Investment considerations

As bulls and bears debate their longer term expectations for revenues at Unilife, many have missed the fact that there are near term catalysts which can be expected to have a very certain impact on the share price well before these longer term forecasts have a chance to play out.

Investors should also pay close attention to the stock promotion efforts which have accompanied the recent press releases and they should be aware of some nearly identical promotions in the past. As shown below, these types of stock promotions can often create more bounce in the share price than the actual news released by the company itself.

Separately, investors who wish to assess the longer term revenue prospects should make themselves aware of the current competitive environment. Many investors appear to have missed the existence of numerous competitors with similar product offerings who already have substantial cooperation from big pharma players.

As a final consideration, many investors have engaged in substantial debate over two negative articles which were published in Forbes in September. These articles contributed to significant volatility in the share price when they discussed a whistle blower lawsuit brought against Unilife by a former employee. Many investors appear to have never read the actual lawsuit and instead have simply relied upon the interpretation as represented by Forbes. Anyone with a longer term interest in Unilife should certainly read the suit themselves and come to their own interpretation. I have included as an Appendix a link to the full lawsuit text filing along with several text excerpts.

Section 1: Long term theses vs. near term catalysts

Last week was a volatile one for shareholders in Unilife (UNIS).

On Monday, the shares had traded as low as $4.03, closing at $4.15. But after the market closed, Unilife announced “an agreement with Novartis to supply clinical products from one of its platforms of injectable drug delivery systems for use with one of Novartis’ targeted early-stage pipeline drugs”.

The mere mention of “an agreement with Novarits” had a predictable effect on the share price, and Unilife quickly traded as high as $5.25 in extended hours trading – an immediate gain of more than 25%.

These gains followed similar gains the previous week, following theannouncement of a long term supply agreement with Hikma Pharmaceuticals on November 20th. Just prior to this announcement, the stock had closed at $2.80.

After trading to as high as $5.25 in extended hours, the shares ended the week at $4.31, but had traded as low as $4.16 again on Friday. In other words, by the end of the week, Unilife had already given up almost all of its sharp gains following the Novartis release. The stock has already received price target upgrades from its three investment banks last week, but this appears to have provided very little support for the share price.

An outpouring of analysis on Wednesday added to the volatility in the share price, but appears to have not given much direction to the share price. In that one day, there were three large short articles and two large long articles published. These authors took turns repeating one another, contradicting one another and ignoring one another. All of this also happened to occur on the same exact day that CEO Alan Shortall was presenting at a conference in New York. Not surprisingly, the share price was very volatile that day, at times being down by 10% or up by 5%. It was equally unsurprising that the share price finally ended the volatile day almost entirely unchanged (up by just 2 cents).

The bull thesis is based on the opinion that this recent series of supply agreements will ultimately produce perhaps hundreds of millions in revenue from big pharma partners. However, even the bulls acknowledge that meaningful revenues are not expected to materialize until after several ramp up periods of as long as four years.

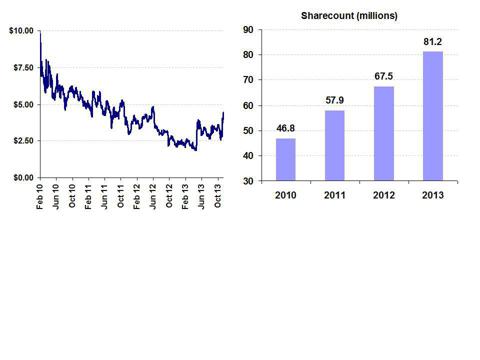

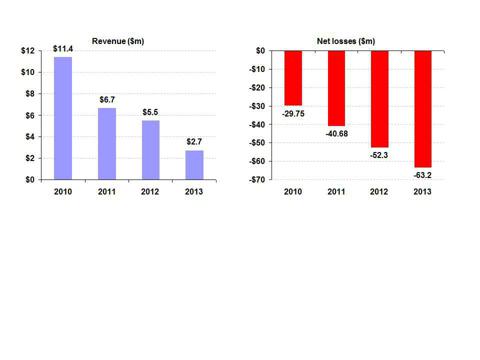

The bear thesis was fully detailed by Kerrisdale Capital which notes that recent announcements from Unilife are nearly identical to numerous announcements stretching back 10 years, each of which suggested that the onset of massive revenues was imminent. Such announcements had consistently caused the share price to soar dramatically, just as they have again done in the past two weeks. As they have been recently, analysts were then quick to upgrade the stock. Yet revenues for Unilife have continued to dwindle while Unilife has steadily issued nearly 40 million new shares in just the past few years.

