Summary

- Globalstar currently sits under a large debt load of over $600 million even as it loses money every quarter.

- The most recent quarter showed only $4 million of EBITDA, falling short of required targets in the credit facility.

- However, bankruptcy risk can be mitigated by taking advantage of the large market cap to conduct a large financing.

- Similar restructurings were completed in 2009 and 2013.

- Evaluating the recent bankruptcy of GTAT is instructive in identifying the risks in Globalstar.

Shares of Globalstar (NYSEMKT:GSAT) have been on a roller coaster ride ever since Kerrisdale Capital presented a short thesis on the company in early October. The shares fell from just under $4.00 to as low as $1.56, before rebounding to the current level of around $2.60. Some of the recent rebound has been due to the release of quarterly earnings where Globalstar revealed a slight growth in subscribers and revenues, along with posting over $4 million in “adjusted EBITDA”.

A key point within the Kerrisdale thesis is that Globalstar will inevitably go bankrupt and hit a share price of true zero. I disagree with some points of the Kerrisdale thesis, but I do see that an analysis of the recent bankruptcy of GT Advanced Technologies (OTCPK:GTATQ) can shed some light on the risks that current holders of Globalstar are facing.

This becomes particularly relevant in light of Globalstar’s recently released quarterly earnings. It is now clear that Globalstar is on track to once again fall short of its required EBITDA covenants as required in its loan facility. This is currently only being permitted by an ever growing equity “cure” provision.

The EBITDA requirements of the credit facility are also spelled out more succinctly in the 10Q. As shown, the EBITDA requirements are as follows:

Period Minimum Amount

1/1/14-6/30/14 $9.9 million

7/1/14-12/31/14 $14.1 million

1/1/15-6/30/15 $17.0 million

7/1/15-12/31/15 $23.5 million

The first problem becomes immediately apparent. In the first 6 month period (1/1/14-6/30/14), Globalstar generated around $6 million of EBITDA, falling short of the $9.9 million target by over $3 million. Only an equity “cure” contribution allowed Globalstar to avoid default. It is easy for investors to miss this because EBITDA is not explicitly broken out in the 10Q or 10K. It must be calculated.

The second problem is that the EBITDA requirement in the credit facility escalates over time, even as Globalstar’s performance seems to be deteriorating. So while Globalstar was around 30% short on EBITDA in 1H 2014, the target for 2H 2014 is now more than 40% higher than that level. By the time we get to 2H 2015, the target is more than double what it was in the previous half.

Adjusted EBITDA for Globalstar (as disclosed on their conference call) was just over $4 million for the quarter. Yet the company needs to produce over $14 million for the combined period of Q3 and Q4. Based on the historical runs rates of around $3 million per quarter, this now looks highly unlikely.

If Globalstar can maintain a constant $4 million per quarter in EBITDA ($8 million per half year), then it will have earned a CUMULATIVE TOTAL of $32 million in EBITDA over the periods specified in the table above. Yet the amount required in just the 2nd half of 2015 alone is already nearly $24 million. Globalstar falls short by nearly an additional $32 million during this time.

Globalstar has already disclosed in its risk factors that:

An inability to comply with the financial and nonfinancial covenants contained in the Facility Agreement could have significant implications. Our Facility Agreement contains a number of financial and nonfinancial covenants. Our ability to comply with these covenants will depend on our future performance, which may be affected by events beyond our control. Our failure to comply with these covenants would represent an event of default. An event of default under the Facility Agreement would permit the lenders to accelerate the indebtedness under the Facility Agreement. That acceleration would permit holders of our obligations under other agreements that contain cross-acceleration provisions to accelerate that indebtedness.

So in short, Globalstar is already failing to meet the EBITDA targets specified in its credit facility. The only reason it has not been deemed in default is due to an equity “cure” contribution that was made. But as the targets get increasingly higher, it becomes harder and harder for Globalstar to continue raising new equity every 6 months in larger and larger sizes. A subsequent default on the credit facility therefore looks unavoidable at some point. This default then triggers cross acceleration on the company’s other obligations. The biggest question mark is simply the timing of these events.

