Summary

- Northwest Bio has been the subject of a massive promotional campaign which has seen the stock price soar.

- Many of the authors involved have close hidden ties to promotional firm MDM Worldwide and / or Redfish Creative.

- In some cases, authors have used fictitious identities and fake credentials within healthcare or finance. In fact they are simply paid writers.

- Redfish Creative reveals its use of bulk pricing for writing undisclosed promo articles and mass message board postings on Yahoo.

- Much of the promotional information written on Northwest has been either misleading or downright wrong.

Note: As part of his investigation, the author has shared the contents of this article along with additional materials with the United States Securities and Exchange Commission.

Note: Additional links and information on these topics has been and will continue to be shared via the author’s website. Readers can sign up for email alerts at www.moxreports.com. All content provided is always free of charge.

Overview

Since 2013, shares of Northwest Biotherapeutics (OTC:NWBO) have more than doubled. At their peak, they were a triple from last year.

During this time, Northwest has raised nearly $80 million from equity issuance on the back of the strong share price.

The driving force behind the share price has been a string of promotional articles from a variety of authors, which have issued very bullish predictions for the stock.

In most cases, the technique being used by these authors is to write on Northwest in conjunction with press releases being released by the company.

Northwest has limited institutional interest from outside investors at just 29%. As a result, the stock is easily influenced by analysis that is sophisticated in appearance.

As I will show below, many of the authors who have written on Northwest are using fake identities and fake credentials. They pretend to be biologists, other scientists or fund managers. In fact, they are just paid writers.

Since mid 2012, Northwest has made use of an IR and “social media” stock promotion firm called MDM Worldwide. Shortly after Northwest began paying MDM, the bullish articles began to appear from these fake authors. At the exact same point in time, MDM built a website for Smith on Stocks and Larry Smith quickly initiated coverage on all of MDM’s small cap biotech clients (including Northwest) with bullish / buy views. Smith has since written heavily on Northwest and has been the most ardent and outspoken bull on the stock.

These authors on Northwest have a broad and visible connection to MDM and / or to “content” firm Redfish Creative, which has done work for MDM. Redfish has already provided me with pricing sheets outlining how much it charges for different types of (undisclosed) paid articles. Redfish has also laid out its techniques for (undisclosed) paid writing on message boards.

Both MDM and Redfish have emphasized the technique of writing articles in conjunction with press releases being issued by their clients.

Mr. Smith has provided coverage to every single small cap biotech client that pays MDM. But both Smith and MDM have taken steps to conceal the relationship and have removed key disclosures.

Readers should note that after I contacted MDM for questions, they quickly notified Smith of my interest. Mr. Smith then found it appropriate to update some of his disclosures regarding his real bio, which had been concealed from investors. This includes the fact that he was barred from the securities industry by FINRA among other issues.

As shown below, much of the content that has been written by the writers described has been either misleading or downright wrong.

Note: MDM has assured me that it has never paid anyone to write any article on any stock. Please keep that in mind as you evaluate the facts below. Mr. Smith did not respond to an email from me.

Background

During the course of 2014, I have been highly focused on exposing undisclosed stock promotions which have artificially boosted the prices of various (mainly biotech) companies. My previous articles can be found hereand here.

Public companies hired IR firms, who then hired writers (aka “consultants”) to conduct massive undisclosed promotions on a wide variety of media portals including Forbes.com, TheStreet.com, Seeking Alpha, Motley Fool and others. The consultant authors pretend that their analysis is independent from the company, but in fact, their analysis is basically sponsored by the company and is (of course) heavily biased towards bullish conclusions.

Where this becomes illegal is due to Section 17b of the securities code, which states that promotions must be disclosed if there is any direct or indirect compensation from the issuer, from a broker dealer or from an underwriter. It was very clear in some cases that the issuers were involved in the promotion.

Section 17b reads as follows:

It shall be unlawful for any person, by the use of any means or instruments of transportation or communication in interstate commerce or by the use of the mails, to publish, give publicity to, or circulate any notice, circular, advertisement, newspaper, article, letter, investment service, or communication which, though not purporting to offer a security for sale, describes such security for a consideration received or to be received, directly or indirectly, from an issuer, underwriter, or dealer, without fully disclosing the receipt, whether past or prospective, of such consideration and the amount thereof.” (15 U.S.C. § 77q(B).)

The most notable example was the Dream Team Group, which was responsible for hundreds of articles in various sites that were entirely fabricated but which boosted the stocks of their biotech clients by hundreds of percent.

In some cases, the authors have been “consultants” who are presumably not actually paid to write articles, but instead are ostensibly providing some other vague services during the time that they write the articles. The reality is that they only get paid as long as they write positive articles.

Single individuals have often used multiple aliases pretending to be industry experts. In many cases, these authors pretend to have strong credentials in the fields of medicine or finance when in fact they are nothing more than hired freelance writers who get paid by the article. Their bios are entirely fabricated.

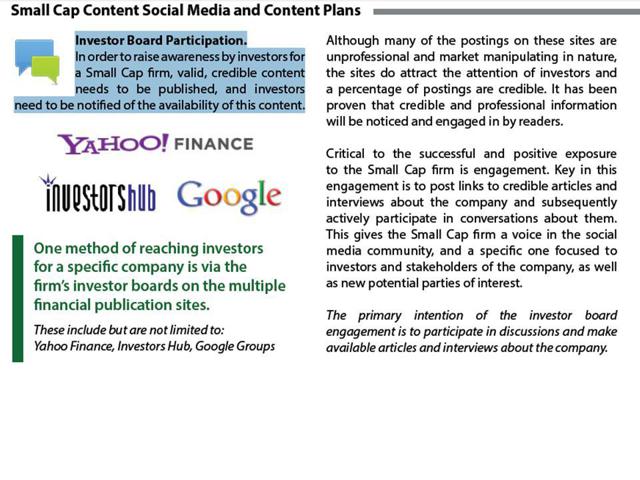

As I will demonstrate below, it has now become apparent that these writers also infiltrate message boards such as Yahoo Finance and Investors Hub to create the false appearance of broad support from retail investors and to refute critics. But once again, these postings are simply bought and paid for and provide misleading information to unsuspecting retail investors.

The stocks involved in these promotions have been mostly biotechs and have tended to be overwhelmingly held by retail investors who can be easily influenced by the appearance of sophisticated and professional analysis. As their share prices soared, these companies raised tens of millions (each) via equity offerings, which would have otherwise not been possible.

In the wake of my recent exposés, hundreds of promotional articles have been removed from these various sites. Some of the companies involved have already begun receiving subpoenas from the SEC. Many of the share prices have fallen by at least 40-60% from their promotional peaks.

Unfortunately, some small retail investors still don’t understand the implications of being caught up in a stock promotion. Many retail investors take the attitude that:

I don’t care if there is a promotion going on. I believe that the results with the company’s drug will drive the share price. I have done substantial due diligence.

Unfortunately, this view is very common when a stock is held overwhelmingly by retail investors.

But at a minimum, most investors will quickly realize that their “due diligence” has been largely based on information that is either highly biased to the positive or even outright wrong. It is information, which has come largely from false experts who have undisclosed relationships and fabricated bios.

