Summary

- Investors and analysts have overestimated the market size for SBC-102 by at least 3-9x.

- Most sufferers of CESD can be treated by proper diet and common statins (i.e. Lipitor) without the need for a $300,000 drug.

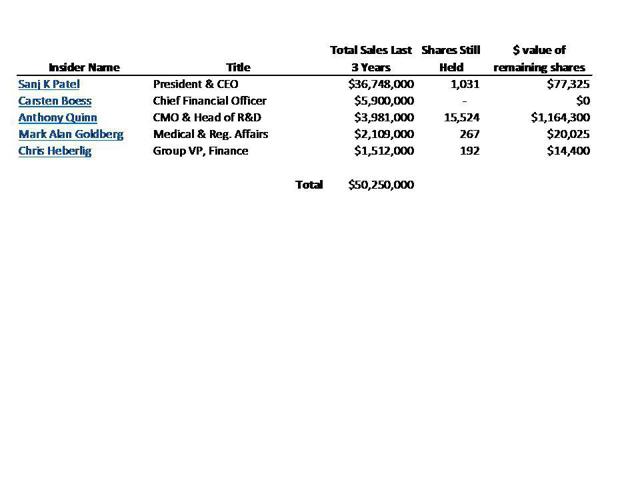

- Management has now sold 95% of its stock, reducing combined holdings to less than 1% of outstanding – even before their drug has completed trials.

- Similar to Raptor and Aegerion, Synageva will likely drop by at least 50% from current levels.

This article is the opinion of the author. Nothing herein comprises a recommendation to buy or sell any security. The author is short GEVA. The author may choose to transact in securities of one or more companies mentioned within this article within the next 72 hours. The author has relied upon publicly available information gathered from sources, which are believed to be reliable and has included links to various sources of information within this article. However, while the author believes these sources to be reliable, the author provides no guarantee either expressly or implied.

[Note: just prior to publication of this post, an article appeared in the European Atherosclerosis journal entitled “Lysosomal acid lipase deficiency – an under-recognized cause of dyslipidaemia and liver dysfunction“. The article contains references to many of the studies and issues which I have referred to below. That article was supported and funded by Synageva and Synageva researchers and is available for purchase via ScienceDirect.]

Company overview

Synageva BioPharma (NASDAQ:GEVA) is a $2.6 billion biotech which specializes in developing drugs for very rare diseases. The company came public via a reverse merger in 2011 with failed biotech Trimeris. At the time of the reverse merger, legacy company Trimeris was held 36% by the Baker Brothers. Recent purchases by the Bakers have served to maintain (but not increase) this stake in the venture. Following five large equity offerings raising over $600 million from stock sales, the Bakers continue to currently hold just 35% of the renamed company, Synageva. The Bakers have made it their practice to buy into each of these equity offerings, typically in proportion to their ownership stake.

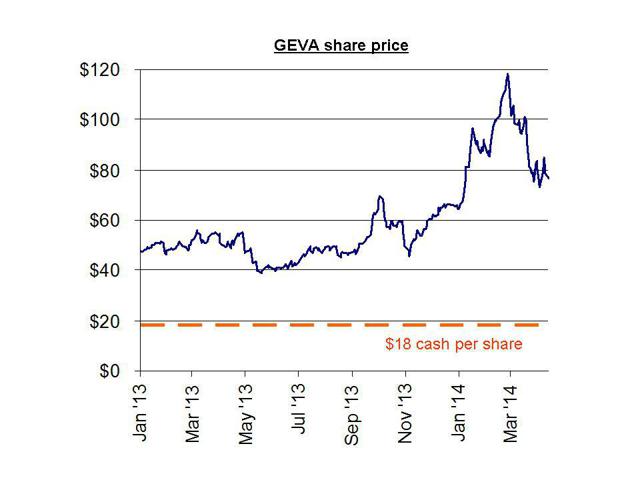

Synageva currently trades at around $75 per share and has a current cash balance of around $600 million (equivalent to around just $18 per share in cash). The company expects to lose $190-205 million in 2014. The company lost $95 million in 2013.

Short interest in the stock has gradually declined over the past few months, and now sits at just 4% of shares outstanding.

In 2013, Synageva derived $13 million in total revenues from royalties on AIDS drug FUZEON along with additional collaboration revenues. But both of these revenue sources are declining and neither is material to the $2.6 billion valuation at present. Synageva has no other sources of revenue at present.

Synageva currently has several preclinical programs which it hopes to advance going forward. But for the time being, it has only 1 compound in clinical trials, sebelipase alfa (SBC-102). This is the compound which we will focus on.

During March, Synageva quickly dropped by around 30%. This was largely due to three factors. First, an unexpected (and unnecessary) $200 million equity offering put heavy pressure on the share price. Second was the news that the company expected it would lose around $200 million this year, which was far larger than expected. And third, it was largely the result of concerns regarding pricing developments at Gilead Sciences (NASDAQ:GILD) which could affect the broader space of rare / orphan drug developers. Gilead has seen heavy backlash over the perception that prices for its new Hep C drug are simply far too high. The company is now taking steps to address these concerns including providing deeply discounted drugs to certain markets such as Egypt. But this discounting precedent caused Gilead and other drug developers such as Alexion (NASDAQ:ALXN) to see similar plunges. These developments are not the primary focus of this article but are still highly relevant to the prospects for Synageva and others. I have included details in Appendix I.

