Disclosure: I am short OPK. (More…)

When I first raised the alarm about Ziopharm Oncology (ZIOP), I received death threats and threats of lawsuits from many retail investors. Some of these can still be found posted online. Many retail investors were so enthralled with this “guaranteed winner” that any suggestion to sell by anyone at any price was shouted down as being illegal manipulation.

I continue to believe that Ziopharm was a tragedy in waiting, and that retail investors never even stood a chance. Yet the stock quickly rose by as much as 25% even after I made my findings public. Following its collapse from near $6.00 to well under $2.00, I wrote an article entitled “Ziopharm: Why retail got slaughtered.” As has been the case in the past, I received a small number of “thank you” notes and an even smaller number of apologies. These are always meaningful to me.

Opko is a different company, with a different management team, a different billionaire investor and a different portfolio of products. But several readers of my most recent Ziopharm article quickly pointed out that the retail situation is entirely identical to what is now happening at Opko Health (OPK).

Like Ziopharm, Opko has an intensely loyal following of retail cheerleaders who constantly state that the right time to sell Opko is “never.” A small number of very vocal readers will no doubt reject all of the findings that I put forth in this article. Yet the parallels are quite clear.

Even Opko bulls admit that the stock is tremendously overvalued. Institutions refuse to own the stock, holding just 14.9%. Meanwhile, retail investors continue to chase the stock upward under the belief that continued purchases by billionaire Dr. Phil Frost mean that further upside is nearly guaranteed.

The problem is that (just like with Ziopharm), the recent purchases by the billionaire are so small that they do nothing to change his overall in price of just $2.99. If Opko falls to $4.00, Frost will make over $150 million, while retail will lose 45% of their money. Retail had also pushed Ziopharm to its limits following small purchases by billionaire investor Randal Kirk at over $5.00. But with his much lower basis at just $1.91, Kirk lost almost nothing when the heavily-shorted stock ultimately collapsed to $1.84.

Institutions are no doubt aware of these small and steady purchases by Dr. Frost, yet they continue to prefer to be short the stock rather than go long. Short interest current stands at $200 million.

The problem here is not Opko itself and the problem is certainly not Dr. Phillip Frost. Most would agree that Opko has now assembled a very interesting portfolio of healthcare products including medical diagnostics and Phase III drug candidates. The real problem is that, like Ziopharm, the price is now about 50-60% above where it should be, given the company’s current business prospects.

From a practical standpoint, the bigger problem for investors is that Opko’s string of acquisitions has created a group of entrepreneurs in multiple foreign countries who now own over $300 million of the stock. These entrepreneurs are now “insiders” but are not part of Opko core management and they are now sitting on tremendous paper gains right as their shares are becoming sellable.

For example, with Prost-Data, Opko delivered over 7 million shares of stock when the price was sitting at $4.33. The seller realized plenty of profit at $4.33, but is now sitting on additional paper gains of nearly 70% in just 6 months, totaling roughly $20 million. That transaction was completed in October, such that under rule 144, the shares will become sellable on or around April 18th, which is now quickly approaching.

As we know, there have been numerous other transactions completed in recent months, just prior to the tremendous surge the stock had. As these transactions start resulting in sellable stock, retail will face up against an “insider cliff.” Opko has issued over 37 million shares to non-management entrepreneurs who sold their businesses to Opko.

Recent developments probably make Opko a decent buy at around $5.00 or even perhaps slightly above. But with the stock hovering at levels 40% higher than that in just a few months, it is highly likely that we will soon start seeing the first sell prints from non-management insiders.

The last sale by an insider of just 50,000 shares took the stock quickly back down to $6.10. As a result, there may well be very good opportunities in the near term to buy on a pullback at prices in the $5.00-$6.00 range. Even Cramer, who loves the company, continues to describe the stock itself as “very speculative” and suggests that buying should come on a pullback in the stock.

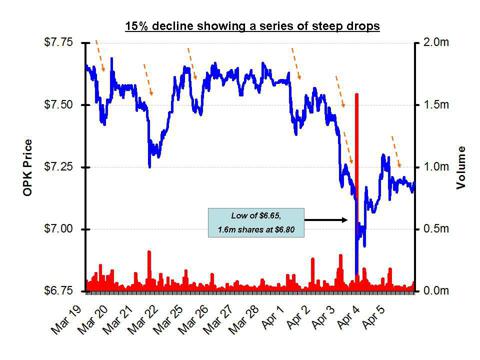

It is likely the case that the upcoming release of 7 million shares has been the cause for the recent volatility and several steep drops in Opko’s share price. On April 3rd, 1.6 million shares were quickly sold at a price of $6.80, and we have now seen 7 steep drops (highlighted below) for no apparent reason.

