- Traders from places like China and Korea are being forced off of their own domestic crypto exchanges but still want to pour money into crypto. GCAP now provides an easy solution.

- GCAP just added crypto products to its trading platform, BOTH long and short with 4x leverage. Much better spreads, liquidity, fees and reliability vs. crypto exchanges or futures.

- GCAP is US listed, established and profitable, but crypto trading has not yet been rolled out in US. US investors are not fully aware of the impact and have not yet bid up the stock.

- Majority of GCAP revenue comes via UK entity, including offshore customers. This allows services to customers including China, Japan and Korea. Again, US investors largely unaware.

- Global rollout to be announced within weeks, should boost stock sharply. GCAP will make its money off of crypto VOLUME regardless of whether crypto prices rise or fall.

This article is the opinion of the author. The author is LONG Gain Capital (GCAP).

*** SECTION I: GCAP – THE NEXT LEG UP FOR TRADING CRYPTO

I am currently long Gain Capital (GCAP) because I see multiple near term catalysts that should send the stock to a rational level of at least $18-23. Near term crypto mania could conceivably send it considerably higher.

Expected catalysts include near term progress announcements from GCAP regarding its ongoing global Bitcoin roll out, as well as regulatory catalysts which will benefit GCAP at the expense of its would-be competitors. Announcements for both are expected in coming days or weeks.

Regardless of the direction of specific crypto currencies in the near term, it seems safe to say that we will continue to see elevated trading volumes for at least the next 12-24 months.

For Bitcoin alone, trading volumes are up 10x in the past few months and a staggering 400x since 2016.

GCAP is now setting up to make substantial profits off of crypto currency VOLUME regardless of whether crypto prices go up or down.

GCAP just launched Bitcoin trading for its customers, but only out of its UK entity. As a result, many US investors still do not appreciate its significance.

Most of the customers for GCAPs UK entity are actually offshore customers from Asia or the Middle East.

GCAP has had on the ground offices in each of Tokyo, Beijing, Shanghai, Hong Kong and Singapore since at least 2011. The company has historically partnered with regional financial leaders including Samsung Financial and Fortune Capital among others.

Each time a new government (such as China or Korea) attempts to stifle or over-regulate its domestic crypto exchanges, all this does is send droves of customers looking for an offshore (global) trading solution. This is exactly what GCAP has just launched and which will be substantially expanded in the next few weeks. Based on the most recent press release, further announcements detailing the latest roll outs should be forthcoming shortly.

Last night South Korea announced that it would be imposing new curbs on crypto trading in that country. The price of Bitcoin quickly fell by as much as 8%.

Perhaps some people are forgetting that the entire point of crypto currencies is to create a system that is not controlled by a single government.

South Korea has shown insatiable demand for crypto and has frequently accounted for as much as 20% of all daily Bitcoin volume, often putting South Korea alone in excess of $1 billion per day. The frenzy for Bitcoin often means that Koreans pay a premium of up to 23% vs. what other countries pay.

The latest move by the South Korean government simply accelerates a change that should have already happened for traders.

With Korea, we are now simply seeing a repeat of what we saw when China supposedly “cracked down” on crypto trading a few months ago.

In September, China announced it would be halting exchange trading of crypto currencies in China. Not surprisingly, Bitcoin crashed 28% that week for its worst week in more than two years, plunging to as low as $3,077. Panicked investors feared that the loss of Chinese money would spark “the end of the crypto bubble”

Bloomberg Sep 2017: Bitcoin Crashes Again After China Moves to Halt Exchange

But Bitcoin prices fully recovered within days and have since skyrocketed as much as 6x since those lows, briefly exceeding $20,000. The brief panic selling was entirely unjustified. In fact, Chinese money did not stop flowing into Bitcoin, it just found new ways to get there.

Queston: So are we in a crypto bubble ? Is it set to burst ?

Answer: I have no idea. And neither do you.

