Summary

- Aemetis now has over $90 million in short-term debts coming due, but only $4.7 million in cash. The company has already begun defaulting on its short-term debts.

- This short-term nature is not reflected in the recent 10Q, due to an accounting technicality that has been missed. More serious accounting issues may have also been missed.

- Creditors have already assumed as collateral ALL of Aemetis’ assets, and are now sweeping cash from Aemetis every night. Some creditors are attempting to seize assets.

- Aemetis recently filed a $100-million S3, and retained an investment bank to advise on financing. A massive near-term equity offering is the only option for Aemetis.

- With share price falling and no other options, the stock could enter a “death spiral” and decline by 50%-80%. Past fraud charges for the CEO could exacerbate equity discount.

(Editor’s Note: Third Eye Capital disputes certain aspects of this article, and contests the author’s conclusions and calculations regarding the loans, the interest rate, the debt service expenses, and the nature and implications of the cash sweep.)

Investment overview

Aemetis Inc. (NASDAQ:AMTX) is a company which is totally off the radar for most investors. The company only recently uplisted to the Nasdaq from the OTC BB, and has no institutional following. As a result, the mostly retail investor base has missed some critical issues with the company.

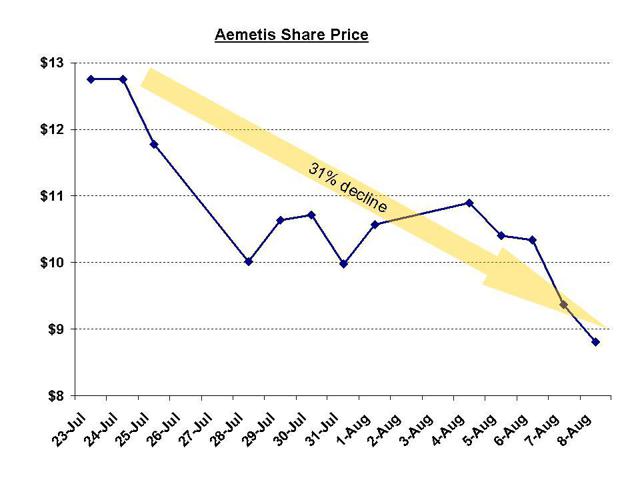

Between May and July, shares of Aemetis rose from $5.00 to over $12.00. But now, the shares have been dropping daily. Even though earnings on August 7th were relatively positive, the shares have fallen by 20% since then, and are already down by more than 30% in just three weeks.

The reason that the positive earnings did not cheer the stock is because Aemetis is very deeply in debt and is already defaulting on obligations in both the US and India. Creditors have already taken 100% of the cash generated by Aemetis this year, and are first in line to take anything else that Aemetis can make. Indian creditors are already attempting to seize assets.

It is clear that Aemetis must issue a massive amount of new stock to pay creditors, and it must do so quickly. Aemetis has over $90 million in short-term debt coming due, and only $4.7 million in cash.

Aemetis has already filed an S3 registration statement to raise up to $100 million, and has engaged an investment bank to help with financing. The equity offering will put extreme pressure on the share price. This is what is driving the share price down.

Because Aemetis MUST complete a financing regardless of price and because of the urgency, the share price will continue to fall sharply. No one wants to be the last one holding shares when the company conducts a huge equity offering.

The shares could fall by a further 50%-80% due to the “death spiral” nature of this financing situation. Past examples will illustrate this problem clearly and why it applies to Aemetis.

Again, the reason that the market has missed this is simply because:

