Summary

- Bone Growth Stimulators (“BGS”) comprise the largest segment of revenue and more than half of profits, while also driving growth at Orthofix.

- Other segments are lower margin, commodity businesses and/or showing declines and pricing pressure. BGS is absolutely the only reason to own Orthofix.

- October 2016: FDA is actively moving to “down classify” BGS from Class III to Class II, allowing cheap competition to flood in, stealing revenues and crushing margins.

- Clear accounting manipulation by 26% demonstrated in recent quarters, Orthofix is currently grossly overvalued as a high growth player with a strong “moat”. (WRONG !).

- Following the FDA move, expect Orthofix quickly to fall by at least 50% (share price of around $15-17).

Note: This article represents the opinion of the author. Nothing herein comprises a recommendation to buy or sell any security. Information in this post has been sourced from a variety of online sources, including current and historical documents from the FDA, the Federal Register, and the SEC, among others. Various links to relevant data and information have been included. Additional information has been provided directly via phone calls to the FDA’s Department of Orthopedics. Additional information may be available from these and other sources. As always, readers should conduct their own research and form their own opinions and conclusions. The author is short OFIX. The author may trade in various securities mentioned within this report, including those of related companies and competitors among others, and including non equity securities including debt securities, options etc, including within or after 72 hours of publication.

Overview

I have been heavily focused on FDA issues with healthcare stocks for almost 20 years. My past articles highlighting problems with numerous healthcare stocks have quickly presaged share price declines well in excess of 50%, sometimes within just days. A few of these articles are shown below. The key theme in all of them is that most investors simply don’t do their research. (This includes institutions as well as individuals.)

Every once in a blue moon, I come across what I describe as a “unicorn short”. This is a short trade where there is massive near term potential downside, but with very little upside potential. It is a truly “asymmetric trade”. That is what we see with Orthofix (NASDAQ:OFIX).

As I will categorically demonstrate, an impending FDA action will send Orthofix stock at least 50% lower in the near future. The documentation below, along with new developments just in recent weeks, shows why I am 100% confident that this is going to happen. Just watch.

Orthofix knows that this is coming and Orthofix is scared. The company engaged a well known lobbying firm, and total payments for this effort now exceed $1 million. The recent lobbying effort appears to have failed. The process is now getting to the late stages and has continued through several important milestones, even in recent weeks. Yet Orthofix has made no adequate disclosure to investors.

Against this downside, Orthofix has virtually no visible upside potential from current levels. According to management, Orthofix already has a #1 market share in BGS (its main product) and the entire size of that market is only $500 million. The market for BGS is rock stable and is only growing by 1-3% per year. For each of these reasons, there is simply no chance of Orthofix pulling in unexpected windfall gains in BGS. Orthofix’s other businesses are either low margin and / or are facing accelerating declines amid soaring competition. As a result, I see no visible chance of an upside stock price surprise in being short Orthofix. Likewise, for longs, once the FDA thesis is understood, there is absolutely zero reason to continue owning the stock (not even in the $20s).

For shorts, clear evidence of significant and recent accounting manipulation, artificially boosting reported numbers, is just icing on the cake. This means that the downside in the share price will come sooner rather than later. Without that manipulation in Q3, Orthofix would already be trading at well below $30 (even prior to the FDA action).

What really makes this trade a “unicorn short” is that it has been totally undiscovered (until now). Neither longs nor shorts appear to have caught on to just how soon or how far this stock is going to fall.

There are very few institutions with a meaningful presence in Orthofix. The ones that were there in early 2016 have already been slowing liquidating during the year due to steadily worsening financial results across Orthofix’s other businesses.

At the beginning of 2016, Consonance Capital and North Tide Capitalwere both 10% and 5% holders respectively. As of September, Consonance had already cut its position size by 60% while North Tide had exited completely. Blackrock and Vanguard (i.e. the “dumb money”) each own 7%.

(Incidentally, last year Consonance was also one of the largest shareholders of Osiris Therapeutics (NASDAQ:OSIR). Shortly after I publicly exposed my fraud concerns at Osiris, the company was forced to restate its financials, the CEO was forced to resign and an SEC investigation ensued. Osiris subsequently fell by as much as 70%.)

In any event, despite the slow and steady liquidation, no one has yet run for the exits at Orthofix. As a result, the stock remains grossly overvalued. There is also virtually no short interest in the stock whatsoever. There are millions of borrowable shares for shorting and the negative rebate on those shares is only 40 bps (almost free). I expect at least 50% downside in the near term. Perhaps more over the longer term.

On the research side, the only real coverage comes from JMP Securities and Jefferies. But JMP rates Orthofix a “HOLD” and does not even include a price target. Jefferies rates Orthofix a “BUY” but has not even updated its coverage in almost 5 months, not even after the most recent earnings declines and visible declines in the other business lines.

The point is that neither JMP nor Jefferies are really doing much work on Orthofix or even really paying attention. Given this, no one should be surprised that they have totally missed this upcoming FDA issue or the accounting manipulation. When the stock price collapses to $15-17, they will simply pull their coverage.

Company Overview

Company: Orthofix

Business: Orthopedic Medical Devices

MarketCap: $700 million

SharePrice: $37.00

LTMRevenue: $406 million

LTMProfit: $14 million

Cash balance: $46 million

PERatio: 50x

NetSales: Stagnant / declining

Stockborrow: Over 1 million shares at Interactive Brokers alone

ShortInterest: 444,000 shares (only 2.6% of shares outstanding)

Options: Liquid calls and puts

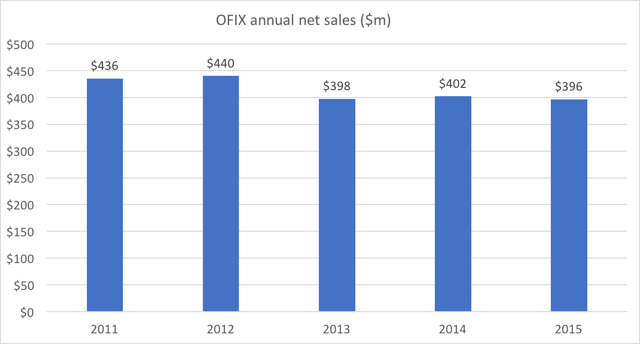

Sales over 5 years have been entirely stagnant.

Legal background – preview

Anyone who has followed Orthofix is well aware of the company’s troubled background with regulators and investors. Over the past few years, Orthofix has paid approaching $100 million to settle a wide variety of criminal violations and lawsuits for accounting misstatements and outright fraud.

Orthofix is fond of stating that “10 out of 11 of our management team are new to Orthofix”. So presumably the past problems are all behind them. But in Appendix I, I will show how there are actually numerous individuals from the bad old days who are still in the same senior roles at Orthofix.

Keep in mind that Orthofix’s past fraud and criminal behavior are NOT the crux of the current short thesis. These problems were bad. Really bad. But by now they are all well known and fully disclosed.

The crux of the short thesis is that the impending FDA ruling and the current accounting manipulation are far more relevant to the share price than the past fraudulent behavior.

The reason that I am highlighting this troubled past at all is that Orthofix continues to mislead investors in a very significant way, but now it is just about different issues. I am trying to highlight the pattern.