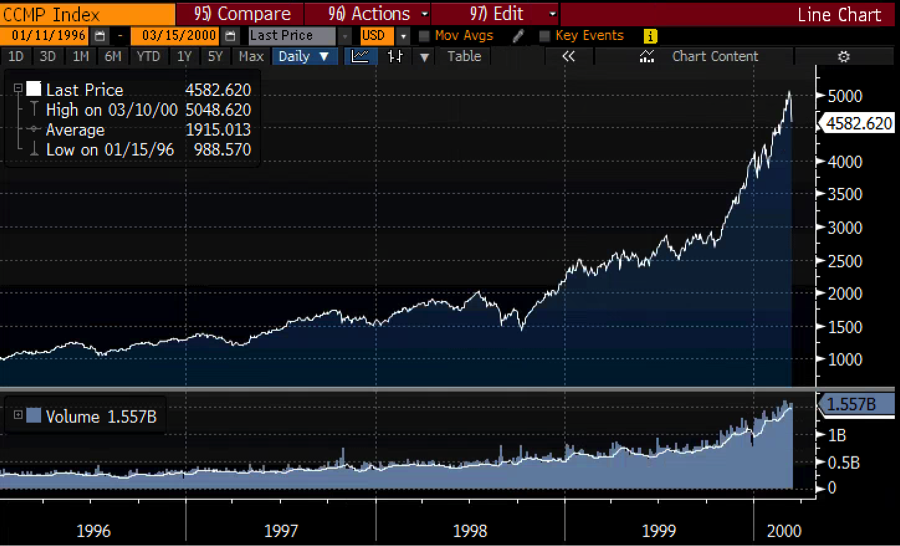

Prior to the bursting of the internet bubble in 2000, Fed Chairman Alan Greenspan gave a now-famous speech warning about the “irrational exuberance” in the markets at the time. Following Greenspan’s speech, markets around the world quickly slumped by more than 3% in rapid succession. Many individual tech stocks fell by more than 30%.

But in case you forgot…..Greenspan actually gave that speech on December 5th, 1996 when the NASDAQ was sitting at just 1,300.

Even after this dire warning from the most powerful central banker in the world, the NASDAQ continued to surge higher for more than three straight years. It ultimately peaked out at just over 5,000 – a full triple from where Greenspan had warned about a “bubble”. In 1999 alone, the NASDAQ skyrocketed by 85% in just a single year !

Take a good look at the chart below showing the NASDAQ from 1996 to 2000. And then ask yourself this: How sure are you that we are now currently in December 1999 rather than December 1996 ?

*** SECTION II: GCAP COMPANY OVERVIEW

| Name: | Gain Capital (GCAP) | |||

| Mcap: | $340 million | LTM Rev | $343 million | |

| Price | $7.80 | LTM EBITDA | $60.6 million | |

| 52w L/H | $5.56 / $8.95 | LTM Net Income | $13.3 million | |

| Avg Volume | 400,000 shares | LTM Op. Cash Flow | $43.9 million | |

| Options | Liquid calls and puts | Debt | $130.6 million | |

| Cash | $225.6 million |

Gain Capital is a global provider of trading services and solutions covering both exchange traded and OTC markets. GCAP uses proprietary trading platforms (web based and mobile) to provide customers with advanced price discovery, trade execution and order management functions.

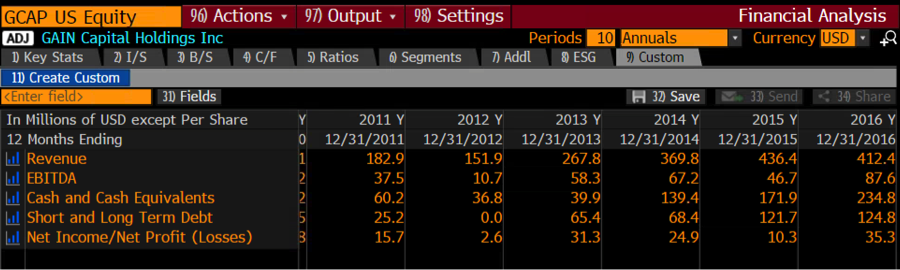

GCAP is consistently profitable and cash flow positive and has been providing similar trading services since 1999. It is a well established and proven player in this space.

Highlights:

- Access (via direct trading, ECNs or CFDs) to over 12,500 financial products, including equities, currencies (now including crypto), commodities, indices and bonds

- Both institutional and retail customers in over 180 countries worldwide

- Physical offices in 14 cities in the US, Europe, Asia, Australia and the Middle East (including Tokyo, Beijing, Shanghai, Hong Kong and Singapore)

- Multiple trading portals including com, CityIndex and FuturesOnline.com.