a) Aemetis is an under-followed stock

b) Aemetis is mostly held by retail and has no legitimate research coverage

c) Aemetis only recently uplisted to the Nasdaq from the OTC BB

Background

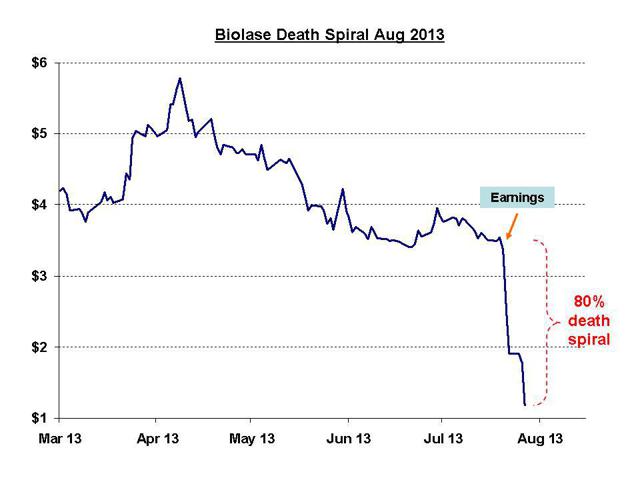

In 2013, I wrote an article describing a “death spiral” at Biolase Inc. (NASDAQ:BIOL) which saw the stock plunge by 80% in a week. The situation was very similar to what we are starting to see now with Aemetis.

In early 2013, the Biolase share price was quite strong and traded as high as $6.00. In August 2013, Biolase had just reported earnings and reported a very mild miss. It certainly should not have been a big deal. But still, the share price plunged by 25% that day. The death spiral had already begun… however, many investors had not yet realized it.

By the time I could finish my article within a few days, the stock had already fallen by 50%. Despite this massive drop in less than a week, I still predicted even further declines. The stock then fell an additional 30% on the day of my article alone.

With the stock down 80% in a week, Biolase took the unusual step of halting its own stock when it hit $1.16, down from $3.60 before earnings. It was an epic plunge in just days, and a far cry from $6.00 just weeks earlier.

Biolase was ultimately able to stabilize and raise some of the money it needed. The stock has recovered to around $2.00, still down by 45% from where it was before.

Biolase offers a good lesson in what triggers a death spiral. Biolase was in violation of its loan covenants and needed to raise money urgently. Issuing stock was the only option, and investors could plainly see that Biolase had filed a large S3 registration statement to sell stock. The situation with Aemetis is nearly identical, except that Aemetis has far more debt than Biolase.

In general, a death spiral will occur when a company needs to pay a fixedobligation (i.e. debt) and when it must use a variable number of shares to do so. Investors know that the stock will fall upon the equity offering, so they sell and the share price falls. But then, the subsequent investors know that the equity offering has not yet happened, so they know that the stock will continue to fall further. They sell, the stock falls, and the cycle repeats again.

No one wants to get caught holding the stock, because it is pre-determined that it will continue falling by even more. As the share price gets lower and lower, the relative dilution becomes larger and larger, which then exacerbates the share price decline even more.

As with Biolase, Aemetis Inc. is now facing a death spiral situation, and for very similar reasons. And as with Biolase, it is purely the fault of management for letting the situation get to this point. More prudent management in years past could have prevented this situation from arising.

Aemetis: Company Overview

Aemetis Inc. is a $200-million market cap producer of “alternative fuels”. The company produces biodiesel from a plant in India, and produces mainly ethanol from a plant in California.

During Q1 of 2013, its ethanol plants were idled, as the company was experiencing recurring negative gross margins. It was literally selling its product below cost, so it decided to shut down. In recent quarters, the company has resumed operations, and a buoyant market for ethanol has seen the company begin to eke out tiny profits in two consecutive quarters. But it is still the case that over the past few years, the company has accumulated over $80 million in cumulative losses.

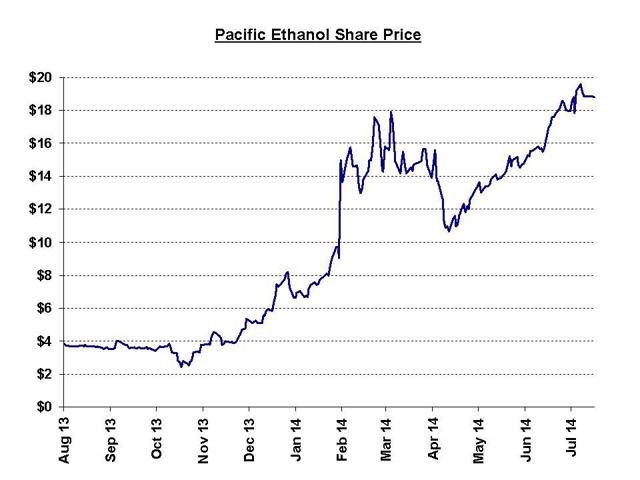

Aemetis Inc. uplisted from the OTC BB to the Nasdaq in May, and its share price quickly shot up from an initial price of $5.00 to over $12.00. One contributing factor was the strong performance of any stock with an ethanol connection. For example, Pacific Ethanol (NASDAQ:PEIX) is up by 400% in the past year. Aemetis has simply ridden on the coattails of the sector.

