Pacira Pharmaceuticals (PCRX) is an emerging specialty pharma company which in 2012 launched an opiate alternative (“Exparel”) for post surgical pain management. The product is currently approved for use in certain post surgical pain applications including removal of hemorrhoids and bunions.

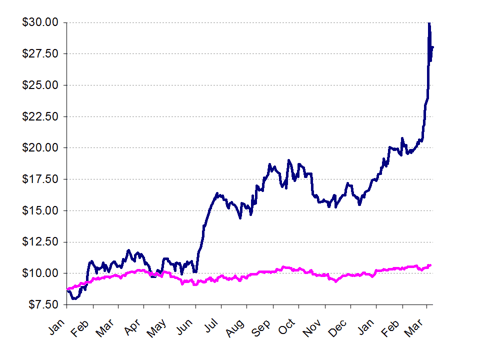

Since the product launch in April 2012, the shares have tripled, enjoying a boost from strong sequential revenue growth along with a surging bull market for healthcare names across the board.

Pacira Share Price vs. NASDAQ Index

Had the price remained in the $12-13 range, the company could easily be viewed as a potential acquisition target for a Big Pharma player looking to expand its pain management portfolio with specialty drugs.

However with the price now hovering close to $30.00, Pacira’s market cap is now roughly $1 billion, making the economics of a buyout prohibitive for any Big Pharma buyer. As a result, at current prices, Pacira will be forced to justify its valuation by expanding sales and by ultimately generating its first-ever quarterly profit. It is currently hoped that this will occur sometime in 2015.

The growth in Pacira’s valuation has occurred very quickly, and in fact has significantly outpaced the growth of Pacira as an operating company as well as the still nascent growth of its only real commercial product. As a result, it may well be the case that a pull back around $18.00 should be expected in the near term – a decline of roughly 30%.

This view is supported by the fact that in January, Pacira saw the onset ofinsider selling by Sanderling Ventures of around $10 million at a price of $18.93.

Likewise, as soon as the shares broke through $18.50, Pacira was quick to issue a $120 million convertible bond which can be converted into Pacira shares.

As the share price continued to rise, the selling continued as would be expected. On March 7th, Sanderling once again reported a cashless exercise of warrants netting over 50,000 shares.

On March 11th, three after-hours block trades totaling over 1.3 million shares (nearly $40 million) went through at a 5% discount to the closing price.

Sanderling’s recent Form 4 filings shows that it was responsible for an additional 374,000 at $27.73 (also about a 5.5% discount to the day’s close). The seller of the remaining 1 million shares should be disclosed shortly.

In any event, the rush seems to be building to begin exiting Pacira at its heightened valuation. Sanderling has now exited the majority of its position. Most recently, rather than sell its shares over several days, Sanderling chose to lock in an immediate 5.5% discount.

There are a number of key issues for investors to consider when evaluating Pacira at its current $29.00 price tag and billion dollar market cap.

Pacira’s Exparel was approved by the FDA in 2011 for specific uses in post surgical pain management, including for removal of hemorrhoids and bunions. Exparel’s ability to facilitate delayed and reduced use of opiate pain killers has caused the company and Wall Street analysts to project a market opportunity of$1 billion in revenues.

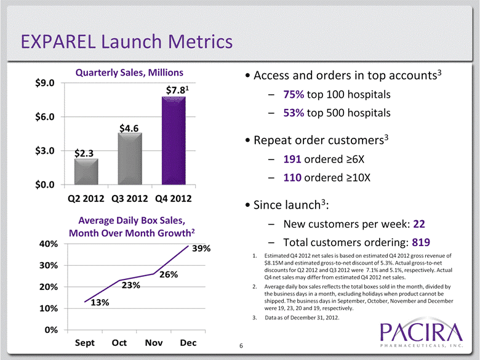

Pacira’s Exparel product was commercially launched in April 2012. Sequential revenue growth has been in the double digits but off of a very low base. Even by the end of its first year, the product has only just broken though $7.8 millionper quarter in sales.

The reason that this is problematic is that the benefit from Exparel had been expected to be quite monumental in that it would be an easy to implement and dramatically improved solution vs. opiates and Patient Controlled (“PCA”) alternatives.

The fact that after one year, the product has been this slow to be adopted suggests that the product is far more marginal and far less revolutionary than had been hoped.