I will demonstrate below that Orthofix is 100% aware of the impending FDA down classification of its most important product. Orthofix even hired a lobbying firm (King & Spalding) to try to sway the FDA (I have included a copy of the letter from King & Spalding, along with links detailing over $1 million in payments). That lobbying effort appears to have failed badly and the down classification is still on track. There have even been new developments in the past few weeks. But despite its knowledge and the huge significance, Orthofix has failed to appropriately disclose any of this to investors.

In addition, I will show clearly below how Orthofix has been manipulating its financial results by pulling various accounting tricks. There is very limited sell side coverage on Orthofix and none of these analysts have adequately caught or highlighted the accounting manipulation. Had Orthofix not performed such manipulation in Q3, the stock would already be well below $30.

So again, just to be clear, Orthofix’s past history of Medicare and accounting fraud are not the dominant reason behind my short thesis. But for those who are new to the Orthofix story, you should at least be aware of the key highlights.

First, 4 years ago Orthofix was found guilty of massive Medicare fraud.

Following that discovery, Orthofix and various individuals pled guilty to obstructing a Federal audit which was investigating the fraud. More criminal charges followed from that.

Orthofix ended up settling with the DOJ and paying over $40 million in penalties. As part of the settlement, the company entered into a “corporate integrity agreement” (“CIA”) with the DOJ in which it vowed to refrain from further illegal activity for 5 years.

Yet within just 1 year, it was already uncovered that Orthofix was involved in a massive bribery scandal in Mexico, in violation of the Foreign Corrupt Practices ACT (“FCPA”). The DOJ extended the terms of the CIA (requiring additional years of probation) and Orthofix paid large fines, vowing to change its act. Yet within 1 more year, Orthofix was involved in another bribery scandal in Brazil.

And then finally, we hit the worst of the worst. Then, making matters even worse, as of 2015, Orthofix was required to restate inaccurate financials which had been released in some or all of 8 different years including 2007, 2008, 2009, 2010, 2011, 2012, 2013 and 2014. This then resulted in a separate SEC investigation. Not surprisingly, class action lawsuits then followed.

According to the lawsuits, the misstatements were not an accident or oversight. They were a deliberate set of misrepresentations designed to boost apparent financial performance and thus the share price. Orthofix settled but would not admit wrong doing.

The pain from past frauds is still ongoing today. Orthofix has already paid over $14 million in 2016 alone (including in Q3) as a result of these past settlements and investigations. The total financial consequence are now approaching in $100 million. For those who are interested, I have included full details of these past frauds, along with links to the criminal indictments and news articles as Appendix I.

If investors had been actually holding out any hope for Orthofix, it would be because they are hoping that CEO Brad Mason can keep the company out of further legal trouble. Mason has been with Orthofix in various roles since 2003. During the peak of the fraud problems, he was working for Orthofix as a consultant and advisor. He had also served as Group President, North America, but was not implicated in the fraud.

Again, as I will demonstrate clearly, Orthofix is well aware of the impending down classification but has withheld this critical information from investors. Orthofix is also clearly manipulating its accounting numbers. As a result, in my opinion, the “bad old days” of Orthofix are not just a thing of the past.

Investment summary

Orthofix is a medical device maker specializing in orthopedics. The largest source of revenue for Orthofix comes from its BioStim Bone Growth Stimulators (“BGS”). Bone Growth Stimulators are an external device that use a pulsed electromagnetic field (“PEMF”)to help increase bone fusion in bone fractures, including spinal treatment.

Orthofix already holds the leading market share for BGS of around 35%. The other primary competitors are Bioventus, Biomet, and DJO.

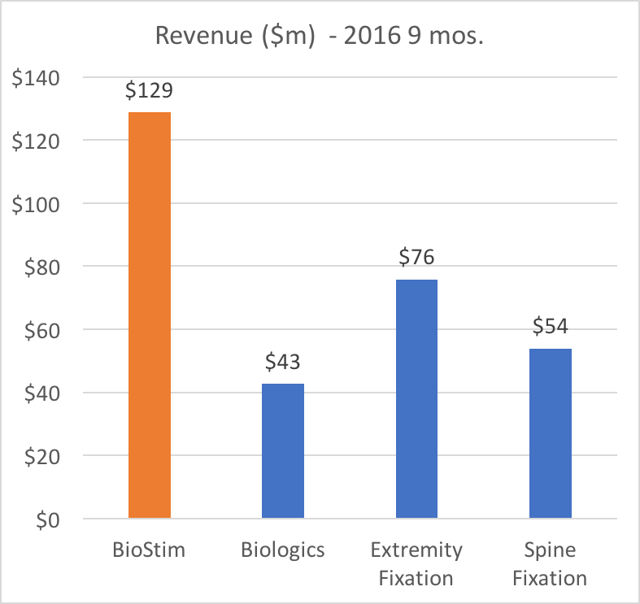

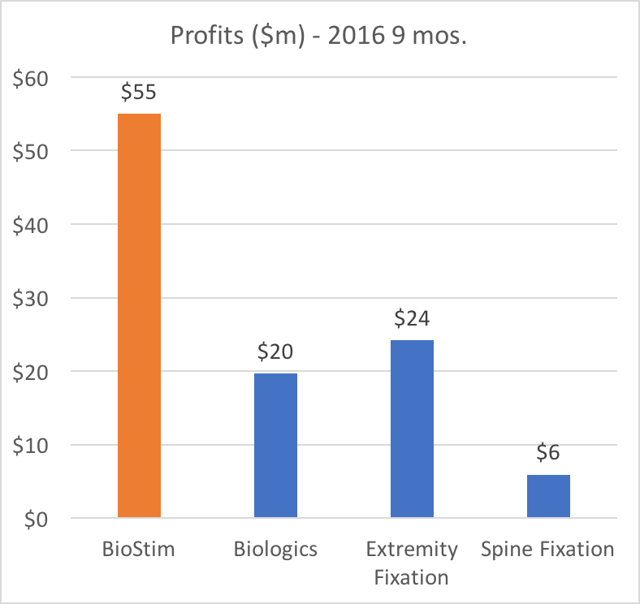

Beyond just revenue, BioStim is by far the most disproportionately profitable product for Orthofix. BioStim accounts for the majority of profits (more than 53% of net margin) at Orthofix. In addition, BGS is also the driving force behind any growth at Orthofix.

As I will explain below, the sole reason that Orthofix can command such high revenues and profits for BGS is the fact that it is classified by the FDA as a Class III device. This restriction severely limits competition. New entrants would be required to get Pre Market Approval (“PMA”) and/or run clinical trials. This takes years and costs many millions of dollars. This high barrier to entry is why Orthofix had previously been able to charge Medicare as much as $4,000 for a device that only costs $100 to manufacture. But that is about to change radically.

Orthofix has several other product lines. But it is clear that none of them create a real reason to own the stock. The impending down classification of BGS is really all that matters. But for those who wish to better understand the deepening declines in Orthofix’s secondary businesses, I have included relevant details at the bottom of this article.

