Summary

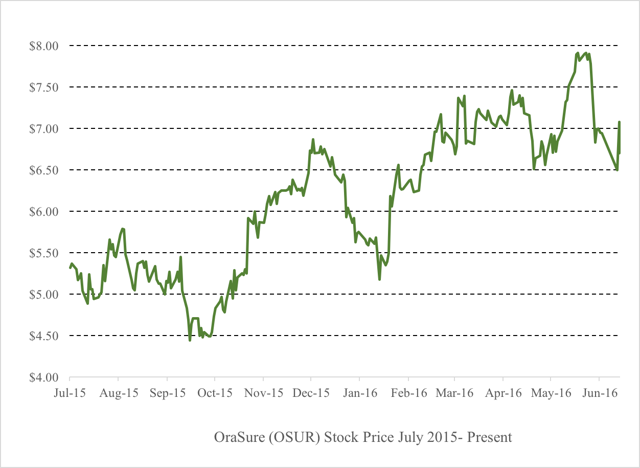

- OraSure dipped just slightly from its 2016 highs on a recent report from Raymond James downgrading OraSure to a “Market Perform”.

- The report completely dismissed significant near-term problems for OraSure. Another BTIG analyst has been quick to defend the stock.

- As shown below, OraSure is virtually guaranteed to lose a very lucrative deal with AbbVie next week, costing it over $40 million.

- As shown, OraSure will lose more than 100% of its annual profits and 90% of cash flow, revenue growth will be eliminated.

- With OraSure trading at 3.5x sales, the stock will quickly lose around 35% as soon as an 8-K is released next week.

This article is the opinion of the author. Nothing herein comprises a recommendation to buy or sell any security. The author is short OSUR. The author may choose to transact in securities of one or more companies mentioned within this article within the next 72 hours. The author has relied upon publicly available information gathered from sources, which are believed to be reliable and has included links to various sources of information within this article. However, while the author believes these sources to be reliable, the author provides no guarantee either expressly or implied.

The perils of sell side research

Over the past year or so, I have written a number of articles highlighting short selling opportunities on overvalued healthcare stocks, which had near-term problems.

It is worth noting that in every single case, we saw uber bullish sell side analysts predicting that these troubled stocks would RISE, often by 50-100% (or even much more).

So how have our analysts done for us?

When I highlighted Revance Therapeutics as a short, the stock had recently surged from $26 to $40 with Cowen calling the stock a takeover target. Cowen pushed a $55 target price. Revance has since collapsed to $13 – down more than 60% and 75% below Cowen’s target.

When I highlighted Osiris Therapeutics (NASDAQ:OSIR), the stock was at around $9. Despite obvious signs of malfeasance, Piper Jaffrey was supporting the stock with a $28 target. It has since collapsed to $5 – down more than 40% – amid an SEC investigation (precisely in line with my warning to readers).

Keryx Biopharm (NASDAQ:KERX) is down by around 40% since I highlighted its obvious problems. The stock had been trading at around $10, but various analysts had just upgraded the stock with multiple targets as high as $32.

Omeros Corp. (NASDAQ:OMER) is down by 45% (and was previously down by almost 50%). The stock had been trading at around $18 before I had written on it, even as analysts were telling us that the stock was worth $30-38. It now trades for just $10.

Tokai Pharma (NASDAQ:TKAI) is down 40%, from $10 to around $6. But analysts had been telling us that the stock was going to as high as $38-44.

Likewise, both BTIG and Raymond James have supported OraSure with targets of $8-9. Today, I will show here that OraSure (NASDAQ:OSUR) is now headed for a very sharp decline of at least 35% (or more), driven by a catalyst which I expect in the next few days.

Sell side analysts have now steered investors wrong once again. We only need to wait a few more days for this to be proven out.

Note: OraSure is also a very attractive short because there are no visible catalysts on the horizon, which could cause any meaningful appreciation in the stock price.

