Summary

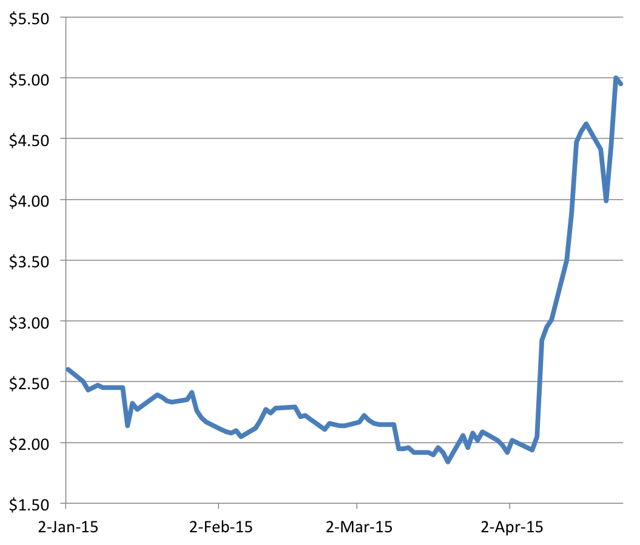

- AirMedia has more than doubled in the past few weeks based solely on a supposed “investment” by A share company Shenzhen Liantronics.

- AirMedia did not disclose the actual contract, but did put out a press release touting a $500 million valuation.

- The real contract reveals that there is no binding deal. In fact, Liantronics has not even conducted due diligence. Liantronics management has verified key details.

- We have seen similar “investment” ploys by NQ Mobile and Pingtan marine which briefly spiked their stocks before they quickly crashed.

- AirMedia should quickly correct back to the $2.00 level from where it started (down by 50-60%).

This article is the opinion of the author. Nothing herein comprises a recommendation to buy or sell any security. The author is short AMCN. The author may choose to transact in securities of one or more companies mentioned within this article within the next 72 hours. The author has relied upon publicly available information gathered from sources, which are believed to be reliable and has included links to various sources of information within this article. However, while the author believes these sources to be reliable, the author provides no guarantee either expressly or implied.

Definition of “sham” – noun: something that is not what it purports to be;

Investment overview

Shares of Chinese small cap AirMedia have jumped as much as 150% in the past few weeks based solely on an announcement that A share listed Shenzhen Liantronics is taking a 5% stake in an AirMedia subsidiary, valuing the company at $500 million. But Liantronics is telling a very different story, saying that it hasn’t even conducted due diligence.

Institutional ownership of AirMedia stands at just 8.6%. As we can see from various chat rooms and Twitter feeds, the main parties boosting the stock are simply headline focused day traders looking to ride the pop on the “news.” There has been no reference to or analysis on any terms of the supposed deal or even basic analysis of the recently released annual report.

The stock has largely been hyped by such retail day trader sites such as:

AirMedia never disclosed the actual contract, but I have obtained a copy and it shows that the deal is very unlikely to go through due to unrealistic clauses which are entirely unachievable. These clauses were deliberately included to protect Liantronics. As a result, Liantronics has also ensured that it has retained full ability to back out of the deal by including a “put option.”

On Friday, shares of AirMedia plunged by nearly 20% on high volume in pre-market trading. Traders were left to wonder why. In fact, this was just after the annual report was released on Friday. Investors who bothered to read it clearly found just slight reference to just some of the actual proposed terms being described. For investors who read and understand them, these small references show that the deal basically will not go through at all. Of greater concern is that the worst of these terms are not even disclosed in the 20F at all, nor is the actual contract itself.

The point is that AirMedia has no deal.

In fact, we have seen nearly identical “investment deals” in the past for Chinese companies such as NQ Mobile (NQ) and Pingtan Marine (NASDAQ:PME). After an initial surge, the stocks cratered each time. The reason was the same: the reality was that there was simply “no deal.”