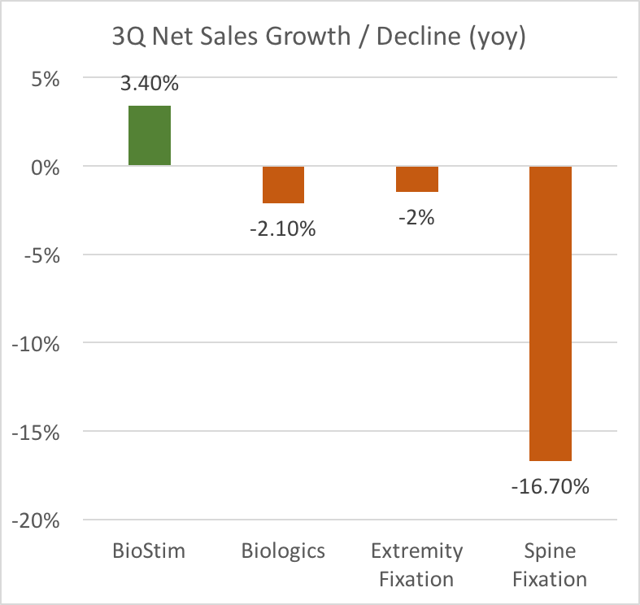

Orthofix’s distant second business had been Biologics (such as bone allografts) but this business is now being eaten away on two fronts as shown below. Margins remain semi-strong, but quarterly sales have now consistently shown declines rather than growth. And pricing has been under repeated pressure due to a sharply increasing impact from a newly introduced competing product from DePuy (a unit of med device giant J&J). Management has repeatedly stated that this segment is about to turn around and get better, and is then surprised each time it gets worse. In fact, further declines are about to accelerate.

Orthofix’s other business segments (Spine Fixation and Extremity Fixation) have shown much lower margins and / or size. There has also been substantial trending weakness. Compared to BioStim, these are largely undifferentiated and low margin commodity products such as spinal screws, plates, rods and bars. Their relative sales are shrinking rather than growing. In the most recent quarter, Spine Fixation revenues plunged by almost 17%. The Extremity Fixation business is not really run out of the US, it is run out of Italy and primarily sells outside the US. But the accounting systems is place are so bad that Orthofix has been forced to only recognize these sales on a “cash basis”. In other words, they only count the sales when the cash is actually received.

The only point is that there is no way that these much smaller and struggling businesses, which are now showing declines, are going to in any way offset the tremendous loss about to affect Orthofix’s main product, BioStim BGS.

IMPORTANT POINT:

The only real reason to own Orthofix stock is because of the high revenues, the high profits and the strong growth behind one single segment: BioStim BGS.

And now that is about to dramatically change.

So here is the kicker !

What no one seems to have figured out is that the FDA is about to “down classify” Bone Growth Stimulators (“BGS”) from Class III to Class II. This means that there is far less of a regulatory hurdle for new competitors to start marketing BGS. With a much lower regulatory hurdle, cheap competition will be able to flood the market driving down prices and stealing most of the revenues outright. What revenues remain will end up on razor thin margins.

The impact of unfettered cheap competition can be seen to be massive. Competitors will soon be able to manufacture competing devices at prices which are as much as 80% below Orthofix’s historical sales price.

Certainly no one on the sell side has properly highlighted this problem to investors. But this is because they simply haven’t done the work.

The prospect of down classification should become obvious to anyone who performs thorough research on Orthofix. Just read the documents and call the FDA and you will know right away.

In 2006, an FDA panel did actually formally vote to down classify BGS. That initial evaluation by the FDA was in response to a petition from a low-priced competitor (RS Medical) who wanted to enter the BGS market.

According to the FDA panel, BGS clearly met the criteria for down classification. As a result, the FDA panel voted to down classify. But then that vote was reversed following an aggressive lobbying effort by Orthofix and the other BGS manufacturers, using DC lobbying firm King & Spalding. For obvious reasons, they wanted to keep out the prospect of cheap competition.

But that was then. This is now. Literally everything has changed!

The process was gradual at first, but there have been significant recent developments over the past few weeks.

In 2012, there was a big change. Congress passed the Food and Drug Administration Safety and Innovation Act (“FDASIA”). The purpose of this act was to speed up and streamline the approval process while reducing regulatory burden to enhance competition and product availability. As a result of this Act, the FDA began “re-reviewing’ hundreds of medical devices for potential down classification.

In 2014, the FDA decided to revisit the down classification of BGS specifically. That is where the new process began.

As part of its 2014-2015 Strategic Priorities, the FDA specifically proposed that BGS be down classified. More recent developments over the past few weeks show that the date of reckoning is now getting much closer.

Keep in mind that by the time of the FDA’s Strategic Review, the FDA already had in its possession all of that lobbying information from Orthofix. Yes, they already knew all of the arguments raised by Orthofix’s lobbying firm. And yes, they still proposed to down classify BGS.

In 2015, the lobbyists once again responded for Orthofix. (Here is a copy of the letter that King & Spalding submitted to the FDA). Their arguments were largely similar to the past arguments raised. Effectively they are simply trying to raise technicalities and trying to create beneficial interpretations of language in the law. But as we will see below, the Class III classification for BGS just doesn’t make common sense. Following passage of the FDASIA Act above, it is clear that these technical objections are not gaining much traction.

And now just a few weeks ago, even after the newest lobbying submission and the inclusion of the historical submission, the FDA has chosen to proceed further with the process anyway.

And keep in mind that this time, it was the FDA that initiated the down classification. This was NOT in response to an outside petition. In other words, this is something that the FDA itself wants to happen.

IMPORTANT DEVELOPMENT:

Just as of October 1st , 2016 (about 10 weeks ago) the FDA just transferred the BGS down classification process to the specific department responsible for handling the down classification (the department of Orthopedics). I have spoken to this department at the FDA. The point is that the process is now “active”. The most important point is that the individuals within the FDA responsible for this evaluation are the same people who previously voted to down classify BGS in the first place.

These developments are all very recent and have NOT been disclosed by Orthofix, even though Orthofix clearly saw fit to hire and dispatch a lobbyist to attempt to fight the threat.

As soon as Orthofix loses its competitive “moat”, we will see revenue immediately fall by around 30% or more. But the much bigger problem is that these revenues are actually responsible for a far greater share of profits at Orthofix. So of much greater importance is the fact that profits (net margin) will fall by nearly half. Any prospects for growth at Orthofix will evaporate immediately.

Again, this lack of disclosure to investors should be viewed in the context of a company which has been busted for issuing false financials, defrauding Medicare, obstructing a federal audit and paying bribes in foreign countries.

By looking to the site OpenSecrets.Org we can actually find out that total payments to King & Spalding just for attempting to defend BGS. These payments now total over $1 million. So this is not a minor effort. This tells me that the perceived “risk” is very real and the consequences are very substantial. It also tells me that this event is important enough that it should be adequately disclosed to investors.

Perspective on conducting healthcare research

Above I mentioned Osiris Therapeutics. After I exposed Osiris, the CEO was forced to resign, the company had to restate its financials and an SEC investigation ensued. The stock cratered by as much as 70%. All of the information in my article was obtained from publicly available sources that should have been available to anyone.

Earlier in 2016, I wrote an article where I stated that I was highly certain that medical device maker OraSure was going to lose a major, multi-year contract with AbbVie (NYSE:ABBV) within just the next few days. This contract was very important, because it accounted for over $40 million and more than 100% of Orasure’s net income.

It was well known that the contract was up for review, with a notification date of July 1st, but sell side analysts kept assuring investors that the contract was safe. Recent support from the sell side had pushed the stock up by 10-15%.

A number of skeptical readers stated that there was simply no way I could know for sure that OraSure was losing this contract in advance, and that I was simply “talking my book” to benefit my short position.