The share price was also no doubt buoyed by a Seeking Alpha article entitled: “Aemetis Is A Potential Four- Or Five-Bagger“, as well as by the initiation of “research” on the company by SeeThruEquity, which came with a $26 share price target.

See Thru claims (in all caps) that it does not get compensated to write such reports. But instead, See Thru charges its clients $11,000 for slots at its conferences. It then issues hyper-bullish research on the attendees “for free”. As noted on the See Thru website, Aemetis is an attendee in See Thru’s conferences.

In reality, this is all just a very transparent way to pay for positive research on one’s own company.

Both the article and the research report contain materials which are largely a simple repetition of company presentations, including links and direct quotes. As a result, they not surprisingly portray the company in a very optimistic light, and contain multi-bagger share price targets.

Yet, both of them ignore the obvious realities which are contained in Aemetis’ SEC filings. Even a quick and cursory read of the company filings reveals the following:

- Aemetis already is and has been in default on its debts, with creditors already attempting to seize assets.

- The company has just $4.7 million in cash and over $95 million in short-term debt coming due.

- Over $65 million of this debt has been classified as “long term”, simply because it is due 1 day after the end of the quarter. As a result, that $65 million is all, in fact, short-term debt by now.

- Aemetis’ major lender is already “sweeping” cash from the company every day, not even trusting the company with cash overnight

- The company’s internal controls for accounting have been deemed to be ineffective.

- Creditors have already claimed as collateral ALL of the assets of Aemetis

- In order to avoid an immediate default, the CEO was forced to personally guarantee $15 million of the debts with 100% of his own personal assets. If Aemetis defaults on even this portion, he loses everything he owns – personally !

As a result of the above, Aemetis (and the CEO) are in the situation where they simply MUST issue stock at any price and in very large size. They must also do so as soon as possible.

The intention to issue equity should be clear. The company just filed an S3 registration statement for up to $100 million. It is huge for a company of this size. The company also disclosed that it has already “engaged an investment bank” to advise on its financing.

An equity offering is desperately needed, there are no alternatives, and the timing is imminent. These are the precursors for a death spiral to occur. This is why the stock has been selling off, even after earnings which were relatively good (compared to the past). Yet, many of the retail holders will have no idea what is coming.

The only reason why the equity offering hasn’t already occurred is that the S3 is not yet effective. This is also identical to what happened with Biolase. But just as with Biolase, the S3 can become effective immediately and with no notice, such that an equity offering could occur at any time.

How has the market missed this?

The reason why this obvious situation has been missed by the market is that aside from existing insiders, the stock is almost exclusively held by retail investors. There is no institutional presence in terms of either investors or research. Because the stock was just recently uplisted to the Nasdaq, it is largely unknown to the wider market.

Furthermore, there are many retail investors who simply invest based on company descriptions who happen to be in hot sectors (i.e. ethanol).

The share price of Aemetis has no doubt benefited from the other soaring ethanol stocks, such as Pacific Ethanol, which has been a stunning 5-bagger in the past year. Aemetis CEO, Eric McAfee was an original founder of Pacific Ethanol, so some people choose to associate the two together, even though Pacific happens to be a far healthier company.

How did Aemetis get into this situation?

In 2012, Aemetis sought to acquire a company called Cilion, but it didn’t have the money. As a solution, Aemetis went to a distressed lender by the name of Third Eye Capital. This was really the beginning of the end for Aemetis.

In July 2012, Third Eye lent around $40 million to Aemetis by means of loans, notes and a revolving credit facility. The “stated” interest rates have been as high as 17%, but due to a creative variety of fees, the real rate of interest has approached 100% per year.

Aemetis clearly had no ability to repay these debts. In fact, it could not ever even service the interest alone. Within less than 6 months, the company was already in default.

As a result, in October of 2012, Aemetis and Third Eye entered into Waiver and Amendment #1. This extended the maturity of the obligations to July 2014 and increased the lending amounts by $6 million.

But… the $6 million could not actually be drawn upon by Aemetis, it was simply extended to account for the unpaid interest. For Aemetis, the only real result was that its debt increased to $46 million instead of $40 million, with no new cash coming in the door.

