Summary

- Revance has soared 50% to all-time highs based on preliminary data from a Phase 2 study, which appeared to indicate that its RT002 was superior to Allergan’s Botox.

- Revance has deliberately shown misleading data and withheld the real information, which would actually be required for FDA approval.

- The CMO quit one day after the data was released and Revance suddenly announced that in Phase 3 it would no longer be comparing to Botox at all.

- For reference, Valeant sold 5 drugs, including competing product Dysport, to Galderma for just $1.4 billion – indicating that Revance is wildly overvalued.

- With no revenues, expect near-term downside of 50% or more.

This article is the opinion of the author. Nothing herein comprises a recommendation to buy or sell any security. The author is short RVNC. The author may choose to transact in securities of one or more companies mentioned within this article within the next 72 hours. The author has relied upon publicly available information gathered from sources, which are believed to be reliable and has included links to various sources of information within this article. However, while the author believes these sources to be reliable, the author provides no guarantee either expressly or implied.

Company stats

Name: Revance Therapeutics (NASDAQ:RVNC)

Product: “Improved” Botox products

Market Cap: $1.1 billion

Avg. Volume: 529,000 shares (approximately $20-25 million/day)

Share price: $36.43

Cash / share: $9.64

LTM revenue: (none. Pre revenue)

Just prior to the recent share price spike, Revance filed an S3 registration statement allowing the sale of 8.4 million shares by restricted major shareholders.

Background

When I first heard about Revance Therapeutics in 2014, I was convinced that it would be a compelling long pick based on its story. Revance is best known for its product in development, RT001, a “topical” botulinum toxin (i.e. Botox) gel, which can be applied directly to the skin with no injections. But the company is also developing an injectable RT002, which is intended to be a longer lasting version of the botulinum toxin injection, hopefully lasting about 2 months longer than Allergan’s Botox.

Upon closer analysis of recent events (and due to the recent share price spike), it has become clear that Revance is in reality a truly compelling short candidate.

Given that the company has zero revenues and its first product is at least 3 years from being on the market (and even that subject to ultimate approval), it is hard to quantify how low the stock could fall. But based on the information below, a drop of 50% or more should be expected.

For reference, Revance went public at $16.00 per share. After hitting $38 in 2014, the stock cratered back to $15.00, when its RT001 failed a Phase 2 study.

The “story concept” of Revance focuses on RT001, which is the topical gel. It is a novel concept, but even the clinical trials for RT001 are suggesting that it could still be largely inferior to traditional Botox. RT001 is currently being studied in a Phase 2 trial for use in hyperhidrosis (excessive sweating), but it is only being tested in a handful of patients to see if it works for a mere 4 weeks.

That is the hope. But it needs to be remembered that traditional Botox works for as long as 9 months. Revance also recently launched a Phase 3 trial for RT001 for “crows feet” wrinkles, but results for that will not be in for at least a year. In these other applications, many are doubtful that it will ever be possible for a large molecule protein to be effectively absorbed through the skin. But again, that is the hope. It should be remembered that Medicis Pharmaceutical (later acquired by Valeant (NYSE:VRX)) had an option to license RT001 for just $94 million (including all milestones but not royalties), but Medicis walked away, apparently deciding that RT001 did not have that much promise. Medicis’ last 10Q can be found here.

The point is that it is ‘not’ the RT001 topical gel concept that has been driving the stock. Instead it is the injectable RT002. It was the presentation in October by Revance management of interim Phase 2 data on RT002 that sent the stock soaring recently.

The whole point of RT002 is that it is intended to be better than traditional injectable Botox. It is hoped to deliver an identical result, but last two months longer. The comparison to Botox is entire point of the Phase 2 “Belmont” study.

