This article is the opinion of the author. Nothing herein comprises a recommendation to buy or sell any security. The author is short INO and UNIS. The author may choose to transact in securities of one or more companies mentioned within this article within the next 72 hours.

Note #1: Prior to publishing this article, the author filed detailed complaints with the US Securities and Exchange Commission regarding the parties and activities described herein.

Note #2: Due to the large volume of documentation obtained by the author, only a small portion is included in this article. However, the author has made efforts to ensure that the SEC and Seeking Alpha are aware of all findings, including those not detailed in this article.

Note #3: Many of the suspect articles referred to below have already been removed by Seeking Alpha. This can be seen by scrolling through Yahoo Finance, where the headlines still remain. However, the author had previously preserved electronic copies wherever possible in order facilitate ongoing investigation of the authors involved.

Investment overview

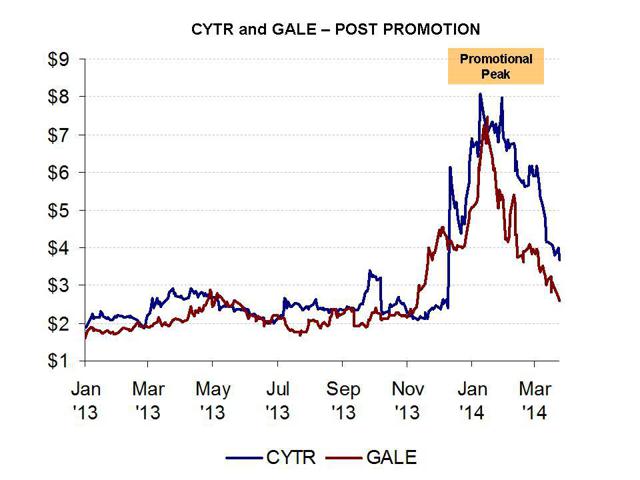

Following my recent article describing undisclosed stock promotions at CytRx Corp (CYTR) and Galena (GALE), using controversial IR firm The Dream Team Group.

These stocks have quickly fallen by 20-30%. Shares of InterCloud (ICLD) next fell by 30% on Friday following class action lawsuits and from concerns regarding paid promotions there by Dream Team writers Tom Meyer and John Mylant. The issues at InterCloud were also uncovered in the wake of my last article. All of these stocks are now down by at least 50% from their recent promotional highs.

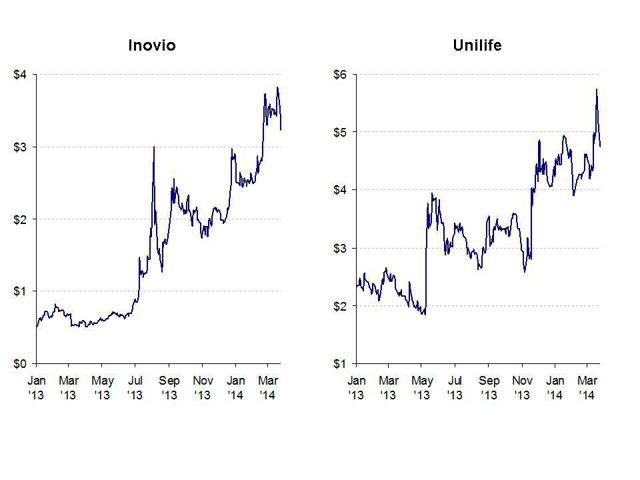

I have now identified clear indications of undisclosed promotions at on both Inovio Pharmaceuticals (INO) and Unilife Corp (UNIS), using IR firm the Proactive Group. Proactive has been listed as a partner of The Dream Team Group on that firm’s website.

In both cases, the promotions took place in conjunction with the release of news and boosted the stock. In some cases, various recent articles have consisted of nothing more than interviews in which management answered convenient questions with positive answers. In other cases, heavy quotes from management were also numerous.

As part of my investigation, I have obtained a copy of the contract for one of the paid writers. I have also obtained various emails from multiple authors in which they confirm their involvement in paid undisclosed writing, including for companies listed as Proactive clients, and including on both Inovio and Unilife.

All the stocks mentioned so far have several things in common: They have minimal investment from institutions and are overwhelmingly held by retail investors who can be easily influenced by paid promotions.

They also happen to have little or no commercial revenues and rely on grants or collaborations.

They are heavily dependent upon promotions to retail investors in order to move the stock.

