Two weeks ago, I wrote an article on Erickson Air Crane (EAC). I predicted the stock would decline by 50% once the market better understood the company’s troubled situation. Erickson declined by 25% that day. Before the day was even done, law firms began announcing investigations into breaches of fiduciary duty by Erickson. Following my article, there are now 6 separate investigations ongoing and the share price has retreated 35% from its recent highs.

Yet prior to my article, the stock had been a triple this year. It had been featured on Cramer and had been the subject of numerous bullish articles predicting a further doubling of the stock. Instead, it will likely give back all of its gains this year, and potentially even more.

Another company which appears headed for a very rapid 50% decline is IDT Corp. (IDT). The stock has many of the same problems as Erickson, yet has doubled this year based on the market’s complete failure of analysis. Once the market gets a clearer picture, IDT is likely to return to well below $10.00, where it was in April, and where it has spent most of the past year.

Like Erickson, there is virtually no short interest in IDT (around 2%). The stock has risen sharply, but clearly not due to a short squeeze. Once long investors reevaluate, there is nothing to support the stock or slow its decline. This is part of the reason for the speed of Erickson’s decline, and it is also why moves down in IDT will be just as sharp.

And just like Erickson, there is a very near term catalyst for the 50% drop in the next few days or weeks.

IDT itself is a very boring company. 99% of revenues come from discount long distance calling services, including those familiar prepaid IDT phone cards, “PIN-less” long distance calling and traffic termination services. That business shows huge volume (over $1.5 billion in revenues) but razor thin margins of 1-2%. As of the most recent quarter, the company is losing money once we look past one time accounting gains. In years past, the company was doing well over $2 billion in revenues, but now the business of international long distance is facing increasing competition from free internet providers. IDT has been able to stem some of the losses by successfully stealing business from competitors in this declining industry. But over the longer term, it is clear that the business of discount long distance will continue to shrink overall.

But those are longer-term problems. The real problems for IDT are much nearer term.

IDT CEO Howard Jonas owns 23.5% of the shares, but due to the dual class share structure, he controls 74% of the voting rights. Like Erickson’s controlling shareholder, Jonas has taken to making the company his private fiefdom, taking actions which may be to the detriment of other shareholders. His extraneous ventures with company funds into projects such as oil shale in Israel, hedge funds, consumer debt collections, Hispanic food delivery, comic books, wireless spectrum assets and technology IP patent litigation, have now lost IDT at least $1 billion.

Crain’s New York Business quoted Mr. Jonas, saying

Every day, entrepreneur Howard Jonas says, he fights an imaginary hydra-headed creature called the Meligoth.

Mr. Jonas got his start selling hot dogs across the street from a methadone clinic and has also dabbled in selling mail-order horoscopes, teak chopsticks and travel brochures.

Crain’s details how Mr. Jonas’ penchant for investing company funds into get rich quick ventures resulted in the share price sinking to just 74 cents a few years ago – a 99% drop. At the time of the Crain’s article, Mr. Jonas’ scheme of the moment was a digression from telecom into shale oil. IDT’s share price performed extremely well based on the red hot prospects for shale at the time, which were much brighter than that of its languishing phone card business.

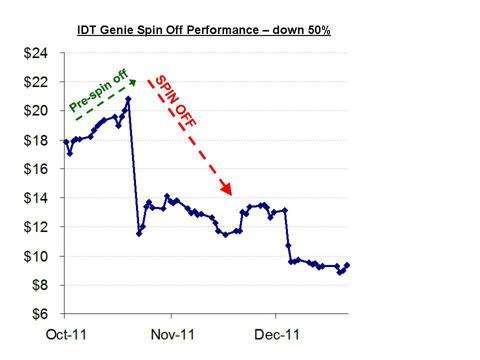

But, as with the others, this new and unfamiliar business failed. So IDT simply spun it off to shareholders. Once shareholders realized that there were no more hot prospects in a new area, IDT’s stock quickly plunged by more than 50%, from $20.00 to around $8.00. It was back to being a non-profitable telecom company once again.

As we can see, the spin off was a “buy on the news, but sell (HARD) on the event” type of trade.

The catalyst for a 50% drop in IDT

IDT’s latest failed venture (Spectrum Communications) has been in the areas of wireless spectrum and “IP Patent Litigation.” IDT spent hundreds of millions in company funds on this venture beginning in 2001. It recently sold a few of its spectrum licenses for a few million dollars, with IDT keeping the few million in proceeds. But the businesses never made money. In 2012, total revenues from these companies amounted to just $600,000, despite the hundreds of millions in investment over a 12-year period.

