A bubble for tech stocks is clearly back. The NASDAQ has more than regained everything that was given up in the Great Recession and at 3,213 it has returned to levels not seen since the year 2000.

Companies that provide technology solutions within the real estate industry are currently getting a very positive double whammy in terms of share price. They are benefiting from a strong perception that the real estate market is recovering and they also get a clear bump up just for being technology stocks during a technology bubble.

There is a noticeable amount of competition between publicly listed real estate technology stocks, including Zillow (Z), Trulia (TRLA) and sites such as MoveInc. (MOVE) and Yahoo (YHOO). In addition, industry leader Red Fin has announced its own intention to go public. As stated, “Last month, Redfinannounced that its listing business grew 120 percent in 2012 and the company plans to more than double its staff of listing agents this year to serve rising demand from its expanding customer base.”

With many technology stocks, we have recently seen notable insider selling in the IPO, along with increased insider selling as soon as the lockup expires. In fact, it is now the case that management from certain companies have begun pushing for “lockup lite,” such that they can begin selling after just 90 days instead of 180 days, subject to a share price trigger.

When Zillow came public at $20.00 per share, the shares quickly jumped to $44.00 before following a fairly steady downward path. It is almost 2 years later and Zillow is just now beginning to recover the value that it had achieved on its first day of enthusiastic trading. Zillow raised over $70 million in its IPO. In the 2 years since, insiders have now sold $128 million in stock. On the day of the lockup expiration, the shares tumbled 13%.

The fact that management teams feel the urgency to cut short the lockup period and begin selling early certainly telegraphs the insiders’ views about how sustainable the sharp spike in these shares will turn out to be. Why else would there be such urgency to shorten the lockup period by a mere 90 days?

The use of these early lockup triggers is somewhat problematic. In some cases, it encourages the company to set its IPO price too low, such that even a moderate pop is enough to allow insiders to get out of their stock. In addition, the binomial nature of the trigger and the potential timing creates a very strong incentive for management teams to “juice” their results with channel stuffing, excess promotion, early revenue recognition or accounting gimmicks.

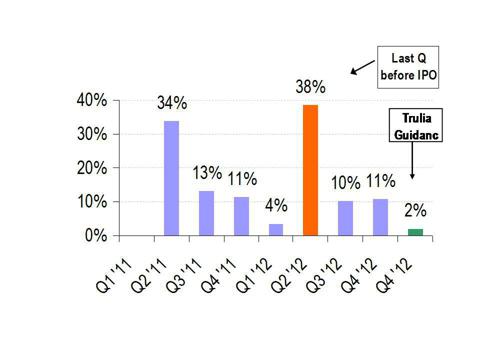

With Trulia, we can see that the biggest surge in both users and revenues came just around the time of the IPO, although nothing appears to have been done improperly. Trulia certainly noticed the advantages of being able to sell stock early during a strong tech bull market, as was done by Zillow. Trulia basically copied the “lockup lite” provision from Zillow.

The official stated lockup date is March 19th, so it is now the case that most investors seem to think that Trulia will be safe from insider selling for another 3 weeks. However, because it copied the Zillow language on the lockup, the shares may become sell-able roughly 2 weeks sooner than investors had planned.

For the insiders, selling early makes perfect sense. Given that lockup dates are often associated with sharp drops in share price, the selling insiders of Trulia would be foolish to not sell at the earliest possible date, before the greater downward pressure hits the stock on March 19th. In short, “lockup lite” allows insiders to beat the officially stated rush to sell.

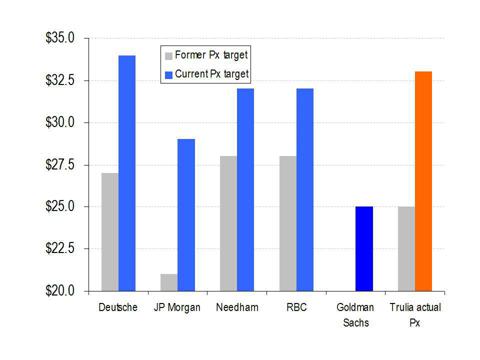

This is all the more so given that Trulia is now sitting at lifetime highs of around $33 and recently hit a $1 billion market cap. Trulia has never had a profitable quarter, and its record 2012 revenues amounted to just $68 million. A wave of sell-side analyst upgrades resulted in an average target price for Trulia of $32.00, but the stock just has continued to soar past all targets.

(Click to enlarge)

As shown above, the current share price is now well above the required trigger for selling before the lockup period ends. Prior to February 13th, sell-side analysts had targets on Trulia of $22-$28. All of the major analysts raised their target on Trulia into the range of $28-34. Yet Trulia has now jumped past all of those price targets and sits at around $33.00 after reaching a high of $38.22.

