Summary

- Heavily promoted by multiple paid promoters (including undisclosed).

- Stock has spiked to an all-time high.

- Company is out of cash and is delinquent in its filings.

- Management with close connections to past frauds.

- Expect a very near-term financing to drop the stock by at least 30-40%.

This article is the opinion of the author. Nothing herein comprises a recommendation to buy or sell any security. The author is short FNRG. The author may choose to transact in securities of one or more companies mentioned within this article within the next 72 hours. The author has relied upon publicly available information gathered from sources, which are believed to be reliable and has included links to various sources of information within this article. However, while the author believes these sources to be reliable, the author provides no guarantee either expressly or implied.

Short Thesis

This is not an article about ForceField Energy’s (OTC:FNRG) business. It is about paid stock promotion and connections to past fraudulent activity.

ForceField Energy is a paid-for stock promotion targeting retail investors. Institutional investment in the company totals just 1% of outstanding shares. ForceField is a company which is out of money and clearly needs to sell stock in the very near term. There has been a flurry of promotions over the past few weeks and months, indicating that a financing is likely imminent.

The promotions have worked and the stock is now hitting all-time highs on increased volume.

Management members have close ties to past fraudulent companies and activities.

Meanwhile, the company has still not filed its annual report (Form 10-K). As soon as the 10-K is filed (potentially within days), ForceField will take advantage of the share price run up to issue a large amount of stock. The stock will likely trade back to around $3.00-$4.00 in the near term.

ForceField is currently running on fumes. As of its most recent financials, ForceField had just $500,000 in cash. It had been reported that ForceField had sold its interest in TransPacific Energy for $2.0 million. However, it was the case that ForceField only received $50,000 in cash. The remaining $1,950,000 was in fact just hypothetical. The “buyer” simply returned its shares of ForceField (which had been owned by the buyer) which were then simply cancelled by ForceField. The cancelled shares are worth nothing and cannot be resold. As a result, ForceField only received $50,000 not $2.0 million.

ForceField has never been cash flow positive. Its only source of cash has been the issuance of new shares. ForceField recently completed several new acquisitions using stock. These acquisitions will increase expenses and cash burn, such that ForceField will need to raise substantial proceeds as soon as the delinquent 10-K is completed.

Background

In the past, there has been some debate about the validity of the business at ForceField Energy. After several failed iterations in the past, ForceField’s most recently adopted line of business is the installation of LED and other energy efficient lighting.

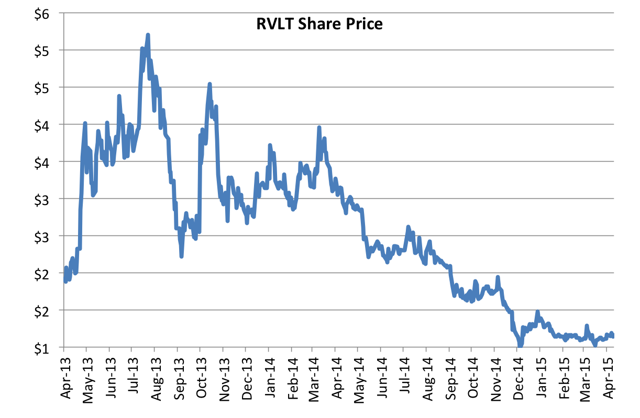

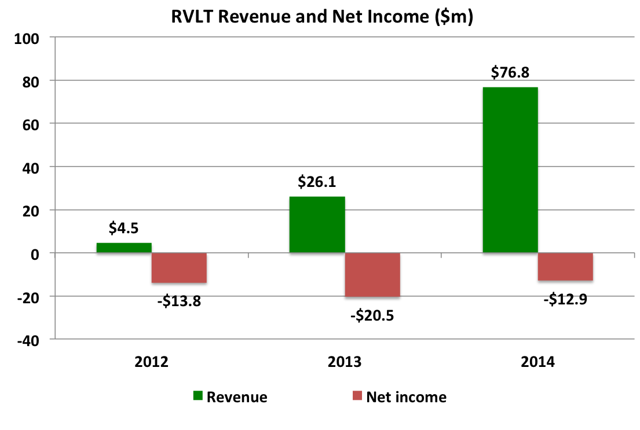

Critics of ForceField’s business model mostly share the same concerns as critics of comparable LED installer Revolution Lighting (NASDAQ:RVLT). Revolution once traded as high as $5.00 (a valuation of over $700 million), but has since plunged 80% to around $1.00. Revenues have continued to build strongly for Revolution, but net losses have increased even more. Despite the headline enthusiasm for the major shift to LED lighting, there is simply too much competition in this low margin business to ever realize a profit.