In multiple cases, we can see selling activity in their stock (either by insiders or the company itself) just after the promotions hit their peaks.

As with CytRx and Galena, I expect the share prices of Inovio and Unilife to be subject to very steep declines due to a) the end of the artificial promotion following exposure and b) the potential for legal consequence from the paid promotions. Due to their recent spikes to multi year highs on the back of these promotions, I see around 40-50% downside in each of these stocks. Yet even this level of decline would simply put each of these stocks back to levels where they were within the past 6-12 months. This is just what we have seen with CytRx and Galena in recent weeks.

Note: Inovio management has stated to me in an email that, aside from The Life Sciences Report, they do not sponsor anyone who posts articles on Seeking Alpha and that they feel the content of various articles is strictly “editorial” and not paid for.

However, Proactive Capital also confirmed separately that Inovio is still a current client. Their full quotes are listed in Appendix I.

Latest developments

Two weeks ago I was focused on exposing undisclosed paid promotions being run by “The Dream Team Group” on stocks including CytRx Corp and Galena Biopharma .

Note: For full disclosure, I have temporarily covered my short position in CytRx, which is now down by more than 50% from its recent highs. However, I may re-initiate a short position at CytRx at any time going forward.

As I released my findings on the Dream Team Group, the result was that over 100 articles on various media sites had to be removed from circulation due to their connections to that IR firm.

This week I switch my focus to the Proactive Group, an IR firm in New York which appears to be running undisclosed paid promotions on Inovio and Unilife as well as many other companies. We can see from the information presented below that the authors which I have identified as being paid authors have written extensively on Inovio and Unilife and in some cases have displayed identifiable patterns. Emails and other documentary materials further support this.

Once again, clicking through the links on Yahoo Finance shows that dozens of additional articles are now being removed due to connections to undisclosed paid promotions. I strongly suspect that the number of articles being removed will increase dramatically in coming days and weeks as more information comes to light.

Exposing the promotions

During this investigation, the way I obtained my information was as follows: First, Tom Meyer contacted me asking me to write articles on companies being paid by the Dream Team. Next, I spoke extensively with Tom to find out the names of the companies which were paying him. But I also made it a point to ask him about other authors, other IR firms and other listed companies that were involved in the promotions. Wherever possible, I made sure to get this information captured in emails.

But I was still not satisfied by speaking only to Tom. Once Tom gave me the names of the other authors and IR firms, I began contacting those parties to ask if they would be interested in writing articles for pay or interested in paying me to write articles for them. Again, I made every effort to confirm this via email.

For example, Mr. Meyer pointed me to Matthew Charles Fox. Mr. Fox is a college student who has written 46 articles on Seeking Alpha in the past 9 months. I did contact Mr. Fox and asked him about his paid writing. He did confirm via email that he gets paid $300 per article and sent me a link to his most recent paid article on Midwest Energy Emissions Corp. (OTCQB:MEEC) which was a client of Dream Team.

Mr. Fox describes Dream Team’s payment process for his Midwest article as follows:

They pay $300 for that. If article is not published on SA they pay $80, and article has to be OK’d by the company beforehand.

Note: At least 9 of Mr. Fox’s articles have now been deleted from Seeking Alpha.

It is also noteworthy that Mr. Fox has taken a unique interest in Plug Power (PLUG) having written 8 hyper bullish articles in just a few months, just as the money losing company sold stock in an equity offering.

In his latest article he had noted that he was “setting the facts straight” and rebuts Citron’s Research’s Andrew Left by saying:

Left’s exclusion of Plug Power’s recent positive developments and a sensational price target enabled the manipulation of share price in favor of his short position.

Citron was certainly short and no doubt was talking his own book, but it is somewhat ironic that Mr. Fox would take such a high road. In my correspondence with him, his only concern about violating federal securities laws was whether or not he would get caught in taking $300 per article. He stated in a separate email:

How do I know your not a SA editor trying to lure me into this and then I’ll just get banned? Haha, i’m just kind of paranoid regarding getting found out on SA.

I don’t see much need to weigh in on the debate between Citron and Fox regarding Plug. Plug Power has surged in price but still sells its product at less than the cost to even manufacture each unit (negative GROSS margins). This has been consistent for years and shows no sign of changing this year. The spark which ignited the stock was a huge upswing in sentiment by retail investors which was driven largely by a surge in articles like those from Mr. Fox, in conjunction with announcements from the company.