It is notable that AirMedia had also done a similar “investment” deal in 2013 with a different supplier by the name of Elec-Tech. That deal (perhaps by coincidence) also supposedly valued AirMedia at $500 million, but with no lasting effect on the share price once investors read the actual terms.

Had AirMedia disclosed the actual contract for the supposed Liantronics deal, the stock never would have risen in the first place. I expect the stock to quickly fall back to around $2.00 where it began before the misleading press release.

This will become entirely clear below.

Part I: Background of AirMedia

As recently as April 7th, shares of AirMedia Group (NASDAQ:AMCN) were trading below $2.00, valuing the company at just $100 million. Basically, it was trading at the value of its cash on hand with no value attributed to the business itself.

As we will see, there are ample reasons for this pessimism towards AirMedia.

AirMedia is in the advertising business in China, placing ad screens on planes and trains as well as outside of gas stations. The stock took a beating in 2011 because it was in the same space as China Media Express (former ticker CCME). CCME was in the business of placing ad screens on intercity buses in China, but it imploded due to fraud when it was found that many of its screens simply did not exist. AirMedia’s stock remained distressed for the past four years and never recovered until the past few weeks.

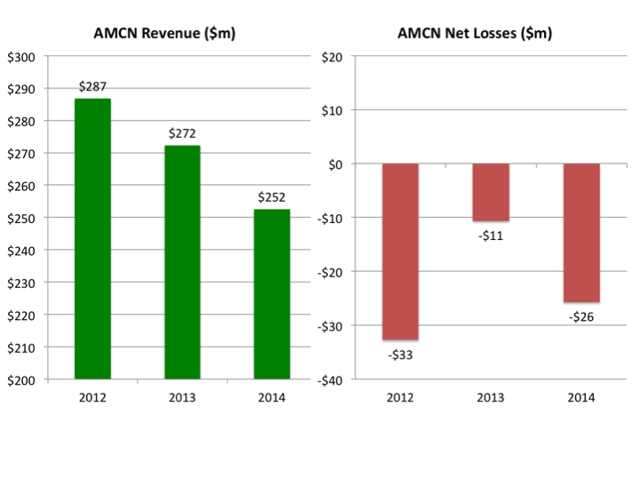

AirMedia has lost money every year for the past 5 years and revenues continue to plunge every year. The company recently gave partial guidancethat results were set to continue their downward slide, repeatedly citing “a soft advertising market” as the cause for ongoing declines.

In April 2015, the company announced that it had obtained concession rightsto provide WiFi service on low speed (“ordinary”) trains on the Shanghai line as well as on high and low speed trains in Jinan. The problem is that AirMedia is not making any money off of WiFi.

In the Shanghai press release, AirMedia had noted that it already had substantial involvement in WiFi:

Before obtaining the aforementioned concession right, AirMedia was granted concession rights to install and operate Wi-Fi systems on the high-speed trains operated by Beijing Railway Bureau, Shanghai Railway Bureau and Guangzhou Railway (Group) Corporation, with which AirMedia established a leading position in Wi-Fi services on high-speed trains in China, in terms of the number of high-speed trains on which it has concession rights to operate on-train Wi-Fi systems. In addition, AirMedia also holds the concession rights to install and operate Wi-Fi systems on ordinary trains operated by Xinjiang Railway Bureau.

What you need to know: Despite already operating on some of the largest railways in China during 2014, we can see from the annual 20F report that this WiFi business has so far generated so little revenue that it is not even broken out for financial reporting purposes.

For anyone who has reviewed the Q&A most recent conference call, it should be clear that company does not yet have a coherent strategy to monetize the WiFi on trains idea, even though they continue to bid on more and more concessions.

So the first point is that this business has generated minimal revenues so far, even though it requires large concession payments. The second point is that around 80% of the company’s business continues to be comprised of providing advertising on screens in airports (WiFi is still a negligible business).