However, I do believe that in the short/medium term Globalstar will avoid a bankruptcy, but only by issuing large amounts of common stock and more convertible debt. It will also need to once again restructure its existing debt. This will likely push the share price to around $1.00, but could still avoid the specter of bankruptcy. This is largely what the company was able to do in 2008/2009, which pushed the share price at the time down to around 30 cents even though it avoided bankruptcy. A similar set of restructurings occurred in 2013, and again we saw a 30 cent share price. Globalstar had originally filed for bankruptcy in 2002, and emerged from the bankruptcy in 2004 as a result of the support from investor Thermo Capital Partners (“Thermo”). But the company has not actually filed for bankruptcy again since that time.

It is important to keep in mind that at a share price of $1.00, Globalstar would still have a market cap of nearly $900 million, which is still a lofty valuation.

Looking at GTAT for clues about GSAT

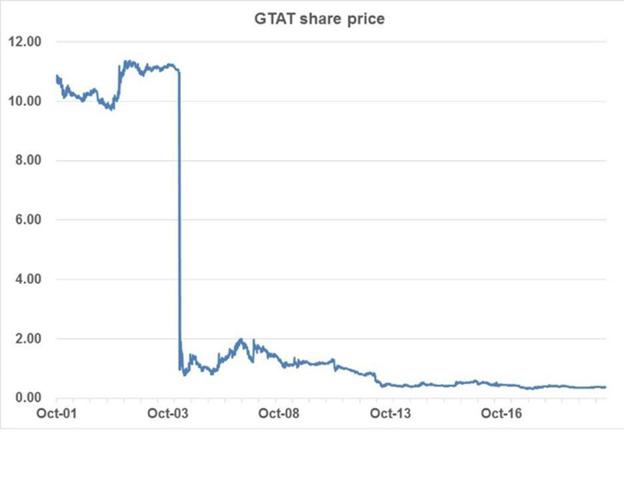

Shares of GT Advanced Technology were trading at $18 in early September, but had fallen to as low as $11.00 by early October. The market cap was still in the range of $1-2 billion. It was still substantial. The company had promised to give a “business update” call which it then delayed. When the call did finally happen, it gave no warning of any imminent financial collapse.

But then on October 6th, with no warning at all, the company declared bankruptcy. It was a shocker. The stock price quickly plunged by 90% to below $1.00. After some resettling, the stock bounced between $1.00 and $2.00 before collapsing to the current level of around 50-60 cents.

Element #1 – An all or nothing bet

GTAT was basically an all or nothing bet. Judging from the POSITIVE ARTICLESwhich had been circulating on the company even into September, it looked like the odds were perceived as being quite good. GTAT was to supply sapphire screens for the new iPhone for Apple (NASDAQ:AAPL). The problem is that if anything went wrong with that bet, then GTAT quickly became a complete zero. A key mistake made by investors (and analysts) was in pricing GTAT as if the Apple business were a done deal.

That is largely what we have with Globalstar. The satellite business of Globalstar has been relatively flat for years, even as losses have ballooned. Net losses in 2014 were already over $900 million heading into Q3, but were trimmed due to reversal of derivative losses tied to the share price. Debts are massive, cash is minimal. Without the perceived value of its spectrum licenses, Globalstar is also a true zero. Like GTAT, it is an all or nothing bet.

Element #2 – A heavy debt load

At the risk of stating the obvious, companies which have no debt have a hard time going bankrupt even when business conditions deteriorate substantially. As the debt burden grows, companies have more and more solvency risk when business deteriorates.

GTAT was on the hook for over $400 million to Apple due to pre payment obligations. Apple had the right to call back this debt at any time and for a variety of reasons. GTAT also had over $400 million of separate debts which could be accelerated as well.

Meanwhile, Globalstar currently has over$670 million of debt as follows:

| Item | Amount ($m) |

| Facility Agreement | 586,342 |

| Thermo Loan Agreement | 64,119 |

| 8.00% Convertible Senior Notes Issued in 2013 | 29,840 |

| Total Debt | 680,301 |

| Less: Current Portion | 7,271 |

| Long-Term Debt | 673,030 |

All of this debt was the result of restructuring in 2009 and 2013. The interest rates on the credit facility escalate to as high as Libor+5.75% (floating rate), yet Globalstar has only $24 million in cash and generates little to no operating cash flow.

