Summary

- ChinaBak recently soared from below $2.50 to $5.00 “news” that LG was entering the China EV market and on subsequent EV subsidy news from China.

- But ChinaBak is not even currently in the EV business and will likely derive zero benefit. Day traders are simply playing a dangerous game of greater fool.

- Creditors recently began seizing the assets of the insolvent ChinaBak and key management has already resigned. The company has been the subject of repeated delisting notices.

- ChinaBak has now lost all revenues and is saddled by over $200 million in near term debts. There is almost nothing left of the company.

- In the past, ChinaBak soared 65% on entirely fake China headlines, only to crash within days.

Note: ChinaBak is a difficult to borrow stock but has liquid calls and puts

Summary

Yesterday, Geoinvesting put out a research piece highlighting significant problems at ChinaBak Battery (NASDAQ:CBAK). ChinaBak had been up by as much as 15% prior to the Geo piece, but then gave up these gains as investors absorbed the information.

I agree with Geo that the stock is likely headed sharply lower once the recent headline hype fades. But I see conditions at the company being far more severe than Geo had articulated.

Shares of ChinaBak have recently soared by as much as 100% due to several battery related headlines out of China. Unfortunately, the insolvent ChinaBak is not even making batteries at present. Its creditors have already seized its last revenue producing assets. That was the main point that Geo had made.

Geo also noted that “book value” on the stock was likely a mere 10 cents per share, and that this was the real worth of the stock now that it is no longer capable of producing anything. This is where my views differ with Geo.

ChinaBak has much larger problems looming and they are more concrete than accounting measures such as book value. Nearly all members of management have already resigned and the company has a deficient board such that it will be subject to its 7th NASDAQ delisting notice.

The only reason for the rise in the ChinaBak Battery is that it has “China” and “Battery” in the name. Headline focused day traders have bought this for a quick pop without even understanding that the company is truly defunct. It is a “zombie stock” which is demonstrably worth zero.

ChinaBak is maxed out on credit and out of cash

The reality is that pinning a number on “book value” or talking about “negative equity” does not really emphasize the fact that this company is truly worth zero. ChinaBak has over $200 million in short term debt and liabilities coming due this year and only around $10 million in cash. It has a mere $1 million available from all credit facilities.

It’s remaining assets, including receivables and inventory are actually worth less than book value because they are impaired.

For example, receivables have been discounted by 25% to account for non-pays while inventory has often been sold at 10-20% below its actual cost. As a result, ChinaBak is actually worth far less than the book value of 10 cents per share because of the asset impairment.

Now that the company has lost its primary assets and is already deeply insolvent, raising new money via an equity offering not possible. This is because ChinaBak’s market cap has now shrunk to such a small size that only a tiny equity raise would be possible. This might delay final seizure by the banks, but it would not prevent it. As a result, no equity investors would be foolish enough to participate in an equity offering for ChinaBak because they know that the new money they are putting in is not enough to save the company from default.

Despite all of this, posters on message boards falsely claim that somehow the Chinese government may actually back this company. This is wrong.

Background

The last time I wrote about ChinaBak Battery was last year. A headline crossed the tape saying that ChinaBak (an insolvent former maker of batteries in China) would be supplying batteries to Kandi Technologies (NASDAQ:KNDI), a maker of small electric vehicles in China.

On the back of this “news”, shares of ChinaBak soared by as much as 65% in a single day on millions of shares in volume. But the headline proved to be entirely false. It was 100% inaccurate.

As I wrote about this epic mistake, the stock quickly gave back 100% of its recent gains, and ultimately traded back down to around $1.00.

Street Insider quickly noted that “China BAK (CBAK) Crashes as Rumor Debunked”

I knew that the Kandi headline was false from the very beginning, but I also called the company just to be complete. In fact, that insolvent ChinaBak had nothing to do with the purported EV maker was clearly no surprise at all. This is because ChinaBak was never capable of making this type of batteries in the first place.

Investors who saw the stock quickly crash by 50% learned a very painful lesson about “buy on the rumor, sell on the news”.

But we are now seeing the same phenomenon once again.

On July 2nd, shares of ChinaBak again shot up as much as 100%, also on millions of shares in volume. The stock had previously been trading at around $2.50 in minimal volume.

According to Reuters, LG Chemical plans to invest hundreds of millions of dollars to build an electric car factory in China. The investment will not even be complete until 6 years from now, by 2020. By this time, insolvent ChinaBak will have been long since foreclosed upon. ChinaBak has already received at least 6 delisting notices from the NASDAQ – and this was BEFORE the banks began seizing assets.

Yet that simple piece of unrelated news was all it took to send ChinaBak exploding up to a level of $5.00. But now the stock has already retreated to $4 – already down by more than 25% from the recent high. Recent news regarding battery subsidies in China has also kept ChinaBak elevated, even though ChinaBak does not stand to benefit in any way.