SECTION I: The Redfish world of paid stock promotion

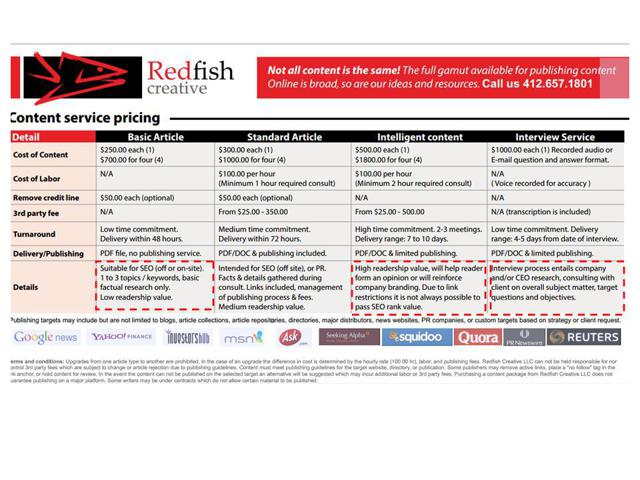

So let’s get right to the point. Here is the pricing sheet, which shows how much I would need to pay to get a stock promoted on various sites such as Seeking Alpha, Motley Fool, Yahoo or Investors Hub (see logos at bottom of graphic). The articles are written by professional writers and are structured to make intelligent use of SEO (Search Engine Optimization) technology in order to get maximum impact.

They are not your average bull articles, instead they are scientifically engineered to get the best response from readers. The authors being paid do not disclose any payment in their articles or any connection to MDM or other IR firms.

The techniques being used are far more sophisticated than those used by the Dream Team Group.

This pricing sheet was provided to me directly from Redfish Creative. I did not use my real name when dealing with Redfish, for obvious reasons.

Redfish Creative is a small two-man shop run out of Pittsburgh.

The “pricing” from the table above makes it clear that a “basic article” includes mere “factual research only.” I can have one of those for a mere $250. But because it is only factual, it therefore has “low readership value.” So let’s forget about sticking to the facts.

By contrast, the more expensive “intelligent content” article will “help the reader form an opinion” or will “reinforce company branding.” This is of key importance. The value of these articles is to persuade investors to buy the stock – not to merely convey facts. This will only cost me $500, which seems like a bargain (but keep in mind that is very much in line with rates I was quoted by Dream Team authors earlier this year. It is the standard rate for various firms in the “phony article” business.)

But if I want an interview of management published, it will cost me $1,000. Some readers may remember that in my past articles on stock promotion I was highly suspicious of what I referred to as “gratuitous interviews” being posted as articles on certain stocks. Now you can clearly see why. The interviews are nothing more than paid infomercials being conducted by paid writers who ask convenient questions to management in exchange for $1,000. Such interviews are then published on mainstream sites under the guise of being independent. They have proved highly effective.

So those are the pricing options.

As I will show below, a small group of Redfish related authors have now written dozens of articles on Northwest Bio, and have written more than 100 articles on other MDM clients.

I did make it a point to contact Mr. Eastman. And I made it a point to inquire about how he promotes stocks in exchange for money. Eastman has emphasized that their process typically involves the use of management when writing on companies and they try to make use of interviews wherever possible.

Note: In the week before this article, I did contact Northwest Bio with questions via email. I received no response.

Here is what Eastman had to say via email. The full text of the email can be found posted here at Moxreports.com.

Thanks for the inquiry. We do indeed work in this environment and have multiple years of experience in doing so. We generally start with a content strategy and subsequent content plan for the target company and work closely with principles involved establishing objectives-outcome, media outlets etc. At times we conduct interviews of key management personnel as part of the content plan as this proves beneficial for the richness of the content itself, along with upcoming catalysts, events, industry news etc. We have a team of writers who publish on multiple sites including Seekingalpha.com, Motley fool, etc. We also control several outlets as well that can be used for advantage.

As for pricing, Mr. Eastman goes on to note that:

Our content plans range from $1,000 monthly to $3,500 monthlydepending upon selected items, features, etc. I think you will find them to be very effective. If we are covering multiple firms, we can adjust a pricing plan accordingly.

In a separate email to me (full email available here at moxreports.com), Mr. Eastman goes on to clarify that Redfish “employs” 4-5 writers (“contractors”). He would not name MDM specifically as his client due to client confidentiality within his contract, but he did go on to give some unmistakable hints about who he was working for:

A good indication though is that if you look at the subject companies we written about (ticker symbol) we were likely retained to by someone with an interest in those firms. It is never the company itself, but rather an IR firm, individual investor, or group of investors.

We have also worked over a 3-4 year period of time with a Investor Relations-Social Media form in NYC. They represent about 20 firms. We built their entire social media structure and content plans.

Even better, Mr. Eastman included links (shown in the email link above) to 5 sample articles (including on Northwest) for which Redfish had been paid. 4 of these articles were clearly on MDM clients. In addition, Redfish states it was involved in creating MDM’s “Chairman’s blog” website.

But in short, there should be zero doubt that Mr. Eastman is referring to MDM as his client. But this should become more clear when we look at the articles that various writers have written on MDM clients below.

(Note: MDM did confirm with me by phone that it has used Redfish in the past, but stated that it has never paid anyone to write any articles on any companies.)

SECTION II: Promotions – which companies and how much promotion?

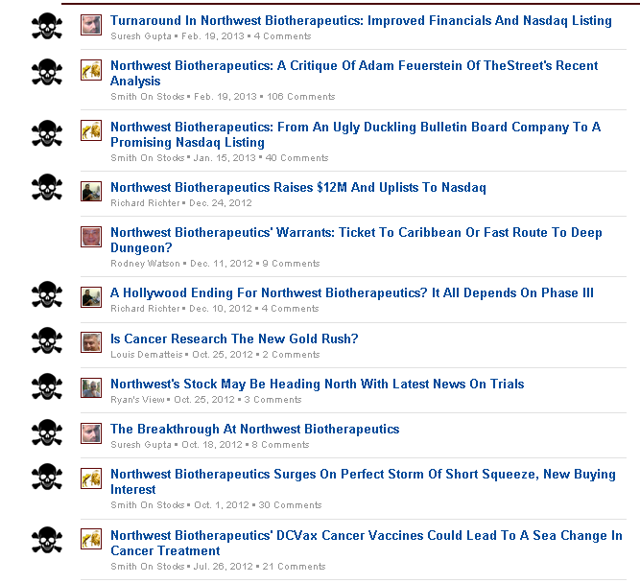

We will now start to see a variety of companies, which have been promoted. The reason I am focused on Northwest is that it appears to be the most heavily and broadly promoted and because the stock has been such a strong performer as a result of the promotion.

