Summary

- Even after a recent drop, Globalstar is still up 7x from its 2013 lows. Yet the financials have deteriorated to the point of functional insolvency.

- Globalstar has all the elements of promotion: mostly retail investor base, lack of top 20 research coverage and a volatile share price with no support.

- Understanding the promotional elements may tell us more about the future share price than trying to understand the technology alone.

- In the past, I have written about very similar promotions that fell by 60-80% once exposed.

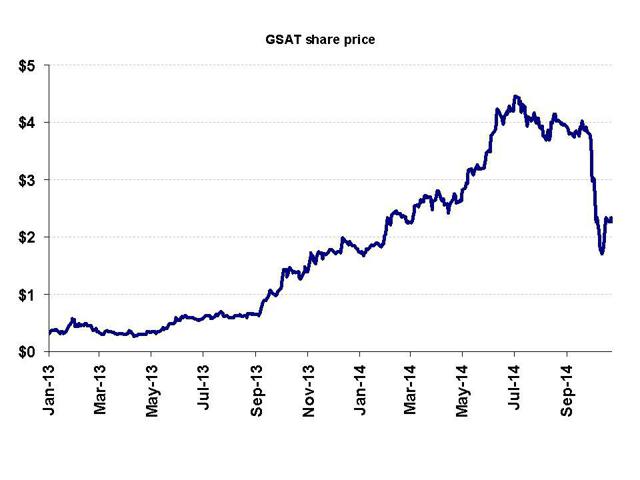

A few weeks ago, Kerrisdale Capital gave a presentation delivering its short thesis on Globalstar Inc. (NYSEMKT:GSAT). Prior to rumors of Kerrisdale’spresentation, Globalstar had been trading at close to $4.00, with a market cap of nearly $4 billion.

After a wave of back and forth conference calls and presentations by Kerrisdale and Globalstar management, the stock bottomed at $1.56 – a decline of nearly 60% in two weeks.

Since then, the stock has rebounded slightly to just over $2.00. The question now becomes how to play Globalstar. The stock is still down 40% since pre-Kerrisdale, but investors must remember that the stock is up from just 30 cents in 2013. As a result, the stock is still up 7x since just last year, even as the company’s financial results have become increasingly strained.

It is very clear that Globalstar is in financial distress. But the first question that investors should ask is “just how deep is the distress ?”

And the second question that investors need to ask is “is Globalstar a simple stock promotion ?” Kerrisdale had originally called Globalstar the biggest stock promotion since the implosion of multi billion dollar Sinoforest. However, the information presented by Kerrisdale focused mostly on the technological shortcomings of Globalstar’s product offering within wireless spectrum and provided less detail about what made the company a likely stock promotion.

How deep is the financial distress ?

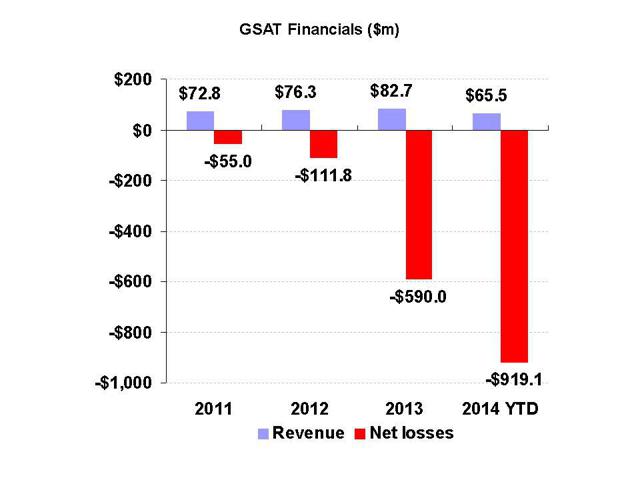

Even a cursory look at Globalstar’s financials shows that the picture is grim. This is very clearly the reason why the stock was trading as low as 30 cents just last year.

Revenues from Globalstar’s satellite offering have been relatively flat for several years now, with only minor growth since 2011. But by 2013, losses had swelled from $55 million to almost $600 million. And in the first 9 months of 2014, the company reported over $900 million in losses already. This is clearly not a sustainable situation.