Investors have seen this routine before. If history is any guide, ChinaBak will quickly fall back to below $2.00 and the light volume will resume once again.

As with the Kandi “news”, the LG announcement has nothing to do with ChinaBak. The company did start construction on a factory in Dalian which it hopes will eventually make batteries for electric cars, but this is still just in the planning stages.

While investors focused on the irrelevant LG headline, they clearly missed the 8K (notably, without a press release) filed by ChinaBak noting that creditors had now seized all of the company’s remaining revenue producing assets. All the company has left is the hoped for project in Dalian which is not yet even complete.

The report from Geoinvesting served to calm down the enthusiasm for the stock. But since it was released late in the day, its effects on the share price were limited.

The only benefit to ChinaBak from the asset seizure is the elimination of $86 million in debt. But with over $200 million in liabilities still remain – well in excess of all remaining assets at ChinaBak.

A FlyOnTheWall headline had described this seizure (as per the 8K) as a “sale” rather than a seizure, which may have furthered the confusion. What is meant by “sale” is that the party which seized the assets from ChinaBak has now sold those assets because of the bank default by ChinaBak. The assets are now truly gone for good.

So how bad is the situation at ChinaBak ?

ChinaBak is deeply insolvent. As of right now, ChinaBak is not doing business with anyone, much less LG or Kandi. The only reason that ChinaBak soars on these types of headlines is because it has both “China” and “Battery” in its name.

The creditors have begun seizing ChinaBak’s last assets. Every member of management has now resigned, with almost all roles being filled simultaneously by the CEO. The company has been the subject of 7 NASDAQ delisting notices due to board member resignations. The company has then appointed new stop-gap board members just to avoid delisting. But this isclearly not enough to rectify the deep negative equity that ChinaBak has due to its minimal assets and massive liabilities. The last remaining sales continue to dwindle (down 25%) and in several recent quarters the products which ChinaBak is selling consists of inventory being liquidated at below cost. The only way for ChinaBak to sell above cost has been to sell dramatically less product.

Were it not for a reverse stock split, the stock price would currently be quoted as a penny stock instead of at $4. The split was also necessary to prevent an outright delisting by the NASDAQ.

Timeline to insolvency

In January 2014, ChinaBak borrowed $86 million from Mr. Jinghui Wang in order to repay overdue bank loans. Note that even this stop gap measure was not nearly enough to cover over $300 million in current liabilities due within 12 months. ChinaBak had less than $10 million in available cash and about $1 million available in credit facilities with which to pay this $300 million. Even after the loan from Wang, ChinaBak was still short by more than $200 million in near term liabilities.

In less than 60 days (March 2014), ChinaBak had already defaulted on the loans

In March, the company had announced that it was working again on a restructuring with Wang. Clearly, ChinaBak tried to fight the seizure and failed.

As a result, by June, Mr. Wang had already closed on and sold the assets which had been pledged as collateral by ChinaBak. These assets consisted of basically the entirety of ChinaBak remaining revenue producing assets.

The 8K announcing the seizure of the assets was not accompanied by a press release and it was put out on July 3rd…1 day AFTER the stock soared due to the LG news.

So how much did ChinaBak lose in this seizure ?

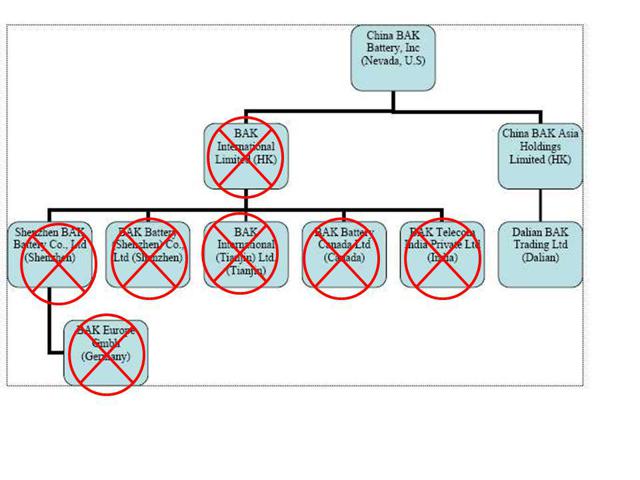

The table below shows which individual subsidiaries were seized by creditors.

The only thing left for ChinaBak (and its US shareholders) are the remaining assets in Dalian which consists of a factory that is still under construction. There is a reason why Mr. Wang did not even demand these assets as part of the collateral. They are not overly useful to anyone at present.

After the seizure, what is left ?

Following the seizure of assets, ChinaBak still has over $200 million in liabilities coming due this year, but now has zero revenues and nearly no assets offsetting the debt.

With the situation being so dire, it is not surprising that management and board resignations have been the norm. Last year, the CFO, treasurer, secretary and CTO all resigned. This left the CEO to take on all of those roles at the same time.