Over the long term, investors can make their own decision as to the long term viability of Plug Power. I ended up getting short Plug Power based on the spike on Tuesday and I am now looking much more deeply into what is moving the stock and the involvement of various authors.

Below are 7 of the 8 Fox articles, the ones that I tracked:

Plug Power: Setting The Facts Straight, A Rebuttal To Citron And The Critics

Tesla And Plug Power: 2 Small Giants That Are Climbing To The Top

Plug Power: Inside The Belly Of The Beast

Plug Power Offers Patient Investors More Than 100% Upside, Part II

Plug Power: The Definition Of An Inflection Point

Plug Power Passed Its Inflection Point And Is On The Verge Of Exploding

Sitting At An Inflection Point, Plug Power Offers Patient Investors More Than 100% Upside

Even after getting confirmation about Fox and other authors, I still wasn’t satisfied. So my research continued. As I talked to each of these new parties, I would again ask for further references to even more authors, other IR firms and other listed companies. I also asked them to send me specific examples of articles that they had paid for.

For example, Tom Meyer told me that he was paying John Mylant to write on Galena and other stocks. John was a prolific author who had written over 800 articles on Seeking Alpha and TheStreet.com. John then confirmed his paid activity in emails to me. John also introduced me to another IR firm he does work for, called CSIR. I then wrote to CSIR who confirmed via email that:

We’ve commissioned a few articles on ICLD already that you will find on Seeking Alpha and Wall Street Cheat Sheet…. I can set up a call with CEO if we need to. If you want to write it, after you write, we would first send a draft to CEO for review and then have you publish. We pay $500 to you upon publication. That’s per article.

The articles on InterCloud had been written by Mr. Meyer and Mr. Mylant, both of whom were working for multiple IR firms besides the Dream Team, such as CSIR.

And from the following email, we can now see the overlap between Dream Team, CSIR and Proactive Group. Ms. Ayot from CSIR noted that:

I’m trying to get something done on SNGX ASAP… Tomorrow? My original writer had an emergency come up. If you can pull this off, I could bump your fee too $600. Let me know if you think it’s possible.

SNGX refers to Soligenix and is also featured prominently on the Proactive client page, not far beneath Unilife and Inovio.

As with all of the other articles, my excuse was that I was “unable” to publish anything on Soligenix in time for Ms. Ayot’s deadline. But she was OK with this, saying:

So for the moment SNGX is taken care of, but good for you to be familiar with the company because we do articles on them every few weeks.

Note: Seeking Alpha is now aware of all of these issues and the articles in question on InterCloud and Soligenix have been removed. I have also filed detailed complaints with the SEC relating to the activities with various companies and individuals involved. .

This is a point that is worth emphasizing: once I identified an author as being paid, I often found that they were eager to work for multiple IR firms covering multiple companies. Likewise, there were a number of listed companies who made use of multiple IR firms at the same time.

My ultimate goal therefore became to simply to identify who was on the take, without caring as much about which companies or IR firms they were working for on any given day. Either they are involved in paid promos or they are not, and this is valuable information.

By using this method I was quickly able to gain indications of paid writing from numerous authors, as follows:

Tech Guru

Tech Guru is a former analyst from Morgan Stanley. In his own words, he has written paid articles “extensively” on Inovio for Jeff Ramson, the founder of Proactive. His most recent article on Inovio was in February, just in time for him to give a $5.00 upside target just before Inovio issued $63 million of new shares. He has also written 4 bullish articles on Unilife, including most recently on March 13th. Unilife is also a Proactive client.

NOTE: MANY OF THE COMPANIES LISTED IN THIS ARTICLE MAKE USE OF MULTIPLE IR FIRMS WITH EACH IR FIRM SERVING A DIFFERENT PURPOSE. UNLESS SPECIFICALLY NOTED OTHERWISE, I AM LIMITING MY COMMENTS BELOW TO THE INVOLVEMENT OF THE FIRM NOTED.

Note: Tech Guru’s articles on Inovio and Unilife have recently been pulled from Seeking Alpha. But in comparing this screenshot to the list of Proactive clients, we can see that nearly every recent article has been for a Proactive client. This includes: Unilife, Inovio, Volition Rx, NeoStem, Agenus, Actinium and more. These articles have also been removed from Seeking Alpha.

