Company overview

Sungy Mobile (GOMO) is a US listed Chinese ADR. The company’s main product is a downloadable “app” for Android phones which allows users to customize their icons and wallpaper. The company currently has a market cap of approximately $900 million and trades on a PE ratio of over 100x. The stock is very liquid and trades $10-15 million (over 400,000 shares) per day. Short interest in the stock is negligible at just 282,483 shares (less than 1% of outstanding).

Investment summary

Sungy represents a compelling short sale opportunity in the near term. At prices above $24, the stock has near term downside of at least 50%, which would still leave it trading above its recent IPO price of $11.22.

Just 2-3 weeks ago, the stock was still trading at around $20, so much of the gains are very recent.

In November of 2013, as China Internet related plays were soaring, Sungy launched an IPO of ADR’s which was downright abusive to investors. Inherent structural problems from the IPO, along with more recent indications of precipitous decline in interest for their products, will likely be the underlying reasons for a dramatic decline in the price. But the actual catalyst for this decline is expected to be the release of the first 20F filing in the next few weeks, along with the upcoming expiration of the IPO lockup.

The IPO’d shares are the only shares which are available to public investors. Sungy walked away with proceeds of $100 million from the IPOand its concurrent private placement. The proceeds are now presumably sitting comfortably in China.

But it is important to note that with the IPO, Sungy set itself up with an unusual dual class corporate share structure where public investors received heavily disadvantaged shares with almost no voting rights and which also happen to have no claim on the underlying assets of the company. Under this dual class corporate structure, US investors get 1 vote per share vs. 10 votes per share for the insiders who hold the special B shares. The result of this is that at the time of the IPO, outside investors put in $100 million in cash but will control less than 4% of the voting power – despite holding 27% of the outstanding shares. It was clearly a great structure and a great deal – for Sungy insiders, but not outside shareholders.

Meanwhile, the operating assets (within the VIEs) themselves remain in separate subsidiaries which happen to be controlled by Sungy management members, Mr. Yuqiang Deng, Mr. Xiangdong Zhang and Mr. Yingming Chang.

For those who wish to better understand the implications and pitfalls of Chinese VIE structures, I had previously written an article at Forbes discussing this topic a while back. For those who wish to read even further, there is a wealth of great information which is updated often atChinalawblog.com. It is safe to say that anyone who does not understand the basics of these structures has no business owning Sungy.

In fact with Sungy, the situation rapidly gets much worse. Buried in the prospectus, we can see that during the IPO process, Sungy was forced to disclose one material weakness along with two significant deficiencies in its internal controls designed to prevent fraud. These were as follows:

- Insufficient accounting personnel with US GAAP experience

- Insufficient IT control over financial reporting

- Failure to maintain ITGC management and security policy

An obvious question might be: So why not simply wait to go public until such serious deficiencies in control could be remedied ?

There are two reasons why Sungy did not wait and instead rushed to get the IPO out the door.

The first reason was that there was simply no need to fix the deficiencies. Even though Sungy is a company based in China, it took full advantage of the United States “JOBS Act”, a piece of legislation which was conceived in the US financial crisis to boost US employment. The Act was finally passed in 2012.

The title of the Act is an acronym for Jumpstart Our Business Startups, and it allows certain companies to apply for “emerging growth status“.

But it might as well be labeled Jumpstart China‘s Business Startups. A number of recent Chinese IPOs have already begun making use of exemptions (a.k.a “loopholes”) within this act which oddly allow even Chinese companies to reduce disclosure and come public despite significant flaws in their internal controls. Examples of recent Chinese companies who used JOBS Act exemptions include Qunar.com (QUNR), 500.com (WBAI) and 58.com (WUBA).

The JOBS Act was a deeply flawed piece of legislation, for these and many other reasons. It was almost a year ago that I wrote about this Act in the context of ServiceNow (NOW), noting that:

Such provisions under the JOBS Act have been controversial. A Bloomberg article entitled

“Job-Creation Bill Seen Eviscerating U.S. Shareholder Protections” quoted the former chief accountant from the SEC as saying:

“It won’t create jobs, but it will simplify fraud… This would be better known as the bucket-shop and penny-stock fraud reauthorization act of 2012.”