Instead, within just 24 hours (July 1) management arranged a hasty pre-open conference call to announce the fact that they had indeed just lost that Abbvie contract. Their announcement was clearly made as a direct response to what I had exposed in my article.

Here is the headline from July 1 (just 24 hours after my article):

July 1: AbbVie backs out of OraQuick HCV test co-promotion deal, OraSure down 16%

Once again, my skeptics were equally unhappy. Now they were insisting that they only way I could know this was though some sort of inside information. Obviously that is not the case. The research underlying my article should have been self evident.

I have undergone a similar process with Orthofix and I am now 100% confident that we will see an FDA down classification in the near future.

Similar research was beneath my short-pick articles on the following healthcare stocks which went on to decline as follows: (my point is that actually doing research really works).

| Name | Ticker | Decline |

| Revance Therap. | (NASDAQ:RVNC) | Down 55% |

| Tokai Pharma. | (NASDAQ:TKAI) | Down 90% |

| Osiris Therap. | Down 50% | |

| CytRx | (NASDAQ:CYTR) | Down 95% |

| Galena Biopharm | (NASDAQ:GALE) | Down 95% |

| Northwest Bio | (NASDAQ:NWBO) | Down 95% |

| Regulus Therap. | (NASDAQ:RGLS) | Down 80% |

| Omeros | (NASDAQ:OMER) | Down 40% |

| Ohr Pharma | (NASDAQ:OHRP) | Down 80% |

| Keryx | (NASDAQ:KERX) | Down 50% |

| Unilife | (NASDAQ:UNIS) | Down 95% |

Note: There is a 6 month “tail” on the revenues at OraSure, such that the company has not yet hit the revenue cliff. Some investors still haven’t figured this out. That, combined with some misplaced Zikka hype, have continued to support the share price. But I expect at least 40-50% downside from current levels.

No one should have been blindsided by any of these stocks. Links to my articles are included in the table above for those who wish to revisit the thesis prior to the sharp declines.

How important is BioStim BGS to Orthofix ?

(Overwhelmingly, extremely important !)

Orthofix’s business is divided into 4 segments (“SBUs”).

- BioStim

- Biologics

- Extremity Fixation

- Spine Fixation

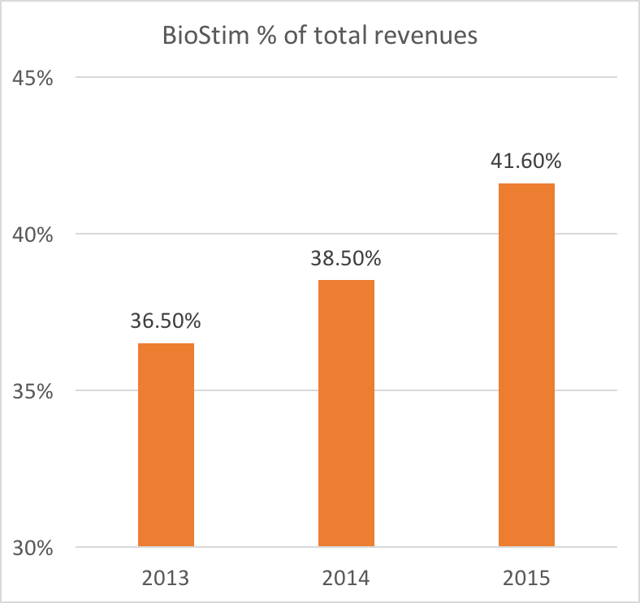

The charts below show how Orthofix is overwhelmingly dependentupon BioStim.

The points to be made are as follows:

- BioStim is the largest revenue generator

- BioStim is also (by far) the largest profit generator in terms of net margin. This is due to its disproportionately high gross margin.

- BioStim is the only unit showing any growth

- BioStim has been increasing as a percentage of revenue

Again, it is worth repeating: BioStim BGS is the largest revenue segment, it is responsible for more than 50% of profits, it represents the ONLY growing business segment, and it has been increasing as a percentage of revenue.

BioStim BGS is absolutely, positively the ONLY reason that anyone owns Orthofix.

Looking at Class III vs. Class II – recent developments

Documentation included below clearly indicates that BGS will be down classified. But before we get into that, it is worth understanding the logic here. It should quickly become clear that BGS should simply not be a Class III device. Common sense (and the FDA) will make this clear.

Bone Growth Stimulators are an externally worn device which emits an electronic pulse which enhances bone fusion. The devices are currentlyclassified by the FDA as Class III devices.

Class III is the highest classification for medical devices and is reserved for the most risky devices. Such devices must typically be approved by FDA before they are marketed. For example, when explaining its classifications, the FDA cites replacement heart valvesas a typical Class III device.

Getting approval for a Class III device is very time consuming as well as very expensive. As such, this has kept lower priced competition from entering the market. This lack of competition has allowed Orthofix to charge premium prices and capture the largest market share among a very small number of competitors. In the past, we have seen Orthofix charge as much as $4,000 for a device which only costs $100 to make.

So what does a real Class III device look like ?

The FDA cites heart valves as a Class III example for a reason. First, (clearly) heart valves are internal devices which must be surgically implanted. Second, any problem with a heart valve has a high likelihood of causing death. In other words, Class III devices such as heart valves are very risky and this is why they are treated as Class III.

Other devices (such as external devices, not surgically implanted and not life threatening) are clearly far less risky than this. This is why they are treated as Class II.

As part of the Food and Drug Administration Safety and Innovation Act(“FDASIA”) of 2012, and in order to help increase competition and improve availability, the FDA has begun a large effort to down classify various devices. This allows such devices to be marketed with far less onerous requirements. (Please note that this Act was passed AFTER the previous attempt at down classification on BGS. In other words, since that time, there is a new and enhanced effort by the FDA to down classify less risky devices).

As noted at the FDALawBlog, as part of its 2014-2015 Strategic Priorities, the FDA’s Center for Devices and Radiological Health (CDRH) committed to assuring the “appropriate balance between premarket and postmarket data collection to facilitate and expedite the development and review of medical devices.”

The FDA assembled a large list of devices for potential down classification.

Very quickly (by 2015) the FDA immediately rejected the obvious candidates. These devices were ones which should certainly remain as Class III devices. As noted, the FDA quickly declined to make any change to the status of 96 devices which were already Class III and were up for consideration.

(The point is this: if the FDA were going to reject down classification of BGS outright, they would have already done so…).

After the initial round of rejections, the FDA did propose to down classify 21 specific product codes, listed here. As is clearly shown, Bone Growth Stimulators (product code: LOF) are included on that list of 21 candidates which the FDA proposed to down classify. The complete list has been included as Appendix II below.

Following this, we can see from the FDA’s website that so far, that the FDA has already down classified 17 different products. The “hit ratio” therefore appears to be very high for products on this list. If they made the list, then they are going to be down classified. The down classification initiative at the FDA is still ongoing. Already in 2016, the FDA has down classified 7 more devices.

But wait, it gets better.

The products just successfully down classified in 2016 are obviously very similar in nature to the Bone Growth Stimulator. For example, here is the final order in 2016 down classifying External Pacemaker Pulse Generators. Here is the final order in 2016 down classifying External Cardiac Compressors.

Just as with BGS, each of these devices are:

– External electrical devices

– Not surgically implanted

– Not life threatening

In any event, so far, it looks as if nearly every device that made the proposal list ends up being down classified. This is especially true of the devices that are similar to BGS.

