Summary

- In May, RH quietly awarded its CEO a massive nine figure incentive package to achieve a $150 share price by any means. Two days later RH announced a $700m buyback.

- In 2017, RH already bought back half of all outstanding shares at prices below $50. Stock then doubled. Further financial engineering can easily attain $150 quickly.

- In October, tiny debt repayment sent stock up 20 points. Now $650m of converts nearing conversion price. But RH previously bought “bond hedges” which neutralize any convert dilution.

- Despite much higher share price, short interest now falling as some shorts realize the financial engineering trap. But short interest still near 50% of float.

- RH suddenly announced its first “investor day” after more than two years. Past events saw announcements move the stock big. Only eight trading days away.

Note: This article is the opinion of the author. The author is long RH and HTZ.

Key statistics

Name: RH (formerly “Restoration Hardware”)

Ticker: (RH)

Market cap: $1.8 billion

Current price: $89.24

52w Lo/Hi: $24.41 / $91.81

Shares out: 21.2 million (float of 18.6 million)

Shares short: 8.8 million (48% of float, 9 days trading volume)

Avg. Volume: 1.1 million shares

*** Section 1: Summary investment thesis

Shares of RH are being driven sharply higher as a result of financial engineering being conducted by RH’s CEO Gary Friedman. Throughout this article, please understand that the described reductions in share count have nothing to do with any type of meaningless “reverse split”. Instead, with RH these are actual and permanent reductions in share count which are having a very predictable effect on the price of each remaining individual share.

Right now some shorts appear to be taking the view that “if RH was a good short at $30, then it must be an even better short at $90”. But in fact, the share count has been reduced so aggressively (via share buy backs) that the market cap of RH is only up by 30-40% since April. Moreover, this moderate rise in valuation is arguably not far out of line with the recent improvements in financial results (and outlook) as announced in September. The September announcement alone saw the share price spike 45% in single day. The shares repurchased by RH were bought at far lower levels and much of these purchases were conducted with cash (not just debt), such that even the comparable rise in enterprise value is also far much lower that this sharp rise in the share price. In other words, comparing the price of a single share between one period and the next is no longer a consistent picture of the valuation of RH as a whole.

So here is what is happening:

In May of 2017, RH’s CEO Gary Friedman was quietly awarded a staggering nine figure incentive package if he can somehow engineer the share price to $150 or higher. Precisely how he achieves this goal is entirely irrelevant.

If Friedman is successful, the value of the total awards to him will exceed $500 million. At least $25 million of this will come to him within just the next few months. All that is necessary for Friedman to receive this payout is the financial engineering and ongoing reduction of share count coupled with even just very slight improvements in RHs business (in fact, whether real or perceived).

Mr. Friedman did not waste any time in putting his plan into action.

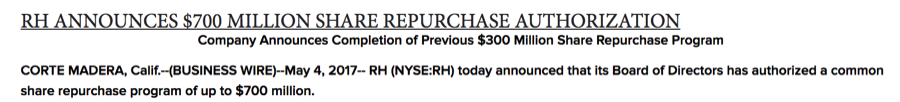

Within just two days of that award (on May 4th, 2017) RH quickly announced a $700 million share buyback to sharply reduce the share float. Some were surprised at the buyback because RH’s stock price had already been rising towards the highest prices of the year (then closing in on $50).

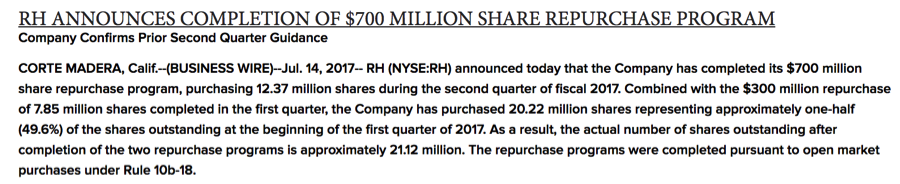

Even more surprising (to some) was that within just 50 trading days, RH had announced that it had already completed the entire $700 million share repurchase, accounting for a significant portion of the daily volume during that time.

What I will describe below is how Friedman is now using a combination of positive cash flow and new debt to further reduce the share count. Friedman is effectively conducting a “stealth/quasi/creeping” going private in order to drastically reduce share count. Ultimately, for Friedman to take home his nine figure package, the equity float must go lower. And this is what is happening. The impact on the share price is entirely predictable.

Throughout 2017, RH has already repurchased half of its outstanding float at an average price of $49.45. The share price has already nearly doubled since those purchases.

But what about the all of that debt ?

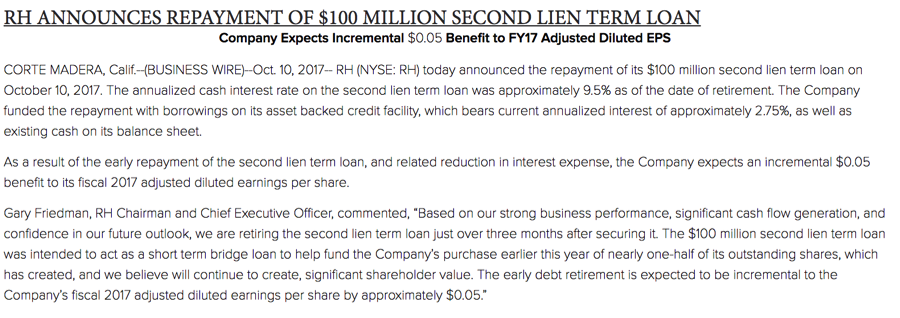

Because of its increased leverage, the market has been very focused on RHs “capital structure”. But changes in leverage can now cut both ways. As a result, when RH suddenly announced three weeks ago that it was already paying down its $100 million second lien term loan (within just 3 months of it being issued), the stock quickly shot up 20 points from the $70s to the $90s, quickly hitting new 52 week highs. And yet clearly that was a just relatively small deleveraging.