By applying for “emerging growth company” status, ServiceNow can opt to disclose fewer years of financial statements. It is exempt from certain disclosures regarding executive compensation. Investment banks love the provision that allows them to publish research prior to their IPOs – a practice which was banned following the dot.com boom and bust.

Perhaps of greatest concern is that these “emerging growth companies” do not need to have an auditor attest to their internal controls as required by post-Enron Sarbanes-Oxley.

Even though these exemptions should cause anger among US investors, the Act has been extremely popular among new IPO candidates. Although ServiceNow is not a Chinese company, its use of the JOBS Act is also quite inappropriate. When I wrote the previous article, ServiceNow had a market cap of roughly $5 billion – hardly suggesting it should qualify as a “startup”.

In any event, by using exemptions within the “JOBS Act”, Chinese company Sungy was able to come public even despite serious deficiencies in its internal controls. This makes it somewhat worse than other Chinese companies who have used the Act for different exemptions.

In fact, the exemptions utilized by Sungy allow the company to go for wellover a year after receiving its money from US investors without even remedying the deficiencies in internal controls. As a result, investors have very little assurance about where the money inside Sungy is going or how the company’s assets are being deployed in this company.

These deficiencies are all the more concerning for an unusual structure like Sungy where investors have no claim on the underlying assets and virtually no voting power.

The biggest risk investors will face is when additional disclosure must be released within Sungy’s first annual 20F filing as a public company, to be released within a few weeks.

Recent indications point to a precipitous decline

But the second reason that Sungy rushed its IPO was perhaps far more important. The offering was launched with perfect timing to coincide with a dramatic spike in revenues and online traffic for its Go Launcher Ex. The fact that the spike coincided with a strong surge in prices for other Chinese Internet stocks made this urgent timing for an immediate IPO even more imperative.

Investors in the IPO somewhat naturally assumed that this growth was natural and sustainable. But independent sources already provide strong indications that this growth was a spike, not a trend. The IPO prospectus included data up until September 2013. But even in the past 6 months, we can already see (shown below) a dramatic decline in 3rd party indicators which should accurately measure traffic and predict revenues.

In recent weeks, additional investors have piled in to Sungy simply because it is a “China Internet Play”. Unfortunately, these investors fail to realize that more than 70% of Sungy’s Go Launcher Ex users are based outside of China. Sungy is NOT a dominant China internet play. Sungy is NOT YY Inc. (YY). Sungy is not Qihoo 360 (QIHU). SUNGY is not Baidu (BIDU).

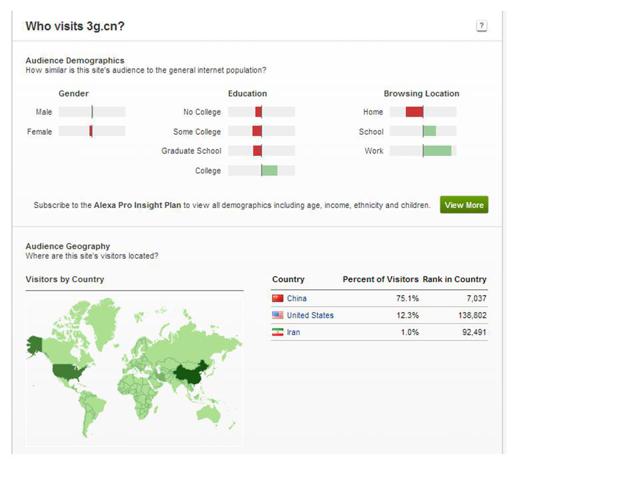

In fact, even Sungy’s mobile portal (3G.cn), which is predominantly in China, ranks it at just a top 7,000 or lower site in China. (see below).

Yet the mistaken notion of “China Internet Play” is largely responsible for the recent surge in the share price.

