Investment overview

Shares of Organovo Holdings (ONVO) have recently skyrocketed due to widespread media coverage and an equally widespread misunderstanding of the company’s near term revenue potential. The stock has risen from $2.00 to over $13.00 in the past 12 months and is now valued at over $1 billion. To date Organovo has generated no real commercial revenues, but has brought in small amounts of money from grants and collaborations. The company hopes to launch its first commercial product, a 3D liver assay, in December of 2014, 13 months from now. A launch of any possible next products has not been announced or discussed, but would likely take several more years for any visibility. So for now, this one product is all that there is to hope for for the next few years.

In July, Organovo conducted an equity offering at $4.50 per share. As a result, the company now has a cash balance of approx. 58 cents per share. Aside from the recently raised cash balance, the sum total of all of Organovo’s other assets is just $1 million.

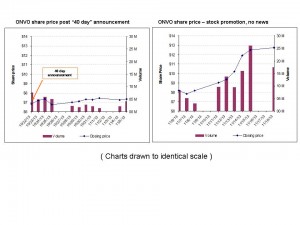

On October 22nd, Organovo Holdings announced that it had presented data demonstrating retention of key liver functions in bio printed tissues for up to 40 days. In response to this, the share price rose modestly from around $6.50 to as high as $7.50 before retreating back below $7.00 once again. The news was out and the stock remained flat for around two weeks. This is clearly not what caused the stock to soar recently.

Starting on November 6th, about two weeks after the announcement, the stock began to take off. Most of this was due to a rapid fire series of bullish articles on the Motley Fool and Seeking Alpha which often came out on nearly every other trading day since the announcement. Many authors and investors have suggested that Organovo may be on the verge of a massive revenue opportunity of tens or even hundreds of millions of dollars in the near term.

During this brief time, the share price has nearly doubled, hitting a new lifetime high of $13.65. The company has nearly 90 million shares fully diluted such that it has now exceeded $1 billion in market cap. It should be noted that there has been no other news whatsoever from the company, only from bullish authors. Readers should also make note of the tremendous surge in volume which has occurred on no substantial news. The point here is that this spike was not driven in any way by the only significant announcement made by Organovo back in October.

Authors who suggest that Organovo is set to begin pulling in tens or hundreds of millions of dollars from sales of liver toxicology assays starting in December 2014 clearly do not understand this product or the market for it.

By now it is well known that drug companies risk losing billions of dollars when one of their drugs enters and then fails clinical trials. Liver toxicity is one of the most common reasons for a drug to fail. As a result, many of these authors have simply created a leap of logic that if the drug companies stand to lose billions, then Organovo must stand to make a fortune by introducing another diagnostic test for them. This isn’t how it works at all.