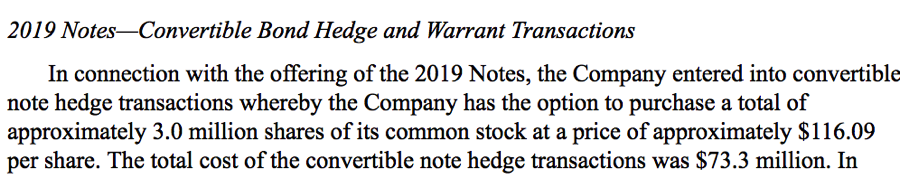

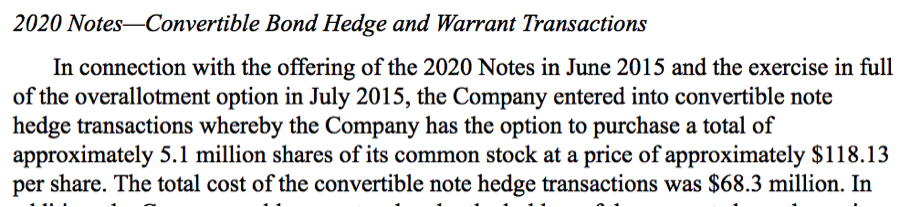

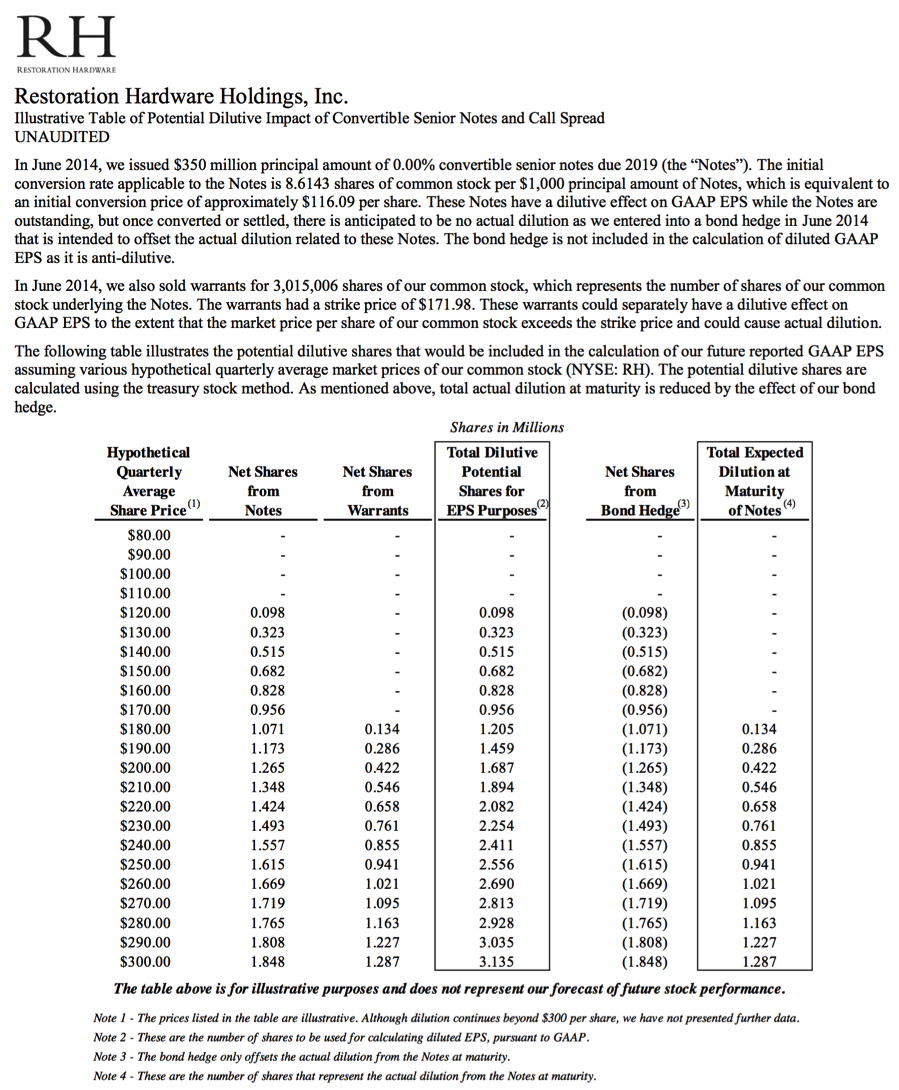

Of RHs remaining debt, the majority ($650 million) is in the form of convertible debt with strike prices of $116 and $118. And now suddenly these conversion prices are quite squarely within range.

But….did you also know that in 2014 and 2015, RH had already purchased complete “bond hedges” from underwriter BofA-ML to fully neutralize dilutiononce those convertibles convert at prices over $116 and $118. There is therefore no dilution until the share price exceeds well over $170.

In 2014 and 2015, RH paid BofA-ML over $130 million for the long legs of these bond hedges to neutralize dilution.

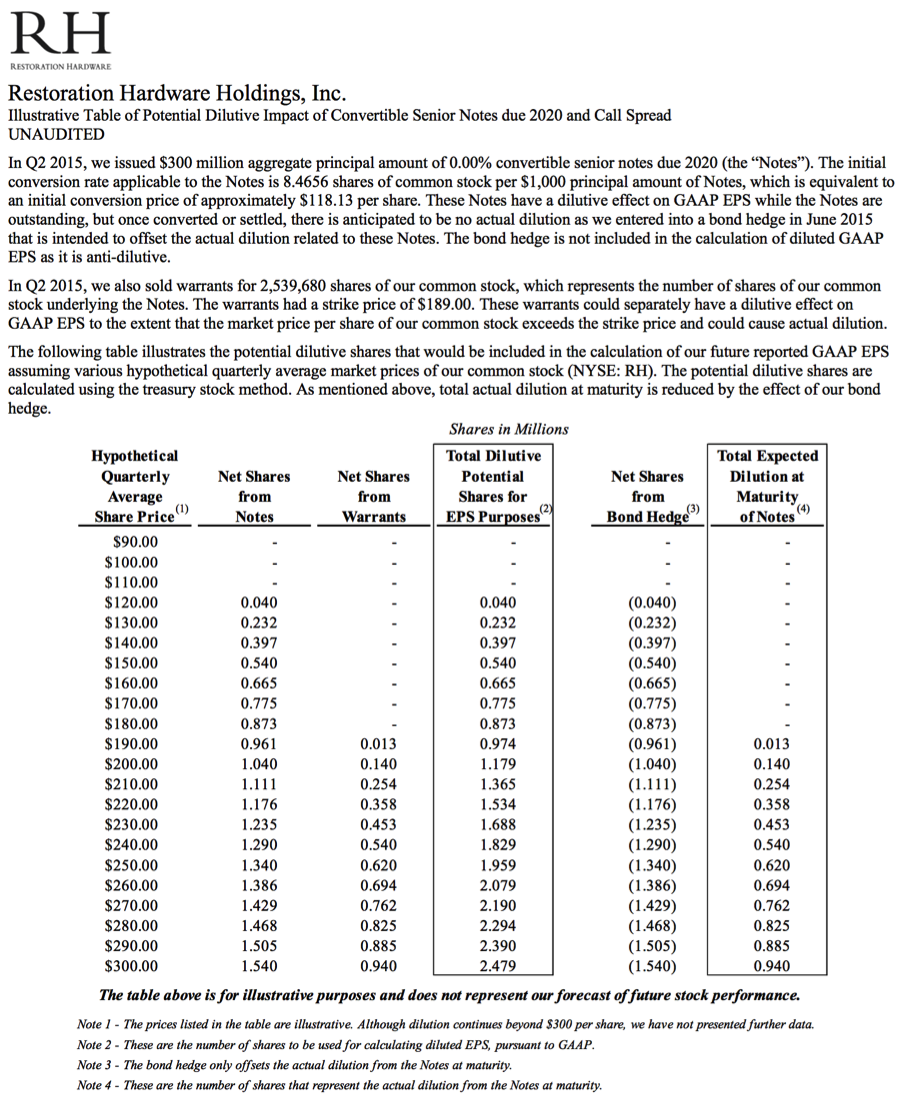

(Terms, details and dilution tables for the bond hedges are included below).