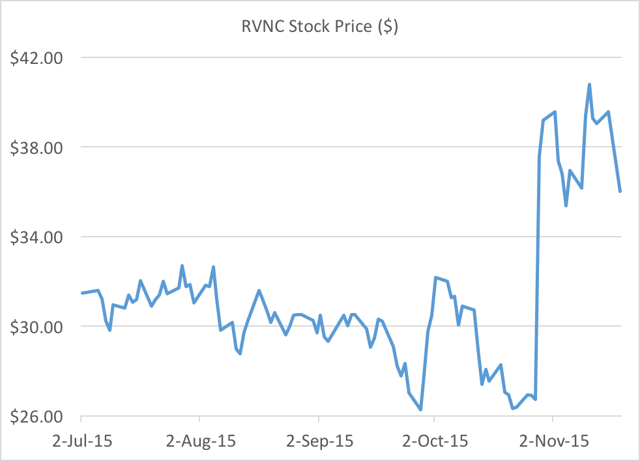

Prior to the release of partial data for its Phase 2 trial on RT002, the stock had been trading at around $26.00. Following management’s presentation of that data (the Belmont study), the stock quickly soared by 50% to over $40.00. The conclusion presented by management was that RT002 was superior to Botox across the board.

This is important for two reasons. First, management has hidden or misrepresented the key data needed to evaluate the prospects for RT002. This is what caused the stock to soar. Second, the valuation for Revance as a company (even if we assume ultimate approval!) now visibly exceeds what it should be worth in the market. This is explained below.

POINT #1: A brief word of common sense

Valuation alone is never a sufficient reason to get short a stock. Overvalued stocks can stay overvalued for a long time. But when gross overvaluation is combined with underlying fundamental problems, it creates the setup for compelling short trades.

This was the case when I wrote about Keryx Biopharm (NASDAQ:KERX) earlier this year. Even though the stock was hitting new lows of $10.00, the stock was still grossly overvalued at $1 billion market cap and had visible underlying fundamental problems. That stock has since fallen to as low as $3.00 and now trades for around $5.00. Downside of 50-70% since I wrote about it.

Not surprisingly, there were no shortage of sell side analysts pitching Keryx as a compelling long trade with massive supposed “upside”. With a high valuation and with minimal revenues, Keryx made an ideal potential client for fee hungry investment banks. The wildly bullish price targets followed accordingly.

Likewise, Revance is already trading at a spectacular valuation but several small investment banks (William Blair, Cowen and Piper) are pounding the table telling us to expect even more upside. With no revenues and no potential products on the market for years to come, Revance is the ultimate investment banking client, so this support should come as no surprise.

But as we will see below (as just as we saw with Keryx), there is likely at least 50% downside in Revance from here.

Here’s the rub.

The market for Botox and its competitors is a $3 billion a year industry. There are currently 4 approved players in this market, all with a highly similar offering. The best known is Botox / Botox Cosmetic which is marketed by Allergan. There is also Myobloc marketed by US World Meds. Then there is Xeomin, marketed by Merz.

Last there is Dysport, which (just like RT002) is intended for cervical dystonia and glabellar lines. Dysport is important because it was sold as part of a package by Valeant to Galderma in 2014. The total package included 5 other marketed drugs (Restylane, Perlane, Emervel, Sculptra and Dysport).

The total purchase price for all of these FDA-approved products to Galderma was just $1.4 billion. Restylane alone had $360 million in global sales in 2013. It was a sizeable drug. So Dysport alone might have accounted for around half of that $1.4 billion value or less. That is around $700 million for an ‘approved’ botulinum toxin treatment ‘already on the market’.

Yet, at current prices, Revance alone (prior to approval of ‘any’ products) is already valued at $1.1 billion.

Even according to its own time line, if everything goes as planned, Revance won’t have any product on the market for at least 3 more years (2018). And of course ultimate approval is not guaranteed.

This alone sets up Revance to be a good valuation short at current prices. Its value already well exceeds what already ‘approved’ competitors have gone for as recently as last year.

But aside from just the valuation there are also more important fundamental points to be made.

POINT #2: What happened to the missing 77 patients?