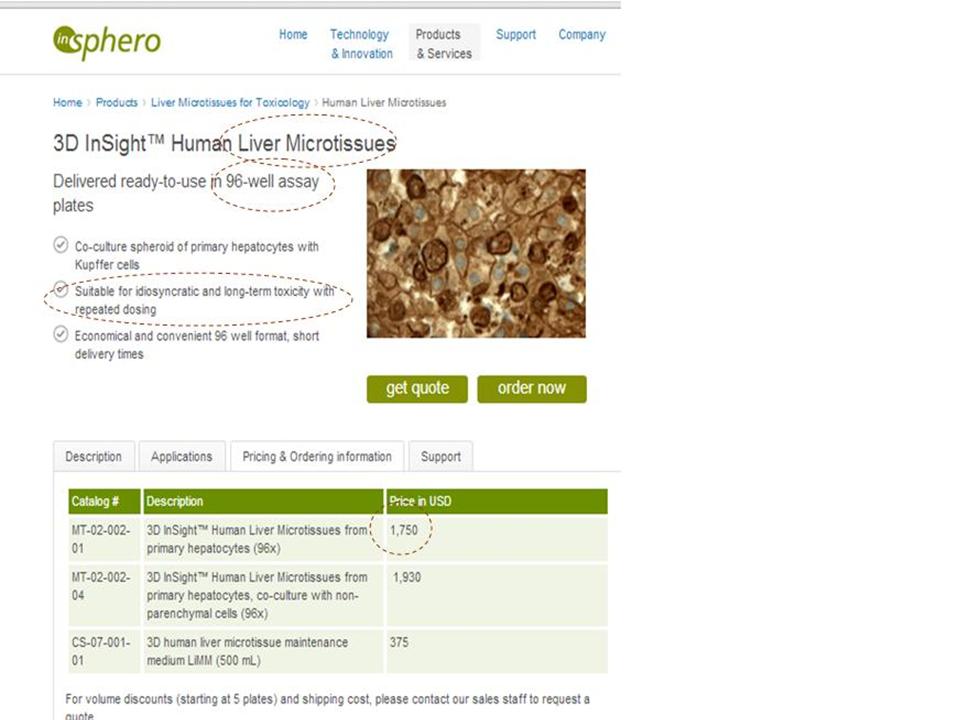

It is clearly the case that much of the overwhelmingly retail shareholder base simply does not understand the market for 3D liver toxicology assays. What they clearly don’t realize is that there are already competing 3D liver assays on the market right now, and sold in the US, which sell for as little as $1,750 per 96 well tray. Yes, these are 3D bio printed liver toxicology assays, which serve the same function as what Organovo hopes to offer. But Organovo won’t even begin for at least another 13 months from now. Retail investors are not aware of competing 3D bio printing companies because many of these companies are not public companies and / or are not US companies. Multiple examples of competing companies in the 3D bio printing space are shown below. Yet because they are not public they have not enjoyed almost daily bullish articles from places such as the Motley Fool.

It is clearly shown below that Organovo’s total revenue potential from 3D liver assays for Organovo amounts to just $3-5 million cumulatively from 2014 through all of 2016. This is because the total market size for 3D liver assays is limited to a few thousand units at most. By 2020, other product offerings (such as kidney assays) may eventually emerge, but so far there is still nothing definitive from the company at all. It should be kept in mind that Organovo has possessed its current technology since 2009, and developing this first product has taken 5 years. So investors should understand that the wait time until we see second product may also be a few more years.

Some of the confusion likely stems from the Organovo presentation which cites a $500 million market opportunity for cell assay products by $2018. The data came from “Scientia Advisors”. Investors need to understand two things. First, this market opportunity applies to an extremely wide variety of assays to be used across the market for a wide variety of uses. It will also be served by many competitors, not just by Organovo. Right now Organovo has in development just a single assay product to fit into this entire market, such that the size of the overall market has very little to do with Organovo’s financials over the next 5 years. Second, investors should be aware that the Scientia data was part of a “sponsored” study in which Organovo hired and paid the firm to produce these estimates

It should also be kept in mind that any revenue in the near term assumes that Organovo is successful in developing the product and that it is launched on time in December of 2014. Investors still bear the risk that the product either doesn’t work as well as planned or is delayed beyond December 2014. For now, we can give Organovo the benefit of the doubt and assume the best for this project. But investors must absolutely realize that the very best case, assuming success, is for a just few million in revenues (NOT a few hundred million). This will be clearly demonstrated below.

Just two weeks ago, prior to a surge in high publicity articles, the stock was sitting flat below $7.00. As the share price has risen due to over a dozen recent articles, management has been selling hundreds of thousands of shares in October and November and has filed a massive S8 registration statement by which they can now issue to themselves over 11 million new shares. This represents nearly 13% of the company in new shares, and would be valued at over $130 million, just for the personal benefit of a small group of insiders.

As should likely be expected, these insider sales and the large S8 equity registration statement escaped the attention of many investors because they have been consistently filed by Organovo management with the SEC on Fridays, and notably after the market was closed. As anyone would expect from this, most investors were quite obviously not even looking at their screen on a Friday at 5 pm. The most recent set of management stock sales came again last week. The SEC filings were released again on Friday. And again it was well after market hours when no one was looking. Links to these filings have been included.

As investors come to realize that Organovo currently has only a few million dollars in cumulative revenue potential over the next 3-5 years, it becomes very difficult to justify the lofty $1 billion valuation. These realistic revenue numbers are a dramatic variance from investors’ mistaken expectations of hundreds of millions of dollars. The biggest near term catalyst for a sharp decline is the ongoing insider sales the huge equity registration by management and the sudden realization that revenue potential is minimal.

Investors should therefore expect the share price to quickly return to below $7.00, where it was prior to over a dozen promotional articles on Organovo released in the past few weeks. As recently as November 5th, Organovo had traded as low as $6.61.

Important Note: The market data with respect to pricing and volumes of 3D liver assays should be seen as highly verifiable. This is how investors should estimate future revenue prospects. Links are included so that they can be verified by anyone. For investors who wish to conduct their own checks, I strongly encourage them to ask Organovo management directly about expected prices and volumes. Management can be reached at [email protected]. Alternatively, investors can ask other 3rd party sources such as Zacks analyst Jason Napodano who has covered the stock or companies such as Insphero (shown below) which already sell 3D bio printed liver assays. These sources will yield estimates that should all be very much in line with the ones I present below.

Background information

Organovo is a stock which lends itself to significant misunderstandings by the market. It also lends itself to over promotion and manipulation. Despite all of the mainstream enthusiasm for 3D printing and bio printing, Organovo has just7% institutional holdings – 93% of the stock is held in retail hands. Stocks such as 3D Systems (DDD) are held in the majority by institutions.