Yet the market has missed the details of these convertibles and bond hedges because just a few months ago, the share price was still below $50, making conversion seem highly unlikely.

(And quite frankly, I am very skeptical that many investors ever even knew about these massive bond hedges in the first place.)

Even aside from earnings announcements, Friedman has made use of other ongoing announcements to propel the share price higher over the past 5 months. There was the announcement of the share repurchase, the announcement of Friedman’s own open market purchases of $2 million in RH stock in the $70s and then the announcement of the early repayment of RH’s second lien notes in October. Each time, these separate announcements have driven the share price sharply higher. This is how we have gotten from the $40s to the $90s in just 8 weeks.

The next catalyst for a sharp spike higher

And now in just 8 trading days from today, RH has suddenly decided to conduct its first “investor day” after more than two years. In the past, RH has made very visible use of such events to make announcements which then sent the stock sharply higher.

There are a variety of announcements that Friedman could be expected to make at (or in advance of) this “investor day”.

The most obvious announcement would be that RH would announce the simple approval of the next leg of its ongoing share buyback.

Or RH could announce a subsequent reduction of leverage.

Or Mr. Friedman could simply reiterate his recent very bullish views on RH’s near term prospects, both in the US and in Europe.

Given the 48% short interest in RH and the moderate trading volume, any of these announcements could easily fuel an immediate and very sharp spike in the share price.

In the event that RH announces yet another shift in the capital structure (i.e. the next leg of the stock buyback or the next debt pay down), such a spike would most likely be permanent rather than temporary.

In the near term, if the share price stays above $100 (up just 11% from current levels) in the next few months, Mr. Friedman will receive an extra $4 million under the recently awarded incentive package.

But if the share price goes North of $150 then just that first near term incentive award swells to $25 million to be doled out to Mr. Friedman in just the next few months.

So ask yourself this: in its first investor day in more than two years, and with $25 million looming in near term incentives, do you think Mr. Friedman will say something positive or something negative

Link: RH to Host Investor Day on November 16, 2017

*** Section 2: Financial engineering works again and again.

Back in August, I published my long thesis on Hertz Inc. (HTZ) when the stock was at just under $14. Many people thought (and said) that I must have lost my mind. The share price (they said) was clearly wildly higher than what Hertz’s troubled fundamentals could justify. And Hertz’s “capital structure” (they said) would only serve to turbo charge a decline in the share price. Just before I published my article, a SELL recommendation from Barclay’s raised the specter of bankruptcy, sending Hertz’s stock plunging by 40% in 2 days.

Hertz shares plunge 21 percent after Barclays downgrade

Against that, all it took was for the slightest of ongoing results to be “less awful than expected” and Hertz was set to skyrocket. And this is exactly what happened. With short interest at greater than 50% of the float, a modest rise in the share price turned into a sharp spike and Hertz’s share price jumped 40% within days. The share price then quickly went on to double to around $28. Hertz is now up by around 75% since where I wrote about it. I am currently long a moderate amount of Hertz.

As I was with Hertz, I am totally aware of the short thesis on RH. In fact, just as with Hertz, I even agree with many of the FUNDAMENTAL observations of the short thesis on RH.

But I will show what the market has missed and why shares of RH are set to very quickly spike sharply higher from here (and then stay much higher going forward). And just as with Hertz, it is the “capital structure” (and changes to the capital structure) which will now turbo charge the share price much HIGHER rather than lower.

Important: Once we saw what Carl Icahn was doing with Herbalife (HLF), it then became very easy to see what Icahn was doing with Hertz. It became very obvious that the price for any single share for each of those companies would have to rise, even despite very visible challenges with their underlying fundamentals. Changes in the share price between one period and the next were no longer comparable for valuing the company as a whole.

With HLF, I tend to agree strongly with Ackman (bearish) about the business, but even more strongly with Icahn (bullish) on the expected direction of the share price.

We can now see similar tactics being used by RH CEO Gary Friedman to “engineer” the RH share price to much higher levels. It has worked with HLF. It worked with HTZ and now it will quickly work with RH.

*** Section 3: Looking at the RH short thesis

By now, the short thesis on RH is quite well known and has been widely disseminated for over two years in a variety of media outlets including Grants, The Wall Street Journal and Baron’s.

In fact, on a strictly fundamental basis, I actually agree with many of these obvious concerns raised by the financial media. But it just doesn’t matter. The share price is headed sharply higher. These media outlets had all raised similar concerns about names like Hertz and Herbalife as well, even as those stocks went on to soar dramatically in price. Notice the prices of RH at the time of these articles (as well as their titles).

| Date | Source |

RH

Price |

Title |

| Aug 2017 | WSJ | $53 | Restoration Hardware’s Wild Ride to Nowhere |

| March 2017 | WSJ | $33 | RH’s Hard to Believe Restoration |

| Dec 2016 | Barrons | $34 | Restoration Hardware: Fears Turn to Reality |

| Jun 2016 | Barrons | $31 | Restoration Hardware Tough to Handle |

So here is the (widely known) RH short thesis in a nutshell:

RH sells very high end (i.e. “over-priced”) furniture to a small demographic of upper income customers. The overall size of that demographic is already quite small and their continued purchasing power is heavily dependent upon ongoing appreciation in real estate and stock market assets. Revenues at RH have steadily increased, and have been driven by a significant expansion effort into a) more stores and b) larger and larger store formats. Once the economy slows (and with it the real estate and stock market values), purchases from these customers will slow sharply. That store expansion (which has so far helped RH) will then become a weight on the business. Many shorts also assume that any decline in RH will then be turbo charged by recent changes in its “capital structure”. This is because RH has been aggressively been buying back its own shares and financing those purchases by issuing debt. Leverage has therefore increased sharply.