Investors should take note that even the investment bankers on the Sungy IPO (JP Morgan and Credit Suisse) maintain share price targets of just $17 and $24 (both issued in 2014). Yet the share price has recently surged to as high as $28 – as much as 50% above where its own optimistic bankers suggest it belongs. Even at the price of $17, JP Morgan rates Sungy a polite “Neutral”.

Sungy’s product offering

Sungy Mobile is a provider of mobile Internet applications, with an emphasis on its Go Launcher Ex and “mobile reading services”. Go Launcher Ex is a “launcher” for android based phones, which means that it is the first software that the android phone sees upon start up. It is the software that “manages apps, widgets and functions on Android smartphones”

The default launcher that comes with an Android phone is typically supplied by Google. After buying the phone, users can then opt to download alternative launchers such as that from Sungy.

Sungy derives its launcher revenues partially from paid downloads, but also largely from advertising spending (as would be expected).

The “mobile reading services” is comprised of an expanding library of original and copyrighted literary works. Readers are charged a fee to access these materials.

A third source of revenue is the mobile portal 3G.cn in China.

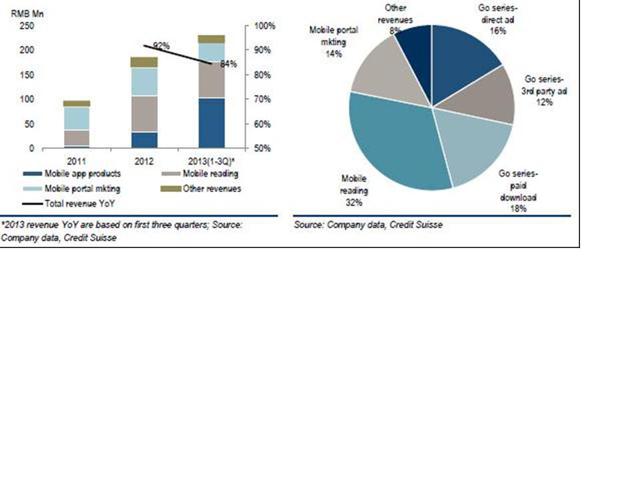

An initiation report from Credit Suisse showed the following revenue breakdown.

In preparation for the IPO, Sungy commissioned (ie. paid for) a report by App Annie. The report yielded the following conclusions below. It is these conclusions which are largely responsible for the strong share price performance upon the IPO.

But investors need to remember that these conclusions were based on a snapshot in time as of September 2013. Because Sungy is a new ADR with limited reporting requirements, there has been no update by Sungy to these metrics since that time.

The conclusions from the IPO prospectus were as follows:

– Sungy was one of the top publishers world wide on Google Apps (in the “Applications” category).

– Go Launcher Ex was number one in the “Personalization” category

– As of October, Sungy had 3 out of 44 of the products with more than 50 million cumulative downloads on Google Play (but this is for “non game downloads” only, as games are much more popular)

– Go Launcher Ex has attracted approximately 239 million users, with over 70% of them being outside of China

– In Q3, average monthly “active” users reached 42 million

Indeed, these metrics make Sungy look fantastic. But in reality the Go Launcher Ex is just a fairly simple customization app for an android phone. The prospectus describes it as follows:

GO Launcher EX offers extensive functions and high performance that turn the use of smartphones into a more productive experience. In addition, through themes, widgets and various levels of customization, GO Launcher EX users can extensively personalize their smartphones and change the otherwise monotonous phones into exciting and sensible instruments that perform more in sync with their owners’ habits andsymbolize the individuality of their owners

Updates since the time of the IPO

According to the JP Morgan initiation report, Go Launcher Ex is the only one of the launcher products which has achieved over 1 million paid downloads. It scored a 4.5 on Google Play and had 1.3 million paid downloads as of the time of the JP report in January.