For those looking to trade the stock, the inherent problem with both of these bull and bear theses is that both are predicated on how potential contracts and revenues will play out over a period of several years. Given the tremendous volatility in the stock recently, long term views may not be of ideal use.

Both sides are free to speculate on the longer term future of Unilife. However in the near term, one thing is quite certain: By the end of December, Unilife will likely be out of cash and the company is almost certain to issue a substantial amount of equity before the Christmas holiday. This is the near term catalyst.

Author Dr. Hugh Akston illustrated this catalyst quite clearly in a recent article. As of September 30th (i.e. two months ago, its last reported quarter), Unilife was down to just $7 million in cash. The company steadily burns around $3 million every month. The company did receive $5 million as an upfront payment from Sanofi in October, but Unilife has already disclosed that it plans on paying down a loan to Varilease for roughly that amount. As of right now, Unilife is therefore down to around $1 million in available cash vs. its consistent cash burn of around $3 million per month.

The incentive to conduct a very large equity offering is clearly substantial. Last week (following the sharp spike), Unilife had quickly risen by nearly 90% and was trading at its highest levels since 2011. But this is simply on a “nominal” share price level. In reality, the large number of shares which have been issued every year means that last week Unilife was closing in on its highest evervaluation (market cap) since coming public in the US. Some investors may not realize this given that the share price has fallen from above $10.00 to around $4.00 at present. Yet it remains the case that the market cap for Unilife had just hit within around 10% of its highest ever valuation since trading in the US.

The recent upgrades by Unilife’s investment banks were all based upon enthusiasm for the Novartis announcement. Yet these banks are not privy to any additional information beyond the press release, which we can all read equally well. The banks simply relied upon this simple press release to provide generous upgrades to their share price targets. Such jockeying for position ahead of a near term equity financing suggests that these banks are looking for an equity offering that will be bigger rather than smaller and which will provide millions of dollars in investment banking fees to whoever is selected by Unilife. Currying favor with the company by upgrading the stock should therefore have been fully expected. These upgrades have failed to support the stock, so it appears that the market has already come to this realization on its own.

Section 2: Evaluating the stock promotion efforts

When looking at the “big picture” at Unilife, investors need to understand that there is an active effort at stock promotion which has been going on for quite some time. The details from this particular effort are virtually identical to other stock promotions, some of which I have highlighted in past articles.

Here is how it typically works. (And readers should keep in mind that I am not specifically referring to Unilife in this description. I am referring to a cookie cutter process that can be seen very frequently across numerous micro cap reverse merger stock promotions)

In each case, the promotion involves a small, money losing reverse merger which supposedly has the potential for massive near term transformation along with billions in revenue potential. At some point, the company issues one or more press releases which happen to mention global mega giants within its industry. Specific terms which would allow for proper revenue forecasting are typically not disclosed for competitive reasons or due to “confidentiality”. The share price often moves to some extent based on these press releases. But much sharper gains appear when certain third party authors interpret these press releases for us and then issue massive multi bagger share price forecasts. Share prices can then often show additional gains of more than 50% in a very short period. But the gains are typically very short lived. Over time most of these promotion efforts end up giving up all of their gains, and in many cases they end of falling even further, for reasons that will be shown below.

On Friday, author Tech Guru weighed in once again to help us “parse” the debate on Unilife. He notes that he expects $50 million in revenue in 2014. By way of comparison, over the past 5 years, Unilife has generated a cumulative total of only around $25 million in revenues. But most of this came in 2010. More recently, revenues have dwindled to around $0.6 million per quarter. During this time span of several years, Unilife has repeatedly issued similar bullish forecasts which made statements such as:

“we have been swamped with demand from a lot of other pharma companies who also have unmet needs.”