The red boxes below show which Proactive clients Tech Guru has written on. It should be noted that many of the remaining Proactive clients are simply smaller and less liquid bulletin board stocks.

I approached Tech Guru with the notion of him writing various articles for me on certain companies, including Inovio and Unilife. Tech Guru was unwilling to write on either Inovio or Unilife for anyone other than Proactive because of the following (see email link):

As discussed on the phone, there are certain companies which I would not be comfortable writing up for various reasons, either due tolongstanding relationship with them from the other client, or others. The ones I mentioned are INO and UNIS for reasons discussed.

The “reasons discussed” were that he already had a relationship with these companies through Proactive such that if he wrote it for me it would create problems with Proactive.

When I asked him specifically about writing up Inovio in articles for me, he said that it would be:

Problematic in that I have written on it extensively before…for Jeff

“Jeff” refers to Jeff Ramson, the founder of Proactive.

As for the logistics, Tech Guru let me know that he gets paid via wire transfer and does fill out a W9 tax form for the IR firms. As a result, confirming my findings should be fairly straightforward using that documentation.

Yes, I send an invoice each month and I get paid by wire. I am a 1099 so yes W9 would work.

For those who are curious about the mechanics of the relationship, Tech Guru also provided me a copy of his contract (with the name of the IR firm removed).

Tech Guru has also clearly indicated that he does paid writing for LifeSci Advisors. I am still assembling further findings on LifeSci.

Tech Guru has written a total of 55 articles on Seeking Alpha covering 26 companies. Among these, 22 of the companies happen to be clients of either Proactive, LifeSci, or both. Not surprisingly Tech Guru was also one of the authors writing on the much pumped Soligenix above, which is also featured on the Proactive client page.

Soligenix is the company which CSIR pays to have written “every few weeks”.

The writing pattern can be best illustrated in the following table, which also includes his disclosure for these articles, showing that he doesn’t disclose any compensation or business relationships.

Tom Meyer was the individual from Dream Team who was responsible for recruiting and paying the writers. Tom first pointed Tech Guru out to me as a great paid writer, but one who charged too much money ($800). Tom also gave me Tech Guru’s personal email address, so it was clear that they had been acquainted.

Tech Guru was a key asset for Proactive. For example, in winning over NeoStem Inc (NBS) as a client, Tech Guru tells me that Proactive had him attend their Nasdaq bell ringing ceremony last August.

The message from Tech Guru was clear: if Neostem retained Proactive, then Tech Guru would write on them to boost their stock. Following that ceremony, Tech Guru did write on NeoStem twice and Neostem is now listed as a Proactive client on their website.

Note: Proactive client NeoStem was also a favorite topic for fellow authors Stock Whisper and Bio Insights who will be described below. These authors also showed interest in Inovio and Unlife as well.

The key point to observe is that multiple anonymous authors all seem to be writing about the same small group of stocks during the exact same period of time, including ones where we can easily identify a paid promotion.

Tom Meyer had also cited Neostem as a great paying company which he hoped to win as a client for Dream Team. The point is that Neostem appears to be a blatant stock promotion and many of these authors appear to have been active in writing on it.

In the same email from Tech Guru, he maps out (in CAPS) his compensation of $4,000-5000 per month for 4-5 articles per month and notes that he has been operating as a paid writer for about a year. This would encompass the entire time he has been posting on Seeking Alpha and basically the entire time since his employment ended at Morgan Stanley.

Through my discussions with Tech Guru, I do have his real name, his full contact details and his employment history via FINRA broker check. But since he uses an alias online, I have chosen to only release those details to Seeking Alpha and the SEC, which they can then verify on their own. In the emails shown, he is only referred to by his first name.

Tech Guru was often reluctant to put many details about company relationships in emails, especially when the information he was sharing blatantly contradicted the views expressed in his written articles. For example, with Unilife, he made it clear that CEO Alan Shortall was a “liar”, “a criminal” and a “scumbag”. This stands in stark contrast to what he had written in his Unilife articles, rebutting shorts who have often been critical of the CEO.

In fact, Tech Guru was very uncomfortable writing on Unilife because he said that CEO Shortall was putting increasing pressure on the writers to write new articles every week and he wanted ever more grandiose statements such as comparisons between Unlife and Apple Computer. This indicates strong involvement from management, just as has been indicated by the other IR firms, CSIR and Dream Team.

Again, Tech Guru had written on Unilife 4 times, most recently on March 13th.

