Summary

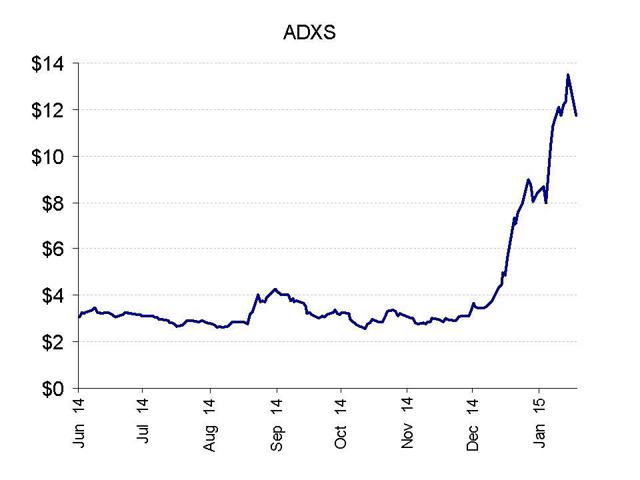

- Advaxis stock has recently quadrupled from $3 to as high as $13.

- Management has a history of promotional and misleading activities, including heavy use of the Dream Team Group.

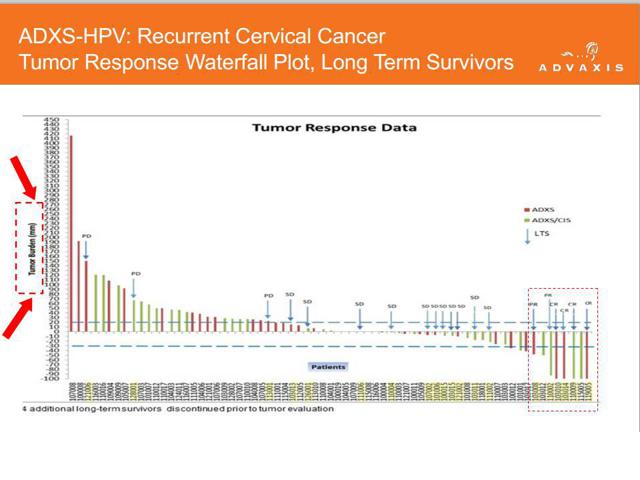

- Tumor response data for its lead candidate has been mis-presented to overstate effectiveness.

- ADXS-HPV has demonstrated notably inferior survival rates vs. alternatives.

- Over 3 million warrant shares are set to hit the market following registration by Advaxis.

This article is the opinion of the author. Nothing herein comprises a recommendation to buy or sell any security. The author is short ADXS. The author may choose to transact in securities of one or more companies mentioned within this article within the next 72 hours. The author has relied upon publicly available information gathered from sources, which are believed to be reliable and has included links to various sources of information within this article. However, while the author believes these sources to be reliable, the author provides no guarantee either expressly or implied.

We are just a few weeks into the year, and already shares of Advaxis (NASDAQ:ADXS) are up by more than 60%. But that’s nothing. The shares have fully quadrupled since their November lows.

Advaxis stock has suddenly become extremely liquid, trading 2-4 million shares per day. It also has liquid calls and puts.

There are a number of factors driving Advaxis’ share price recently. Part of the rise is due to the rise in other biotechs, such as Kite Pharma (NASDAQ:KITE) and Juno (NASDAQ:JUNO), with Advaxis rising in sympathy.

Kite and Juno were both recent IPOs which have been very well received due to their apparent prospects in immuno-oncology therapies. Those who promote Advaxis do so by claiming that tiny Advaxis is also on the way to a multibillion dollar market cap along with Kite and Juno.

But Advaxis is not Kite, nor is it Juno. The underlying technology is fundamentally different, although this has clearly been lost on the mostly retail investor base.

Advaxis has been around for 13 years and yet has only completed a single Phase 2 trial. That trial had to be run in India, in just a single site. Despite the obvious problems with the Phase 2 study (described below), Advaxis has made the questionable decision to take it into Phase 3 trials. This “decision” has also served to boost the stock. But in Phase 3, Advaxis is actually using an entirely different study design – meaning that it cannot even guess what the results might be. It is pure nonsense.