As with tech bubbles in the past, when Wall Street needs to find a way to get bullish about money losing companies, Wall Street just changes the metrics and uses non-GAAP items such as “Adjusted EBITDA” and “Adjusted Net Loss.” The measures basically allow a company to report all of the things that are beneficial in the short term, while ignoring items like interest, depreciation and the cost of stock options which still need to be factored in to the business. In effect, companies that report these numbers are saying, “if you focus on all of the positives and ignore all of the negatives, then our company is doing quite well. Trulia’s prospectus and earnings releases contain numerous warnings and caveats associated with these metrics while GAAP does not even recognize them.

Management and insiders already sold $15 million of shares in the IPO. We can also see from the prospectus that insiders may have the option to sell prior to the March 19th lockup expiration, as a result of the share price exceeding $23.80 for 20/30 days.

The total number of shares that become sellable at the lockup date is over 6 million, which constitutes over 22% of the total share count. There are ample reasons to expect substantial selling even before the final lockup expiration.

By way of reference, on Tuesday, Trulia fell by more than 11% on volume of just 300,000 shares. The catalyst was a downgrade from Buy to Hold by Deutsche Bank.

So even if the 6 million insider shares were sold over a period of numerous days, one would expect the share price correction to be significant.

Valuation

Although Trulia has made substantial progress in both financial and non-financial metrics, it is still the case that Trulia has never turned a profit.

The latest surge in the stock, which added over $9.00 to the share price, was the result of Trulia simply getting to a level where it was almost breaking even. Judging by the current $892 million valuation, many investors are no doubt trying to predict a trajectory for Trulia’s earnings. They are expecting a substantial jump into profitability within 1-2 quarters. Until that happens, we can see that Trulia is a phenomenally expensive stock vs. its peers.

If Trulia can continue bringing in record growth even while further increasing prices, then the best result in 2013 is likely to be somewhere between breakeven and $1-2 million per quarter in earnings. So in any event, even if Trulia achieves massive success in 2013, the valuation vs. current market cap will end up being a P/E in the range of 100-200x which is likely not a sustainable valuation over the course of 2013.

And in any event, a P/E of 100-200x certainly would provide adequate incentive and justification for insiders to sell as early as they can around the lockup.

| 2012 Revs | 2012 Income | Market cap | Users / Month | |

| Trulia | $68 M | ($11 M) | $892M | 23 m |

| Zillow | $117 M | $6 M | $1,500 M | 46 m |

| Move.com | $190 M | $6 M | $388 M | 15m |

Business prospects

There are several reasons why investors should not be banking of a seismic improvement in Trulia’s financials. In other words, Trulia may not be able to lock in the record revenues that would be necessary to take the company from being a money loser into a profitable company in 2013.

First, the current financial results have been achieved due to a large surge in subscribers even while Trulia raised its pricing to subscribers. This had mostly occurred as Trulia was coming public in its IPO and as the trigger-based lockup expiration was being calculated.

Further gains of any similar magnitude would require yet another dramatic increase in the number of subscribers even as subscription rates would need to be further increased by a substantial amount.

Second, the outcome of the lawsuit against Trulia by Zillow is still uncertain.

A few years ago, Zillow created what it calls “Zestimates” as a way to obtain a vague estimate of the value of a home based on data from public filings. When Trulia launched a very similar service, Zillow sued. The outcome of the lawsuit is uncertain; however, even a quick glance at Trulia’s website reveals numerous similarities to Zillow’s patented Zestimates. Likely remedies could include financial penalties along with an inability to continue providing the service for Trulia.

Third, order to justify the current $892 million valuation, the magnitude of the needed financial improvement is tremendous.

Trulia’s past financial performance is as follows:

| 2009 | 2010 | 2011 | 2012 | |

| Revenue | $10.3 m | $19.8 m | $38.5 m | $68.0m |

| Net income | ($7.0 m) | ($3.8 m) | ($6.1 m) | ($10.9 m) |

| EPS | ($0.40) | ($0.21) | ($0.92) | ($0.87) |

Assuming that costs will increase only half as fast as revenues, Trulia would have to achieve the following growth rates in order to provide the following valuations.

| Revenue growth | Revenue ($m) | Net income ($m) | P/E | P/Sales |

| 25% | $85.1 | -$3.4 | (283.3) | $11.48 |

| 50% | $102.1 | $2.6 | 372.5 | $9.57 |

| 100% | $136.2 | $14.8 | 66.2 | $7.18 |

| 200% | $204.2 | $39.1 | 25.0 | $4.78 |

As we can see, even if Trulia can double its revenue over the next year, it would still be trading on a P/E of 66x and a Price / Sales of 7x. Yet we can already see the law of diminishing returns kicking in as Trulia grows.

In contrast to the scorching growth when Trulia was a small startup, QoQ growth looks set to dip into the single digits going forward. If this ends up being the case, then even if Trulia can start earning a profit, its P/E ratio will be well over 100x.