But against this short thesis, there is a very visible wild card which has been a significant head scratcher for anyone who has been short the stock.

RH CEO Gary Friedman has also been using his personal funds to aggressively acquire millions of dollars worth of RH shares in the open market. His earlier purchase of nearly $1 million in July of 2016 could arguably be justified by the low price of $27.50 at the time.

But then in September of 2017 (just 6 weeks ago) Friedman again used his personal funds to purchase an additional $2 million of stock at an average price of $70.28. Friedman’s latest purchases occurred at the highest share prices for RH since late 2015. Friedman’s most recent purchases at $70.28 in September marked the beginning of the subsequent rise in the stock from the $70s to the $90s, a further 30% rise in just those 6 weeks.

So let’s look at what the larger market is missing here.

*** Section 4: Smarter shorts have been very QUIETLY reversing their views on RH

(Hint: No short seller is going to tell you that they are desperately looking to get out of their position in RH. Duh. Given the information below, I would be rightfully be quite skeptical if anyone who was short RH started aggressively trying to convince me to sell my shares of RH.)

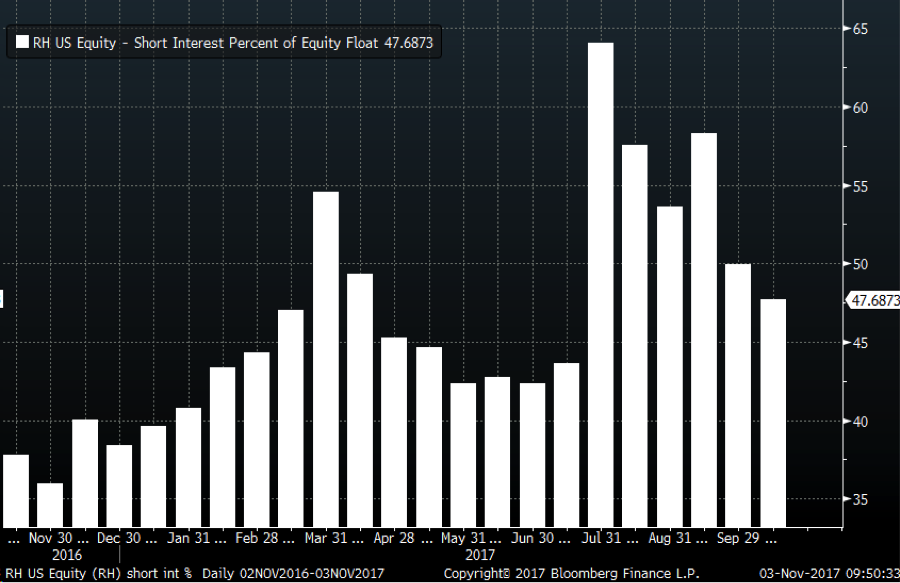

A few months back, short interest in RH had exceeded 60% of float. This is what we call a “suicide short”. With the stock having doubled since this time, it has certainly lived up to the name “suicide short”.

Since that time, the short interest has fallen to 48% of float. It is still basically a “suicide short”, but clearly some of the smarter shorts have started to comprehend the implications of the ongoing financial engineering by RH’s CEO, which will continue to send the share price ever higher.

And note that even this small level of short covering over the past two months has contributed to the sharp rise in RH’s share price. From September through October, short interest fell only modestly from 58% of float to 48% of float but the share price rose by more than 20 points during that time (and this continued rise was already AFTER earnings had been released). So if there is a larger unwinding of short positions, then we should expect a much larger upward move in the stock from here.

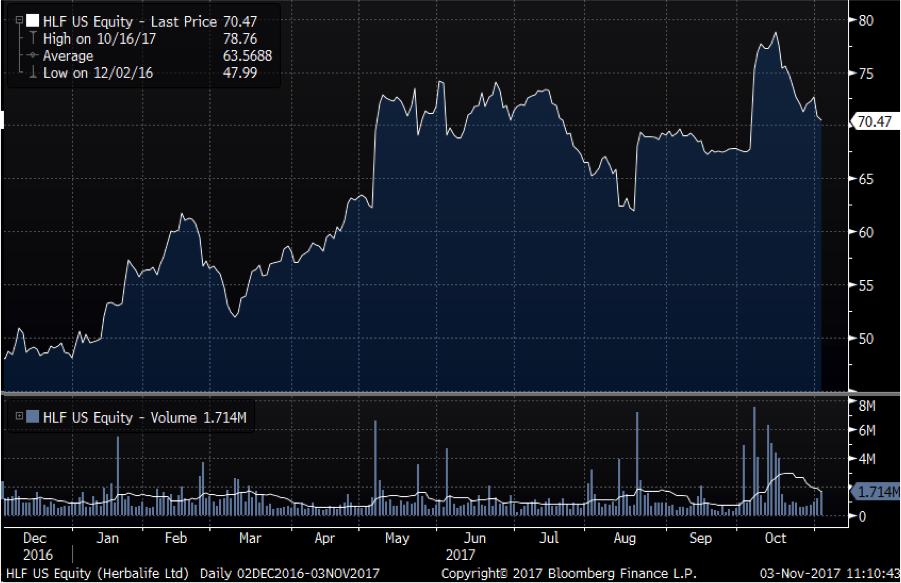

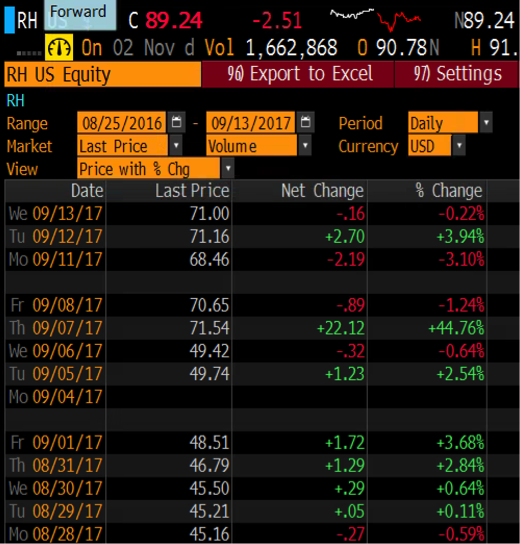

Also remember that on September 7th RH shot up by 45% in just a single day, from $49 to $71, following the release of better than expected earnings and guidance. So that is the level of short term price volatility we have come to expect from RH when it puts forth a meaningful new announcement.

At nearly 50% of float, the remaining short interest is still absolutely massive. Even attempting to slowly get out of small positions is noticeably pushing up the price of RH. The current short position amounts to fully nine days of trading volume.