A cursory read of the Revance Belmont presentation on the Phase 2 results for RT002 appears to be compelling. RT002 appears to be better than Allergan’s Botox across the board.

The problem is that management is misrepresenting the data and playing games with the numbers. Without such game-playing, we have zero indication that RT002 has any benefit over Botox. If that is the case, then the downside in the stock is immense.

First off, in showing efficacy, Revance has withheld 77 patients who were involved in the study. Their results were included in the safety numbers, but then omitted when looking at efficacy.

This can be seen by a closer read of the presentation.

The study was divided into 5 populations. There was a placebo arm, a Botox arm and three arms for different doses of RT002.

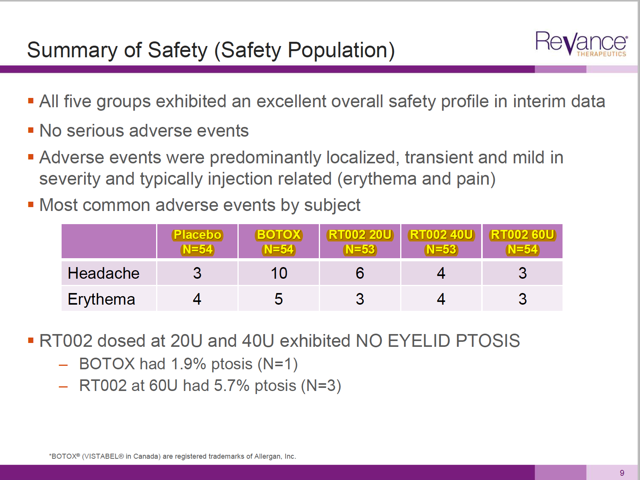

On the slide dealing with safety, management reports results for 268 patients in total, roughly 53-54 in each arm. (See N=53,54 at top row in yellow).

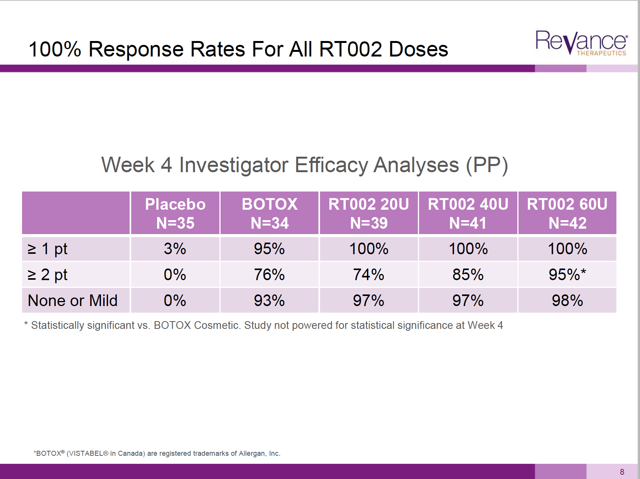

But when we get to the supposedly compelling data on efficacy, there are 77 patients missing from the results. Notice that the N changes down to a range of 34-42 in the top row.

These patients were given the product and had some result (either satisfactory or not). With 29% of the patients missing from the actual data, we have no idea what the actual results are.

But actually the problems get much worse.

POINT #3: Revance has presented misleading efficacy data regarding RT002

In 2014, the FDA put out a document entitled Guidance For Industry: Upper Facial Lines: Developing Botulinum Toxin Drug Products. The document spells out clearly what is required in getting botulinum toxin drugs approved for facial lines.

The improvement in the appearance of wrinkles is scored in points on a 4 point scale. No wrinkles is 0, mild wrinkles is 1, moderate wrinkles is 2 and severe is 3. Most patients would start at a level of 2 or 3. This is a key reason why the FDA demands a two grade improvement. A patient who starts at a grade of 2 and improves to a grade of 1 has sustained an improvement that could also be considered “noise”. That is why the FDA demands a score of 0 or 1 AND a 2 grade improvement.