In the event that the “all or nothing bet” from above fails, or is even delayed, Globalstar has no conceivable way of paying these obligations. This leaves equity holders with nothing. Yet Globalstar is still priced with a market cap of close to $2 billion.

Element #3 – the analysts are not much help

Prior to the bankruptcy of GTAT, analysts were nearly all holding neutral / positive views on the company. Even Dougherty which had a Sell rating still suggested a target price of $9.00. Goldman Sachs told us it was a $14.00 stock, while Cowen told us it was worth $18.00. Within days, the bankruptcy emerged and the stock traded below $1.00.

Globalstar only has two small boutique analysts covering the stock, Odeon Capital and Chardan Capital. They rate the stock with $5-6 target prices, implying at least a double from current levels. As I have mentioned previously, investors should be concerned about the lack of mainstream coverage from any analysts from a top 20 firm. The real irony here is that the two firms who cover the stock must know that a financing is likely imminent and they stand to benefit from any investment banking business. An equity offering will certainly hit the share price, but lowering the price target might cost these banks the underwriting business. I do not expect to hear any warnings or caution expressed by these analysts.

The point is that we should not expect to hear about anything relating to near term liquidity events from the analysts. This has been clear in the past with situations such as GTAT and it will become clear again with Globalstar.

Element #4 – Information from management

So far management at Globalstar has vigorously attempted to rebut the negative views of Kerrisdale. In their conference call rebuttal they noted items such as the moderate revenue growth, growth in pure subscriber numbers and even the number of lives that have been saved with Globalstar phones (over 1,000). They have also made it clear that they don’t face any near term solvency issues.

Two months before filing for bankruptcy, GTAT held its quarterly conference call where it noted that it did not need to raise any capital and that they expected to end the year with over $400 million in cash on the balance sheet. Their subsequent delayed update call did nothing to alert investors to the true state of the situation with Apple or of the impending liquidity crisis and imminent bankruptcy filing.

The point is that this is just the way that it works. No one should currently expect Globalstar to come out and say that they have concerns over liquidity.

But a peek back to 2008/2009 and 2013 shows just how these things come to pass.

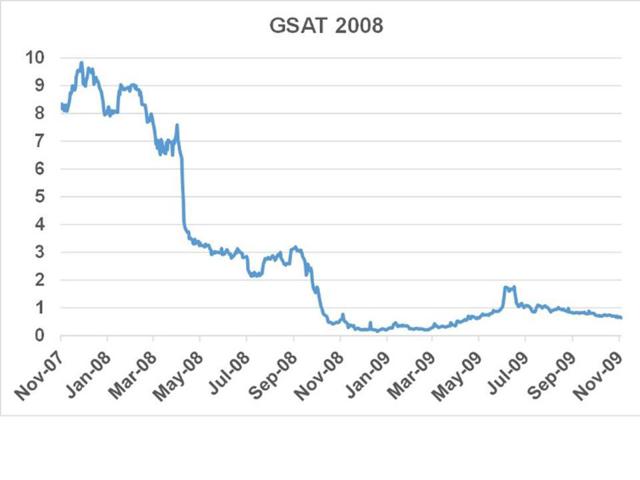

It may seem difficult to recall, but back in 2008, Globalstar still had a share price of nearly $10.00. In April of 2008, when the share price was still at around $6.00, the company was able to launch a convertible bond offering raising $150 million with a coupon of only 5.75%

But by the end of that same year, just a few months later, the stock was at 22 cents as the company was unable to service its debt obligations. Certainly when the share price was at $10.00 at the beginning of the year no one would have expected this outcome.

It took much more than a single day (a la GTAT), but the total decline in 2008 was well over 90%.

In 2009, the company was able to once again obtain a credit facility from a syndicate of lenders. But this was only possible due to an arrangement where controlling shareholder Thermo made available $60 million via a contingent equity agreement to fund interest and principal payments in the event of shortfalls.

The 5.75% convertible bonds were ultimately exchanged for new convertibles. The new convertibles were re-struck with a lower conversion price and with a higher coupon of 8%.