This is why Advaxis had previously spent much of its life as a 10 cent busted reverse merger biotech. In 2013, the company did a massive 1:125 reverse split to get the stock above $3 so that it could list on NASDAQ. However, the stock frequently continued to languish below $3.00 even after its uplisting. Even after completion of its only Phase 2 study, Advaxis was still sitting at well below $3.00.

It is clear that it is not some major clinical progress that has driven Advaxis to quadruple. Instead, much of it has been simply heavy promotion. Well designed stock promotions can easily have an explosive effect on micro caps, causing them to briefly surge by hundreds of percent before giving up all of their gains. Examples are shown below.

If history is any guide, we will see a sharp decline in Advaxis very quickly, taking the stock back to around $4-5 where it was in December. This is simply another heavily promoted, retail driven microcap stock being traded by technical day traders for the moment. Advaxis is held more than 70% by retail investors such that it is often subject to much wilder swings on sentiment than stocks which have broad institutional holdings.

Yet despite the obvious problems with Advaxis, it is unlikely to fall to zero any time soon. There is enough positive sentiment for immuno-oncology stocks that Advaxis will continue to be able to issue more stock in equity offerings as long as the offering price is low enough. This is why we will see prices around $4-5 and not prices of $1-2.

The recent registration of over 3 million warrant shares may be the catalyst for the decline when those shares hit the market. The company raised $17 million in December at $4.25. But since then the share price has tripled and volume has surged. As a result, I fully expect the company to undertake an even larger equity offering very quickly. This will further pressure the share price back down to $4-5. I expect that such an offering could already be in the works and could come any day now.

Advaxis and its management have a visible history of promotional activities and misleading investors which should be of concern to those who are buying the stock at such lofty current levels.

Former Advaxis CEO Thomas Moore was charged by the SEC with misleading and defrauding investors in his previous company, Biopure. He had the company issue promotional statements which caused the stock to jump above $7.00 per share. He then used the spike in price and volume to raise $35 million in an equity offering. As the negative truth eventually filtered out, the stock plunged by 60% – initially. Biopure eventually filed for bankruptcywithout ever receiving FDA approval for its products.

From the SEC complaint:

In 2003, Biopure Corporation (“Biopure”), and its chief executive officer, head of regulatory affairs and general counsel engaged in a fraudulent scheme to misrepresent and conceal from investors the truth about its applications for Food and Drug Administration (“FDA”) approval of Hemopure….two days after receiving the complete response letter from the FDA, Biopure issued a fraudulent and misleading press release that gave the false impression the company had received positive news from the FDA. That day, Biopure’s stock closed at $7.30 per share, a 22% increase over its previous day close. For four additional months from August until December 1 1,2003, Biopure continued to conceal from investors that it had received a complete response letter from the FDA, continued to make false statements about its dealings with the FDA and failed to disclose the true scope and nature of the deficiencies with the BLA identified by the FDA. Indeed, on one occasion in September 2003, Biopure disclosed in a prospectus filed with the Commission that the July 30 letter it received was a complete response letter. When Biopure’s stock price dropped on heavy trading, the company told investors that the reference to the letter as a complete response letter was a “mistake” by a “junior lawyer at a law firm” retained by the company. The disclosure was quickly “fixed” with the filing of an amended prospectus that omitted the reference to the letter as a “complete response letter.” As the truth about Biopure’s applications for FDA approval gradually became public, through a series of incomplete disclosures, the market reacted. As of year-end 2003, Biopure stock was trading below $3.00 per share.

Moore was replaced as Advaxis’ CEO by current CEO Daniel O’ Connor in 2013. However, he did not immediately leave the company. Instead, Moore stayed on as a “consultant.” With O’Connor at the helm as new CEO and Moore as its consultant, Advaxis began making use of stock promotion firm “the Dream Team Group.”