“We expect to be supplying this to many pharma companies in the near future,”Allan said.”

Past press releases dating back as far as 4 years include the following. (Note these are all PRIOR TO 2013, and as such should have already had an impact on revenues).

2010 – Unilife and sanofi-aventis Agree to Exclusivity List for Unifill(TM) Ready-to-Fill Syringe

2010 – Unilife and Stason Pharmaceuticals Sign Asian Distribution Agreement for the Unitract(TM) 1mL Safety Syringe

2011 – Unilife Signs Clinical Development and Supply Agreement with Global Pharmaceutical Company

2011 – Unilife Wins Supply Contract with Nation’s Largest Healthcare Alliance

2011 – Unilife Starts Unifill Syringe Sales to Another Pharmaceutical Customer

2011 – Unilife Commences Initial Supply of the Unifill® Syringe to Sanofi

2011 – Unilife on Schedule to Fill Initial Orders for Unifill Syringe

2012 – Unilife Signs Long-Term Supply Contract for the Unifill Prefilled Syringe

In many cases, these press releases were just as exciting as the recent ones in 2013. They also consistently provided (very brief) boosts to the share price of Unilife as expected.

But the results have varied dramatically vs. expectations.

The points from these graphs demonstrate the following: the share price has been steadily declining for the past several years, even as Unilife has consistently issued millions of new shares. Likewise, revenues have dwindled by more than 70% while losses have grown substantially. All of this has occurred despite the consistent release of “news” from Unilife which has been largely similar to that which was released in the past few weeks.

It is therefore unclear how Tech Guru could be so optimistic regarding a tremedous surge in revenue next year.

A few months ago, I highlighted a different campaign by Tech Guru with Neonode Inc. (NEON), which appears to be nearly identical to the promotion of Unilife in virtually all respects. The similarities and parallels here should be patently obvious to anyone who has followed Unilife.

Tech Guru began writing on Neonode earlier in 2013. Between March and September, he wrote bullish articles on the company on average every 2-3 weeks. Neonode is engaged in licensing touch sensor technology, mostly to electronics OEMs.

Just like Unilife, money-losing microcap Neonode had put out several very promising press releases this year which could be linked to global giants within its industry. Over a period of months these included such heavy weights as Samsung and LG, along with automotive contracts with Volvo. Clearly this was going to be huge and transformational.

Just like Unilife, Neonode had been putting out nearly identical press releasesfor years, but consistently failed to generate meaningful revenues – despite the global giant partners. Just like Unilife, Neonode has never earned a profit in its numerous years in business. And just like Unilife, the press releases from Neonode were always kept vague and omitted the most relevant details, typically due to competitive or confidentiality reasons.

Given that multiple years of nearly identical press releases from Neonode failed to produce large scale revenues or any profits at all, it is unclear why Tech Guru would project that more identical press releases in 2013 would somehow lead to near term windfall profits and a skyrocketing share price. But by trumpeting names like LG and Samsung and predicting returns of more than 400%, his articles did cause the share price to briefly rise by around 60% to as high as $8.84 up from around $5.00 in March.

Just like with Unilife, the investment bankers were quick to upgrade Neonode based on nothing more than the very vague press releases. Investment bank Craig Hallum initiated coverage on Neonode when the stock price was just $3-4, and put a target of $7.50 on the stock, implying that they expected Neonode to double. The timing of this coverage was downright bizarre given that Neonode had just lost its largest customer, Amazon (AMZN), which had been responsible for 40% of its revenues at the time. But the upgrade worked and Neonode rose. By August, Neonode had still failed to replace its lost revenues and reported a notably large earnings miss which sent the stock plunging by more than 20%. What did Craig Hallum do ? They upgraded the stock again – now with a $10.00 target. This upgrade, along with more bullish articles by Tech Guru (predicting a $27 share price) sent the stock to just under $9.00. This sequence of events is all detailed clearly in my September article.

By now, this sequence of events should all feel very familiar to those who follow Unilife. So far they have been largely identical.