Revolution currently has a market cap of around $150 million based on quarterly revenues of $27 million. Meanwhile (following the stock promotion), ForceField also has a market cap of around $150 million despite quarterly revenues of just $2 million. On this basis alone, it is clear that ForceField has a long way to fall.

In fact, prior to a recent acquisition, ForceField had no material revenue. The recent revenues are simply the result of acquiring an existing installer (which was acquired for stock) which already had revenues.

Like Revolution, the primary catalyst which has driven the stock up has been the repeated partnerships being announced with companies that might allow ForceField to expand its sales. But as we can see from Revolution, even obtaining massive sales in this business still does not allow for even remote profitability.

Note in the chart below that revenues at Revolution have grown massively from $4 million to $77 million in 3 years. Yet profitability is as elusive as ever. This is why the stock price is down 80% from its peak.

But again, this is not an article about ForceField’s business model. It is an article about a paid stock promotion and connections to past fraudulent activity.

The history of Forcefield

ForceField began its life as a Chinese reverse merger known as SunSi, focused on the manufacture in China of a certain chemical used in the production of polysilicon. Note that this is NOT simply the history of the shell company. The Chinese SunSi was run by current ForceField management David Natan and Richard St. Julien, who still run the company today.

The Chinese activities failed to produce meaningful results. More importantly, in 2011, Chinese reverse mergers became uninvestable due to rampant fraud in the space. There was clearly no money to be made by running a Chinese reverse merger.

As a result, Natan and St. Julien simply changed the name of the company and moved its nominal operations to Costa Rica as they searched for a new business definition.

The company’s next venture was via TransPacific Energy, making “Organic Rankine Cycle” units to maximize heat recovery and minimize waste. After a back and forth fraud lawsuit, ForceField sold TransPacific back to its original owners for $50,000 cash and the return of stock.

Most recently, the company is now in the business of being a distributor of LED lighting which it buys from a single manufacturer in China. In March of 2013, the company formed a subsidiary in Costa Rica. Up until its recent acquisition of American Lighting (“ALD”) the company had noted that “All of the Company‘s long-lived assets are located in Costa Rica.”

You may ask “why Costa Rica?” That will become clear later in this article.

The bull thesis on ForceField is that it has bid on over $100 million worth of lighting jobs. The bull case states that if the company were to realize even a fraction of that pipeline, it would send the stock sharply higher.

First off, we should again note that Revolution is already doing $76 million in sales without coming close to turning a profit. Yet that company is only valued at $150 million.

But there is something else that isn’t right here either. A full $95 million of this supposed “pipeline” is comprised of a single job which ForceField bid on, but which has yet to be fulfilled. Aside from that, all remaining hoped-for jobs total just $5 million. It is next to nothing.

The $95 million job is simply a red herring designed to prop up the share price. And so far, promoters have successfully used this to run up the share price. We will see more about this below.

ForceField and stock promotions

In the past, ForceField was a Dream Team client. The Dream Team was a firm that got paid to write undisclosed paid articles, which were edited and approved by management teams of their clients. The retail targeted articles were designed to prop up the share price and volume so that companies could issue stock to raise money. The scam worked exceptionally well.

But now there is a new generation of different promoters which use a variety of techniques. What we can see is clear evidence of recent promotions at the precise time when ForceField needs to issue stock to raise money.

This creates two immediate concerns.

First, the share price is artificially way too high as a result of the promotions.

Second, the stock is about to head sharply lower due to an upcoming and much needed financing.

In the near term, I expect to see ForceField hit $3.00-4.00. Over the longer term, it should trade substantially lower.

Before getting into the current round of promotions, it is useful to review ForceField’s involvement with the Dream Team Group.

Back in 2014, I wrote a detailed article about stock promotion firm “The Dream Team Group” which was hiring out writers to conduct undisclosed paid promotions on small cap companies. The writers would pretend to be well qualified industry experts putting forth a professional analysis (and a strong buy) on a stock. In fact, they were simply hired gun writers with no credentials whatsoever. Yet their professional writings invariably caused their target stocks to soar. The authors managed to infiltrate a wide variety of locations, including Forbes.com, TheStreet.com, Seeking Alpha and the Wall Street Cheat Sheet.