So what does the FDA say ?

Again, I did contact the FDA’s department of Orthopedics, which I confirmed is responsible for reviewing the classification. Obviously, they aren’t going to tell me the result of any final order until it comes out, but some useful information can always be had by calling. I am highly confident that the sell side has made no such effort prior to putting out their perfunctory reports (all of which are now outdated). Go ahead, ask them.

The biggest thing I learned was what seems to explain the delay so far in down classifying BGS. The process had previously been assigned to the department of Neurology and Physical Medicine. This was the wrong department. Just as of October 1st, 2016 (just 10 weeks ago) I was told that the process had been transferred to the department of Orthopedics.

First off, this makes much more sense, given that BGS are an Orthopedic device.

Second, it explains why the down classification hasn’t already happened.

Third, it tells me that the process is still proceeding on course towards down classification.

Perhaps of greatest importance is the fact that I was told that the team reviewing the down classification includes many of the same people from the team that had previously voted to down classify BGS in prior years. These people already know all of the arguments raised by Orthofix’s lobbyist and they have chosen to proceed anyway.

BGS down classification – chronology summarized

2006 – FDA proposes to down classify various medical devices including BGS from Class III down to Class II in order to streamline approvals, stimulate competition, improve availability and lower prices. The proposal to down classify BGS was prompted by an external petition to the FDA from medical device maker RS Medical which wanted to make competing lower cost devices. FDA panel initially votes to down classify BGS based on evidence.

2006 – Massive lobbying effort to the FDA by King & Spalding to reverse the vote succeeds. Vote is reversed and BGS not down classified. (King & Spalding is a D.C. based lobbying firm which represents Orthofix and others in front of the FDA).

2012 – Congress passes the Food and Drug Administration Safety and Innovation Act (“FDASIA”) in order to streamline approvals, increase competition and improve availability of med devices.

2014 -Following passage of the FDASIA Act, the FDA begins a Strategic Review in which it seeks to down classify various devices. The FDA quickly proposes to down classify BGS (product code: LOF). But this time, the FDA took its own initiative to down classify and was not prompted by any external petition.

2015 – King & Spalding again submits its arguments against down classification in 2015, focusing on technicalities.

2015 – By the end of 2015, the FDA declines to down classify 96 medical devices which it believes should remain Class III. However, an additional 21 devices (including BGS) are placed on the list of devices proposed to be down classified. By December 2015, FDA announces that it had already completed itsevaluation of 100% of the devices on the list.

2016 – After evaluation period was completed in 2015, FDA formally down classifies 7 devices more so far in 2016 (so far, as of July 2016). This takes the total to 17 devices so far. The FDA repeatedly down classifies external devices which are not life threatening (similar to BGS). The down classification process continues to be ongoing.

2016 – In October, FDA transfers the down classification process for BGS to the department of Orthopedics, including the same people who previously voted to down classify BGS. Again, the FDA has continued taking these steps even after it has received all of the lobbying arguments from King & Spalding.

Where are the disclosures from Orthofix

Again, back in the “old days” (actually just a few years ago), Orthofix was found guilty of Medicare fraud, of obstructing a Federal audit, of bribery in two different foreign countries. It then came out that multiple years’ worth of financials had been falsified and needed to be restated.

But supposedly the past is behind us.

If the threat of BGS down classification merits $1 million in total payments to a lobbying firm in DC, then it certainly must be both highly likely as well as very severe in its consequences.

Orthofix is clearly very concerned, yet there has been no sufficient warning to investors.

Looking at accounting manipulation

I spend a lot of my time analyzing financial and accounting information. But I am not a CPA. As with everything else in this article, the analysis below is just my opinion. And in my opinion, the manipulations below were very stealthy. But once you know where to look, they become downright obvious.

Let’s start with the old accounting anecdote:

A businessman was interviewing job applications for the position of manager of a large division. He quickly devised a test for choosing the most suitable candidate. He simply asked each applicant this question, “What is two plus two?”

The first interviewee was a journalist. His answer was, “Twenty-two”.

The second was a social worker. She said, “I don’t know the answer but I’m very glad that we had the opportunity to discuss it.”

The third applicant was an engineer. He pulled out a slide rule and came up with an answer “somewhere between 3.999 and 4.001.”

Next came an attorney. He stated that “in the case of Jenkins vs. the Department of the Treasury, two plus two was proven to be four.”

Finally, the businessman interviewed an accountant. When he asked him what two plus two was, the accountant got up from his chair, went over to the door, closed it, came back and sat down. Leaning across the desk, he said in a low voice, “How much do you want it to be?” He got the job.

Accounting manipulation – the smart way vs. the dumb way !

Again, the crux of the sell thesis on Orthofix is that the FDA will down classify BGS and then revenues and profits for Orthofix will quickly evaporate. As soon as the FDA makes that announcement, we will see Orthofix trade to $15-17.

But as a separate issue, the visible accounting manipulation is just icing on the cake for this short trade. It means that even if we briefly ignore any impact from the FDA, Orthofix should still be trading well below $30 – TODAY !

Looking back at the history of Orthofix, we can see that the company has often employed a wide range of devices in order to get its financial numbers up.

Note that Q2 results were a notable disappointment causing the stock to sell off by nearly 20%. Then in Q3 numbers were again a disappointment due to each of the non-BGS businesses performing poorly. Note that these results were STILL a disappointment even though they were actually boosted by the manipulations shown below. As a result, the stock fell again. Without the manipulations below, the numbers would have been much worse. We can see that in reality, Orthofix should be trading well below $30.

Obviously Q3 was another disappointing quarter for Orthofix. The only “saving grace” for Orthofix in its bad Q3 numbers was a sharp spike in its reported adjusted EBITDA. But so far no one seems to have caught on to the accounting tricks used to achieve this.

For Q3, Orthofix reported $23.5 million in EBITDA. It was a notable surge in an otherwise bad quarter, and seemed to indicate that the declines were perhaps not as severe as we might think.

But as shown here, the real number should have been $18.65 million, not much of a surge at all. As a result, Orthofix was able to boost its EBITDA by almost $5 million, or 26% by using artificial devices. As for the analysts, they either didn’t catch these moves or else they simply didn’t care.

Keep in mind that there are two ways to go about manipulating one’s accounting numbers: the smart way and the dumb way.

The dumb way is to figure out how big of a financial hole you need to fill and then conduct one gigantic revision right at the top or bottom line. This is the dumb way because it is so conspicuous that even the laziest of analysts and investors will be unable to ignore it.

Instead, Orthofix has manipulated its numbers “the smart way”. Orthofix finds multiple different levers which can be pulled. Each one is too small to really get much attention. In addition, each manipulation is derived from an area of the income statement which is not typically an area of heavy focus. As a result, no one catches on.

Infrastructure spending irregularities – $1.73 million = 9.3% boost

As readers of my past articles will remember, any time I come across blatant “mistakes” or “inconsistencies” in a company’s SEC filings, it should be cause for great concern. This is especially true when looking at the fraud in the backgrounds of the individuals as highlighted above. Not surprisingly, whenever I “catch them in the act”, I find that these “mistakes” or “inconsistencies” ALWAYS seem to benefit management and the financials. This was exactly what led to my exposure of Osiris Therapeutics and we are now seeing it again with the “mistakes” I have found in Orthofix’s SEC filings.