Aemetis was just borrowing more money from Third Eye so that it could pay the money directly back to Third Eye. Third Eye is doing nothing illegal here. This is how Third Eye makes a fortune. In mafia movies, it’s called “the vig”.

But wait, it gets better.

In order to compensate Third Eye for this extension and waiver, Aemetis was required to “pay” an additional “waiver fee” of $4 million. But again, Aemetis had no cash, so this was just tacked on to the debt. So now the obligation became $50 million, instead of $40 million. And again, there was not even any new cash coming in the door at Aemetis.

The balance of the debt therefore increased by 25% in just 4 months!

That equates to an annualized rate of over 95%!

That was October, 2012. Within just 4 more months (February 2013), the company was again in default. So Aemetis agreed to Waiver and Amendment #2.

This time, Aemetis was required to issue shares to pay an additional extension fee of $1.5 million. In addition, Third Eye required McAfee Capital to pledge millions of shares as collateral. McAfee Capital is the investment company owned by Aemetis’ CEO, Eric McAfee, and which holds some of his shares.

That was the second default waiver within 8 months.

The third default and waiver happened just 3 more months later, with more waiver fees and increased debt balances in respect of unpaid interest.

Then, there was a fourth default and waiver. And a fifth. And a sixth. And a seventh.

At each new waiver just a few months apart, Third Eye would impose additional fees and would jack up the interest rates. The net result was that by late 2013 (less than 18 months), Aemetis’ debt to Third Eye had ballooned to over $72 million from just $40 million.

The “vig” was quickly compounding at a truly unsustainable rate.

By the end of 2013 (within 18 months), total annual debt service amounts were accruing and almost $30 million per year – and this for a debt that started at just $40 million.

But Third Eye still wasn’t satisfied, and was repeatedly demanding warrants. Aemetis was already in default. If Aemetis attempted to say no, Third Eye could just foreclose on the assets of the entire company. Third Eye could now call all of the shots.

As a result of the heavy warrants and shares being issued, Third Eye quickly owned over 17% of the entire company!

But at the current valuation, Third Eye’s equity stake is worth just $34 million – only half of what it has lent to Aemetis. And the problem now is that Aemetis has demonstrated a very limited capacity to pay down these debts.

As a result, Third Eye is now agitating for the equity offering. In one default waiver amendment, Aemetis agreed to give Third Eye 100% of the proceeds of any equity offering it conducts in excess of $7 million. This is how Third Eye plans to get its money back.

The stock will clearly be crushed and Aemetis will end up getting almost none of the proceeds, but Third Eye will get its incredible pound of flesh out of the deal after just 2 years.

What happened with earnings? Why is the stock falling?

Last Thursday, Aemetis reported Q2 earnings, and the numbers appeared good on the surface. But the share price quickly fell by 10% that day, and continued its descent on Friday. This is just what we saw with Biolase.

In the press release, the company noted the following:

- Revenues increased 21% vs. Q2 2013

- Net income was $2.7 million, compared to a loss of $9 .6 million in Q2 2013

- Aemetis paid down $13.6 million of debt (interest and principal)

These all would appear to be very positive developments. As such, retail investors were likely confused by the sharp drop in the stock.

More savvy investors quickly realized that positive comparisons to 2013 are unfair, because the plant had been idled for almost a month during Q2 2013. Had it not been idled, revenues would have come out as being largely flat, despite a very buoyant ethanol market in 2014.

In reality, the results are actually a bit of a disappointment.

As for the debt, a closer read of the subsequently released 10Q reveals that debt service expenses are still accruing at over $5 million per quarter (a run rate of over $20 million per year). In addition, every penny of cash generated by Aemetis has already been handed over to creditors, mostly to Third Eye.

But even after handing every penny of cash that came in the door, Aemetis still has over $95 million in short-term liabilities coming due. Aemetis has made virtually no progress whatsoever, even in the best ethanol market in a decade.

Note: Many investors could have easily missed the short-term nature of $65 million these liabilities, because in the Form 10Q, they are classified as “long-term liabilities”. The reason for this classification is that Aemetis agreed with Third Eye to set the new maturity date as July 1, one day after Q2 ends. As a result, they were technically considered to be “long-term” obligations in the most recent 10Q – but only by a single day. These obligations are now clearly short-term liabilities.