As it has done many times in the past, and with many varied new ventures, IDT just announced it would be spinning off these undesirable assets. The spinoff was announced in May and should be completed imminently.

Once that happens, IDT will go back to being just a money losing telecom with minimal growth and razor thin margins. Of greater concern is that investors will now get a chance to see first hand the economics behind the hundreds of millions of IDT funds that were wasted on this speculation.

As before, the share price is likely to plunge by 50% back to below $10.00. Investors had pinned their hopes on IDT’s success in these divergent businesses to pull IDT out of its telecom malaise. But IDT will no longer be able to hold out those hopes once these assets are spun off.

Mr. Jonas has demonstrated that he is comfortable with entering into numerous related party transactions with himself, his family and the several other companies he owns. This has likely helped him push through this string of massively destructive transactions which have no relevance to IDT’s telecom business.

Mr. Jonas appointed his son Shmuel (aka “Samuel”) Jonas as the COO of IDT. Shmuel’s previous experience was as an apartment manager in the Bronx and as an operator of a frozen dessert delivery business. Shmuel became a member of management at the age of 25 and currently earns over $400,000 per year.

Mr. Jonas also appointed his other son Davidi (aka “David”) Jonas as CEO of the Spectrum spin off. Davidi’s former experience was that of a Rabbi in the Bronx and a high school teacher of Judaic studies. Davidi is 26 years old and has been employed by IDT / Spectrum since 2012. How these experiences translate into running a struggling public company focused on wireless spectrum and IP patent litigation remains unclear.

IDT’s General Counsel (responsible for approving its large corporate transactions and spin offs) happens to be Mr. Jonas’ sister, Joyce Mason.

IDT obtained its insurance policies from IGM Insurance Brokerage, owned by Mr. Jonas’ father, his mother and his brother in law (Jonathon Mason).

Mr. Jonas also appointed his son-in-law (Michael Stein) as Vice-President of Corporate development.

His other company (Jonas Media group) gets cheap office space from IDT, and last year owed IDT $300,000. Separately, IDT Domestic Telecom has paid up to $300,000 to lease office space from Howard Jonas and Shmuel Jonas.

Following its spin-off, Howard Jonas became Chairman of IDT’s CTM spin off. He is also Chairman of IDT spin off Genie Energy. He continues to be extremely well compensated by these companies even after they are spun off from IDT, currently earning 7 figures.

One recent development deserves particular notice.

Prior to approving this latest spin off to shareholders, Mr. Jonas awarded himself 10% of the equity in Straight Path IP. Presumably this was all approved by his sister and his son. More details on the problems with Straight Path are provided below.

IDT has financial problems, strategic problems and corporate governance issues. But there is a reason why the market has missed these problems at IDT, causing the stock to double.

Institutional ownership is very low. The only fund that is a 5% holderhappens to be a Vanguard index fund. Index funds do not do stock specific research. Instead they try to simply track the overall indices.

In addition, there is no mainstream research coverage of the stock, despite its $500 million market cap. There is simply no institutional commitment to this stock by those who invest or provide research.

The few funds who own IDT have no idea what it is they are sitting on.

Like Erickson, IDT insiders have become quick to sell substantial amounts of their stock. Director Eric Consentino recently sold 75% of his holdings,Bill Pereira (President of IDT Telecom) recently sold around 70% of his saleable stock. When options vested in June, General Counsel (and sister of CEO Howard Jonas) Joyce Mason twice sold 100% of the underlying shares on the exact same days.

IDT occasionally receives the benefit of positive articles and headlines which consistently point out the following bull case:

- Strong cash balance of $160 million

- Low P/E ratio of 9 times earnings

- High dividend yield of 6%

- Strong share buyback program

- “Hidden undervalued assets”

This is why the stock has risen. Yet even a simple analysis will prove that all 5 of these points are all entirely wrong.

When the market actually does some analysis, it will find that:

- The cash is already spoken for

- The company is losing money (negative P/E)

- The dividend has been cancelled

- The buybacks have been discontinued

- The “undervalued assets” are more likely to be a liability going forward.

Without institutional ownership or research coverage, these mistakes have been entirely missed by the market, even as the stock has doubled.

Because the stock has doubled due to mistaken information, once the current holders realize see these mistakes, the 50% correction is likely to be both swift and steep.

1. Strong cash balance of $160 million – WRONG!

Every positive mention of IDT seems to point out that the company has $160 million in cash, representing 1/3 of its market cap. Clearly (they say) this makes it a “safe” stock to own.

Yet a closer look reveals that this cash is more than already spoken for.