Organovo has just one analyst who has covered it, Jason Napodano from Zacks. However, Mr. Napodano has recently dropped coverage of Organovo due to the valuation. On the Twitter page for TheStreet.com’s Adam Feurstein, a series of tweets and retweets between Feuerstein and Napodano now suggests that “At this price, I think $ONVO could be as much as 500% over-valued.”

When a stock is only owned by retail investors and there is limited research coverage, it is very easy for the stock price to be heavily influenced by articles in the media. This is especially true when the articles come in rapid succession almost every day. Of course, investors need to be aware that many of these very bullish articles come from those who happen to own the stock and would like to see it go up.

In arriving at my revenue projections, I conducted simple market analysis and identified competing 3D liver assays which are already being sold on the market. The price for these 3D liver assays is readily obtainable. It is also easy to estimate the number of units that might be sold in a year. According to clinicaltrials.gov, there are around 500 new drugs which enter phase 1 testing each year. Organovo might hope to gain a significant share of these. They might also hope to gain a share of roughly 1,000-2,000 other compounds that could be tested each year. Each 3D liver assay tray contains 96 wells which can be used to conduct independent tests. As a result, for any given drug, a single tray should be more than ample. Based on this, if Organovo was extremely successful and immediately captured significant market share, it might end up selling as many as 1,000 total units of these 3D liver assays in a year. As a result, we come up with a number of roughly $2 million per year in revenue to Organovo. But this is beginning in 2015 after the product is launched in December of 2014. For the year 2014, investors should remember that product revenue should be close to zero.

That is a very simple method of market analysis that helps us approximate total revenues for Organovo. It is not going to be precise down to the dollar, but it shows clearly shows the following:

There is precisely zero chance of Organovo reaping hundreds (or even tens) of millions of dollars in revenues over the next 3-5 years. Organovo management certainly can have no such expectations. Only the retail investors do as a result of a recent string of bullish articles. Even if an investor wants to arbitrarily double all of the assumptions above, it does not even come to $10 million cumulative revenues for the next 3 years total. Beyond 3 years, we have been given no indication when additional products will be launched.

In arriving at my unit calculations, I first used clinicaltrials.org. I then cross checked my numbers with those which had been prepared by Zacks, who had consulted directly with Organovo management when making their revenue estimates. As a final check, I spoke directly with Swiss company Insphero which already sells these 3D bio printed liver assays for drug toxicology. The results are all quite consistent at a maximum of a few thousand units per year for the total market size. Insphero is the company that sells these 3D bio printed liver toxicology assays for $1,750. More details are included below.

The market for 3D liver assays is simply not a large one, the prices are not very high, and there are already other competitive products actively selling in the market. Those who have projected hundreds of millions in sales have simply failed to look at the market for this product. Instead they simply (and falsely) assume that any product being sold to big pharma must automatically generate hundreds of millions of dollars.

It should come as no coincidence that my estimates above are very closely in line with the estimates of Zack’s research in their detailed initiation report on the company. On Page 16 of the report Zack’s shows clearly that the company is expected to generate revenues of $0.5 million in 2014 and then $2.0 million in 2015, going to as high as $4 million for all of 2016. Zack’s used a different method than I did in arriving at these estimates: they interacted directly with management in putting revenue estimates together.

I contacted Zack’s analyst Jason Napodano a few days ago to see if these revenue estimates were still valid or if anything had changed. He noted that his revenue estimates are still valid for upcoming years. Nothing has changed. Mr. Napodano has written on Organovo on multiple occasions and has been consistently positive on the company and on their technology and prospects. But because he has a much clearer picture of the realistic revenue potential over the next 3-5 years, he last maintained a $5.00 share price target for the share price. His last coverage was updated just 12 weeks ago.

But now we can see from the Zacks’s website that the company is no longer providing updates on Organovo. When I wrote to Mr. Napodano about this, he stated “I dropped coverage given the exorbitantly high valuation. Can no longer recommend people own it.”

A price between $5.00 and $7.00 is certainly where Organovo should be expected to trade in the near term. This is where it was just 2-3 weeks ago. This is well below the current levels and certainly below the lofty levels expected by those who have inaccurately suggested hundreds of millions in revenue.

We can contrast the market research approach to numerous other articles which have appeared in the press in recent weeks. On Friday, one Seeking Alpha author applied simple random guesswork in trying to calculate revenue potential stating:

We don’t how long it will take ONVO to reach $100 mill. to $200 mill. revenue, that might better support current prices, as there is not enough guidance from the company to make those projections. But a reasonable guess of going from $0 to $100 or $200 would be at least three years, which would put is in the FY 2017-18 timeframe as being the earliest when we would expect annual revenues to reach that level.

In fact, there are actually plenty of data points to help quantify just how much revenue Organovo can expect from its only product (3D liver assays) over the next 3-5 years.