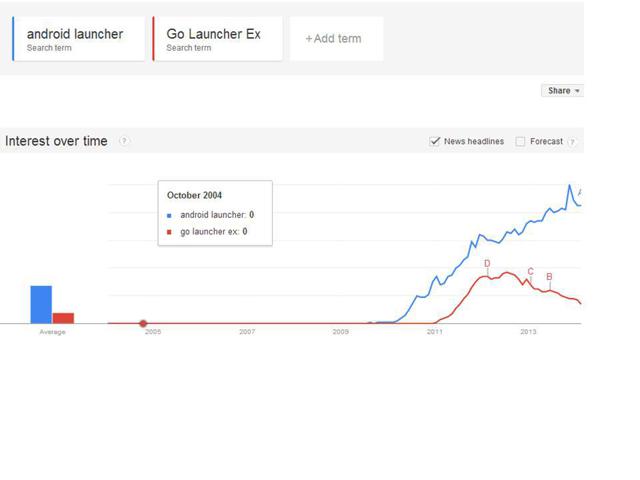

But a better leading indicator is to look at Google Trends.

The above screen shots can be replicated by going to Google Trends and entering the search terms “android launcher” and “Go Launcher Ex” as shown above.

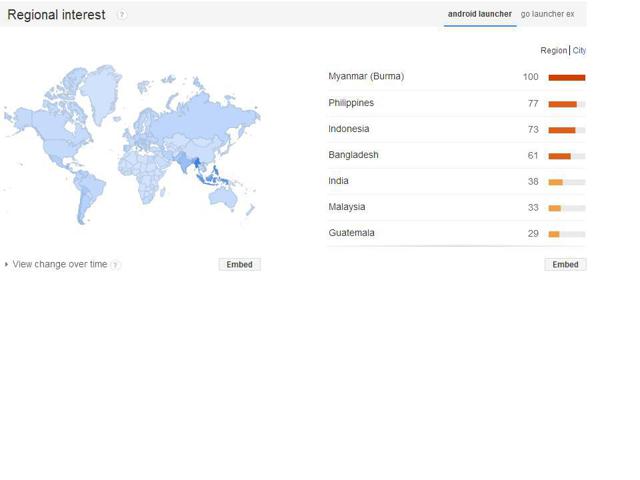

These screen shots show two things. First, even though downloads peaked in 2013 (according to App Annie), actual searches for Go Launcher Ex peaked in 2012 and have been on a straight line decline since that time. Second, much of the real interest in downloads is coming from places like Myanmar and Bangladesh which are very difficult to monetize. We already know that over 70% of the business is coming from outside of China. But we can also see that the interest in Go Launcher Ex is largely coming from markets which are well away from the desirable US and European markets as well.

This is most likely the reason why Sungy did not bother to include a geographic breakdown of its users in the IPO prospectus.

It should be noted that GDP per capita in these countries sits at around $1,000-2,000 per year. They simply do not have the disposable income to either a) pay for downloads or b) attract advertising dollars.

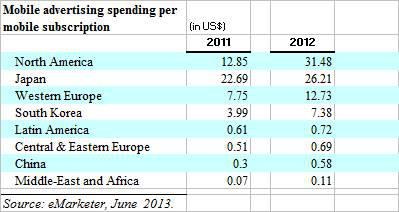

As part of the IPO prospectus, it included a table showing market stats on mobile ad spending. (Note these are NOT stats for Sungy, they are stats for the market).

The table states the obvious: North America, Europe and Japan comprise the overwhelming majority of mobile ad spending. They are also responsible for the largest amount of nominal growth.

What does App Annie say now ?

