MiMedx Group (MDXG) is a very interesting company which could potentially have a promising future. But at the current price there is now substantial downside risk with very little chance for further upside.

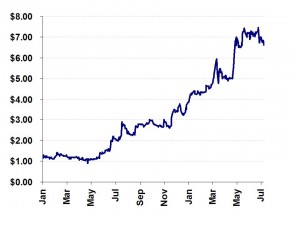

There have been a small number of factors which pushed its share price up by 60% in recent weeks, making its peak gains since 2012 in excess of 600%.

However, we are now seeing the convergence of several very strong and concrete sell catalysts which could presage a drop of at least 20-30% in the near term. The recent departure of the chairman and founder, along with his large sales of stock have already begun to cause the shares to start dropping daily. The next leg down will likely be the result of a massive S3 offering where other insiders will be cashing out. The total size for the S3 is a very large at nearly 25% of the company’s market cap.

MiMedx describes itself as a developer of “regenerative biomaterial products processed from human amniotic membrane”. The company collects human placentas via a donor program from mothers delivering their babies via C sections. These mothers can opt to donate the placenta rather than have it discarded as medical waste. The placentas are then processed into products which can be used to aid healing in traumatic wounds and burns.

The use of placentas in medical care has been around since the early 1900’s. However it dropped significantly in the 1980-1990’s due to concerns over hepatitis and HIV transmission.

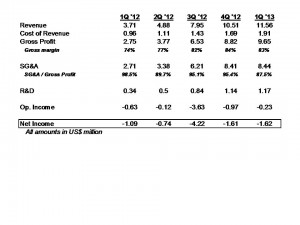

MiMedx now sports a fully diluted market cap of $660 million, however the company has never generated a profit. Total annual revenues stand at just $27 million. Revenues have been growing, but the net loss has been consistent for the past few years at around $8-12 million. As a result, the company has no retained earnings and instead has an “accumulated deficit” of $71 million.

At its current stage of development, the company must still spend very heavily on incremental sales and marketing spend to generate any additional revenue. As a result, there is not much chance that MiMedx will see profitability in the foreseeable future.

From its quarterly financials, we can see the following data:

– Gross margin is high due to low cost of donated placentas

– But typically around 90% of gross profit is consumed immediately by SG&A

– As a result, losses continue to grow despite slightly increasing revenues

On the balance sheet side, the company runs a very “asset light” business model with only $3 million in Property, Plant and Equipment. The current cash balance is only $5 million relative to a $2 million quarterly cash burn. Both of these factors mean that there is virtually no cushion of safety relative to its $660 million market cap.

The company now becomes difficult to value because there are no earnings and virtually no cash or even assets.

The stock has had a very good run this year, doubling from $3.84 to over $7.00 in June. Part of the run has been due to the company’suplisting to the NASDAQ in April. Prior to April, the company had been a relatively illiquid micro cap on the OTCBB. This event saw the share price immediately pop by nearly 40% from its then price of $5.00 to over $7.00. It is almost always the case that small OTC companies will experience a brief pop following their uplist to the mainstream NASDAQ.

The stock also benefited from being added to the Russell 2000, 3000 and Global Indexes on July 1st. Index rebalancing means that index tracking funds simply must buy the stock once it is added to the index, regardless of whether or not it may be poised for a near term decline. Once the stock was uplisted to the NASDAQ, getting it into the Russell was fairly straightforward and was almost guaranteed to provide a boost to the share price. The Russell indexes cover around 98% of all traded small cap stocks, so inclusion of MiMedx was almost a certainty.

Both of these recent catalysts delivered a boost to MiMedx shares, but in both cases they are short term boosts that were not the result of fundamental business changes.

There have recently emerged several very obvious “sell signals” at MiMedx.

The biggest question for shareholders to ask is “why should we keep holding as the company and the insiders are selling millions of shares at the top ?”.