This author demonstrated no research into the market and simply stated that by 2018 Organovo might be raking in as much as $200 million. This is a staggering amount of revenue and is in no way supported by anything that Organovo currently has in the works or has even envisioned in the near future.

(Perhaps by coincidence, when this article was released trading 3 days ago, CEO Keith Murphy filed to note that he had just sold another 100,000 shares. His filing to notify investors came after the close of the market on a Friday, so many investors might be expected to have missed this.)

Similar revenue projections in multiple other articles are the sole reason why the share price has doubled in the space of two weeks to its current billion dollar valuation. They have truly lit a fire under retail investors which then sparked momentum traders to pile in. But these types of projections for the next 3-5 years are entirely without foundation. They are wrong. When the momentum traders take the reverse direction on the stock, a significant correction should be expected. Momentum traders by definition do not even care what a company does. They only care about the near term direction of the stock. Momentum traders tend to pile in in force and amplify movements to the upside as well as to the downside. Yet they are “direction agnostic” and are just as happy to profit from a stock on the way down.

Over a ten year time frame, Organovo can be expected to attempt to develop other revenue streams such as assays based on other organs like the kidney. But these are years away and we do not have any visibility on when they might be launched. Organovo has possessed its current technology since 2009 and the first commercial product, the liver assay, will not be launched until 5 years after that time. In the more distant future, the real excitement for the company is the potential to develop fully functioning replacement organs for transplants. But this is even further away and has no impact on the current share price.

At present, the reality for all investors is that Organovo is only capable of producing liver tissues that are just 1 millimeter thick and which can be sold in trays for less than $2,000. Even this will not become a reality for another 13 months, and then only if all goes as planned. The notion that Organovo will reap hundreds of millions in revenues at any time in the foreseeable future is pure fiction.

There is already significant competition in the 3D bio printing space

Organovo is the only publicly traded company that is solely focused on 3D bio printing. This has led many investors to believe that it is the only company engaged in this business at all. This is completely mistaken.

Below I will list a quick 7 notably obvious direct and indirect competitors within the 3D bio printing space. Like Organovo, these companies are all involved in the printing of cell matter such as organ tissues using 3D bio printing technology. But readers should note that beyond these 7, there are many, many more for those who care to search around. As with Organovo, many of these companies have their roots within some of the worlds most prestigious universities and research institutes. (Organovo’s origins came from theUniversityofMissouri). These various competitors are active in theUS, Europe and inChina. Some of them are already are commercializing products well ahead of Organovo.

For example Swiss company Insphero sells 3D liver assays for drug toxicology and has partnered Cyprotex. A spin-off company of the Swiss Federal Institute of Technology (ETH) Zurich and the University Zurich, InSphero was founded in 2009 by Dr. Jan Lichtenberg, Dr. Jens M. Kelm and Dr. Wolfgang Moritz. On the Insphero website, these are very clearly marked as liver assays for toxicologyand they are very clearly marked as 3D bio printed products. These serve the identical purpose that Organovo hopes to serve 13 months from now. But for Insphero they are already on the market. The price comes in at just around $1,750 for each 96 well tray. Different tests can be run independently in each well, such that one tray is sufficient for 96 different outcomes. This means that one tray should be largely adequate to get test results for a single drug. Product inquiries forUS sales can be direct to [email protected] or via theirUS sales number at +1 207 751-4908.

Insphero describes its current operations as shown below. This should look familiar to Organovo investors, except that Insphero has already been selling its product since 2012.

InSphero is a leading supplier of organotypic, biological in vitro 3D microtissues for highly predictive drug testing. The company, headquartered in Zurich, Switzerland, currently counts 7 of the top ten global pharmaceutical and cosmetics companies as customers. InSphero 3D Insight™ Microtissues enable more biologically relevant in vitro applications in efficacy and toxicology.

I did call Insphero directly and spoke to a sales representative who confirmed that the market for these 3D liver assays (which have been on the market for over a year) is only in the thousands of units total. The sales rep noted that in a large spike before the upcoming holiday season, the company actually shipped nearly 100 units in a week, which was extremely large. I also confirmed that the primary use of these tests (as with Organovo) is for drug toxicology testing by pharma companies.

Here is a screenshot from their website.

Yet another competitor is the Wake Forest Institute for Regenerative Medicine, run by Dr. Tony Atala. Their business should sound very familiar to those who follow Organovo. As noted in livescience.com.

Atala’s group has pioneered 3D printing methods that aim to build human organs with layer upon layer of cells. Their bioprinting methods lay down the cell layers along with artificial scaffolding to keep an organ’s structure intact as it takes shape – a technique that has allowed the group to make tiny, less complex versions of full-size human organs. “We’re printing miniature solid organs: miniature livers, hearts, lungs and vascular structures (blood vessels),” Atala told LiveScience.

