Summary

- In 2014, CEC pulled an accounting gimmick in order to remain “financially responsible” in the eyes of the Department of Education (“ED”).

- Calculations indicate that CEC’s failure to sell Le Cordon Bleu will result in its Composite Score plunging to below 0.7 – deep into the category of “not financially responsible”.

- CEC is already on Heightened Cash Monitoring 1 and is likely to fall into HCM 2, changing its access to almost $700 million in Title IV funds.

- CEC has over $70 million in near term off balance sheet lease liabilities and has burned over $50 million over the past year – its cash balance is shrinking quickly.

- Separately, CEC is facing more than 2 dozen separate investigations and lawsuits which could potentially result in over $100 million in penalties.

This article is the opinion of the author. Nothing herein comprises a recommendation to buy or sell any security. The author is short CECO. The author may choose to transact in securities of one or more companies mentioned within this article within the next 72 hours. The author has relied upon publicly available information gathered from sources, which are believed to be reliable and has included links to various sources of information within this article. However, while the author believes these sources to be reliable, the author provides no guarantee either expressly or implied.

CEC Investment Case – Short

Shares of Career Education Corp. (NASDAQ:CECO) are set to decline by around 60% on multiple catalysts.

Shares of Career Education Corp. (NASDAQ:CECO) are set to decline by around 60% on multiple catalysts.

In 2014, Career Education Corp. or “CEC” received $695 million in federal funds via Title IV of the Higher Education Act. Pursuant to the Title IV Program regulations, each eligible higher education institution must, among other things, satisfy a quantitative standard of financial responsibility that is based on a weighted average of three annual tests, which assess the financial condition of the institution.

For each of 2013 and 2014, CEC scored 1.5 out of 3.0, where 1.5 is the bare minimum score to be deemed “financially responsible” and eligible to receive Title IV funds without restriction.

But last year, the only way that CEC was able to maintain this score was by stating its intention to sell its famed (but failing) culinary school, Le Cordon Bleu. It was an accounting gimmick, which allowed CEC to shift over $200 million in expenses into discontinued operations.

However, CEC had already been placed on Heightened Cash Management 1 (“HCM1”) due to administrative concerns raised by the Department of Education over misrepresentation of placement rates. The HCM status affects how and when the funds are disbursed.

It appears that recent financial declines, including CEC’s failure to sell its failing Le Cordon Bleu schools, will now result in CEC falling into the lowest possible category of “not financially responsible” and could see the company downgraded to HCM2.

CEC had warned of this possibility in its risk factors in its most recent 10-K. The company disclosed the failure of the LCB sale in December 2015. But so far, it appears that no one has performed the detailed calculations, which reveal that the plunge in its Composite Score has already taken place. The calculation methodology is made public by the Department of Education such that those who care to make the effort can do it themselves before it is disclosed by CEC.

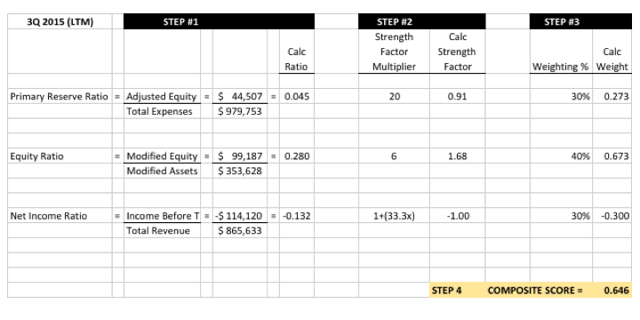

I have performed the calculations and they show that CEC will now fall to a level of 0.646 – well below the 0.90 threshold for “not financially responsible.”

Under HCM2, CEC would no longer receive direct Title IV funds and instead would have to use its own cash to front to students. If this happens, it would be a disaster for CEC and would see enrollments plunge. Again, last year CEC received $695 million (over 90% of its revenues) from Title IV sources.

CEC does not even remotely have the cash to fund such enrollments. CEC appears to have a total of $185 million in unrestricted cash. This equates to around $2.72 per share in cash, which happens to be right where the stock trades. Investors are valuing the ongoing business of CEC at zero.

However, short term off balance sheet lease obligations (within the year) and ongoing cash burn will take net cash down to around $80 million ($1.20 per share) this year.