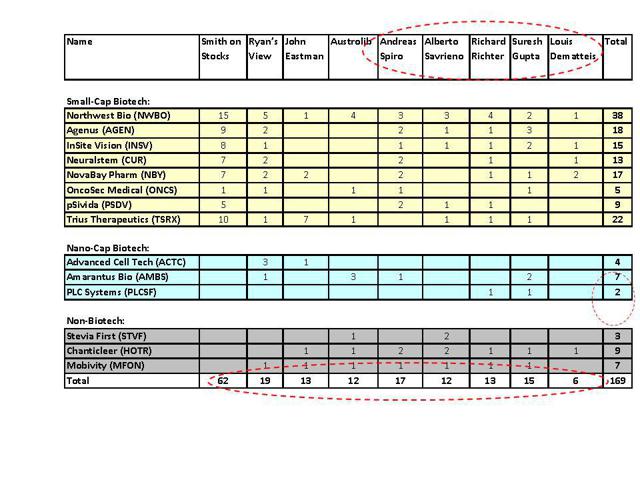

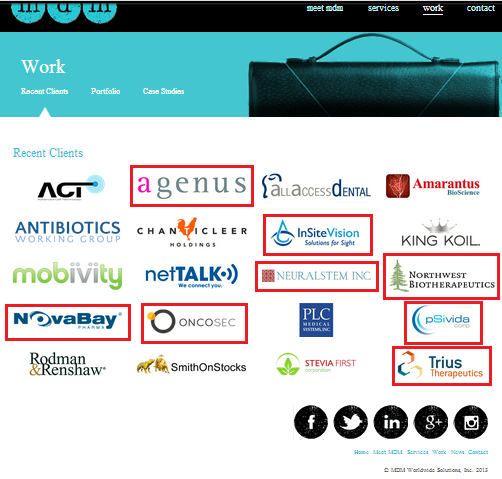

The following table lists MDM clients and the authors who wrote about them most heavily. MDM used to list its clients on its webpage. But following my March articles on undisclosed stock promotions, MDM deleted the client page. It can still be found using an internet tool called the Wayback Machine for those who care to verify MDM’s client list.

The numbers in the table represent the number of articles written on each MDM client by each author.

We can see that Northwest Bio (an MDM client since 2012) ranks #1 with more than 3 dozen articles. Almost half of these have come from Larry Smith (Smith on Stocks). Smith will be discussed in greater detail below.

All of the authors below (including Smith) have ties to MDM. This will also be clarified below.

The key point from the table above is that this small group of affiliated authors doesn’t just write on one or two MDM clients by chance. Instead, they each provide extensive coverage to a large number of MDM clients even when those companies are in totally different industries, are of totally different sizes and have no sensible overlap. In the bottom row, we can see the total number of articles that each author has written on MDM clients.

Together they have written 169 times on MDM clients! (See bottom right of table)

This is true even for the nano cap penny stocks such as 9 cent Amarantus (OTCPK:AMBS) and even the 1 cent PLC Systems (OTCQB:PLCSF).

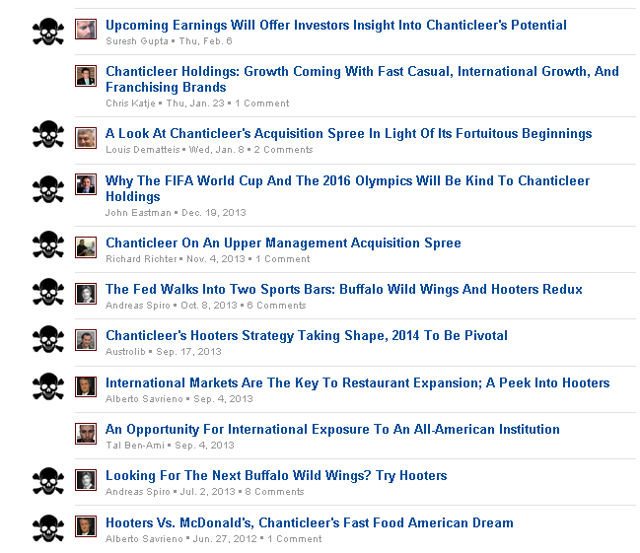

This is also true even when it requires writing on other tiny illiquid nano caps (all of which are MDM clients) such as Chanticleer (HOTR) and Mobivity Holdings (OTC:MFON). Chanticleer runs a string of Hooters restaurants and has very little in common with Mobivity, a mobile marketing company.

Both of these MDM clients are just $15-20 million in market cap and largely illiquid. They have attracted minimal attention from anyone other than Redfish writers. Yet the authors who write about these two totally unrelated stocks tend to a) write about both of them (not just one of them) and b) write heavily about biotech companies who have also paid MDM.

Please note: I didn’t find these patterns by accident. Mr. Eastman did inform me of a substantial and effective paid campaign that was run on MDM’s Chanticleer / Hooters.

After Mr. Eastman told me about Chanticleer, finding the rest of their articles became easy. In many cases, the authors named above are about the only authors who have expressed interest in these companies. At the time, truly independent authors had no virtually interest at all in many of these tiny, illiquid nano caps.

The patterns described here should be quite obvious from looking at the table above. If they are not immediately obvious then you should have another look at the table and it should become quite clear.

It should also be clear that these various “Hooters authors” have written most heavily on Northwest Bio with almost 2 dozen articles. The articles are mostly highly bullish and often served to buttress Northwest against the serious concerns of critics. (Those issues on Northwest will be addressed separately below).

SECTION III: The use of multiple fabricated bios and fake names

I have circled 5 fake identities at the top of the table above. In total, these fake authors alone wrote more than 60 articles on MDM clients, 66 articles on Northwest Bio alone.

Yet unsuspecting readers end up being duped into thinking that they are reading independent analysis coming from a real person with real credentials (such as a “fund manager” or a “biologist”) rather than a mere infomercial.

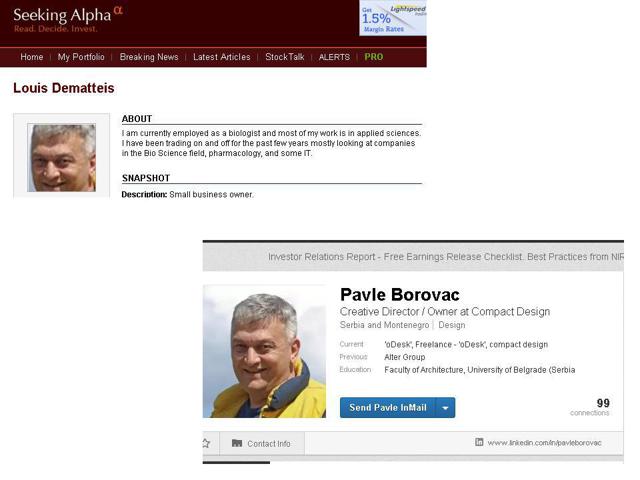

Anyone who is willing to do the work can find that these identities are fake. In fact, I believe that much of the writing behind them is being subcontracted out to Eastern Europe and the Philippines (where the level of English is high) using a placement firm called oDesk which is used by freelance writers and computer programmers.

For example, we can see that Louis Dematteis claims to be a “biologist” on Seeking Alpha and he has a closely cropped picture of his face. On linkedIn, we can see the exact same (uncropped) picture for a man in Serbia named “Pavle Borovac” who contracts for oDesk. He is a mere contract web designer for hire, not a “biologist” who invests in biotech. Here is his profile as a web designer on oDesk. Nearly all of the Louis Dematteis articles can be directly tied to MDM clients, including Northwest.

I strongly encourage readers to click the links above to see that the pictures are in fact identical, just cropped differently.

But let’s keep looking at more of the people who have been writing on Northwest Bio and other MDM clients.

I strongly encourage readers to click on the links to the named authors below to read their bios. It would actually be amusing if it weren’t so illegal.

Alberto Savrieno is a supposed “European” who works for a “family office.” Yet he has written on 12 articles on MDM clients. Again, oddly, this includes the $15 million company Hooters, it also includes tiny Mobivity along with 3 articles on Northwest.

Likewise for Andreas Spiro from “Geneva” who wrote 19 articles for MDM clients. Again, this includes $15 million market cap Hooters and $20 million Mobivity. He wrote 3 articles on Northwest.