For those who are not familiar with the Dream Team, it is a stock promotion firm that was responsible for publishing hundreds of articles on a wide variety of investment sites promoting various biotech stocks using impressive sounding authors. However, all of the articles were bought and paid for by the client companies and the supposed medical expert “authors” were simply fabricated identities.

Fake posters were also used to infiltrate message boards and social media sites such as Twitter to create the appearance of broad support for companies.

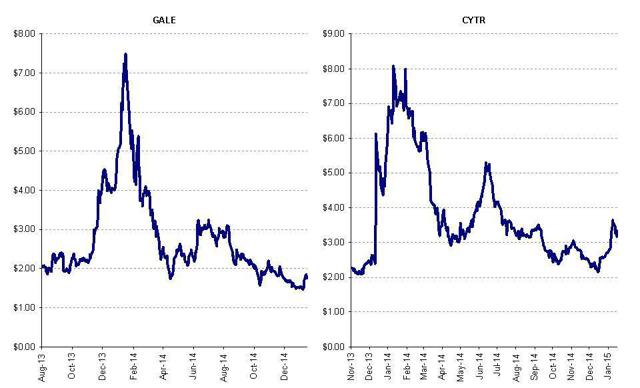

I first exposed the activities of this group in an article last year entitled “Behind The Scenes With Dream Team, CytRx And Galena“. Following that article, hundreds of their articles were removed from a wide variety of investment web sites. For those who wish to understand how powerful stock promotions can fuel stock prices, I strongly recommend reading that article.

Like Advaxis, shares of heavily promoted biotechs CytRx (NASDAQ:CYTR) and Galena (GALE) had quickly soared by hundreds of percent. Following my exposé of the promotion scheme they quickly crashed by 60-80%. I expect that Advaxis will do the same. The graphs below illustrate what we will see with Advaxis: first the promoted quadruple, then the rapid implosion as day traders rush to exit.

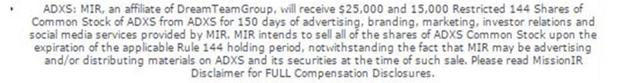

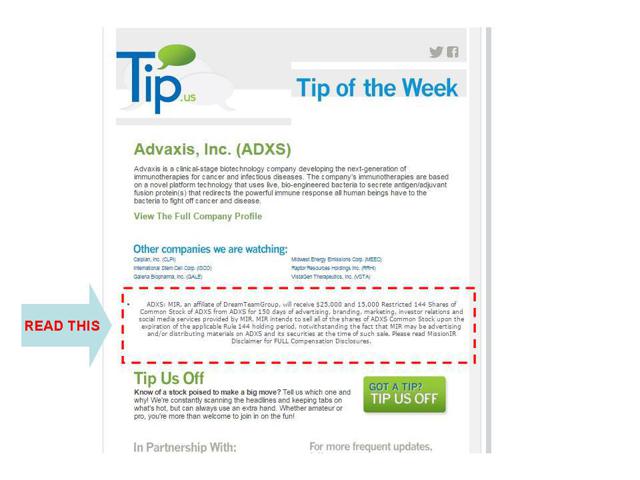

A screenshot showing the disclosure of payment of $45,000 from Advaxis can be found here for one campaign.

From a separate campaign (shown below) DTG received $25,000 and 15,000 shares of stock. The disclosure noted that:

Meanwhile, the Dream Team and its Mission IR subsidiary made Advaxis the focus of a successful case study on stock promotion for their marketing materials, boasting about:

A comprehensive social media relations campaign to broadcast ADXS news, blogs/articles, stock activity and investment highlights to an audience of more than 1.7 million viewers.

The most recent spark which lit up the stock was an investment in December by Adage Capital, upping their stake to over $20 million in Advaxis. Retail investors therefore take the view that Adage has done deep due diligence and is making a concentrated bet on Advaxis. The reality is that Adage manages over $25 billion such that this position represents less than 0.001 of their holdings. The point is that what looks like a large position to retail investors is actually a miniscule position to Adage. The strategy that firms like Adage take is to hold numerous highly volatile small cap stocks based on a sector allocation (such as immuno-oncology) and then buy in at rock bottom prices. Some of them are bound to be doubles and triples just like Advaxis has already been since Adage last bought at $4.25.

