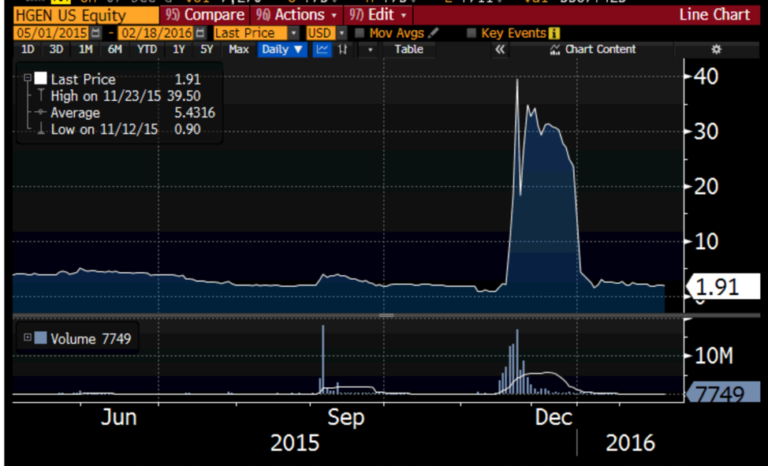

KaloBios (KBIO) Infinity Squeeze. In November 2015, “Pharma Bro” Martin Shkreli orchestrated a violent short squeeze on failed biotech KaloBios that caused its share price to rise by a staggering 10,000% in just five trading days. KBIO had been perceived by short sellers as a “no brainer near term zero”. KBIO’s only real drug had just failed and the company had insufficient cash to pay over $6 million in debt.

(Note: Subsequent to its delisting, KBIOs ticker was later changed to HGEN)

Yet the fact that KBIO was entirely defunct and insolvent did nothing to slow the meteoric rise of its share price. And that is the entire point. No matter how abysmal a company’s financial condition may be, when the number of shares shorted exceeds the tradeable float, even the most utterly worthless stocks can spike much higher. When such squeezes take hold, fundamentals can cease to matter for a time. The share price simply becomes a short term math problem.

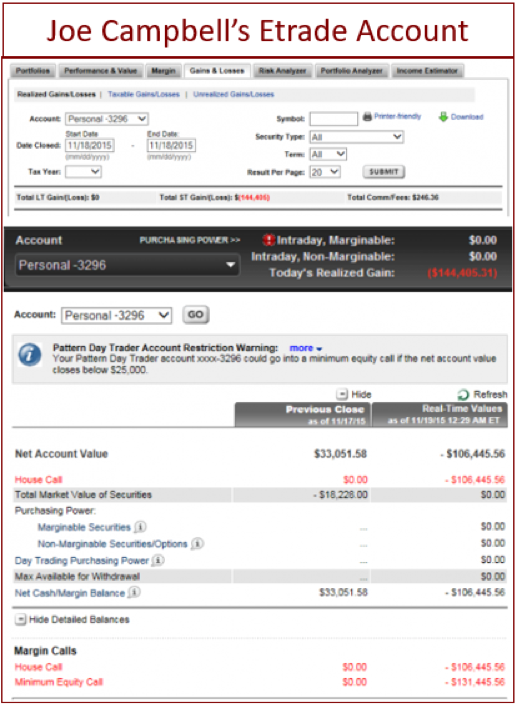

The KBIO infinity squeeze is most memorable for retail trader Joe Campbell who launched a GoFundMe campaign to help pay for his personal trading losses which he suffered as a result of having a fairly small short position in KBIO. Not only did the $37,000 in his E-trade account go to zero, but Campbell was left owing E-trade an additional $106,000 in addition.

- Trader Begs for Help to Pay E-Trade $106,000 After Biotech Blow-Up (Newsmax, Nov. 2015)

- Trader calls off appeal for help with $106,445.56 E-Trade debt (MarketWatch, Nov. 2015)

Martin Shkreli, often referred to as “the most hated man in America,” is generally more famous for his move in 2015 to raise the price of an AIDS drug by 5,000%. His unapologetic profiteering and general public insolence ended up drawing massive public ire down onto the entire biotech space.