The list goes on and on, and includes “Richard Richter,” “Suresh Gupta” from India and “Louis DeMatteis” the biologist.

Note: Please make an effort to remember these names, as they will become more important in the text below.

The identities described above are all to some extent fabricated or enhanced and are being sponsored by one underlying party with a strong interest in MDM’s clients. In total, they have written nearly 2 dozen articles on Northwest Bio alone as part of more than 60 articles on MDM clients.

I did not include the writer Austrolib in the list of fake authors. This author who states he “invests in the Austrian economic tradition” (another European reference) can be found to be living in Miami, where he “writes financial content for a living.” So he is simply using a pseudonym and is not truly fake. He has written 12 articles for MDM clients, 4 articles on Northwest.

In the past, these authors were not discreet about the team effort, as shown in the following screen shot showing related articles for Car Charging Group (OTCPK:CCGI). They all write on the same companies at the same time.

This can be also seen clearly on their Hooters (Chanticleer) campaign where almost every article comes from one of these named authors. Again, Chanticleer is an MDM client and Mr. Eastman informed me that he had conducted a paid campaign on Chanticleer for an IR firm in New York.

When describing the need for such promotions, Mr. Eastman pointed out to me that:

Please remember the company itself cannot generate their own content as it is PR, and there are SEC and FDA rules to content with. That leaves paid individuals as I’ve mentioned above, and journalists and the like, to do a good job. It is long term.

SECTION IV: What about Larry Smith (Smith on Stocks)?

Observant readers will also note the presence of Larry Smith of Smith on Stocks in the table above.

Smith is important because he has been the most ardent bull on Northwest (and because he has provided dedicated coverage to all of MDM’s other small cap biotech clients as well). His articles have repeatedly moved stock prices of Northwest and other MDM clients.

Yet Mr. Smith has been concealing many important issues from his readers and from investors.

This includes his close relationship and history with MDM, the real details behind his professional background as well as his investor relations activities.

Last week I called MDM and asked a few questions about MDM’s relationship with Smith and with Eastman. As already mentioned, MDM has clearly informed me that there is no paid promotion campaign with any MDM clients.

Shortly after that call to MDM, there began to appear posts on Yahoo message boards stating that Richard Pearson would be writing a negative article on Northwest Bio.

At the exact same time, Mr. Smith suddenly provided an extensive update to his existing disclosure on Seeking Alpha and on his website. He clearly knew that the jig was up and he began revealing details of his past, which had previously been concealed.

It is quite clear from this chain of events that MDM was on the phone with Smith as soon as I hung up the phone.

I would encourage readers to read the new disclosure by Smith and ask why this very damaging information is only coming after he was found out by me. After explaining his “ethical breaches” and the “Scarlet Letter” on his name resulting from his regulatory expulsion from Wall Street, Smith has now made it explicitly clear in his disclosure that he does not receive any compensation from IR firms or from hedge funds. He only receives subscription revenues from his site.

In a few paragraphs, I will highlight some hidden disclosures by Smith, which describe the business of his DLS Research.

But let’s start from the top and see why Mr. Smith had to put out this new disclosure after he learned about my investigation.

First, Smith was kicked out of the brokerage and research business in 2003 when he was barred from the industry by FINRA. Smith notes in his (newly updated) disclosure that the mediator had specifically sought to end Smith’s career on Wall Street due to the violations involved.

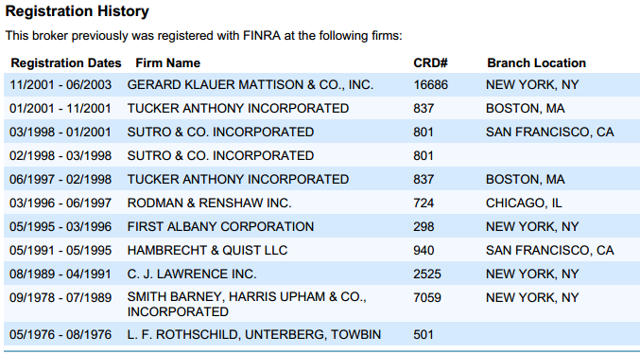

Prior to being expelled, Smith had spent his last 8 years in the business bouncing around between small shops (i.e. not as a big hitter at H&Q or Smith Barney as shown in his various profiles).

Prior to a few days ago, Smith had only disclosed to readers his early career history at two prestigious firms, H&Q and Smith Barney. He neglects to show how he ended his career by working for his last 8 years at various bucket shops such as Sutro and Rodman & Renshaw. None of this had been disclosed to readers or investors until the last few days when Smith was alerted by MDM that I was paying attention to it.

Below is the real history from FINRA broker check.

Mr. Smith has actively touted his incredibly strong bio in various locations and as extra ammo within his articles. He has made it clear that his experience and expertise are the reasons that we should listen to him and not to the uninformed critics of Northwest.

The incredibly strong bio that he has portrayed in his profiles has helped him move the stock of Northwest and others.

The key point is that Mr. Smith has clearly cherry picked a certain portion of his career to portray to investors while ignoring the parts that indicate bucket shops. As we will see below, this type of deliberate cherry picking is exactly what he does when presenting information on Northwest Bio. It is a technique.

Smith then neglected to mention to readers that the reason he left the industry in 2003 was that he had actually been barred altogether from the industry by FINRA.

According to FINRA Broker Check:

Smith engaged in conduct inconsistent by effecting stock transaction shortly before issuance of research report which he had prepared concerning such stock; caused a violation of exchange rule 472.40(2)(III) by failing to disclose that he held securities in stocks recommended in research report he authored; engaged in conduct inconsistent by opening accounts at a member firm that concealed fact of his employment at another member firm; and violated exchange rule 407(b) by maintaining securities at another firm without consent of his employer.

The seriousness of these offenses for a Wall Street analyst cannot be overstated. Smith showed a deliberate willingness to deceive his employer, the brokerages and (most importantly) investors.

As a result, in 2003, Smith was barred from the industry for the time. This is what really resulted in Smith launching his “consulting firm” DLS research.

As we will see below, DLS Research (i.e. Larry Smith) was created to focus on investor relations and stock promotion and not “research.” DLS does not have a website, nor does it even publish research reports.

As we will also see below, DLS (i.e. Larry Smith) has also advised institutional investors on financing deals for biotech clients and then he takes additional compensation when warrants are exercised. Smith on Stocks continues to write positive articles about those companies.

Concealing a close relationship with MDM

Ultimately, Smith launched SmithOnStocks.com, which does write about stocks. MDM did confirm with me that they built the site for Smith. Smith posts ample content on his site and then condensed content on Seeking Alpha, which then links to his site.

Since establishing a relationship with MDM, we can see that the majority of his articles fall into two categories: either a) companies where he has advised hedge funds and where he has received compensation tied to their warrants or b) companies who happen to be clients of MDM.