This is why existing shorts are trying to be very QUIET about getting out of their positions in order to minimize a potentially significant short squeeze from here.

But as we have often seen in the past, there will inevitably be some “dumb money” that gets badly burned.

The dumb money is staying short on the simple view that “if RH was a good short at $30, then it must be a great short at $90”.

*** Section 5: The Bull Thesis for RH (on the share price, not the business)

Share price vs. valuation

Yes, during 2017 shares have more than tripled off of their sub $30 lows. And yes, anyone who has been long or short during this time has participated 1:1 in this 60 point move.

But it is very important to understand that this categorically DOES NOT mean that the VALUATION of RH has tripled. In other words, despite the share price move, RH has not necessarily become equally expensive as a company.

The all time high for RH was just over $100 in 2015. So as we now approach that level again, some people are tempted to try to call the top in the stock.

But because of the changes to the capital structure since 2015, the market cap of RH is less than half of what it was back then, while the enterprise value (“EV”) is actually half a billion dollars LOWER – EVEN at the same share price of around $100.

Conclusion: Because of continuing changes in the capital structure, comparing the share price from period to period is no longer an accurate reflection of changes in the value of RH as a company.

Just during 2017, RH has been making use of very aggressive share repurchases to cause a PERMANENT reduction in the outstanding share count. As a result, despite the “triple” in the share price, the market cap has only risen by less than 50% since the end of Q1.

In addition, aside from the debt funding much of the share repurchase were conducted with cash and the average purchase price was at just $49.45. As a result, the rise in EV has also been far less than what would be surmised by looking at the share price.

Think of it this way: RH borrowed around $600 million to buy back $1 billion of stock at the time. The balance was paid for with cash. The value of that debt stayed constant at around $600 but the value of those shares repurchased has since nearly doubled to nearly $2 billion.

And remember that the 50% rise in market cap that we have seen this year was actually coming off of a very low base. The share price had been sitting at deep multi year lows.

In addition, some amount of bounce from those levels is arguably quite justifiable given that in September:

- GAAP revenues increased by 13% (relative to single digit growth at competitors).

- Earnings came in at 65 cents per share vs. 44 cents in the year prior (an increase of 48%)

- RH boosted guidance on 2017 revenues to $2.42-2.46 billion

- RH boosted 2017 net income guidance to $70-77 million

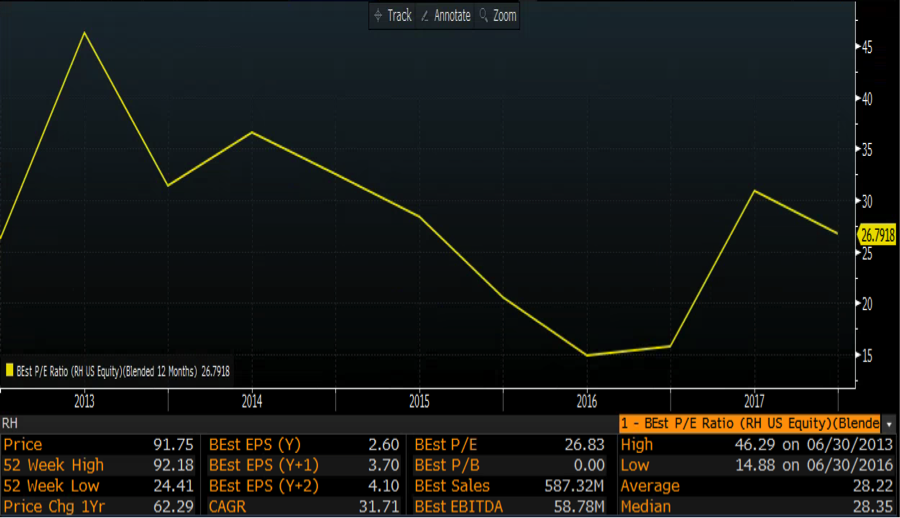

Analysts have also upped their outlook for RH substantially. Consensus wall street expectations for earnings this year has increased by 43% over the last 6 months to $2.60 currently from a low of $1.82.

The recently improved outlook is actually quite significant.

In fact, we can see that RH currently trades at around 26 times consensus earnings estimates. This is actually slightly LOWER than where RH has traded vs. estimates in the past. It is also steeply lower than the 30-40x multiple where RH traded two years ago (when the stock was also near $100). So the stock price comparison of today is truly no longer comparable. It is apples to oranges.

RH share price multiple vs. consensus earnings estimates

My only point is that some level of valuation increase is certainly merited vs. 6-9 months ago. And once we factor in changes to the capital structure, the moderate rise in RH’s overall valuation is not excessive.

SO HERE IS THE BIG QUESTION:

Question… So are these share repurchases just “financial engineering” to artificially make the price of each share higher ?

Answer… YES, YES, YES. These repurchases are absolutely financial engineering.

But…. It simply doesn’t matter. The share price will continue to go much higher as the actual share count continues to decrease. In addition, even very small improvements in earnings (or even just in guidance, Mr. Friedman ! ) will start to have a disproportionately larger impact on the price per individual share.

Anyone who has been long or short the stock during 2017 has participated 1:1 in the share price rise. And they will continue to participate 1:1 as the share price moves up towards its next level of $150. Because that is the level to which CEO Gary Friedman needs to “engineer” the stock price.

*** Section 6: In 2017, Friedman was given a NINE FIGURE incentive to engineer a $150 share price for RH

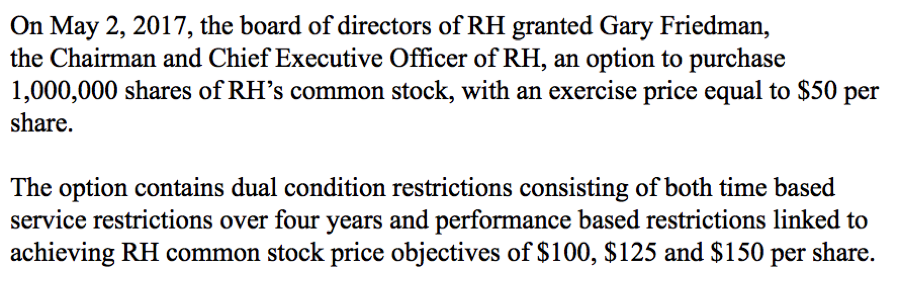

On exactly May 2nd of 2017, RH quietly awarded CEO Gary Friedman a massive nine figure contingent equity compensation package which aggressively incentivizes him to increase RH’s share price. The precise method of HOW he achieves this price is entirely irrelevant.

The incentives to Friedman have an “exercise price” of $50 per share but are “restricted” until the share price reaches prices of $100, $125 and $150. If he does not meet these share price targets, then the options are restricted for a period of 20 years. Mr. Friedman is currently 60 years old.