But the risk / reward proposition is entirely different for retail investors who are chasing it higher at prices north of $13.00. Investors need to keep in mind that even when the stock falls to $5.00, Adage will still be making a very attractive return on its overall investment. The same will not be true for those who are buying at current levels.

Ultimately what matters for Advaxis will be the fundamentals. And with Advaxis, there are major fundamental problems.

How is Advaxis misleading investors?

The most important point to view with Advaxis comes from their recent corporate presentation. In it is a slide that highlights “tumor response data” for its ADXS-HPV. The data has been mis-presented to overstate how effective the drug is in shrinking tumors.

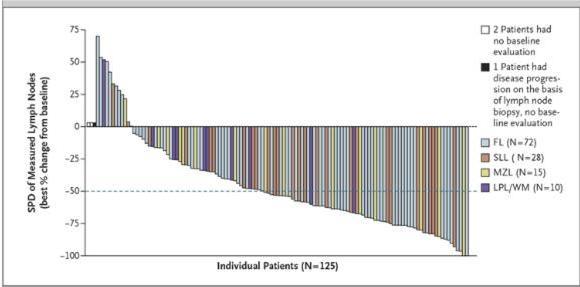

ADXS-HPV is Advaxis’ lead compound and is currently being pushed into Phase 3 trials based on this information. The chart highlights each patient and the height / direction of the bar on the graph illustrates the tumor response rate.

The overwhelming standard for displaying such information is to display it in percentage terms so that we can compare the response across tumor sizes between patients. Here are 3 examples from the New England Journal of Medicine which demonstrate this standard:

http://www.nejm.org/doi/full/10.1056/NEJMoa1314583 (figure 1)

http://www.nejm.org/doi/full/10.1056/NEJMoa1302369 (figure 1)

http://www.nejm.org/doi/full/10.1056/NEJMoa1006448 (figure 2)

This is how example #1 looks. Notice it is measured in percentage terms. Notice also the massive “skew” to the right. This shows that in most cases there is heavy percentage shrinkage of the tumor. That is what these studies are hoping to achieve.

But what we see with Advaxis is entirely different. In fact, it is almost meaningless.

Advaxis displays their information in millimeters rather than percent. But (more importantly) they also conveniently cut off the data at minus 100 millimeters. This clearly gives the impression that the “minus 100’s” are all minus 100%, indicating a complete response. So in other words, they created a chart which is meant to look like the standard chart, but which overstates their results.

If a 100 mm tumor shrinks by 100 mm, then that is a fantastic result. But if the tumor size was 1,500 mm then a 100 mm shrink is nearly irrelevant. This is why the data is virtually meaningless.

Notice also the skew is to the left, meaning that more of the tumors tend to increase in size rather than decrease.

Once we realize that this data is displayed in millimeters and not in percent, the problem becomes evident. Many of the patients who would have otherwise been classified as “partial response” or “complete response” are in fact not categorized with any response at all. We can see that this is a transparent attempt to massage the data into making ADXS-HPV look more effective than it really is. (Author’s Note: I took a screen shot of Advaxis’ presentation just prior to publication of my article. Since publication of the article it appears that the company has updated the presentation to reflect tumor shrinkage data in %, not millimeters.)

Overall, just 6 patients out of 110 generated any response (complete or partial) whatsoever. That is less than a 6% response rate. Yet based on this, Advaxis has made the “decision” to go into Phase 3 trials. It is nonsense.

Why does this matter?

