Summary

-

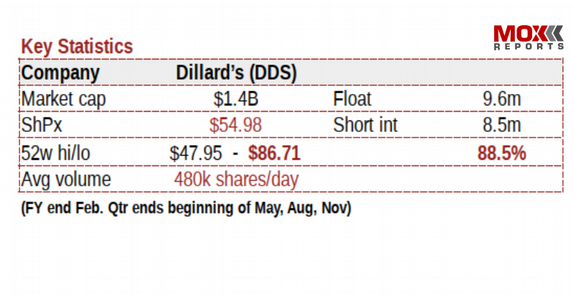

As a result of its hyper aggressive share buyback, Dillard’s now has a short interest equal to 88.5% of the remaining float. The stock is (once again) likely to see the same recurring violent short squeeze that keeps sending it back to the $80s and $90s.

-

With Dillard’s, I have played this “violent rebound trade” multiple times during 2017, 2018 and 2019. These rebounds to the $80s and $90s are becoming very predictable. Even a few new incremental buyers will mean that there are simply no shares left for Dillard’s shorts to cover. Period.

-

After announcing “weak earnings” on August 15, Dillard’s very briefly plunged to $48, exacerbated by a slew of sell side downgrades. But the stock quickly rebounded to as high as $59 once the market focused on the 800,000 shares bought back during the quarter just ended August 3.

-

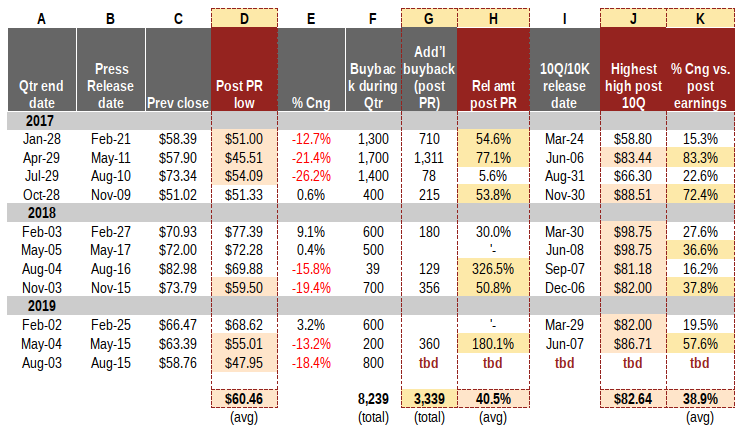

However…and this is very important…over the past three years Dillard’s has conducted a disproportionate amount of its share buybacks in the very brief windows of time after it releases bad earnings in a PR, but before the 10Q is formally filed a few weeks later. See table below.

-

When the 10Q gets filed this week or next, we will learn how many more shares were repurchased after August 15 (during that very high-volume weakness from the earnings PR). Given Dillard’s past actions, I expect to see a further 300-600k shares bought back during this post-PR window and that the float will drop further to around 9 million shares. See table below.

-

The reason for the hyper-aggressive buyback is simple. Dillard’s owns real estate valued at $150-300 per share, and the buyback will leave insiders as the owners of this real estate. Simple. With short interest now at 88.5% of float shares short, I expect that Dillard’s will quickly see the same recurring violent squeeze to much higher levels.

This report is the opinion of the author. The author is long DDS. See disclosures and disclaimers.

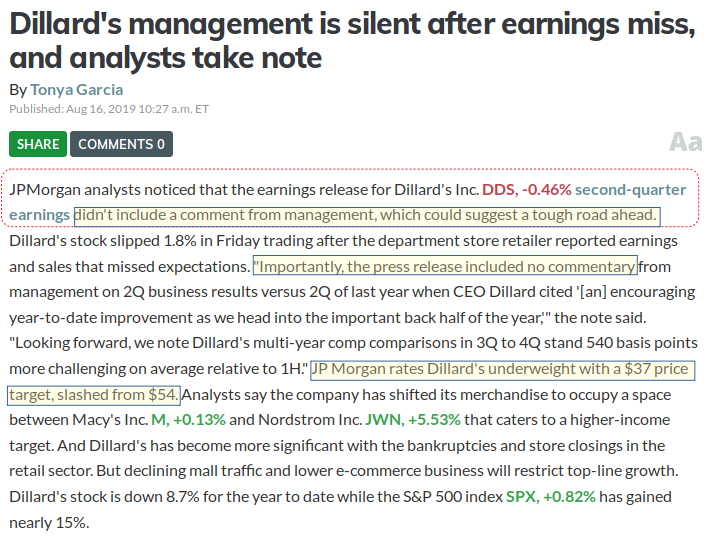

Analysts and investors are (once again) missing the punchline with Dillard’s. Every few quarters, an earnings initial press release causes Dillard’s share price to get absolutely demolished. The unexpected “earnings miss” is then exacerbated by a string of analyst downgrades which are even further exacerbated by a very determined silence from Dillard’s management.