Investment thesis

Synageva’s SBC-102 is highly likely to be approved by late 2014. FDA approval is likely not a concern or a problem.

Yet management has been rushing to sell nearly all of its holdings in Synageva. Management has now unloaded over $50 million in stock, representing more than 95% of its holdings. This has occurred even before its drug completes clinical trials.

CEO Sanj Patel alone has now sold nearly $37 million in stock…and holds less than $100,000 remaining. In April, Chief Medical Officer Anthony Quinn sold more than half of his remaining stock valued $1.7 million.

Meanwhile, the company was also quick to issue new shares in March, raising an extra $200 million that it did not even need. Synageva already had over $400 million in cash on its books.

Although the cash balance is still only $18 per share, this opportunistic offering resulted in Synageva raising far more cash than it needs, simply due to the desire to cash in on a high share price.

It is very easy to see why management has been so quick to sell.

The problems for Synageva are as follows:

- The market for SBC-102 is in reality much smaller than has been predicted (as shown below, analysts have overestimated the market size by 3-9x)

- Most of those who suffer from CESD have such mild symptoms that they do not require a $300,000 drug (depending on the severity, diet and simple statins like Lipitor will often suffice)

- For those with serious symptoms, other more permanent solutions are becoming available via bone marrow and stem cell transplants.

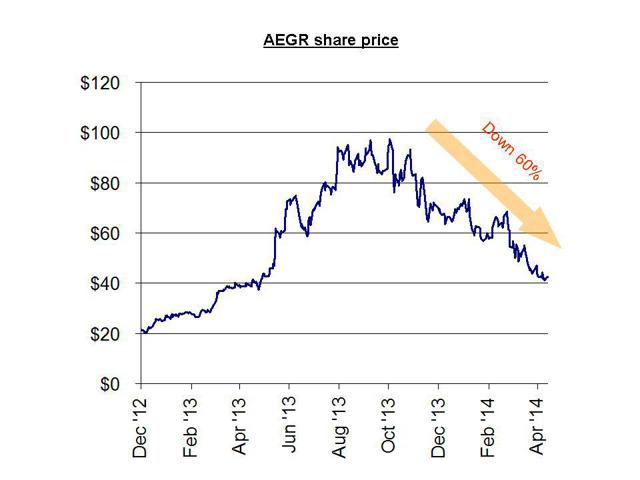

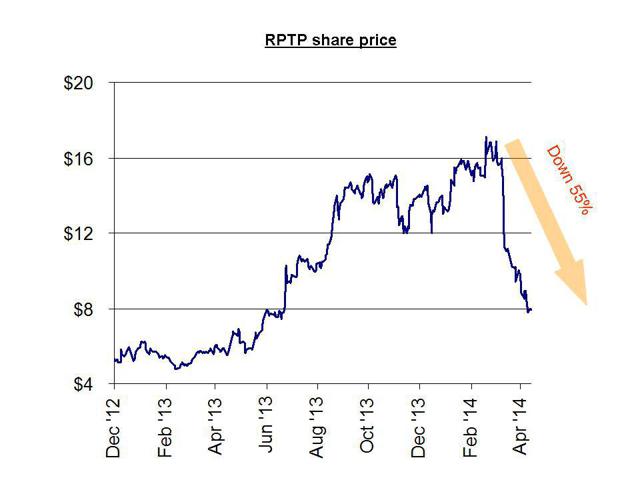

We have seen this exact same phenomenon with other rare / orphan drug developers. There is an initial surge when a company looks set to sell its drug at orphan prices of $100,000-500,000 per patient. The share price surges by hundreds of percent in anticipation of the company becoming “the next Alexion.” But when the market better understands the limited size of actual market, the stock quickly gives up its gains, plunging by at least 50%. Near identical examples are shown with Aegerion (AEGR) and Raptor (NASDAQ:RPTP), each of which plunged by 50% or more after their sharp run ups failed.

LAL D / Wolman Disease / CESD

SBC-102 is currently in clinical trials for treatment of lysosomal acid lipase deficiency (“LAL D”). There are two variations of this genetic ailment, one is when it is early-onset (in infancy), while the other is late-onset (typically childhood to young adult).

When LAL D manifests itself in infancy (i.e. “early-onset”), there is typically a complete absence of the LAL enzyme leading to harmful amounts of lipidsaccumulating in the spleen, liver, bone marrow, small intestine, adrenal glands and lymph nodes. Symptoms which follow include enlarged liver and spleen (hepatosplenomegaly), poor weight gain, low muscle tone, a yellow tint to the skin and the whites of the eyes (jaundice), vomiting, diarrhea, developmental delay, low amounts of iron in the blood (anemia), and poor absorption of nutrients from food. This nearly always results in fatality, typically before age one. When describing early-onset LAL D in infants, it is known as Wolman Disease (“WD”). There is currently no approved treatment on the market for WD.