Perhaps of greatest importance is that Trulia recently gave guidance that sequential revenues are set to increase by just 0-3% in Q1 2013. Quarterly revenue growth is shown as follows:

Instead of seeing even double-digit revenue growth, a much more likely scenario is that Trulia will show a more realistic level of growth, and the valuation will contract to more sensible levels. This growth pattern should be quite obvious to the insiders in Trulia who know the industry well. And as a result, there exists a very significant overhang risk as the 6 million shares under the lockup are now becoming free to trade.

It should become clear that if Trulia shows some meaningful growth and can achieve profitability, then a justifiable valuation for the company likely falls between $18-$22.

However, developments in the industry may keep Trulia from achieving the growth that it is hoping for and may impact its potential to become profitable in 2013-2014. Under such scenario, a price somewhere below $18.00 could become very justifiable for the market.

Industry developments

According to the WAV group, sites such as Zillow and Trulia have far less content than the MLS does. In addition, the content they have is substantially less accurate. Zillow and Trulia fail to list a significant portion of the houses that are available on the MLS.

For the houses that they do list, the information is often inaccurate or outdated. For example, when a house has been sold or the price has been reduced, the MLS will reflect it almost immediately. Third party sites such as Zillow and Trulia often do not make such updates for as long as 1-2 weeks.

A few months ago, Ben Caballero (founder and chairman of the National Association of Real Estate Professionals – NAREP) formed a non-profit group with the express purpose of combating the inaccurate listings posted on sites such as Zillow and Trulia.

Trulia conducted its own study of inaccurate listings on its own site and concluded that it was less than 10%. However, a study by the WAV Group had revealed that a whopping 36% of the active listings on Trulia and Zillow were in fact no longer active at all, as reflected in the MLS databases. Mr. Caballero states:

I have no doubt their slowness to purge expired listings is a deliberate strategy. If you believe they have a different reason for doing so, then I have some valuable swampland in central Florida I’d like to sell you.

To the extent that Zillow and Trulia end up being forced to remove as many as one third of their listings, the impact will be felt both in terms of monthly visitors as well as in advertising revenue.

In addition, it is now becoming the case that companies which provide the listings to Trulia and Zillow are beginning to cut them off or demand far greater restrictions on their use. For example, as of January 1st, Point2 Technologies (a listings syndicator) is giving control over the listing back to the brokers and placing substantial restrictions on their use by publishers such as Trulia and Zillow. As stated,

A new listings distribution policy from the industry’s second-largest real estate listings syndication platform strictly limits what publishers can do with data they get, and challenges the business models of some.

On the rental side, Zillow and Trulia have increasingly been experiencingrental fraud postings. The issue is big enough that both have had to address it on their websites.

Typically the poster will take an identical posting from a similar site, then make a few minor edits, while cutting the asking price by 30-40%. Such a price typically appears to be an exceptional bargain, and results in a large volume of calls from prospective renters. The scammers then try to get the interested party to send a small deposit check, or they try to get them to fill out a credit check application in an attempt to commit identity theft.

The obvious solution to this problem is to perform greater verification. Some verification is currently performed, but obviously not enough to prevent fraudsters from abusing the system. The consequence of a greater supervisory effort would of course be the fact that many of the listings would be removed.

Conclusion

The market is now going through a very visible bubble in technology stocks. The NASDAQ is now at levels not seen since the Big Bubble thirteen years ago. Tech stocks with an additional real estate focus are benefiting even more due to improved prospects for the real estate market going forward.

However, the valuations which have been awarded to Zillow and Trulia are now so expensive that even phenomenal growth over the next 2 years would fail to put them at any type of sensible market valuation.

In bull markets, investors and analysts often become quite complacent in terms of what they will pay and what they will accept. Investors are currently looking for excuses to buy, not to sell, as they chase the returns upward. Sell-side analysts are looking for excuses to raise price targets.

The historical precedent of a 180-day lockup is now being waived on various occasions because the market is so strong that companies and their bankers can simply get away with pushing the envelope a bit further than in the past. However, many investors seem to be unaware of the stealth lockup releases based on share price triggers. The result is that when insiders start unloading stock, share prices will suffer.

Trulia has 6 million shares which will be fully sellable in less than 3 weeks. By incorporating a triggered lockup release, insiders have already telegraphed their eagerness to sell into a strong market and their realization that time matters greatly in a bubble market.

Even in the best case scenarios, a very high rate of growth will simply not justify the valuation that is already in effect. Meanwhile, various headwinds, such as the initiative by the NAREP chairman and Point2 Technologies to get inaccurate and outdated listings pulled from Zillow and Trulia, could potentially have a large impact on the sites’ ability to attract viewers and achieve profits.

Even at prices which are 25-35% below current levels, both Trulia and Zillow would still be required to post very strong growth in order to justify their valuations.

Yet Trulia has given guidance of just 0-3% revenue growth in Q1.

With Trulia, the near-term catalyst for a sharp drop in the share price will be the onset of insider selling as it pertains to the 6 million locked up shares. That lockup expires on March 19th; however, additional heavy selling could occur early as long as the share price remains above $23.80.