*** SECTION III: GCAP AS A NEW CRYPTO PLAY

In October, GCAP first made mention of its plans to offer Bitcoin trading to its customers. However, it was a very understated mention. Given the ongoing crypto mania, even that slight mention was enough to generate a few headlines at the time. But without further details there was not enough to get excited about other than general crypto hype and speculation at the time.

In addition, any focus on Bitcoin at the time was also drowned out by stronger than expected financial results from GCAP’s existing business. Following a number of cost cutting measures, GCAP now has significant operating leverage such that even moderate increases in interest rates or market volatility end up having an outsized benefit to its bottom line.

Anyone who expects to see further increases in market volatility or interest rates should also expect to see a significant boost to GCAP even before any benefit from Bitcoin or other crypto trading revenues. The stock should then trade up accordingly.

Article Oct 2017: Gain Capital surges 15% post-earnings

But now in December, GCAP has just formally launched Bitcoin trading for its customers. GCAP is a US listed stock with headquarters in New Jersey. But because the first phase of its roll out has been for UK customers only, the stock price has not yet jumped in the US. The vast majority of GCAPs revenues come through its UK entity, including its offshore customers from around the globe.

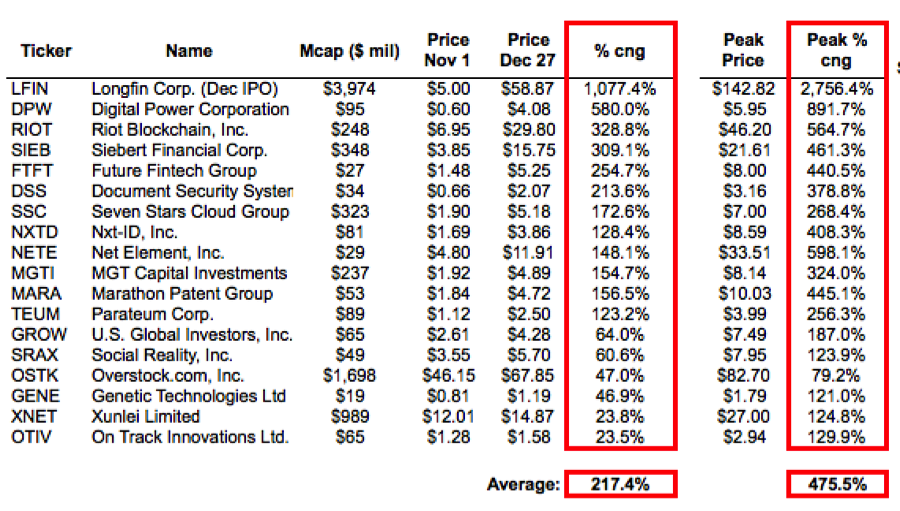

In recent weeks the insatiable demand for any equities with crypto exposure has pushed numerous small caps up by hundreds of percent, even when many of their real business prospects can be viewed as quite dubious.

Below is just a partial list of recent share price moves tied to some sort of crypto or block chain news. These share price moves all occurred since November 1st. The average peak move for these stocks is a staggering 475.5% gain in just that seven weeks !

The premises beneath several of the stocks above are just downright silly and yet they have repeatedly quintupled within a few weeks.

By contrast, GCAP is a profitable and established financial services provider, which now offers a very viable and competitive Bitcoin trading platform which has the potential to generate very significant revenues and profits starting immediately.

As shown above, GCAP has been in business since 1999 and provides access to over 12,500 financial products to investors in over 100 countries. Following its UK Bitcoin trading roll out in December, the company announced that it will extend this to a global roll out in the coming quarter and will extend Bitcoin trading via its Forex.com in select additional markets by the end of 2017. In other words, this is already happening and progress results should be announced in the coming days or weeks.

Those near term announcements could have a meaningful impact on the stock. Given that GCAP already provides access to thousands of financial products, it seems intuitive that the ongoing roll out will go on to include additional crypto currencies such as LiteCoin, Etherium, etc. Any such additional announcements of new crypto currencies would also be expected to have a further positive impact on the stock which could be significant.

It is very important to remember that GCAP will make its money off of crypto volume regardless of whether crypto prices are rising or falling.

*** SECTION iV: CURRENT PLATFORMS FOR CRYPTO TRADING ARE AWFUL

It is still early days for crypto trading. As such, many traders around the world may not yet fully appreciate just how truly awful their trading terms are relative to more mature financial instruments.

What GCAP has just rolled out is a vastly superior solution for many crypto traders around the world.