When LAL D manifests itself later in life, there are a wider variety of outcomes and severities to the deficiency. Unlike early-onset WD, the enzyme is present, but it is present in a malfunctioned form. In this latter case, it is known as Cholesteryl Ester Storage Disease (CESD). More information on the wider variety of outcomes due to CESD is provided below.

What is driving the $2.6 billion valuation of Synageva ?

Both manifestations of LAL D (i.e. both early-onset WD and late-onset CESD) can be considered ultra-rare afflictions. But only with WD is it ultra severe (life threatening) in all cases. SBC-102 has been granted orphan drug designation in the US and in Europe, and has been granted Fast Track Designation by the FDA.

Terms like “ultra rare,” “orphan drug” and “fast track” often result in premium valuations for the drug companies who can attain them. What these terms mean are that a drug is likely to come to market more easily, more quickly and at a tremendously higher price than for normal drugs.

For example, Alexion currently trades with a market cap of nearly $30 billion even though it markets only a single product sold to a few thousand patients. That product is Soliris, for treatment of several ultra rare immune disorders. The cost for Soliris: over $500,000 per patient.

In 2013, Alexion brought in over $1.5 billion in revenue, implying a total patient count of around 3,000 (perhaps slightly more, assuming some discounting in price takes place). Beyond just revenues, Alexion has also been highly profitable with this one drug. Even after R&D and selling expenses, Alexion was able to achieve operating margins will in excess of 25%. In 2013, net income was $252 million, putting Alexion on a PE of over 100x.

If Synageva held any such bullish prospects, then it would certainly be very difficult to reconcile this with the wholesale liquidation of stock which has gone on by the key members of management.

As shown in the table below, Synageva management members have been extremely quick to sell nearly all of their shares. They have done this almost as quickly as they get them via option grants.

A list of all of the recent share sales by management has been included as Appendix II. As part of this, it can be seen the CEO Patel continued to sell nearly $10 million in stock this year. He now holds just $77,000 in stock. In April, the CMO sold more than half of his remaining stock. This follows sales of nearly all stock by other key members of management.

The purpose of the analysis that follows is to explain WHY management has expressed such urgency in selling nearly all of their shares of Synageva as quickly as possible.

Will SBC-102 be approved for WD and CESD ?

The answer is an almost certain “yes.” Even the bears on Synageva should agree that SBC-102 will be approved by the FDA without issue.

The real issue for investors is that there are three major commercial problems facing SBC-102, which explains management’s heavy share sales.

Problem #1: the total addressable patient population has been dramatically overestimated.

To evaluate this problem, we need to look at the two afflictions (WD and CESD) separately.

There is little debate about the fact that (early-onset) WD in infants is an ultra rare affliction. In fact, it would more aptly be described as ultra-ultra-ultra-ultra-rare.

According to the NIH, WD is expected to occur in just one out of every 350,000 live births. That means just 8-10 cases per year in the US.

The numbers for WD are so small and are tied to new births such that that even if SBC-102 were to replace Soliris as the world’s most expensive drug, the total revenue it might realize would still not even justify the cost of the clinical trials and R&D.

So then WD is not where Synageva’s ambitions have been stated for commercial purposes. Instead, it is the hopes for treatment of (late-onset) CESD that have propelled the stock higher.

In attempting to size this market, the primary study being cited by Synageva management and analysts was one conducted in Germany which came to the conclusion that CESD should have a prevalence in the general population of about 1:40,000. That equates to 25 patients per million, or about 7,500 total affected individuals in the US.

In its corporate presentation, Synageva has cited a wide ranging number from 1:40,000 to 1:300,000 and used multiple studies, blending together the ultra rare WD with the more common CESD. But it is clear from their estimates that many analysts have focused heavily on the 1:40,000 number. Morgan Stanley estimates the total patient population at exactly 7,500 people (exactly in line with 1:40,000). Wedush tones this down a bit and estimates it at just over 5,000.

What these sources fail to mention is that the German study was NOT a measurement of the incidence of CEDS in the German population at all. Instead it was a simple extrapolation of what might be expected in the overall population of Germany based on a gene mutation model applied to just 2,023 individuals. This is very important.

The findings from this genetic modeling exercise were certainly not a clear cut measurement. This can be illustrated by the clumsy wording of the conclusion of the study. It comes to its 1:40,000 (25 per million) number by stating:

Assuming Hardy-Weinberg equilibrium, the homozygote carrier frequency can be estimated to 6 per million. Applying these results to the German general population, about 91 E8SJM homozygotes aged 18 years or younger would be expected. Under the assumption that this mutation represents about 50% of all CESD-causing mutations, the prevalence of CESD (homozygotes or compound heterozygotes) among German newborns is estimated at 25 per million, or a total of 366 cases under the age of 18.

After reading that paragraph, most readers likely walk away simply saying “huh ?!?”

The point to this very clumsy conclusion should be obvious. It does not even remotely resemble a statement that 25 people per million actually HAVECESD. It is just an exercise in genetic modeling.