Airport advertising is AirMedia’s primary business and it is why AirMedia loses so much money. This just so happens to be the money losing business in which Shenzhen Liantronics is supposedly going to invest. (Note: these financials become very important when viewing the contract below.)

AirMedia has also tried to divest itself of its worst money losing units, but these were so also minor in size that they do not move the needle much in terms of achieving overall profitability. This should also be clear to anyone who has read the recent annual 20F report.

AirMedia has seen significant turnover in CFOs, reporting the resignation and replacement of its CFO nearly every year for the past 5 years. In 2011 (just after the implosion of China Media Express), the entire finance team quit at once. AirMedia had disclosed that “During the year ended December 31, 2011, we experienced turnover in the chief financial officer, the financial controller, and the financial reporting director and other key positions within the accounting and financial reporting department.”

The point of all of this is simply that there are ample reasons why the stock has historically traded simply at cash value, with investors attributing no value to the underlying business.

Part II: The pump on AirMedia – stock doubles within days

On April 8th, AirMedia’s stock jumped by more than 40%, suddenly trading nearly $40 million in volume when it announced that Shenzhen Liantronics would invest $25 million for a 5% stake in an AirMedia subsidiary. As pointed out by AirMedia, this would imply a value for the entire company at RMB 3 billion (equivalent to approx. $500 million).

Liantronics (SHE:300269) is a US$2 billion market cap company listed on China’s A share market. The company manufactures LED advertising displays.

Chinese brokerage firm Sinolink Securities was quick to add fuel to the fire, speculating that Liantronics was angling to buy the remaining 95% of the company and that the implied price would be US$8-10. AirMedia quickly jumped by an additional 50%.

It is this speculation (that the entire company will be bought out at $8-10) that has been the biggest cause for the spike in the share price.

As a result of the continued speculation, AirMedia have spiked even further. The shares have now more than doubled and have hit 5-year highs.

At the current price, AirMedia is valued at nearly $300 million. This is more than double its recent levels, but still only around half of the “implied” investment value as stated by AirMedia and Sinolink. Retail day traders who are buying into AirMedia still clearly see it as an implied double from here.

Key investment thesis

AirMedia will quickly fall by at least 50-60% back to its original level of around $2.00.

What is important to note here is that AirMedia only put out a simple press release touting the headline “investment” terms by Liantronics. AirMedia did NOT actually disclose the actual contract with Liantronics. Even in the recent 20F filing, the actual contract (which, if real, should have certainly been deemed to be material) has not been disclosed.

There is only an “equity pledge agreement” where Liantronics is not even a signatory. Again, Liantronics has not signed this agreement as disclosed by AirMedia.

More importantly, the equity pledge agreement shown by AirMedia does not include the key terms of the actual contract. It is these key terms that virtually ensure that there will be no deal for the AirMedia subsidiary and that gives Liantronics the right to take back all of its money.

The most important point here is that had AirMedia disseminated the full contract allowing investors to see the real terms of the deal, the stock never would have risen in the first place.

At best, this transaction may provide a short-term loan to AirMedia which must quickly be repaid. At worst, the money will never be transferred in the first place

Part III: How do I know the investment by Liantronics is a sham ?

First, because I found a copy of the actual contract via Liantronics.Second, because I actually spoke with Liantronics to get the real information.

The actual contract has not been disseminated in English so no one seems to have found it yet. The research by Sinolink makes no reference to these actual terms and only refers to the press release from AirMedia.

For easy reference, readers can flip to the bottom of the contract to see that it is indeed signed by Shenzhen Liantronics and that the date is April 7th, 2015. This is the same date as the announcement by AirMedia and is the same date as specified on AirMedia’s vague “equity pledge agreement.”

Here is a copy of the Chinese version of the contract from Liantronics.

Here is a copy of the translated version of the contract.

For those who wish to double check, they can also use Google Translate to verify.