First, MiMedx’s charismatic and well known Chairman (Steve Gorlin) juststepped down to pursue other interests as of June 26th. His resignation came shortly after the company was successfully uplisted to the NASDAQ. An 8K was filed, but there was no press release communicating the resignation to the street.

Mr. Gorlin had been Chairman since its inception in 2008. He has also been the influential founder of a host of other successful biotech companies including Hycor Biomedical, Theragenics Corp, CytRx Corp, Medicis, EntreMed, MRI Interventions, DARA BioSciences, and Medivation.

Mr. Gorlin is not just stepping down from MiMedx, he is also selling stock in large size.

In the past year, Mr. Gorlin has already sold over 1.1 million shares, including 50,000 shares which have been sold since the uplisting. His most recent sales were completed at $6.46, but his earlier sales from late 2012 were as low as $2.70.

When key leaders at a company decide to step down and sell their stock, it is always worth noticing. These are presumably the individuals that know the most about a company and the prospects for its share price. Even when they are stepping down, they always have the option of holding on to their shares. But in this case Mr. Gorlin has been selling heavily.

But the biggest catalyst for a potentially sharp move downwards is the filing of a massive S3 registration statement by MiMedx which allows for the sale of $150 million in stock – nearly one quarter of the market cap of the entire company. This statement was just filed in July.

Two thirds of the shares to be offered will be new shares, delivering up to $100 million in proceeds to the company. But one third of the shares (around $50 million worth) are coming from selling stock holders who are looking to exit their position in MiMedx.

Having $50 million in stock coming from selling shareholders sends a very strong sell signal to those who are still in the stock. Meanwhile a deal size which is around 25% of the company’s market cap is likely to cause an automatic drop of at least 20-30% once the shelf becomes effective in the next few weeks. This would imply a price somewhere below $5.00.

MiMedx is not a widely followed stock, with only two boutique analysts covering the company. Neither one is from a major Wall St. research house. However, these downward catalysts have not escaped the attention of some of the more astute shareholders. The share price has already begun to decline in the wake of Mr. Gorlin’s resignation and the filing of the S3.

The investors who are doing the selling are no doubt asking themselves why they should wait around as the company and insiders sell millions of shares into the market. The near term direction of the stock is now quite predictable.

Prior to Mr. Gorlin’s resignation 3 weeks ago, the stock had hit a new high of $7.72. Following the resignation, the stock quickly came off by around 10-15% before stabilizing. The shares had recovered to $7.00 by July 2nd. When the S3 was filed on July 3rd, the stock once again quickly dropped to $6.50.

The shares have continued to grind lower since that time and are now testing the $6.00 mark.

Predicting the actual offering price for the massive secondary is difficult for several reasons. First, the stock is up 600% since 2012. New investors will clearly require a substantial discount to ensure they are not buying at the top of a spike. Second, the size of the offering is so large that it will be difficult to manage in terms of daily trading volume and percentage of float. And third, given that the company still has minimal revenues, no profits and minimal assets or cash, there is no “intrinsic floor” above which MiMedx should trade.

As a result, an offering price of $4.50-5.00 is most likely to be the case. This represents about a 20-30% drop from current levels. At prices below $4.00 MiMedx starts to present an attractive buy. But at prices above $5.50, there is still clearly substantial downside. At prices above $5.50, MiMedx is clearly either an “avoid” or a “short”.

Company fundamentals – longer term prospects

Over the short term, the insider selling and the huge S3 offering will clearly control the direction of the share price. But once that overhang is removed, MiMedx will trade according to its fundamentals and performance. As a result, over the longer term, it is necessary to have a better understanding of the company’s products and their prospects.

MiMedx’s primary technologies are AmnioFix and EpiFix in tissue repair, which together constituted 95 % of revenues in 2012.