From the Form 8K dated May 2, 2017.

As noted, the options contain time restrictions and are awarded over a four year period. But under certain conditions, the options all get awarded immediately AND they then vest immediately too. We will see this below.

On the date of that award in May 2017, RH closed at $48.62 such that the large award size seemed not-so-relevant vs. their restriction prices of $100-150. (Obviously they are suddenly looking much more relevant now that RH has doubled in just 6 months.)

And here is where it gets interesting.

On May 4th 2017 (just two days after Friedman received his incentive) RH suddenly announced that that it had authorized a $700 million share repurchase program.

With his massive incentive package in place, Friedman didn’t waste any time in aggressively reducing the outstanding share count. Within just 50 trading days (on July 14th) RH announced that it had already completed the entire $700 million repurchase. Wow, that was fast.

In fact, this $700 million buyback followed on the heels of a $300 million buyback in Q1 (just a few weeks earlier) which had been effected in the run up to Friedman’s incentive package being awarded to him.

Together this means that in just a six month period, RH bought back 20.22 million shares, cutting the outstanding share count by half (49.6%) from where it stood in early 2017. Against the total outlay of $1 billion, we can see that RH bought those shares for $49.45 (and they are now trading at around $90).

So yes, the share price has tripled since Q1 from below $30 to over $90. But because the share count has been cut in half, the market cap has only increased by 50% from those deep multi year lows.

And again, since that time we have seen sharp improvements in revenues, earnings and cash flow, such that a higher valuation is certainly justifiable.

As a result, against all expectations, the first of Friedman’s trigger levels (the $100 mark) is suddenly squarely in sight. As we will see below, from here it will be very easy to for Friedman to get the price per share to $150 using the exact same technique. And the massive short interest is only going to help Friedman make this happen even sooner.

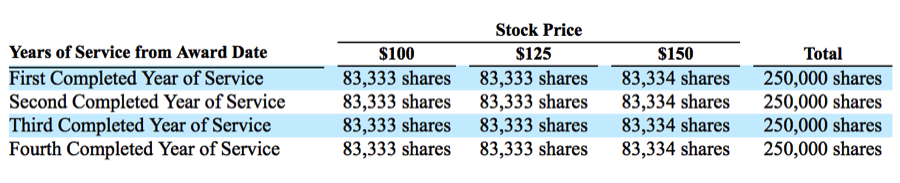

From the RH Proxy Statement (dated later in May 2017) we can see the breakdown of how these options are awarded.

The takeaway from the table above is that if Friedman can keep the stock above $100 (just 11% above current levels) by the 1st anniversary of his award (i.e. in May 2018) he will be awarded an extra 83,333 shares which would be worth an additional $4.2 million. (Remember, the strike price is $50 such that the intrinsic value of the awards would be $100 minus $50=$50.)

But….

But….

If Friedman can get the stock a bit higher, to above $150, by May 2018 then two things will happen.

First, the intrinsic value goes up by 100% (not by a mere 33.3%). At a share price of $150, intrinsic value goes from $50 to $100 per option (i.e. $150 stock price minus $50 strike price = $100 intrinsic value).

More importantly, under the schedule above, Friedman would also get three times as many underlying shares.

In other words, if CEO Gary Friedman can get the share price over $150 by May 2018, just his FIRST brand new additional award will suddenly be worth a cool $25 million just a few months from now. It’s a pretty nice incentive package.

So ask yourself this: what do you think Mr. Friedman has in mind to announce at his first “investor day” after more than two years ?! We will find out in just 8 trading days.

Identical awards are to be given to Friedman over each of the four upcoming years, such that in addition to his paid salary and bonus, and in addition to the shares that he already owns, this single incremental incentive piece then pays Friedman an additional $100 million over four years

Looking back to that $2 million purchase of RH stock that Friedman made in September. Friedman bought those shares at $71. So if the stock price does rise to $150, he would make a profit just over $4 million. But his incentive awards would end up being worth over $100 million.

It is very clear to me that these ongoing purchase of stock by Friedman have more to do with “signaling” so as to help him get the stock price to $150. They have less to do with the actual economics of those newly purchased shares. Signaling or not, these purchases will most likely have the desired effect and will continue to boost the share price higher.

As a result, I fully expect to see Mr. Friedman continue to make more open market purchases even at prices well over $100. It only makes sense. And when the CEO starts announcing his open market purchases at all time high prices of over $100 per share, I fully expect that this will have the exact effect that Mr. Friedman desires (in other words, more buys by Friedman will again drive the even stock higher).

Either way, after 40 years in the retail business and at the age of 60, Mr. Friedman is getting within pistol shot of locking in a near term nine figure payout.

*** Section 7: OK…but what about all of that debt ?

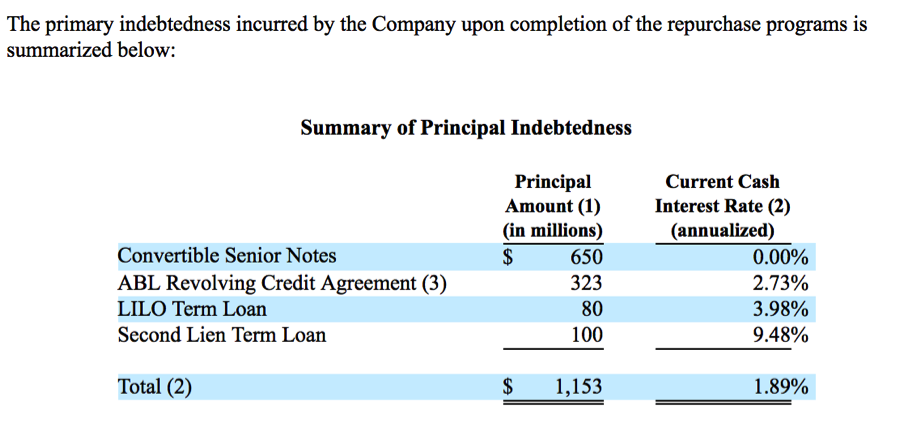

One thing keeping many shorts in place on RH is the fact that these massive share repurchases have been largely financed with debt. Because of the share repurchases in 2017, RH’s total debt load went from $532 million in July of 2016 to $1.15 billion by the end of the July 2017 quarter (announced in September 2017).

So basically an extra $600 million in debt to take out $1 billion in stock.

(The $1.15 billion debt figure is the number disclosed in July by RH. RH also has $233 million in “capital leases” associated with its properties which some analysts treat as debt).

Beyond that debt, the balance of the funds used to buy back stock were obtained from operating cash flow as well as from cash on hand. The cash on hand was largely the result of previous bond offerings.