But as stated before, ultimately Tech Guru said that he would not be able to write paid articles for me on either Inovio or Unilife because he had an exclusive arrangement with Jeff Ramson at Proactive on these companies and that this would create a conflict with his work for Proactive.

Note: All of Tech Guru’s articles on Inovio and Unilife have since been removed from Seeking Alpha.

Stock Whisper / Equity Flux

Another writer identified to me by Tom Meyer was Stock Whisper. But Tom wasn’t too fond of Stock Whisper because he was from some foreign country and often had grammatical mistakes in his articles.

I did contact Stock Whisper and confirmed that he comes from Stockholm, Sweden and that he does get paid to write articles, charging a rate of$500-600 per article. In addition, Stock Whisper confirmed that he also writes under the name of Equity Flux. The description of Equity Flux on Seeking Alpha is “Equity Flux offers its clients financial consultancy services.” But it does not specify the nature of the services or the clients.

Via email, Stock Whisper informed me that he writes “all technology and biotechnology articles” for Equity Flux. This would include his articles on Galena (a Dream Team client) as well as his writing on Inovio which is listed on the Proactive website as a Proactive client.

He also appears to have an account with Motley Fool where he writes under the name Mohsin Saeed where he has written on Galena, a Dream Team stock. Again, most of these paid writers tend to be quite mercenary and they will work for any IR firm that pays them a few hundred dollars.

We can see that since November, Stock Whisper and Equity Flux wrote on Inovio 3 times, It also happens that this was almost immediately before the company conducted its equity offering right as the stock was hitting a 7 year high.

Stock Whisper also wrote on Unilife just 2 weeks before it’s S8 was filed, allowing insiders to sell up to $12 million in stock.

I never did get Stock Whisper’s real name. But in terms of identification, I did make sure to confirm the email address which Stock Whisper uses for PayPal. As a result, there is a clear paper trail for establishing payments.

Note: The articles from Stock Whisper on Inovio and Unilife have been removed from Seeking Alpha.

Bio Insights

One last paid author which Tom identified to me specifically was

Bio Insights, who has written over 400 articles on Seeking Alpha

alone. Clearly it is the case that many of these articles will have

nothing to do with any paid promotion. This is the same thing

we saw with John Mylant, a confirmed author for Dream Team

who had written over 800 articles on at least 3 sites including

SeekingAlpha, TheStreet.com and Wall Street Cheat Sheet.

Tom also gave me the real name of Bio Insights, which I have

confirmed. But since he posts under an alias, I have not shared

his real name here.

The pattern of his articles is noteworthy. It includes a large

overlap with Tech Guru and Stock Whisper, at nearly the

same times, on Proactive clients including Unilife, Inovio,

Thermogenesis, Neostem, Soligenix, and others.

In November, there were a series of short articles released by

various authors questioning many aspects of Unlife’s business

and management. Prior to this, Bio Insights had never weighed in

on the stock. He quickly wrote two rebuttals to the Unilife shorts

within a few days time and predicted that the share price would

double. Since that time he has not spoken again about Unilife

despite considerable developments and movement in the share

price.

Likewise he has also written two positive articles on Inovio.

My concerns with Bio Insights are as follows: First, he was

identified to me as a paid writer by Tom Meyer. Second, he has

written large number of articles on Proactive / Dream Team

clients. For example, he wrote on CytRx at the early part of that

promotion in October. Third, there is a very obvious overlap

between the articles of Bio Insights and Tech Guru and other

identified paid writers. Fourth, the articles all appeared within the

promotion window for these stocks and in fairly close proximity to

the other authors from above.

Bio Insights does run a series of independent websites that post

articles on biotech stocks. One of his sites has in the past picked

up and syndicated several of my Seeking Alpha articles, all ofwhich

were short pieces.

Looking at additional authors

As shown above, there are multiple authors who have demonstrated a strong interest in these companies at the exact same time, which also happened to coincide with financings. It is also clear that Tech Guru has written on 26 companies, of which 22 happen to be clients of either Proactive or LifeSci. I submit that 22 out of 26 indicates a strong pattern.

Stock Whisper, also named by Tom Meyer as a paid writer for Dream Team, has written at least 16 articles which appear to have been for identified paying IR firms, including on both Inovio and Unilife. This includes articles under his own banner as well as under Equity Flux.

