Summary

- Keryx has been marketing Auryxia off label conveying a “two for one benefit”.

- An “iron benefit” is absolutely critical to the successful marketing of the drug, but Auryxia has not been approved for this.

- Keryx has even marketed the detailed financial savings involved from this unapproved indication.

- Similar illegal marketing practices by Aegerion quickly led to an FDA warning letter and DOJ investigation and a sharp decline in the stock.

- I expect a sharp decline in Keryx.

This article is the opinion of the author. Nothing herein comprises a recommendation to buy or sell any security. The author is short KERX. The author may choose to transact in securities of one or more companies mentioned within this article within the next 72 hours. The author has relied upon publicly available information gathered from sources, which are believed to be reliable and has included links to various sources of information within this article. However, while the author believes these sources to be reliable, the author provides no guarantee either expressly or implied.

Authors note: Prior to publication, the author reported Keryx’s marketing practices described below to the United States Food And Drug Administration under their “Bad Ad” outreach program. As a result of the findings below, the author is short KERX.

Company fundamentals

Name: Keryx Biopharm (NASDAQ:KERX)

Market Cap: $1.1 billion

Share price: $9.31

Cash/share: $1.64 per share

LTM Rev: $2 million

Product Rev: $422,000 (net)

Avg Volume: 2-3 million shares/day

Options: Very liquid calls and puts

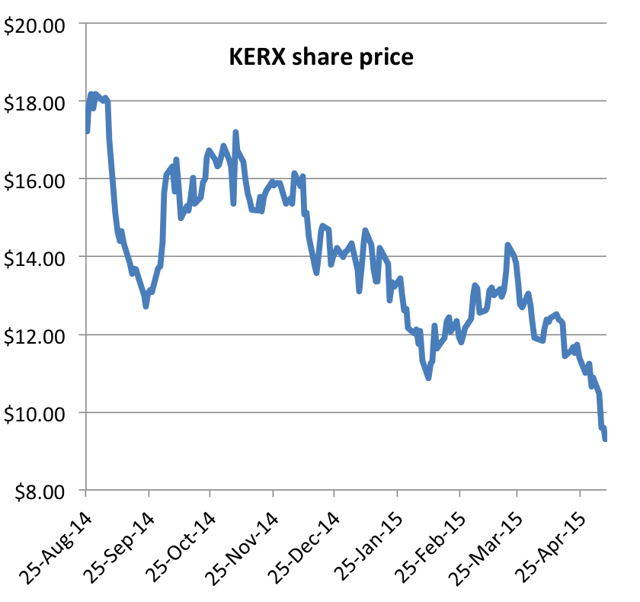

Keryx recently announced Q1 earnings following the Q4 2014 launch of its only product, which controls phosphorous levels in dialysis patients. Disappointing revenues quickly sent the stock to a new 52-week low as analysts began downgrading the stock.

On Friday, further disappointing weekly prescription data caused the stock to break another 52-week low, hitting $9.28.

Despite the new lows, former CEO Ron Bentsur just filed to sell over 1.5 million shares last week.

Section I: Summary

One of the biggest risks with smaller cap pharma companies who are just bringing their first drug to market is that they are inexperienced and will commit major blunders even after their first drug gets approved.

Some of these blunders, such as illegal marketing practices, are so blatant and obvious that it is difficult to imagine how the executives of a major company could commit them.

Federal and state laws, including the False Claims Act, state that pharma companies may only market drugs based on their “label” as specifically determined by the FDA.

According to falseclaimsact.com:

Although physicians may prescribe a drug for an off-label use, pharmaceutical companies violate federal law, including the False Claims Act, when they market, promote or encourage physicians to use their drugs in an off-label or non-FDA approved manner. Pharmaceutical companies that have engaged in illegal off-label marketing or promotion of their drugs have paid the Government hundreds of millions of dollars as a result of Federal False Claims Act cases

We have seen this before and we can now see this in looking at the marketing practices being used by Keryx Biopharm (KERYX). Keryx just released its Q1 earnings and disappointing revenues sent the stock to a new 52-week low.

Keryx has a single product approved and on the market. The product is Auryxia (prior to launch it was known as “Zerenex”) which is approved for “the control of serum phosphorus levels in patients with chronic kidney disease on dialysis.” That is the only indication for which it is approved.

However, initially Keryx had been hoping to get it approved for a second indication – on the basis that it can increase iron stores.

In 2014, Management had described the iron benefit as being “critical” to the drug’s sales because it differentiates the drug from its competitors and would allow for considerable cost savings by dialysis centers.

So again, marketing Auryxia on the basis of an iron benefit is crucial for actually achieving sales of the drug.

Not only did Keryx not get that approval, but the elevated iron levels were cited as a safety issue.