But for marketing purposes of SBC-102, all that mattered was obtaining a hard number which justified large revenues. In this case, that number was a hard and fast 25 per million.

Yet many seem to have ignored the very next (and most important) sentence in this German study, which states:

This estimate is in apparent conflict with the small number of CESD casesreported in the literature.

The “apparent conflict” and the “small number” of CESD cases should be very obvious. What it means is that IN REALITY, we don’t find anything even remotely near a 25 per million incidence of CESD.

According to the NIH website in 2007 (the same year as the German study)

Cholesteryl ester storage disease appears to be a rare disorder. About 50 individuals affected by this condition have been reported worldwide.

Since that time, and with the onset of clinical trials for a specific drug targeting CESD, there have been efforts by Synageva to increase awareness and reporting such that it should be expected that this will have increased from just 50 cases over the past 7 years.

Much of the reason for the low reported incidence of CESD is simply due to the fact that the disorder is “considered a benign indication” in most cases. It can in fact be treated by simple changes to diet and the uses of fairly simple statins such as Lipitor. As a result, it is often never even reported as a disease at all. This will be described further as part of Problem #2.

But it should also be noted that a more recent US study conducted in 2013 evaluated the incidence of CESD across various racial groups and estimated prevalence at 1:130,000. In other words, the “apparent conflict” disclosed in the German study and being used by the research analysts (i.e. bankers) is that these numbers are overstated by 300%.

Some of the bankers do get credit for paying attention to the wide spread in the numbers presented by management. For example, Nomura points out the oddly large size of the variation between management’s estimate of 1:40,000 and 1:300,000. Nomura then settled on a number in between at 1:150,000. That is about 7 per million, instead of 25 per million.

Not surprisingly, this resulted in Nomura placing a target on the stock that is $20 lower than Morgan Stanley. Morgan Stanley is clearly estimating a market size that is around triple that of Nomura.

Goldman Sachs took a similar approach, and an even smaller market size, and ended up with a $72 share price 12 month target upon initiation.

But moving into the next section, we can see that the real problems are about more than just debating the numbers. This is where all of these analysts are much further off, and why their share price targets will ultimately be cut in half from current levels.

Problem #2: unlike WD, many who suffer from CESD face very mild symptoms

With early-onset WD, the implications are categorical. There is a complete absence of the LAL enzyme. Symptoms are severe and if it is left untreated the individual will not survive. The entire purpose of having orphan drug status is to incentivize drug companies to develop treatments for underserved “orphan” areas such as WD.

But again, due to the ultra low incidence of WD, this is not where Synageva’s actual commercial hopes lie. Even at ultra high prices, there are simply not enough cases of WD each year to generate adequate revenue.

Synageva hopes to commercialize SBC-102 mostly for treatment of the (relatively) more common late-onset CESD.

The problem is that when it is late onset as it is with CESD, the symptoms are not black and white as they are with WD. In CESD, patients have a mutationto the enzyme (rather than a complete absence) and therefore still express some amount of enzyme. However, it has varying degrees of functionality.

According to the National Organization for Rare Disorders (NORD)

The symptoms and severity of cholesteryl ester storage disease (CESD) are highly variable from one individual to another. Some individuals may develop symptoms during childhood; others may have extremely mild cases that cause few symptoms. Still other individuals may not have any noticeable symptoms (asymptomatic) and may go undiagnosed until well into adulthood.

Under the section entitled “treatment,” NORD goes on to note that

A hypolipidemic diet and statins are the main therapeutic tools used against CESD. …The combination of diet and drug administration has led to dramatic reductions in the levels of lipids such as cholesterol and triglycerides in the blood of affected individuals.

It is from observations such as these from NORD that we can see that the severity of a LAL D diagnosis can vary quite widely from life threatening at one extreme to just heavy nuisance at the other. It is also safe to say that those in the nuisance category are not going to be spending over $300,000 on an ultra rare orphan drug. Instead, they will monitor their diet more carefully and take a statin such as Lipitor.

Obviously, with the most severe cases of CESD such mild treatment would not suffice.

Yet current sell-side analyst estimates are calculated based on the assumption that the vast majority of all individuals who could be considered to have a CESD diagnosis will require the $300,000 drug. This is simply wrong.

This is not to say that CESD is without the potential for serious, life threatening consequences – in SOME cases. NORD goes on to note that:

In most cases, CESD is considered a benign condition, but in some cases significant complications may eventually develop including fatty liver (liver steatosis), fibrosis and finally micronodular cirrhosis with liver failure and esophageal varices due to altered hepatic venous circulation. The vessels swell and sometimes may rupture, causing potentially life-threatening bleeding. Abnormal enlargement of the adrenal glands (adrenomegaly) may also occur in few cases.

The point is that for some small portion of the CESD patient universe, there may be a genuine need for a $300,000 drug. But the size of this paying population is going to be incredibly small, nowhere near the thousands that analysts have been projecting when they have forecast hundreds of millions in revenue.