We can see quite clearly that RH’s share price is indeed very, very sensitive to any changes in its capital structure. But this knife cuts both ways. Any REDUCTION in leverage can also send the share price spiking sharply higher.

On October 10th RH announced the early repayment of its $100 million 9.5% second lien term loan. At the time, RH was still trading at just $72. In the three weeks that followed, RH then quickly soared by more than 20 points as investors started to recalibrate their assessment of RH’s “Capital Structure”.

Much of that $100 million repayment was actually more of a refi, with RH using a 2.75% asset backed facility to make the payment. Even though only a portion of that term loan was actually repaid with cash, the share price still spiked sharply higher.

My point is that when we (very soon) see even larger reductions in leverage, we should expect to see much greater upward spikes in the share price.

In fact, that tiny refi / pay down was very small potatoes compared to what is coming next.

Just a few months ago, when RH’s share price was below $50, no one seemed to focus on the fact that $650 million of RH’s debt is actually convertible into stock.

The conversion feature may have seemed largely irrelevant at the time because the conversion prices on those convertible bonds are set at $116.09 and $118.13 which was more than 100% above the prevailing share price just few months ago. It seemed safe to assume that if there was to be any eventual conversion than it would be far into the future.

But as recently as September (after the share price had spiked above $70), RH was already telegraphing it investors how it viewed this “debt”.

For some reason, RH began “carving out” the calculating of those convertibles. In the September earnings release, RH suddenly described its total indebtedness as follows. (Note the carve out of the converts, as well as the advance disclosureof the bridge loan repayment which then happened 4 weeks later).

Outside of the convertible notes that are due in June 2019 and June 2020, we had aggregate debt of approximately $504 million at the end of the second quarter, including a $100 million second lien bridge loan that we expect to repay in full by year end.

Here are the terms of those two convertibles.

Convertible terms: $116.09 strike zero coupon convertibles

Convertible terms: $118.13 strike zero coupon convertibles

But now with the stock closing in on $100, those conversion prices become much more relevant because that “debt” can be extinguished if the share price stays above the $116-118 levels. It is now becoming clear why RH was alerting us to this back in September.

And then it gets even better. The “bond hedges”.

Even fewer people are aware that back in 2014 and 2015 when RH issued those convertibles, the company simultaneously entered into “call spread” transactions (AKA “bond hedges”) with BofA-ML (the convert underwriter). The purpose of these call spread transactions was to neutralize any eventual dilution which would occur when these bonds eventually converted into stock.

Under the terms of those call spreads, RH completely neutralizes any dilutionthat would occur when the stock prices exceeds $116 and $118. This was a separate contract with BofA-ML such that even many of the convertible investors are likely unaware of it.

So instead of having dilution at $116 and $118, there is no dilution under the convertibles until the share price exceeds well over $170, even when they are converted.

This type of an option package is certainly not free. RH paid a huge sum of money to BofA-ML for the massive benefit of incurring no dilution under the convertibles until North of $170.

But those large payments were made by RH back in 2014 and 2015, such that all of the cost is in the past, while all of the benefit is in the present.

The full details of these option purchases by RH can be found in the SEC filings. For example, on the “long” leg of the call spread (“bond hedge”) purchases, the terms are disclosed as follows:

The documents below were from 2014 and 2015. As such I currently believe that most current investors are fully unaware of them.

NO DILUTION. WHAT TO LOOK FOR: In the tables below, look to the column on the far right to see the net impact of the convertible vs. the call spread which was purchased by RH. In each case you will see that “total expected dilution” is zero until share prices well in excess of $170.

BOND HEDGE #1 – NO CONVERT DILUTION UNTIL SHARE PRICE OF OVER $171.98

BOND HEDGE #2 – NO CONVERT DILUTION UNTIL SHARE PRICE OF OVER $189.00

Re-evaluating RH’s total debt picture

In a Form 8K released in July 2017, RH included a table showing its total indebtedness following the $700 million repurchase.

Total debt was listed as $1.15 billion, including the $100 million term loan and $650 million of converts.

Some portion of that $100 million term loan has already been paid down. And if Friedman can engineer even a slightly further rise in the share price from here, then the converts will get extinguished (with no dilution until North of $170).

From the Form 8K in July of 2017.

Note: From the multiple disclosures above, we should assume that the information on total indebtedness in this table above will be subject to significant change in the very near future.

*** Section 8: Accelerated vesting. The end game for RH and Friedman.

OK. In this section, your initial reaction is likely going to be one of heated disagreement. But please hear me out. I have occasionally done some decent work in the past.

In addition to the equity incentive awards above, totaling $100 million, Friedman also has numerous other past incentive awards. These are also subject to vesting periods and trigger prices at over $100.

After 40 years of working in the retail business, and at the age of 60, Mr. Friedman is now within striking distance of getting all of these option awards to be exercisable and immediately vested. If this happens, Mr. Friedman then gets to quickly retire with a very solid and immediate nine figure payout.

Keep in mind that just a few months ago that no one would have thought that RH’s share price could possibly by closing in on $100. And yet here we are.

So how does Friedman turn these equity incentives into a nine figure reality in the very near term ?

Again. Just hear me out.

Step one. Reduce the share count to a level where the price per individual share is well over $150. The aggregate value of the company is now increasingly being shifted onto bond holders, and across a smaller and smaller number of common shares. Again, just use common sense. As the SHARE COUNT declines, the proportionate SHARE PRICE increases for each individual share. Duh !

Step two. Conduct this process in a way that minimizes further increases in the enterprise value. Use as much operating cash flow as possible and maximize the impact of prior share repurchases at much lower levels. For example, RH borrowed $600 million to repurchase $1 billion of stock. The stock price then nearly doubled. As such, a very slight increase in debt (ie. EV) was accompanied by a share price that jumped nearly 100%.

In the recent earnings announcement, Mr. Friedman has very explicitly told investors that this is exactly what he is doing and exactly what he will continue doing. Note, this is now turning into a huge pile of cash flow which can be used to buy back more stock or pay down debt. Here is what Friedman told investors in September:

Our efforts to optimize inventory and reduce capital spending generated $282 million of free cash flow in the first six months of 2017, and we now expect to generate approximately $400 million of free cash flow for the year, which should address any concerns about our balance sheet and debt ratios. We have reinvested the $282 million of free cash flow generated in the first half, and the $263 million of cash and investments on our balance sheet at the beginning of the year towards the repurchase of our stock, which we believe is an excellent allocation of capital for the long-term benefit of our shareholders.