To gain information, I posed as a paid stock promoter looking to write undisclosed paid articles. The chief writer for the Dream Team (Tom Meyer) then began giving me assignments.

The main stocks I wrote about in this promotion scandal were Galena Biopharma (GALE) and CytRx (NASDAQ:CYTR), both of which ended up plunging by as much as 50-80% when the promotions unraveled. CytRx has rebounded some, while Galena has continued to plunge.

But there were other companies which I did not give as much attention to because they were too small or illiquid to matter at the time. (Although I did not write about many of these stocks, I did notify all of the various websites such as Seeking Alpha, TheStreet.com and Wall Street Cheat Sheet so that they could remove any articles and ban any violating authors).

ForceField Energy is one such stock. At the time, it was one of a number of beaten down illiquid stocks which didn’t seem to be catching the promotional wave. But now it appears that the continued promotional efforts have resulted in the stock hitting all-time highs on much greater volume. This is all occurring just as the company needs to raise money.

ForceField was a paid Dream Team promotion which was written about by both Tom Meyer (multiple aliases including Wonderful Wizard and others) and John Mylant. These were the two main Dream Team writers. Their articles have since been removed from Seeking Alpha, but the original references can still be found in various places. In addition, ForceField is listed here among the other Dream Team clients on the Investors Hub page for Mission IR. Mission IR was the Dream Team subsidiary responsible for handling the paid articles.

Mr. Meyer was also attempting to recruit me as a paid writer specifically for ForceField. ForceField was an ongoing project of his.

It should be kept in mind that the standard process for these writers was to submit their drafts to management at the target company for review before publishing. In other words, management of these companies knew and encouraged the illegal stock promotion as a way of getting their share prices up.

But now it seems that a variety of other promoters have taken the helm from the now defunct Dream Team Group.

One such promoter is “Goldman Small Cap Research” (no connection to Goldman Sachs). As it turns out, Tom Meyer from the Dream Team was moonlighting for Goldman Small Cap Research in addition to working for the Dream Team. Tom informed me that the primary advantage of writing articles for Goldman Small Cap Research was that he gets paid with money orders made out to “cash” such that he could avoid paying taxes or being traced.

Tom had assigned me to write an article for Goldman Small Cap on LiveDeal (NASDAQ:LIVE), which I sent to him for his review and for company approval. Tom had been writing his articles for LiveDeal using a female alias by the name of Christine Andrews at places such as TheStreet.com and Wall Street Cheat Sheet. (Those sites were informed and those articles have since been removed)

After I submitted my article, Tom responded with edits and a new title. This is a copy of the edits provided to me by Rob Goldman for an undisclosed paid article on LiveDeal which was requested to appear on either TheStreet.com or Seeking Alpha. Goldman Small Cap continues to engage in paid promotions for Live Deal, as shown. (Note: I never accepted payments for any articles and I saw to it that none of the draft articles would ever be published).

The point of all of this is simply that Goldman Small Cap is a pay to play research firm used for hyping microcap stocks.

So now let’s see how Goldman Small Cap covers ForceField Energy.

Tom, along with Dream Team’s John Mylant, both had previously written multiple articles on multiple sites on ForceField, touting it as a strong buy. Goldman Small Cap has now taken over directly for Tom and just a few weeks ago released a report on ForceField, hyping the company with a $10 target, stating:

“ForceField Energy has recently achieved a new 52-week high on strong volume via the strength of very favorable news on the business development front and appears primed to continue this trend. A diversified green energy provider, FNRG’s recently acquired subsidiaries enable the Company to serve as distributors, installers, and managers of large scale LED lighting projects for Fortune 500 companies. Since FNRG does not produce its own products, it can offer best of class solutions and not be subject to current and potential gross margin deterioration of a commoditized product like LED lights, that may plague other companies. Moreover, its “No Money Down” project financing approach has already garnered sizable deals and a hit list of over $100M worth of potential projects in its pipeline, via active bids. This innovative model typically fosters greater than industry standard top-line growth and valuation.”

(Notice the focus on the $100 million worth of projects with no mention of the fact that $95 million of it comes from one speculative hoped-for project).