Since the last quarter, the company has paid down the mortgage on its headquarters for $21 million, reducing cash to around $140 million. (The headquarters had been abandoned within 1 year of its purchase at the peak of the US real estate market.)

Against its new cash balance of around $140 million, IDT has $270 million of current liabilities, including:

- $151 million of already accrued expenses

- $90 million of deferred revenue

- $25 million of customer deposits received

- $4 million in other current liabilities

For anyone conducting the analysis, it is plain to see that IDT actually has a negative current account. This condition was notable enough that it had to be disclosed in the recent 10K under Liquidity and Capital Resources. IDT disclosed a “deficit in working capital” of $33.4 million.

So it turns out that because of the huge liabilities, IDT is cash poor, not cash rich. This explains why IDT has stopped paying dividends and is no longer buying back stock. There is nothing “safe” about a stock with this type of liquidity position.

2. Low P/E ratio of 9 times earnings – WRONG!

In the most recent quarter, IDT reported revenues of $397 million and net income of $8.7 million.

The Motley Fool then embarrassed itself with a computer generated headline stating

IDT Beats Analyst Estimates on EPS

This was downright silly for 2 reasons. First, there is only 1 analystcovering the stock. But even small, boutique firm Chardan Capital just downgraded the stock to “hold.” The Fool has simply repeated automatic data feeds from CapitalIQ, leading some to believe that IDT has both analysts and earnings.

In fact, these “earnings” were actually the result of one time accounting gains due to resolution of prior legal matters. Otherwise IDT would have reported a net loss rather than a profit. In order to see this, one must actually read the financials rather than use a computer to simply scrape numbers from Yahoo and Google Finance sites. The downgrade from Chardan is no doubt the result of the loss being incurred by the business once we exclude gains. There is also no reason for shareholders to expect any value at all from the spin off of the disappointing spectrum assets. The Spectrum spin off will have just 3 employees, one of whom is Mr. Jonas’ 26-year-old son.

Management put a good face on things. Despite the fact that the business is now losing money, management noted “This is the 13th consecutive quarter of year-over-year increases [in revenue].” The revenue increases have been the result of the “PIN-less” Boss Revolution service, which has cannibalized the historical business of physical cards that IDT offers. It has also stolen revenues from other companies who offer physical phone cards. Yet over the longer term, it will be difficult to grow the business of offering international long distance discounts. Services such as Vonage offer free international calls, while services such as Skype even allow free video calls to foreign countries.

What we now have is a company that has inadequate cash whose business is now losing money in an industry which is facing competition from free service providers.

But there is even more to the story.

3. High dividend yield of 6% – WRONG!

Some investors continue to view IDT as a dividend stock. In 2011, the company made 4 dividend payments. In 2012, the company made the first 3 dividend payments. But IDT missed its December 2012 dividend and has not made a payment during the first half of 2013.

Clearly investors would like to see IDT resume dividend payments. But if the company were to resume its dividends, the drain on cash would exacerbate its already problematic current account deficit.

Neither of these situations is good. Yet some small investors continue to regard IDT as a “safe” and desirable “cash rich dividend stock.” This is obviously not the case. And once again, we can see that the problem is a lack of cash.

4. Strong share buyback program – WRONG!

In 2012, when the share price was at around $9.00 (and when IDT still had ample cash), the company was still buying back stock (and it was still paying dividends). However these purchases ended in July of 2012, and there have been no disclosed purchases since.

The two problems that IDT faces now are:

- It doesn’t have the cash to buy back shares

- The shares are trading at the highest level since 2011 (right before the GNE spin off)

As with the dividend, current investors would arguably like to see a buyback. But likewise, the drain on cash would be a significant negative. In addition, buying back shares of a company whose business is losing money while the stock is at a 3 years high would be unjustifiable for a company with noticeable cash constraints.

5. “Hidden undervalued assets” – EXTREMELY WRONG!

The notion that IDT might have a number of “hidden assets” which were being obscured within the bowels of a sleepy telecom company is what got several small, independent authors excited. This a primary reason why the stock has recently doubled.

In fact, these “hidden assets” are actually the greatest cause for concern. This is where IDT is destroying value and awarding sweetheart deals to its CEO who controls the votes.

Over the past 10 years, IDT has repeatedly tried to branch out into a business that will get it away from the declining, low margin business of providing long distance services.

Crain’s wrote an entire section entitled:

“Beyond Phone Cards: IDT’s Record of Diversification” with detailed performance metrics, which I include as Appendix I.