On line 364 of that FDA document, we can see clearly that:

“Success should be defined as achievement of a score of 0 or 1 AND a two-grade improvement from the baseline, on both the IA and the SSA scales concurrently, to ensure clinical significance. Because it may be possible to move to an adjacent category on the assessment scale with only a small level of improvement, a one-grade change may not represent a clinically meaningful intrasubject change.”

Note from the above that a “one grade change” does not count for significance because it is simply too easy to end up moving to an adjacent category.

We know that Revance would have definitely measured the two grade changes in this study. Yet in its presentation to investors, Revance only included the “one grade” change in the following graph.

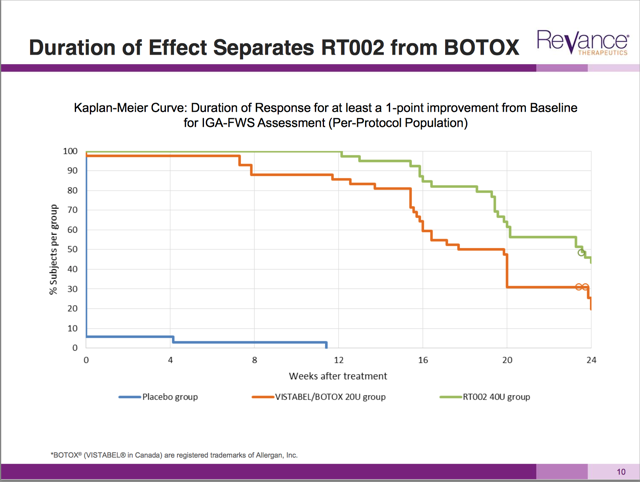

More so than any other slide in this presentation, this graph caused the massive jump in the share price. The graph is basically saying “this is how much better we are than Botox”. This is very important.

The graph shows the duration and the decay in the results of RT002 vs. Botox vs. a placebo. Clearly the placebo had no effect (bottom line). And just as clearly the green line of RT002 is above the orange Botox line at all levels.

Yet this is a graph measuring changes of 1 point or more wrinkle improvement. Basically, (according to the FDA) this data is meaningless differentiation because a 1 point change does not matter for FDA approval.

So to be clear, Revance has shown us data which makes RT002 appear favorable to Botox, but has deliberately withheld the actual data which was measured and which would be evaluated by the FDA.

We can be sure of one thing: if RT002 had shown a meaningful improvement at the 2 point level, it would have certainly been shown as a graph. In fact, on slide 8 of the presentation Revance shows some 2 point changes – but only at 4 weeks, which is less than the time period that Botox is effective.

So the data we have been given is totally irrelevant according to the FDA.

I am quite certain that the people bidding up the stock are not aware of the FDA’s guidelines on wrinkle scoring as it applies to getting FDA approval. If they were, then they would certainly not be bidding up the stock at all based on that graph.

(As we will see below, following the presentation of this “compelling” data, Revance suddenly announced that in Phase 3 it would no longer be comparing RT002 to Botox at all, and instead would be comparing to just a placebo. This should be highly concerning to anyone bidding up the stock).

POINT #4: Missing patient data

Also in the document above, it is clear that the evaluation of wrinkle improvement needs to be based on ‘both’ the assessment of the clinician as well as on the observation of the patient. In other words, measured patient satisfaction is a required criteria for FDA approval. Yet again, this key piece of FDA approval data has been omitted in comparing RT002 to Botox. And again, if the data were favorable, then we can be sure it would have been included.

It is important to note that if Botox and RT002 received even equal patient satisfaction scores, then that would be deemed a failure for RT002 for lack of differentiation vs. Botox. After all, the differentiation vs. Botox is what this study was supposed to be all about.

If Revance had reported patient satisfaction numbers which indicated that RT002 was equal to Botox, then that would be a failed study and the stock would not have budged.

In any event, patient data is key to FDA approval. And that data was omitted the Revance presentation which caused a 50% jump in the stock. As we will see below, the medical review for Allergan’s Botox clearly includes this data.

