Summary

- A recent report from Vista Partners sent OHRP soaring by 60%. The contents, including a $31 price target, was provided and paid for by Ohr management.

- Ohr stock had just collapsed to as low as $6.86 due to a recent failure of its drug in clinical trials.

- Squalamine was previously owned by Genaera Pharma. The drug had already failed following clinical trials such that Genaera sold it to Ohr for less than $100,000.

- Recent encouraging results from Ohr were actually reported by Genaera as early as 2003, but the drug was still discarded as unviable.

- Investors should expect to see shares of Ohr return to $5.00 or below. Ohr is a truly compelling short and has liquid options.

Background

Over the weekend, physician Michael Sacerdote penned an article discussing Ohr Pharmaceutical (NASDAQ:OHRP), which was quite thorough and scientifically rigorous. He posted three major conclusions:

First, despite the apparent clinical efficacy of squalamine, the drug would be a commercial failure because it does not reduce the need for overall injections into the eye.

Second, with any possible approval being at least 4 years away, the drug will be too far behind rival Opthotech’s competing drug, Fovista. This again will result in commercial failure.

Third, the value of squalamine is zero.

Dr. Sacerdote is a physician and his scientific analysis reflects that. However, I do believe that the doctor has missed the much larger point with Ohr and squalamine.

In fact, this drug never had a real shot at success in the first place. The information gleaned from recent Phase 2 trials has been known for more than 10 years. Yet the drug was already determined to be commercially unviable and was effectively discarded by its previous owner for de minimis proceeds.

Most importantly, the recent surge in the stock has simply been the result of a stock promotion provided and paid for by Ohr management. It has nothing to do with the prospects for squalamine and everything to do with management’s desire to issue more stock in equity offerings going forward. Ohr currently has a market cap of $250 million and less than $20 million in cash, with no near-term drug prospects.

Recent developments

Shares of Ohr Pharma have been extremely volatile lately. The stock is held overwhelmingly by retail investors who can be easily influenced by small amounts of publicity, even when the underlying data is clearly not well understood.

On June 23rd, shares of Ohr rose by 16% due to the following announcement:

Clearly, the headline was very positive. And the contents within the press release were also very positive.

But the devil was in the details.

In fact, buried deep within the press release was the fact that squalamine actually missed its primary endpoint. The goal of the entire study was to reduce the frequency of Lucentis injections and this did not happen. The drug failed its objective. Period.

But given the incredibly positive spin, it was not at all surprising that retail investors bid the stock up. It was also not surprising that self-appointed biotech vigilante Adam Feuerstein was quick to cry foul.

One day later, Feuerstein pointed out the fact that the drug had actually failed. He also called management to task for the incredibly deceptive press release. Within two days, shares of Ohr were down by as much as 40%, briefly hitting $6.86, down from $11.40 post press release.

Yet within two more days, shares of Ohr were again up by as much as 60% from those lows, briefly hitting $10.97 again. The main contributor to this surge was an “upgrade” by Vista Partners, which placed a new $31 price target on the stock.

Lest anyone miss their upgrade, Vista even put out a press release to trumpet it and included the key reasons for why Ohr should be a $31 stock.

Vista Partners Updates Coverage on Ohr Pharmaceutical, Inc. (NASDAQ: OHRP); Raises Price Target to $31

The bullish upgrade and the soaring share price were then further amplified by media sources such as Benzinga and TheStreet.com.

But there is one major problem here. The report issued by Vista (including the $31 target) was fully bought and paid for by Ohr management.

This fact was not disclosed in the press release by Vista and was therefore missed by both Benzinga and TheStreet.com (as well as other market sources). It was also clearly unknown to the retail investor base and it appears that very few people appear to have read the actual report from Vista Partners.

For those who wish to read the actual Vista report, I have included a pdf copy at moxreports.com.

But it gets worse.

