Summary

- Straight Path holds wireless spectrum and patent troll assets. The stock is up by 100% in the past month, and is held overwhelmingly by retail investors.

- Announcements that it was suing Apple, Verizon and others sent the stock soaring. But past awards to STRP have been consistently at just $1-$2 million from other giants.

- Straight Path’s patents begin to expire next year, and two weeks ago (AFTER the Apple/Verizon announcement), elements of the first one were invalidated by the USPTO as “unpatentable”.

- Straight Path’s wireless spectrum assets are in the millimeter bands, and are years away from commercialization, if at all. There is currently no logical reason to bid up the stock.

- Yet, retail investors have bid up the stock by 100% due to a simple FCC blog post requesting comments on mm spectrum. Straight Path is likely to fall 50%.

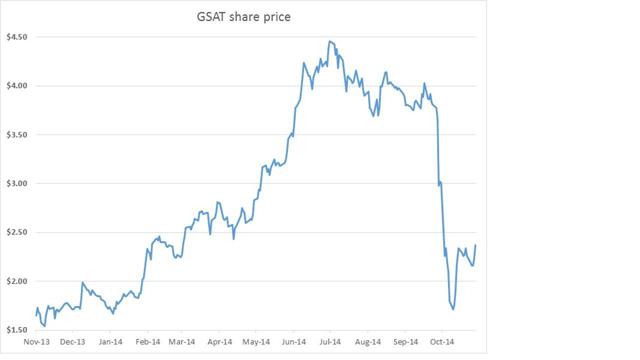

The recent travails of Globalstar Inc. (NYSEMKT:GSAT) serve well to illustrate how retail-oriented stock promotions can achieve wildly overvalued share prices, until they are found out and come crashing back to earth. Prior to a report from Kerrisdale Capital, Globalstar had been trading at almost $4.00. Following a lengthy exposé on the true value proposition at the company, Globalstar fell to as low as $1.56, a max decline of well over 50% within 2 weeks. It has now rebounded slightly. Institutional ownership stands very low at just 35%, and there is minimal institutional research on the name. It is overwhelmingly a retail investor stock play, which explains how the stock ended up trading up to such unjustifiable levels (and why the crash was so severe).

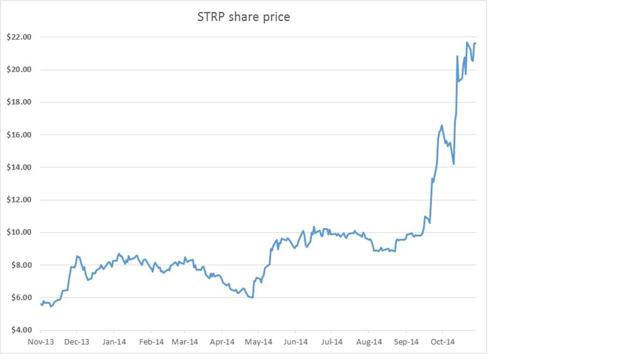

The company I am focused on today is Straight Path Communications (NYSEMKT:STRP), whose share price is up by around 100% in the past month, solely due to a handful of misunderstood headlines regarding its wireless spectrum and its small portfolio of patent troll assets. Once investors grasp the underlying reality, Straight Path is likely to give up most of these recent gains and should fall by around 50%, back to where it was a few weeks ago. In April, Straight Path had traded as low as $6.00. It is currently trading north of $20.00.

Straight Path currently has a market cap of $250 million. Despite the rise in the share price, there is virtually no short interest in the name, at just 2% of shares outstanding and only 1 day’s trading volume. As far as I can see, there are at least 1 million shares available to borrow at brokers such as IB.

Also, like Globalstar, institutional investment is very, very low at just 26%. There is no institutional research coverage for Straight Path. Please note that Straight Path has a July 31 year-end, such that it just released its Annual Report for fiscal 2014 (which ended in July), and the company is now in fiscal 2015.

In short, Straight Path soared because it announced in September that it was filing patent claims against Apple, Avaya, Cisco, and Verizon. Retail investors are envisioning massive settlements with hundreds of millions, simply based on the size and scope of the giant targets.

But the reality is that Straight Path has already filed and/or won 12 similar suits against very similar defendants, including some of the largest giants in the tech space, such as BlackBerry, Netflix, Vonage, Sony, Toshiba, LG, Samsung, Skype and eBay. Despite the dozen wins, Straight Path has only brought in a total of $18 million, or around $1.5 million each.