In March 2018, Shkreli was sentenced to seven years in prison for defrauding investors in connection with his two MSMB hedge funds and for manipulation of shares of Retrophin. Retrophin was another small biotech where Shkreli had gotten himself appointed as CEO by way of investing into the company.

But as for the massive squeeze he orchestrated on KBIO, the infamous Shkreli has never faced significant formal consequences. In fact, when looking at the numerous instances of orchestrated infinity squeezes over the past 10 years, it is notable that so far no one has faced consequences for doing so.

- ‘Pharma bro’ Martin Shkreli sentenced to 7 years in prison (CNBC, March 2018)

- Martin Shkreli allegedly ‘went on warpath’ after drug company booted him as CEO, and threatened his successor. (CNBC, July 2017)

- Who is Martin Shkreli – ‘the most hated man in America’? (BBC News, Aug. 2017)

Lesson number one. Fundamentals do not matter. Period. In early November of 2015, KBIO was an utterly defunct, failed biotech clearly headed for insolvency. KBIO had just a single feasible drug in clinical trials at the time and had no revenues. When that drug failed, KBIO was left with insufficient cash to pay nearly $7 million in debt. KBIO quickly slashed headcount by 61% and then publicly announced that earlier hopes of pursuing strategic alternatives would not be viable due to having such limited cash resources. Then on November 17th, 2015, the Nasdaq notified KBIO that the stock would be delisted because it had failed to file a 10-Q for the September quarter.

So to be clear, KBIOs problems were catastrophic and unfixable. The stock was (rightfully) regarded by short sellers as a “no brainer near term short to zero with no realistic possibility of recovery.”

- KBIO Shutting Operations, Ending Clinical Programs (Genetic Eng. & Biotech News, Nov. 2015)

- KaloBios to Wind Down Operations (KaloBios Press Release, Nov. 13th, 2015)

KBIO is suddenly resurrected. Shares of KBIO had bottomed at 44 cent on November 16th, 2015, but then quickly spiked back to over $2.00 on November 18th. Most observers attributed the rise to some simple (but unexplained) short squeeze. As “an obvious zero”, KBIO attracted many small retail short sellers, looking to “play the fade”. In fact, there was a very good reason why the stock had been spiking up from 44 cents.

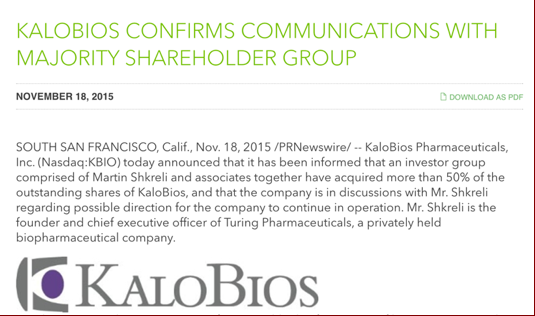

After the close of markets on November 18th (just one day after KBIO received its delisting notice), KBIO announced that an investor group led by Martin Shkreli had just acquired “more then 50%” of KBIO’s shares. So this is why the share price had spiked from 44 cents. When the market opened the next day, KBIO skyrocketed from $2.00 to over $14.00 on staggering volume, as terrified shorts scrambled for the exits.

- Update: KaloBios Saved From Shut-Down By Turing Pharma’s Shkreli (Xtalks.com, Nov. 2015)

After the close on November 19th, KBIO released a second announcement, stating that the group had now acquired a full 70% of outstanding shares and that Shkreli had been appointed as KBIO’s new CEO and Chairman. Shkreli’s group had stated that it would inject an initial $3 million in cash with an additional $10 million following shareholder approval. By November 23rd, KBIO had briefly hit $45 per share. But, even then Shkreli was not yet finished with his plan.