Point #1: The inclusion of nonsense conditions means that the deal will never happen

Note: Within the contract, the parties are specified as follows:

Party A:Beijing Shengshi Lianhe Advertising Co. Ltd i.e. the transferor

甲方: 北京盛世联合广告有限公司

Party B: Shenzhen Liantronics Co. Ltd

乙方: 深圳市联建光电股份有限公司

Party C:AirMedia Advertising Group Co. Ltd

丙方: 航美传媒集团有限公司

In order for the investment to go through, the contract specifies that the AirMedia subsidiary earn an AUDITED PROFIT in 2015 of RMB 200 million. That is equal to approximately US$31 million. If this does not happen, then Liantronics simply gets its “investment” back plus a 10% annual cost of funds fee.

Readers may wish to pause for a moment now and start frantically hitting the sell button.

Because the odds of the sub earning a profit of $31 million are basically zero. It was a “nonsense” condition that was included because it simply allows Liantronics to back out.

It is also worth noting that because the requirement is for AUDITED numbers for 2015, any investment from Liantronics could not even be finalized until after that audit is complete sometime in 2016.

Perhaps of greatest importance is the fact that nearly 50% of the concessions which will be placed into the subsidiary EXPIRE by the end of 2015. This is why Liantronics structured the deal the way they did. Again, this is of key importance. Because it shows that once Liantronics does complete due diligence, there will simply be no way for AirMedia to earn a profit of $31 million.

In the contract, it is noted that the “basis for pricing” was the net profit of RMB 200 million (equivalent to US$31 million)

The Basis for pricing:is according to Party C’s 100% stock right, which after the promised audit comes up to a net profit of RMB 200,000,000 in 2015.

In Chinese:

2、定价依据:以丙方100%股权在2015年承诺的经审计的扣非后的净利润2亿元为定价依据

It is also specifically noted that in the event that the transaction is deemed null and void, then Liantronics must be paid back the entire investment plus 10% annualized cost of funds.

Should the authorized decision maker of Party A or Party B regards this transaction null and void due to non-compliance with the decision-making process or other legal reasons, Party A must pay RMB150,000,000 to Party B within 5 working days receiving the notice for repurchasing Party C’s 5% equity, as well as pay Part B 10% of the annual cost of the capital as the payment for the use of the funds, from the very next day when Party A receives the full amount of the transaction under this agreement until the repurchase of the share is completed.

In Chinese:

如本次交易被甲方或丙方有权决策机构因未履行决策程序或其他法定事由 而认定为无效的,则甲方需在收到乙方通知后的5个工作日内以人民币1.5亿元现 金回购乙方购买的丙方5%的股权,并按照10%的年资金成本向乙方支付资金占 用费,占用期为甲方收到本协议下全部交易金额的次日至股权回购完成日。

AirMedia has lost money 5 years running. That much is obvious. But we can see by looking at total revenues and concession fees that the sub business can’t possibly earn this much profit (if, in fact, there is even ANY profit at all).

AirMedia disclosed during its March conference call that

AirMedia currently expects its net revenue for the first quarter of 2015 to range from US$53 million to US$56 million…… AirMedia currently expects its concession fees to be approximately US$45 million in the first quarter of 2015.

There are two points here. First, revenues are declining significantly. In Q4 last year, AirMedia did $65 million in revenues, so they will show sequential decline of around 15%.

Second, we can see that GROSS profit for the entire business, including all of the airport advertising and including the other advertising and WiFi businesses comes to just $10 million per quarter. And this is before SG&A and all other operating expenses. In Q4, SG&A alone ran at $15 million (more than all projected gross profit).

In 2014 (the full year), the GROSS profit of the entire company was just $16.6 million. Selling and marketing alone amounted to $25 million while G&A expenses ran at $26 million. Again, EACH of these is well more than the gross profit for the entire company. For the full year, operating losses amounted to $35 million. After adjustments, net losses still came to $26 million.