Mr. Huanyu Mao was appointed to the role of CTO in January, but had already resigned by April.

The result of the resignations is that ChinaBak no longer has effective internal controls for accounting purposes because it lacks people to even balance the books. But now that the company is no longer manufacturing anything for sale, accounting will certainly be less important.

In addition, the members of the board have also been quick to resign, resulting in the 6 delisting notices from the NASDAQ. Mr. Mao was also a board member, such that ChinaBak now has an incomplete board of directors and will once again be subject to delisting for this reason alone.

Last year, following two board resignations, the head of the audit committee tried to appoint her adopted son (different last name) to a board post in order to stave off the delisting. The NASDAQ wouldn’t permit this, so the son was forced to resign. Next, the audit head appointed one of her colleagues (a business teacher from a college in Texas with no board experience) to the role.

This all became a moot point, because that audit head soon quit the role herself. The company then re-approached the son to again take the role. He then resigned in October.

It has simply been a game of musical chairs with management and board members as the company seeks to delay a delisting.

The point is that ChinaBak cannot keep any board or management seats filled because it is basically in the process of shutting down on an involuntary basis. The resignations tell us this.

In reality, none of this should come as a surprise. ChinaBak’s performance over the past few years has basically told us that this is what was coming.

In 2012, the company was still selling its products at slightly above cost, even as it was losing tens of millions of dollars at the bottom line. But by 2013, the company was liquidating inventory at below cost, magnifying these losses even more. Recent quarters have seen sales of products at slightly above cost, but only due to the dramatically lower level of sales. Again, the losses have continued since 2008.

So who is buying ChinaBak ?

Some people will simply trade headlines even when the underlying fundamentals are non existent. Those who get out quickly enough can even make money doing this. But those who hold shares for more than a day or two can quickly see their money evaporate when the stock quickly collapses.

The company itself has already warned us that the end is likely near. The following disclosure comes from the most recent 10Q which was put out before the asset seizure. (The proceeds of the Wang loan were used to repay Bank of China).

We have net liabilities, a working capital deficiency, accumulated deficit from recurring net losses incurred for the current and prior years and significant short-term debt obligations maturing in less than one year as of March 31, 2014. We have been suffering severe cash flow deficiencies. Because we defaulted on repayment of loans from Bank of China in August 2013, we are experiencing and, we believe, will continue to experience significant difficulties to renew our credit facilities or refinance loans from banks. Upon request of Bank of China, Shenzhen Municipal Intermediate Court ordered a freeze of all of our properties in Shenzhen BAK Industrial Park and Tianjin Industrial Park Zone near the end of fiscal year 2013. We repaid our defaulted loans from Bank of China on January 9, 2014 and our frozen properties were released by the court on January 13, 2014. In order to extend the bank loans to various dates to March 2015, we were required to pledge our assets in Shenzhen, including land use rights and property rights, equipment and inventories. As of March 31, 2014, we had access to $67.1 million in short-term credit facilities and $25.8 million in other lines of credit, almost all of which were utilized to the extent of short-term bank loans of $65.3 million and bills payable of $25.8 million, leaving only $1.8 million of short-term funds available under our credit facilities for additional cash needs. These factors raise substantial doubts about our ability to continue as a going concern.

Conclusion

ChinaBak has not made a profit since 2008. It has survived by pledging all of its assets so that it can borrow cash to stay afloat. But now the creditors have begun seizing the assets and are not lending any more money. The company is simply shuffling between defaults to different counter parties.

The company’s sales have plunged and what remains of inventory is often being liquidated at below cost. Even after the recent asset seizure, the company still has over $200 million current liabilities coming due this year and only around $10 million of available cash with which to pay. The company now has minimal fixed assets while inventory and receivables are both deeply impaired.

Of greatest importance, the company now has no revenue producing assets such that a) it cannot generate cash and b) it now cannot borrow against those assets.

The recent spike in the share price of ChinaBak (following news of LG in China) is just what we saw last year when it spiked on “news” of supplying Kandi Technologies. It is incorrect “news” for ChinaBak and it will quickly be reflected in the share price.

Predicting the timing of the delisting will be difficult. But it is easy to see that as traders once again trade out, we should quickly see the stock at back below $2.00.

The big question that people often ask is: with all of these problems, who in their right mind would hold CBAK ?

The answer is that day traders who play charts and headlines can often flip the stock for a quick profit. But these are the types of investors who clearly don’t care what it is they own, they only care which direction it is moving for the moment. Such investors are just as likely to short ChinaBak on the way down, again without even knowing anything about the underlying (lack of) fundamentals. It is a pure momentum trade, and for now the momentum is down.

This article is the opinion of the author. Nothing herein comprises a recommendation to buy or sell any security. The author is short CBAK. The author may choose to transact in securities of one or more companies mentioned within this article within the next 72 hours.