Investment summary

On June 6th, shares of OraSure briefly hit a new intraday high for the year at $7.99. Shortly thereafter, a downgrade from Raymond James caused the stock to drop to below $7.00, a modest decline.

The cited reasons for the Raymond James downgrade were a) the stock had reached its target of $8.00, meaning that there was little additional upside and b) OraSure faced the simple possibility of losing a lucrative co-promotion deal with AbbVie (NYSE:ABBV).

However, Raymond James has substantially dismissed the real likelihood of losing the co-promotion deal. It has also dramatically downplayed the full impact to be felt on OraSure’s stock price.

As the stock price became even weaker in recent days, breaking below $6.50, sell side firm BTIG came out defending it with a $9.00 target.

For the AbbVie deal, Raymond James noted that:

To be clear, our working thesis is that this relationship is sustained through 2019

The firm then notes that in the event OraSure does lose the relationship, then the stock probably goes to “near $6.00.” So they are suggesting downside of a mere 10-12%.

The report from BTIG was downright bizarre. The firm states that it “does not have a strong opinion” about the termination of the contract, but reiterates a $9.00 target.

The actual realities with OraSure are far more severe:

– OraSure is now virtually guaranteed to lose the AbbVie deal (as shown below)

– The six-month notice date is June 30, 2016 (i.e. today). The announcement could take place at any time on or after that date. OraSure will have 4 days to file an 8-K.

– The impact on OraSure will be very significant, and the stock should trade back to $4.50 or below (at least 35% downside)

– At current prices, OraSure is definitely a Strong Sell

Below, I will show where the analysts have it completely wrong.

Company overview

OraSure Technologies is a medical device company, which primarily makes a variety of healthcare diagnostic tests. The company is best known for its rapid point of care (“POC”) tests for HIV and Hep C. These are known as OraQuicktests and they provide test results within about 20 minutes. For 2015, sales of these two types of tests accounted for around 40% of revenues at OraSure.

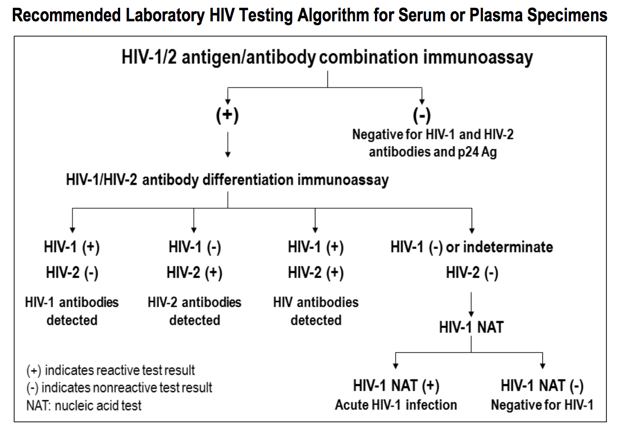

The idea of a rapid oral HIV test was initially very promising. However, OraSure suffered from an unfavorable update to the CDC’s (Center for Disease Control) guidelines which recommend that laboratories conduct initial testing for HIV with an FDA approved antigen/antibody combination (4th generation) immunoassay that detects HIV-1 and HIV-2 antibodies and HIV-1 p24 antigen to screen for established infection with HIV-1 or HIV-2 and for acute HIV-1 infection and that none of the assays in the currently recommended algorithm are FDA-approved for use with oral fluid or dried blood spot specimens.

As a result, the CDC update cramped much of the upside from OraSure’s HIV test. This greatly increases the reliance on its Hep C test.

OraSure also provides diagnostic tests for other infectious diseases (including flu, H1N1 and Ebola), but these account for less than 5% of revenue. Other products include substance abuse testing kits (9% of revenues) and cryosurgical systems (10%) of revenues.

The company also has a subsidiary, which sells genetic testing kits, which is responsible for around 20% of revenues.

Net revenues increased by 11% from 2014 to 2015, reaching $119 million. However, this growth was entirely due to the revenue boost from the co-promotion deal with AbbVie. Without that deal, OraSure is not really growing revenues at all.