The point is that even within the small population that is affected by CESD, most individuals have such minimal symptoms that they certainly will not be paying $300,000 or more for treatment. Many may not even know that it is called CESD. Some individuals that have it may even be entirely asymptomatic.

But there was also some excitement that Synageva has been able to complete enrollment in its Phase 3 clinical trial with over 50 patients. Presumably this would ensure that there is a large universe of patients around the world. Right?

Wrong.

It is very important to note that the Phase III clinical trial “inclusion criteria” are simply that there exists in the patient a “Deficiency of LAL enzyme activity confirmed by dried blood spot (NYSE:DBS) testing at screening.” What this means is that even patients who don’t have debilitating symptoms (i.e. the “benign” ones) can be accepted into the trial as long as they simply evidence some sign of LAL deficiency.

As shown above, there are plenty of people who would test positive for CESD without even having symptoms or without even otherwise knowing that they had the indication. These people would certainly be accepted into the trial, but would certainly NOT end up paying $300,000 for the drug.

As a result, the enrollment of the trial is by no means an indication of who might end up actually paying $300,000 for the drug.

Problem #3, for those with a severe need, there are multiple other serious treatment options becoming available. These are permanent, one-time options as opposed to ongoing drug therapy.

As mentioned above, for those with only mild-to-moderate issues with CESD, there are ways to deal with it which are not burdensome at all. This includes proper diet and the use of drugs like Lipitor. There are also other alternatives such as cholesterol and triglyceride medications.

But even when we get to severe, life threatening cases of WD and CESD, there are still alternatives. These alternatives are very important to consider due to the high price at which SBC-102 will be sold.

CESD is often diagnosed in adolescence, such that a patient might end up being treated for as long as 70 years or longer. With an annual price tag of $300,000 or more, that implies a total cost to treat which could potentially exceed $20 million! This is certainly an instance where the party paying for reimbursement would want to be well informed of all realistic alternatives.

As early as 2000, this study noted that “Wolman Disease Successfully Treated by Bone Marrow Transplant.” The focus of this procedure was on an infant with WD who would have otherwise died. At age 4, following the transplant, the patient was growing and healthy. This procedure is unlikely to be broadly applicable for WD (i.e. for an infant) itself because of the risk of death due to the transplant itself. But it must be remembered that CESD is by definition a late onset of LAL D, such that it will be applicable to older children and adults who could more easily tolerate a bone marrow transplant.

The issue to keep in mind is that bone marrow transplants have successfully been able to permanently treat LAL D, which applies to CESD. The alternative for the patient to consider would be to keep taking a drug that costs $300,000 per year for the rest of his life. Again, this could even exceed $20 million total depending on the age of the patient when diagnosed.

A similar treatment success, but this time with stem cells, was also described in this report entitled “Successful treatment of Wolman disease by unrelated umbilical cord blood transplantation.” Again, the patient treated was an infant, so technically it was treatment for WD. But the results should apply to both WD and CESD (i.e. both are simply LAL D with different ages of onset).

The implications are the same. For patients (or their insurers) the decision becomes whether or not to be treated once and for all via a transplant or to continue paying $300,000 per year for life and still be dealing with the unresolved health problem.

So now we know why management has sold virtually all of their stock! The real world incidence of CESD is as much as 70% less than had been described, the severity of CESD typically does not even merit the $300,000 treatment…and in the few instances where it does, other more permanent options are becoming available.

With these facts in mind, the heavy selling by management becomes quite understandable.

Have we seen the same situation with other orphan drug stocks ? Yes.

Orphan drug stocks are now a red hot topic and have been seen as a source of windfall profits to the biotechs. As a result, we are seeing many of these biotechs overshoot due to hype and excess enthusiasm simply associated with their orphan status.

We can see repeatedly that orphan drug stocks overshoot on the way up when the market gets too excited about their potential to sell drugs for $100,000-$500,000 per year. Once the market better understands the real world potential, the share prices plunge by 50% or more.

For example, Aegerion Pharmaceuticals launched its orphan drug to much fan fare in December of 2012. Yet (just like Synageva) there were contradictory indications provided about the size of the addressable market. These varied by a factor of 10x (ranging from as few as 300 patients to as many as 3,000 potential patients).

In the interim (while there was still hype and uncertainly), the share price quadrupled during 2013, from $25 to over $100, as investors accepted the higher patient number as fact. As the actual performance failed to materialize, analysts were quick to cut their ratings on the stock (after the fact) and the stock is now down by nearly 60% from those highs.

For example, as recently as April 1st, Jefferies cut its price target to $80 from $90. The share price currently sits at around $45.

When the stock was still trading at over $80.00 in November, author Matt Berry had warned of this outcome using easily obtained and publicly available information. His point was simple: the real market size for this drug could in no way generate the kind of revenues to support this $3 billion stock. It was simply a function of market size. As was easily predicted, earnings were a disappointment, and the stock has since been cut in half.

As with Synageva, management at Aegerion were very heavy sellers of their own stock. In the past year, just as the stock was peaking, insiders unloaded over $85 million in their stock. The stock is now down by around 60% since its peak in October. Given the advance warnings and management selling, investors should have known better.