Crypto exchanges suffer from terrible liquidity, enormous spreads and high fees. One journalist recently reported paying $16 in fees to move just $25 in cash. At times of great market volatility, we have seen bid/ask spread on Bitcoin exceed $1,000 on various exchanges. These exchanges/wallets are unreliable and not secure. In December alone, CoinBase suffered two incidents where its users were unable to execute their trades during times of extreme market volatility. Multiple exchanges have been hacked with little recourse to affected crypto holders.

If these exchanges were traditional brokers, they would have gone out of business long ago. Yet due to lack of alternatives, CoinBase now has more users than brokerage giant Charles Schwab.

CNBC November 2017: CoinBase alone had more users than Schwab.

Yes, this situation is absurd. But it is also likely to change quickly.

So I expect that GCAP should very easily be able to convert many of these users away from their existing exchanges and wallets.

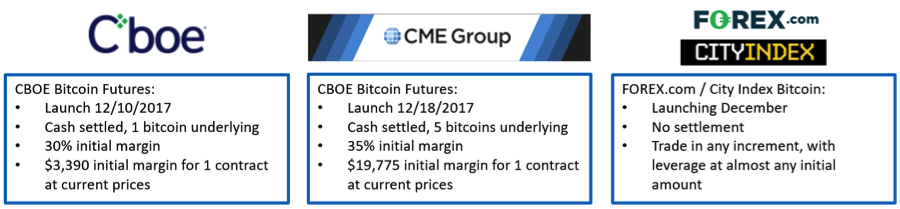

Likewise, trading crypto futures is not suitable for the majority of crypto traders around the globe.

First, the minimum contract size is one full Bitcoin. The initial margin requirement is $3,000-$4,000 for just a single Bitcoin, which is far too large for the majorty of Bitcoin investors. Even when the price of Bitcoin was under $3,000 many investors could only participate on platforms that offered small fractional Bitcoin investments.

Futures have an expiration date. Investors are continually forced to “roll over” their expiring futures contracts by buying longer dated ones. Anyone who forgets to do this this ends up getting stuck with physical settlement, which is a clear problem for anyone who has bought on margin and doesn’t have enough money to accept delivery of a full Bitcoin.

In some (but not all) cases, futures providers are allowing investors to go short Bitcoin. But in most of these cases, the margin requirement ends up being as high as 250%. In other words, to short 1 Bitcoin, you would have to post more than $30,000 at current prices. Again, this is prohibitive for the vast majority of small Bitcoin investors around the world.

*** SECTION V: LOOKING AT GCAPs CRYPTO TRADING PLATFORM

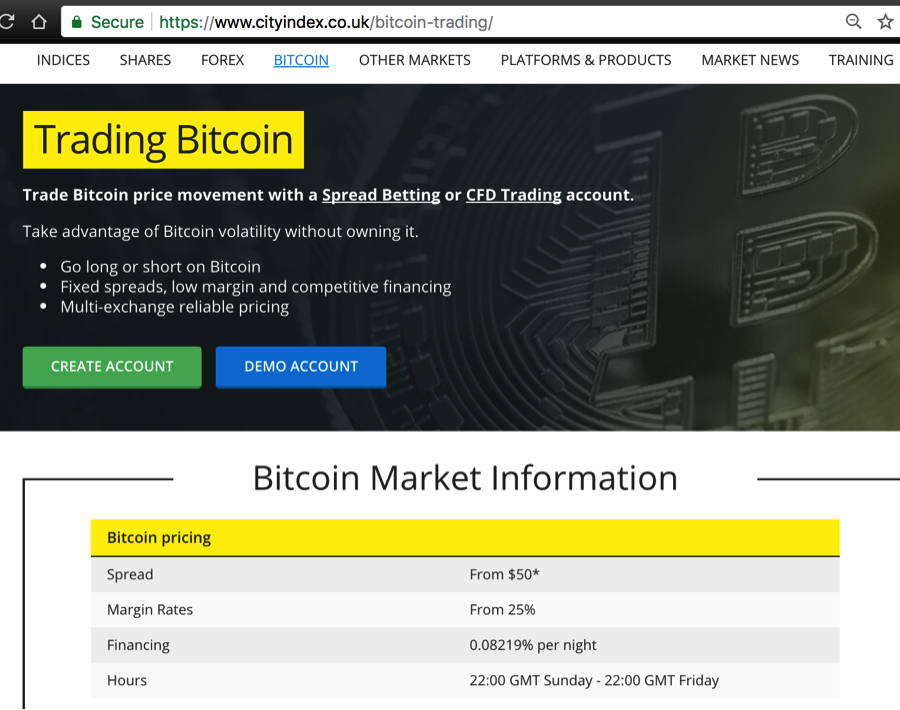

As we can see below, for many traders GCAPs product offering will be vastly superior over the existing alternatives of using exchanges/wallets or futures.