This view is supported by looking at the repeat order numbers and customer growth numbers.

Of its 819 accounts at present, only 13% have ordered more than 10 times, while only 23% have ordered more than six times. Wall Street analysts have chosen to view this situation as “the glass is 13% full” as opposed to taking the view that “the glass is 87% empty.”

The reason that this is cause for concern is that Pacira has disclosed the total number of surgeries where Exparel could be appropriate is in excess of 40 million per year, suggesting that repeat orders would be both numerous and large. This was the basis for the “$1 billion” revenue prediction.

The magnitude of the revenue stall is evidenced by the fact that Pacira has also disclosed that it already has access and orders in 75% of the top 100 target hospitals. It is therefore not the case that the medical community is unaware of the existence of Exparel.

In fact, Pacira’s three largest customers (out of 819 total) account for fully 55% of revenues.

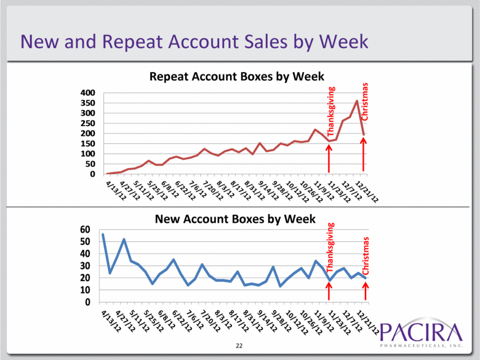

A similar way to look at this problem is by noting the slowing growth in “new account boxes” per week. When Exparel was launched in April from a base of zero, new account growth was decent at 60 per week.

Yet by December, that growth rate had already slowed to around 20 per week. Even if we factor in slowdowns for Thanksgiving and Christmas, that number remains well below 30 per week and continues to trend lower.

Again, to put this in perspective, Pacira has a target market of over 40 million surgeries per year, yet even with repeat orders, the company is still only showing repeat order boxes in the hundreds per week.

Even if Pacira were selling 10x this amount, it would not be coming anywhere close to achieving a meaningful market share vs. its 40 million surgeries. So even though the sequential growth rate looks good vs. its low base, it continues to be the case that by year end this hoped-for blockbuster drug had achieved a presence that would not even be noticed by anyone, unless they had a very specific reason to be following Exparel sales.

By year end, Pacira had sold just 5,497 boxes of Exparel vs. 40 million potential surgeries.

So in fact, even if Exparel were selling at 100x of where it is now (549,700 boxes), it’s market share would still be just over 1%.

The de minimis market share by year end was not due to any lack of effort by Pacira. In fact, Pacira has had a massive and full blown marketing strategy in effect since well before the commercial launch. Pacira noted the following pre-launch efforts:

Our commercial team has executed on a full range of pre-launch activities for EXPAREL including:

(I) publications and abstracts for the EXPAREL clinical program efficacy and safety, health outcomes studies, and review articles on postsurgical pain management;

(ii) health outcomes studies which provide retrospective and prospective analyses for our hospital customers using their own hospital data to demonstrate the true cost of opioid-based postsurgical pain management;

(III) key opinion leader, or KOL, development programs and advisory boards to address topics of best practice techniques, guidelines and protocols for the use of EXPAREL, educational needs of our physician, pharmacist and registered nurse customers, nerve block clinical studies and additional indications for the future development of EXPAREL and

(iv) education initiatives such as center of excellence programs, preceptorship programs, pain protocols and predictive models for enhanced patient care, web-based training and virtual launch programs.

In addition, Pacira had already developed a 60 person sales force dedicated to Exparel.

The point is that Pacira put forth the biggest and best effort possible. But following its launch in April 2012, Exparel has generated almost no sales relative to what had been projected.

The double-digit growth against the very small base really only translates into a few hundred boxes per week.

And as we have seen with past drug launches, blockbuster drugs tend to be blockbusters from the very beginning because the drugs are novel and fill a much needed void. For drugs that are slow to be taken up, the chances of eventually morphing into a late blooming blockbuster are greatly reduced.

However, there is potential for the addressable patient market to increase beyond its current low level. Pacira is currently evaluating Exparel’s potential for use in knee and chest surgeries. In December, Pacira also announced apartnership with Aratana Therapeutics which will study Exparel’s use as a pain killer in cats and dogs.

