Summary

- CEO of Lion Biotech resigns following subpoena.

- Stock has fallen by 12% already.

- There is a wide web of parties with ties to Galena.

Back in March, I highlighted the undisclosed paid stock promotions being run by the Dream Team Group in connection with CytRX (NASDAQ:CYTR) and Galena (GALE). In the wake of that scandal, we have seen both of their stock prices plunge by more than 60%. Galena has been formally subpoenaed by the SEC.

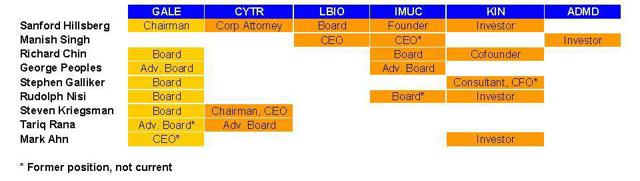

It was no coincidence that I picked these two companies at the same time. Both were using the Dream Team Group. But in addition, they shared board and management members.

As the following table shows, there are in fact a wider range of companies, which share members of the board, the advisory board and management with Galena. The table shows the overlap between companies of the 8 individuals involved. In addition, Galena, CytRX and ImmunoCellular (NYSEMKT:IMUC) were all clients of the Dream Team.

As it turns out, the fallout is not yet done. It looks like there are additional companies, including those above, which are being impacted. The most obvious one is Lion Biotechnologies (OTCQB:LBIO), which disclosed that it had been subpoenaed in April in connection with the SEC’s investigation of Galena.

Following an internal investigation at Galena, CEO Mark Ahn “resigned” for personal reasons. More recently, Lion Bio’s CEO Manish Singh just announced that he is also resigning for “personal reasons.” As we will see below, it may be more complicated than this.

Our first clue comes from the report from the special committee investigating the Galena paid promotion scandal. Within that report, it is noted that:

During our investigation, we discovered that another of the Company’s investor relations firms, Lidingo Holdings LLC (“Lidingo”), might have engaged in improper conduct relative to the payment of bloggers for promotional articles written about the Company. As a result, the scope of our investigation expanded to include an analysis of whether the Company’s retention and management of Lidingo violated any law or Company policy. In connection with that analysis, we have made the following findings of fact:

(9) We found evidence that Lidingo paid bloggers to write promotional articles about the Company and that the Company was aware of this fact;

(10) We found evidence that Lidingo intended and claimed to have raised the Company’s stock price through its efforts;

(11) We found that Mark Ahn granted stock options to Lidingo as part of its compensation for its services without Board approval, which is contrary to Company policy;

The conclusion from this is that the Dream Team was not alone in its stock promoting activities. There were other firms (such as Lidingo) engaged in the same behavior.

How much do they get paid? Well, here is a copy of the contract, which shows Lidingo getting 250,000 at the money stock options from Galena.

By digging deeper, we can also see that Lidingo was awarded shares in another small client called Advanced Medical Isotope (OTCPK:ADMD), which is also included in the table above. On Page 19 of the S1 registration statement, we can see that Lidingo had previously been awarded 1.6 million warrants exercisable until June 4, 2012. 600,000 of these were exercisable at 9 cents and 1 million were exercisable at 25 cents.

In fact, this was identical to the terms of the warrants, which were also issued to an entity named Lavos LLC, which was run by a Maria Santos. This is also shown on page 19. Here is a copy of the contract between ADMD and Santos. Required duties are notably vague, only stating that:

1. DUTIES. The Company hereby engages the Consultant and the Consultant hereby accepts engagement as a consultant. It is understood and agreed, and it is the express intention of the parties to this Agreement, that the Consultant is an independent contractor, and not an employee or agent of the Company for any purpose whatsoever. Consultant shall perform all duties and obligations as described on Exhibit A hereto and agrees to be available at such times as may be scheduled by the Company. It is understood, however, that the Consultant will maintain Consultant’s own business in addition to providing services to the Company. The Consultant agrees to promptly perform all services required of the Consultant hereunder in an efficient, professional, trustworthy and businesslike manner. A description of the Consultant’s services are attached hereto as Exhibit A and incorporated by reference herein. In such capacity, Consultant will utilize only materials, reports, financial information or other documentation that is approved in writing in advance by the Company.

It should be noted that the compensation awarded to Lavos (AKA Maria Santos) and the description of the duties involved is identical to those laid out in the similar ADMD contract for Lidingo.

Lest there be any doubt about the similarity between the two, the last page of the Lavos contract actually has a typo on it, which should remove all doubt. In the signature page, Advanced Medical Isotope forgot to change the signatory name and instead left in “Kamillia Bjorlin” of Lidingo. From the first page, we can see that this contract was made out for Lavos. The point of this is that both companies are serving the identical function.

Why does all of this matter?

As it turns out, Ms. “Santos” is in fact Mrs. Maria Singh, the wife of Lion Bio’s just-resigned CEO who resigned for “personal reasons.” This can be found out by looking at the information on file for Lavos with the Nevada Secretary of State. It clearly shows Maria S. Singh as the managing member. Mr. Singh and Mrs. Singh can also be shown to be related on Intelius.

Getting back to her husband, we can see that the share price of Lion Biotech fell by nearly 12% on the news of the resignation of CEO Manish Singh. The point is that for any of the companies which have had involvement in the stock promotion scandal, there is likely to be a combination of further downside and/or limited upside in the share prices. This includes the stocks listed in the table above.

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.