In fact, the most recent 4 wins (against BlackBerry, Netflix, Vonage and ZTE) only brought in an average of $600,000 each. At these levels, these suits can only be described as “nuisance suits”.

In addition, although announcing these wins for the full size, Straight Path has only recognized $4.4 million as revenue in 2014, because the remaining amounts are deemed too uncertain to be collected. Yet, the sunk legal costs of these wins already exceeds $8 million. So far, Straight Path has only recognized $2 million of these costs.

But wait, it gets better. The patents that Straight Path is asserting actually start to expire in 2015 – just next year – making the ultimate future of this business very limited.

But wait, the best is yet to come.

On October 9th (three weeks after the announcements of launching the Apple/Verizon suits), the USPTO ruled that various parts of the Straight Path’s primary core patent (the ‘704 patent), were “unpatentable”.

As a result, it may now be impossible to even collect on the suits that are in process.

No 8K was filed at the time announcing this development. Instead, it was simply buried in the recent annual 10K filing.

A back and forth legal battle has begun over this patent, and Straight Path has noted its intention to appeal.

A second reason for the spike in the share price was an announcement from the FCC which simply stated that it was asking for comments in a Notice of Inquiry on the potential use of spectrum bands above 24 GHz for use in mobile communications. This could one day potentially include the spectrum assets (28GHz and 29 GHz) owned by Straight Path. But even the company itself discloses that any progress on this is likely to be years away, if ever.

In fact, the spectrum assets (which have been owned by Straight Path/IDT since 2001) are already being utilized by customers, including AT&T, TelePacific Communications and UNSI.

So what is it bringing in for revenues?

For all of 2014, total revenues from spectrum amounted to just $424,000 in 2014 and $525,000 in 2013. And (as shown below) that is the level we should probably expect for at least the next 5 years.

But again, as with Globalstar, a small group of retail investors has somehow come to the conclusion that they alone have figured out that Straight Path is sitting on a spectrum goldmine. As we will see below, this is demonstrably not the case.

Background of Straight Path and IDT Corp.

Straight Path was spun out of its parent company IDT Corp. (NYSE:IDT) in 2013. IDT is best known for its legacy as a provider of discount calling cards for making international calls. As competition from free or ultra-cheap international calling services (such as Skype, magicJack and Vonage) has increased, this business has become nearly profitless, and IDT reached out into a wide range of get-rich-quick schemes in a variety of areas, including investment in shale oil, hedge funds, real estate, consumer debt collection, broadcasting and even comic books. This also includes Straight Path.

The spectrum assets which are now part of Straight Path were first acquired by IDT for $55 million in 2001 from the bankrupt Winstar Communications. Winstar had spent hundreds of millions on that same spectrum, before going bankrupt with it. IDT then spent hundreds of millions of dollars itself, trying to build out these assets. It then abandoned these efforts, before spinning off the assets to shareholders in the form of Straight Path.

IDT has largely been run as a family fiefdom for and by the relatives of CEO Howard Jonas. Mr. Jonas appointed his son Shmuel (aka “Samuel”) Jonas as the COO of IDT at the age of 25. Shmuel’s previous experience was as an apartment manager in the Bronx and as an operator of a frozen dessert delivery business. Mr. Jonas also appointed his other son, Davidi (aka “David”) Jonas, as CEO of Straight Path. Davidi’s former experience was that of a Rabbi in the Bronx and a high school teacher of Judaic studies. Davidi was 26 years old, and has been employed by IDT / Spectrum since 2012. IDT’s General Counsel (responsible for approving its large corporate transactions and spin-offs) happens to be Mr. Jonas’ sister, Joyce Mason. IDT obtained its insurance policies from IGM Insurance Brokerage, owned by Mr. Jonas’ father, his mother and his brother-in-law (Jonathon Mason). Mr. Jonas also appointed his son-in-law (Michael Stein) as vice-president of Corporate Development.

The point is that because of these relationships, it is easy to approve these get-rich-quick ventures which are notably value-destructive and unfriendly to shareholders. As featured in Crain’s New York Business, these diversions into high-risk, speculative (and totally unrelated) ventures such as Straight Path have now cost IDT shareholders over $1 billion in destroyed value.

As noted by Crain’s,

“IDT’s Howard Jonas has a million ideas. He’s lost $1 billion. Read about his latest scheme.”