It should be considered very likely that RT002 and Botox BOTH had very high patient satisfaction scores. In other words, RT002 would likely have been no better than Botox which would have indicated a FAILED study.

POINT #5: Omitting baseline characteristics

A third omission by Revance was the omission of the baseline characteristics of the patient populations. For example, it is well known that men are less responsive to botulinum toxin treatments than women. Age is also an important factor because it determines underlying skin resiliency. Whether a patient has received Botox in the past also matters. Yet we are given no data on the comparative populations. To the extent that there was any skew in the age or the gender between sample groups, then the data become even more meaningless. Including the baseline characteristics is just common sense in any such presentation. The lack of such data should be very noticeable.

We can see this by looking at data on Allergan’s Botox.

POINT #6: Comparing Revance’s data to Allergan’s data

The best way to illustrate how glaring these omissions are is to look at the medical review for Allergan’s Botox.

Even looking at just one single table provides a wealth of information in the Allergan medical review, even as this data was all omitted in Revance’s presentation.

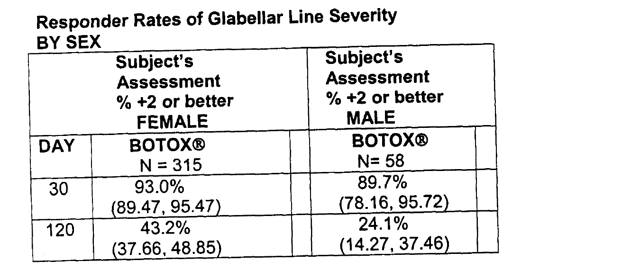

The graphic above was taken from Allergan’s medical review for Botox. There are 3 points to note. First, because the FDA requires SUBJECT (i.e. Patient) assessments (not just the clinician’s) this is obviously a subject assessment table. It is basically a measure of patient satisfaction. Remember that Revance did not provide any subject assessment data.

Second, in contrast to Revance, this table is measuring 2 point moves in wrinkle scores. Again, this is included because this is explicitly what is required by the FDA for approval. Remember that Revance only disclosed data for moves of 1 point or more for data points beyond 4 weeks.

Third, there is a breakdown of results by gender for the 315 women and 58 men.

(And perhaps a fourth point to notice is the considerable difference in efficacy in men vs. women in the data above. That’s why this table is important to include in the first place).

Viewing the information above clearly makes the omissions and misrepresentations from Revance glaring.

If this is not immediately clear, then readers should re-read the section above and then re-read Revance’s Belmont presentation.

POINT #7: Reading “between the lines”

Again, the omissions and misrepresentations should now be seen as entirely glaring. Based on the data provided, there can be very little certainty that RT002 is in fact superior to Botox at all. Even if RT002 were a great product and was equivalent to Botox, this would be a FAILED study because the whole point was to demonstrate superiority to Botox. If this is the case, then the downside in the stock is now immense.

And now we can see that the plot thickens. A lot.

First, just one day after the Revance data was presented, Revance’s Chief Medical Officer (also a co-founder) suddenly quit the firm. In order to entice him to stay on for two more months, the firm then offered him accelerated vesting on his options. This can be found in the subsequent 10Q filing. Readers should ask themselves why the CMO would suddenly quit if RT002 was such a success and with the stock at an all-time high. One does not need to be too cynical to come to the conclusion that the timing of his departure, right after the Belmont presentation, is not a coincidence.

Second, (it gets worse) Revance announced that in its Phase 3 trial, it would no longer be running a comparative study of RT002 vs. Botox at all.

Instead, it would only be comparing vs. a placebo. Now that you can see the gross deficiencies of the data provided by Revance, this development should in fact come as no surprise. Phase 3 trials are much more rigorous that Phase 2 trials and if the ultimate data showed no relative superiority of RT002 vs. Botox, then it would be a major negative for RT002. As a result, Revance has simply opted to decline to compare to Botox in Phase 3 at all.