Each time a “new, new thing” emerges in the investment world, IDT has been quick to jump in. They have typically jumped in at peak prices. This has included such diverse activities as hedge funds, distressed consumer debt collection, wireless spectrum, shale oil in Israel and even comic books, among other things. IDT tends to get into these activities even though they are far removed from the company’s core business of providing long distance.

Once IDT realizes that it will not strike it rich on these businesses, the investment is simply spun off to shareholders.

Past examples include the following:

- Genie Energy (GNE) which was spun off to shareholders in 2011. Genie shares have remained flat, but the spin off company has swung to annual losses following the spin off. While part of IDT, the company entered the oil shale business in Israel at the peak of the oil boom in 2008, following its entry into retail energy distribution in 2004 (natural gas). The GNE spin off resulted in a quick 50% drop in IDT shares.

- IDT Carmel consumer debt collection. Close to the peak of the credit bubble, IDT expanded into debt collection and investment in past due debts. IDT ended up exiting the business in 2009 (at the bottom of the credit crunch). It sold the portfolio of past-due debt with a face value of $952 million for just $18 million.

- CTM Media. Over the space of several years, IDT invested in a wide range of media assets, including brochures, comic books and the broadcast license of an AM radio station. The media assets were spun off in 2009 and IDT recorded impairments of over $30 million on CTM related assets. Following the spin off, the board changed Mr. Jonas’ cash compensation agreement and awarded him 1.8 million shares at around 60 cents per share. CTM conducted a 1:20 reverse split in 2011 and now trades on the OTCBB, however, there is effectively no volume.

- Real estate. At the peak of the real estate boom, IDT invested in a new corporate headquarters in 2008, paying over $50 million. Within 1 year of the real estate purchase, the headquarters had been abandoned. The headquarters is currently still marked on the books at $42 million, but IDT says that it is currently unable to determine its value. IDT says that it will try to determine recoverability in Q4 2013 and will report any impairment at that time. The balance of the mortgage was recently paid down following dispute.

- Hedge funds. In July 2007 (the last peak of the stock market), the company had investments in “pooled investment vehicles including hedge funds for strategic and speculative purposes” which totaled $112 million, out of a total of $661 million in cash and investments at the time. Investment in hedge funds is now down to around $10 million (but is not marked at fair value) while cash is down to $140 million.

- Wireless spectrum licenses (Straight Path Communications). In 2001, IDT acquired wireless spectrum licenses from bankrupt Winstar holdings for around $55 million. In 2009, IDT recorded impairment charges of $62 million on these assets. In Q3, the company recorded a gain by selling a small number of the assets and is now spinning off the remaining assets. IDT ended up wasting $300 million to build a backhaul network, but its Spectrum president noted that they were “five or six years too early.” In an odd twist, IDT then sued that former president for diverting 200 of the best licenses to his own business. The president counter sued.

The point is that IDT’s board and management have a history of approving and entering into forays into new, unrelated businesses which have nothing to do with long distance. The company sticks with it for a few years, but when material revenues repeatedly fail to occur, the company simply hands the assets to shareholders via spin offs.

One more recent venture is Straight Path IP which is engaged in the now hot sector of pursuing technology patent litigation. Following wins by companies such as VirnetX (VHC) and Vringo (VRNG), the space became very “hot” with billion dollar potential. The sector has also been chased by substantial amounts of inexperienced “hot money,” bidding up prices.

The most troubling aspect of this transaction is that prior to the spinoff, IDT simply awarded 10% of the equity to CEO Howard Jonas as personal compensation. The shares vested immediately. This business is a lottery ticket. In all likelihood, it will end up not being a home run. But in the event that the IP practice does win a big suit and strike it rich, Mr. Jonas received his lottery ticket for free, after it had been purchased using company money. Lottery tickets are typically dumb investments, but a free lottery ticket is always worth keeping if you can get someone else to buy it for you.

The newest “new, new” ventures – Fabrix and Zedge

Shale oil is not hot anymore. Nor are wireless spectrum, comic books, real estate, consumer debt or hedge funds. As a result, IDT has focused on two even newer “new, new things.”

The company is once again getting into the red hot sectors of the day – “cloud based video streaming” and “mobile apps and services.” Unfortunately, once again these investments are not making any money and IDT has no experience in these areas.

In December, IDT increased its stake in Fabrix to 86%. This trade cost $1.8 million for an additional 4.5% stake, implying a total stake value of around $35 million. Fabrix is in the red hot (but nascent) business of “cloud based video processing, storage and delivery.” Revenues for the past quarter were just $2.6 million and the venture is still losing money.