Despite the lack of approval for this indication, we can now see that Keryx is marketing the drug as having an iron benefit anyway. In fact, Keryx has continued to state that the iron benefit is what differentiates Auryxia from competitors and that the drug will allow dialysis centers to save $2,000-$4,000 per patient by cutting out the extra injectable iron that is required by IV during dialysis.

This is nothing less than illegal off label marketing. I believe that the FDA and potentially the DOJ will be obligated to act on these findings.

Section II: An important example – what happenedto Aegerion?

A similar instance of illegal off label marketing gives us a good idea of what to expect from the current practices at Keryx. Last year Aegerion (AEGR) received a DOJ subpoena for similar practices shortly after receiving an FDA warning letter. The company was not only forced to discontinue the illegal marketing, but was also forced to “remediate” – actively communicating to the public what had happened and why it was wrong.

Additional problems sent Aegerion even lower following the DOJ investigation.

Aegerion’s CEO had appeared on Jim Cramer’s Fast Money TV show in June of 2013 and made certain claims about their drug Juxtapid which went well above and beyond its FDA approval.

(Juxtapid is approved only for use as an adjunct to a low-fat diet and other lipid lowering treatments, to reduce specific lipids in patients with HoFH. People with this disease have a decreased ability to remove excess LDL cholesterol (so-called “bad” cholesterol) from the bloodstream.)

KEY POINT: What is most interesting here is that even though these highly visible comments were vastly out of line with Juxtapid’s FDA approval, no one (not the brightest analysts or investors) saw any problem with the comments. In fact, investors simply bid up the stock at the time!

Aegerion’s CEO made a second appearance on CNBC in October 2013, making similar comments. But this time someone reported the segment to the FDA and the FDA quickly reacted with a very serious warning letter. The FDA even went so far as to demand remediation, stating:

Because the violations described above are serious, we request, further, that your submission include a comprehensive plan of action to disseminate truthful, non-misleading, and complete corrective messages about the issues discussed in this letter to correct any misimpressions about the approved use of Juxtapid.

The DOJ quickly followed suit with a full investigation and subpoenas.

At the time, Aegerion was still trading near $60. The stock has since plunged to $20 on these and a variety of other concerns.

Aegerion did cease its illegal marketing practices and did ultimately make public communications to correct the misinformation. Over a year after the initial appearance on Cramer, Aegerion disclosed that it had resolved the FDA issues. But by this time, the damage to the stock was already done.

Question: What should we learn from Aegerion?

Lesson #1: Even though the Aegerion violations occurred blatantly in the public eye, no investors or analysts managed to spot them until an FDA warning letter and DOJ subpoena were issued. Everyone missed what was sitting in plain sight.

This is identical to what we see with Keryx.

Lesson #2: Like Keryx, Aegerion was marketing its first ever drug which helps to explain how management could be guilty of such an amateurish blunder.

Lesson #3: The FDA is equally concerned about illegal promotion regardless of where it happens, in the clinic or in the mainstream media.

The FDA subsequently provided a statement to CNBC noting that:

Regardless of the media or venue used to disseminate promotional messages about prescription drugs, pharmaceutical companies undermine the drug approval process and may put the public at risk when they promote drugs for uses that have not been proven safe and effective.

As shown below, we can already see Keryx using multiple different venues to conduct the off label promotion for the unapproved indication.

Lesson #4: Being forced to discontinue the off label promotion can have a disastrous impact on sales all by itself. This is simply because without the promotion the drug’s sales will fall sharply.

In addition, this heavy impact is further magnified by the impact of the “remediation,” where the company must go out and actively communicate the facts about the inaccuracies to the public.

Without the ability to convey a quantifiable iron benefit, Keryx will not be able to achieve meaningful sales of Auryxia. The financial impact will be very significant. Keryx itself has made it clear in the past that the “iron benefit” was critical to selling the drug.

Section III: Looking at Keryx and off label marketing

Overvaluation alone is never a sufficient reason to short a stock. Overvalued stocks have a way of becoming increasingly overvalued before they finally break.

It is oddly the case that when a company has zero revenues, it is in fact often the worst time to short the stock because its true prospects cannot be quantified. In the meantime, boundless hope prevails.

Instead, the right time to get short a stock is once it starts to deliver results and those results can then be verified as a great disappointment. The right time to short these stocks is therefore typically on the way down.

Even after a 50% drop from its highs of last year, shares of Keryx Biopharm are undeniably grossly overvalued. The company trades with a market cap of over $1 billion, despite generating its first quarterly net sales of just $422,000 from its only product Auryxia. Auryxia launched in December and has had a full quarter to ramp up sales.