From these facts, it becomes apparent that both Inovio and Unilife look like the subjects of paid promotions. Next, we can take a look for broader patterns with other authors to see if there is any reason for further attention. For example, with the Dream Team, it became easier for me to spot Tom Meyer’s many aliases because they were consistently the ones writing heavily on Galena and CytRx. A similar analysis of Inovio and Unilife is instructive.

This does not mean that I have a “smoking gun”. It just indicates the patterns I am looking for, as I did with CytRx and Galena. As a result, I will not call out any authors by name.

I look for authors who:

Write on the same companies that I believe are being promoted

Write during the same time frame as the identified promotion period

Write with more than normal frequency on the promoted company

Write excessively favorable analyses

Here is what jumps out at me from doing this analysis:

Two additional authors

Author #1 is noteworthy for engaging in what I refer to as the “gratuitous CEO interview”. Of 10 articles published by this author, 4 were bullish articles on Inovio while one was a bullish article on Dream Team client Galena.

It was Tech Guru who helped me better understand the wisdom of using multiple IR firms. He noted that:

its been my experience that when there are 2 firms on the same company they do very different things. for instance one firm like a mission IR for example would do promotional stuff- interviews, videos, syndication, whereas another one like Proactive or LifeSci Advisors to use those examples, would be the ones doing the seeking alpha articles, setting up road shows, and being more strategic in general. I work for the latter type of firms. I’ve never seen a case where there is direct overlap among firms doing the same thing, for the same client.

In fact, we can see Inovio CEO Dr. J. Joseph Kim is a big fan of this type of interview.

He recently appeared on a local podcast called “Money Matters” hosted by two retail brokers from Merrill Lynch and Wells Fargo. The fact that the hosts had precisely zero prior knowledge of Inovio should be obvious from the beginning, when host David Ebner shows he doesn’t even know that name of the company, pronouncing it “In-vivo”. The show is a privately produced low-budget way to provide executives with interviews and brokers a shot at some publicity which they can then post on YouTube. It is similar to the old public “cable access” shows which get free airtime in off hours on cable TV.

It is worth observing that this local show is hosted by these brokers in Philadelphia, just about 20 miles from Inovio’s headquarters. The questions and answers were all basically in line with the 4 recent interviews given to Dr. Kim by Seeking Alpha authors. For those who wish to see a textbook example of the gratuitous PR interview, the “interview” on Money Matters is a must view podcast.

What I look for in this type of interview is whether they are objective interviews or if the read like company driven press releasess that simply disseminate management’s spin. The timing of the interviews is also noteworthy, in relation to the capital raise.

A closer read of recent interviews shows that the questions and answers are so transparent and gratuitous that management should have simply put out a press release or put out Q&A on its website. Instead they participated in a gratuitous interview with an anonymous author.

Tech Guru has made it clear that he is being paid to write on Inovio by Proactive. He also explained to me the tactic being used, the gratuitous interview. Within a 4 week period, we can see multiple gratuitous interviews, just as the company was raising cash and allowing the company to communicate press release-like views to trumpet and justify their actions.

Author #2

A separate author also felt the need to give a personal interview to CEO Dr. Kim just before the capital raise.

That author had demonstrated a wide focus on various stocks in various industries, typically writing 1-2 articles on 17 companies. Only when it comes to 2 companies listed on the Proactive website does he write with much frequency, writing 12 times on the two companies (5 on Inovio). In both cases, the strong positive views come despite the fact that both companies lack meaningful commercial revenues and have already risen dramatically.

Again, I am not in possession of a “smoking gun” email confirmation on either of these last two authors. I am simply observing the obvious patterns that I am now following as I look further into this, including the use of gratuitous interviews. This is a topic on which I hope to elaborate further going forward.

Looking back to the framework for this type of analysis, we can see these authors wrote on the promoted stock, during the promoted period, with greater than usual frequency and with exceedingly favorable analysis. That is my only point.

Stock promotion – objectives and tactics

Lately I am realizing that many people completely misunderstand the objectives and tactics of these stock promotions. The objective of publishing paid articles is definitely NOT to cause dramatic one day spikes in the share price. Such spikes seldom last very long and they also attract too much unwanted attention.

The goal of these issuer compensated promotions is to create a sustained groundswell in investor enthusiasm. This attracts longer term money and provides a gradual and sustained rise in the share price that will ideally last long enough for the company to sell large amounts of stock.