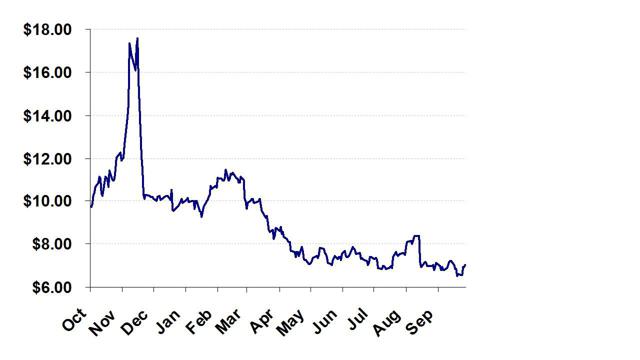

Each time the new ventures fail to produce results, IDT typically spins them off to shareholders, as it did with its failed energy project, Genie Energy (NYSE:GNE). Genie is a shale oil play which was acquired by IDT at the peak of the shale boom, and then was later spun off to IDT investors in 2011. The share price of Genie has fallen from $9.00 in 2011 down to $7.00 at present, although (like Straight Path) it did see a brief spike in 2013 to almost $18.00, before falling by more than 50% to current levels.

As we saw with Genie, we are currently seeing a similar spike in Straight Path, which should correct quickly back to its original level of $10.00 or so.

Genie Share Price

The typical modus operandi for the IDT spin-offs is for the Jonas family to take additional management and board positions in the new company, paying themselves handsomely. At Genie, Howard Jonas (CEO of IDT) also became the new CEO and chairman, paying himself handsomely for the role, despite the fact that the share price has faltered and Genie continues to lose money.

At Straight Path, Mr. Jonas appointed his 26-year old son, Davidi Jonas, as CEO, and has already awarded him over $1 million in compensation. As mentioned before, Davidi had previously worked for his father at IDT for almost 2 years, but prior to that, his only work experience was as a high school teacher of Judaic studies and as a Rabbi. Again, that is the CEO of Straight Path.

Straight Path currently has only 6 employees and operates out of a space in Glenn Allen, Virginia, which it rents for just $575 per month. A separate office in New Jersey is rented for $733 per month.

What caused the share price of Straight Path to double?

Back in early September, Straight Path was trading at just $9-$10 on very low volume. But a series of announcements from the company has sent the stock doubling since then, recently hitting an all-time high of $22.00.

Straight Path has two business segments. One is in wireless spectrum assets, and the other is in enforcing patents (i.e. patent trolling) with a small portfolio of IP assets. The recent announcements pertained to both segments.

In each case, the announcements have been largely misinterpreted by the overwhelmingly retail investor base, such that the share price should be expected to return to around $9-$10 when investors realize the facts.

PART I: The real prospects for the patent portfolio?

The first catalyst for the spike in Straight Path was an announcement that on September 24th the company had filed patent infringement complaints against Apple (NASDAQ:AAPL), Avaya Inc. and Cisco Systems (NASDAQ:CSCO). On September 26th, the company then filed against Verizon Communications (NYSE:VZ).

Clearly, this is something that could have multi-billion dollar potential, right? Wrong.

We can actually get very close to determining the value of these suits. Based on past facts, it is highly likely that Straight Path will, in fact prevail, in these suits. The company has already filed similar suits against other tech mega giants, including Sony, Toshiba, BlackBerry, LG, Samsung, Skype, eBay and others. More importantly, it has already been winning these suits.

But the key point here is that while Straight Path has indeed won these infringement suits, the amounts that it has won have been tiny. They have also been very consistent in their size.

As I will show below, there are a wide variety of issues facing Straight Path and its patent troll prospects. What it all boils down to is that the revenue prospects are very much limited. Yet, by bidding up the stock by 100%, retail investors are clearly assuming that there must be truly massive revenue potential ahead. This is wrong.

There is precisely zero chance of Straight Path winning even $10 million off of any one of these suits. In fact, the real number is most likely less than $1 million each.

Problem #1: The amounts won are demonstrably very small

For the year ended July 31, 2014, Straight Path won 8 of these suits against the tech mega giants, for a total of $15.8 million, which amounts to around $2 million each.

In the subsequent few months, Straight Path prevailed in 4 more suits, bringing in $2.4 million more. For this second part, we are now talking about just $600,000 each for the suits against the giants BlackBerry, Netflix, Vonage and ZTE.