For those who care about accounting ratios, Aemetis has a stated “current ratio” of 0.4. That should already be extremely concerning. Anything below 1.0 indicates meaningful financial weakness. Anything below 0.5 indicates a severe liquidity issue.

But in fact, it is much worse. Because all of these liabilities are now short term, the real current ratio for Aemetis is just 0.1. The company is visibly insolvent.

What about “alternative” financing sources?

California Energy Commission Grant

In late July, Aemetis put out a press release stating that “Aemetis announces $3M CEC grant award”. Even though $3 million is not enough to move the needle vs. over $90 million in upcoming debts, the $3 million would serve as a small amount of welcome relief.

However, it appears that investors may have assumed that this money was already distributed to Aemetis. This is wrong.

There are several problems here. First, the grant is still contingent upon approval of the project. It has not even been distributed. Second, the grant is a matching grant, which means that Aemetis itself must put up $3 million in order to receive the grant. But Aemetis only has $4.7 million in cash total. Third (and most importantly), as part of one of the default waivers, Aemetis already agreed that any proceeds from grants would go straight to Third Eye. Aemetis will see none of the money from this grant.

California Ethanol Producer Incentive Program.

Aemetis is eligible to participate in this California program, which subsidizes ethanol producers in times when crush spreads are too low to make money.

Unfortunately, the program also requires ethanol producers to repay the funds when times improve. Because times are good for ethanol right now, Aemetis actually owes money to this program.

As a result of this, Aemetis noted in the most recent 10Q that:

During the six months ended June 30, 2014, the strength of the crush spread resulted in the accrual and obligation to repay CEPIP funding in the amount of $1.8 million, the entire remaining amount of funds received from the program.

This is in addition to the other debts listed for Aemetis.

EB-5 Visa program

This is an odd one. In an attempt to obtain funding, Aemetis enrolled in a program by which it can effectively sell US immigration visas to foreigners. Foreigners can “invest” $500,000 each into notes issued by Aemetis. Because they are investing in a US business and presumably creating jobs, the foreigner then gets a US immigration visa.

The notes can be converted into Aemetis stock at a price of $3.00 – but only after 3 years.

Even though this appears to be a great deal (getting stock at $3.00), Aemetis has only managed to sell 3 of these visa investments since 2012, raising just $1.5 million. The reason that there has been no demand is that investors need to wait for 3 years in order to get their stock. These investors will know that they come behind over $90 million in debt, such that there is a very real chance that they may never get paid. In fact, in 2013, Aemetis was not even paying the owed interest to these investors who paid their $500,000 each. Not surprisingly, selling more of these has been difficult.

Despite only selling 3 of these in the past 2 ½ years, Aemetis continues to state that this is a source of funding which they hope to rely upon.

But once again (and of greatest importance), Third Eye has already laid claim to any potential proceeds from this source. In Default Waiver #5, Third Eye forced Aemetis to agree to remit any proceeds from EB-5 sales to Third Eye.

Loans from board members

In the recent past, CEO Eric McAfee has already forgone actual cash payment of his salary and benefits, because Aemetis is unable to pay. Aemetis simply accrues these expenses along with the other debts which it is not paying. But because 100% of his personal assets have been claimed by Third Eye as collateral, Mr. McAfee is no longer able to extend any form of credit to Aemetis.

As early as 2009, board member Laird Cagan extended $5 million of credit to Aemetis, which was secured by assets of the company. But as usual, the company was unable to even pay the interest. As a result, the company issued stock to Mr. Cagan in exchange for the $5-million debt. As a result of this, Mr. Cagan ended up quickly owning 12% of the entire company, which he acquired at just 45 cents per share.

This once again demonstrates what we are about to see: when the company has debts which it cannot pay, and when issuing stock is the only option, the price at which stock can be issued tends to be very, very low. Aemetis will truly issue stock at any price, because it has no other options.

Complications for an equity offering – accounting issues

I was an investment banker on Wall Street for nearly a decade. I helped many troubled companies raise money when the situation looked very desperate. One thing I learned is that there is almost always a price at which a deal can get done.

I do believe that Aemetis will be able to complete some amount of financing to stave off insolvency. But it is also clear that the price at which a deal gets done for Aemetis will be very, very low.