The point is that Liantronics set an unobtainable hurdle of RMB 200 million (US$31 million) in profit. It is a win-win for Liantronics. If the sub was somehow able to earn this much money, then it would indeed be a great deal for Liantronics. If not, Liantronics simply gets its money back.

What is important to note here is that because of the “put option” described below, AirMedia cannot even use any of the supposed investment money because Liantronics has the right to call all of the money back, plus interest.

To the extent that any money can in fact be received, it is nothing more than a short-term loan (pending due diligence) that cannot be used because of the redemption feature.

Point #2: There are two built in “put options” to make sure the deal doesn’t go through

So here is where it gets worse.

Just to be sure that no money permanently changes hands, Liantronics and AirMedia also specified that there had to be a two built in “put options.”

The first put option belongs to AirMedia and it says that in the event that AirMedia finds any different investor within 75 days, then it can simply give Liantronics back its money and cancel the deal.

This is important because it shows that Liantronics is clearly not determined to “buy the remaining 95%” as stated by Sinolink. In fact, Liantronics does not seem to even be very determined to purchase this initial 5%. No party who had any serious intention of buying 5% of a target would allow the target to simply cancel at its own discretion and sell to someone else.

Had Liantronics actually intended to secure a full stake in the AirMedia sub, they would a) not have allowed the investment to be called away from them and b) demanded some sort of right of first refusal or option on an additional stake.

But because Sinolink has not seen the actual terms, they are unaware of any of this and have therefore speculated that Liantronics will buy the entire company for $8-10.

The second (more important) put option belongs to Liantronics and it says that even after 75 days, if Liantronics wants its money back, then Liantronics can simply cancel the deal.

This language for the two put options can be found here in a “follow up arrangement”:

The follow-up arrangement:Within 75 calendar days from the date of Party B’s cash payment, Party C shareholders can choose to sell Party C’s equity to a third party investors. However Party C must notify Party B promptly, and after 5 working days after the issuance of the notice Party A will pay Party B RMB150,000,000 to repurchase the 5% equity Party B bought from Party C, as well as pay Party B 10% of the annual cost of the capital as the payment for the use of the funds, from the very next day when Party A receives the full amount of the transaction under this agreement until the day when the repurchase of the share is completed. 75 calendar days after Party B completes cash payment, Party A has no right to request redemption of Party C’s 5% equity bought by Party B, unless Party B requests Party A’s repurchase. Should such circumstance occurs, Party A must pay RMB150,000,000 to Party B within 5 working days receiving the notice for repurchasing Party C’s 5% equity, as well as pay Part B 10% of the annual cost of the capital as the payment for the use of the funds, from the very next day when Party A receives the full amount of the transaction under this agreement until the repurchase of the share is completed.

In Chinese:

5、后续安排:在乙方完成现金支付后的75个自然日内,丙方股东可以选择 将丙方股权出售给第三方投资者,但必须及时通知乙方并于通知发出后的5个工 作日内,甲方以人民币1.5亿元现金回购乙方购买的丙方5%的股权,并按照10% 的年资金成本标准向乙方支付资金占用费,占用期为甲方收到本协议下全部交易 金额的次日至本款规定的股权回购完成日。在乙方完成现金支付后的75个自然日届满后,甲方无权要求赎回乙方已购买的丙方5%股权,除非乙方要求甲方回购, 在此情况下,甲方需在收到乙方通知后的5个工作日内以人民币1.5亿元现金回购乙方购买的丙方5%的股权并按照10%的年资金成本向乙方支付资金占用费,占 用期为甲方收到本协议下全部交易金额的次日至股权回购完成日。

如本次交易被甲方或丙方有权决策机构因未履行决策程序或其他法定事由 而认定为无效的,则甲方需在收到乙方通知后的5个工作日内以人民币1.5亿元现 金回购乙方购买的丙方5%的股权,并按照10%的年资金成本向乙方支付资金占 用费,占用期为甲方收到本协议下全部交易金额的次日至股权回购完成日。

This is why the stock plunged by nearly 20% on Friday

The 20F which came out on Friday had a single paragraph which made reference to the fact that the deal could be cancelled at will. Even though the 20F makes no reference to the $31 million profit condition, this was enough to spook some investors. The stock plunged to nearly $4.00 from $5.00 in pre market trading on hundreds of thousands of shares.