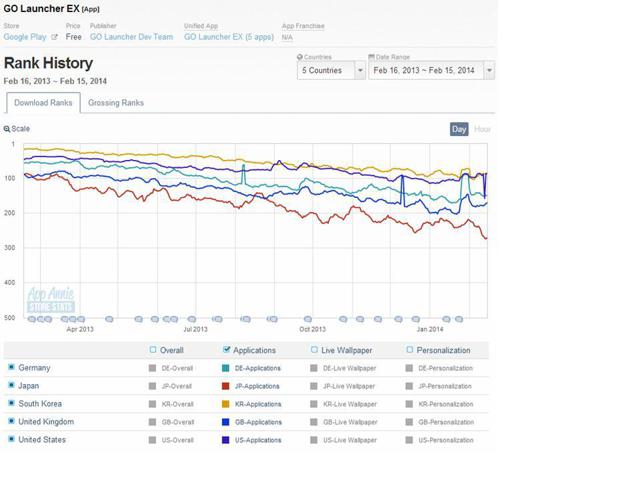

The IPO prospectus relied heavily upon the commissioned one-time report from App Annie. But a closer look at subsequent developments reveals that App Annie data itself (as reflected in Google Play) is showing a peak and subsequent decline in downloads of Go Launcher Ex. Naturally we should not expect this type of negative data to have been included in a commissioned (ie. paid for) report as part of an IPO prospectus.

The scale of the chart above (from 0-500) tends to understate the size of the declines in downloads. But by looking closer, one can see that Go Launcher Ex was largely a roughly top 50 product just a year ago (as was indicated in the IPO prospectus) but it has now fallen to being largely a top 100-200 app (with the exception of South Korea). The impact between a top 50 and a top 200 is typically exponential, not linear, such that the effect on subsequent revenues from paid downloads and ad spending will by necessity by dramatic. This will likely become clear in Sungy’s first 20F filing as a public company which will be released in a few weeks.

Trends with the mobile portal 3G.cn

The drop off in popularity for the Go Launcher Ex is largely mirrored by a similar drop off in recent months for the 3G.cn portal in China.

Detailed web statistics can be found for 3G.cn by searching at Alexa.com. As expected, the vast majority of traffic comes to this site from within China.

But more importantly, we can see what has happened to traffic at 3G.cn since the IPO just 3 months ago. Fortunately, Alexa provides stats which happen to coincide with this 3 month period.

As shown in the graphic above, at the time of its IPO Sungy’s 3G.cn happened to be a top 50,000 global website. But within just 3 months, this has slipped to top 75,000.

For those who (for some reason) seem to compare Sungy’s 3G.cn to Baidu, Sina or Qihoo, it can be easily seen that within China there are already more than 7,000 website which rank higher than Sungy’s 3G.cn in China.

Conclusion

Sungy’s IPO makes it a troubling investment in two different respects. First, the security which investors buy is strongly disadvantaged. It has almost no voting power due to the deliberate dual class share structure. It also has no claim on the underlying assets of the operating company due to the VIE structure. The company founders and insiders still run the operating assets, despite the conflict of interest that this creates vis a vis the public shareholders. In addition, Sungy made use of an inappropriate JOBS Act exemption to come public in the US despite having multiple serious internal control deficiencies.

The second issue is that these abuses give us a strong indication about management’s attitude towards how it will treat its outside shareholders. This includes how they timed the IPO.

The company rushed to come public at just the time when its business metrics were peaking. Investors must keep in mind that the primary product being offered by Sungy is simply an app which allows one to customize things like icons and wallpaper on one’s cell phone.

Independent metrics now show that most areas of Sungy’s business are now showing sharp declines in interest rather than continued surging growth. This is very typical for “one hit wonder” app and game developers.

What is less typical is when a company is able to rush out such a disadvantaged security to investors just as its metrics are peaking and at just the right time when all of the sector comps are hitting all time highs.

Given the aggressive structure that was sold to investors and the newly declining metrics, Sungy should be expected to trade back down to around its IPO price of $11.22 (eventually even lower). The reasons for this will become clear as soon as the company’s first 20F is released in the next few weeks. The aggressive nature of the IPO should also be expected to signal heavy potential selling upon the upcoming expiration of the IPO lockup.

Note: prior to publication, the author did speak with Sungy’s IR rep. The company currently says it is in a quiet period ahead of earnings and is not responding to requests for information. The earnings date has not yet been announced.

Author’s Disclosure:

Based on the above, the author is short GOMO.