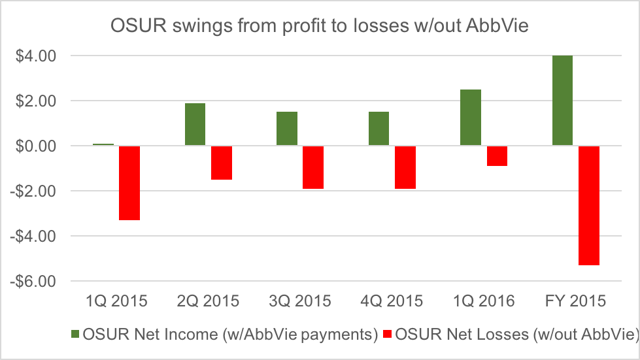

Prior to the AbbVie deal, OraSure had lost money every single yearsince 2007.

In 2015, as a direct result of the AbbVie co-promotion deal, OraSure then reported its first profitable year, with a net income of just $8.1 million.

Profitability has continued into Q1, with net income of $2.5 million for the quarter.

But again, as we will see below, more than 100% of net income in each quarter is derived from the relationship with AbbVie. Without it, OraSure returns deep into continuous loss making territory.

(This is in stark contrast to the views expressed by the BTIG analyst).

The co-promotion deal with AbbVie

In June 2014, OraSure signed a co-promotion deal with AbbVie, which was reported to be worth up to $350 million if all milestones were met. AbbVie was to market its VieKira Hep C drug along with OraSure’s rapid point-of-care Hep C test and AbbVie was to have exclusive co-marketing rights.

The deal has two parts, both of which were enormous for OraSure.

The first part is up to $75 million exclusivity payments. These exclusivity payments will continue on for the life of the deal (5.5 years), or until it is terminated, regardless of performance. That equates to $13.6 million per year in guaranteed revenue for OraSure.

The second part is up to $55.5 million in milestone payments per year if certain annual targets are met. The actual payments are determined according to how many new patients are enrolled in the patient database above a certain threshold.

The enthusiasm for the deal was quickly reflected in the stock price, and OraSure soared from $6 in June to $10 by year-end 2014, An increase of around 65%.

It is now 2 years later and we are approaching AbbVie’s first “right to terminate” date. AbbVie has the right to cancel the deal as of December 31, 2016. But it is important to note that AbbVie must give 6 months notice in order to terminate.

That means that the termination can be announced at any time on or after June 30th. Given the huge impact on revenues and net income, this is most certainly a material event, requiring an 8-K to be put out. OraSure will have 4 days from the notice of termination to put out the 8-K.

The negative effect on the stock should be immediate and substantial as soon as the 8-K from OraSure is released.

There are three points to take away from this article.

The first point is that the termination of the deal by AbbVie is virtually certain (in contrast to the statements from analysts). And AbbVie is highly incentivized to make the termination happen at the earliest possible date.

The second point is that the effect on OraSure, both the company and the share price, will be very significant (again in contrast to the analyst assurances). I currently expect a share price decline of at least 35%.

The third point is that following its appreciation from $4.50 to current levels, OraSure is already dramatically overvalued vs. its med device peers.

Each of these points is detailed below.

POINT #1 – Termination of the deal is virtually certain

The problem here is that the entire deal has been an abject failure for both parties. Neither AbbVie nor OraSure are making any significant product sales off of the deal. Yet under the terms, if the deal is not terminated, AbbVie is still obligated to pay over $40 million in additional exclusivity payments. As we will see, AbbVie’s sales of its Hep C drug have been deeply below expectations for almost 2 years now. We will also see that performance (OraSure leads and sales) under the co-promotion deal has been dismal. As a result, AbbVie is virtually guaranteed to terminate the deal. To continue such a deal simply makes zero sense whatsoever for AbbVie.