Another nearly identical example is Raptor Pharmaceuticals . Raptor was a $7.00 stock when it obtained FDA approval for Procysbi, but the stock barely budged until it received orphan designation in the US and Europe. These designations, along with ample analyst upgrades, sent the stock to as high as $17.00. When the sales failed to meet expectations due to a smaller than forecast market size, the shares quickly plunged to their current level of around $7.00.

As with Aegerion, investors had ample warning in advance from Gravity Research which predicted the plunge based on overhyped forecasts of the tiny market size for Procysbi. Just like Matt Berry’s analysis on Aegerion, the analysis simply used easily obtainable public information to demonstrate a far smaller market for Procysbi than had been billed. The ultimate outcome was a decline in the stock of 55%. This should have been entirely predictable.

Also like Aegerion (and also like Synageva) management at Raptor has been heavy sellers since the stock peaked out. In the past few months, insiders have sold nearly $7 million and there have been no insider buys.

As with these other orphan drug examples above, investors should have known better.

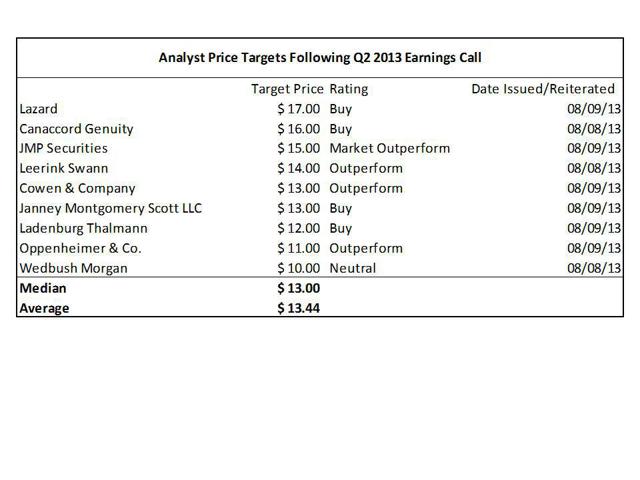

This dismal performance is all the more notable given the unanimous bullishness given across the board by the sell side analysts. Gravity had included the following table highlighting the research calls expressed on Raptor.

In each of these cases, the information so easily obtained by these independent authors was somehow entirely overlooked by multiple investment banks who happened to be raising money for the companies. This analyst optimism is identical to what we see at Synageva, and we see it even by a number of the same investment banks.

With Raptor, the stock did briefly touch the high share price targets, but only before it fell by 50% to current levels where it now sits. Likewise, the share price targets on Synageva did serve to temporarily lift the stock to those levels before the current decline which we are now seeing.

As these miscalculations become apparent once again, we are also likely to see a decline of at least 50-70% in the share price of Synageva from current levels down to around $30-40. This level of decline would simply see the stock trading back where it was 1 year ago.

Management has no doubt been thrilled with the bullish support from Wall Street analysts, as it has allowed them to sell more than 95% of their shares, much of it in the past few months. These same investment bankers then reaped millions in fees from an equity sale by Synageva in March which raised over $200 million in proceeds.

But what about the big institutional buying by the Baker Brothers?

Much of the confidence in Synageva stems from the continued buying by the Baker Brothers. In the March equity offering by Synageva, the Baker Brothers purchased 375,000 shares at a price of $105.80. So clearly they were looking to increases their holdings substantially, regardless of price, right? Wrong.

The Baker Brothers strategy with Synageva has simply been to maintain their original ownership position and avoid dilution. Prior to the reverse merger with Trimeris in 2011, the Baker Brothers owned 36.2% of the company. And now 3 years later, following a continued stream of purchases at every equity offering, they now own 34.89% – i.e. almost unchanged. All they have done is maintain their percentage stake in the company which they have owned for years.

This is almost identical to the strategy that we have seen with Dr. Philip Frost in his ongoing purchases of Opko Health (NYSEMKT:OPK). Dr. Frost continues to buy shares of Opko on a weekly (or even daily) basis, seemingly regardless of price. But what many investors fail to realize is that his ownership position has remained largely unchanged. Unlike, Synageva, Opko has largely refrained from issuing shares for cash and instead has been issuing shares as consideration for a string of acquisitions. In this way, Opko is increasing its number of “shots on goal.”

Were it not for his open market purchases, Dr. Frost would see his ownership stake in the company fall dramatically due to the for-stock acquisitions. But this is far different than the idea that he is conducting a “creeping takeover” (which view has been proposed incessantly by various small investors).

As with Dr. Frost and Opko, the Baker Brothers have an in-price which is at least 60-70% below current levels and a position size which is already large. The implications are twofold: First, incremental purchases vs. the large existing position do not really raise the in-price by very much. Second, with the in-price so low, it becomes nearly impossible to end up losing money on this position unless the stock falls by more than 70%.

With both the Bakers and Dr. Frost, their objectives and constraints are far different for the rest of us, such that they can feel free to continue to buy shares at much higher prices without an impact on their performance. The rest of us cannot say the same.