It must be kept in mind that Pacira is a company that has never generated a profit and still operates on a negative gross margin. Against this backdrop, the valuation of nearly $1 billion is clearly unsustainable and is likely to contract in the near term.

When quarterly earnings were announced on March 7th, the shares quickly dropped by more than 5%. The concern among investors was that the company had done nothing to reverse its ongoing negative gross margins.

Indeed, Pacira missed on earnings, delivering a loss of $0.50 vs. expectations of a loss of $0.42.

In fact, even this loss of $0.50 was actually the result of several factors which mitigated a substantially larger loss.

Total share count had increased dramatically during 2012 from 16.4 million to30.3 million. When spread out over the greater number of shares, this reduced the loss from what would have been $0.93 to just $0.50. Yet even this $0.50 was still a 20% greater loss per share than had been predicted by analysts.

In addition, 2012 Pacira’s financials actually benefited quite substantially from the termination of two partnerships, both of which were terminated in 2012.

As a result of these partners walking away, Pacira was able to immediately realize a total of $18.3 million in revenues from “collaborative licensing and development.” Each of these involved revenues which had previously been treated as “deferred revenues.” These revenues are now history and will no longer be recurring. In fact, the amount recognized from collaborations is actually slightly greater than Pacira’s total revenues from actual “product sales” which will be recurring.

Despite this miss and the impact of helpful mitigating factors, analysts were quick to raise their share price targets on Pacira by nearly 50%. Yet with share price targets of $32.00-$33.00, the current share price is now just 10% below analyst targets for 1-year performance.

Following the 5% drop into the $24.00 range, the analyst upgrades caused Pacira to jump as much as 20% to over $30.00

There are quite a few near-term factors which the analysts seem to be ignoring as they take a long term and hopeful view for eventual profitability and material revenues.

Marketing expense is substantial, but is not the element which dominates the equation. In most cases, early stage pharma companies must expend an amount which is greater than their early stage revenues in order to successfully market their product and grow their revenue stream.

In Q4, Pacira spent $13.3 million on SG&A, well above the Q4 product sales of $8.2 million. For 2012, Pacira spent $46 million on SG&A, which is well more than double the $18.1 million in product sales. But again, this is not the problem.

Instead, the real problem is that unlike most one-product pharma companies, Pacira also suffers from a negative gross margin. Pacira is actually selling its drug at a price which is less than the cost to manufacture it. In fact, for Q4 Pacira had a negative gross margin of -18%.

The reason for this is that Pacira still incurs fixed costs of around $30 million for manufacturing Exparel, along with variable costs of around 10-15%.

On the recent conference call, it was noted that:

In 2013 and 2014 as we’re putting Suite C online, that fixed cost number may move around, may tick up a little bit, as I indicated, because we’re doing those two things in parallel. But as we get beyond into ’14 and we’re operating only in Suite C, we should have just a fixed cost number that might be in the 30, $35 million range. We’ll have to see as we go forward here.

What this means is that the negative gross margin will continue until such time as there is a substantial ramp up of sales of Exparel.

Making this goal a reality will certainly take both time and luck. On theconference call, the CEO noted that:

We are on track to break even during 2014 and we continue to believe that Exparel represents a blockbuster platform for post-surgical pain control.

The key takeaway from this is that for at least 1-2 more years, we should not expect any profit whatsoever from Pacira. An eventual profit from Pacira will no doubt depend upon Exparel achieving “blockbuster” status.

Both Pacira management and Wall St. analysts have conducted a bottom up analysis of the post surgical pain management market and have come to a conclusion that Exparel represents a “$1 billion opportunity” – i.e. a blockbuster.

In fact, many drug companies across a wide range of products regularly conduct a similar type of analysis and the results are always very large revenue predictions.

Yet when we look at the overall drug market from a top down perspective, we can see that billion-dollar drugs, which are so commonly predicted, are seldom realized in the real world. This is just an observable fact in the marketplace based on actual sales data.

As noted by a recent article at the Pharmacy Times, in order to make the list of “best selling drugs of 2011” a drug needs to reach revenues of just $2.7 billion. Any drugs with revenues in the $1 billion range are also very close to the best seller list. Yet in order to get to this level, Pacira will need to quickly increase annual sales by about 300x.