I expect the stock to trade at around net cash per share at around $1.20. The primary catalyst for the decline in the share price would be the disclosure by CEC that it has been deemed “financially not responsible” by the Department of Education. Additional (secondary) catalysts may come in the form of significant legal settlements from the more than 20 active lawsuits or investigations against CEC.

Background

There was a time when for profit education stocks were a veritable gold mine for investors. Aggressive marketing allowed the companies to grow enrollments at unprecedented rates while Uncle Sam footed the bill through loans and grants.

But now the party is coming to an ugly end.

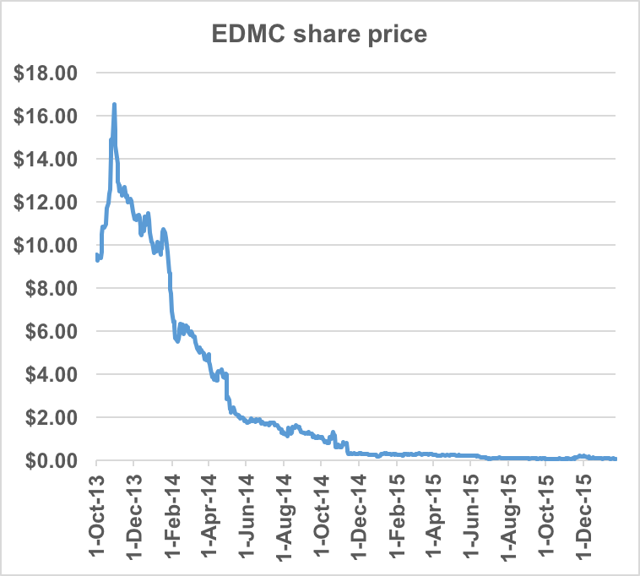

Shares of Apollo Education (NASDAQ:APOL) are down by nearly 70% this year. Shares of ITT (NYSE:ESI) are down by a similar 70%. But even those are far better off than Corinthian Colleges and Education Management Corp., which have basically gone bust (down 99-100%).

Apollo’s University of Phoenix has been placed on probation by the US Department of Defense for various violations. The US Department of Education enacted a rule (the “gainful employment rule“) which could eliminate government funding to hundreds of thousands of students at underachieving for-profit colleges. The FTC, the OIG, the SEC and dozens of state attorneys general are in the process of suing or investigating the for-profit schools for misrepresenting placement rates. The Department of Education has also put forth a “90:10” rule, which eliminates Title IV funding for schools, which receive more than 90% of their funding from Title IV sources. This is a direct shot at the for profit sector.

The point is this:

The for-profit education sector has reaped billions of dollars from federal loan and aid programs, even as completion and job placement rates continue to be dismal. Against this, the for-profits have repeatedly been found to use marketing tactics, which are overly aggressive and blatantly misleading.

The Feds and the State governments are using a wide variety of legislative tools to clamp down on the abusive nature of the for-profit education sector. We can see from the collapse of Corinthian Colleges and Education Management that the various governments are not pulling any punches and are perhaps even looking for ways to curtail the rapid growth of the for-profit sector, which includes shutting these players down altogether.

The focus of this article is on Career Education Corp. or “CEC.” CEC shares are already down by more than 60% for the year, but are likely to fall by another 60% due to recent developments.

As with the other for-profit schools CEC is facing a wave of investigations and lawsuits over deliberate inflation of job placement rates. Only the first of these has been settled and that one already cost over $10 million alone. There are more than 20 remaining active suits and investigations against CEC coming from the FTC, the OIG and more than 20 state governments.

CEC has already disclosed how recent legislative changes have forced it to close dozens of its physical schools. As we will see below, the vice appears to be tightening much more on CEC.

Meanwhile, both the CEO and the CFO recently resigned.

The former CEO was replaced by Todd Nelson who came from both Apollo Education and Education Management Corp. However, Mr. Nelson has a track record, which is littered with regulatory problems, which resulted in over $100 million in past fines and penalties. The state and federal governments are no doubt very familiar with Mr. Nelson, his companies and their practices.

CEC has a market cap of around $200 million and currently has around $185 million in unrestricted cash (around $2.72 per share) and appears to have no long-term debt. Investors appear to be valuing the business itself at zero while naively valuing the stock at what appears to be cash per share.