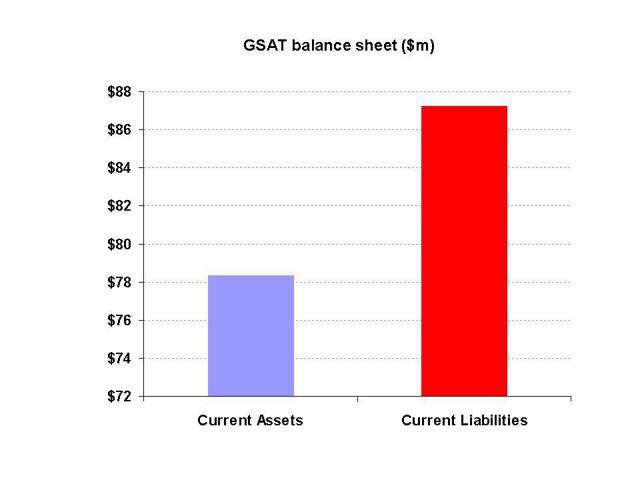

The biggest problem is that Globalstar has over $600 million of debt and generates little to no operating cash flow. Against this, Globalstar has only $24 million of cash. Globalstar already has a working capital deficit (a negative current ratio), such that short-term liquidity is already becoming visibly problematic. Long-term liabilities also exceed long-term assets.

In short, this is a company that is in very deep and dire trouble. On paper, it is already functionally insolvent, while it faces over $600 million in debt.

This is clearly why the stock was trading at 30 cents just last year. But investor enthusiasm and reports from two small brokerages have focused on Globalstar’s holdings in wireless spectrum. It simply comes down to the fact that hopes for a multi billion dollar monetization of these holdings are what propelled Globalstar from 30 cents to over $4.00 and a $4 billion market cap. Without that hope, we would be right back to 30 cents again due to the company’s functional insolvency.

Is Globalstar a stock promotion ?

Kerrisdale’s presentation focused heavily on the technological aspects of Globalstar’s holdings in wireless spectrum and then came to the conclusion that they are largely obsolete, unneeded and will ultimately become largely worthless. As a result, Kerrisdale predicted a default on the $600 million in debt, a bankruptcy and a stock price of zero.

What immediately struck me about Globalstar is that this type of detailed technological analysis can often be seen to be largely unnecessary. Globalstar does in fact possess all of the elements of a classic stock promotion. In the past, I have exposed a number of very similar promotions and watched as their share prices declined by as much as 80%.

But in doing so, I consistently did not bother to engage in much debate about the merits of the companies’ claimed technologies.

I have seen many investors spend considerable amounts of time trying to research, understand and quantify the technological claims made by stock promotions. It is a process that can go on endlessly. There are always arguments to both sides, and typically neither side is willing to concede on their views.

What I have found instead is that when all of the elements of a stock promotion are present, then a debate over the technology quickly becomes a moot point.

Today, I will look at three past stock promotions, which I have exposed, each of which fell by 60-80% once the hype subsided. It should be noticed that when I wrote these articles, I did not need to spend much time at all debating the company’s underlying claimed technology. Instead, all I had to do was confirm that they possessed many of the typical elements of stock promotions. Following a sharp run up, they were almost guaranteed to fall.

(Note: Seeking Alpha has launched a beta version of a performance tracker. This version measures performance based on the closing stock price AFTER articles such as mine have come out. It is designed to measure the opportunity that investors had to make money. When I talk about share price changes, I refer to the change since the last close BEFORE my articles came out. This demonstrates the overall level of mispricing that was present pre article.)

I will then show how Globalstar shares all of the common features of these stock promotions.

When one takes a step back and looks at the big picture, it is easy to feel very foolish for being taken in by a stock promotion. In fact, they are all variations on a very similar and basic theme, as follows:

A small company with a consistent history of financial failure suddenly develops a new game changing technology, which it oddly happened to acquire very cheaply. The overwhelming majority of investors who come to understand this get rich opportunity happen to be unsophisticated retail investors. While there is almost always some level of institutional involvement, it is the exception rather than the rule. In the broader sense, large numbers of institutional investors for some reason could not figure it out. The valuation soars to unprecedented levels despite very shaky underlying fundamentals. Mainstream research analysts refuse to cover the stock, but one or more boutique specialists back the stock with hyper bullish forecasts in anticipation of investment banking revenues.