AbbVie’s VieKira (Hep C) sales have been a massive disappointment

Back in 2014, AbbVie knew that it was a latecomer to the Hep C market. Gilead’s (NASDAQ:GILD) Sovaldi had already been approved in December 2013 and immediately began racking up blockbuster sales. Sales of Sovaldi in Gilead’s first quarter alone amounted to over $2 billion. Gilead’s second Hep C drug, Harvoni, launched not long thereafter and also hit immediate blockbuster status. The price tag on these drugs from Gilead is up to $120,000 for a 12-week treatment.

AbbVie’s Viekira Pak wasn’t approved until December 2014.

Clearly, AbbVie was looking for ways to compete with Gilead’s drug.

One tactic was to simply cut price. Another tactic was to cut a co-promotion deal with OraSure, which gave AbbVie exclusive rights to co-promote a Hep C drug with a rapid point-of-care diagnostic test.

As shown early on by Gilead, the international Hep C market is worth tens of billions of dollars. As a result, AbbVie was willing to spend big. The co-promotion deal with OraSure was reportedly worth up to $350 million to OraSure. Even with the price cuts on VieKira, AbbVie initially noted that it expected $3 billion in Hep C drug sales in its first year. In contrast to Gilead, AbbVie sells VieKira for around $80,000.

Following an initial expected launch with $3 billion in sales, there was expected to be a significant ramp up in subsequent periods as well.

Yet despite the discounts and the co-promotion deal, sales of AbbVie’s VieKira have been a deep disappointment. In its first full year, 2015, AbbVie pulled in sales of around $1.6 billion – about half of what it had expected. This is when the OraSure co-promotion deal would have been in full swing.

The weak sales then continued into 2016, with Q1 sales coming in at $414 million. So 2016 is on track to be in line with the dismal 2015.

Not only have absolute revenues been a deep disappointment, but there has been absolutely no ramp up in sales even after 6 quarters.

The first major problem was that not long after it was launched, VieKira was facing serious heat from the FDA.

The warning was described as follows:

The hepatitis C infection treatments Viekira Pak (AbbVie) and Technivie (AbbVie) may increase the risk for serious liver injury, particularly in those with underlying advanced liver disease …. The FDA will now require the company to add information about serious liver injury adverse events to the Contraindications, Warnings and Precautions, Postmarketing Experience, and Hepatic Impairment sections of the Viekira Pak and Technivie drug labels.

AbbVie’s stock quickly dove by around 15% on this news.

The second big problem for AbbVie and VieKira was the launch of a competing drug by Merck (NYSE:MRK) and the unexpectedly aggressive price-cutting by Merck. For example, as a result of the price cuts, AbbVie soon lost much of its business with Veteran’s Affairs.

But overall, it continues to be the case that Merck and AbbVie have failed to steal significant market share from Gilead, despite their price cuts and heavy marketing spend. Gilead has managed to hold on to a market share of about 85%, while Merck and AbbVie fight over the remaining 15%.

In fact, for AbbVie, the struggles appear to be getting worse. In January, AbbVie gave guidance of $2 billion in VieKira sales for all of 2016. But by April, that guidance had been slashed by 25% to $1.6 billion.

In short, even this long after launch, sales are low and stagnant. AbbVie’s VieKira has failed to become a successful drug, which largely eliminates the company’s motivation to spend big on the co-promotion agreement.

But more importantly…

How do we KNOW that AbbVie will cancel this contract ?

Against that backdrop of dismal sales with zero growth, AbbVie continues to make large guaranteed payments each year to OraSure. The total of these payments is up to $75 million, in increments of $13.6 million per year.

By canceling the deal, AbbVie can therefore save itself just over $40 million from a deal that clearly isn’t working. Given the ongoing weak sales of VieKira and the lack of performance from the co-promotion deal, continuing to pay over $40 million makes absolutely zero sense for AbbVie.

The other component of compensation under the deal takes the form of “milestone payments,” which are awarded if new patients enrolled in the patient database exceed certain thresholds. The other evidence of the failure of this deal is that nearly 2 years after the deal was signed, OraSure has not even received any milestone payments whatsoever.