We can see from the past that coverage of ForceField by Goldman Small Cap has been extensive, with at least 20 different notes and reports.

Promoter number three: In addition to the Dream Team (Tom Meyer) and Goldman Small Cap, ForceField is also being promoted by Mark Bonnaci’s Small Cap Street promotion machine. Small Cap also uses the name Cap Rock.

Perhaps not by coincidence, Small Cap Street is also currently co-promoting LiveDeal along with Goldman Small Cap. Their report on ForceField came in February and cites as a source for info (in small print at the very bottom) Goldman Small Cap Research.

Small Cap Street was recently highlighted for promoting an OTC marijuana stock called Growlife (OTC:PHOT) which was halted by the SEC as a fraud and which has since plunged to just 2 cents. In that article, the same author sheds light on a different stock promotion by Small Cap Street called Provectus (PVCT) which has since plunged by 80%. The point is that having your stock promoted by Small Cap Street / Small Cap IR is a sure sign that there is a promotion campaign going on, elevating the stock price to unnatural levels.

Promoter number four: Ultimate Stock Alerts uses the technique of associating the name of ForceField with larger much more liquid stocks in various press releases posing as news articles, such as this one featured on MarketWatch. The article pretends to be a research note highlighting 3 great stocks: Organovo (NASDAQ:ONVO), BIND Therapeutics (NASDAQ:BIND) and ForceField. In fact, it is clear from reading this article that the purpose of mentioning these other stocks is simply to hijack their high traffic hit rates and draw attention towards much smaller ForceField. Ultimate was paid $35,000 to get this note posted on MarketWatch posing as a research article.

The names listed above are the heavyweight promoters, but there are other lightweight promotions going on nearly every week. This includes paid mentions at “US Markets Daily” and “Journal Transcript“.

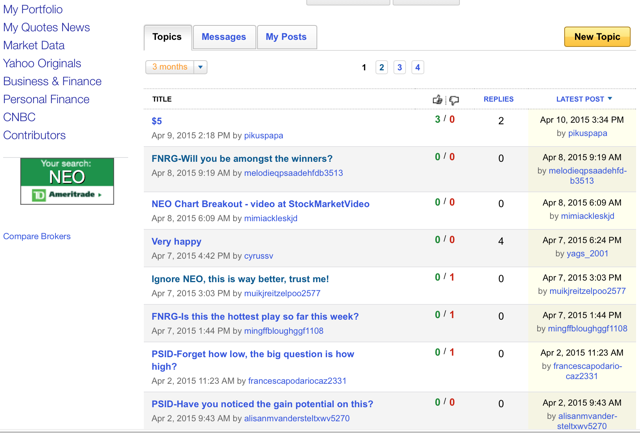

Message board promotion: There is also an ongoing campaign to populate message boards (such as Yahoo) with bullish messages about ForceField. This has proved to be a very successful method of luring in retail investors.

Here is one example taken from the message board for Neogenomics (NASDAQ:NEO). The strategy for these posters is to seek out companies whose share price has risen strongly and which are getting a lot of attention. The posters then seek to draw readers’ attention to ForceField. Some small portion of the readers end up buying into ForceField, elevating share price and volume. Surprisingly, this strategy can work if there are thousands of postings to other high performing and high interest stocks.

The way to find these postings is to simply look for stocks which are spiking up on high volume. The ForceField postings can often be found there. Aside from Neogenomics, we can see the same thing on the BioTime (NYSEMKT:BTX) message board and on the Chanticleer Holdings (HOTR) board, among many others. None of these companies have anything in common with ForceField or its purported energy/lighting business.

Paid email promotions: ForceField is also the subject of several paid email promotions targeting retail investors. The most recent of these consists of a paid promotion via “Penny Stock Prophet” which began this week. PSP was paid $15,000 to send out these promo emails, which (of course) cite Goldman Small Cap Research as their source. More information and the full promo can be found at pennystockprophet.com

It is no coincidence that this flurry of promotional activity is all happening at the same time for a company which happens to be out of cash. Because ForceField is delinquent with filing its 10-K, it is likely not able to issue stock right now. But as soon as the 10-K comes out (likely within the next few days), we should expect a large equity offering to drop the stock back down to around $3.00-4.00. The timing of all of this promotion should be seen as no coincidence.