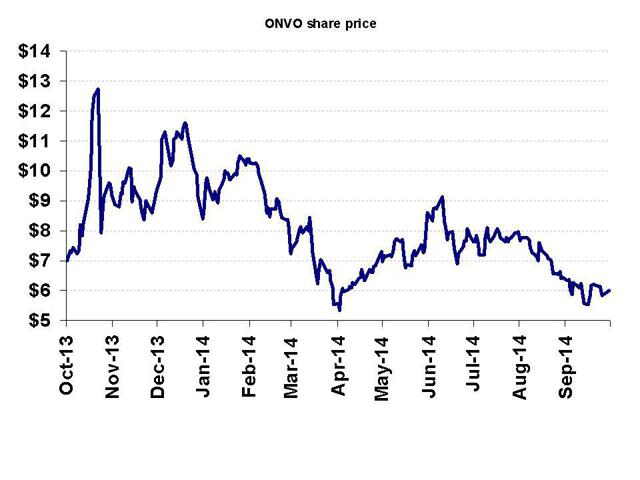

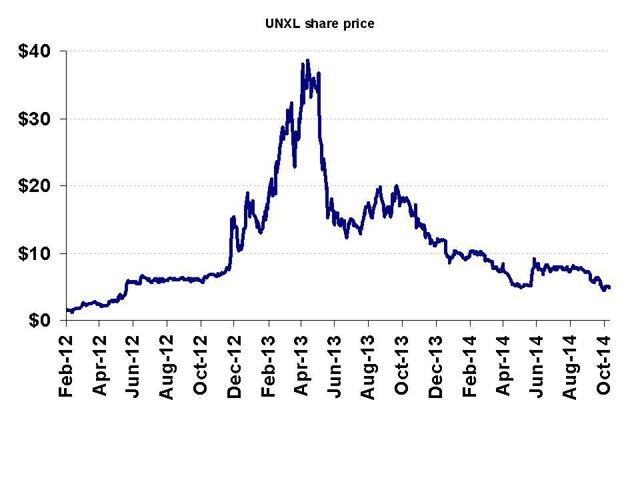

Clearly, this description applies quite precisely to Globalstar. But it also applies in almost identical fashion to at least a dozen other stock promotions, which I have written about. The ones I focus on today are Organovo (NASDAQ:ONVO), Uni-Pixel (NASDAQ:UNXL) and Neonode (NASDAQ:NEON), each of which declined by 60-80% following my articles. (Click on the links to read my past articles).

The first clue: overwhelming reliance on retail investors

When a small cap company has institutional holdings of less than 50%, it should be considered a major red flag. For larger companies, such as the then $4 billion Globalstar, this threshold should be set even higher at perhaps 80-90%. To be clear, for a company of Globalstar’s size, we should normally expect at least 80-90% (or more) of the stock to be held in institutional hands.

Instead, Globalstar has institutional holdings of just 36%. Although there are clearly some institutions who have bought in, it is tiny for such a large company. Note that this 36% applies to the free float, which represents all shares available to the public to buy. It does not count insider ownership.

Heavy reliance on retail does not guarantee the existence of a stock promotion. But it should be considered a red flag and as a reason to keep looking for further evidence.

Low institutional ownership was my first reason to evaluate each of Organovo, Uni-Pixel and Neonode. It was why I continued looking for further evidence.

The second clue: The pot of gold is always at the END of the rainbow

Were it not for a get rich quick opportunity in wireless spectrum, Globalstar would likely be trading back at around 30 cents. It is pure faith that is holding the company afloat.

This is a factor that all stock promotions have in common. The underlying equity is worth nearly nothing (other than the value of any cash), but the value of the stock is greatly inflated based on enthusiasm. The contrast is always stark.

The other factor that is common is that investors have been convinced to ignore multiple years of consistent failure, because the hoped for end game is expected to change everything.

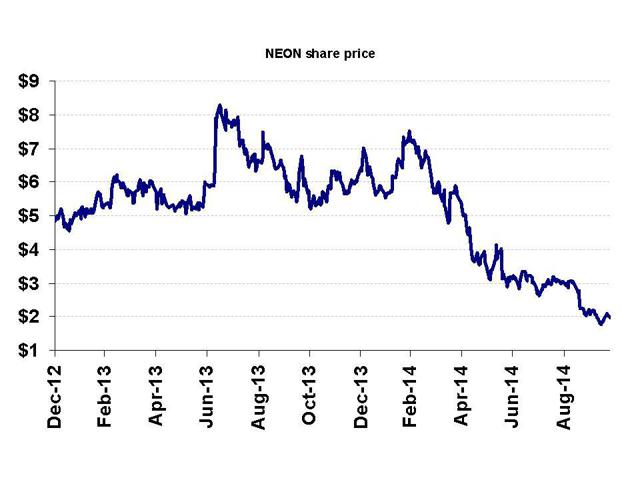

Shares of Neonode had soared to over $9.00 based on the hype that they were about to begin doing business with tech giants LG and Samsung. It was not a lie. Neonode was in fact doing business with these tech giants. Unfortunately, as I pointed out, Neonode had been doing identical business with very similar tech giants for years and had never managed to break a profit. The technology simply did not offer a meaningful profit potential. As this became apparent, the stock imploded to below $2.00.