In early 2012, investors began showing caution when anticipating near term revenues from new drug launches. The caution was well deserved. Even drugs which saw hundreds of millions in sales in their first quarter post launch saw their share prices decline from previously run up prices.

Shares of Vertex (VRTX) had ended the year 44% below their 52 week high, even though it had achieved record breaking sales of $420 million for just its first quarter on the market.

Regeneron (REGN) launched its macular degeneration drug Eylea and within just 6 weeks, it had achieved total sales of $25 million.

By contrast, Pacira ended its first year with just $14.6 million in total sales of Exparel.

Now it is 2013 and risk appetite has increased dramatically among investors, yet a January article entitled “Drug Launch Failures: A Rising Trend” shows that this optimism may have gotten ahead of itself.

The fact that Exparel has been on the market for a full year and has only generated revenues of $14.6 million basically tells us in advance that its blockbuster potential has been dramatically overestimated by both management and by analysts.

This is all the more applicable given that these small revenues result from Exparel’s status as a full-price solution without any current generic equivalents.

Exparel’s revenues will likely to continue to show continued steady growth off of its very low base. Yet even if revenue growth were to suddenly jump to exponential levels, it would take years to come anywhere close to what is being forecast.

And the overarching reality is that if the product was not an immediate success when launched, then there is no new catalyst which would cause growth to suddenly become exponential.

Still a small cap company with growing pains

Now that its market cap is approaching $1 billion, Pacira will be viewed by many as an emerging mid-cap stock. But while the stock appears to be a mid cap, the underlying company still bears all the hallmarks of a small-cap company with many of the predictable challenges and growing pains.

In 2012 and prior to the launch of Exparel, Pacira had been dependent upon both DeopDur and DepoCyte for its revenues. But then its partners Novo and EKR terminated their partnerships with Pacira.

Pacira subsequently disclosed that:

We do not expect our currently marketed products, other than EXPAREL, to generate revenue that is sufficient for us to achieve profitability because we expect to continue to incur significant expenses as we commercialize EXPAREL and advance the development of product candidates, seek FDA approval for our product candidates that successfully complete clinical trials and develop our sales force and marketing capabilities to prepare for their commercial launch.

Yet these terminations actually had the effect of boosting the revenue which Pacira was allowed to report to investors. Revenues which had previously been accounted for as “deferred revenue” were able to be immediately recognized in full.

On the manufacturing side, it can also be seen that Pacira is facing similar challenges to many of its peers with a fraction of the market cap. It is the manufacturing difficulties that have caused Pacira to sell its only commercial product at a price which is below cost. This is still a work in progress.

Also in 2012, the Medicines and Healthcare products Administration conducted a standard inspection of Pacira’s manufacturing facilities and noted certain “critical deficiencies.” The result was a cessation of manufacturing activities for DepoCyte along with a selective product recall.

As with many small-cap companies, much of the valuation for Pacira lies in hopes and expectations that there will be additional applications that may expand the revenue potential. Yet investors often fail to appropriately monitor and handicap these new developments.

Internally, Pacira also has made use of a number of notably small-cap business practices such as related party transactions.

For example, in reality Pacira only retains a part time Chief Medical Officer who acts as a consultant rather than an employee.

Pacira’s Chief Medical Officer, Gary Patou, is actually a Managing Director withMPM Capital, an investment fund which owns shares of Pacira. Under the terms of his “consulting agreement” with Pacira, the Chief Medical Officer is only required to spend up to 50% of his time working for Pacira.

Pacira CEO David Stack is also a Managing Director from MPM. Separate from that he also has his own company called “Stack Pharmaceuticals” where he serves as Managing Partner. The StackPharma (“SPI”) webpage discloses Mr. Stack’s roles as follows:

Through an SPI engagement, he is currently serving as President, CEO, and a member of the Board of Directors of Pacira and is also a Managing Director at MPM Capital.

In addition, Dave is a Director of Bio-Imaging Technologies, Inc., PepTx, Inc., Molecular Insight Pharmaceuticals Inc. and Elixir Pharmaceuticals Inc.

Under the original consulting agreements with Stack Pharmaceuticals, Pacira ended up paying Stack over $500,000 for items such as office space, a telephone system, work on its website and research for Exparel.