Again, the dual concerns are that a) the share price has been elevated to artificially high levels, and b) the stock is about to crash based on a badly needed upcoming equity offering.

Past connections with past fraudulent activity

In reality, the notion that ForceField is being promoted before an equity raise should come as no surprise. Aside from their history of using the Dream Team to promote their stock, ForceField’s three top managers all have extensive ties to past fraudulent companies which have gotten into substantial trouble, including investigations by the SEC, FBI, the US Senate and the Canadian Federal Government.

ForceField is run by CEO David Natan. Notably, Mr. Natan does not name any of his past companies on his official bio. We can now see why.

From Bloomberg we can see the detailed history of Mr. Natan and his lengthy history of working with promotional companies based out of Boca Raton. For those who don’t know, Boca Raton happens to be the center of stock promotion (and sometimes fraud) in America.

Further digging shows that his past companies are mostly bankrupt former pink sheets companies based out of South Florida, such as MBf, Global Technovations and IMX Pharma.

Just prior to running ForceField/SunSi, Mr. Natan was CFO of a company called SFBC and he was the one responsible for signing off on their financial statements.

SFBC was basically a south Florida recruitment mill for finding subjects (often illegal immigrants) to act as guinea pigs in clinical trials for drugs that had not yet been approved by the FDA. A lengthy and scathing exposé on SFBC can be found on Bloomberg, entitled “Big Pharma’s Shameful Secret”, and it is well worth reading. Anyone who has an interest in pharma or clinical trials should absolutely read that article. In the wake of this exposé, SFBC’s share price fell by as much as 75%.

According to the fraud complaint filed in the District Court of New Jersey, SFBC told investors that it had a new state of the art facility which would drive the majority of revenues going forward. In fact, the building was nothing more than a dilapidated former Holiday Inn that

was so structurally unsound that the Miami Dade County Unsafe Structures Board has since ordered the facility to be demolished.

It was fraud, plain and simple.

The fraud case goes on to state that:

SFBC risked its reputation and recruitment ability by utilizing a variety of unethical and dangerous practices that severely compromised the integrity of the drug trials conducted by the Company. For example, as detailed below, SFBC violated applicable minimum waiting requirements, used deceptive payment schemes to decrease the likelihood that a participant would report adverse reactions to the drugs being tested, failed to put into place adequate controls to prevent participants from applying to concurrent drug trials at other facilities, and failed to ensure that participants – the majority of whom are low-income individuals who speak English, if at all, as a second language – provided the required “informed consent.”

Further, in order to ensure that SFBC’s improper and unethical practices remained hidden from public view, the Company hired regulatory companies that were completely beholden to SFBC and its employees. For example, throughout the Class Period, SFBC paid hundreds of thousands of dollars to a regulatory company called Southern Institutional Review Board (“Southern IRB”) – a supposedly independent review board (“IRB”) – to oversee and “approve” a substantial portion of their clinical tests. Southern IRB was owned and operated by the wife of a senior officer of SFBC. Similarly, SFBC utilized LeeCoast IRB to supervise its tests, despite the fact that LeeCoast IRB was owned by an SFBC subsidiary and employees of LeeCoast were paid directly by SFBC with checks prepared by SFBC’s own accounting offices.

Clearly the goal of all of this was to prop up the stock so that money could be raised. And that plan worked quite well.

Defendants’ untrue and misleading statements and omissions allowed SFBC to project the appearance of growth and success, which inflated the price of SFBC’s securities and enabled the Company’s insiders to enrich themselves at investors’ expense. Indeed, during the Class Period, the individual defendants sold significant portions of their SFBC stock, generating tens of millions of dollars in personal profits. They were also able to orchestrate two large secondary offerings of SFBC securities, which allowed the Company to raise a total of approximately $250 million from unwitting investors.

Insider sales were large. As noted in the Sought Florida Business Journal, “SFBC execs pull in $15.71M from stock sales“. This was just shortly before the fraud came unraveled and occurred before the stock price collapsed.

CEO Natan isn’t the only one with connections to fraudulent companies in his background. Like Mr. Natan, Chairman Richard St-Julien refrains from actually naming any of his past ventures or employers. He simply notes in his biothat:

Richard has a great deal of success and experience as a practicing attorney in the areas of Commercial and International Law. In addition, Richard has been involved in numerous business ventures as an entrepreneur in Canada, the U.S., China and other countries.