Author Stock Matusow ran two articles in December highlighting what appeared to be some very attractive trades put on by the Bakers. The premise was that by “following the smart money” we could also make money for ourselves.

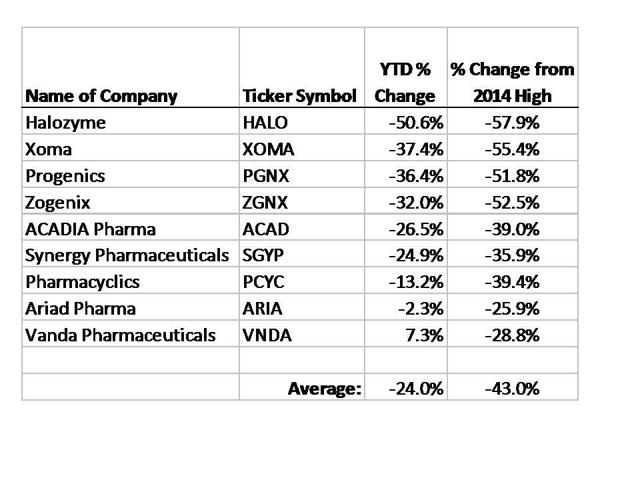

The following table shows the results of the investments highlighted in these two articles:

As we can see, simply following the smart money” and buying these Baker stocks would have led to average declines of 24% YTD and 43% declines vs. their recent highs.

The point is not to suggest that the Bakers are bad investors. Nor is it to suggest that they have simply ridden up a multi-year bubble in biotech stock prices. The only point to make is that the Baker Brothers have their own sets of opportunities and constraints which are not applicable to the vast majority of outside investors. Playing follow the leader is the wrong way to invest in biotech stocks. The right way to invest is to evaluate all facts and data and then decide where the most profitable investments will be relative to today’s prices.

Conclusion

As it applies to Synageva, the point should be clear. Common sense is showing us that there are likely to be just dozens or perhaps (at most) hundreds of applicable patients for SBC-102 at prices of $300,000 or more. This is far less than the thousands of patients which would be necessary to justify the current market cap of over $2 billion.

In addition, we can see that many of the potential patients may have symptoms which are so mild that they do not require the high priced drug. For those with severe symptoms, there are already alternative therapies (transplants) which may represent permanent cures rather than ongoing expensive treatments.

Meanwhile, management continues to sell its shares as fast as it can, mostly refusing to retain anything more than token holdings of the stock. So far management members have cashed out of more than $50 million in stock in the past three years. CEO Sanj Patel has personally sold nearly $37 million in stock and currently holds a mere 1,031 shares remaining – almost nothing.

Realistically, we should expect to see Synageva decline by around 50-70% from current levels.

Appendix I – Developments at Gilead and impact on drug pricing

In December the FDA approved Gilead Sciences’ Sovaldi, used to treat hepatitis C. The drug is fantastic. It is the closest thing we have to an outright cure.

It was granted Breakthrough Therapy Designation by the FDA and is effective on 90% of patients in as little as 12 weeks, only involving daily pills.

However, Gilead’s exorbitant pricing of the drug for $1,000 per day or $84,000 for 12 weeks of treatment has caused unbridled backlash from many stakeholders. “Never before has a drug been priced this high to treat a patient population this large, and the resulting costs will be unsustainable for our country,” said Express Scripts chief medical officer Steve Miller. Specialty drugs comprise less than 1% of all US prescriptions but account for ~28% of total spending on pharmaceuticals. Sovaldi is not the most expensive drug in the world, but costlier drugs typically treat extremely rare conditions whereas 130-150M people suffer from hepatitis C globally, 3.2M in the US.

Involved parties are not just idly complaining either. In its first guidelines on treatment of hepatitis C issued in early April, the World Health Organization suggested tiered price discounts by branded drug makers, voluntary licensing, and even compulsory licensing to combat unbearable prices. Express Scripts plans to create a coalition of employers, government health plans, and private insurers and is also working with doctors to delay treatment on many patients until lower-priced alternatives are on the market, probably in 2015. Representative Henry Waxman sent a public letter in late March: “Our concern is that a treatment will not cure patients if they cannot afford it.” Last month, US lawmakers asked Gilead to explain the $84,000 price tag.

With so many pricey drugs on the market, it is curious that this was the drug that finally sparked such an massive outcry about drug pricing. It is particularly notable given that this is for a drug which is extremely effective at treating a very serious problem.

On Friday March 21st (just after the close of stock markets), Gilead announcedthat it would be offering the drug to Egypt at discounts of 99% vs. the $84,000 cost.

On Monday March 24th (in reaction to the Friday announcement), shares of Gilead dropped by as much as 6%. Other orphan drug makers such as Alexion and Synageva dropped by 7-10% as well. The message was clear that companies may no longer be free to simply set pricing at the highest level the market will bear. There can be qualitative consequences to even the perception that a company is charging too much for a drug – even when it is an effective drug for a much needed indication.