We already know that nearly all proceeds of the offering will simply be handed to Third Eye. This is already a problem for potential investors, because they know that a financing will not go to improve the business or increases capacity. The financing itself does nothing for Aemetis and everything for Third Eye.

But, in fact, there is a much larger problem looming for Aemetis.

Aemetis may have additional accounting problems. which could require an even bigger discount from anyone who might choose to finance the company.

In its annual 10K filed in March, Aemetis noted that:

We have identified material weaknesses in our internal control over financial reporting which have materially adversely affected our ability to timely and accurately report our results of operations and financial condition. These material weaknesses have not been fully remediated as of the filing date of this report.

The deficiencies in internal control were not minor, in fact, they were very significant.

The 10K (p. 28) explained that there may be significant problems with the numbers, most importantly, including cash flow numbers.

The material weaknesses identified are: Ineffective controls exist to ensure that the accounting and reporting for complex accounting transactions are recorded in accordance with GAAP. A number of significant audit adjustments were made to the general ledger, which collectively could have a material effect on the financial statements. These adjustments were made up of entries to properly record the carrying value of debt issue costs, warrant accounting and various other adjustments summarized in our Report to the Audit Committee communication.

As part of our review of the financial statements included in the 10-K, we also made significant revisions to the statement of cash flows and various notes to the financial statements, which indicate that additional controls over disclosures need to be evaluated.

The company also noted that it was making efforts to remediate these problems.

But here is where it becomes much more problematic.

A few weeks later, when Q1 was reported, Aemetis noted that

There were no changes in our internal controls over financial reporting during our most recently completed fiscal quarter that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

Despite the “no changes”, Aemetis management is now saying that the previously disclosed problems no longer matter.

On page 30 of the Q1 10Q and on page 35 of the Q2 10Q, it is noted that:

Our controls and procedures are designed to provide reasonable assurance that our control system’s objective will be met and our CEO and CFO have concluded that our disclosure controls and procedures are effective at the reasonable assurance level.

Something is quite wrong here.

When a company discloses serious deficiencies in its accounting controls in one quarter and then says that no changes have been made, it is not possible to suddenly say that the numbers, including cash flow, are all just fine. Yet, this is what Aemetis has done.

The fact that these problems are being swept under the rug at just the time that the company is looking to complete a large equity offering makes the problem that much worse.

This is clearly something that small retail investors will miss, but larger investors who might finance the company will spot immediately. To the extent that they have any concerns over the accuracy of the accounting numbers, they will definitely require a steeper discount on the equity price.

Past 10b5 fraud charges against the CEO, Eric McAfee, will not help that matter either.

In a previous OTC BB oil and gas company, Verdisys, Mr. McAfee was also the largest shareholder and CEO.

According to the SEC, McAfee duped the company’s board into buying useless software from a different company which he controlled. He then diverted that money to a stock promoter to promote the stock.

McAfee then fabricated a large receivable from a supposed customer, and forced the accounting department to put out the 10Q filing without letting the auditor review it. The auditor had already raised revenue recognition issues with the transaction. He did all of this in order to prevent the share price from falling.

This is all pretty bad stuff. As a result, Mr. McAfee was sanctioned for fraud violations, and cease and desist orders were issued.

Here is what happened, according to fraud proceedings with the SEC:

Verdisys issued two million shares of common stock, valued at $1 million, ostensibly to acquire software, but that the software had been deemed not useful, and Verdisys was therefore recording an impairment expense of $1 million.

McAfee had convinced the Verdisys board to purchase the software by claiming it would allow the remote monitoring of oil and gas wells, which would complement Verdisys’ sales of broadband satellite links to oil and gas companies. McAfee controlled the company selling the software, and he knew that the software only screened job applications and resumes of health care executives and did not monitor conditions in oil and gas wells. McAfee did not tell the company’s directors that the transaction compensated a stock promoter, who received half of the two million shares.

As a result, McAfee caused Verdisys, essentially a start-up company, to not disclose that it had issued one million shares and incurred a compensation expense of $500,000, to retain the promoter, before it could claim significant assets, revenues or business operations.

Verdisys delayed the filing of its quarterly report for the quarter ended September 30, 2003 (the “3Q Form 10-QSB”), after its auditor raised revenue recognition issues concerning a material $1.5 million receivable related to the company’s largest drilling contract. While the filing was in abeyance, McAfee caused Verdisys to issue an earnings release predicting the company would soon report record earnings.