Christina Ayot from CSIR made this clear when she said:

Love to talk further about some of the companies I work with, compensation, etc… Curious to know what sites you write for. Many of my clients are looking for diversity.

Likewise, Tom Meyer encouraged me to use aliases in addition to my real name so that extra breadth could be created in the groundswell.

You mentioned earlier you were going to get a name at WSCS. Let me know if you need any help with that. Also, I’d recommend getting a name other than Rick Pearson. You’re already Rick Pearson at Seeking and The Street so its good to branch out.

The goal of these promotions is ultimately to attract institutions who will buy into an equity offering. I have seen many retail investors make the point that these institutions are unlikely to make their investment decisions based on small time independent blog articles. As a result of this, it is assumed that institutional investors should not be able to cast any blame on the promotion. This is wrong.

The text of the promotional articles may not really matter that much to the institutions. But what the articles really achieve is a mobilization of retail money which elevates the share price to an unnatural level. When institutions buy in (even at a discount), they are buying in to an artificially inflated stock which has been propped up by a retail oriented promotion. When the promotion falters, the stock should be expected to fall sharply.

This is exactly what we saw with CytRx. The promotional articles along with concurrent news releases took the stock from around $2.00 to as high as $8.35 in just a matter of weeks. CytRx then sold over $80 million in stock at $6.50. As the promotion faltered (and even before my last article), the stock was already down by nearly 25% following the offering. Institutions have every right to feel that they were duped based on nothing more than the prevailing artificial price level. CytRx is now down by more than 50% since hitting its artificial promotion highs of over $8.00.

What should you be looking for ?

I have observed and written about many similar stock promotions over the past year. And in the past I have even explicitly expressed concerns aboutTech Guru, well before this article. I would encourage readers to go back and read those articles.

One obvious tactic to look for is a surge in articles just before a needed financing. Often times these are “orphan” articles from “orphan” authors. By this I mean the sudden appearance of a seemingly experienced author who has never written about any other company before. After the article is out, the author disappears and never writes about another company again.

With Unilife, we can see the sudden appearance of multiple orphans just weeks before the S8 was filed.

With Inovio, we can see the opposite pattern. This is a surge in repeat articles from the same authors who suddenly feel compelled to write very frequently despite adding little new content.

For example, on Inovio, a small group published on one small cap, pre commercial biotech company 14 times. None of their articles had a dramatic effect individually.

But the collective effect, along with company news and data releases helped get Inovio to a multi year high of $3.95. For much of 2013, Inovio had traded below $1.00. The spike in price was just in time for the company to raise money that it said it previously didn’t need.

Don’t be fooled if an author has many non-paid posts. For example, John Mylant (who I exposed in my last article as a Dream Team writer) had written over 800 articles on SA and numerous articles on TheStreet. Most of his paid content appears to have begun in 2013, but was camouflaged by the large number of articles on large cap stocks.

A deeper look at Proactive Capital

Proactive Capital is an IR firm located in New York. A screen shot of its client list can be found here. As shown on the website for the Dream Team Group (a.k.a. Mission IR), Proactive is listed as a partner of Dream Team in the IR business.

As shown before, the following table shows that of the 26 companies on which Tech Guru has written, 22 are clients of Proactive or LifeSci. Tech Guru does not disclose payment in any of his articles, but he has made it clear to me in email and by phone that he gets paid to write on Proactive clients. Emails demonstrating this were included above the Tech Guru section.

Many readers would have never spotted any of this until it was pointed out. But when viewed in this format it becomes too obvious too ignore.

Proactive was founded by Jeff Ramson in 2008. It appears that getting into the IR business was Mr. Ramson’s obvious solution after being forced out of the brokerage business due to a long stream of severe regulatory violations.

Prior to this IR business, Mr. Ramson founded and ran a brokerage called Great Eastern Securities. This is a link to the FINRA Broker Check report for Great Eastern. Starting on page 13 we can see more than 20 pages of violations and disclosure events resulting in millions of dollars in penalties for Mr. Ramson and Great Eastern.

These include fraudulent activity, churning, lack of registration by brokers, failure to report customer complaints and retroactively changing commission rates to inflate charges to customers by hundreds of thousands of dollars.

By 2006, Mr. Ramson had been personally barred from associating with any NASD member. Great Eastern’s broker-dealer registration was then revoked in 2007. Mr. Ramson’s ability to earn a living in the brokerage world was over.