WakeForestis far enough along in its development of that it has already been selected by the DoD to lead the following programs, as noted.

The Wake Forest Institute for Regenerative Medicine is leading the $24-million effort funded by the Space andNavalWarfareSystemsCenter, Pacific (SSC Pacific), on behalf of Defense Threat Reduction Agency (DTRA).

And then of course there is New Jerseybased Hurel Corp. which develops and commercializes similar 3D bio printed products. Hurel was a spin out from Schering Plough (now Merck) labs from 2007. The company is now backed by Sanofi. According to MedCityNews,

It [Hurel] has raised $9.2 million in a Series A round for its lead product – a technology that replicates the human liver, using living cells, and referred to asorgan-on-a-chip or human-on-a-chip.

Hopefully this also sounds very familiar to investors in Organovo, because this is in line with what Organovo hopes to launch in 13 months or so.

Beyond just livers, there are also other 3D bio printing companies focused on different tissues. Texasbased TeVido Bio Devices is focused on developing 3D bio breast tissues for breast cancer victims. This is similar to the larger and longer term ambitions that Organovo has for fully useable tissues. They havealready stated that they expect that it will take 7 years and at least $40 million in order to get to the beginning of clinical trials. Companies such as TeVido and Organovo can therefore expect a long and expensive slog before they are even able to contemplate the beginning of FDA trials on such products.

But competition for developing 3D tissues and assays is not just limited to Europe and the US. It has become an explosive business in China. Already theHangZhou University of Electronic Science and Technolgy is printing 3D bio printed body parts. Likewise a company called Unique Technology based inQingDao has already supplied its 3D bio printers to dozens of universities acrossChina.

There is also competition emerging offering to provide 3D bio printers more broadly to other organizations. Germanybased envisontec already commercially sells a 3D bio plotter which can be viewed here.

For those who wish to look further, there are dozens more institutions and organizations which are actively involved in 3D bio printing. For those who are interested in seeing many more, I included a short list of the 3D bio printing partners who work with Insphero as Appendix II.

The first issue here is that there are numerous other 3D bio printing entities aside from Organovo and that some of them are clearly further along than Organovo.

But the more important issue is that these dozens of other 3D bio printing entities do NOT get the benefit of daily hype articles from sources such as the Motley Fool. This is simply because they are not publicly traded and no one (ie. motivated shareholders) benefits in the short term from giving them excessive hype and sensationalism. It is very important for investors to realize that speculative companies with tradeable stocks get far more attention than their private counterparts simply because traders want to profit from stock moves.

Looking more closely at the 3D liver assay product

The low price of the 3D liver toxicology assay should not come as a surprise to anyone who knows pharma testing. 3D liver assays will not fully replace traditional testing methods anytime soon. The pharma companies will still conduct first line animal testing, and will then proceed on 2D liver tissue samples and then conduct the 3D test last.

The concept of a “3D bio printed liver toxicology assay” sounds very exotic (and presumably expensive) to many retail investors, but in fact it is just another fairly simple diagnostic test for pharma companies. Many investors might not realize that the thickness of these “3D” samples is in fact just a mere 1 millimeter. It hardly appears to be “3D” at all, but it does in fact meet that definition from a technical perspective.

At present the biggest technical challenge is in creating the vascular structures for delivering blood that is necessary to support thicker structures, so 0.5-1.0 millimeters is the current limit for thickness of these tissues. We could certainly print thicker samples with a bio printer. This is physically achievable. But they would quickly die for lack of blood flow. At less than 1 millimeter the blood circulates by simple diffusion such that vascular structures are not necessary.

According to Organovo CEO Keith Murphy,

Murphy cautions. “Our ability to make tissue thicker than about one millimeter is restricted by our ability to deliver nutrients and oxygen to the cells. Today, nobody can integrate the small vessels and capillaries needed for thicker tissue. Therefore, we’re not making whole organs,” he stresses, although doing so may become possible eventually.

This reality may come as a shock for those who envision Organovo as a company which prints large and thick human organs using a 3D bio printer. Many are not aware of the 1 millimeter limitation. The reality is that even getting to just one millimeter in thickness has been a massive challenge and accomplishment.

The real point is that for pharma companies this just another simple 1 millimeter liver diagnostic which will hopefully offer additional predictive value prior to determining whether or not to go into clinical trials. And we can see that the cost of these tests is around $2,000 or less for a 96 well tray which gives the ability to conduct 96 individual tests. Interested readers should feel free to verify these numbers with Organovo management, with companies such as Insphero or with analysts such as Jason Napodano or other 3rd party sources.