Benefits of GCAP’s CityIndex include:

- GCAP customers can go long or short

- Ability to use 4x leverage with small account sizes.

- The fees and spreads involved are a small fraction vs. existing exchanges/wallets (spreads as low as $50 with GCAP vs. as high as $1,000 on exchanges)

- Far lower dollar margin size than for Bitcoin futures

GCAP’s decision to begin its crypto currency roll out in the UK makes perfect sense.

London continues to be the world’s largest international currency trading center. Many customers who sign up through GCAPs UK (London) entity are actually offshore customers. Which means that GCAP can already begin offering services to Bitcoin traders from Japan, China and Korea (which are currently responsible for the vast majority of Bitcoin trading).

*** SECTION VI: GCAP vs. SIEBERT FINANCIAL (SIEB)

Recent news from Siebert Financial (SIEB) saw that stock quintuple from $4 to $20 in just days, even before it realized a penny of additional revenue. Siebert had announced with Overstock.com (OSTK) that the two would enter into a partnership to offer deeply discounted online trading. The financial prospects for GCAP are visibly far more significant than even the best case scenarios for Siebert, which suggests that there should be quite meaningful near term upside in GCAP’s share price.

SECTION VII: REGULATORY CATALYSTS TO BENEFIT GCAP

On the regulatory side, GCAP stands to substantially benefit from potential regulatory changes from Europe’s securities regulatory (the ESMA).

In addition, on December 15th, 2017, the European Securities and Markets Authority put forth its most recent update on proposed regulatory changes to providers of similar financial products in Europe. Following the announcement, competing providers such as IG Group (LSE: IGG), CMC Markets (LSE: CMCX) and (LSE: PLUS) each dropped by 10% or more on the day.

On the same day, GCAP was up by more than 5% after it put out a statement in support of the regulatory changes.

Overall, the ESMA is proposing leverage caps on providers of CFDs and other financial instruments. But the caps are well above the 4x level which GCAP offers on Bitcoin products. As a result, this will have no impact on GCAPs Bticoin offering. Instead, it hinders competitors who would otherwise try to offer much higher leverage to win away customers. Likewise, the ESMA is also discussing an outright prohibition on instruments like binary options. GCAP does not offer any form of binary options, so it would not be affected. But various competitors do offer binary options in an attempt to win customers. As a result, it is those competitors who would be forced out of the market.

*** SECTION VIII: CONCLUSION

There are several near term catalysts which I expect to push GCAP to $18-23 in very short order. However, given the tremendous hype that elevated the other crypto names above, I would not be surprised if the stock spiked substantially higher once a series of announcements starts hitting markets in coming weeks.

GCAP has already begun rolling out a Bitcoin trading platform to its customers which provides tremendous advantages vs. wallets/exchanges or futures. Based on the most recent press release, additional announcements should be coming within days or weeks.

The timing for this roll out is perfect. With South Korea now moving to put restrictions on crypto trading, many traders from this huge market will be actively looking for a new trading platform.

GCAP has already rolled out its Bitcoin platform to customers of its UK entity. But most of these customers are actually offshore (non UK/Europe). In other words, GCAP is already in a position to offer its services to Korean, Chinese and Japanese traders.

South Korea alone often amounts to 20% of daily Bitcoin volume, amounting to over $1 billion per day.

At present, GCAP is established and profitable with just 130,000 customers in total.

During 2017, we saw individual days on which CoinBase added over 100,00 customers in just 24 hours despite its very painful and expensive limitations.

Article: Coinbase adds 100,000 users in 24 hrs, Shows Surging Interest in Crypto

Likewise, despite its blatant inefficiencies and problems, CoinBase now has more users than Charles Schwab. For reference, Charles Schwab is valued at over $60 billion in market cap.

Even the most modest levels of customer uptake for GCAP should quickly deliver very outsized financial results.