(Not surprisingly, these “mistakes” for some reason always seem to be of benefit to the company and not to their detriment. Go figure.)

In 2014, Orthofix initiated “project Bluecore” to improve systems processes, including ERP.

In the Q2 form 10Q, Orthofix discloses that: “Over the life of the project the Company has spent$27.5mm, of which $18.6mm has been capitalized. We expect to spend an additional $1.9mm”.

But then in the Q3 form 10Q (3 months later), Orthofix disclosed that: “Over the life of the project, the Company has spent$26.6 million, of which $18.1 million has been capitalized. We expect to spend an additional $0.8 million over the remainder of the project.”

Did you catch that ?!?

In Q2, Orthofix stated that they had already spent $27.5 million. But 3 months later, somehow this historical numberactually went down after the fact to $26.6 million. Obviously the real world doesn’t work this way. But thanks to the magi of accounting, companies can always find a way to pull a rabbit out of a hat to help boost a bad quarter.

The difference here presumably runs straight to the bottom line, with a benefit of $900,000.

Here is where it gets really weird.

Even though the incurred cost supposedly declined after the fact, Orthofix still chose to add back an additional $827,000 to EBITDA and EPS as one time adjustments. This alone added 4 cents to EPS.

To see these add back changes, it is easiest to compare the Q2 press release to the Q3 press release.

In total, the infrastructure manipulations benefited Orthofix’s EBITDA calculations by $1.73 million. (A boost of 9.3% from the base line number).

As you can see, the size of this one item is not massive and it was buried in a line item that likely no one (other than me) even focuses on. This is how the trick eludes attention from investors and analysts.

One time tax provisioning reversals – $2.4 million = 12.9% boost

This next lever was used to provide an apparent cut to Sales & Marketing Expense to abnormally low levels. S&M has typically run consistently around 45%. But in Q3, this was slashed to 42.4%. A large part of this was due to an accounting reversal of certain tax liabilities which flow through S&M. These are things like sales and use tax, property taxes, and other business taxes (ie. Not income taxes). Orthofix had provisioned this at the beginning of the year and then reversed it just in time to boost quarterly numbers as soon as results fell far too short. This is something that is entirely left to the discretion of management.

In total, the S&M tax manipulations benefited Orthofix’s EBITDA calculations by $2.4 million. (A boost of 12.9% from the base line number).

So again, a not-too-large accounting reversal in an area that doesn’t get much attention. So investors don’t really notice. But it is starting to add up.

Reversing allowance for doubtful accounts – $720,000 = 4% boost

In Q2, allowance for doubtful accounts was $9.56 million. But for Q3, that number was reduced to $8.84 million, resulting in a savings of $720,000. The allowance decreased not only in absolute terms, but also as a percentage of sales. So far I have found no explanation to justify this $720,000 benefit.

In total, change to allowance for doubtful accounts benefited Orthofix’s EBITDA calculations by $720,000. (A boost of 4% from the base line number).

Again, small enough to not raise flags and in a place where no one is looking.

Reversal of Obsolete Inventory – ???? = undisclosed size !

This one is great !

Orthofix had previously taken a reserve for writing off Excess & Obsolete Inventory (“E&O”). This amount or reason is not described in the financial statements so it is impossible to calculate just how much this boosted EBITDA. In any event, somehow Orthofix suddenly decided that formerly unsellable inventory (Excess & Obsolete) could now be sold. And, as always, this fortuitous development just happened to come along right when Orthofix was having a terrible quarter and needed to make its numbers.

In discussing E&O, Orthofix did disclose on the conference call that gross margin had been boosted by around 1%. As a result, we can estimate this artificial benefit at around $1 million. (1% of approximately $100 million in sales).

But since I can’t document the calculations, I am just ignoring this last item.

So even without the extra million from E&O, we can see that EBITDA was boosted by 26%. None of these items was big enough to stick out on its own and none of them really occurred in any key area of focus for analysts or investors.

Everything was cleverly kept below the radar, and the headline of soaring EBITDA reads great in an otherwise very disappointing quarter.

Beyond BioStim BGS – looking at the Biologics segment

Looking at the information above, it becomes clear that the only real reason that anyone owns Orthofix at current prices is because of a misplaced confidence in BioStim. And when the FDA moves to down classify Orthofix, that reason is going to be decimated.

In the past, there was sometimes a second reason to own Orthofix and that was its Biologics business.

Biologics mainly consists of bone allografts and tissues, including Trinity Elite and Trinity Evolution, which are “derived from human cadaveric donors”. (i.e. harvested from dead people).

(Incidentally, this happens to be the same business that Osiris Therapeutics is in, so it is one that I understand quite well.)

Orthofix’s bone allografts are mainly comprised of its Trinity ELITE and Trinity Evolution products. These contain viable cells and are used in surgery in the treatment of musculoskeletal defects for bone reconstruction and repair.

But keep in mind that Orthofix doesn’t actually PRODUCE these products and does not even own the IP.

What Orthofix really has is just a marketing agreement with the Musculoskeletal Transplant Foundation (“MTF”) which is a non-profit tissue bank.

In reality, MTF does all the work and then Orthofix just charges a “marketing fee”. The revenues are not enormous but the margins appear to be high because there is no cost of goods sold. There are of course heavy selling costs.

MTF processes the tissues, maintains inventory, and invoices hospitals and surgery centers and other points of care for service fees

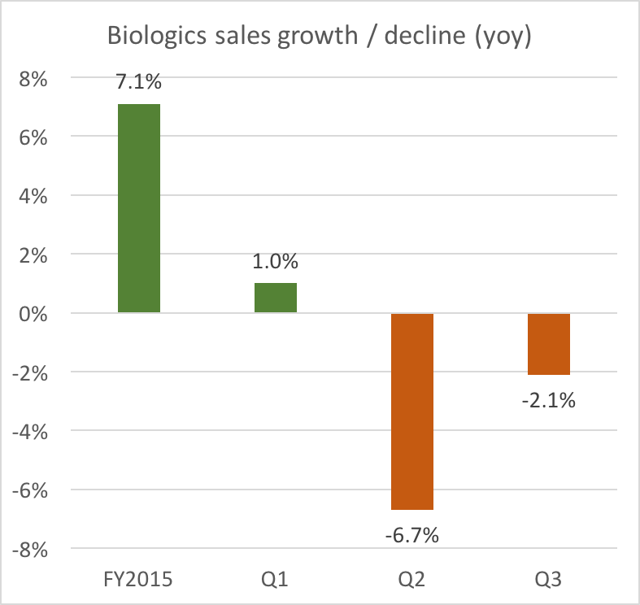

In the past, this segment was attractive for two reasons. First, because Biologics afforded high net margins of around 50%. Second, in the past, this segment also used to show appreciable growth. For example, from FY2014 to FY2015, Biologics grew by 7.1%.

This has now begun to dramatically change along with the adoption of a competing product called Vivigen from Depuy (part of J&J). And it is about to get worse.

When Depuy’s Vivigen product was launched last year, it was quickly named among “THE NINE BEST NEW SPINE TECHNOLOGIES FOR 2015“. And as soon as its sales started to gain traction, it began to have an appreciable effect on Orthofix’s Biologics division.