IDT also holds an investment in Zedge Holdings. This business provides wallpaper and ring tones to cell phone users. Although it generates many clicks, the business is generating revenues of $1 million per quarter, just breaking even at $100,000.

These latest lottery tickets provide no visible benefit to IDT even though they were very expensive to acquire. Telecom continues to account for $1.5 billion in revenue. As a result, IDT continues to divide its reportable segments into Telecom Platform Services (99% of revenues) and “all other” (just 1%). The 1% in “all other” comprises Zedge, Fabrix, Straight Path IP, Straight Path Spectrum, Real Estate and “other small businesses” – combined!

At just 1% of revenues, “all other” assets continue to suck up IDT’s time and money. Yet they have consistently failed to live up to the excessive hype. Those counting on these areas to further boost the share price are simply not reading the numbers. They are also ignoring the steady stream of similar failed ventures in IDT’s past.

Conclusion

IDT has recently logged triple digit gains on the back of several extremely enthusiastic articles which have ignored the details of both the current financial condition and the past history of failed high profile ventures. The stock has benefited from computer-generated headlines which inaccurately portray the current financial condition.

In contrast to these headlines, the stock is not cash rich, it doesn’t pay a dividend, it isn’t buying back shares and it is now losing money (once we look past one time accounting gains). Following the 100% run-up, this puts IDT’s shares in a very precarious position.

CEO Howard Jonas owns 23.5% of the shares, but controls 74% of the votes. As a result, Mr. Jonas can run IDT any way he wants, even to the detriment of all minority shareholders.

At least 6 of his family members have been able to benefit from employment and contracts. Meanwhile, his son and his sister are the ones responsible for approving the transactions which award Mr. Jonas personal equity stakes in these projects bought with company money. This raises very serious fiduciary and corporate governance issues.

IDT continues to derive around 99% of its revenues from the boring and low margin business of discounted long distance calls and termination services. This has been consistent even though the company has engaged in a large number of large and speculative ventures into the latest “hot investment” areas of the past decade.

In each case, IDT sticks with the “new, new thing” for a few years and then simply spins off the business to shareholders as it returns to its sleepy legacy business. Then, when a new hot investment idea comes up, IDT tries its hand again.

The latest ventures (Fabrix and Zedge) have all the elements to make for great cocktail party chatter for CEO Mr. Jonas. But the “cloud based video storage” and wallpaper / ringtones have not generated material revenues (much less profits). In a year or two, these businesses will likely be the next in IDT’s long series of spin-offs of unrelated businesses to shareholders. IDT will then continue on as a low margin provider of long distance.

IDT has overshot its share price by 100% now. The few institutions who own it appear to have very small passive positions and there is virtually no research coverage.

Meanwhile, this is a stock that has been untouched by the shorts. Short interest stands at just 1-2% of shares outstanding. As a result, as the long funds sell into the spike in the share price, there is no short covering to support the stock on the way down.

As soon as current investors catch on to the mistakes that have been made with IDT, the share price should experience a fairly rapid correction of around 50% to $10.00 or below.

The clear catalyst for the 50% drop will be the spin off of the nearly worthless assets of Spectrum in the next few days or weeks.

Appendix I – “Diversification” at IDT

This section comes from the article and interview in Crain’s which describes IDT’s history of using coming money to fund failed ventures in totally unrelated businesses.

Beyond Phone Cards: IDT’s Sorry Record of Diversification

Credit Card Collections Business

Launched in 2006 with $78 million purchase of debt portfolio. Generated operating losses of $77 million until IDT sold the portfolio in 2009 for $18 million and exited the business.

Vitarroz Food Products

An IDT subsidiary bought it in 2006 for $5.2 million. IDT’s ethnic grocery division produced $7.3 million in losses over 2008 and 2009, and the company exited the business in 2009.

IDT Global Israel

Launched in 2003 at undisclosed cost. Generated $19 million of losses over three years ended in 2008. Sold in 2008 for what IDT calls a “nominal amount” and recorded an $8.8 million loss.

Liberty Broadcasting

IDT bought a radio network in 2001 for an undisclosed sum and launched a conservative talk network in 2003. Sold it in 2005 for an undisclosed amount after suffering $7 million in write-downs.

IDT Entertainment

Launched in 2003. Generated about $40 million in losses over its life before it was sold in 2007 for $220 million in cash and other considerations.

Headquarters at 520 Broad St., Newark

IDT acquired building in 2008 for more than $50 million in cash and assumed debt. Abandoned building in 2009 as staff shrank. Building is now empty.

Disclosure: I am short IDT, EAC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.