Institutions will be well aware of the upcoming insider cliff, even as retail investors are not. And selling ahead of any upcoming sale of shares is sensible, just as it is when selling ahead of IPO lockup expirations.

What do we mean by “huge”?

Dr. Frost has an enviable track record in making healthcare investments. He has demonstrated the straightforward wisdom of buy low, sell high.

Many retail investors view the weekly buying by Dr. Frost as being “huge,” “tremendous” or “enormous,” Relative to the purchases of retail, the buying does appear to be sizable. Some of his larger recent purchases have even exceeded $500,000 in a single day. $500,000 certainly appears to be a large sum to retail. Yet relative to his historical purchases (now worth over $1 billion) at far lower prices, these new buys are so small that they have virtually no impact on his in-price or his position size. This is nearly identical to what we saw with billionaire Randal Kirk’s buying in Ziopharm.

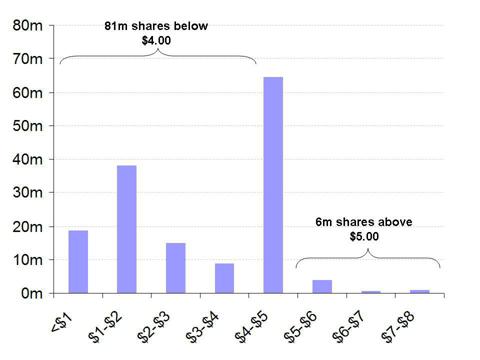

As we can see in the chart below, Dr. Frost has conducted the largest portion of his buying in the $4.00-$5.00 range. All combined, purchases above $6.00 are so small that they almost do not even show up on the graph. Purchases above $5.00 are also negligible.

Dr. Frost began buying into Opko when it was known as eXegenics. The initial transaction was for $8.6 million to buy roughly one half of the company, translating to 44 cents per share. Dr. Frost has purchased 80 million shares at below $2.00 (much of it below $1.00). All transactions, including the recent ones, at above $5.00 total only 6 million shares.

The result of this is that his overall in-price is just $2.99 – more than 60% below the current prices where he continues to nibble.

This means that Dr. Frost’s return profile vs. retail (purchasing now) is as follows:

| Stock price | Dr. Frost Profit | Retail’s Loss |

| $3.00 | Breakeven | -58.9% |

| $4.00 | $151 million | -45.2% |

| $5.00 | $301 million | -31.5% |

Dr. Frost will still be able to make hundreds of millions of dollars on this position even in the case where the current purchasers suffer very steep losses. As with Randal Kirk in Ziopharm, this is why Frost is a billionaire. And as with Randal Kirk, the continued buying in small size serves his own interests very well.

The insider cliff

When I last wrote about Opko, I noted that insider selling had begun. As did Ziopharm, Opko responded forcefully to my article. And as with Ziopharm, the share price rose dramatically on their press release.

The biggest problem with the press release was that Opko stated that:

No other sales by Company officers or insiders are currently contemplated.

The problem is that the term “insiders” now comprises a far larger group of individuals than Opko’s core management. Opko has now completed numerous acquisitions in countries such as Chile, Mexico, Brazil, Israel, Spain, Canada and the US. In most cases, these acquisitions were completed by issuing Opko shares to the founders of the targets.

In “contemplating” further insider sales, it seems unlikely that Opko could have received much clarification from these numerous other insiders in various foreign countries during the 2 hours prior to putting out a press release.

We can see that the term “insiders” now comprises a far larger group than Opko management. The table below shows recent Opko acquisitions along with the number of shares issued.

| Name | Country | Shares issued | |

| Cytochroma | Canada | 20,517,030 | |

| Prost-Data | USA | 7,072,748 | |

| Farmadiet | Spain | 125,000 | |

| Finetech | Israel | 3,615,702 | |

| Claros | USA | 4,494,382 | |

| Pharmacos Exakta | Mexico | 1,372,428 | |

| TOTAL | 37,197,290 |

We can see that the total is 37,197,290 shares valued at nearly $300 million. This is not Opko’s money, this is money that is now waiting to end up in the pockets of the entrepreneurs in various countries who sold their companies to Opko. We can see that many of these holders are now sitting on tremendous paper gains – even after the gains they made from the initial sale at then-prevailing prices for the Opko stock they received.