The lackluster launch and disappointing sales are the first catalyst for a further decline in Keryx. The second catalyst will likely be the FDA (and potentially DOJ) fallout from their marketing practices.

Note that Keryx also received royalties of $753,000 in Q1 from Japan Tobacco for JT’s sales of Riona in Japan. These royalties have been running at less than $1 million over the past year and are not expected to make up a substantial part of revenues.

Expectations had been running high for Auryxia last year, with the stock hitting as high as $18, valuing the company at nearly $2 billion. But in Q1, the stock has shown a steady decline of around 30%, coinciding with the launch of Auryxia. Again, Auryxia is Keryx’s only product. The stock now trades for around $9.

What is Keryx doing wrong?

Given the incredibly low level of sales, it is not surprising that Keryx is putting on the full court press to boost sales in any way that it can. On its Q1 conference call, management noted that it was pursuing “geographic and label expansion.”

We can now see that Keryx has been going too far on the sales effort and has been already engaging in blatant off label marketing of Auryxia.

KEY POINT: Not only is Keryx making these statements in public venues (such as earnings calls and to trade journals) but we can see from the comments below that they are also making these statements to doctors.

Keryx has been conveying that Auryxia has a “two for one benefit” in that it not only has an ability to control phosphate, but that it also has the benefit of increasing iron stores. The unapproved “iron benefit” is being marketed as a distinct competitive advantage vs. alternatives and as a way for dialysis centers to save thousands of dollars per patient.

Yet Auryxia is only approved for a single indication, as follows:

AURYXIA is a phosphate binder indicated for the control of serum phosphorus levels in patients with chronic kidney disease on dialysis.

CEO Greg Madison has already been telling publications such as Fierce Pharma Marketing the following:

As Auryxia works, patients absorb iron, something many dialysis patients need anyway. By using Auryxia over a competing product, dialysis centers can cut out 52% of the extra injectable iron they provide to deficient patients, Madison says–and simultaneously cut down on costs.

The reason that this matters is that Medicare pays a flat rate to the dialysis centers. Any cost savings that they can enjoy from not using IV iron stay with the dialysis center.

In terms of communications with doctors and dialysis centers, Madison also noted that:

Reps will be pushing iron absorption as a selling point with that audience, too, focusing on the fact that reducing the need for IV iron can reduce the risk of overall side effects like anaphylaxis.

Madison even went so far as to quantify the benefit to dialysis centers, saying:

All told, according to Madison, the savings per patient per year from using Auryxia over a competitor range on average between $2,000 and $4,000. He’s confident those figures will boost his company’s new med at a time when patients, providers and payers are taking a closer look at pharmacoeconomics.

References to the use of off label marketing can also be found within comments on Keryx’s recent Q1 conference call.

On the call, management noted that:

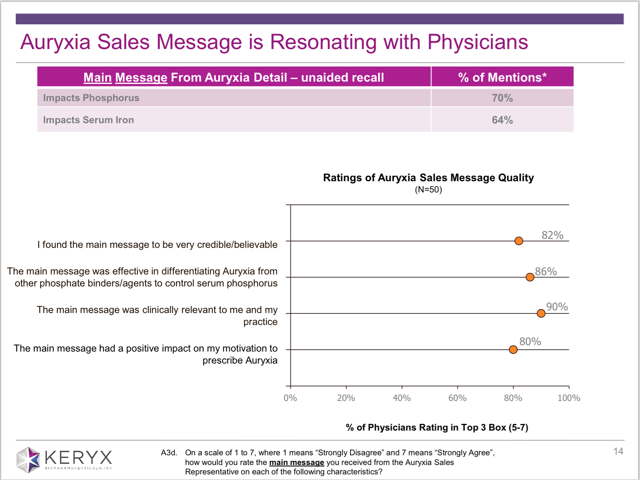

We have been able to recognize the differentiation and impact of the Auryxia message through recent market research with target prescribers that have interacted with our sales representatives. The data on this slide gives us confidence that the Auryxia message is being delivered and extremely well received…. On the top of this slide, you’ll see that the majority of nephrologists unaided recall that Auryxia is a unique phosphate binders because of its ability to control phosphate AND increase iron stores. Almost verbatim we have been hearing from physicians the two for one benefit with Auryxia.

Here is the slide to which they are referring. The entire presentation can be found here (although I am expecting that it may be changed following publication of this article). I have saved a copy of it for future reference.

Note that this slide states how the “sales message is resonating with physicians.” It is clear that Keryx is marketing Auryxia as having a benefit for which it is not approved.

Fully 64% of the respondents “recall” that Auryxia impacts Serum Iron. In other words, they are being pitched this benefit in the sales calls.