Yet it remains the case that most investors have not figured this out and still think that the deal is “on.”

Here is that paragraph.

In April 2015, Shengshi Lianhe entered into an agreement with Liantronics to transfer to Liantronics 5% equity interest in AM Advertising for RMB150 million. Liantronics agrees to make payments for the transfer after the change in AM Advertising’s equity ownership is duly registered in government records. Before such change registration, we plan to consolidate certain media business lines under AM Advertising through internal re-organization. During the period of 75 calendar days after Shengshi Lianhe receives full payment from Liantronics, or the Waiting Period, we may elect to sell our equity interest in AM Advertising to third parties, and if we so elect, Shengshi Lianhe will repurchase such 5% equity interest from Liantronics for an amount equal to RMB150 million plus applicable fees. The applicable fees will be calculated as 10% of RMB150 million per annum for the period from the date on which Shengshi Lianhe receives Liantronics’ full payment through the date on which such repurchase is completed. In addition, if we elect not to sell to third parties during the Waiting Period, Liantronics may request that Shengshi Lianhe repurchase such 5% equity interest after the end of the Waiting Period. Repurchase price in this situation will equal to RMB150 million plus applicable fees, which will equal to 10% of RMB150 million per annum for the period from the date on which Shengshi Lianhe receives Liantronics’ full payment through the date on which such repurchase is completed.

Part IV: But what does management at Liantronics have to say?!

In order to gain full clarity on this supposed “investment” and on Liantronics intentions, I held a conference call with Liantronics’s security department regarding the details of the transaction with AirMedia.

The key points were as follows:

1. Liantronics has not even conducted any due diligence on AirMedia or its subs.

2. $31 million is the required profit target for the business in 2015 after AirMedia spins off its gas station media business and airport WiFi business. This is the basis for a hypothetical $500 million valuation.

3. Liantronics does not know undisclosed financial details of AirMedia and both parties did not discuss further details.

4. This supposed transaction is entirely still in its initial stage. Even if the deal were to be eventually closed, based on the agreement between Liantronics and AirMedia, within 75 days after the closing deal, AirMedia has the right to revoke the deal. And after 75 days after the closing deal, Liantronics still has the right to revoke the deal.

5. In the event that AirMedia cannot finish its spin off and/or cannot meet the net profit target in 2015, Liantronics may opt to not close this deal and/or revoke this deal even after its closing.

6. Currently, to Liantronics’s best knowledge, AirMedia did not start its spin off process yet and both sides did not resume the continuing negotiation and/or discussion regarding the implementation of the transaction yet.

So basically, there had been discussions, but there is no deal. The state of discussions is so preliminary that Liantronics has not even conducted due diligence. In short, the terms of the deal itself will basically preclude it from happening.

Part V: In China, we have seen identical sham investments before

In all fairness, investors should not be surprised to see this type of sham transaction being used to hype a Chinese small cap. We have seen the same thing repeatedly in the past when beaten down companies are looking to prop up their stock.

The two recent examples that stick out most notably are with NQ Mobile and Pingtan Marine.

On May 30th, 2014, NQ Mobile announced that it was selling a minority stake in its FL Mobile unit to Bison Capital. The headline terms were nearly identical to what we see with AirMedia.

And oh by the way, Bison Capital (the investor behind the NQ “investment”) happens to be one of the only major investors in AirMedia. Bison also sits on AirMedia’s board. Keep this in mind as you read the details below.