Buried deep on page 10 of the report, and in much tinier font, is the disclosure from Vista that (emphasis added):

This report has been prepared by Vista Partners LLC (“Vista”) with the assistance

OHR Pharmaceutical, Inc. (“the Company”) based upon information provided by the Company. Vista has not independently verified such information, and in addition, Vista has been compensated by the Company for advisory services for a one year period. Vista and its officers may have an equity interest – both restricted and unrestricted in the securities mentioned herein.

The key points to understand are as follows:

- The information in the Vista report was provided solely by Ohr management itself

- Vista then does not even bother to verify any information

- Ohr pays Vista for “advisory services” which includes putting out reports like this one.

The report from Vista is nothing more than a late night infomercial provided by Ohr management, yet it caused the share price to soar by 60% in two days.

It is very clear from the share price reaction that the heavy retail base of investors in Ohr did not even bother to read this report. If any of them did, they certainly did not find the tiny disclosure buried on page 10. Certainly, Benzinga and TheStreet.com missed this.

So Strike One for Ohr is the misleading press release on June 23rd, which painted a failed clinical trial in a stunningly positive light.

Strike Two is the use of a paid stock pump to further elevate its shares using a $31 share price target and a firm, which doesn’t even bother to verify the information provided solely by Ohr.

Looking at the history of Ohr will reveal Strike Three.

It is the fact that squalamine largely never stood a chance at getting approved or of achieving commercial success in the first place. The drug was purchased for next to nothing after it had already failed to prove itself viable in clinical trials. It was largely just an excuse for Ohr to run a stock promotion with the goal of issuing stock to raise tens of millions of dollars.

The history of Ohr Pharma

Ohr Pharma was created in a simple reverse merger transaction in 2009, which was arranged by financier Orin Hirschman. Mr. Hirschman then appointed his father Shalom Hirschman to act as a consultant to oversee the purchases of various small and inexpensive pharma assets. By this time, the father had already sold to the corporate entity several “pre-clinical” drug assets in exchange for warrants on 5 million shares with a strike price of just 50 cents. Not a bad deal for mere “pre clinical assets.” The son already owned 18.9% of the public company by virtue of having arranged the reverse merger.

The company then appointed fellow financier Andrew Limpert to serve as its CEO. According to SEC filings, Limpert had (up until the previous year) been a control person for an investment advisor known as Belsen Getty. He also served various roles such as chairman and CFO of two publicly traded reverse mergers, Nine Mile Software and Profire Energy. For reference, SEC filingsthen describe the fraudulent activity, settlements and cease and desist orders involved from then CEO Limpert’s activity with manipulation and non-disclosure in these other reverse merger stock deals.

Later in 2009, with Limpert at the helm, Ohr completed the acquisition of Squalamine, Trodusquemine and related compounds from Genaera Liquidating Trust. The Company paid a mere $200,000 in cash for all of these compounds.

The cost per compound therefore comes out to something well under $100,000 each. We don’t know exactly how many compounds were purchased in this basket transaction so we can’t determine the exact average cost.

The first question becomes: why were the Hirschmans and Limpert able to acquire these compounds so cheaply?

The answer is that they arguably had no value whatsoever.

Squalamine was acquired from a Pennsylvania biotech company called Genaera, which had just wound down and liquidated its remaining assets for just a few pennies per share in June 2009. Among the “assets” being sold off were the rights to squalamine (for age related macular degeneration), trodusquemine (for obesity and now breast cancer) and various other compounds. (Genaera had previously attempted to develop squalamine under the trade name EVIZON).

Despite being shopped to dozens of potential bidders, the compounds failed to attract high bids and Ohr was able to walk away with the rights to all of these various compounds for just $200,000.

These assets were basically given away in bulk, and for a very good reason. In 2007 (two years BEFORE going out of business) Genaera disclosed that:

Additionally, preliminary information on subjects enrolled in Study 212 suggested that EVIZON™ was unlikely to produce vision improvement with the speed or frequency necessary to compete with recently introduced treatments. With this information, as well as evolving guidance from the FDA on clinical endpoints, we concluded there was no pragmatic option for the registration and commercialization of EVIZON™ for the treatment of wet AMD.