Third, just one week after the data, the company was quick to issue $126 million worth of stock – even though they had $141 million in the bank already. In March, Revance had disclosed in the 10K that it has ample funds to get through the next year without raising money. The equity offering was completed at $36.00.

To be clear, Revance did not need the money. Instead, they simply took advantage of the all-time high stock price which resulted from the misleading presentation of data. Revance now has around $9 per share in cash (and no revenues). This provides virtually no cushion for the share price.

Each of these factors is a clear indication of what management is trying to hide: the “better Botox” is not what it seems.

The fact that Revance will not be comparing to Botox in Phase 3 is of critical importance for 2 reasons. First, it sheds light on the misrepresentations from the previous presentation. After all, if the data were in fact so compelling in Phase 2, then why not confirm it in Phase 3. But of greater importance is that fact that without a comparative study in Phase 3, Revance will never even be able to market the drug as an improved version of Botox. It basically loses all marketing ability to differentiate itself. And that is the only selling point for RT002. This is of critical importance.

Conclusion

Revance is currently developing two products and is best known for its concept RT001, a Botox-like “gel” which can hopefully be applied topically without needles. But RT001 is not what has been driving the stock higher. Medicis walked away from RT001 suggesting that it may not be the product Revance suggests.

Shares of Revance soared by more than 50% following the release of interim “data” by the company in its Belmont presentation on RT002, the injectable product. The reason for this share price spike is that Revance portrayed its RT002 as being categorically superior to Botox.

But we can see a host of misrepresentations and omissions by Revance that cast massive doubt on this conclusion. The share price should not have budged from $26.00 based on this presentation at all.

Dozens of patients were omitted from the efficacy study. We don’t know which ones or why or what their impact is on the efficacy data.

In convincing investors that RT002 was superior to Botox (via a graph), the company deliberately included wrinkle improvement of 1 point or more, rather than using the 2-point criteria which is required by the FDA. The FDA has already specifically declared that 1-point moves are irrelevant.

Revance would clearly have measured the number of 2-point moves, but they have withheld this data in the only place that it matters. This strongly indicates that the real data is not favorable for RT002.

Also required by the FDA are patient satisfaction scores. And Revance certainly obtained these scores in the study. Yet Revance has also withheld this data from investors. Again, even if the patient satisfaction results between the two arms were merely similar, it would be massively detrimental to Revance’s ability to claim that RT002 is superior to Botox. Being the same is tantamount to a failed study for RT002, because the whole point is to be superior to Botox.

Next, it is glaringly obvious that we have been given no baseline characteristics or demographics for the patient populations. This is of crucial importance in evaluating the data because of the different responses for older vs. younger patients and male vs. female patients.

By contrast, a read of Allergan’s Botox medical review shows that ALL of that information was included (as, of course, it should be).

The fact that the CMO quit his job just one day after this data fiasco should be seen as very telling.

It is also telling that (despite the supposedly compelling superiority of RT002 vs. Botox), Revance announced that it would no longer be comparing RT002 to Botox when it proceeds to Phase 3. This strongly reinforces the idea that RT002 does not really show any meaningful improvement over Botox.

The only question that remains is where should the stock trade once investors come to the conclusion that RT002 is not in fact superior to Botox. The easiest answer would be that the stock should trade back to $26.00, where it was prior to the Belmont presentation. But in fact if RT002 is not superior to Botox, the real level for the stock should be dramatically lower.

Because Revance is not running a comparative study of RT002 vs. Botox in Phase 3, even if the product is approved, the company will have zero ability to market the product as being superior to Allergan’s Botox. This would place the company as another also-ran competitor among 4 other existing marketed competitors. This is a far cry from being the market dominating product.

In any event, from a simple common sense standpoint, we can see from the Valeant sale of already-approved and marketed Dysport for an estimated $700 million, which, even in the best-case scenario, indicates Revance is wildly overvalued at current prices.

Expect downside of 50% or more.