In reality, it is a bit more colorful than that. Mr. St. Julien appears to be an expert at moving money around in places such as (again, no coincidence) Costa Rica. Costa Rica is, of course, where ForceField ended up establishing its operations and where 100% of its assets were located until 2014.

In 2009, Mr. St. Julien was working as a lawyer in Costa Rica helping to funnel cash to and from convicted fraudster Jean LaFleur who was running a fraudulent scheme in Belize.

The Canadian federal government was suing LaFleur for $7 million for his role in a government sponsorship scandal. According to the Globe and Mail:

Federal lawyers allege in the court documents that Mr. Lafleur “tried to liquidate his assets when it became obvious that [the government] would undertake legal action to recoup money that it had paid to [Mr. Lafleur] as part of his fraudulent scheme.”… Mr. Lafleur said as part of his bankruptcy proceedings that he called on Mr. St-Julien to invest the money on his behalf in Liechtenstein, the Caribbean and Belize… Mr. St-Julien is a member of the Quebec bar, but he is working in Costa Rica, and has refused to explain what happened to $460,000 from the house sale that was invested in his Belize company, Parameter, which is now insolvent.

LaFleur was ultimately sent to prison for his role, but the money disappeared.

As for ForceField’s CFO, Jason Williams, he notes on his bio that he was previously at Protective Products of America (OTCPK:PPAFQ), which happens to be a pink sheets company that trades for less than 1 penny. Not surprisingly, Protective was based in South Florida. In the 3 years that it traded as a public company, Protective never filed a single financial statement, so it is unclear what Mr. Williams’ actual duties might have been at that company. (At ForceField, financial statements have been delinquent in each of the past 3 years, again raising doubts about his role as CFO).

But it gets better.

Prior to that, Williams notes that at PharmaNet he was an integral part of the management team that facilitated a market capitalization rise from $150 million to $800 million during a three-year period. It does sound impressive.

However, this bio fails to mention some key facts. Most importantly, PharmaNet is in fact the same SFBC that settled fraud charges two years after the Bloomberg article.

Yes, in fact, the stock did spike to a valuation of over $800 million during the tenure of Mr. Williams. But that was before it cratered to as low as $50 million (down 85%) in the wake of the Bloomberg fraud exposé.

I would encourage readers to re-read the fraud case against SFBC and its management to fully appreciate its implications.

From the introduction of the fraud case:

This is a case about a company that repeatedly misled investors about the most fundamental aspects of its business and operations. That company is SFBC, and throughout the Class Period, SFBC and its senior officers told investors that SFBC was a well-run business with highly-qualified management and significant competitive advantages in its field. In reality, however, SFBC suffered from a raft of undisclosed problems that infected its business and threatened the Company’s very survival.

After the US Senate launched an official investigation into the company, they simply began running their clinical trials in Canada.

You can read about the name change and the move to Canada in this article.

“Troubled SFBC changes its name in hope of changing its fortunes“

The point of this is that all three top managers have substantial ties to companies with fraudulent activities in the past. They are now all working together in a fledgling company that is hitting all-time highs even as there are obvious signs of stock promotion. And of course, the company happens to be out of money.

Conclusion

ForceField Energy is a stock promotion pure and simple. The company has been engaging paid promoters to issue a series of upbeat reports on its prospects which has successfully powered the stock higher. Some of the reports on ForceField have made use of undisclosed promotions pretending to be independent authors. Since this time last year, the stock has nearly doubled off of its lows and volume has increased several fold. This is a reflection of the success of the promotions.

Management has a troubling history of involvement with fraudulent companies, misleading investors and the ability to shift money around in international locations such as Costa Rica, where ForceField continues to maintain the bulk of its operations.

The hype surrounding ForceField continues to focus on “$100 million” worth of projects being bid on, while ignoring the fact that a single white elephant project accounts for $95 million of the supposed pipeline.

With ForceField running dangerously low on cash, the timing of the recent flurry of hype and promotions becomes clear. ForceField has still not filed its annual Form 10-K (it is delinquent). But as soon as the 10-K comes out (any day now), ForceField will end up issuing a large amount of equity. This will be the catalyst for a very sharp drop in the share price to $3.00-4.00 or below.

Note: The author did attempt to contact ForceField management; however, calls to their corporate office were not returned.