Again, it should be kept in mind that these tiny awards have been in suits against the largest giants in the tech industry, which have combined revenues in the hundreds of billions. These are basically just “nuisance lawsuits” designed to pull in around $1 million each, and the giants can just pay to make them go away.

The point is that even if we can expect Straight Path to win in the suits against Apple, Avaya, Cisco and Verizon, the amounts will likely be in the range of $1-$2 million each (at most). So, at most we are talking about perhaps $6-$8 million. At the low end of the range ($600,000 each), we would be talking about less than $3 million in total.

Clearly, even in the best-case scenario, this doesn’t merit the stock price doubling in a few weeks, adding over $100 million in market cap. Instead, it was just excessive and misplaced retail enthusiasm due to the headlines about suing Apple and Verizon. There is no chance of a massive settlement for Straight Path.

Problem #2: Running out of new parties to sue

Relative to the other problems, this one is relatively minor. But it should become fairly obvious to readers.

So far, Straight Path has filed suits against around 15 parties, which includes the following:

- Skype

- eBay

- Bandwith.com

- BlackBerry

- Sony

- LG

- Samsung

- Toshiba

- Vocalocity

- Amtran

- Huawei

- ZTE

- Vonage

- Verizon

The problem now is that Straight Path will quickly run out of new parties of adequate size to sue. There are a limited number of giant targets in this size range, and Straight Path has now hit most of the low-hanging fruit. Only a few other names (such as perhaps Hewlett-Packard) quickly come to mind. Straight Path will no doubt broaden its target list. But at most, the company might be able to find another 20 parties to sue. As the parties get smaller and smaller, the likely awards will also get smaller. So we can assume that future revenues from patent trolling may be somewhere in the range of perhaps $20-$40 million at most, and perhaps even less than $10 million as the award sizes shrink. This would include any proceeds that we should expect from Apple and Verizon.

But as we will see below, looking at gross proceeds ignores the cost of litigation, which can be in excess of 40%. It also ignores the fact that much of the awards are “contingent”, and collection is not even reasonably assured. So in reality, the likely best-case scenario is now a future benefit to Straight Path of less than $20 million.

Problem #3: What are the REAL revenues? What are the COSTS associated?

Clearly, the headline numbers look great. In a short period of time, Straight Path appears to have pulled in over $18 million in patent troll wins. But this is not the case. In fact, for the full year of FY 2014 (ended July 31), Straight Path only recognized $4 million in revenue from these suits. The total wins as of that time were already over $16 million. One problem is that portions of the amounts are too uncertain in terms of collectability to declare as revenue. It is not as simple as “win $16 million and collect $16 million”.

Meanwhile, the costs associated with these wins are very concrete and represent money already spent. These costs already exceed $8 million spent for just $4 million in recognized revenues. But Straight Path has so far only recognized $2 million of the costs.

As a result, the real benefit (in terms of profit) to Straight Path has so far been just around $2 million from all 12 suits.

Problem #4: Straight Path’s patents begin to expire in 2015 (next year!)

Here, we can see that the problems start to become more serious and structural.

Retail investors have gotten very excited about Straight Path’s patent troll prospects, but not just because of the recent wins. These wins (a total of $18 million in revenues, only $4 million of which was recognized) are clearly too small to justify a doubling of the share price and an extra $100 million in market cap.

Instead, these wins are being taken as an indicator that bigger and better wins are set to come and the Straight Path can truly make a sustainable business out of suing tech giants. Unfortunately, that party is set to end much quicker than many retail investors understand.

The reality is that the key patents begin to expire next year, such that there is truly no sustainability to the patent troll revenue stream.

This is why Straight Path was in such a rush to begin filing suits as soon as the spin-off was completed, and why it continues to rush to hit the biggest names in the industry (such as Apple) as fast as it can.

Problem #5: As of October, elements of Straight Path’s core ‘704 patent were found to be “unpatentable”. Is it game over?

Back in April of 2013, Straight Path was already suing Sipnet EU, a Czech technology company, for infringing Straight Path’s core ‘704 patent. Sipnet filed with the US patent office for a Inter Partes review with the goal of demonstrating the claims within the patent are in fact “unpatentable”. Straight Path fought this hard in 2013, but just two weeks ago, on October 9th, the USPTO issued an administrative decision that most of the ‘704 patent is in fact “unpatentable”.

Despite the magnitude of this decision, Straight Path did not put out an 8K at the time to disclose it to investors. Instead, it was simply buried within the recently released 10K (page 15) that:

During the pendency of an inter partes review, or related appeal, any litigation related to the patents in review could potentially be subject to an order to stay the litigation while the review proceeds. Therefore, while a review is pending, we may be unable to enforce our patents.