These are the reasons why I think that Globalstar can avoid a bankruptcy in the near term. Much of the debt can be restructured. At current share prices, Globalstar still has a market cap of nearly $2 billion. This means that the company could also issue new shares and convertible bonds to investors and raise perhaps $200-250 million if the discount was large enough. But we can see from 2008 what impact this might have on the share price. At that time (April 2008), the convertible offering which raised just $150 million ended up seeing the share price basically cut in half, even though the market cap was substantially larger than it is now.

Element #5 – It’s all in the risk factors

Much of the “post mortem” analysis on GTAT has focused on identifying where investors went wrong. This was a bankruptcy that no one saw coming.

Yet it was clearly disclosed in the GTAT risk factors that:

Apple has no minimum purchase obligation and if Apple does not purchase sufficient quantities of sapphire material, our revenues will suffer and we may be unable to meet our obligations to repay advances that were provided to us. We have granted certain exclusivity rights to Apple with respect to the sapphire material manufactured with our ASF systems….Although we have significant minimum supply obligations, Apple has no purchase obligations… Apple has committed to make a $578 million prepayment … We must repay the Prepayment Amount ratably over a five year period beginning in January 2015, either as a credit against Apple purchases of sapphire material or as a direct cash payment to Apple. Without significant sapphire revenue from Apple, we would still be required to repay in cash…In addition, these repayments may exhaust all of our cash and, if we are unable to make a payment when due (or fail to meet our supply obligations), we will be in default and Apple will have the right to acquire control and possession of the ASF systems and/or our subsidiary …The prepayment installments from Apple may also be cancelled prior to payment, or repayment accelerated…. Finally, if the repayment of the Prepayment Amount were to be accelerated, it would likely produce a cross-default under our 3.00% Convertible Senior Notes due in 2017, or the 2017 notes, and our 3.00% Convertible Notes due in 2020, or the 2020 notes (correspondingly, an acceleration of the 2017 notes and 2020 notes would likely produce a cross-default under the Prepayment Agreement), and we may not have sufficient resources at such time to satisfy these obligations.

The above text made GTAT fairly toxic. While there was no way to predict the bankruptcy outright, it is clear that this is a stock that should have traded at an “Apple discount” rather than an “Apple premium”. Yet all of the investors and analysts simply overlooked this.

With Globalstar, the risk factors have already been made clear. But like GTAT, the stock trades at a premium as investors and two analysts ignore the risks. As a result, the stock still trades at a premium valuation rather than at a risk adjusted discount.

Specifically, Globalstar discloses that it has historically been a money losing venture and that it expects to continue losing money going forward. It also discloses that if it fails to satisfy its debt covenants then it will default on its obligations, resulting in cross acceleration of other obligations. Like GTAT, in hindsight no one will be able to say that they weren’t forewarned.

Looking at Altman’s Z score

One way to illustrate the financial strain of Globalstar is to look at an Altman’s Z score. In general, the score is used to predict the risk of bankruptcy in publicly traded companies.

More important than the score is to analyze the components of the Z score. There are four distinct inputs, each of which tells us something very important about a company’s ability to remain solvent. By looking at the components (rather than just the score) we can seek to identify Globalstar’s relative strengths and weaknesses as they relate to solvency.

The four inputs are finally plugged into the following formula to derive a composite score:

Composite Score = 1.2A + 1.4B + 3.3C + 0.6 D + 1E

The four components are as follows:

Component #1 – A: Working Capital / Total Assets

Globalstar has negative working capital of -$10 million divided by total assets of $1.3 billion which gives us a value of -.007.

More important than the simple number though is the concept that this is a measure of short term liquidity strength. The negative number states the obvious, that the current account deficit creates near term solvency risk for Globalstar.

Component #2 – B: Retained Earnings / Total Assets

Once again, it is the concept that matters more than the actual score. Retained earnings is the company’s measure of long term ability to generate profits. As we know, Globalstar has been a consistent money loser such that it has a retained deficit (negative retained earnings) of $1.5 billion.

In terms of its score, that results in a component score of -.154.

Component #3 – C: EBIT / Total Assets

Here we are attempting to look at the innate ability of a business to generate operating profits. That is to say, is this a business that is capable of selling its product / service at a profit. We can see from the weighting in the formula above that this is clearly and by far the most important determinant of a company’s ability to remain solvent.