Unfortunately, the fact is that this apparent cash balance is very misleading. What investors have missed is the fact that CEC has $71 million in short term off balance sheet liabilities this year due to ongoing lease payments (including from schools being shutdown, such as LCB). The company has also burned more than $50 million in cash in the past 12 months.

As a result, the real net cash balance for CEC should be viewed at around $80 million, or around $1.20 per share.

This should all become apparent once the next earnings report is released shortly.

In the past, CEC was a successful operator of online as well as brick-and-mortar schools. But the problem is that brick and mortar schools are too expensive to operate compared to online only programs.

As a result, in 2014, CEC completed the shut down of 21 of its then physical campuses. It also created a “transitional group” of 12 more campuses, which are to be shut down by 2017.

In September of 2015, CEC completed the “sale” of its Missouri College campus. However, the company received no proceeds from this sale, and in fact, it was required to make additional working capital payments to the “buyer” just to complete the supposed “sale.”

As disclosed:

We received no consideration for the sale of Missouri College and recorded a loss on sale of $0.9 million for the quarter ended September 30, 2015. The terms of the agreement provide that we make certain working capital payments to the buyer; accordingly, these amounts were included in the loss calculation.

The point is that CEC literally can’t even give away its assets for free. They have to pay 3rd parties just to give away the assets.

In December of 2015 (4 weeks ago), CEC announced that it had failed to sell its Briarcliff College. As a result, CEC is forced to “teach out” the remaining programs and record a loss of $6-8 million.

This leaves CEC with its “University Group” (the mostly online programs of Colorado Technical University and American Intercontinental University) and its “Career Colleges Group” (the 5 physical campus schools which offer career training in fields like healthcare and fashion/interior design).

The majority of CEC students fall within the University Group, where it is now the case that around 90% of the students are online only.

The latest of its schools to face a shutdown is the famed culinary school Le Cordon Bleu. LCB contributed $173 million of revenue in 2014 but also generated losses of $67 million. As of Q3, CEC management seemed confidentthat a sale of LCB could be effected, such that the school could keep running for students without saddling the parent company with the huge ongoing losses.

But now it all hits the fan, because in December 2015 it was announced that the hoped-for sale had fallen through and that CEC would instead conduct a “teach out” through 2017. A teach out means that CEC will continue to run the school and allow current students to finish their programs, although no new students will be accepted. The additional drag on cash and earnings (losses) is therefore set to continue for at least 2 years going forward.

The failed sale could not have come at a worse time for CEC. The company’s financials have already deteriorated to the point where it will be deemed “financially irresponsible” by the Department of Education (“ED”).

The ED makes public its scoring methodology for schools, which wish to participate in the Title IV government funding program, which funds student loans and grants.

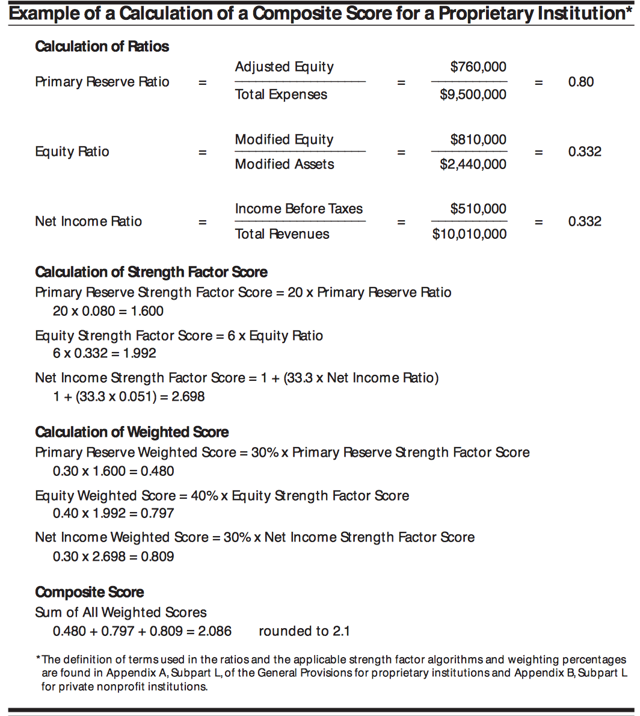

Here is an example calculation as provided by ED. The purpose is to illustrate the methodology.