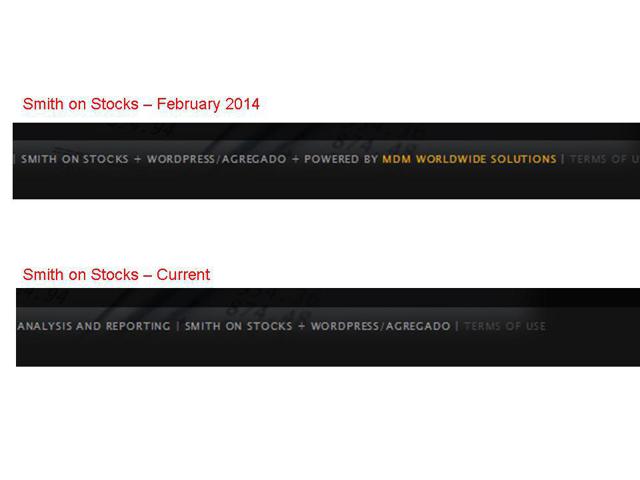

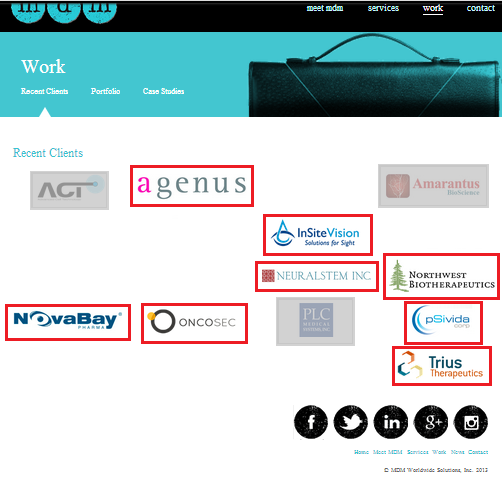

For a time we could see the connection between Larry Smith (Smith on Stocks) and MDM in several places online. But immediately after my March articles on illegal stock promotion, both Smith and MDM took deliberate steps to conceal their relationship.

Below is a page from MDM’s website prior to March. The Smith on Stocks logo is featured prominently, along with a list of other MDM clients.

This page was deleted from the MDM website in March, shortly after my previous articles exposing illegal stock promotions. It can be found by using an internet tool called the Wayback Machine.

I added the red squares to highlight the stocks, which Smith has written about. Clearly, there are plenty of MDM clients in which Smith has no interest, right? Look again.

Smith only writes about biotechs, and he doesn’t write about nano-cap penny stocks. A few of the MDM clients listed are not even public. So if we white out the non-public companies and the non-biotechs, and then gray out the nano cap penny stocks, we can see the following:

Voila !

What we can see is that Smith has written on precisely every single “small cap biotech” stock which is an MDM client – bar none. More importantly, he has done so quite often (more than 60 times on Seeking Alpha alone plus dozens more on his own site). Smith is clearly a genuine asset to MDM.

Next, we should look at the timing.

Smith originally developed his own website, which was run by Blueline International up until mid 2012. This can again be found using the Wayback Machine. It is notable that up until that time he had never written about any MDM client, despite having written over 100 articles on a wide variety of biotech companies.

In early 2012, MDM built a new website for Smith and he quickly began initiating MDM clients with “buy” recommendations.

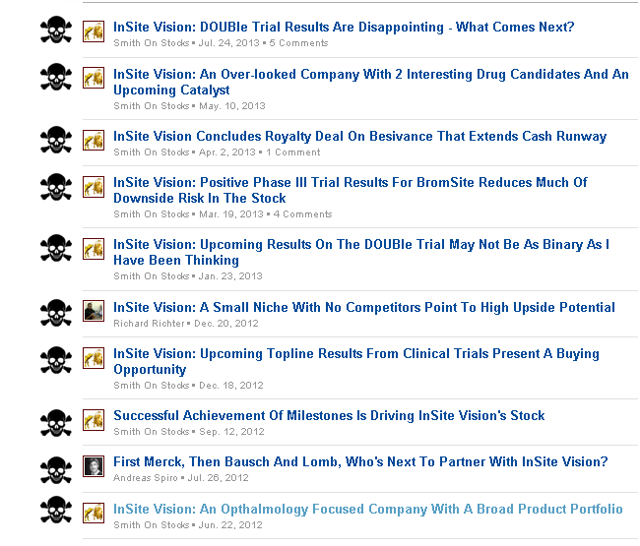

This includes Smith on Stocks favorites such as Neuralstem (NYSEMKT:CUR), InSite Vision (OTCQB:INSV), OncoSec (NASDAQ:ONCS), Trius Therapeutics (TSRX) and Agenus (NASDAQ:AGEN), and of course Northwest Bio, among others. It quickly included 100% of MDM’s “small cap biotech” clients.

Again, this of course excludes MDM clients, which are not public, which are not biotechs or which trade for just pennies.

Now, do you remember Louis Dematteis (the fake “biologist”), Andreas Spiro, Richard Richter, Alberto Savrieno, Suresh Gupta and the other fake “Hooters authors” from above? These were the authors that can be tied to Redfish and writing on MDM clients. Ryan’s View was also a key writer.

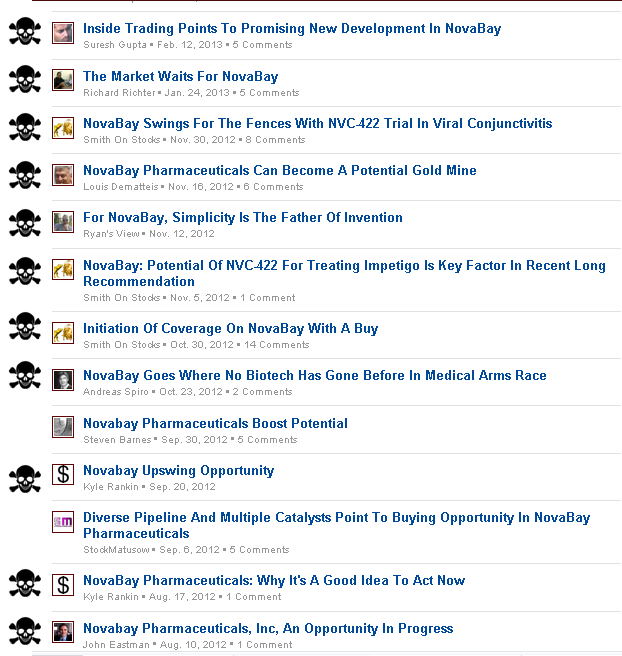

How did the timing of Smith’s initiations coincide with these other authors? Look and see.

Shortly prior to Smith’s initiation of Northwest Bio, most of these authors did not even exist and had never written on anything. But as soon as Smith began initiating on MDM’s clients, the variety of fake authors suddenly appeared and began initiating on the same exact stocks… at the same exact time… with the exact same bullish views.

This can be best illustrated by looking at MDM client Northwest Bio. Smith initiated on July 26th, 2012 stating, “I am starting my coverage of Northwest Biotherapeutics with a Buy.”

Not convinced? The same can be seen with MDM client InSite Vision and the other MDM clients covered by Smith. In each case, these authors did not exist shortly before Smith initiated coverage. As soon as Smith initiated on the name, the newly created fake authors from above initiated at the same time. Not surprisingly, the views were all the same as well telling investors to buy the stock.

Still not convinced yet? How about MDM client Nova Bay (NYSEMKT:NBY)?

For those who need even more convincing, I strongly suggest going back and looking up the first articles being written on each of the MDM clients listed in the table in Section II. You will see the same pattern repeated again and again for MDM clients where Smith is involved.

More deliberate steps to conceal the relationship

Starting just at the time of these group initiations in 2012, it was suddenly noted on Smith’s site that his site was “powered by MDM Worldwide.” This can also be verified with the Wayback machine.

But following my articles on paid stock promotions (published in March 2014), this reference was deleted from his web page. As with the deletions by MDM, this effectively concealed the relationship. The changes to Smith’s website occurred at almost the exact same time as the page deletions on MDM’s site shown above.