The drug was a failure and it was basically being given away as part of a bulk package of compounds for a nominal sum as part of winding up a bankrupt company.

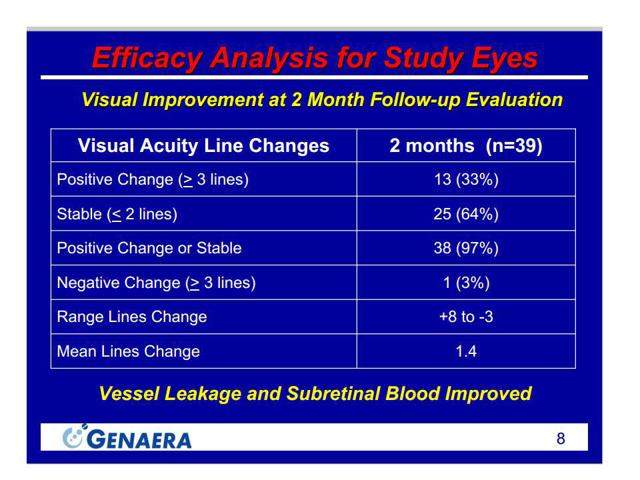

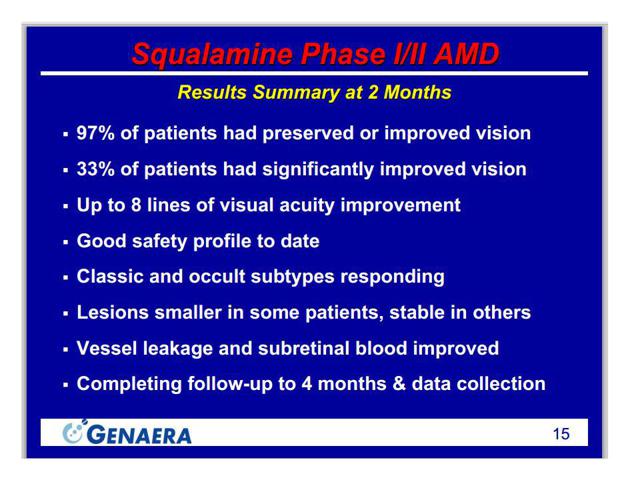

But what is interesting here is to note that the original optimism by Genaera for the drug was based on vision and visual acuity, including “up to 8 lines” of visual acuity improvement. Sound familiar?

The key point to understand is that these optimistic views on the efficacy of squalamine were expressed in a Genaera presentation to investors – in 2003 !!! They are nearly identical to what Ohr just disclosed in 2014 – 11 years later.

Ohr had absolutely no basis whatsoever for pretending to be surprised at any new and positive results. The company knew that in-line results should have been achievable since the day they bought the drug.

Had these results actually mattered, they would have been used as the primary end point for the study. But they did not matter, so they were not used.

Now it is 2014, and a subsequent test of squalamine (not surprisingly) yields very similar results. Ohr had reported in its press release that “Percentage of Squalamine plus Lucentis PRN-treated patients gaining three, four and five lines in visual acuity was more than double the placebo plus Lucentis PRN arm.”

It sounds great. But does it matter?

We can see that in 2014 the results that are being reported by Ohr are in fact slightly worse than the results we saw back in 2003. And even with those slightly better results reported by Genaera in 2003, the drug was ultimately abandoned as being irrelevant and commercially unviable. Aside from Ohr, no one was even willing to pay a meaningful sum for this discarded drug.

This was a drug with no real commercial value. Genaera was happy to basically give it away as part of a basket package deal.

What is the point of all of this?

Once again, Ohr is being incredibly misleading by pretending that these results are new or are any sort of surprise. These results are simply a repeat of similar information, which had been released 11 years earlier.

In fact, Ohr would have been fully aware of these findings in 2009 when it purchased the drug from Genaera. The latest press release is nothing more than a ruse to get the stock up. And the ruse was then repeated and trumpeted by Vista Partners (the firm that doesn’t verify any information provided by Ohr management).

The second question becomes: why would Ohr even bother taking an already failed drug through clinical trials?