Under Rule 144, we will see that the first chunk of stock will become freely sellable in less than 2 weeks, and comes from Prost-Data whichreceived stock at $4.33.

With CytoChroma, we have a bit longer to wait, but the number of shares which can hit the market exceeds 20 million shares and the gain for the seller is now nearly $50 million – even after the gain on the initial sale. This could be part of the reason why we are now seeing increased volatility and sharp drops in the share price of Opko lately.

Why won’t institutions buy Opko?

Even more so than Ziopharm, we can see that the shareholder base in Opko consists almost entirely of retail investors. Institutional investors are neither blind nor dumb. They are just as capable of reading the “Latest Insider Buys” headlines. Yet we can see that institutions only hold tiny 14.9% of Opko stock.

There are several reasons why institutions are refusing to buy into Opko. First, the company has swelled to a $2.5 billion market cap, precluding making any reasonable profit on the stock vs. its near-term prospects.

Opko currently trades at over 60x Sales. This makes Opko one of the most expensive stocks to own among all healthcare stocks. Even if Opko starts to generate material revenues sometime later in 2013, the company is several years away from generating the type of profit that could justify this valuation. Even once Opko generates a profit of $100 million (vs. the current loss of $10 million) the company would still be trading on a healthy 25 P/E. This is likely to be years away.

Second, institutions have come to learn that Opko is looking to be a perpetual “deal and dilution machine.” Every time Dr. Frost issues another 10-20 million shares in an acquisition, it only further raises the bar for profitability because the market cap becomes that much larger. Most investors expect a continued string of deals, particularly given the sky high share price. Third, Opko has become a collection of disparate and distinct healthcare business ventures which makes it nearly impossible to value the company. It more closely resembles a VC company, which should be valued at a much lower multiple.

The only thing that institutions can currently be certain of is that Opko is tremendously overvalued. But they can’t even determine by how much due to the wide variety of unrelated businesses which Opko has now purchased.

No one knows how to properly value Opko, but they do know that the past acquisitions strung out over 3 years have still not produced meaningful revenues or any profit whatsoever – even though past expectations by retail were also very high at the time the deals were announced.

Lastly, institutions may likely have much larger reservations that retail investors regarding the longer-term risk of investing in a very richly valued “one man show.”

Right now the sky-high value of Opko stock is attributed solely to the current level of involvement by Dr. Frost. At age 77, Dr. Frost has had a much longer career than most and if there is any sign that his involvement in Opko looks to decline even modestly, then the share price could potentially trade at a significant discount to the value of Opko’s underlying business portfolio. Relative to the current “Dr. Frost premium” this could create tremendous downside. The eventual non-involvement by Dr. Frost is clearly inevitable, but the timing of it remains entirely unpredictable which keeps institutions out.

Retail investors need to ask themselves the downside question of what Opko is worth as a freestanding company, assuming little to no involvement from Dr. Frost. That is the downside scenario that institutions are unwilling to bear.

In any event, we can see clearly that for a wide variety of reasons, investors simply refuse to own Opko even despite its investment-worthy size of $2.5 billion.

Instead, institutions are SHORTING Opko

We can see that Opko is now a very sizable company and the institutions which choose to be involved express their interest preferably on the short side. Currently, there are nearly 28 million shares of Opko sold short amounting to nearly $200 million.

Again, short selling institutional funds are also neither dumb nor blind. They are well aware of the steady trickle of headline-grabbing purchases by Dr. Frost.

As with Ziopharm, short selling institutions love Opko as a short and they have committed to their short position in a very large size. When institutions refuse to go LONG but are extremely enthusiastic about going short, retail investors need to ask themselves if they really feel that they have an informational advantage which justifies chasing the stock to ever higher levels.

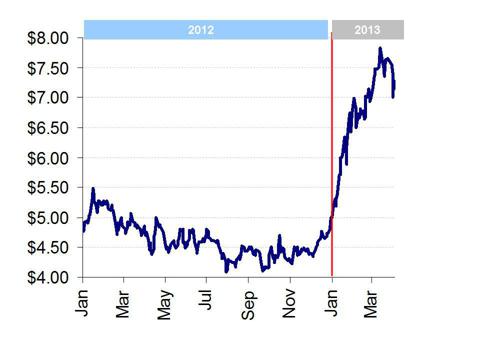

It should also not be lost on retail investors that the huge short interest in the stock has been present ever since the stock was at $4.00-$5.00, roughly 40% below current levels. It was also the same level where short reports began in earnest regarding Opko’s prospects and valuations.