Here is a quote from that award:

ViviGen is the first cellular allograft to focus on recovering, processing and protecting viable lineage committed bone cells. New evidence supports the use of bone cells instead of MSC’s for bone healing. It is made of viable cryopreserved corticocancellous bone matrix and demineralized bone. Because of its properties, ViviGen can be considered to be an alternative to autograft.

And here is what began happening to Orthofix’s Biologics sales just after Vivigen was launched.

Last year, Biologics was growing by over 7%. Then Q1 continued to show slight growth, but just barely. But then Q2 got hit hard with a 6.7% decline in Biologics sales. Here is what management had to say on the Q2 conference call:

Net sales in our Biologics SBU declined 6.7% for the period due to our reduction in Trinity volume, which was primarily a result of an exclusion from a large national hospital account, as well as an increase in competing product offerings.

We remain optimistic about this SBU returning to growth in Q3 and Q4 and achieving growth in the low-single-digits for the full year.

Note that despite managements “optimism” about a recovery in Biologics into Q3, we can see that Biologics sales declined again in Q3.

Management then changed its views on the entire business. On the Q3 conference call, management noted that:

Considering our result over the last few quarters in our Biologicsbusiness, we’re now anticipating a low to mid single-digit DECREASE in year-over-year net sales for the fourth quarter and full-year 2016.

The reality is that Biologics is getting hit on two fronts. Anyone who is familiar with this business (including Osiris, Orthofix and Depuy) knows that it is a business that is gradually getting more competitive and less profitable each year. It is getting worse rather than better.

Extremity Fixation Segment

Even in a good quarter, Extremity Fixation only represents around 20% of profits for Orthofix. This is somewhat of a niche business where Orthofix already commands a large market share. As a result, easy opportunities for growth are very limited, even though quarterly results are often volatile.

Orthofix was originally founded in Italy a few decades ago and was focused on the Extremity Fixation business. These devices consist of pins, rods, bars and screws to hold bones in place after complex fractures. They are used for things like deformity correction and limb lengthening. In contrast to the Spine segment below, these devices are primarily used externally.

Orthofix continues to sell these devices, but the business is largely run out of Italy. Around 80% of the sales are non US sales. Obviously the rising US dollar has not been kind to the results for this segment. As a result, management repeated discloses the “constant currency” results which naturally appear much better on paper. But in reality, this means little for dollar denominated investors in a US company which reports in dollars.

This segment has a history of accounting problems. The segment cites limited visibility for the fact that it has been forced to use “cash basis” accounting to account for all sales. In fact, this is almost exactly what we saw at Osiris not long before the SEC investigation. It was part of my original short thesis on Osiris prior to the 70% plunge in the stock.

The cash collection policy means that revenue reporting is very lumpy and volatile. The past 2 quarters showed decent apparent growth. But this was largely because they were being compared against an easy previous comp when cash collections had been low.

Anyone who has historically been long Orthofix is certainly not banking on Extremity Fixation to move the needle.

Spine Fixation Market

Orthofix acquired the Spine Fixation business back in 2006. The company now provides a fairly full range of spine fixation products, including screws, rods, and plating systems, etc. In other words, this is a “hardware” business.

This is effectively a higher volume, low margin, commodity hardware business. Total profits from this segment amounted to just 6% of total profits for Orthofix.

One thing to note is that management discloses that 65-70% of the Spine Fixation sales actually go through the Biologics sales force.

So in other words, when the sales force is selling higher margin bone allografts, they then attempt to bundle in some sales of low margin spine products.

But following Depuy’s launch of Vivigen, Orthofix’s Biologics sales have been getting hit hard. This therefore has an even greater impact on Spine Fixation because it is such an undifferentiated product.

As a result, Spine Fixation revenues fell 17% YOY in Q3. Without a strong Biologics offering, Spine is going to be a product that is harder and harder to sell.

Again, certainly no investors are banking on this small segment to move the needle for Orthofix.

Conclusion

Because BGS are classified by the FDA as Class III medical devices, there is very little competition in the space. As a result, Orthofix can charge ultra high prices and still command a huge market share.

The FDA has proposed to down classify BGS to Class II status, which would make it easier and cheaper for competitors to offer similar devices. Cheap competition will flood the market at a fraction of the cost.

Timing is uncertain, but given the latest developments in October the down classification could come quite soon.

King & Spalding is a DC lobbying firm that represents Orthofix and others in front of the FDA. The firm has already been paid over $1 million for its attempts to influence the FDA to not down classify Bone Growth Stimulators. The risk and the consequences for Orthofix are big, they are real and they are near. This is why over $1 million has been spent. Yet investors have not been adequately warned.

Orthofix’s significant history of Medicare fraud and accounting misstatements are not the crux of the short thesis. But they should serve as food for thought regarding why the FDA issues have not been adequately disclosed to investors.

I believe that the down classification of BGS is a virtual certainty. First of all, it just makes common sense. Second, we can see from the FDA’s actions that they have continued to proceed with down classification through multiple milestones, including in recent weeks. Third, the FDA has recently been down classifying multiple very similar devices.

Back in 2006, the lobbying effort by King & Spalding succeeded. The FDA had already decided that the evidence indicated that BGS should be down classified. But King & Spalding was able to get the FDA to actually reverse its decision.

But then came the Food and Drug Administration Safety and Innovation Act (“FDASIA”) which was passed by Congress in 2012.

Following that Act, the FDA began to revisit hundreds of devices that should be down classified. Last year (2015), the FDA did immediately rule out down classification for 96 devices which it determined should remain as Class III. So if the FDA were going to not down classify BGS, they would have already made that decision.

The FDA then selected 21 devices which it proposed to down classify.

BGS are included on that “short list” of 21 items that the FDA wants to down classify.

So far, through 2016, the FDA has already down classified 17 devices. This includes 7 in 2016 and includes multiple devices that were very similar to BGS (external, electronic devices which are not life threatening).

King & Spalding sent in another lengthy letter to the FDA in an attempt to oppose the down classification, but the FDA down classification process has continued through multiple milestones since then.

In October 2016 (just 10 weeks ago), the FDA transferred the down classification process to the department of Orthopedics which is responsible for handling this.

I believe that BGS will definitely be down classified. As soon as the FDA announces this, Orthofix’s share price will trade to $15-17.

Recent accounting manipulations consisted of multiple items, each one of which was too small and too obscure for investors to notice on an individual basis. But in aggregate, they had a material impact on Q3 results. Without the benefit of this, Orthofix would already be trading below $30 (even before the FDA action).

The only sell side research on Orthofix comes from two firms who have issued brief reports which are already months outdated. They clearly are not following any of these developments.

BGS is responsible for more than half of the profits at Orthofix. Orthofix is overwhelmingly dependent upon BGS.

Each of Orthofix’s other business lines are facing unique challenges, pressures and declines. The only reason that anyone actually owns Orthofix is for the stable revenues and high profitability of BGS.

Again, as soon as the FDA down classifies BGS, I expect the share price to quickly trade to $15-17.

Appendix I – Orthofix regulatory violations, accounting misstatements and outright fraud

Please understand that the contents of this section are NOT a key part of the short thesis. I am simply including details on historical problems to demonstrate that various individuals have been present or involved in activities which blatantly deceived investors, consumers and or the government. The point I am trying to make is that there is a reason why investors have not been warned about the ongoing down classification proceedings. Investors should also consider this background when evaluating the section on accounting manipulation.