What happened next with Neonode was quite predictable. Neonode and its management sold $19 million in equity. Craig Hallum ran the deal (as expected) and made millions in fees. Meaningful revenues from the mega announcements may still be years away (if ever) and the stock price quickly fell by around 30% back to around $5.00 – right where it began. Prior to the offering, Tech Guru had been writing bullish articles on Neonode every 2-3 weeks for a 5 month period. This was a dedicated and persistent effort. But following the offering, the articles suddenly ceased for several months.

Many investors may wonder if such promotions can actually have a meaningful impact on the share price. The answer is a categorical “yes, they can”, especially if executed by a professional. This point can be made clear with a separate example.

Lately the Novartis news has taken center stage to the point where many investors have stopped focusing on the recent Hikma news from November 20th. The Hikma announcement caused Unilife to soar by more than 30% to $4.03. But after the initial surge, investors began a meaningful sell-off as they fully evaluated the news. It was only a double promotion from a paid subscription service called “The Focused Stock Trader” that sent Unilife soaring.

The graph below illustrates the sequence of events.

– Nov19 / 20 – Unilife announces Novartis news – stock rises to $4.03

– Nov21 – UNIS stock immediately trades down as low as $3.63 (down 9.9%) closes at $3.73

– Nov22 – 25 – UNIS struggles to hold above $4.00

– Nov26 – TFST promo article to paid subscribers only – UNIS immediately jumps from $3.85 to as high as $4.38 (13% jump and a new 52 week high).

– Nov27th – TFST article released on SA at 2:35 pm – stock jumps again from below $4.20 to as high as $4.50 (breaking yet another 52 week high)

– Nov28th – Thanksgiving – market closed

– Nov29th – Friday – stock closes at $4.40

– Dec 2nd – Stock closes at $4.15 (down 6%) hitting a low of $4.03 again (right where it began)

– Dec 2nd (after market close) – Novartis news released

The conclusion from this is that the stock had been quickly falling below $4.00 until it was pumped up by TFST and his distribution to his subscriber and then the follow through on Seeking Alpha. The stock was quickly losing momentum again, and the only thing the resurrected it was a new press release regarding Novartis.

TFST is a paid stock promotion letter. According to its results page, TFST is among the best investors in the entire stock market throughout the history of time eternal. Better than Buffet, Ichan or Soros by a long stretch. It notes that:

As our results show, The Focused Stock Trader recommendations were correct 52 out of 55 trades for an average return of 29.69% per trade with 2 trades generating returns in excess of 200%. The average holding period for our recommended trades, not including open trades, is 24 days. THE FOCUS STOCK TRADER HAS BEEN CORRECT 95% OF THE TIME GENERATING 30% EVERY 24 DAYS.

Apparently by following TFST, one can quickly become immensely wealthy. Fortunately, TFST makes its expertise available to the public, for anyone willing to pay $400 per quarter ($133 per month) or $1,200 per year ($100 per month). Based on this, it is very easy for TFST to pull in a 6 figure income from subscription revenue irrespective of the performance of any trades it recommends.

A closer look at TFST reveals that many of these stock picks end up being for very speculative reverse mergers which demonstrate great volatility. The research underlying them is often questionable, yet TFST has apparently generated significant returns on the upside, quickly selling before these stocks fall back to Earth.

For example, back in August, TFST highlighted Organovo Holdings (ONVO). Histrack record notes that he had sold the stock for prices as high as $11.20. But when the stock was trading at over $12.00, I highlighted the fact that much of its gains were due to misinformation and inaccurate comparisons to 3D printing stocks such as 3D Systems (DDD) and Stratysys (SSYS). The article from TFST contains the exact type of misinformation that I had referred to. He noted that

Needless to say, Organovo can do for 3-D printing what Microsoft (MSFT) did for PCs and Ford (F) did for the automobile; make a long-sought after dream a reality.

Shortly after TFST was selling at $11.20, the stock quickly ended up falling below $8.00. The stock has recently jumped due to the CEO’s presentation at retailinvestorconference.com. But even on that conference, the CEO went out of his way to make clear that Organovo is NOT a 3D printing stock.

TFST clearly benefited from the rise in the Organovo even though its research was largely unfounded. So, what’s the harm ?

