. It has also made use of its credit facility with its banks.

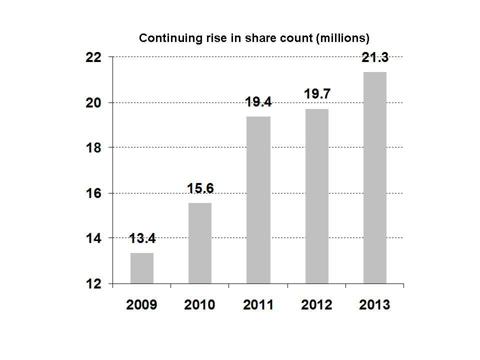

The problem is that the base of investors who need to receive a return keeps growing larger and larger.

Meanwhile, we can see that despite stable revenues, StoneMor continues to be unprofitable every quarter.

Distributions approaching a breaking point

Schemes such as this are always unsustainable. When they suddenly end, it comes without warning.

As the investor base continues to grow, the financing need grows exponentially larger as does the need for finding an ever growing supply of new investors.

StoneMor has been tapping both equity and debt investors in order to continue funding this above market 8-10% dividend.

Part of the problem lies in the fact that insiders and institutions refuse to own StoneMor. In most cases, retail investors either cannot or will not perform the analysis necessary to properly evaluate the security. Instead they just keep cashing their dividend checks and hoping for the best.

In its recent earnings announcement, StoneMor illustrates why retail investors have been overly confident in receiving their dividend even as institutions steer clear.

The earnings release states that

Distributable free cash flow (non-GAAP) for the three-month period ended June 30, 2013 increased to $24.9 million from $13.3 million for the same period last year, an 86.8 % increase.

Hopefully more astute investors will realize that the term “distributable free cash flow” is a fabricated non GAAP measure and specifically does not refer to operating cash flow. It is effectively a made up metric.

For example, the release noted that “distributable free cash flow” in 2Q2012 had been $13.3 million. In reality, OCF that quarter was only $6 million. Against that $6 million in OCF, StoneMor had paid out $12 million in dividends that quarter. As usual, it financed this by issuing debt.

Had StoneMor actually generated that $13.3 million in cash, there would be little to be concerned about when paying a $12 million dividend for the quarter. But instead, we can see clearly that this metric is meaningless as StoneMor still needed to borrow to pay the dividend for which it lacked cash. In reality, StoneMor paid out a dividend which was double what it actually generated in OCF.

It is important to note that this arbitrary non-GAAP “distributable free cash flow” number does not even approximate real cash flow. According to the company, the components of this number include GAAP cash flow, plusadditions for the Merchandise Trust. But as disclosed in the most recent 10Q:

The merchandise trusts are variable interest entities (VIE) for which the Company is the primary beneficiary. The assets held in the merchandise trusts are required to be used to purchase the merchandise to which they relate. If the value of these assets falls below the cost of purchasing such merchandise, the Company may be required to fund this shortfall.

Adding in the value of the Merchandise Trust into this new “distributable free cash flow” metric renders it basically meaningless.

It is notable that StoneMor’s treatment of this “distributable free cash flow” has already been evaluated by the SEC and this view has been rejected. Yet StoneMor continues to disclose this manufactured and arbitrary metric as a way of suggesting that the dividend is in some way sustainable.

The $24.9 million in “distributable free cash flow” for 2Q2013 is a very inspiring number on the surface. But it is misleading in two respects. First, it includes a one time cash benefit of a lawsuit win by StoneMor.

But more importantly, it uses the same flawed methodology to suggest that StoneMor is actually generating cash that it is not.

In reality, StoneMor paid out the largest dividend in its history at nearly $13 million during Q2. Meanwhile, actual operating cash flow stood at just $9 million. So once again, StoneMor paid out around 150% of its OCF as a dividend.

But the impression given by the recent press release is that StoneMor only paid out $13 million while generating $24.9 million. This is simply not the case.

Meanwhile, the share count has now ballooned to over 21 million, up by more than 50% in 4 years. Total debt now stands at $230 million. Interest paid during the first 10 months is already at $10 million.

As the investor base has expanded, each of the new investors becomes “entitled” to the ever expanding payment obligations.

Conclusion

StoneMor continues to be unprofitable and generate insufficient cash flow to pay its dividend. StoneMor continues to tap the debt and equity markets for ever larger sums in order to continue paying an above market dividend. As a result, its share count and debt obligations have continued to expand over the years.

StoneMor’s continued publication of the “distributable free cash flow” has confused some retail investors into believing that the company does have adequate cash flow to pay its huge 9% dividend. However the SEC has already disallowed that methodology for computing cash flow.

Paying out an enormous 9% dividend has now become quite obviously unsustainable. As the investor base continues to expand, the payment obligations expand exponentially creating the need to continually raise ever larger amounts of new money from more and more investors. StoneMor has now disclosed that it is now dangerously close to breaching debt covenants (within 1%).

As with the Whiting Trust, StoneMor is likely to fall by 30-50% as soon as investors decide to exit.

As with Whiting, the catalyst for this move is not dependent upon StoneMor cutting the dividend in advance.

Now that the stock has gone ex-dividend and earnings have been announced, there is simply no reason to continue holding the stock. The best move is to exit and eliminate the 30-50% downside risk before other sellers act first.

Disclosure: I am short STON. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.