In the past, we can see a host of regulatory violations and outright fraud at Orthofix. This is a company that has been busted by the DOJ, the SEC, the department of Health and Human Services (“HHS”) and the OIG among others. The violations were as egregious as they were numerous and Orthofix was clearly found entirely guilty.

As would be expected, a number of individuals were fired dung the course of these investigations and indictments. A number of other individuals within management were criminally indicted themselves.

But surprisingly, given the severity of the fraud and regulatory violations, there has been a large degree of management continuity. Many of the same individuals are in place, still running Orthofix.

Current President and CEO Brad Mason has been with Orthofix off and on since 2003 (13 years). Between 2010 and 2013, he had served in a variety of consulting and advisory roles. Davide Bianchi, President of Orthofix International has been with Orthofix since 2013. Michael M. Finegan is Orthofix’s Chief Strategy Officier and has been with the company since 2006 (10 years). Jeffrey M. Schumm is Orthofix’s Chief Administrative Officer, General Counsel, and Corporate Secretary and has been with the company since 2007 (9 years). Robert A. Goodwin is the President of Biologics and has been with the company since 2006 (10 years).

This management continuity needs to be kept in mind when evaluating recent developments, including failure to disclose very material FDA problems (which, as demonstrated, are fully known by management) as well as recent accounting manipulation in 2016.

Unfortunately, the reality is that fraud and manipulation are absolutely rife within the Med Device space in the US.

Just this week, Orthofix added a new board member, Alex Lukianov, who had formerly been CEO of spinal med device competitor NuVasive (NASDAQ:NUVA). Last year Lukianov was forced to “resign” as CEO following his “violations of personnel and expense reimbursement policies“. NuVasive has so far refused to disclose further details. However, just after his resignation NuVasive ended up paying millions to settle fraud charges with the DOJ involving violations during his time as CEO. According to the DOJ press release, “Defrauding Medicare and Medicaid by paying kickbacks to physicians and promoting uses not covered by Federal health care programs will not be tolerated“. In any event, after leaving NuVasive, Lukianov was in need of a job, so now he is a board member at Orthofix. Earlier in the year, Orthofix appointed Michael Paolucci to the board. Paolucci is another former NuVasive executive who had worked under Lukianov.

Article: NuVasive CEO Resigns After Probe Finds Policy Violations

Article: NuVasive Stock Tumbles on News of HHS Fraud Investigation

Already in 2016, Orthofix has incurred over $14 million of expense in relation to an SEC enforcement action which it was forced to settle over sweeping accounting misstatements and Medicare fraud. This includes millions in expense in the most recent Q3 alone.

Looking back, we can evaluate the relevant events between 2012 and 2015.

Violation #1 – Medicare Fraud (GUILTY)

In 2012, Orthofix pled guilty to civil and criminal Medicare fraud chargeswith the DOJ, including $42 million in fines. The fraud involved gouging Medicare for inappropriate an overpriced sales of its Bone Growth Stimulators (the main product at Orthofix).

Article: Orthofix To Pay $42M To End DOJ Medicare Fraud Case

In that suit it was noted that, “Orthofix made false claims for payment for certain items of durable medical equipment used by patients in their homes, in particular osteogenesis stimulators, covered by Medicare, Medicaid and other federal and state purchasers. Medicare would pay approximately $4,000 to purchase a device that costs only $100 to manufacture.” Currently Orthofix is still “onprobation” as a result of that guilty plea. Orthofix discloses that, “In the event that we fail to satisfy these terms of probation, we could be subject to additional criminal penalties or prosecution, which could have a material adverse effect on our business, financial condition, results of operations and cash flows.”

Violation #2 – Obstruction of a Federal Audit (GUILTY)

From looking at the website for the FBI, we can see that in connection with their Medicare fraud, Orthofix was also found guilty of obstructing a federal audit in an attempt to cover up the fraud. In the end, at least 9 doctors were also charged in the fraud ring.

Despite the tremendous legal exposure from ongoing “criminal probation”, they continued to commit other flagrant violations.

Violation #3 – Paying Illegal Bribes in Mexico (GUILTY)

Orthofix later settled with the DOJ over violations of the Foreign Corrupt Practices Act where it paid bribes to win business in Mexico. Not only was Orthofix prosecuted by the US government, but it also paid $4 million to the Mexican government.

Article: Orthofix Pays $7.4 Million To Settle Mexico Bribes

Violation #4 – Paying Illegal Bribes in Brazil (GUILTY)

Orthofix entered into a “deferred prosecution agreement” which stated that the company must refrain from future violations for 3 years or face additional penalties. But within just 1 year (in 2013), the company was already investigating improper foreign payments in another country, this time in Brazil.

Article:Orthofix reaches agreement “in principle” with SEC over Brazil FCPA allegations

As a result, Orthofix was then currently embroiled into a DOJ investigation which encompassed illegal payments in both countries.

But wait, it gets better.

Violation #5 – Accounting Misstatements (8 years !)

Then in 2015, the company completed a multi year financial restatement due to accounting misstatements which then became part of an SEC investigation. Amazingly the, accounting misstatements were gigantic and covered misreported numbers over a tremendous timespan, including 2007, 2008, 2009, 2010, 2011, 2012, 2013 and 2014 ! That is 8 years containing misstatements!

Article:Orthofix to restate results due accounting errors

The point is this:

I have demonstrated Orthofix’s clear knowledge of this impending crisis. Yet investors have not been adequately warned. This event clearly merits its own very prominent risk factor in Orthofix’s financials, yet this has not been done. Orthofix should also be spelling this event out to investors in its presentations and conference calls. Again, this has not been done.

Those with a good view on Orthofix’s regulatory history are likely NOT SURPRISED but this omission.

They should also not be surprised by recent accounting manipulation which has been used (including in the most recent quarter) by Orthofix to meet Wall Street estimates and boost the share price. Orthofix management throws in every accounting gimmick but the “kitchen sink” in order to manipulate their apparent financial results. Overall, Orthofix recently inflated its adjusted EBITDA by as much as 26% using pure accounting tricks.

Appendix II – product codes to be down classified by FDA

| Product Code | Description |

| LFD | Saliva, artificial |

| LLX | Catheter, sampling, chorionic villus |

| LMF | Agent, absorbable hemostatic, collagen based |

| LNC | Applicator, hyperthermia, superficial, rf/microwave |

| LOA | Device, testicular hypothermia |

| LOB | Dilator, cervical, synthetic osmotic |

| LOC | System, rf/microwave hyperthermia, cancer treatment |

| LOF | Bone growth stimulator |

| LPQ | Stimulator, ultrasound and muscle, for use other than applying therapeutic deep |

| LTF | Stimulator, salivary system |

| LZR | Ultrasound, cyclodestructive |

| MBU | Condom, female, single-use |

| MRK | System, imaging, fluorescence |

| MVF | System, laser, photodynamic therapy |

| MVG | System, laser, fiber optic, photodynamic therapy |

| MYM | Assay, enzyme linked immunosorbent, parvovirus b19 igm |

| MYL | Assay, enzyme linked immunosorbent, parvovirus b19 igg |

| MYN | Analyzer, medical image |

| NXG | Fluorescence in situ hybridization, topoisomerase ii alpha, gene amplification and deletion |

| NZC | Stent, urethral, prostatic, semi-permanent |

| OAY | Light source system, diagnostic endoscopic |