The harm is that when stock promoters put out unfounded research on tiny, speculative reverse mergers, investors end up buying into these stocks without understanding that there are very substantial risks. TFST’s next pick was Fab Universal (FU), which he ended up making a whopping 99% on, selling it at $10.75. Congratulations to TFST, however that stock has since been halted after a fraud expose by GeoInvesting. Prior to the halt, this stock had last traded at $3.07. Trading has not yet resumed. Anyone who has been stuck holding a Chinese microcap which has been halted due to fraud allegations would likely not hold much optimism for the future of Fab. TFST was smart enough to get out at $10.75, but its subscribers may not have been so lucky. On its website TFST notes that:

In our reporting, we will suggest the purchase point; however, it is up to you to decide when to close out the position.

Likewise, on Unilife, we will have no idea how quickly TFST will end up running for the exits. In fact, it may well be the case that TFST will have the benefit of selling to individuals who are still buying based on research provided by TFST. That advantage, along with over $100,000 per year in subscriber income, makes for a great business model for TFST.

A longer look at the TFST track record shows a predisposition towards speculative and volatile reverse merger stocks which often end up in the cross hairs of short sellers. Revolution Lighting (RVLT) which TFST was selling as high as $5.00 was later exposed by a short selling and fraud focused site the StreetSweeper. The stock subsequently fell by as much as 50% from where TFST was selling, and it now sits at around $2.80. But it appears to have been another great trade for TFST who got out early. Likewise, it is very difficult to understand how anyone could have ever recommended beleaguered OCZ Technology (OCZ) which has been on terminal status for over a year.

TFST had noted that :

Short sellers are still holding on, but perhaps not for long. OCZ’s short position is at an unsustainable 79.3%.

Within a month, the shares had already plunged by around 80%. Since that time the shares have fallen by more than 95% and now trade for around 10 cents. It looks like there was a reason why the short interest was so monumental.

Yet OCZ has continued to be a promo pump target even now. Ashraf Eassa recently warned that there is still a pump campaign trying to spread rumor of a buyout on this now dead stock.

In separate disclosure on November 29th, TFST noted that his holding periodwas as short as just 14 days. The point is that small reverse mergers can often pop due to the sensation which surrounds vague press releases. This is especially true when the press releases include the names of major, global industry players. As players such as TFST have demonstrated, the best way to profit from such hype is to buy the rumor and (very quickly) sell the news.

The promoters behind Unilife have demonstrated a consistent tendency to back speculative, money losing reverse merger stocks. As with TFST, other backers have found themselves on the opposite side from short sellers.

Tech Guru had previously penned an article to rebut the short thesis on Coronado Biosciences (CNDO). Coronado had the implausible idea of making medical treatments out worm eggs which grow on pig feces. Tech Guru sought to debunk the short thesis which had been highlighted again by such skeptics as the StreetSweeper.

In its “public oath” the StreetSweeper states that:

We aim to partner with the public in exposing corporate fraud and bringing its engineers to justice. To that end, we pledge to investigate credible allegations of misconduct and – if the evidence supports those accusations – report the truth about our findings. At the same time, we agree to disclose any conflicts that could potentially color our judgment. By embracing these core principles, we hope to protect ordinary Americans and deliver them news that they can trust.

Readers can take that “public oath” with whatever grain of salt that they like. The point from it is that sites such as the StreetSweeper do not focus on stocks which are merely overvalued by 10-20% or which might have a bad earnigs quarter. They are focused on catalysts which are far more dramatic and which imply far larger share price moves.

As with Unilife, the shorts made their case by saying citing a horrible track record by management, including huge share sales despite no revenues. In backing this company, Tech Guru was defending the indefensible. As should have been expected, the use of worm eggs from pig feces failed in clinical trials and the share price plunged from over $8.00 to as low as $1.25. Yet the elevated share price before the failure allowed management to raise over $200 million from stock sales over the past few years. The shorts were particularly focused on the fact that a small group of insiders had been repeatedly involved in similar speculative ventures which soared on the hype but which imploded following large share sales. Since the implosion of Coronado, Tech Guru has ceased providing further updates on the company.

The point from these examples is that generating excitement around tiny reverse mergers which generate little to no revenue is far easier than generating excitement around larger companies which are profitable and stable. This is precisely why promoters choose such companies. Yet by ignoring or denying the warning signs highlighted by the skeptics, these promoters can often encourage other investors to invest in stocks which have very significant (and unknown) downside potential.