What does “DLS Research” really do?

Fortunately, I managed to find an old version of his web page, which included an unpublished description of what DLS Research really does. Again, this was a version with no external links to it buried inside Smith’s site. I believe Smith does not know it is still findable. I put a red box around the DLS text, which is not being disclosed to readers. But as we can see from the language, this text was written after the launch on Smith on Stocks.

SmithOnStocks is owned by DLS Research, LLC, a biotechnology consulting firm that was founded in 2003. DLS Research, LLC does consulting work of various forms primarily with biotechnology companies and biotechnology investors. In no event does DLS Research seek to obtain access to or use non-public material. This consulting work can include but is not limited to advice on competitive forces; addressable markets; how to make disclosures to investors; opinions on investment strategies of potential investors; current financing trends on Wall Street and how they may affect the company; how to attract potential interest in the company from Wall Street analysts and Internet bloggers; general investor relations advice; reproduction in audio, video and written form of previously presented management event presentations and press; helping the company’s various releases to gain broader viewing throughout the Internet; identifying investor websites that are interested in companies like theirs, etc. Consulting fees start at nominal rates and can increase based on the amount of work that is done. In most cases, the consulting will be done with companies that the author knows very well, believes have interesting potential and on which SOS may write. No consulting client companies have editorial rights of any kind in regard to any publications of SOS and each recognizes and acknowledges that SOS will endeavor to only write a balanced view representing both negative and positive investment aspects of any company.

I was also able to uncover a separate hidden page, which describes further activities of DLS Research and how it interacts with institutional investors. This page can be found if you type in the exact right address, but there is no link to it from Smith’s main page. Unless you figure out where to look, this page also cannot be found. Mr. Smith may have simply forgotten about it.

It reads as follows:

DLS Research has performed due diligence for an institutional investor that was instrumental in its decision to invest in equities of certain companies. As part of that investment the institutional investor received warrants. DLS Research, LLC has no ownership in any of these warrants, but may receive cash compensation if the warrants obtained are exercised; this is a component of the consulting fee received for the due diligence. This type of agreement applies to the following companies: Acadia Pharmaceuticals, Access Pharmaceuticals, Athersys, BioSante Pharmaceuticals, Corcept Therapeutics, Cyclacel Pharmaceuticals, Discovery Laboratories, Mela Sciences, Oxigene, Soligenix and XOMA.

The odd thing here is that Smith gets paid only if the company ends up raising new money when the warrants are exercised. Again, this relationship has remained undisclosed on his website and on Seeking Alpha. It helps to explain his views on non-MDM clients such as Athersys (NASDAQ:ATHX), Discovery Labs (DSCO) and Mela Sciences (MELA).

Smith most recently published strong findings on Discovery Labs on June 13th, 2014 stating: “I continue to recommend purchase of Discovery Laboratories.”

No free lunch from Smith on Stocks

SmithOnStocks.com is a “subscription” website which Mr. Smith runs and where he puts up substantially more content than he does on Seeking Alpha. Mr. Smith charges $29.99 per month to subscribe to this site.

Despite the subscription charge, much of the detailed content is 100% free to readers.

Yet “free” is apparently a relative term.

By analyzing the articles on his site, we can see that the majority of content for MDM clients (such as Northwest) and for his warrant clients (such as Discovery Labs and Athersys) is disseminated for free, maximizing the distribution.

The point of all of this is that Smith only initiated coverage on Northwest after he initiated a relationship with MDM. Since that time he has become a prolific writer on Northwest and suddenly on all of MDM’s other small cap biotech clients. The timing coincides perfectly with the creation of new (fake) authors who focus almost exclusively on MDM clients and who can be tied to Redfish.

Smith has taken deliberate steps to conceal his regulatory background, his IR activities and his relationship with MDM. Yet Smith has also been the loudest and most vocal defender of Northwest Bio against critics who see the company as being promotional and misleading investors. During this time, he has been a very vocal and prolific writer on Northwest.

SECTION V: Beyond articles – looking to the message boards

Getting back to Eastman and Redfish again, we can see that these types of promotional efforts are highly professional. They are not limited to simple bull articles. Instead, content is highly engineered to be optimized for search engines. Mr. Eastman has made this very clear to me.

In addition, the effort extends to engaging in conversations on message boards to gain further traction and the appearance of widespread popular support.

For Northwest Bio, this is highly relevant because the stock has a very active message board with hundreds of posts per day. Sadly, many retail investors rely on the NWBO board as a source of information and can be swayed by the sheer volume of positive comments that come out.

Below is a copy of the brochure that Redfish sent me which deals with message boards.

Anyone who has relied upon their “friends” from the Yahoo or iHub message boards may now wish to strongly rethink their confidence in the bullish analysis being found on these sites.

A favorite tactic for the paid shills is to try to generate camaraderie amongst retail investors to resist “the shorts” or “the bashers.” In fact, many of these warnings are coming from people using false identities who are being paid for their efforts.

Message boards are dumb. Hopefully most readers here are aware of that. But they also have a tremendous impact on retail investors. This is why stock promoters make heavy use of message boards.

Note: As mentioned before, early last week I did contact MDM with questions for this article. Shortly thereafter, there began to appear messages on Yahoo Finance warning readers that I would be publishing an article on Northwest Bio and why readers should not listen to me.

SECTION VI: How sophisticated have targeted articles become?

Mr. Eastman emphasized to me the importance of scientifically engineering the articles to achieve the desired effect. Simply writing a “dumb” article touting a stock has become entirely ineffective these days. More is needed.

Separately, several years ago MDM had released a case study on one of its clients where it noted:

MDM first monitored keywords, investor boards for sentiment, studied traffic patterns, and discovered other hidden points on the world wide web where discussions were taking place that were directly focused on ACT as a company, as well as the discovery of opportunities for discussion based specific technology and research interest segments. Success in this campaign was made possible through careful consideration traffic flow and direction to and from websites where analytics could usefully be tracked. This was accomplished through creation of new ‘discussion based’ content centered and based on press releases, implementation of discussion based topics to accompany the new content, deep linking those ‘discussion based topics’ to company controlled articles (within specific groups and social media accounts) based on the saturation of interest, and then monitoring traffic to and from those entry points.

That case study has since been removed from MDM’s website. But the point is clear: engineered content is far more sophisticated than most readers understand and it requires coordination with company issued press releases.

SECTION VII: Northwest Bio – evaluating discrepancies vs. disclosure

Northwest has paid promotion firm MDM Worldwide to manage a “content strategy” and/or media strategy. MDM has special relationships with authors who then write positive articles on its clients. That much is quite obvious. It is what MDM does.

During this time, Northwest has continually issued various statements to investors in the form of press releases and SEC filings. These press releases have served as necessary fuel for MDM, Eastman and Smith.

As for MDM, even the company’s own website has emphasized the importance of coordinating press releases and “news” with “discussion based content” and “company controlled articles.”

As for Mr. Eastman’s, we can evaluate his previous comment again:

Please remember the company itself cannot generate their own content as it is PR, and there are SEC and FDA rules to content with. That leaves paid individuals as I’ve mentioned above, and journalists and the like, to do a good job. It is long term.

As for Mr. Smith, there was the hidden disclosure from his DLS research that notes that his work includes:

helping the company’s various releases to gain broader viewing throughout the Internet

The point of this is that without a steady stream of press releases, it is almost impossible for promoters to generate fresh content. Northwest has issued steady streams of press releases, which are then picked up and turned into “discussion based content” by the real and fake authors we have seen above.