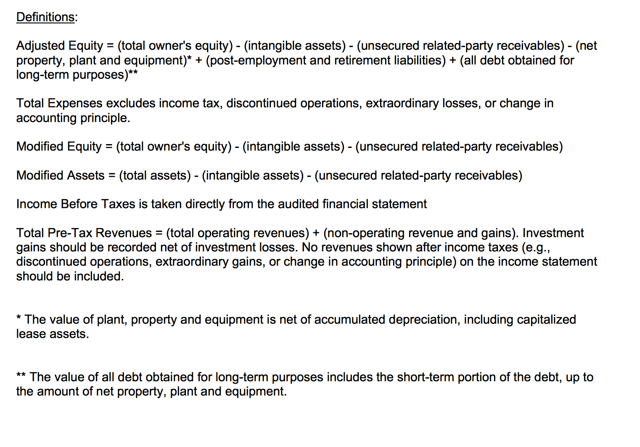

For clarity, the accounting definitions of the terms above are also provided.

The calculation is somewhat convoluted and involves a number of specified accounting definitions. As a result, it appears that the market has not yet digested the fact that CEC would now be deemed “financially irresponsible” by the ED according to the latest financial numbers.

Once the market figures out this score, the stock price is likely to fall dramatically.

The Composite Scores range from -1.0 to +3.0. A score of 1.5 to 3.0 means “financially responsible” and eligible to receive Title IV funds without restriction. A score of 1.0 to 1.4 means “in the zone” of financial responsibility. “Zone” schools can still participate but may need to post a large letter of credit and adhere to other restrictions. Schools, which score below 1.0 are deemed “not financially responsible” and must obtain provisional certification and adhere to certain “cash monitoring” requirements.

Even before the recent problems at CEC and before the failure to sell Le Cordon Bleu, ALL OF CEC’s SCHOOLS had already been placed on Heightened Cash Management 1 status (“HCM1”). But with the recent problems, it is also likely to be downgraded further to HCM2.

There is a big difference between HCM1 and HCM2.

Academic institutions on HCM1 can still draw down from FSA funds to cover disbursements in largely the same way as unrestricted schools. But schools on HCM2 are far more restricted.

A school placed on HCM2 no longer receives funds under the Advance Payment Method. After a school on HCM2 makes disbursements to students from its own institutional funds, a Reimbursement Payment Request must be submitted for those funds to the Department.

This is crucial. A school, which is placed on HCM2, must front all of the money itself to students and then try to get reimbursed by the ED after the fact.

HCM2 is a very big deal. Out of the thousands of Title IV schools in the US, only a few dozen are currently on HCM2.

CEC had already warned investors of this possibility in 3Q 2015:

ED may impose monetary or program level sanctions, impose some period of delay in the Company’s receipt of Title IV funds or transfer the Company’s schools to the “reimbursement” or Heightened Cash Monitoring 2 (“HCM2”) methods of payment of Title IV Program funds. While on HCM2 status, an institution must disburse its own funds to students, document the students’ eligibility for Title IV Program funds and comply with certain waiting period requirements before receiving such funds from ED, which results in a significant delay in receiving those funds.

Last year, CEC received $695 million in funds via Title IV out of total revenues of over $741 million.

This would mean that under HCM2, CEC would have to come up with nearly $700 million in cash of its own to front to students before attempting to get reimbursed by ED. But CEC simply doesn’t have the money. Without that funding, enrollments would (by necessity) plunge dramatically.

So just how bad are things at CEC? Very bad.

In the past, CEC disclosed that it had received a Composite Score of precisely 1.5 in both 2013 and 2014. In other words, CEC was already at the lowest level possible to be considered “financially responsible.” Given the obvious deterioration in CEC’s finances, it should not be surprising that the company has fallen out of the “financially responsible” category.

The timing of last year’s decision to “sell” LCB is notable. By stating just its intention to sell LCB, CEC was able to shift all of the LCB expenses (over $200 million in 2014) into discontinued operations. This was the only way that CEC maintained its score of 1.5 (“financially responsible”).

CEC went to great lengths within its disclosure to describe what would happen if it fell into “the zone” of 1.0-1.4. But the company failed to go into much detail about what would happen if it fell into the lowest category – i.e. below 1.0.