Other Unilife bulls appear to be engaged in a different strategy when writing about Unilife.

In the past year, Fusion Research has gone from zero articles on Seeking Alpha to almost 400. A new article appears from them on almost every trading day, with the result that Fusion is now #1 on long ideas, #1 on services stocks and #1 on industrial goods. These rankings are based purely on number of hits.

Fusion describes itself saying:

Fusion Research is managed by a team that has been actively involved in the financial research industry for over 5 years. Our business is rooted in principles of trust, integrity and fundamentals-driven markets.

But it also notes that

We create strategic partnerships with companies and firms to gain unprecedented domestic and international following of our coverage.

In fact, a closer look at Fusion’s own website reveals that Fusion is actually an IT outsourcing firm which focuses on simple web development and HTML. There is a link where once can “learn more” about its investment research activities. But that link is broken and leads to nowhere.

In its almost 400 articles, Fusion has consistently written about mega cap stocks which have a huge built in following of thousands of readers. But it has also made it a point to write about smaller stocks which have recently shown dramatic price moves and which will also automatically generate a large number of hits.

The key point is as follows: During a two week period, shares of Unilife soared by as much as 88% on the back of two press releases which are encouraging but still far too vague for planning or forecasting purposes. Prior to this, the shares closed at $2.80 and the shares have already begun a substantial retreat.

The attention of promotional authors can often have an even larger impact than the news from the company itself. While this can often create great short term trading opportunities for those who are nimble, holding these stocks after they peak can end up producing substantial losses on the way down. Investors should be aware that those who promote such stocks often have zero intention of holding the shares and often intend to play it as a quick “buy on the rumor trade”. Other authors are simply attracted to the most volatile stocks which tend to generate the largest number of page views and typically do not even buy the stocks they are writing about.

Section 3: Competitive considerations for Unilife

Many of the recent articles have been overwhelmingly focused on highlighting the dramatic upside associated with Unilife, while downplaying the substantial risks of buying on this spike. They have also ignored the competition.

There is a reason why promotional authors tend to ignore the risks and competition: it works.

We can very easily see what happens when an author pays even moderate attention to risk elements after a stock has already spiked. Once the stock has spiked, any attention to risk can send it sharply lower.

On December 2nd, Dr. Thomas Carr wrote a very bullish article on Unilife entitled “Unilife: Set To Double In 2014?“. In his opening pitch, he notes that he is long the stock and that:

As it turns out, demand for Unilife’s unique medical dispensing technology is so strong and growing so fast that shares of the company may well be one of 2014’s best investments in the healthcare sector.

What was the result of this strong enthusiasm from one who identifies himself as a “doctor” ? The stock actually fell 7% that day. There are two reasons for this.

Despite his own personal bullishness and disclosing a long position in the stock, Dr. Carr was forthright enough to at least mention the substantial downside that comes along with Unilife. He noted that:

New and current investors should keep in mind the risks outlined above. The company may well be covering up past fraudulent activity. The Biodel deal may well fall through. Management may continue its unfortunate streak of over-selling its EPS potential.

But of much greater importance was the fact that Dr. Carr was among the first to pay more than passive lip service to the existence of substantial competition within this market.

Even Unilife itself discloses that there is meaningful competition in this space. But the mostly retail investor base in Unilife often seems to feel that Unilife is inventing a new product and will quickly command a monopoly in the space.

In its most recent 10K filing, Unilife discloses its view on the competition which already consists of some of the largest and best financed giants in the healthcare industry, saying:

We are aware of five companies which specialize in the production and supply of glass ready-to-fill syringes. These companies are BD, Gerresheimer, MGlas AG, Schott and Nuova Ompi. We estimate the market concentration rate for these five companies to be approximately 95%. We believe BD’s market share to be in excess of 50%, as it has supply relationships with most pharmaceutical companies and contract manufacturing organizations.

The point that investors need to realize is that this is not a soon-to-be-created new market which will be dominated by Unilife. It is already an established and highly competitive market.