In many cases, investors are substantially persuaded to buy the stock, but without the author ever telling any outright lies. The author is seldom foolish enough to write that 2+2=5. Such a strategy would be downright foolish and would be immediately disproved by other authors.

Instead, the authors often include large caveats about content being just an opinion or being uncertain. But in the end, investors are told to rely upon the credentials and credibility of the author. As we can see with Smith, the portion of his bio, which he chooses to reveal was indeed impressive and in the past has helped him generate support from thousands of followers.

The examples that follow are not in any way meant to be exhaustive. These are just a few of the relevant examples.

IMPORTANT POINT: The point of these examples is NOT whether or not the reader agrees with the author on the facts presented. The point is whether or not the author has made statements, which contradict Northwest’s formal disclosure in any way.

Note: In the week prior to publication of this article, I did attempt via email to reach both Larry Smith as well as Adam Feuerstein. Neither party responded with comments.

Example #1 – The “giant needle” debate?

Just prior to ASCO, Northwest made public some data that indicated “extensive necrosis and partial collapse” of a tumor following just 3 treatments with DCVax-Direct. This seemed to “prove” that DCVax was working. The share price soared (as expected) due to the perceived effectiveness of the drug.

Adam Feuerstein of TheStreet.com remarked (sarcastically)

I’m shocked that when you plunge a giant needle four times into a tumor mass, then take a scan of that tumor mass, you find damage. Who could have guessed?

Mr. Smith rebutted Feuerstein, saying:

It seems indisputable that we are seeing a biological effect that we would expect with an immune therapy as immune cells are being attracted to the tumor and are attacking cancer cells.

The fact is that Mr. Feuerstein missed the point in his statement. It is not the needle itself, which is causing necrosis and collapse. Instead it is the injection of a liquid – ANY LIQUID – which causes the destruction. Even an injection of simple saline solution into a tumor could cause substantial destruction.

This was later addressed by Dr. Aman Buzdar speaking on behalf of MD Anderson, which is involved in running the trials for Northwest. Dr. Buzdar has earned himself the wrath of Northwest bulls due to his criticism of recent promotional statements by Northwest. Nevertheless, he was the official spokesperson for MD Anderson, which is running clinical trials for Northwest, such that his views do deserve consideration.

According to Dr. Buzdar:

The weakness of this approach is that there have been many studies in which tumors are injected locally — the injections could consist of anything — and you see tumor regression because of necrosis caused by inflammation

Mr. Feuerstein was therefore wrong about the underlying cause of the tumor destruction. But also, the conclusion presented by Mr. Smith is entirely wrong in itself.

It is far from “indisputable” that this effect is biological at all. If the effect is ultimately determined to be a “physical” effect – i.e. simply due to the injection of any liquid causing inflammation – then we are left with a drug that is not having any more effect than saline solution. Investors have therefore relied on incorrect information as having been “indisputable.”

This is a far stronger statement than Northwest itself has ever made publicly about the effectiveness of DCVax Direct. Instead, the statement has been communicated in a statement coming from an MDM relationship author.

Example #2 – What about the early release of “interim data”?

Following the interview with MD Anderson, Mr. Smith made the following statement:

This is an open label trial and it is not unusual for a Company to release interim data before the end of the trial. There is nothing illegal or unethical in doing so as long as the information is accurate. My best judgment is that Dr. Buzdar is speaking for himself and not M.D. Anderson.

Mr. Smith has also stated that:

The phase 1/2 trial is open label which means that results are known to investigators and the Company as they occur.

First off, MD Anderson did follow up with an official statement, which noted that:

MD Anderson was not involved in [Northwest’s] decision to disclose the [DCVax] study information prior to the completion of the research. Therefore, we felt it was important to state that fact. We also felt it was important to state our belief that releasing incomplete research data is not accepted practice in our field.

Dr. Buzdar was in fact speaking for MD Anderson and not for himself. But this is not the point.

The real misstatement that was made by Smith is that this was in any way an “interim analysis.“

This is absolutely NOT interim data being released. Instead, it is PATIENT LEVEL DATA being released in an arbitrary manner by Northwest at a time when the results just so happened to be positive. This is highly unusual.

As to the involvement of the trial investigators themselves (as opposed to just Northwest), Buzdar noted that:

Investigators at MD Anderson and the two other hospitals conducting the DCVAX-Direct study have not reviewed or analyzed data at allbecause patients are still being enrolled and treated. The statements being made by Northwest Bio about DCVax-Direct are derived from patient case report forms, which the hospitals are obliged to send to the company because it sponsored the study

This is of key importance. The data released by Northwest was not interim data and was not even reviewed or analyzed by the investigators involved.

What Northwest did was to put out raw patient level data. Larry Smith then “analyzed” the situation and declared the situation great for the stock. The stock price then soared. This is the promotion technique we see being repeated by those with an interest in Northwest.

It is cherry picking and the selective portrayal of anything that could be viewed as positive. Based on this, it is no wonder that Smith’s readers would buy the stock.

Example #3 – Is PFS an acceptable end point?

This is another example of a debate between Feuerstein and Smith, which has gotten off point. Feuerstein has accused Northwest of “sneaking” in a new risk factor into its 10-K, warning that PFS may not be an acceptable endpoint. Feuerstein was mistaken on this point because this risk factor had already been included in a prospectus for a previous equity offering.

When or where this information was disclosed is entirely irrelevant to the real discussion on PFS. The real point of relevance is that Northwest has disclosed this as a risk factor, but Smith has presented compelling reasons to ignore it. But the information he presents is blatantly cherry picked and ignores substantial evidence to the contrary.

The cherry picking of positive evidence in favor of Northwest is the pattern that should be of concern to those who have been relying on Smith’s promotional “analysis.” Readers are guaranteed to see any new developments in the most positive light possible, while ignoring any facts that would raise concerns about Northwest.

In its recent disclosure, Northwest has included the following risk factor:

The primary endpoint of our Phase III trial is progression free survival. Sometimes regulators have accepted this endpoint, and sometimes not. There can be no assurance that the regulatory authorities will find this to be an approvable endpoint for Glioblastoma multiforme cancer.

Yet Mr. Smith stated flat out in an article that “Progression free survival is a solid primary endpoint for DCVax-L phase 3.” He then went on to basically tell readers to ignore the risk factor altogether, stating:

As everyone knows, lawyers write risk factors that try to cover any possible event. I remember one that recently warned that the Company’s production facility which was in a west coast city was at risk of being destroyed by a tsunami.

The debate over the appropriateness of PFS continues. Everyone is entitled to their own view.

But the acceptability of PFS will ultimately prove to be of key importance for DCVax-L. If it turns out that the FDA will not accept DCVax-L based on PFS, then the whole trial largely becomes a moot point. The drug will simply fail due to improperly selected endpoints.

As always, Mr. Smith is able to find impressive evidence to support his view, which also happens (of course) to be very beneficial to Northwest.

Mr. Smith states:

In rapidly progressing cancers, there are credible opinion leaders who believe that progression free survival is a very good endpoint. In a recent article in Neuro-Oncology, the authors concluded:

“In glioblastoma, PFS and OS are strongly correlated, indicating that PFS may be an appropriate surrogate for OS. Compared with OS, PFS offers earlier assessment and higher statistical power at the time of analysis.” Here is the link to the article is as follows:

Another recent video also goes into a discussion about using progression free survival as an endpoint in metastatic melanoma, which like glioblastoma multiforme is a rapidly progressing cancer. This is an interesting discussion (link).