The failure of the deal is equally visible from the OraSure side of the equation. By looking through the financials, we can see that there is virtually no activity being performed. OraSure discloses that it pays a fee to AbbVie for detailing the OraQuick test. This fee is classified under Sales and Marketing.

Under an agreement with AbbVie, we are co-promoting our OraQuick® HCV test in certain U.S. markets, including general practitioners and certain specialty physicians. Under this arrangement, AbbVie has agreed to detail our OraQuick® HCV test in the physician markets and we pay AbbVie a fee for these detailing services.

The way that this works is that each time AbbVie details the product to a physician, the physician is then provided as a “qualified lead” to OraSure and OraSure then pays a fee to AbbVie.

But despite a slight increase in HCV test sales, OraSure’s Sales and Marketing expense actually fell by 15% in 2015.

What this means is that AbbVie is not even bothering to detail the product to physicians under the co-promotion agreement. And as a result, OraSure is not paying them any meaningful fees.

There is quite literally no activity ongoing under the co-promotion agreement.

Yet we can see that BTIG takes a very contrived “glass is half full” view of this problem. BTIG notes that if OraSure loses the deal, then it would not be required to pay detailing fees. But with TOTAL Q1 Sales and Marketing Expense (across all products) of just $8.7 million, there is very little to be saved.

In reality, common sense (and the benefit of hindsight) now tells us that this was clearly a bad idea and a bad deal for AbbVie from the get go.

Co-promoting VieKira with an exclusive diagnostic device does nothing to ensure that doctors will actually end up using VieKira. They can just as easily start using the OraSure test while prescribing Gilead’s drugs. In addition, the revenue (and commissions) to be gained by the AbbVie sales rep for selling additional OraSure tests are so low by comparison that the AbbVie sales reps have zero incentive to even bother pushing the low-priced OraQuick devices. While a single course of AbbVie’s VieKira can run around $80,000 per patient, the OraQuick device costs just around $20. There is simply no upside for the sales reps to promote it in practice.

In other words, the co-promotion deal has failed and it was destined to fail from the very beginning. Combined with the ongoing dismal sales of VieKira, AbbVie is now virtually 100% certain to cancel its exclusive arrangement with OraSure, which would otherwise cost it over $40 million over the next few years.

As for timing, AbbVie will almost certainly cancel as soon as the notice date (June 30) arrives. OraSure will be required to release an 8-K announcing the termination within 4 days of receiving notice from AbbVie, which means the announcement can be expected as soon as next week.

POINT #2 – The effect on OraSure’s share price will be very significant

Despite its downgrade of the stock, Raymond James had expressed optimism that the relationship with AbbVie would remain intact. Clearly, we can see from the above that this is highly, highly unlikely.

Raymond James had also suggested that even if the deal was terminated, the stock price might trade to around $6.00 and not much lower. Again, this is far too optimistic.

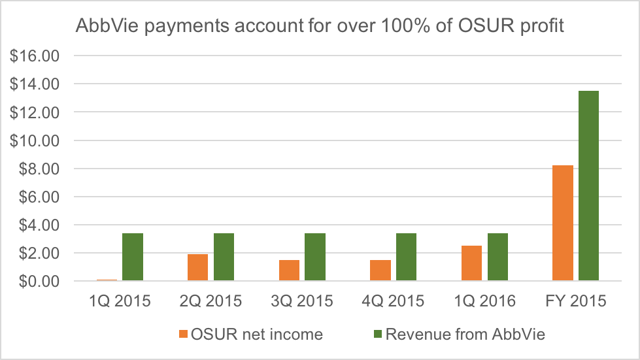

OraSure has only recently swung to profitability, following 7 years of continuous losses. The deal with AbbVie accounts for more than 100% of all of OraSure’s profit in each of the past 5 quarters.

The boost from this deal is hard to overstate. The exclusivity payments to OraSure are just free money with a 100% gross margin. The payments therefore flow straight to the bottom line.

For full year 2015, OraSure earned $8.2 million. But the payments from AbbVie amounted to $13.5 million.