This all happened after the announcements about suing Apple and Verizon sent the stock soaring. Yet, it may now be the case that Straight Path cannot even attempt to enforce ANY of the pending suits.

As shown in the final decision from the USPTO:

The Board has jurisdiction under 35 U.S.C. § 6(c). This final written decision is issued pursuant to 35 U.S.C. § 318(a) and 37 C.F.R. § 42.73. For the reasons discussed below, we determine that Petitioner has shown by a preponderance of the evidence that claims 1-7 and 32-42 of the ʼ704 patent are unpatentable.

Yesterday, an 8K was filed noting that the action had been stayed (as expected from the disclosure above), and that Straight Path has again said it intends to appeal.

The point of all of these problems is that investors have massively overestimated that revenue potential from Straight Path’s very limited patent portfolio. In doing so, they have bid up the stock price by as much as 100%, adding $100 million in market cap. The fact is that the realized benefit to Straight Path has only been a few million dollars.

Future benefits are certain to be very limited, due to the expiring patents and the fact that elements of the core ‘704 patent have now been found to be “unpatentable”.

PART II: What about with wireless spectrum?

The fantasy of winning riches from the wireless spectrum game is now turning into a classic value trap for retail investors. We saw it with the rise (and then plunge) in Globalstar, and we are now seeing it again with Straight Path.

This is not much different than what we saw with the boom and bust in marijuana stocks earlier this year, and what we have seen with Ebola stocks in recent weeks.

As with Globalstar, Straight Path is overwhelmingly held by retail investors, and lacks any meaningful institutional analyst coverage. In both cases, retail investors should ask themselves why both buy-side and sell-side institutions are shunning these companies as investment ideas. After all, if there were even modest prospects for large upside, institutions would be flocking to these stocks in droves. But they are not.

Prior to the spin-off of Straight Path, parent company IDT had acquired the spectrum assets from Winstar out of bankruptcy in 2001. IDT had paid $55 million for these assets. Winstar had spent hundreds of millions of these assets, and went bankrupt in the process.

The logic of this particular scheme was that paying $55 million for something that had recently been “worth” several hundred million must be a good deal. The problem was that just because these assets had “cost” several hundred million didn’t mean that they were “worth” anything at all.

IDT then spent as much as $300 million trying to effect its own build-out on these assets. But when this failed, the company simply spun off Straight Path as a separate entity to IDT shareholders. This is the same model that IDT has used for multiple other failed business ventures, including Genie Energy.

So far, the spectrum assets have proven to be of limited use. Total revenues from spectrum for the past 2 years have amounted to just $424,000 and $525,000.

But the hope is that the FCC will one day approve the very specific frequencies held by Straight Path for use in mobile communication networks. At that time, the value of these spectrum holdings would soar dramatically.

The FCC recently put out a Notice of Inquiry, which I would strongly encourage people to read.

What it comes down to is this:

The FCC is now simply asking for comments about the implications of opening up the higher frequencies (above 24 GHz, known as the “millimeter frequencies”) for use in mobile communications, in order to facilitate the eventual development of higher-capacity “5G” digital networks. The bull case is that one day, this could potentially include the 28 GHz and 39 GHz frequencies where Straight Path has licenses.

The first point should be obvious. This is simply a “Notice of Inquiry”, where the FCC is seeking a wide range of comments on technical and practical implications of opening the millimeter frequencies. The FCC is simply asking questions, not by any means delivering policy. As can be seen from the link above, the length and scope of the questions mean that this is a multi-year discovery process.

The document runs 38 pages long, and concludes with:

The beauty of today’s Notice of Inquiry is that no one in this room knows where it will eventually take us. Which spectrum bands above 24 GHz can be effectively used in the short term, over the long term ? Will the technologies be mobile or fixed, unlicensed or licensed ? What equipment will be necessary to utilize these bands ? Only research and time will tell.

Investors in Straight Path should pay particular attention to the reference to the use of unlicensed spectrum, which would end up making the millimeter bands held by Straight Path largely worthless.

In fact, it is quite clear that the FCC is evaluating a broad range of alternatives for freeing up spectrum, most of which would have no benefit to Straight Path.