NQ said that it would sell a 5.8% stake for $25 million, which would value the FL unit alone at $425 million. The news sent NQ’s stock soaring by more than 50%, sending it briefly back above $10.

But (just like the AirMedia deal), there were certain “conditions” to the deal. There was a “redemption right” (a put effectively) which said that if FL did not complete a qualified IPO within 12 months then Bison gets its money back.

Within weeks, the market began to understand that the investment was a sham and the share price plunged by 50%.

That did not stop NQ from trying again in December. In its second attempt, NQ announced that it was selling 100% of the FL mobile unit for an even greater amount, this time $630 million. But by December, the market wasn’t being fooled again.

It has now been nearly 12 months and there is no IPO in sight. NQ (the entire company) is now valued at just $329 million, with the value of FL mobile being near zero. Just last week, Omar Khan, the Co-CEO decided to step downfrom his role at the company.

As shown above, shares of NQ are now down by 60-70% since that time.

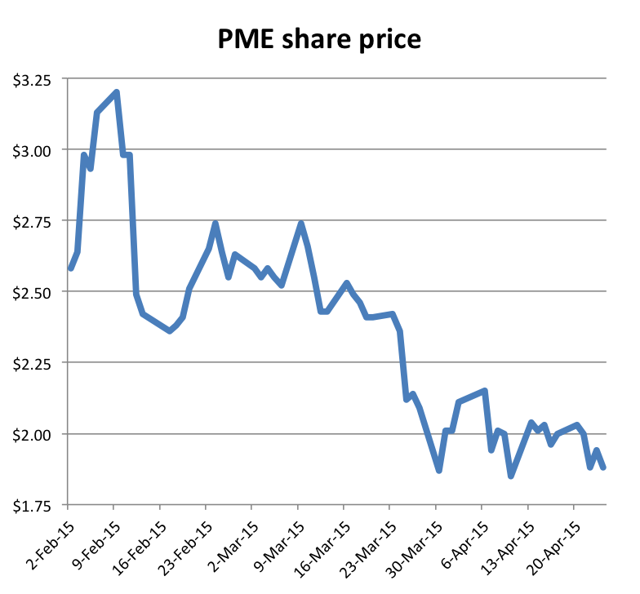

With Pingtan Marine (yet another sham investment), the situation was also almost identical. Pingtan announced in February 2015 that China Agriculture Industry Development Co was investing $64 million to buy an 8% stake. Pingtan touted that this valued the company at $800 million and the stock (of course) briefly soared to over $3.00 and was valued at nearly $300 million (still a considerable discount to $800 million).

But once investors actually evaluated the actual contract and understood the profit conditions involved, the stock quickly plunged back to lower than where it started.

Pingtan now trades at less than $2.00 and is valued at just $150 million.

In fact, AirMedia itself has done this identical dance before. How did it work out ?

In 2013, AirMedia announced that a company called Elec-Tech was acquiring a 21% stake on AirMedia’s Great View Media subsidiary for $104million. Elec-Tech is a competitor to Liantronics in the electronic display business.

The acquirer was a supplier to AirMedia. As with the current situation, the implied valuation was around $500 million for AirMedia.

However, it was then disclosed that 100% of the investment amount from this “investment” had to be used to simply buy product from the supplier. By year end, 50% of the investment amount had already been used to buy displays. It is little more than a line of credit from a supplier.

As disclosed in the 2013 20F,

In May 2013, several entities affiliated with AirMedia, including GreatView Media, the primary operating entity of our gas station media network, and its then-existing shareholders, entered into an investment agreement with Elec-Tech International Co., Ltd., or Elec-Tech. Pursuant to the investment agreement, Elec-Tech agreed to invest RMB640 million (US$104 million) to purchase ordinary shares representing approximately 21.27% of the equity interest of GreatView Media. After the completion of the transaction, AirMedia controls 61.41% of the equity interest of GreatView Media and the senior management team of GreatView Media indirectly holds 17.32% equity interest in GreatView Media through Zhongshi Aoyou, which is wholly owned by the management team. Pursuant to this agreement, the then-existing shareholders of GreatView Media agreed to cause GreatView Media to utilize Elec-Tech’s contribution for the sole purpose of purchasing LED screens from Elec-Tech or its subsidiaries. As of December 31, 2013, GreatView Media purchased 1,000 sets of LED screens in total from Elec-Tech for our gas station media business in the amount of approximately US$57 million.