For 1Q 2016, OraSure earned $2.5 million. But the payments from AbbVieamounted to $3.4 million.

Here is where the BTIG report is the most flawed. BTIG attempts to state that these payments do not have a 100% margin impact because OraSure would have had to spend money in the past on customer training, etc.

The real fact is: once OraSure loses the co-promotion deal with AbbVie, it will need to BEGIN spending heavily on Sales and Marketing for the first time.

As a result, even though the loss of AbbVie will result in $13.6 million, the real effect on the bottom line will be noticeably GREATER than $13.6 million. So the net margin effect is, in fact, greater than 100%.

But to keep the analysis simple, I am just assuming that the impact on the bottom line is the full $13.6 million.

Without the payments from AbbVie, OraSure immediately returns to a loss making status for the foreseeable future. As noted before, prior to the AbbVie deal, the last time OraSure turned any kind of a profit was in 2007.

Not only are the payments from AbbVie 100% profit, but they are also 100% cash. For full year 2015, OraSure generated $15.8 million in operating cash flow. But $13.6 of this came from the AbbVie exclusivity payments. In Q1, OraSure reported $4.7 million in operating cash flow, but again, $3.4 million but straight from the AbbVie exclusivity payments.

The point is that roughly 90% of cash flow and more than 100% of net income are the direct result of the AbbVie deal. Without that deal, OraSure transforms into a money losing company, which generates virtually no cash.

So now, let’s look at the sky-high valuation of OraSure. The key problem is that in addition to losing money and not generating much cash, OraSure will be showing little to no growth.

POINT #3 – Even prior to the pending loss of AbbVie, OraSure was already dramatically overvalued vs. its peers.

When Raymond James downgraded OraSure from Overweight to Market Perform, its first reason was simply that the stock had reached its full value at $8.00 and there was no further upside to be had.

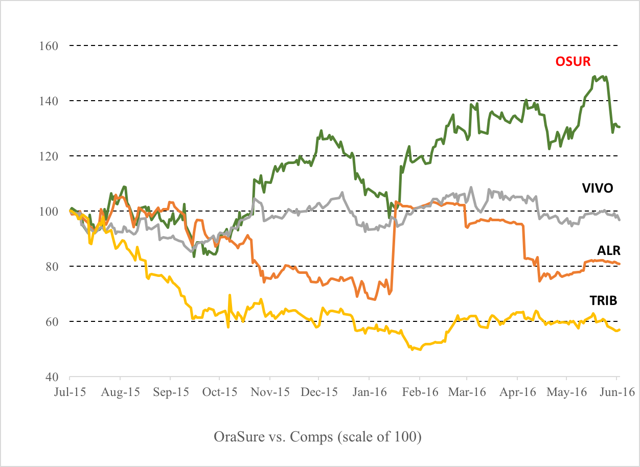

But we can also see that OraSure has dramatically outperformed all of its peers over the past 12 months.

As shown above, Meridian Bio (NASDAQ:VIVO) and Alere (NYSE:ALR) are both down slightly and have never really been up over the past year. Trinity Biotech (NASDAQ:TRIB) is down by more than 40%.

Trinity is quite similar in size and business to OraSure. The company makes point-of-care diagnostic tests used to detect autoimmune, infectious and sexually transmitted diseases, diabetes, and disorders of the liver and intestine. Like OraSure, the company does around $100 million per year in revenue. It is also substantially more profitable than OraSure. Again, that stock is now down by 40% since last year. Trinity made a profit of around $20 million last year, putting it on a P/E ratio of about 10x and a Price to Sales ratio of around 2x.

The next best comp is Meridian, which is also very similar. The company sells clinical diagnostic test kits, for certain gastrointestinal, viral, respiratory and parasitic infectious diseases as well as bulk antigens and reagents. Last year, the company did $194 million in revenues and was more profitable than OraSure. Meridian is also down by around 30% from last year. Like Trinity, Meridian is profitable and trades on a P/E of around 20x.