In September, the big news for Unilife was the Sanofi contract which may eventually lead to meaningful sales of Lovenox in prefilled syringes. But in its September conference call, Unilife noted that

the IMS data for Lovenox for 2012 shows the sale of over 450 million prefilled syringes with Lovenox in it.

The point is that there are already hundreds of millions of units of being provided by competitors on the market two years before Unilife even plans on entering the picture in 2014. Many investors have been entirely unaware of this competitive reality and have assumed that Unilife is about to create a multi billion dollar monopoly.

Dr. Carr briefly listed a number of Unilife’s competitors within the space who have existing or pending product offerings which will largely compete within the same space.

In addition to Beckton Dickinson (BD), Gerresheimer, MGlas AG, Schott and Nuova Ompi (which were mentioned by Unilife), Dr. Carr also mentions such giants as Amgen (AMGN), Pfizer (PFE) and West Pharmaceuticals (WST). Medical giant Baxter International (BAX) is also active in prefilled syrniges. Baxter is valued at $37 billion based on annual sales of over $14 billion.

The point is that breaking in to this space will be difficult, even despite several encouraging potential supply contracts. The competition in this space is well established and extremely well financed and will have the ability to compete aggressively on volume, quality and price.

Conclusion

The market has now had the opportunity to digest in full the recent news from Unilife along with the ample analysis from third party authors. CEO Alan Shortall has had the opportunity to speak to investors in New York and the sell side analysts have already had their chance to upgrade the stock.

With all of these events now being mostly digested, the stock appears to be once again giving up its recent gains rather than continuing to surge higher.

The market may well be already pricing in an equity offering due to the realization that Unilife will likely be out of cash before Christmas.

Much of the sharp rises in the stock can be tied to recent promotional articles by authors who tend to focus on short term trades in speculative reverse merger stocks. In the past, some of these efforts have sensationalized press releases from other micro cap reverse mergers and have predicted a surge in near term revenues and multi bagger share price returns. This is an easy task when the press release includes the names of global giant heavy weights.

But when similar such press releases have been consistently issued for years without meaningful resulting revenues, investors should likely ask themselves how the latest series of press releases will create a result that is in any way different.

There is already existing competition in the specialty syringe space, with hundreds of millions of units being delivered even just for individual drugs such as Lovenox. Those who have been under the impression that Unilife has created a novel product and will soon be commanding a monopoly would do well to expand their research into the substantial competition in the specialty syringe space.

Appendix I – details of Unilife lawsuit

For those who wish to read the details of the Unilife lawsuit in their entirety, updating filings from August can be found at the following link at my website atmoxreports.com. Readers can also sign up for email alerts. There is no charge for this and email addresses are not shared with anyone. Ever.

Readers should also be aware that Unilife has already responded to the article on Forbes. A link to that response can be found here. However, readers should also note that there are a number of items in the actual whistle blower lawsuit which do not yet appear to have been responded to by management.

The lawsuit was brought by Talbot Smith, formerly an executive at Unilife who was hired in 2011. The suit notes that Smith was a Stanford graduate with a BS in Industrial Engineering and an MS in Operations Research. His starting salary was $230,000 plus various incentives including bonuses and stock options.

The gist of this lawsuit can be seen on the first page of the filing. The cited “causes of action” are a) violations of Sarbanes Oxley and b) violations of the Dodd-Frank Act.

Sarbanes Oxley (or “SOX”) was passed in 2002 in direct response to various accounting scandals including Enron, Tyco and Worldcom. SOX requires that top management certify the accuracy of SEC filings and dramatically increased the penalties for fraudulent activity.

Dodd Frank was passed into Federal Law in 2010 in response to the financial crisis which began in 2008 and also was designed to incorporate enhanced protections for investors.

As noted, the lawsuit was originally filed and received by the US Department of Labor/OSHA. The lawsuit notes that the Secretary of Labor did not make a final determination within the 180 day deadline, but that “sufficient prima facie evidence was found to begin an investigation” (page 2). As a result, the case was moved to Federal Court.

This filing is very long because it also incorporates original copies of the press releases and the 10K filing which are said to contain the inaccurate statements.