But then…but then…but then…when the 10Q is filed just a few weeks later, we learn that management was aggressively buying back shares into that same exact price weakness which occurred after the press release, but before the actual filing of the 10Q.

And then…and then…and then…each time the market uncovers this from the newly released 10Q, the now-heavily-shorted stock then violently rebounds into the $80s or $90s. There is now enough data that we can populate a data table to prove this pattern.

As shown below, Dillard’s has been making use of this “kitchen sink PR gambit” for several years. Obviously the company cannot kitchen-sink every quarter, but when they do, they often use the very brief window to buy back more than 50% more shares above what they had already purchased during the entire quarter. After all, during these occasional down drafts, the share price gets very low and the volume gets very high. It is a very sensible strategy.

How to read the table below:

Column D. Dillard’s occasionally releases terrible earnings and remains silent to investors and analysts. The stock tanks (very briefly) into the $40s or low $50s.

Column G and H. But during that period of post-PR share price weakness, Dillard’s buys back a disproportionately large amount of shares… before the 10Q is actually filed. In 2017, 2018 and 2019, Dillard’s bought back more than 3.3 million shares just during the very brief windows after the PR is released but before the 10Q is filed. This is an additional 40% above what had been bought back during the regular quarters.

Column J and K. In nearly every quarter, after releasing the 10Q the stock rebounds into the $80s or $90s, a rebound of 39% overall (but even sharper vs. the low quarters).

Going going gone….In the most recent quarter ended August 3, Dillard’s bought back 800,000 shares. This was 8% of the entire remaining float within just 90 days time, which is very, very aggressive. But as the float continues to disappear, it is getting tougher and tougher for the company to buy the remainder without immediately pushing up the price. As a result, their increasing aggression during these very brief windows of “unexpected weakness” is in no way surprising.

What to expect when the 10Q is released. The 10Q should be released by late this week or early next week. I expect we will see that Dillard’s purchased an additional 300-600k shares during this post PR price weakness. As shown above, this is entirely in line with their past behavior in 2017, 2018 and 2019. And in fact, there is a meaningful chance that we may see more than this.

In past “kitchen sink” quarters, the company often bought back at least an additional 50% more shares during just the brief window of several weeks before the 10Q was released. In 2017, Dillard’s did this two quarters in a row, buying back 700,000 shares after the February press release and then buying 1.3 million shares after the May press release. These large purchases occurred just during the brief post-PR window and were in addition to the large purchases which had been made during those quarters. In 2018, Dillard’s engaged in post PR buying in 3 of the 4 quarters. And in 2019, Dillard’s bought back 360,000 shares just after the May quarterly PR, before filing the 10Q for that quarter.

Short interest vs. float. You do the math. As a result of the most recent buybacks up to August 3, there are only 9.6 million shares left in the float. The short interest of 8.5 million shares therefore equates to 88.5% of the float. But when the 10Q gets released, I suspect that the float will be down to around 9 million shares. So you do the math.

Conclusion. Dillard’s is once again set up for its (as usual) recurring violent squeeze. It is not possible to predict the exact day it will happen or how high it may go. But no one should be surprised at yet another violent squeeze back to the $80s, the $90s or perhaps even higher this time.

Reminder…on fundamentals. Despite the supposed doom and gloom. Dillard’s is simply not a terminal retail story in any way, shape or form. Revenues are stagnant, but quite stable. The company remains profitable and cash flow positive with little debt, which is why it continues to be rated as investment grade.

Reminder…on valuation. I get it, Dillard’s is a mall-based retailer. And just like the others, I expect that its retail business will continue to soften over time. However, expectations for the retail business are not why the company has bought back more than 70% of the outstanding shares. The company is buying back its external float because doing so will leave the existing insiders as the owners of the 44 million square feet of real estate owned by the company. The value of this real estate has been estimated generally at a few billion dollars (ranging from roughly $150-$300 per share). I have zero expectation of ever obtaining such lofty share prices, because the insiders have no incentive for this to happen. However, I do have every expectation that Dillard’s will continue to shrink the share count via buybacks until the insiders end up owning all of that real estate. As the share count goes lower, the value per share goes sharply higher. For both longs and shorts, this pushes the share price higher, at the exact same time as the tighter float exacerbates an already-high short interest. At prices in the $50s, I (once again) see very little additional downside in the share price, against a very meaningful chance of a very sharp upward squeeze.