So in 2008 he founded Proactive Capital, the IR firm which is responsible for generating positive press for Inovio, Unilife and around 20 other small cap, retail oriented speculative companies.

Mr. Ramson’s background in the dark side of the brokerage world may give him some unique capabilities with respect to his IR clients. Tech Guru has stated quite clearly by phone that

Proactive is very good at, especially situations where you want to galvanize trading volume…when you need to shake out some small clients who are holding the stock. They’re very good at literally systematically getting the volume up.

All I know is that a lot of their clients tend to be companies that don’t trade that much, and then all the sudden after they’re done with them they start trading. So I assume he is doing something along those lines.

It is certainly noticeable that volume on Inovio and Unilife has picked up dramatically over the past year, during the time in which these writers were focused on the company. Despite having de minimis commercial revenues and institutional ownership of just 8%, Inovio has been trading around $30-40 million nearly every day lately. That a staggering amount for a stock that traded at 60-70 cents less than a year ago.

What about the fundamentals for the stocks ?

When I previously wrote about CytRx and Galena, I made it a point to note that I was mostly ignoring the case for the companies’ fundamentals, including the near term prospects for their drugs. Several sell side analysts have come out since then and have been bullish on the prospects for CytRx and Galena in clinical trials.

Despite this, the stocks continue to fall further, hitting new lows for the year. The question is: why are investors rushing for the exits and ignoring the fundamentals ?

The answer is simple, and it is something that I pointed out in my last article.

First, to the extent that these companies have been involved in undisclosed promotions just in time to sell / issue large amounts of stock, it calls into question many of the bull case assumptions which have been made regarding the stock – including the drugs prospects’ in clinical trials. Obviously this remains to be seen.

Second, there is the legal risk of class action lawsuits and SEC actions which is much more near-term than the companies’ revenue prospects. These are the concerns that have already become apparent at CytRx and Galena.

Third, to the extent that money has been raised via equity offerings during the promotions, there is the legal risk that the company will not be able to keep this money in the event of lawsuits from investors who feel they were duped. Again, this remains to be seen.

Fourth, the simple end of the promotion means that the steroid-like boost to the share price will be highly likely to fade. I believe that this is a near certainty.

I fully expect sell side analysts on the stocks mentioned above to maintain very bullish outlooks on the stocks listed in the article, just as they have done on CytRx and Galena. I also fully expect the share prices to fall despite the obvious support from these analysts. In most cases, the analyst views are very hypothetical and express what the stock “should” be worth if management has been 100% forthcoming in their statements. But the reality may be sharply different than the theory, especially due to potential legal fallout.

Conclusion

I hope that my methodology has been obvious in this article. I am only short 3 stocks in this article, yet I have deliberately gone out of my way to show the detailed interrelationships among the various authors, IR firms and listed companies. It is a goal of mine to continue to get more information out to the public, irrespective of any stocks in which I have a position.

Prior to publication of this article, the information contained herein (and considerably more) had already been shared with the SEC. It has also been shared with Seeking Alpha in hopes that it will be possible to eliminate this element from the forum.

I believe that this phenomenon of undisclosed paid promotions is going to turn into a mini scandal among small caps. We have already seen rapid plunges in shares of CytRx, Galena and InterCloud. There is a high potential among similar names for SEC investigations and class action lawsuits.

I am currently focused on Inovio and Unilife as compelling short targets. With each of these companies there exist significant indications of undisclosed promotions prior to stock sales. And in addition, the companies are trading at multi year highs at artificially inflated valuations.

There are 3 potential catalysts which I expect to impact the share prices here. First, their promotions will now come to an end, removing the steroid-like boost that has supported the stocks. Second, the initiation of class action lawsuits just as we saw with CytRx and Galena. Third any potential fallout from possible SEC investigations, as we have already seen with Galena.

Appendix I – Responses

On Tuesday the author left messages with Inovio and Unilife. By Thursday there was still no response from Unilife.

Inovio had this to say:

We are currently a sponsor of Life Sciences Report but the one article on INO that I see was written by them and posted on SA was prior to Inovio being a sponsor. We are designated as a sponsor on current articles written by LSR on Inovio. Any other commentary about Inovio on SA is editorial, i.e. not paid for.

The author did speak briefly with a representative from Proactive Capital and offered the firm a chance to respond and comment. By the time of publication, the author had not received any detailed response from Proactive, aside from a confirmation that both Inovio and Unilife are current clients.