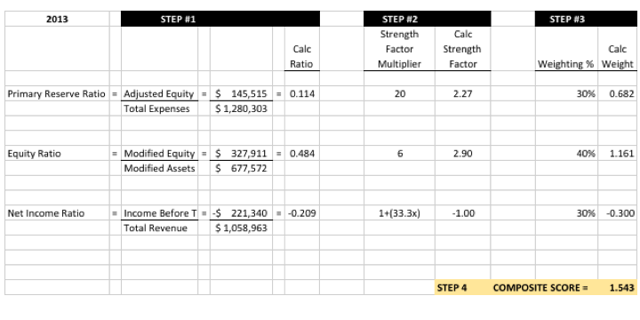

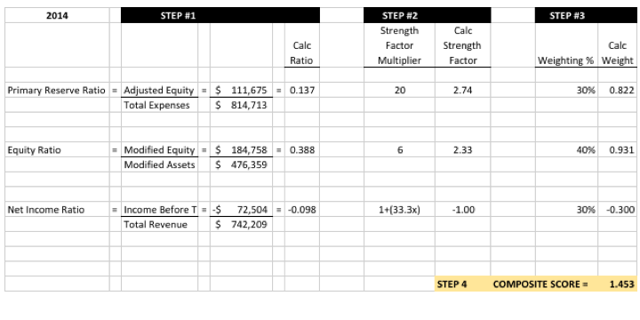

Below are the calculations performed for the last 12 months as of Q3 2015, which show that CEC now earns a score of just 0.646. These are my calculations. For the sake of completeness, I have included as an Appendix the calculations for 2014 and 2015. This just verifies that this methodology does indeed result in scores of 1.5 for both 2013 and 2014, as disclosed by CEC and as calculated by the Department of Education.

Again, the definitions of the accounting terms above (such as adjusted equity, modified equity) can all be found here.

As per the ED, note that the “strength factors” in the calculations are calculated such that they cannot be greater than 3.0 or less than -1.0. As a result, the Net Income factor is the same (-1.0) in all three years. The point is that seasonality from using Q3 numbers does not affect these calculations. Instead, it is the steep plunge in equity that has caused the change.

Note: the table above calculates the Composite Score for CEC based on LTM numbers from Q3 2015, with the assumption that LCB expenses and revenues are added back into continuing operations from discontinued operations.

As per the 8-K from CEC dated December 11th, 2015:

LCB contributed $128.2 million and $172.6 million of revenue and ($43.5) million and ($66.6) million of operating losses for the nine months ended September 30, 2015 and for the year ended December 31, 2014, respectively. As a result of the decision to teach-out the Le Cordon Bleu campuses, the results of operations for these campuses will now be reported within continuing operations.

A look at the new CEO

One thing should be jumping out at investors by now: the state and federal governments have the for profit institutions in their sites. Government agencies are aggressively implementing new rules, which are effectively turning off the federal funding spigot. They are also coming after bad actors with lawsuits and investigations.

Following the resignation of the former CEO and CFO, CEC appointed Todd Nelson as the new CEO in August of 2015. Nelson had previously served as CEO and Chairman of Apollo Education between 2001 and 2006. He then served as Chairman and CEO of Education Management from 2007 until 2013.

During his 13 years with those predecessors, Nelson amassed a track record, which involves hundreds of millions worth of fines paid out by Apollo and Education Management.

In 2004, Apollo paid what was at the time the largest settlement of its kind for its actions under Nelson after a review by the U.S. Department of Education.

A government review of the University of Phoenix, the country’s largest for-profit university, paints a picture of a school so hungry to enroll new students that it has threatened and intimidated its recruitment staff in meetings and e-mail, pressured them to enroll unqualified students and covered up its practices to deceive regulators. In a 45-page report obtained by The Arizona Republic, the U.S. Department of Education describes corporate culture overly focused on boosting enrollment. The review, based on site visits and interviews with more than 60 employees and former employees, led to the largest settlement of its kind last week. The Phoenix-based university agreed to pay $9.8 million without admitting any wrongdoing.

Nelson left Apollo in 2006, but even 3 years later in 2009, Apollo was forced to pay $78.5 million to settle Justice Department charges that under Nelson the company had illegally paid recruiters based on the number of students they enrolled.