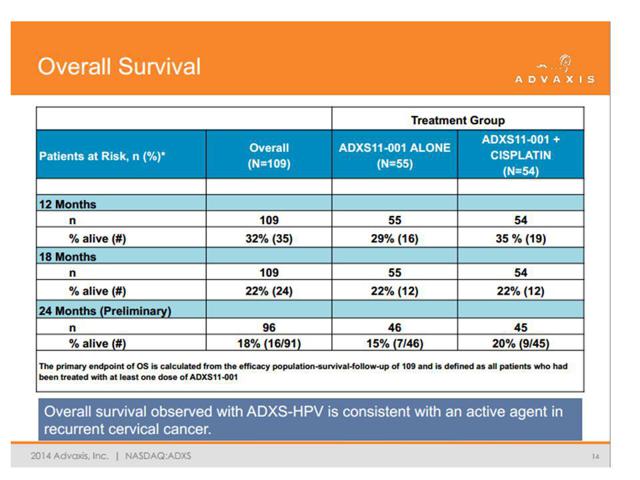

In an older copy of their corporate presentation, we can see a page which highlights the overall survival statistics for ADXS-HPV. This page was then quietly removed from the presentation, but I made sure to save a copy. The reason Advaxis removed the page should be obvious when reading below. The newly revised corporate presentation can be found here.

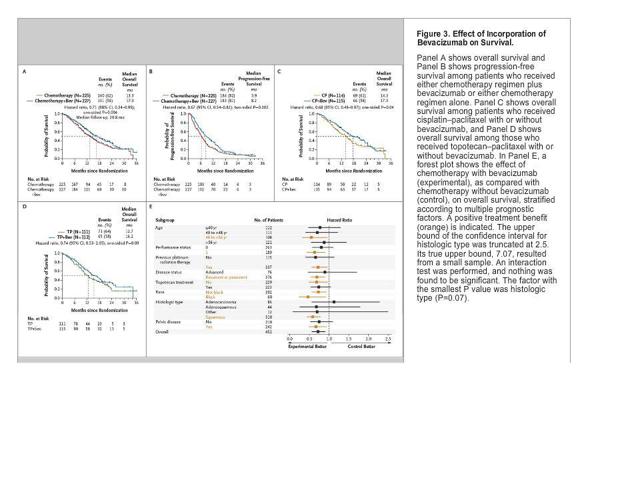

The problem is that after 12 months we can see a survival rate of just 29-35% in the two arms of the study. This is less than half of what was reported in a 2014 study using Avastin (bevacizumab) as reported in the New England Journal of Medicine (see Figure 3c below.)

Using some common sense on clinical trials

Many retail investors think that they understand the clinical trial process, but oftentimes they clearly do not. A great detailed explanation can be found in the report “Why Do So Many Phase 3 Clinical Trials Fail?“

One thing that retail investors routinely fail to understand is that drugs do not “pass” Phase 2 trials. Instead, companies gather data and then decide for themselves whether or not to proceed into Phase 3.

So why do so many expensive phase 3 trials fail ? It is because many companies will proceed into Phase 3 even when their prospects are marginal because it provides a much needed boost to the stock price. The companies can then raise enough money that they can attempt to proceed with other drugs even if the main drug fails in Phase 3. This happens very commonly in small cap biotech.

Investors need to keep in mind that most clinical trials for new drugs make use of multiple trial sites in reliable test markets such as the US or Western Europe. But with Advaxis, the company made use of just a single trial site located in India. It is very often the case that such results cannot be reproduced once actual rigor is added into the equation in a real Phase 3 trial. Inability to replicate seemingly strong Phase 2 data is why a very large number of drugs end up handily completing phase 2 trials only to fail phase 3 trials.

Adam Feuerstein of TheStreet.com highlighted several other problems with the Phase 2 trial. The study did not have a true control arm and there was no difference in overall survival between the two arms of the study.

Feuerstein noted that:

An objective comparison between these two studies doesn’t exactly justify the optimism which Advaxis claims to see in the ADXS-HPV data. If the vaccine were truly effective, we should be seeing a stronger synergistic effect between ADXS-HPV and cisplatin. Instead, we see a median overall survival of 8.5 months for ADXS-HPV plus cisplatinin the Advaxis study compared to 8.9 months for cisplatin alone in the Moore study. Not exactly confidence inspiring…Unfortunately, I’m not sure Advaxis’ next step with ADXS-HPV will tell us much more about the vaccine’s efficacy. An ongoing, U.S.-based phase II study is set up to enroll only 67 patients with recurrent cervical cancer. The study isn’t randomized and has no control arm.