Some of the claims by Smith state that products being supplied by Unilife were not “validated” (as had been claimed by Unilife) because the FDA required activities had not been completed at the time that these statements were made to investors. Unilife subsequently brought in FDA auditors who stated that by the time of the audit, the validation could be considered complete.

These FDA claims will therefore be very difficult for either side to verify. The argument Talbot would make is that compliance would have been achieved well after he reported his observations to the FDA, but prior to the audit. The argument from Unilife is simply that this is not true.

Other claims should be less ambiguous. For example, on page 7, we can see Smith’s claim that the previous 10K filing made inaccurate statements to investors regarding shipments of “commercial” product by Unilife. Talbot backs this statement by noting that “no revenue had been collected from commercial sales of the Unifill product”. Ultimately, an audit by the SEC will be able to trace documentation of this claim and make a determination. This should be black and white.

Likewise, Talbot claims Unilife made false statements about its production lines. Talbot claims that at the time of the statements, two of the production lines were actually still in Denver, Colorado, and certainly not installed. Again, this should be a very black and white matter to resolve in an investigation.

In general, I am far less focused on the FDA issues because I believe that they will be far more difficult for either side to resolve. But on Page 11, the lawsuit describes additional product quality failures which had supposedly been reported by Smith via email. The lawsuit then notes that

The following day, Mojdeh told Smith to come into his office. Mojdeh instructed Smith that he should not put any concerns into emails because they could be used against the company in future legal action

Once again, an investigation will certainly dig up any emails prior to this conversation. Either the emails referred to by Smith exist or they do not, so there should be a conclusive result to an investigation by the SEC.

Other claims may be easy to document, even though actual “intent” may be hard to prove. On page 11, the lawsuit notes that:

Unilife also took actions to mislead investors about its customer demand and manufacturing capacity. To this end, Mojdeh directed Smith to have his team purchase 1,000,000 units of Unifill components per month in spite of the fact that there was no customer demand or manufacturing capacity to justify this level of purchasing. Mojdeh told Smith that the objective of the purchases was to make suppliers believe that Unilife was manufacturing at this volume, with the hope that the information would leak to the financial markets.

The point here is that proving that Unilife made unnecessary purchases at huge volume should be relatively straight forward. And this could easily be explained by the ballooning losses and dwindling revenues seen over the past 3 years. Yet actually proving the intent of Mr. Mojdeh will likely be a more difficult endeavor in an investigation or a courtroom.

On page 12, the lawsuit states that:

Another action that Unilife took to mislead investors was to run fake production when investors or customers were visiting the facility. On more than one occasion, scrap was run through the machines to make it appear that Unilife was making product when it was not. Product was placed on skids by the warehouse doors to give the false appearance that product was being packaged and send to customers when it was not.

Presumably the only way to get much resolution will be when the SEC subpoenas the warehouse workers who either did or did not perform these activities. The truth should be easy to get at because warehouse workers typically do not have a large financial inventive to bend the truth when faced with the potential for perjury charges. In addition, there are likely a large number of warehouse workers. Keeping a secret gets harder as the number of individuals increases.

On Page 13, the lawsuit notes that

Shortall made comments that were posted on the Yahoo! Finance message board on July 10th, 2012, indicating that Unitract was profitable with a 20% gross margin, when Unilife was in fact losing $1.00 per unit.

Again, this will be an easy one to either prove or disprove.

Conclusions regarding Unilife lawsuit

The details spelled out in the lawsuit vary between crystal clear and verifiable to murky and difficult-to-prove. Some investors may be inclined to wonder why we have not already seen some resolution to these matters given that they relate to issues dating back to 2011. Other investors may be inclined to feel that if we haven’t seen consequences yet, then there may simply be nothing to worry about.

In general, SEC investigations take considerable time and there are no “hints” along the way which would given guidance as to the eventual conclusion. For example, in October 2013 the SEC was just providing final resolution to the fraud case at YuHe International, which has been ongoing since 2011. China frauds were a big focus in 2011, and in October 2013 the SEC finally got around to issuing final judgment against China Media Express (“CCME”), also following fraud that was uncovered in 2011. The point is that these things can often take a few years before visible results are uncovered. No one should expect that there would have already been an immediate result just because these findings were made public over a year ago.

Disclosure: I am short UNIS, ONVO. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.