The point to be made is that OraSure has continued to stay noticeably elevated simply as a result of the benefits it has enjoyed from the AbbVie deal.

So the question then becomes: without AbbVie, what are we left with at OraSure ?

We can now see that without AbbVie, OraSure is a money-losing business across the board. It is also one that generates virtually no cash.

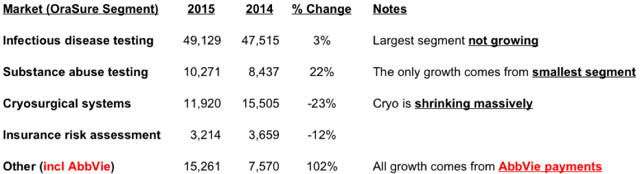

The problem gets worse as we look for growth.

OraSure’s largest business segment is Infectious Disease Testing, responsible for around 40% of revenues. However, that segment (even with the AbbVie promotion going on) grew just 3% last year. OraSure is a no growth business.

Cryosurgical systems, the 2nd largest segment actually shrunk by 23%.

In fact, the only segment to show any appreciable growth was Substance Abuse Testing. However, that accounted for just 10% of total revenues.

(Note that “Other” revenues of $15.2 million included $13.6 million from AbbVie)

The above numbers are for OraSure’s main business segment. OraSure has a second business segment, the DNAG segment, which sells genetic testing kits. Sales here increased from $23.8 million to $29.9 million.

Overall revenues at OraSure increased from $106.5 to $119.7, an increase of $13.2 millon. However, $13.6 million of revenues came from AbbVie. OraSure is therefore shrinking, not growing.

The valuation crisis at OraSure

Despite the fact that OraSure will be losing money every quarter, and despite the fact that OraSure will be generating virtually no cash, and despite the fact that the business is slightly shrinking (not growing), OraSure continues to be valued at more than 3.5x sales

Conclusion

Back in 2014, AbbVie was willing to do whatever it took to crack the Hep C market from first mover Gilead. It was willing to discount prices and spend big on a co-promotion deal with OraSure. That deal was potentially worth up to $350 million, showing just how ambitious and optimistic AbbVie was at the time.

Two years later, the deal has revealed itself to have been poorly thought out and a complete failure.

Sales of AbbVie’s VieKira have been dismal and continue to disappoint. Sales are low and there is no growth.

Nearly two years after the deal was signed, OraSure has received no milestone payments whatsoever. But more importantly, we can tell by looking at OraSure’s financial statements (in particular Sales and Marketing expense) that activity under the co-promotion agreement appears to be truly nil. There is quite literally nothing going on under the co-promotion agreement at all.

And yet AbbVie continues to pay $13.6 million per year in guaranteed exclusivity payments to OraSure for doing absolutely nothing. These remaining payments would total over $40 million if the deal were not cancelled.

As a result of these factors, AbbVie is now virtually guaranteed to cancel this failed deal as soon as the termination date allows on December 31, 2016. AbbVie is required to give 6 months’ notice, meaning that OraSure should be notified right around June 30th. OraSure will be required to put out an 8-K announcing the termination within 4 days.

Without the $13.6 million per year in easy revenues from AbbVie, OraSure is in big trouble. Very big trouble.

The revenues from AbbVie are 100% margin, such that they flow straight to the bottom line. They are also 100% cash. This comprises more than 100% of OraSure’s annual profit and around 90% of OraSure’s cash flow. It also made up all of the “growth” that OraSure saw in 2015.

Without these payments, OraSure is a money losing company, which generates virtually no cash and which is not growing. Yet it is currently trading at 3.5x Sales. OraSure is therefore grossly overvalued on an absolute basis, as well as vs. its med device/diagnostic peers.

As soon as the 8-K is released, most likely within the next few trading days, OraSure should be expected to fall by at least 35% to around $4.50 or below. Note that in late 2015, OraSure had been trading as low as $4.50, even with the AbbVie deal in place. So there may be substantially more downside below that level.