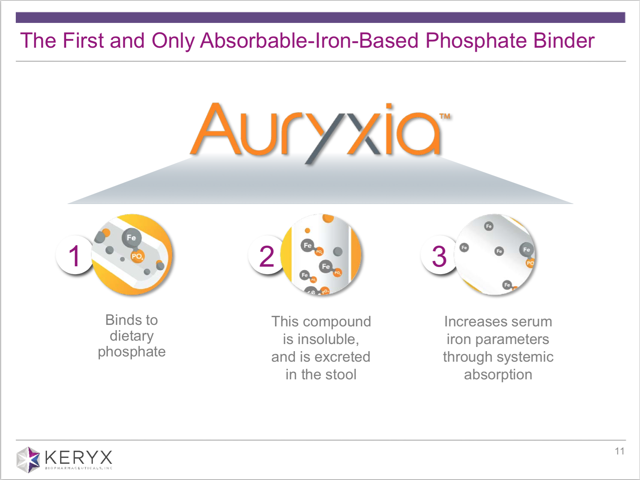

From page 11 in the presentation, we can also see the following slide which explicitly states this benefit.

Item #3 above states that Auryxia “increases serum iron parameters through systemic absorption.” Again, this is how the “iron benefit” of Auryxia is being marketed, but this is not something for which it is approved.

How does Keryx expect to benefit from this off label marketing?

In the initial launch press release, Keryx had noted that:

End-stage renal disease (ESRD) represents the most severe stage of CKD, as many metabolic factors, such as iron and phosphorus, are out of balance. The majority of ESRD patients require chronic treatment with phosphate-binding agents to lower and maintain serum phosphorus at acceptable levels. In addition, iron can be severely depleted in dialysis patients and they therefore are often treated with intravenous iron and other medications. Approximately 450,000 ESRD patients require dialysis in the U.S., with the number projected to rise in the future.

Note that in its official press release, Keryx stopped short of conveying any iron benefit. But from the subsequent notes seen above, we can see that the “benefit” is that Auryxia can be seen as a substitute for intravenous iron. Again, this indication has not been approved by the FDA.

In the past, Keryx tried but failed to gain approval for iron indications. Instead, the iron “benefit” was included as a safety warning.

Last year on the Q2 conference call, Keryx stated that

So as we await potential label there, I think iron parameters that we have talked about there are obviously a critical component of that and a potential big differentiator for us in the market place.

Shortly after approval (when the drug was still known as Zerenex), Adam Feuerstein of TheStreet.com had noted that:

As an iron-based phosphate binder, “Zerenex’s” most important advantage — differentiating it from the competition — was supposed to be its ability to reduce the use of anemia drugs like Amgen’s (AMGN) Epogen in kidney dialysis patients. Keryx has long promoted the idea that kidney disease specialists and dialysis providers would flock to “Zerenex” because of the cost savings resulting from fewer injections of Epogen.

But the “Zerenex” label approved by the FDA makes no mention of the drug’s beneficial effect on anemia, nor does the label say anything about reductions in the use of anemia drugs. Sometimes, when FDA doesn’t agree with a company about the desire to highlight a potential drug benefit, regulators will still allow the company to include relevant clinical data in the label. Not this time.

FDA barred Keryx from including any anemia-related “Zerenex” data in the clinical studies section of the label.

KEY POINT: So the key point is that having an iron benefit was critical for the marketing of Auryxia/Zerenex to dialysis centers. Use of it would supposedly result in large cost savings by not needing to use injections of drugs such as Epogen. Keryx did not win approval for an iron benefit, but Keryx is marketing that benefit anyways – claiming cost savings of $2,000-$4,000 per patient.

Conclusion

Keryx is clearly marketing Auryxia as having a benefit for which it was not approved. More importantly, this “benefit” is the key differentiation point for the product. Without being able to make these marketing claims, Keryx will see its already flagging sales crippled.

The FDA has made it clear that illegal off label marketing of drugs will be acted upon, regardless of the venue in which it is done. In the past, the FDA has not only forced offenders to discontinue the practices, but they have also demanded public remediation to clarify the issues to the public.

Keryx has already made clear that its sales reps are sending out the “iron benefit” message to their intended target audience, the dialysis centers and physicians.

Even WITH the off label marketing, sales of Auryxia have been a steep disappointment, pulling in net sales of just $422,000 in its first full quarter following its December 2014 launch.

The former CEO just filed to sell over 1.5 million shares despite the fact that the stock is hitting new 52-week lows.

In the meantime, Keryx is still valued at over $1 billion. But probably not for very long.

Key catalysts for further decline in Keryx:

- regulatory intervention due to off label marketing practices

- continued revenue disappointment

- further analyst downgrades

Authors note: prior to publication, the author did speak with a medical rep from Keryx who confirmed that there is no iron benefit as part of the drug’s label.