Again, Smith has stated information which is factually correct and which clearly supports Northwest. But once again, Smith has also deliberately cherry picked information which will put Northwest in a positive light.

If I wanted to paint a picture that PFS is an approvable end point, I could certainly do so also. What I would do is just what Smith has done. I would provide quotes from parties (similar to Northwest) with an interest in drug development. These are the ones who WANT to see PFS used because it makes it easier for their drugs to get approved.

This is akin to providing quotes from big oil companies about their views on the environmental impact of burning hydrocarbons. Everything is apparently just fine.

Alternatively, I could also present an equally compelling case that PFS is NOTan approvable endpoint because it delivers no real benefit to the patient. It is “measurable” but it is not meaningful. This is why the FDA has been reluctant to accept it.

I can find equally prestigious doctors and scientists to support a very strong view against the use of PFS.

For example in the Journal of Clinical Oncology it is noted that:

It is time for the oncology community and regulatory agencies to take a hard look at PFS and challenge its growing use [by pharmas] as a primary efficacy end point. There should be good evidence for its ability to predict improved QOL or OS improvements if it is to play a central role in defining new standards of care. If it does not have these properties, we must measure the true end points of importance to our patients, and not something that has as its chief advantage ease of measurement or speed of trial completion.

This came from a doctor who happened to have no conflicts of interest with the drug industry.

The following abstract addresses some of the inherent biases in PFS.

For those who follow the oncology space, it should be clear that relying on PFS for approval is in fact a major risk. Smith had cited the approval of Avastin for use in glioblastoma multiforme based on PFS.

But – of course – he neglects to note that the previous approval of Avastin for breast cancer was revoked due to lack of OS benefit. Again, this is cherry picking facts in order to portray Northwest in the best light possible.

Example #4 – Prospects for revenue from Germany?

Here Mr. Smith was very cautious in his choice of words. But the end result was that he planted the $50,000-$100,000 number into the heads of readers and investors. It is a very big number and many investors have now incorporated that into their expectations.

My speculation is that the price of the drug will be in line with that of breakthrough cancer drugs or roughly $50,000 to $100,000 per year. I want to re-emphasize that the Company absolutely refuses to make any comment on my price estimate until reimbursement negotiations are concluded.

Clearly Smith has included (and re-included) massive caveats here that management refuses to comment. So what we have instead of a comment from Northwest is Smith planting the $50,000-$100,000 number into the heads of readers in a way that can be walked away from when it doesn’t happen. In the short term, it still managed to get investors into the stock.

Yet we know clearly that Northwest cannot actively market the drug into Germany. And even Northwest itself has repeatedly likened the German program to “compassionate use.” Reimbursement at the level of $50,000-$100,000 is borderline nonsense.

Northwest has indeed refused to comment. But the number still got out there, now didn’t it? This is why it is crucial to have such articles come out from various authors.

Example #5 – What are the odds of approval?

The other related writers are far less cautious in their wording than the Wall Street trained Smith.

For example, Austrolib states that:

DCVax-L still has a good chance of being approved. And all sides agree that DCVax-L’s side effect profile will most likely come in benign, as side effect profiles tend to do for other autologous vaccines.

Clearly no management team would ever make such bold statements themselves in an actual press release. But instead, an author with clear ties to Redfish clients made it for them.

Conclusion

Investors in Northwest Bio and a variety of other biotechs now have every right to be concerned about their supposed “due diligence.” Much of what they have been relying on is either misleading or wrong.

Dozens of fake articles have been written by fabricated authors in attempts to elevate the stock price. The message boards are being infiltrated by shills who run deliberate campaigns. Readers are completely unaware that such campaigns are conducted.

Even the prestigious Larry Smith of Smith on Stocks (the biggest Northwest bull) has been concealing volumes of relevant information from his readers, including his close relationship with MDM Worldwide, his troubled past and his historical IR activities. Only after knowing he was caught has Smith reluctantly begun disclosing limited amounts of this information.

Various parties involved, including Smith and MDM, have stated clearly that there has never been any payment made for articles.

Yet the emails I obtained from John Eastman suggest otherwise in many cases. Backing up the information from Eastman is the fact that hundreds of articles on MDM clients have all been written by the same group of authors and have delivered glowing portrayals of MDM clients.

These authors were all created in the same narrow time frame to cover the same stocks that Smith was covering and with the exact same bullish views. And they all happen to be MDM clients.

Some retail investors may still take the view that:

I don’t care if the stock was promoted, I believe in the prospects for the drug

Again and again, such a view has proven to be naïve and expensive.

First — many smarter investors will quickly realize that they probably do not understand Northwest or DCVax nearly as well as they thought they did. Smarter investors will realize that much of their supposed knowledge and perceptions about Northwest have absolutely been shaped by a promotion that was designed to create favorable perceptions of the company. Most investors only really “know” what these authors have told them. Upon reflection, this should be obvious and it should be very concerning.

Second — if the company did in fact have such strong prospects (as touted by the bullish promoters) then there would be no need for anyone to engage in undisclosed stock promotions, which could truly put at risk the entire future of the company. The simple fact that anyone engaged in a stock promotion raises serious doubts about the underlying fundamentals.

Third — the fact that the promotion (now exposed) is going to stop means that the share price will likely fall on its own. This is what we have seen with past promotions. Once a promotion pushes the stock up, it is imperative for the promotion to continue. This no longer becomes an effort to make the stock rise any further, but instead is an effort just to keep the stock from falling on its own. This is why we see so many repeat articles from the same authors. Once these authors are exposed, the articles stop. Then the share price inevitably falls. Every single time. This is just how stock promotions work.

Northwest has clearly been paying MDM for “social media” and / or “content” services over the past two years. During this time, there was a noticeable and dramatic surge in promotional articles being written on Northwest.

These articles were overwhelmingly coming from authors with ties to MDM, including Redfish, which indicates that it gets paid to write articles. Many of these authors are using false names and fabricated credentials.

As shown in the table in Section II, nearly every public company, which is an MDM client also happens to have had a large ongoing stock promotion involving the same small group of authors to write on all of the stocks. I encourage readers to re-read the table above, which shows the overlap between the fabricated authors and the MDM clients on which they wrote.

The takeaway from the points above is that even investors who still hold on to bullish views on a company’s drug prospects (despite the knowledge of a promotion) should not be surprised to see the stock fall dramatically now that the promotion has been exposed.

The last few stock promotions I exposed (found here and here) were primarily biotech stocks with various oncology drugs. Following my articles, many small retail investors quickly defended the stock on the basis of the drug’s prospects, which they felt they had thoroughly researched. These stocks are now mostly down by at least 40-60% following the exposure of the promotions.

Notes: The author did attempt to contact management at Northwest Bio in the week before publication but Northwest did not respond with answers to questions. The author did attempt to contact Larry Smith for comment in the week before publication, but Mr. Smith did not respond to an email. The author did attempt to contact Adam Feuerstein for comment in the week before publication, however Mr. Feuerstein was on vacation and was not available for comment.

This article is the opinion of the author. Nothing herein comprises a recommendation to buy or sell any security. The author is short NWBO. The author may choose to transact in securities of one or more companies mentioned within this article within the next 72 hours.