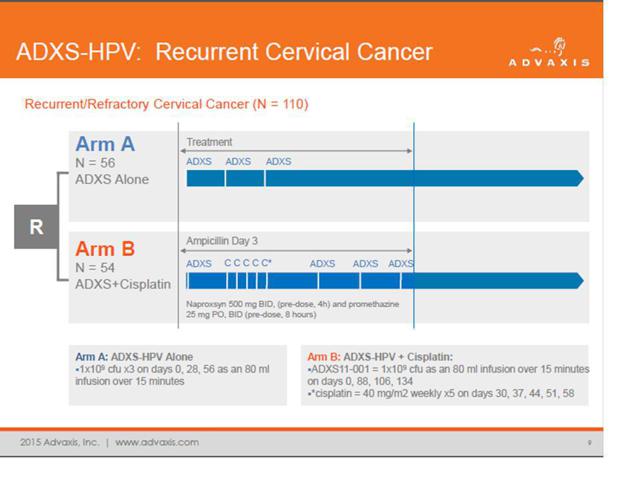

Complicating matters further, the structure of the Phase 3 trial has been radically changed from that of the Phase 2 trial.

From the presentation, we can see the following description of the Phase 2 design. Basically it was a comparison of ADXS-HPV alone vs. ADXS-HPV + Cisplatin.

Yet from a recent press release, Advaxis states:

Under the proposed collaboration, the GOG Foundation and Advaxis will conduct an adequate and well-controlled Phase 3 clinical trial of concurrent chemotherapy and radiation therapy (CCRT) compared to CCRT combined with ADXS-HPV in women diagnosed with high-risk, locally advanced cervical cancer. Prior to commencing this study, Advaxis will discuss the proposed Phase 3 program with the U.S. Food and Drug Administration (FDA) and will update its investigational new drug (IND) submission. FDA may request additional information at that time, and Advaxis will work expeditiously to respond to any such requests.

So Advaxis is now comparing ADXS-HPV with chemo and radiotherapy (CCRT) to CCRT alone. This is entirely different than what was done in the Phase 2 trial in India which simply compared ADXS-HPV with and without Cisplatin. This means that Advaxis (and investors) have no idea what results to expect from the new study.

Such an approach is quite literally preposterous. Basically Advaxis is proceeding into a Phase 3 trial without having even performed a comparable Phase 2 trial first !!

Conclusion

Shares of Advaxis have soared due to excess hype and promotion. But there is a very clear reason why this stock has spent most of its 13 year life being valued at less than $100 million in market cap.

The only reason that Advaxis is drawing investors is that the hype surrounding immuno-oncology is so strong in companies such as Kite and Juno. In order to keep hope alive, Advaxis is pursuing combo studies with drugs from other pharmas such as Merck and Medimmune. However these are simply Phase 1/2 studies.

With its lead compound ADXS-HPV, we can see that Advaxis appears to be manipulating information to puff up an otherwise inferior drug. Studies of alternate cervical cancer drugs have produced far better results as recently as 2014.

The structure of Advaxis’ Phase 2 clinical trial in India is highly problematic. This is further illustrated by the attempt to change the trial design to something new and untested in Phase 3.

These problems are so absurd that there is clearly no reason for Advaxis’ stock to be surging – aside from heavy promotion and a huge contingent of technical driven retail traders.

As shown above, management has a history of fraudulent dealings and use of stock promotion firms including the Dream Team Group.

The run up in the stock from $3 to over $13 is quite clearly artificial and unsustainable and it will quickly reverse itself. On January 6th, (just as the stock was really starting to run) Advaxis filed a post effective amendment to its S3 filing allowing for the sale of over 3 million shares underlying previously issued warrants. This represents nearly 15% of shares outstanding. As these shares begin to hit the market, they will be the catalyst which breaks the momentum on the stock and sends it back to around $4-5 where it began. A second catalyst will be a very predictable second equity offering from Advaxis, taking full advantage of the spike in price and volume.