It all comes down to Intellectual Property (“IP”)

The reason that there are so many competitors in the US, Europe and China is that there are still tremendous amounts of IP which are available through hundreds of universities which have been focused on 3D bio printing for as long as a decade. There are many ways to achieve similar ends and 3D bio printing is still in its infancy. As a result, patenting one’s own process certainly does not prevent others from obtaining their desired outcomes through slightly different means.

The technology being used by ONVO was licensed from the University of Missouri in 2009 for just $25,000 along with 1-3% of future revenues, if any. In 2010, the company entered into further licensing agreements for additional technology for just $5,000 plus reimbursement of patent costs. In 2011, ONVO entered into similar licensing agreements withClemsenUniversity for a total of $32,500 plus an additional $32,500 in patent costs.

As of 2013, the value of all of ONVO’s non cash assets (ie. all of its intellectual property) was valued at less than $900,000. This should not be surprising when one realizes that the only product currently on the horizon is the drug toxicology liver assay which commands a low price of less than $2,000 and a small market size of perhaps 1,000 units per year.

In the meantime, ONVO only spends a mere $1 million per quarter in R&D expenditures.

Significant transformation in the world of technology and biotech is tremendously expensive. This holds true without exception. For example 3D systems still spends over $10 million per quarter on R&D even though its technology seems to be at a more mature state. And in developing an electric car that will actually sell, Tesla Motors (TSLA) spends over $50 million per quarter !

By contrast, Organovo spends around $1 million per quarter and its total IP (which it purchased) is valued at well under $1 million.

The one thing that Organovo has done quite successfully is to raise over $60 million from investors due to the strong share price. Yet much of the share price strength has resulted from hyper bullish articles from authors who engaged in pure speculation about bio printed full organs and other outcomes which are clearly decades in the future. Despite all of the hype and the soaring share price, the stock continues to be held 93% by retail investors and has attracted no mainstream Wall Street research coverage. In fact, the heaviest source of promotion for Organovo is via the presentations atRetailInvestorConferences.com. This should be seen as highly unusual even for companies with market caps even as small as $200-300 million, and certainly unusual for a company which has now surged to over $1 billion.

The point from this is that there is a very clear reason why Organovo has attracted no institutional or research interest. Organovo bought some very inexpensive IP 5 years ago. The company spends very little on R&D and its only near term product offering is for a simple diagnostic which is already on the market from other competitors. Meanwhile, Organovo has heavily targeted retail investors and has been able to use that hype to raise around $60 million over two years from stock sales.

What are the insiders doing ?

Looking at the insider behavior at Organovo is very interesting.

Over the past few weeks (and as the share price was soaring due to articles), CEO Keith Murphy has sold 200,000 shares of stock, bringing him in nearly $2 million. On each case his SEC filings were stealthily submitted after the market close and on a Friday, such that many investors may not have seen this at all.

Chief Strategy Officer David Eric has also sold nearly 100,000 shares.

CTO Sharon Presnell recently sold 75,000 shares, and sold and additional 75,000 shares in August.

Of greater concern is the fact that on November 8th, Organovo filed a massiveS8 registration statement which now covers 11 million shares to be issued to management. This represents nearly 13% of the company and would be valued at well over $100 million for this small group of individuals. S8 filings are often sources of concern for investors because they basically allow management to issue large amounts of stock to themselves or their “consultants” for any reason. The filings can be done on very short notice. S8 filings were a much abused vehicles by Chinese reverse merger companies during the wave of fraud that hit these companies in 2010-2011. They used these S8’s to issue large amounts of stock to themselves and their cohorts and then quickly sold the stock at highly inflated prices. S8’s were largely how many of the Chinese fraudsters made themselves rich. This does not mean that all S8’s are bad. It just means that it is an easy way for insiders to award themselves tremendous amounts of stock on very short notice. Investors should rightfully view large S8’s with skepticism.

And by the way, this recent S8 registration statement by Organovo was again stealthily filed by management on a Friday (Nov 8th), well after the close of the markets such that most investors did not even see it. The filing of this massive S8 fortuitously coincided with the recent ramp of the stock following a string of bullish articles.

The point from this is that management can feel free to sell as many of their current shares as they wish, because they know that they can simply issue themselves another 11 million more.

Going back further, we can see other interesting insider activity.

As of the initial public offering in 2012, company founder Gabor Forgacs owned 13.9% of the company. As an owner of more than 10% of the company, he would have been required to report any sales of his stock.

Also at that time, his son Andras Forgacs held 1.8% of the company and was a director. This is below the 10% threshold, but as a director he would still have to report any share sales.