McAfee participated in efforts to justify recognition of the $1.5 million receivable. On November 19, 2003, to meet the filing deadline and avoid any drop in the company’s stock price, McAfee ordered Verdisys’ accounting staff to file the 3Q Form 10-QSB, even though the auditor had yet to review the financial statements found in the filing. The 3Q Form 10-QSB filed as a result claimed Verdisys had earned total current period revenues of $2.09 million, including the questioned $1.5 million receivable. The 3Q Form 10-QSB did not disclose that McAfee’s attempts to confirm recognition of the $1.5 million receivable involved a buy-out agreement, by which Verdisys would assume substantial liabilities and forego collecting upon the $1.5 million receivable to purchase the drilling project from which the receivable arose.

As a result of the conduct described above, McAfee caused Verdisys to violate Section 10(b) of the Exchange Act and Rule 10b-5 thereunder, which prohibit fraudulent conduct in connection with the purchase or sale of securities.

Ultimately, McAfee settled with the SEC, paid a fine and moved on to other projects. Verdisys later changed its name to Blast Energy, and is no longer listed.

I don’t expect that any retail investors have conducted this level of research in evaluating their investment in Aemetis. But it should be expected that investors who might choose to participate in an offering of up to $100 million will focus quite clearly on this history.

The fact that Aemetis recently disclosed its internal accounting problems and then quickly covered them up just in time for a financing will certainly be noticed, and will be another factor which will require a steep discount in selling new equity.

It will not be lost on the investors that absolutely all of Mr. McAfee’s personal assets have been pledged to secure the loans of Aemetis. If the Aemetis creditors choose to foreclose, they will take everything he has. As a result, there is a very high amount of pressure on Mr. McAfee to get an equity deal done and to perhaps conveniently overlook the accounting problems which might interfere with getting his personal assets back under his own control and out of the clutches of Third Eye.

Please note: I did attempt to contact Aemetis by phone for comment and clarification on these issues, but my calls have not yet been returned.

Conclusion

Right now, there are very strong tailwinds boosting alt energy stocks such as biodiesel and ethanol plays. This can be clearly seen by looking at the soaring share prices of stocks such as Pacific Ethanol.

But unfortunately, the dire straits in which Aemetis has landed basically ensure that no amount of tailwind is going to benefit Aemetis shareholders. For any amount of cash that comes in, Third Eye Capital stands ready to confiscate it. Third Eye is already “sweeping” cash from Aemetis every night. That applies to cash from biodiesel and ethanol sales, from grants and subsidies and even from Aemetis’ unusual US visa selling program. Third Eye and the lenders take everything.

Aemetis has over $90 million in near-term debts, and just $4.7 million in cash with which to repay it. But as of the last 10Q, much of this was technically referred to as “long-term” debt. There is no mistake that this is currently short-term debt now.

Aemetis has already defaulted on loans, and its Indian creditors have already begun attempting to accelerate the seizure of assets. Each time a default is waived for a few months only adds massive new debt burdens to the company in the form of waiver fees, penalties and new interest. The “vig” is compounding at an unsustainable rate.

But now the burden is getting so high that Aemetis risks collapse, and now Third Eye finally needs to convert these debts into cash.

Aemetis has filed a $100 million S3 in order to sell equity, and has engaged an investment banker to advise on financing. As a result, the share price has already fallen quickly by 30% in 3 weeks.

But now that the financing becomes more visible, the share price decline is likely to accelerate. No one wants to be left holding the stock when all of the other buyers disappear ahead of the offering. This is just what we saw with Biolase last year, when the stock plunged by 80% in a single week.

Concerns over accounting issues and internal controls will likely mean that the discount required in an equity offering is even deeper than might otherwise be the case. Investors will want to know why Aemetis is now ignoring the accounting problems just revealed in March, and why they are being ignored right ahead of a must-complete equity offering. The past history of similar fraud by the CEO will certainly not help this issue with investors.

Based on these issues, a quick drop of 50%-80% in the share price is now entirely predictable.

This article is the opinion of the author. Nothing herein comprises a recommendation to buy or sell any security. The author is short AMTX. The author may choose to transact in securities of one or more companies mentioned within this article within the next 72 hours.