This is something we see all too often in the world of microcap reverse merger biotechs. A company buys a drug “asset.” The result is not to buy the best drug. Instead, it is to buy the cheapest drug asset it can find and then simply maximize the hype surrounding it. The stock soars and the company raises tens of millions by selling stock. This capital raised can hopefully be used later on to buy or develop a real drug, one that actually might work. In the meantime, executives and directors pay themselves hundreds of thousands per year in salaries while they wait.

By 2010, Ohr had purchased a small variety of compounds from different sources. Total cash outlay was well under $1 million such that the cost for each compound continued to be negligible. The company then took on new management with more “marketable” credentials than Mr. Limpert.

Dr. Irach Taraporewala was appointed CEO with a base salary of just $61,000 plus some stock. It turns out that Dr. Taraporewala was an associate of Shalom Hirschman (the father), with both of them working together at an OTCBB penny stock company called Advanced Viral Research. That firm went bust in 2009, just as Orin Hirschman was assembling the Ohr reverse merger. The timing was therefore perfect.

The Hirschmans then appointed Sam Backenroth as CFO. Mr. Backenroth was just 26 years old with two years of work experience and had no experience as a CFO. His starting salary was $24,000.

The point from all of this is that the goal is not to “succeed at any cost” like a true pharma company. Instead, it is a strategy known as “fake it ’til you make it.“

Acquire assets and people with minimal value or relevant experience and then spin an impressive story around some massive future potential. When the stock soars, raise as much money as possible to create as much “disposable capital” as possible.

In this way, the financiers can turn an investment of a few hundred thousand dollars (used to purchase defunct compounds) into “disposable capital” of tens of millions.

When the stock needs a little help, management can always rely on stealthy paid reports (such as from Vista Partners) and misleading press releases to help boost it up a notch. In addition, by building relationships with a few small cap investment banks, these types of companies can occasionally get bullish sell side coverage. It is obvious to these banks that companies like this will be frequent investment banking clients due to the never-ending need for capital.

This is the formula for reverse merger riches, and I feel that I am seeing it clearly once again in Ohr. The only problem is that ordinary shareholders find themselves sitting on a serial dilution machine due to the never-ending stream of equity offerings. Meanwhile those behind the promotion can simply award themselves more and more stock options to maintain their ownership.

Conclusion

Dr. Sacerdote came to the conclusion that “Value of Ohr’s squalamine eye drops for wet age-related macular degeneration is $0 or less.”

I entirely agree with Dr. Sacerdote’s conclusions, but for very different reasons. Dr. Sacerdote makes reference to such items as the “biological activity” and “molecular weight” of squalamine. I see this analysis as being accurate but largely unnecessary.

Squalamine was purchased for a negligible cost from a bankrupt pharma because it had already failed and was clearly worthless. Dozens of other buyers had the opportunity to bid on squalamine and no one was willing to pay a material price.

Ohr acquired the cheapest compounds that it could and then appointed the cheapest management that it could. There was never any real chance of these compounds succeeding.

Instead, Ohr has used misleading press releases and stealthy paid “research reports” to boost its stock price and raise money via stock sales.

Ohr Pharma is little more than a fool’s game for retail investors which has been engineered by clever financiers.

As of now, Ohr has around $20 million in cash and no material tangible assets. Its drug compound portfolio should be evaluated in the context of the facts provided above. Against this, the market cap of Ohr is still over $200 million.

As investors come to terms with the stock promotion and the questionable assets, the stock will likely fall by at least 50%.

Even though much of Ohr’s current approx. $20 million in cash was raised in April, the recent efforts at pumping the stock tell us that we should be on strong lookout for more equity offerings coming up due to the fact that Ohr has zero near-term revenue prospects.

(Editors’ note: the author confirmed that he attempted to contact OHRP’s IR team regarding these concerns).

This article is the opinion of the author. Nothing herein comprises a recommendation to buy or sell any security. The author is short OHRP. The author may choose to transact in securities of one or more companies mentioned within this article within the next 72 hours.