By December 2012, Gabor Forgacs had reduced his stake to 12%. But by April of 2013, he had reduced it to 9.7%, beneath the 10% reporting threshold. This was just prior to the uplisting in 2013, when the stock soared for the first time to over $8.00, up from around $1.00 a year earlier. And by being below the 10% threshold, Mr. Forgacs would not have to report that he sold his stock. We can see from SEC filings that Mr. Forgacs has not provided any information about holding any Organovo stock since 2012. Mr. Forgacs resigned from the board in 2012 such that this stock sales also would not be reportable. We therefore cannot tell how many (if any) shares Mr. Forgacs still holds. But the pattern of his actions appears to have been conducive to being able to sell when he wanted to without having to report the sales which would alert investors.

Meanwhile, his son Andras resigned from the company in July 2013, also as the stock had just hit all time highs at the time. This would also allow him to sell his stock without reporting it. There are also no subsequent updates indicating that Mr. Andras continues to hold his original position so we really don’t know.

The last filings indicating ownership by the Forgacs were in March of 2012.

But perhaps a bigger question for investors is why did the founder and his son resign from this company at all ? If the future is so bright for Organovo, then presumably these two founding insiders would want to go along for the ride.

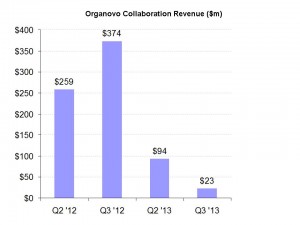

A word on Organovo’s collaborations

Like many development stage biotech and healthcare companies, Organovo was able to secure several collaborations with big pharma names. In 2010, they secured a deal with Pfizer and by 2012 they had delivered constructs to Pfizer for internal evaluation. No update has been provided since then as we now approach 2014. In 2011, Organovo entered into a research agreement with United Therapeutics. The agreement had later been expanded, but it appears that it still expires several months from now. In January of 2013, Organovo entered into a collaboration agreement with the Knight Cancer Institute atOregonHealth & ScienceUniversity (“OHSU”), to develop more clinically predictive in vitro three dimensional cancer models with the goal to advance discovery of novel cancer therapeutics. However this is purely academic and does not appear to provide any revenue to Organovo. Additional recent announcements have been made including Hoffman LaRoche and L’Oreal but no revenue from these has been disclosed either.

These name brand collaborations have added instant credibility and have occasionally boosted the share price. But the fact remains that in the past these big names have paid up to have a look at what Organovo has for them, and then they have moved on after looking.

This should be readily apparent by looking at the amount of collaboration revenue which has been steadily dwindling each quarter. As of the most recent quarter, Organovo brought in just $23,000 in collaboration revenue. By contrast, in 2012 the total for the year was over $1 million.

Learning from the past – have we seen this before ?

At the beginning of 2013, Casey Research published an article describing the then-recent moves in the stock, which were also spectacular. The description provided by Casey is now about a year old, but should seem oddly familiar to those who have witnessed the moves of the past few weeks. Investors should read this carefully, keeping in mind that it describes a the effects of a promotion that happened over a year ago !.

From Casey Research:

ONVO went public at $1.65 per share on February 14, 2012 and experienced some impressive momentum out of the gate, climbing to $3.01 (an 82% increase) by May 17. That’s when things really went crazy. Just one month later [IN JUNE 2012], ONVO traded as high as $10.90 (a 560% increase from the close on its first trading day just four months prior) after some of the larger newsletter companies like Motley Fool wrote numerous positive articlesabout the company and helped propel it to a $500-million market cap (despite no change in fundamentals) virtually overnight.

Think about that for a second. ONVO was trading for half a billion dollars despite generating less than $1 million in revenue during the prior twelve-month period. Yes, that’s a price-to-sales ratio of over 500. And it’s not like theforward one- or even two-year revenue projections were calling for growth that could come close to justifying that valuation. The numbers just didn’t make sense. When investors once again came to their senses and recognized this reality, the stock fell – hard. By mid-July 2012, ONVO was once again trading below $2.00 per share. Despite a brief pop above $3 per share in mid-October, the stock remained flat through mid-December.

The point from this excerpt is that we have seen the exact same phenomenon again. It is a series of hyper bullish articles (also coincidently coming primarily from the Motely Fool) all coming at the same time which sent this stock soaring within 2 weeks and without any new fundamental developments from the company. Casey makes a good point as well. Investors shouldn’t be looking at the current price to sales ratio, they should be looking at the 2-3 year forwardprice to sales ratio. As shown above, revenue for 2015 should not be much more than $2 million under any circumstances. But now we are at over a $1 billion market cap such that the forward price to sales ratio is still at least 500 times projected sales. And even if they grow these sales in 2016, we are still talking about 200-300 times sales.

Conclusion

There is an old saying that if you repeat a lie often enough, it becomes “the truth”. This does not mean “truth” in the literal sense, instead it just means that the lie becomes universally accepted.