It also happens to be where I suggested the stock could now be considered a “buy” in my last article. The $4.00-$5.00 level remains the right price to be buying Opko shares, but doing so means waiting for some period of time until the stock corrects – i.e., as Cramer said on Friday, “buy on a pullback.” Investors can also stay short the stock through a correction, effectively playing both sides of the trade.

Since the $4.00-$5.00 range, Opko has had several new developments, including the CytoChroma acquisition and the RXi (RXII.OB) pooling of assets. Yet the value of Opko as a company has exploded upwards by an additional $1 billion since December. Regardless of whether one is long or short, it is clear that these developments do not in any way justify an extra $1 billion. As a result, the conclusion by institutions is that despite the recent developments, the rise in the share price simply makes Opko now more overvalued than ever. At any prices above $6.00, Opko is still a compelling short and the institutions know it. At prices of $4.00-$5.00, the stock becomes a buy. While in the $5.00-$6.00 range, it is just a “wait and see” for next results.

Evaluating current business prospects

4KScore

When I last wrote about Opko, I tried to inject a dose of reality regarding the prospects for Opko’s 4KScore test for prostate cancer. In Opko’sresponse, which drove the stock higher, they notably did not challenge any of my concerns.

As I previously stated, investors need to realize that 4KScore cannot generate even a fraction of the many billions projected by a small number of authors. We know that 4KScore could begin to produce respectable near-term revenues, but we also know that virtually all investors and analysts attribute the vast majority of Opko’s $2.5 billion valuation to the prospects of only 4KScore. It is the only near-term material revenue candidate.

In many cases, we can see that these projections have been issued after the rise in the stock, in an attempt to justify the valuation rather than predict what it should be. In forecasting many billions in 4KScore revenues, these projections were based on securing a tremendous market share (as high as 50%) even while incorporating a price which is nearly triple what other tests go for.

Since the time of my last article, The New York Times has begged to differ with the bullish forecasts for 4KScore dominance. The Times noted that:

More than a dozen companies have introduced tests recently or are planning to do so in the near future. Rather than looking at a single protein like P.S.A., which stands for prostate-specific antigen, many of these tests use advanced techniques to measure multiple genes or other so-called molecular markers.

The Times also noted that total spending related to prostate screening was around $12 billion. We still need to wait for the first sales of 4KScore to begin in the US. If it turns out that 4KScore is in fact more successful than any of the many alternatives, even then the revenue projections provided by many Opko uber-bulls, will come in at billions less than forecast. It has the potential to be a very successful product, but investors need to recognize the reality of this market.

RXi Pharmaceuticals

In March, Opko completed the pooling of assets with RXi in which it contributed all of its own RNAi assets in exchange for shares of the Pink Sheets listed company. The RXi trade could provide longer-term benefits to Opko, but investors need to be aware that any benefits in the near term (3-5 years) are basically out of the question.

While RNAi is an exciting area of biotech, it continues to be the case that the FDA has never approved a single RNAi therapeutic. RXi is a tiny Pink Sheets listed company which was spun out of Galena Biopharma (GALE).

RXi’s CEO recently described its first year in business as “nearly flawless.” Yet he mostly described the fact that the stock has gone up along with the deal with Opko. It had initially traded at 15 cents and subsequently doubled to over 30 cents. But aside from the stock price, it remains to be the case that RXi has only a single Phase I product and pulled in just $100,000 in revenues solely from government grants. The net loss for the year was $26 million.

In short, there is a very clear reason why this company is still on the Pink Sheets. If Opko eventually receives any benefit from RXi, it will be quite a few years away. In other words, the recent run-up in the stock cannot be attributed to RXi.

There are many other challenging details surrounding RXi and Galena, but given that the impact on the valuation on Opko is so small, I will save those for another article.

CytoChroma

The CytoChroma acquisition was completed in February in exchange for 20 million shares of Opko plus up to $190 million of additional milestone payments to be made by Opko. The 20 million shares were initially valued at $100 million, but that value has now jumped to $140 million given the recent rise in Opko’s share price. This has provided a quick gain of $40 million in just 3 months to the selling founder.