And again, this happened to be the same announcement in which Friedman told investors 4 weeks in advance about the upcoming “repayment in full”of the $100 million in second lien notes. When that repayment did happen 4 weeks later, the stock quickly shot up 20 points.

Step three. Even though the price for a single share is now much higher, the enterprise value is actually NOT much higher. In other words, depending on the eventual share count (and the split between equity vs. debt) a potential acquirer would have no problem paying $100 per share, $200 per share or $1,000 per share, or whatever. All they care about is the overall valuation of RH.

This is why I referred to Friedman’s approach as being a “stealth/quasi/creeping” going private. He is shifting the value of the company onto debt holders (and out of the equity markets) with the equity portion being spread across fewer and fewer shares. When the share count gets small enough (and the share price high enough), he can then sell the entire company if the overall enterprise value merits such a sale.

Again, even when the stock hits $150, the company will certainly be nowhere near 5x as expensive as it was at $30 just 6 months ago. With the changes in the capital structure, those numbers are no longer comparable.

Remember that RH’s enterprise value is now substantially lower than it was in 2015, even as its performance is on a strong upswing. RH is also now trading below where it has historically traded vs. forward PE estimates.

So how does Mr. Friedman sell all of RH for an enterprise value North of $3 billion. (Again, forget about the share price. With a flexible cap structure, the share price could be engineered to end up $50 or $500 and it wouldn’t matter to an acquirer.)

There are two obvious potential acquirers both of whom could easily afford to snap up RH. And for each of these parties, their motivation is strategic such that a swing in valuation of even 20-30% in one direction or their other would not be the deciding issue.

A sale to Amazon

I know. I know. It is getting cliché for people to keep speculating that Amazon (AMZN) is going to buy every public company in sight. But with RH, it actually makes very good sense.

Amazon’s recent purchase of Whole Foods surprised many people. It communicated to all of us a very significant strategic focus for Amazon. First, Amazon is now actively looking to expand into businesses with bricks and mortar operations. Second, Amazon is focused on acquiring brands and customers in at the high end of the price/quality spectrum.

In both of these respects, RH is identical in furniture to what Whole Foods is in groceries. Amazon’s visible push to the higher end is also why Amazon did not buy Kroger and it is exactly why Amazon would never want to buy Wayfair (W).

I am certainly not alone in sizing up Amazon’s ambitions in expanding into the high end bricks and mortar furniture business.

In May 2017 (just 6 months ago), Fortune Magazine made a great pitch for why Amazon will do exactly that.

And the Wall Street Journal said the exact same thing in May 2017:

A sale to Williams Sonoma

A potential sale of RH to Williams Sonoma is potentially easier and more interesting, yet many investors are likely tempted to dismiss the idea unfairly.

Williams Sonoma already has an enterprise value of nearly $5 billion, but it has almost zero debt. As a result, levering up to acquire RH would certainly be quite achievable.

Williams Sonoma owns competitors to RH including Pottery Barn and West Elm. But sales growth has been consistently stagnant. While Williams Sonoma has been growing only in the low single digits, RH has been killing it in the low to mid teens in terms of revenue growth (including in the most recent quarter). The reason why is that RH has built a sustainable brand and a loyal customer base.

As a result, Williams Sonoma would not need to penny pinch and try to lock in a low end valuation in acquiring RH. It could justify paying a premium price simply due to the very obvious synergies that the acquisition would bring. Both of the companies are headquartered in Northern California, making integration very easy. Both companies distribute fairly similar product lines, which would then allow for the consolidation of third party manufactures, shipping and distribution. There would be instant cost savings from day one.

As we know, RH CEO Gary Friedman used to be president and COO of Williams Sonoma. When he was passed up for the CEO spot 16 years ago, he then came on as CEO of RH. And RH has since done quite well in creating a brand and capturing market share.

The one argument I have heard against such an acquisition is that Friedman may now insist on getting that CEO spot for the combined entity post acquisition. But Friedman is now 60 years old. After 40 years in the business, I think he would be willing to let that honor pass by if it involved him getting immediate vesting on over $100 million in payouts.

Again, I understand that many people are still stuck thinking that RH was “expensive” when it was at $30. As a result, trying to get comfortable with the notion of a buy out at $150 is going to be tough.

But when we factor in the changes to the capital structure, the improvements in the business and then look at the overall valuation, the specific share price becomes irrelevant.

Either Amazon or Williams Sonoma could easily justify the purchase of RH at current or higher levels. And (as we have already seen) further financial engineering by Friedman could easily get the share price to over $150 without a commensurate rise in the valuation (“EV”) of the company.

*** Section 9: Conclusion. RH is going much, much higher. Very, very soon.

(Note: The short interest of nearly 50% of float is not really part of my bull thesis on RH. But the unwinding of short positions will certainly cause the stock to rise much sooner (and much higher) than it would do otherwise based on just the financial engineering.)

RH’s CEO Gary Friedman began his career in the stock room of The Gap (GPS) in 1977 following a short stint in community college where he reportedly received fairly low grades. Against those humble beginnings, Friedman has been singularly ambitious.

From increasingly senior roles leading Gap, then Williams Sonoma (WSM) and now RH, Friedman keeps climbing the retail ladder. And when one ladder has no more rungs, he simply switches ladders.

Friedman is now 60 years old and just 6 months ago was given a nine figure incentive package which can be entirely obtained if Friedman can simply financially engineer RH’s share price to over $150. Within just 2 days of Friedman receiving that award, RH suddenly announced a $700 million share repurchase, which was then fully executed in just a few weeks.

The financial engineering (along with some positive announcement from Friedman) have seen the stock triple in 2017. But the deeply reduced share count means that the valuation is not all that much higher than where it was in April. At the same time, RHs financial performance has undeniably shown visible improvements which do merit a higher valuation.

There are a variety of levers that Friedman can pull in order to get the share price to $150.

As we saw following a small (and only partial) pay down of the $100 million term loan, RH’s share price is now extremely sensitive to and changes in leverage. The stock quickly jumped 20 points. As the share price now nears the $116 and $118 conversion prices of RHs two convertible bond issues (totaling $650 million), investors will rightfully begin to recalibrate their view on RH’s share price vs. perceived leverage. I very strongly suspect that most investors have been totally unaware of the massive “bond hedges” that RH purchased back in 2014 and 2015, which fully neutralize any dilution from the conversion of those bonds into shares until the share price reaches over $170.

As we saw, in the most recent earnings announcement, RH is already “carving out” the calculation of that convertible debt when it describes its total indebtedness. That was the same earnings announcement that disclosed the intention of paying down the $100 term loan fully 4 weeks before it actually happened.

Disclosure: I am/we are long RH.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The author is long RH and HTZ. The author may transact in various securities mentioned within this article within 72 hours.