The second point is that there are a number of potential choices above 24 GHz. For Straight Path, it is clear that it is banking on the 39 GHz far more than on the 28 GHz (LMDS). The company discloses that:

In the previous two quarters we have worked with a radio vendor that has developed a next-generation PMP radio that operates in the LMDS (A1) frequency. We have already entered into Spectrum leases as a result, and we expect the adoption of PMP to increase due to the cost effectiveness and flexibility to scale due to wide coverage area sectors.

We expect to work with this and/or other radio vendors to develop a similar offering in the 39 GHz frequency, where our Spectrum holdings are far greater. The development of such a radio will take time, and in the interim we are using our LMDS holdings to demonstrate the proof of concept with the intent of offering a similar capability in 39 GHz when it is available.

Keep in mind that the “Spectrum leases” which are referred to above are what was responsible for less than $1 million in revenues in the past two years combined.

The third point is that the advent of 5G networks is expected to happen by around the year 2020 or later. This is a widespread industry forecast, as can be found by simply running a Google search on “5G 2020”. In other words, we are still 6 years away from even the potential for the widespread use of ANYmillimeter spectrum in 5G networks. And again, there is certainly no guarantee that it will be the 39 GHz that Straight Path made its bet on 13 years ago. Yet, the stock has already doubled in just a few weeks, and now sports a market cap of over $250 million.

The objective of using millimeter spectrum is to build out backhaul networks for cell phone voice and data connectivity. The envisioned solution is that small antennae would be placed close to ground level in high-traffic areas to connect those areas to the fiber optic network of the carrier. The key limitation is that these millimeter frequencies typically cannot penetrate intermediate objects, such that they must be used in areas which are limited to “line of sight”. However, there are currently efforts being made to attempt to mitigate this limitation. These are all part of the issues that the FCC is reviewing to determine spectrum policy for 5G by 2020.

Conclusion

Shares of Straight Path have doubled in the past month, simply due to extreme hype by the retail investor base over several press releases and 8Ks in late September. The news has been interpreted by the retail investors to mean that Straight Path is on the verge of winning mega patent troll suits against such giants as Apple and Verizon. The hype has also been driven by a simple blog post from the FCC, requesting comments on the potential use of millimeter frequencies for cell phone backhaul networks.

The reality is that Straight Path has already demonstrated the full commercial potential of its patent troll portfolio. Its wins from tech giants such as BlackBerry have recently fallen to an average of just $600,000 per suit, and that is without taking the 40% cost of litigation into account. In addition, the patents begin to expire next year, greatly limiting the potential for future suits. Most importantly, the USPTO has already begun invalidating parts of Straight Path’s core ‘704 patent as being “unpatentable”. As a result, Straight Path may now be unable to enforce even the pending suits.

In wireless spectrum, Straight Path owns licenses in two bands, the LDMS and the 39GHz bands. The FCC has only just to evaluate the use of any millimeter frequencies, and is now only requesting comment in advance of expected 5G rollouts in 2020. There are a wide range of alternatives for building backhaul networks, including the use of unlicensed spectrum. However, a blog post by the FCC asking for comments on the use of millimeter frequencies has also been the reason for the quick doubling of the share price in just a few weeks. The lengthy regulatory process and key limitations of the millimeter frequencies mean that any revenue potential from these licenses could be 5-6 years away. In the meantime, these assets generate just a few hundred thousand dollars per year.

The “news” which has caused Straight Path to double was hardly news at all. The doubling was more the result of retail hype and a lack of institutional ownership and lack of research coverage.

We have seen similar irrational price surges and crashes in other retail heavy names which can trade up solely on misplaced hype and sentiment.

As a result, the share price should be expected to return back to $10.00, from where it began just a few weeks ago.

Disclosure: The author is short STRP, GSAT.

The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The author was previously an investment banker for a major global investment bank and was engaged in investment banking transactions with a variety of technology companies. The author has not been engaged in any investment banking transactions with US listed companies during the past 5 years. The author is not a registered financial advisor and does not purport to provide investment advice regarding decisions to buy, sell or hold any security. The author currently holds a short interest in GSAT and STRP and has provided fundamental and/or technical research to investors who hold a short position. The author may choose to transact in securities of one or more companies mentioned within this article within the next 72 hours. Before making any decision to buy, sell or hold any security mentioned in this article, investors should consult with their financial adviser. The author has relied upon publicly available information gathered from sources, which are believed to be reliable and has included links to various sources of information within this article. However, while the author believes these sources to be reliable, the author provides no guarantee either expressly or implied.