Because Globalstar has a variety of complex derivative issues which affect the bottom line, I simply look at Operating Profit (Loss) as a measure of EBIT.

As before, the number is negative. In the most recent 4 quarters, Globalstar lost $115.4 million at the operating level. This results in a C value of -.088.

The problem is becoming clear. For the first three measures of financial strength, Globalstar has already scored negative values on all of them.

Component #4 – D: Market Cap / Total Liabilities

This component is really a way of asking “how achievable is it to raise equity in order to pay down debt”. This is where Globalstar scores best and it is why I think the company is very likely to issue equity and equity linked (convertible) securities in the near future.

Globalstar has a market cap of around $2.0 billion, but liabilities of only $1.4 billion. This results in a component score of 1.43. But it should be kept in mind that the weighing on this factor is the lowest of all of the ratings at just 0.6.

Component #5 – E: Sales / Total Assets

Last, the Z score looks at total revenues. This tells us the ability (a proxy) of the company to bring cash in the door regardless of the profitability it may entail, expressed as a function of assets. In other words, how productive are the assets.

For Globalstar, total revenues over the past 4 quarters amounted to $83 million vs. total assets of $1.3 billion. This results in a score of 0.06. It tells us what we should already know, that Globalstar does not make productive use of its asset base.

Globalstar’s Altman’s Z Score

From the components above we can see that:

Z Score = 1.2 (-0.007) + 1.4 (-0.154) + 3.3 (-0.088) + 0.6 (1.43) + 1(.060) = 0.4036

So the composite score for Globalstar is just 0.4036. Readers should keep in mind that anything below a score of 1.8 is interpreted to mean that a company is headed for bankruptcy. A score of near zero is quite definitive.

But again, evaluating the individual components is far more instructive.

We can see that Globalstar has a moderate ability to refinance its debts, but this weighs against miserable scores for all other relevant attributes. This includes long term profitability, short term profitability, short term liquidity and overall asset productivity.

Thus the best way to interpret this is that the smartest move for Globalstar is to take advantage of its only real strength (its large market cap) and issue equity and / or convertibles quickly before the market cap shrinks any further.

Conclusion

Globalstar has nearly $700 million in debt even as it continues to lose money hand over fist. The ability to generate cash is highly constrained. Aside from management, it is difficult for anyone to envision any dramatic turnaround in the satellite business that would result in ultimate profitability.

As a result, over the longer term, the solvency bet on Globalstar will by necessity be a bet on its ability to monetize its wireless spectrum. This is the only way that Globalstar can avoid an ultimate bankruptcy.

Over the shorter term, the problems are more acute.

The only thing that Globalstar really has going for it is a very sizeable market cap which could allow it to sell a decent amount of equity and convertible bonds.

In retrospect, GTAT could have done the same thing. Prior to its bankruptcy, GTAT still had a market cap of well over $1 billion. It could have raised substantial amounts of cash and been less vulnerable to the catastrophic risk of cross defaults and cross acceleration. It is unclear why they chose to gamble the entire company the way that they did.

If Globalstar is smart, they will take advantage of their huge market cap and adequate liquidity at current levels and issue $400 million or more in equity and equity linked (convertible) securities. This would likely push the share price down by around 40% from current levels, but it would also help to mitigate the current level of bankruptcy risk, which is ultimately very high.

Disclosure: The author is short GSAT.

The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The author was previously an investment banker for a major global investment bank and was engaged in investment banking transactions with a variety of technology companies. The author has not been engaged in any investment banking transactions with US listed companies during the past 5 years. The author is not a registered financial advisor and does not purport to provide investment advice regarding decisions to buy, sell or hold any security. The author currently holds a short interest in GSAT and has provided fundamental and/or technical research to investors who hold a short position. The author may choose to transact in securities of one or more companies mentioned within this article within the next 72 hours. Before making any decision to buy, sell or hold any security mentioned in this article, investors should consult with their financial adviser. The author has relied upon publicly available information gathered from sources, which are believed to be reliable and has included links to various sources of information within this article. However, while the author believes these sources to be reliable, the author provides no guarantee either expressly or implied.