In a separate instance, shares of Organovo had soared to nearly $14.00 on hopes that it would revolutionize the world of drug development with 3D printed liver assays. But Organovo’s technology had been around for years. In Organovo 1.0, the stated mission was to sell completed 3D bioprinters. When this failed, Organovo began positioning itself as Organovo 2.0, selling 3D printed testing assays. Once the market began to understand that this was also less than viable, the company repositioned itself as Organovo 3.0, which would focus on running testing itself. In the meantime, the share price has fallen by 60%.

We can see the same repositioning with Globalstar. First, the company was poised to dominate communications via satellite as soon as it emerged from bankruptcy. As investors got tired of ever ballooning losses, the company repositioned the focus to the multi-billion dollar spectrum opportunity.

In 2012 / 2013, shares of Uni-Pixel rose from $8.00 to as high as $42.00 based on nothing more than hype about a similar end game opportunity. As with the examples above, Uni-Pixel had acquired some very cheap technology and over a period of years had failed to deliver any meaningful results

When I wrote about Uni-Pixel, it was at a time when many other investors were debating and hyping it, using very deep and sophisticated analysis of their supposed technology. I didn’t bother debating them on the technology. Many readers were furious that I could issue such strong and negative outlook on the company without ever engaging in the debate on its technological merits. The stock has now crashed by more than 80% since its peak. It was simply a promotion.

To me, this was very simple. I had identified all of the elements of a stock promotion, such that whatever the hype was about the technology was likely to be more of a distraction from what really mattered. This is exactly what we are now seeing with Globalstar.

Many retail investors are now busying themselves by reading up on the ins and outs of TLPS and FCC spectrum auctions and approvals. Instead, they should really be taking a further step back to see if it is purely a stock promotion.

The third clue: lack of mainstream analyst coverage

Prior to the report from Kerrisdale, Globalstar was a $4 billion company whose stock had soared at the time by more than 10x since the previous year. Yet there is still a noticeable lack of any meaningful research coverage. Not a single top 20 investment bank covers the stock.

Investment banks do not make money off of their research. But they do use research as a lead in towards making other revenues. Research leads to sales and trading activity, which generates trading commissions. It also can lead to investment banking revenues by establishing relationships with management.

Even when a company is marginal, it is quite common for top 20 banks to initiate with a “hold” or “neutral” recommendation just so that they can begin to generate trading commissions or investment banking fees on the name

The point is that for a company of this size, it is extremely unusual to see that not a single top 20 investment bank is willing to provide any research coverage.

It is not surprising that banks would not initiate with a “sell” recommendation. Sells, by nature, end up applying to a much narrower audience (typically only those investors who already happen to own the stock). And clearly initiating with a sell rating is not likely to generate investment banking relationships.

This is not to say that there is zero coverage at all on Globalstar. But the only two houses providing research coverage on Globalstar are two tiny boutique firms, Chardan Capital and Odeon Capital. Not surprisingly, both of them rate it a “buy” and see the stock as a double or triple from current levels.

This was also the case at both Uni-Pixel and Neonode. Just like Globalstar, these companies managed to attract coverage from a small boutique investment bank and get ratings, which predicted multi bagger returns in the near term simply by echoing management’s bullish sentiments.

In both cases, the bank focusing on these names was Craig Hallum, which is in a similar tier as Chardan and Odeon. There was also a high focus on retail.

Uni-Pixel received share price targets as high as $58, which sent the stock on a tear from $8.00 to as high as $42.00 (intraday) in just 6 months. Retail investors were in a frenzy. Not surprisingly, as the stock peaked, Uni-Pixel sold $35 million of stock at $32.00 (via Craig Hallum of course), setting the stage for the stock to decline. The stock quickly began its descent and now trades for around $5.00, down by around 80% from its peak.