And then 9 years after his departure, in 2015, Apollo was forced to pay $13.1 million to settle charges that Nelson illegally granted hundreds of millions worth of backdated stock options that helped him sell $82.8 million worth of stock for himself.

In addition, Apollo faces a string of investigations and lawsuits over deceptive marketing and false claims, which went on during Nelson’s tenure.

Apollo looks like it is going to survive (for now). But things are much worse for Nelson’s former company Education Management.

In 2015, Education Management agreed to pay $103 million in debt forgiveness to over 80,000 former students to settle charges brought by 39 state attorneys’ general for practices under Nelson. The wide-ranging charges related to recruiting practices, false and misleading graduate placement statistics, graduate certification and licensing, and student lending activities.

In 2014, Education Management settled with San Francisco for $4.4 million for illegal marketing practices under Nelson at its Argosy art school.

In 2013, Education Management settled with Colorado’s attorney general for lying under Nelson that the company was seeking to have Argosy’s psychology program accredited by the American Psychological Association. It also misleadingly told psychology students that upon graduation they would be eligible to become licensed psychologists, which was unlikely.

In 2011, the Justice Department and five states sued Education Management under Nelson for lying to regulators regarding illegal incentive-based paymentsto recruiters based on the number of students they recruited.

What does this have to do with CEC ?

The regulators and investigators are no doubt familiar with Todd Nelson. Organizations under his command have already been forced to pay hundreds of millions in penalties for improper actions. Now he is simply sitting atop a new organization with a litany of legal problems stemming from bad behavior.

CEC’s most recent legal problem comes from a Civil Investigative Demand from the FTC, which the company received in August of 2015. The investigation regards deceptive marketing or advertising, just like the ones that took down Education Management with its $103 million payout.

CEC is still under investigation by the Department of Education regarding inflation of placement rate reporting.

CEC is also under investigation by the OIG regarding its proper or improper administration of Title IV funds, including how it handles payments with student withdrawals, how it documents attendance with online classes and how it processes refunds.

CEC also faces multiple suits under the Federal False Claims Act, which state that CEC provided false certifications to the Federal government, causing the Federal government to make improper payments. The suits each seek treble damages.

Most importantly, CEC faces lawsuits and investigations from 20 different states’ attorneys general regarding recruitment, placement stats and certifications. This is almost identical to what we saw with Education Management with its $103 million settlement.

Education Management now trades for just 7 cents on almost no volume.

Conclusion

For the past two years, CEC was just barely able to remain “financially responsible” (a score of 1.5 or above) in the eyes of the Department of Education. Last year, this was only achieved by CEC stating its intention to sell its Le Cordon Bleu.

However, CEC has consistently demonstrated that it is unable to sell any of its schools. In fact, it has had to pay money just to give the schools away. Not surprisingly, the supposed sale of LCB fell through. This means that over $200 million of expenses will come back into continuing operations, which has a heavy impact on CEC’s Composite Score with the Department of Education.

Losses have continued to mount, while CEC’s cash balance has continued to shrink.

According to the methodology provided by the Department of Education, the failure to sell LCB combined with ongoing deteriorating financial results as of Q3 would now result in a composite score of well below 0.90. In other words, CEC would now be categorized as “not financially responsible” – by a wide margin.

CEC has already been placed on Heightened Cash Management 1 (“HCM1”) status for “administrative reasons.” Because of the “not financially responsible” designation, the Department of Education would now have ample justification to classify CEC as HCM2. If CEC falls into HCM2, it would no longer receive Title IV funds in advance. Instead, it would need to front up to $700 million of cash, which it does not have.

CEC’s cash balance is being rapidly consumed by over $70 million in short term off balance sheet lease obligations (due within the year) as well as over $50 million in cash burn over the past year.

Separately, CEC faces dozens of investigations and lawsuits. The first of these alone was settled for over $10 million. CEC’s new CEO, Todd Nelson, presided over two competitors who paid hundreds of millions in penalties for their actions during his tenure. The regulators are no strangers to the CEO and haven’t been shy about handing down massive penalties.

Appendix Composite Scores for 2013 and 2014

(As per the Department of Education, numbers are rounded to the nearest decimal point).

(Rounded up to 1.50 as per ED guidelines)