- KBIO Appoints Shkreli CEO, Announces New Financing (KaloBios Press Release, Nov. 19th, 2015)

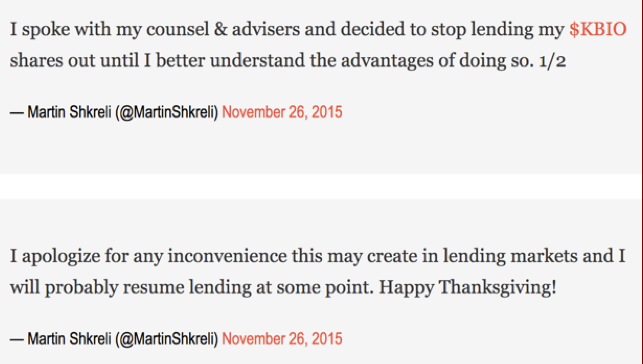

Phase two. Forced borrow recall. After briefly hitting $45, KBIO quickly retreated into the $20s. After all, it was still just a defunct biotech stock without a real drug. Even with a bit of cash from Shkreli, the stock was worth nowhere near a market cap of over $200 million. Short sellers piled in to short more in the $20’s on the basis that “this was just a squeeze” that would quickly fall apart.

As KBIO’s share price had been spiking, short interest had been growing. And Shkreli now owned 70% of the outstanding shares. Then on Thanksgiving Day 2015, when markets were closed, Shkreli tweeted that he had decided to recall his KBIO shares that had been lent out to short sellers. The resulting squeeze was just a simple math problem. When Shkreli recalled his shares, brokers would be forced to buy-in the short sellers, causing it to spike uncontrollably.

When the market reopened on Black Friday for a shortened session, shares of KBIO continued to squeeze higher reminding some investors of the Volkswagen/Porsche infinity squeeze from 2008. Shares surged 31% as shorts trampled over one another to close their positions. The stock again surged back to as high as $45, and remained elevated for weeks thereafter.

- KBIO Stock Rockets +65% after CEO Shkreli Stops Lending Shares (Investorguide.com, Nov. 2015)

- KBIO short sellers facing squeeze, CEO Shkreli will no longer lend stock (MarketWatch, Nov. 2015)

Everyone loses. The 10,000% squeeze in KBIO was epic in amplitude but was ultimately very short lived. Within six more weeks the stock would end up being delisted and was once again trading for less than $2.00. Even though trader Campbell had been entirely correct with his assessment of KBIO’s abysmal fundamentals, the quick spike from $2 to $44, wiped him out beyond any repair. Many other short sellers were no doubt wiped out by this unexpected spike of unprecedented magnitude, even though their assessment of the fundamentals had also been entirely correct.

On December 17th, 2015, just one month after the 44 cent bottom on KBIO, Shkreli was arrested by the FBI on federal fraud charges. The fraud charges were totally unrelated to anything with KBIO, but with no ability to access financing KBIO immediately sought Chapter 11 bankruptcy protection. By January, KBIO shares had already been delisted from the NASDAQ.

- ‘Pharma Bro’ Shkreli sentenced to seven years for defrauding investors (Reuters, March 2018)

- SEC v. Martin Shkreli, MSMB Capital, et. al. (Securities and Exchange Commission, Dec. 2015)

- “Devastated” Short Who Launched Online Begging Campaign Was Right: KBIO Disintegrates (Zero Hedge, Dec. 2015)

- Martin Shkreli burns KaloBios bulls a month after squeezing out bears (MarketWatch, Dec. 2015)

- Former Hedge Fund Manager and New York Attorney Indicted in Multimillion Dollar Fraud Scheme (The U.S. Attorney’s Office – Eastern District of New York, Dec. 2015)

- KaloBios Pharmaceuticals files for bankruptcy in wake of Shkreli arrest (Reuters, Dec. 2015)

- KaloBios’s stock crashes after Nasdaq delisting allows trading to resume (MarketWatch, Jan. 2016)

Key Takeaways From KBIO Infinity Squeeze

- The ability to say “I told you so” six months down the road has precisely zero value. Especially for traders who went broke in the process.

- When shorting any stock, it is always important to know who is on the opposite side of the trade, and what he might be capable of.

- “Easy to short” does not always equate to “easy to cover”. As late as November 16th, short interest in KBIO had stood at less than 6%. The cost to borrow shares was not excessive. The sudden double whammy of rising short interest against a sudden change in available float is often easy to miss, especially because there are slight delays on the reporting of short interest and ownership changes. Actual short interest is generally only disclosed bi-weekly while investors generally have at least several days to disclose changes in their holdings.

- The fact that Martin Shkreli ultimately came to an unpleasant end does nothing to reverse the losses of those who were on the wrong side of the KBIO squeeze.