Stack Pharma continues to use the same street address that Pacira uses on its SEC filings, which is at #5 Sylvan Way in Parsippany, NJ.

Previously, Pacira’s Vice President, Commercial, Taunia Markvicka also came from David Stack’s Stack Pharmaceutical, holding a dual role between Stack and Pacira.

Pacira Board Member Gary Pace also receives a large amount of consulting income from Pacira which is separate from the income he receives for being a director. His consulting income has been rising very quickly.

In June 2011, the original agreement provided for $5,000 per month in consulting income plus the right to receive 10,000 shares.

Within 9 months, the income was doubled to $10,000 per month along with a doubled 20,000 shares.

Within a few months of this, these amounts were again revised upwards to $15,000 per month (with a removal of the annual cap) along with a substantial 70,000 shares of Pacira.

So that ends up being $180,000 per year plus options on over $2 million worth of stock being awarded to a board member for the separate (non-board) consulting services he provides to the company. In addition to that, Mr. Pace is eligible for a $200,000 bonus in connection to the Suite C manufacturing facilities being built by Pacira.

In the proxy, it was noted that:

As a result of Dr. Pace’s new compensation arrangements, the board determined that he will no longer qualify as an “independent director” under applicable NASDAQ rules. As a result, Dr. Pace intends to resign from his position as chairman of the nominating and corporate governance committee and a new chairman will be appointed at the committee’s next meeting.

With arrangements like these in place, it would obviously be quite inappropriate for Dr. Pace to continue chairing any corporate governance committee.

The role of Governance Chair had previously paid Dr. Pace $10,000 per year prior to his resignation.

In addition to supplying Pacira with its part time Chief Medical Officer and Chief Executive Officer, MPM Capital has also been supplying Pacira with deals.

MPM is a shareholder of Aratana, which will now be collaborating with Pacira on the use of Exparel as a pain killer in cats and dogs.

MPM is also a shareholder and board member in Rhythm Pharmaceuticals which also recently entered into an agreement with Pacira.

Yet despite the decidedly small cap impression left by this series of related party issues, Pacira management has taken a notably large-cap approach to executive compensation.

For the prior two years, compensation to the top three executives exceeded $4.5 million even though Pacira continues to operate with a negative gross margin and at a time when annual revenues were only $15 million.

Likewise, directors have also made out well, with total director compensation of around $1 million for the past two years, as disclosed in the last proxy.

In addition, option grants were quite substantial in 2012. During 2011, there were 395,000 options issued, taking the balance of options outstanding to 2.3 million.

Yet in 2012 alone, there were 2.1 million new options granted, bringing the total balance of options outstanding to 4.0 million. Of these, 3.9 million are vested as of December 31, 2012.

This compares to a total outstanding share count of 30 million, so roughly 13% of the total current share count. The average exercise price is just $7.78.

Conclusion

Pacira has an interesting product in Exparel. The product may allow use of opiates which is either delayed, reduced or both. Yet the very slow adoption of the drug to date demonstrates that the drug will most likely fall well short of its hoped-for blockbuster status.

The stock price has soared due to optimism over its “billion dollar” prospects and due to a hyper bullish market for development stage drug companies.

With the stock having tripled to close to $30.00 and a $1 billion market cap, it seems that the market is still ignoring the fact that Pacira has negative gross margins and no prospects for profitability for the next two years.

Analysts from the company’s investment bankers have been quick to revise their share price predictions upwards, even when earnings targets have been missed by a wide margin, and even as realized revenues have been minimal and have generated negative gross margins.

When the market cap of a small-cap company soars, investors often forget that the underlying company may still be operating as a company with very small-cap characteristics and small-cap risks.

With Pacira, these elements include:

– numerous related party transactions

– a part-time Chief Medical Officer

– tremendous customer concentration

– product failures and material cancelled partnerships

– regulatory failures and manufacturing risks

The initial progress made with Exparel certainly justifies a price higher than the $10 level where it was last year, but still well below $20.00 given the negative gross margins and slow uptake of the drug.

With the price of Pacira hovering at close to $30.00, a correction of at least 20-30% seems very likely as well as justified in the near term.

On the upside, with a price of near $30.00 there is very little headroom for further upside. This is particularly true given that the current $29.00 share price is now just 10% below the recently increased analyst targets of $32-33.