Appendix II – Stock sales by GEVA management

During 2014, 2014, Synageva insiders have sold nearly $13 million in stock, including over $9 million from CEO Sanj Patel alone. This brings total management sales to more than $50 million. Management has now sold over 95% of its shares. As a result of the recent selling, management now owns less than 1% of the total share count.

| Date | Insider Name | Title | Dollars Sold | Shares Sold |

| 4/1/2014 | Anthony Quinn | EVP, CMO & Head of R&D | $ 1,670,691 | 20,000 |

| 3/12/2014 | Chris Heberlig | Group Vice President, Finance | $ 755,992 | 7,670 |

| 2/18/2014 | Carsten Boess | SVP, Chief Financial Officer | $ 1,012,369 | 9,927 |

| 1/28/2014 | Sanj K Patel | President & CEO, Director | $ 9,014,999 | 102,300 |

| 12/3/2013 | Mark Alan Goldberg | SVP, Medical & Regulatory Affairs | $ 423,649 | 7,000 |

| 11/18/2013 | Carsten Boess | SVP, Chief Financial Officer | $ 546,857 | 9,927 |

| 11/1/2013 | Mark Alan Goldberg | SVP, Medical & Regulatory Affairs | $ 349,753 | 7,000 |

| 10/1/2013 | Mark Alan Goldberg | SVP, Medical & Regulatory Affairs | $ 450,203 | 7,000 |

| 8/20/2013 | Carsten Boess | SVP, Chief Financial Officer | $ 682,188 | 14,481 |

| 8/16/2013 | Carsten Boess | SVP, Chief Financial Officer | $ 204,121 | 4,300 |

| 7/25/2013 | Sanj K Patel | President & CEO, Director | $ 4,801,679 | 100,000 |

| 7/15/2013 | Chris Heberlig | Group Vice President, Finance | $ 122,249 | 2,524 |

| 7/11/2013 | Carsten Boess | SVP, Chief Financial Officer | $ 622,933 | 13,237 |

| 6/11/2013 | Sanj K Patel | President & CEO, Director | $ 2,845,756 | 70,000 |

| 4/5/2013 | Sanj K Patel | President & CEO, Director | $ 1,570,276 | 31,605 |

| 4/3/2013 | Sanj K Patel | President & CEO, Director | $ 1,954,542 | 38,395 |

| 4/1/2013 | Mark Alan Goldberg | SVP, Medical & Regulatory Affairs | $ 239,831 | 4,416 |

| 3/1/2013 | Mark Alan Goldberg | SVP, Medical & Regulatory Affairs | $ 224,217 | 4,417 |

| 2/20/2013 | Sanj K Patel | President & CEO, Director | $ 3,443,621 | 70,000 |

| 2/1/2013 | Mark Alan Goldberg | SVP, Product Development | $ 210,892 | 4,417 |

| 1/18/2013 | Anthony Quinn | SVP, Chief Medical Officer | $ 473,106 | 9,447 |

| 1/16/2013 | Anthony Quinn | SVP, Chief Medical Officer | $ 278,025 | 5,553 |

| 1/16/2013 | Carsten Boess | SVP, Chief Financial Officer | $ 487,614 | 9,927 |

| 1/2/2013 | Mark Alan Goldberg | SVP, Product Development | $ 209,896 | 4,417 |

| 12/19/2012 | Chris Heberlig | Vice President, Finance | $ 183,705 | 4,000 |

| 12/13/2012 | Sanj K Patel | President & CEO, Director | $ 2,772,438 | 60,000 |

| 12/4/2012 | Sanj K Patel | President & CEO, Director | $ 1,712,105 | 35,000 |

| 11/30/2012 | Sanj K Patel | President & CEO, Director | $ 1,726,818 | 35,000 |

| 10/17/2012 | Chris Heberlig | Vice President, Finance | $ 198,620 | 4,000 |

| 10/16/2012 | Carsten Boess | SVP, Chief Financial Officer | $ 497,650 | 9,927 |

| 9/4/2012 | Chris Heberlig | Vice President, Finance | $ 49,100 | 1,000 |

| 8/31/2012 | Sanj K Patel | President & CEO, Director | $ 3,462,891 | 70,000 |

| 7/26/2012 | Anthony Quinn | SVP, Chief Medical Officer | $ 376,501 | 7,500 |

| 7/19/2012 | Anthony Quinn | SVP, Chief Medical Officer | $ 125,000 | 2,500 |

| 7/18/2012 | Carsten Boess | SVP, Chief Financial Officer | $ 323,091 | 6,618 |

| 6/25/2012 | Anthony Quinn | SVP, Chief Medical Officer | $ 1,056,874 | 26,000 |

| 6/1/2012 | Chris Heberlig | Vice President, Finance | $ 35,733 | 1,000 |

| 6/1/2012 | Sanj K Patel | President & CEO, Director | $ 1,766,318 | 50,000 |

| 5/16/2012 | Carsten Boess | SVP, Chief Financial Officer | $ 1,522,933 | 39,709 |

| 3/23/2012 | Sanj K Patel | President & CEO, Director | $ 1,676,410 | 50,000 |

| 2/27/2012 | Chris Heberlig | Vice President, Finance | $ 165,960 | 4,500 |