Lately the headlines have been filled with bullish articles on Organovo which predict massive near term revenues as a result of providing billion dollar savings to big pharma companies. Many of these articles have been written by individuals who happen to own stock in Organovo and who have certainly derived great benefit from the recent doubling of the stock in two weeks.

The actual truth is that Organovo hopes to launch a fairly simple 3D liver assay in 13 months from now. It is hoped that this product will offer some incremental benefit above and beyond animal testing and 2D testing. Existing products are already on the market and sell for less than $2,000 for a 96 well tray. The total market size for all such liver assays for all competing suppliers numbers in the mere thousands of units.

As a result, Organovo’s revenue potential should be expected to add up to just a few million dollars over the next few years – certainly NOT hundreds of millions of dollars. And in fact, NOT even tens of millions.

But the sheer repetition of this misinformation of late has caused Organovo’s share price to double in about 2 weeks, now hitting a $1 billion market cap. The latest surge has been driven by high volume momentum traders who do not even care what the company does. These traders are also agnostic about share price direction. They are just as happy to profit from falling share prices as they are from rising share prices. They can exacerbate downward moves in the share price just as they have exacerbated the recent upward moves. As a result, as soon as investors realize the reality of Organovo’s actual revenue potential, the share price should be expected to see dramatic moves lower on very high volume.

In the meantime, management insiders continue to sell large amounts of stock at current prices pulling in millions of dollars personally. And now they have registered over 11 million more new shares to give themselves. Organovo as a company will certainly not be pulling in $100 million in revenue any time soon. The only ones to get this much money will be Organovo management when they personally award themselves the 11 million shares of stock under the recently filed S8.

Appendix I – practical considerations for shorting Organovo

Following the dramatic spike in the share price, many investors have lamented to me that shorting Organovo is often “impossible” due to lack of stock borrow..

A much better alternative is to sell the December call options. When selling options with a fairly low strike price of $5.00, the performance is basically identical to shorting the stock. Investors get 1:1 exposure on both the upside and the downside. The only drawback is that if the share price falls below $5.00, the investor no longer benefits from additional downside. But the major advantage here is that selling calls does not require the short investor to borrow stock, so there is no expensive borrow fee. In reality, selling naked options like this is often no more risky than shorting common stock. It does require an additional level of option approval from one’s broker, but this is well worth it because this technique applies to many stocks aside from Organovo.

Another alternative is to buy the “in the money” puts. Many investors shy away from puts because they are seen as being a very risky “all or none” bet. That certainly applies to “out of the money” puts. But if the stock price is below $12.50 and the investor buys $12.50 puts, he is already “in the money” and the option will largely perform 1:1 on the way down just like being short stock. As with selling calls, the short investor does not need to pay the expensive borrow. However there is typically a moderate premium that must be paid. So if the stock is at $11.50, the investor might pay $1.50 for the $12.50 put, effectively getting short at $11.00. Because the stock is at $11.50, the investor has paid a 50 cent premium. One advantage here vs. being short the stock is that if the share price does rise dramatically, the investors losses are capped at that $12.50 level. But should the stock fall back to $8.00, this $1.50 bet pays off $4.50 (a triple). And again, if the stock rises above $12.50, the investors losses are capped.

Appendix II – A few more 3D bio printing partners who you’ve likely never heard of

Cyprotex, UK

Cyprotex is an expert in-vitro CRO, that is using InSphero 3D liver microtissues for compound de-risking

Hamilton Robotics

A leading global supplier of liquid handling robots with proven 3D experience.Hamilton’s systems are in use at InSphero for large-scale production of microtissues.

http://www.hamiltonrobotics.com

INTEGRA Biosciences AG

Offers a range of automated hand-held and bench-top pipetting instruments ideally suited for production and assaying of 3D microtissues in InSphero’s GravityPLUS Platform.

http://www.integra-biosciences.com

Luxcel Biosciences Ltd., Ireland

Luxcel Biosciences develop and provide phosphorescence and fluorescence based sensors for use with InSphero 3D microtissues.

Perkin Elmer Corp.

Working closely with InSphero on integrating InSphero GravityTRAP assay plates for 3D microtissues into their Opera and Operetta High-Content Analysis systems for functional imaging.

Promega Corp., USA

A leading supplier of assay kits, who works closely with InSphero since 2010 to validate and to optimize assays for use with 3D microtissue spheroids.

SIRION BIOTECH GmbH, Germany

Develops genetically modified 3D microtissue solutions using InSphero’s GravityPLUS system.

Solentim Ltd., UK

The fully automated bench-top system CellMetric for measuring visual, non-invasive cell content will soon support automated assessment of 3D microtissue size in the GravityTRAP plate.

Sophistolab AG, Switzerland

InSphero’s partner for histological analysis of 3D microtissues with a strong expertise in immuno-staining and microtissue handling.

Disclosure: I am short ONVO. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.