With two products in Phase III trials, CytoChroma clearly has greater near-term potential than RXi, but it also remains the case that these are not revolutionary products like those being investigated by RXi. Instead they are simply Vitamin D derivatives which are hoped to be able to treat Chronic Kidney Disease in Stage 3 and Stage 4 status. The total market size for this application is just 8 million patients such that even if one or both drugs passes Phase III, and even if Opko ultimately captures a significant market share, the overall revenue potential over the next three years certainly cannot justify the extra $1 billion in market cap for Opko. Yet some Opko bulls have suggested that these products will generate a staggering $6.5 billion per year in revenues, making it one of the best selling drugs of all time. Again, reality needs to be factored in against the current unlimited optimism.

The point from each of these examples is that the new developments, even though positive, do not come anywhere close to justifying the extra $1 billion in market cap that Opko has added in just a few months. Even Opko bulls agree with this sentiment.

Now that non-management insiders are sitting on over $300 million in Opko stock, the near-term risk is that they will sell the bounce. The sharp selloff after a small sale by Opko’s Chief Accounting Officer suggests that a much larger and faster drop will accompany the first sale by these very large insiders.

So why does Dr. Frost keep buying?

Even since my last article, Dr. Frost has continued buying small amounts of stock, typically in blocks of less than 50,000 shares at a time relative to his position of over 150 million.

If the stock were to go to $14.00, Frost would continue to buy in a steady trickle. If the stock were to drop to $4.00, he would also do the same. Part of the reason for this is that Opko continues to issue an enormous amount of stock for much needed cash and for acquisitions.

Some have likened Frost’s purchases to an “ongoing share buyback,” yet we can see that in 2013, Frost has purchased just 14 million shares even as Opko has issued 45 million shares in the past 3 months via the convertible and the CytoChroma acquisition. Dr. Frost also purchased some of the convertible bond issues for the same reason.

The net result of these transactions is that despite his steady trickle, Frost’s percentage ownership of Opko has actually decreased during 2013. But his purchases have helped to offset his decrease in ownership which has resulted from ongoing dilution to all shareholders.

Anyone who follows Opko knows by now to expect numerous additional acquisitions, and they should also expect these acquisitions for stock. As a result, it is expected that Dr. Frost will continue to buy small amounts Opko stock regardless of the price. But the continued trickle of buys by Frost helps him to simply maintain some of his ownership, not increase it.

But a much more important reason for Frost to continue to buy is the signaling value, which keeps the share price high. This simply provides Frost with a much more valuable acquisition currency for continuing his purchases of other small companies.

A recent Bloomberg article described Frost’s incessant penchant for doing small healthcare stock deals and quoted him as follows:

The almost-octogenarian billionaire isn’t winding down just yet.

There are investors to placate, Teva to mend, Opko — and perhaps new companies — to build. Asked why he hasn’t adopted golfing or other hobbies of the superwealthy full time, his face gives way to a faint smile.

“This is what keeps me going,” he says.

Conclusion

Dr. Frost is in this business because doing healthcare deals is what “keeps him going” as he approaches his 80th birthday. With a cost basis of just $2.99, he still stands to make hundreds of millions of dollars even at stock prices below $5.00. Dr. Frost is nearly guaranteed to see a successful return from Opko at any foreseeable price.

Yet for the non-management insiders who have been issued over 37 million shares worth over $300 million, making themselves wealthy at a much younger age will likely prove to be more important than completing strings of deals with small healthcare companies.

And for retail investors who are now buying the stock at over $7.00, profit is likely the only objective. These are the investors who stand to lose up to 45% once the insiders start selling.

With a valuation of $2.5 billion, Opko shares are tremendously overvalued. At over 60x Sales, the stock is quite obviously overvalued relative to the current fundamentals. But more importantly, the stock is still tremendously overvalued even relative to the stock’s near-term prospects for 4KScore and its new Vitamin D products which are still in clinical trials. This is the reason why non-management insiders have a major incentive to sell.

Even those who are bullish longs on the stock now quickly admit that the only reason to continue buying Opko is that the continued buying by Dr. Frost makes this “safe.” The huge short interest from institutions continues to contradict this hope by retail investors. Meanwhile, institutions continue to refuse to own Opko on the long side.

As we saw in February, the sale of just 50,000 shares by an insider quickly took the stock back down to $6.00. In advance of the April expiration of the 144 restrictions on Prost-Data, the stock is again showing significant volatility to the downside, and retail is the only one wondering why.

In the near term, there are likely to be opportunities to get back into the Opko story, perhaps at prices in the $5.00-$6.00 range. In the meantime, staying on the sidelines or getting moderately short the stock are the best way to play Opko.