MiMedx went public via reverse merger in 2008, but it was only in 2011 that the company acquired its primary tissue repair business in the form of Surgical Biologics. At the time of the acquisition Surgical Biologics developed allografts (tissue transplants) processed from the membrane of the amniotic sac to be used for a wide range of medical applications including ocular surface repair, gum repair, wound care, nerve/tendon protection, spine surgery and burn treatment among others.

Following the 2011 acquisition, the new company launched what are now the company’s key products. First MiMedix launched AmnioFix to enhance soft tissue healing. The primary applications for AmnioFix are in surgical, sports medicine, and orthopedic medicine. Shortly thereafter the company launched EpiFix, a similar product but repurposed for enhancing wound care, especially the healing of chronic, hard to heal wounds such as burns and diabetic foot ulcers. MiMedx believes the wound care market is the largest opportunity. Both Products are derived from dehydrated Amnion/Chorion membrane (dHACM) using MiMedx’s proprietary purion process which produces dHACM from donated amniotic sacs. To protect the critical IP of the Purion process, MiMedx has 5 issued patents, and over 20 pending. The key to the effectiveness of both products are the numerous growth factors, cytokines, and extracellular matrix proteins in dHACM. Not only do the company’s products reduce time, but also total cost to heal a soft tissue injury. Notably, MiMedx’s products also have a five year shelf life at room temperature.

A key distinction between MiMedx and other companies with novel healthcare offerings is that MiMedx’s products have not been approved or reviewed by the FDA as they qualify for section 361 of the Public Health Service Act. As stated by MiMedx’s 10-K, if a product qualifies for Section 361, “no FDA review for safety and effectiveness under a drug, device, or biological product marketing application is required.”

While the company has already implanted its products in many patients, it is impossible to know the exact impact of this regulatory difference over the long term. The most notable risk from this specialized classification is the possibility that the FDA could reclassify it. Obviously this would be enormously detrimental to MiMedx’s businesses, as the company could potentially be forced to apply through the typical lengthy and expensive FDA approval process. As stated in the 10-K, “We also cannot assure you that the FDA will not impose more stringent definitions with respect to products that qualify as 361 HCT/Ps.”

To qualify for section 361, a product must be minimally manipulated (from the original tissue), intended for homologous use, manufactured with nothing except water, crystalloids, or sterilizing/preservative agents, and not dependent on living cells for its primary function. It appears that if the definition of homologous use were made more stringent, MiMedx could be at risk.

MiMedx has experienced strong revenue growth as the company’s products have been adopted in various situations requiring regenerative therapy. Of 2012’s $27.1 million in total revenue, 48 % was derived from surgical and sports medicine (AmnioFix), 42 % was derived from wound care (EpiFix), and 10 % was derived from other sources. However, the company expects EpiFix sales to overtake AmnioFix sales. Following the departure of founder Steve Gorlin, MiMedx is run by Chairman and CEO Pete Petite.

Conclusion

MiMedx is an interesting company with an interesting product. Regardless of whether investors are selling at $5.00 or $7.00 the stock can still be considered a homerun vs. its price of just $1.00 last year.

Revenues continue to grow, but the required SG&A spend has continued to prevent MiMedx from breaking a profit. The company has only $5 million in cash and only $3 million of Property, Plant and Equipment.

Given that the company now sports a $660 million market cap, it is easy to see why recently departed founder Steve Gorlin and other insiders have been quick to want to sell millions of shares at current prices.

The S3 statement sets MiMedx up to offer $150 million in stock, roughly one quarter of the company’s current market cap. As a result of the size and the large component which is insider sales, the upcoming offering will most likely be priced below $5.00.

The insider selling and the massive S3 overhang mean that the next 20-30% of downside in the stock is highly probable in the near term.

But at prices of $4.00-5.00, the stock could start to become an attractive buy depending on how the business continues to build. It should be kept in mind that at prices of $4.00-5.00 (post offering) MiMedx will be very well funded with over $100 million in cash. In addition, the overhang from selling insiders will have been removed. Both of these strengthen the buy argument for MiMedx at prices of $4.00-5.00.