This game can be played again and again with retail heavy, speculative names. Not long thereafter, Hallum rated Neonode a $10.00 stock, sending the stock itself to $9.00. Again, by being the only research provider, Hallum was easily tapped to lead the inevitable equity offering. Neonode raised money at $6.50. The stock now trades for around $2.00.

A quick flip through Chardan’s equity coverage universe reveals that it tends to focus on fairly speculative names with a high frequency of multi-bagger targets.

For investors in Globalstar, understanding the dynamics of such small brokerages can help them steer clear of the pump. For those who are interested in finding good short opportunities, these types of coverage lists can be a goldmine.

A few years ago, fortunes were made by investors who took the naïve approach of simply shorting any Chinese reverse merger, which had coverage from Rodman & Renshaw. More recently, I have done well by frequently shorting names, which have aggressive targets by Craig Hallum.

The point is that when ALL of the mainstream research providers refuse to provide research on a multi-billion dollar company, leaving only 1-2 small, hyper bullish, retail focused boutiques, it points strongly to a promotional stock.

The fourth clue: what does the share price action mean ?

When I wrote about Organovo in November of 2013, the stock was approaching $14.00 intraday. The market cap was over $1 billion. The article I wrote was not in any way sophisticated. Instead, I simply highlighted that there was already existing competition that had been on the market for almost two years with a product that was functionally identical. Organovo was not set to release its own product in development for at least another year.

This simple revelation on my part coincided with a drop of nearly 40% in two days on this billion dollar company.

It was not the strength of my argument that caused the drop. It was the uncertainty and lack of thorough research by those who were in the stock. Even this simple revelation came as a major shock to these investors, including the institutions who were in the name. This is the only way to explain the violent sell off.

We can see the same phenomenon with Globalstar, and it is largely a function of the first three clues. It is clear that retail will seldom have a very deep understanding of a complicated technology play. But if there were a stronger instructional base, then it would be almost impossible to see the stock implode by 60% in just 2 weeks. If these investors had done thorough research and had any conviction in the name, they would clearly have been buying more not letting the stock get cut in half. Both Chardan and Odeon have made efforts to defend the stock. But given the fact that they are smaller boutiques and that there are no top 20 banks to chime in, the research support has been largely ineffective.

In short, the steepness of the decline itself helps to show that the underlying support for this stock was very weak indeed. It is itself another signal that this was more of a promotion than a fundamental play on a sound technology.

Conclusion

I have made it a point to pay close attention to all of the presentations and conference calls by both Kerrisdale and Globalstar management. I have listened to the experts that each side has produced. But what it comes down to is that the investment case for Globalstar is not based on the technology. It is based on the promotion.

Globalstar is still up by nearly 8x since its lows of 2013, despite the fact that its financial condition has deteriorated to the edge of functional insolvency. Globalstar is hemorrhaging money at a rate, which cannot continue.

Aside from the dramatic spike in the share price, the elements that accompany it speak loudly to promotion. For some reason it has largely been retail investors who have bid up the stock while most institutions (with a few exceptions) have largely not been interested. It is an investment story where we are told to fully ignore the dismal present, because there is supposedly a huge back-end-loaded payoff in the future. Yet there are no top 20 investment banks willing to provide any coverage to this supposed opportunity; only two small and ultra bullish boutiques are interested. Finally, the ease with which the share price was toppled speaks loudly to the lack of conviction that is held by those in the stock. This typically tells us that the investment case is weak and has been only lightly or poorly researched.

Despite the initial 60% drop in Globalstar, it has only shown a slight bounce on short covering. At current prices, Globalstar remains a compelling near-term short.

Disclosure: The author is short GSAT.

The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The author was previously an investment banker for a major global investment bank and was engaged in investment banking transactions with a variety of technology companies. The author has not been engaged in any investment banking transactions with US listed companies during the past 5 years. The author is not a registered financial advisor and does not purport to provide investment advice regarding decisions to buy, sell or hold any security. The author currently holds a short interest in GSAT and has provided fundamental and/or technical research to investors who hold a short position. The author may choose to transact in securities of one or more companies mentioned within this article within the next 72 hours. Before making any decision to buy, sell or hold any security mentioned in this article, investors should consult with their financial adviser. The author has relied upon publicly available information gathered from sources, which are believed to be reliable and has included links to various sources of information within this article. However, while the author believes these sources to be reliable, the author provides no guarantee either expressly or implied.