Despite the completed investment valuing AirMedia at over $500 million, the stock continued to trade for around $2.00 until this latest “investment” was announced and promoted in 2015.

The point is that “the devil is in the details.” The “investment” by Elec-Tech was also little more than a loan and in no way justified an increased valuation for AirMedia.

Part VI: Conclusion

The only reason why AirMedia has more than doubled is simply because of a supposed “investment” by Shenzhen Liantronics which ostensibly values the company at around $500 million. The supposed investment deal is not what it has been purported to be.

The supposed investment by Liantronics into AirMedia is a sham transaction. It can be simply cancelled by either party and it is contingent upon AirMedia’s subsidiary earning an impossible profit level. The transaction was deliberately designed so that it would never end up going into effect and that it could be easily reversed at any time.

This becomes more obvious in light of the fact that nearly 50% of the airport concessions will expire by the end of 2015.

As a result, there will be no lasting investment. If any proceeds are received by AirMedia, they will simply be repaid due to failure of the terms required.

Common sense should tell us that the contract is neither certain nor material. If it was, AirMedia would have been forced to disclose the actual contract itself as an attachment to the 8K and 20F.

But the market has clearly reacted as if the contract were very real and very material, adding nearly $200 million in market cap to the company’s value within the past 2 weeks.

We have seen identical surges before based on nearly identical sham contracts with companies such as NQ Mobile and Pingtan Marine. These surges have always shown violent reversals once investors figure out the real terms of the supposed deals.

So now investors should watch for a rapid reversal in AirMedia’s share price, with the stock quickly headed back to $2.00 from whence it began.

Authors note: Last week I had attempted to discuss these issues with management by phone prior to publication without success. Shortly before publication, I did receive an email back from management with answers to several questions. I did not tell them I had a full copy of the contract or that I had spoken to Liantronics.

Management stated that they are confident that AM Group Co (the subsidiary) can reach the profit goal of 200 million RMB and that there will be no consequences if they do not. This appears to contradict both the written contract as well as the statements from Liantronics, which are consistent with one another.

As to possible cancellation of the transaction, management stated that it has the right for 75 days to sell equity to a third party and cancel the investment from Liantronics. That is straight out of the contract.

They also pointed out that the investment would be cancelled if it were not paid by Liantronics within 30 days of the transfer of equity. Again, that is also straight out of the contract.

However, in terms of Liantronics right to cancel the deal, management simply stated that

“There is no specific terms and conditions under current transaction agreement as to the conditions when Liantronics will cancel the transaction;”.

This statement is inconsistent with both the contract and with statements from Liantronics. More importantly, it is inconsistent with statements from AirMedia’s own 20F filing, which state that after 75 days Liantronics can require repurchase of the entire investment. This can be for any reason, (including failure to meet the profit target).

Again, as shown above, from the 20F filing:

In addition, if we elect not to sell to third parties during the Waiting Period, Liantronics may request that Shengshi Lianhe repurchase such 5% equity interest after the end of the Waiting Period. Repurchase price in this situation will equal to RMB150 million plus applicable fees, which will equal to 10% of RMB150 million per annum for the period from the date on which Shengshi Lianhe receives Liantronics’ full payment through the date on which such repurchase is completed.”

I also asked when AirMedia expected to receive any proceeds. Management simply quoted the press release, simply stating “Liantronics will pay the proceeds within ten (10) business days once the transfer and registration formalities with government authorities are completed;”.