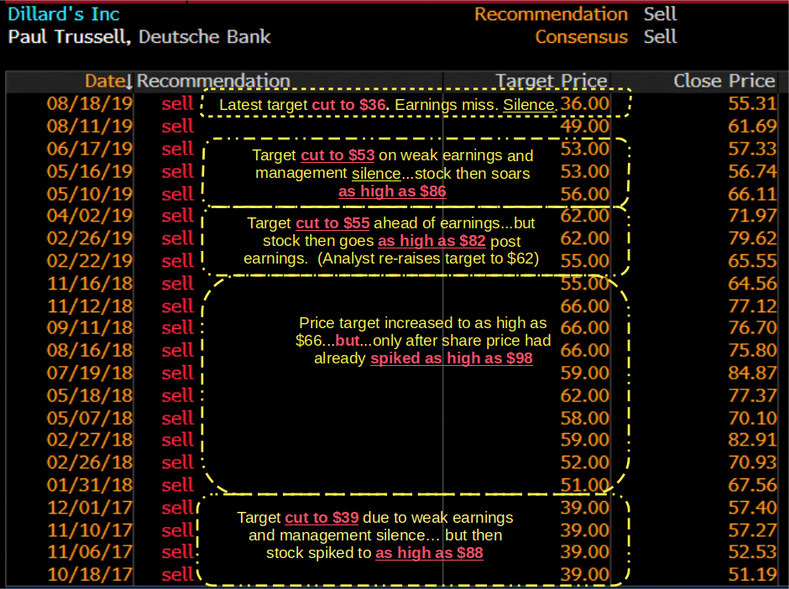

Sell side analysts. The more it reoccurs, the funnier this joke becomes. After an extra-dreadful quarter, sell-side analysts seek to “punish” the company’s silence with the only weapon they have: draconian downgrades in their price targets. This “punishment” from the sell side is what makes it possible for Dillard’s to buy back a large amount of shares during this very short window, when prices hover in the $50s and low $60s. But within just a few weeks, the stock has repeatedly squeezed into the $70, $80s or $90s. And then later (well after the share price spikes has hit the $80s and $90s) sell side analysts then found reasons to re-ratchet their targets upwards…only to re-re-re-slash their targets back down in the subsequent quarters, and (as usual) for the same recurring reasons.

Here are just a few examples of this behavior dating from August 2019 back to May 2017.

-

Dillard’s management is silent after earnings miss, and analysts take note (Marketwatch, 16-Aug-2019)

-

Dillard’s Inc. (DDS) PT Lowered to $36 at Deutsche Bank (StreetInsider, Aug 2019)

-

Deutsche Bank Maintains Sell on Dillard’s, Lowers Price Target to $36 (benzinga, Aug 2019)

-

Dillard’s price target lowered to $56 from $62 at Wedbush (The Fly, Aug 2019)

-

BofA withdraws Dillard’s last Buy rating after earnings slide (Seeking Alpha, November 2018)

-

Jeff Reeves says Dillard’s is a “pretty darn bad retailer” (Marketwatch, May 2017)

Apparently CNBC does not follow Moxreports. In June 2019, with short interest spiking above 70%, I predicted that Dillard’s would soon squeeze violently. A few weeks later, the price spiked to $86 just in the last hour of trading. The media was oddly mystified by the analysis which should have been found by any google search of “Dillard’s squeeze”. The stock stayed in the $70s and $80s until “unexpectedly weak” earnings caused the recent plunge to the $50s.

-

Dillard’s (DDS) could quickly double on “upside perfect storm” (24-Jun-2019, Moxreports)

-

Video: Here’s what’s behind Dillard’s Big Move (19-Jul-2019, CNBC)

——————–

This report is the opinion of the author. It is not a recommendation for anyone anywhere to do anything at any time. Do your own research, form your own opinions. The author is not an investment adviser. The author is long DDS. The author may conduct transactions on various securities mentioned in this report (or on securities of competitors of other comparable companies, securities etc.) within the next 72 hours.