Summary

- Tokai’s attempt at a Phase 3 trial is based on data from just 6 patients out of 87 in Phase 2, based on after-the-fact cherry picking of data.

- Tokai dramatically changed its trial design between Phase 2 and Phase 3, and the FDA has already warned Tokai about problems with its trial design.

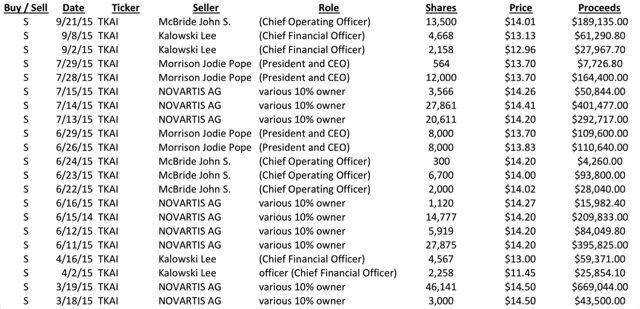

- Insider selling has been rampant ahead of preliminary data in 2016.

- Tokai just filed a massive $150 million S3 registration statement in order to raise money before Phase 3 results are known.

- Expect 60-70% near-term downside in the stock.

This article is the opinion of the author. Nothing herein comprises a recommendation to buy or sell any security. The author is short TKAI. The author may choose to transact in securities of one or more companies mentioned within this article within the next 72 hours. The author has relied upon publicly available information gathered from sources, which are believed to be reliable and has included links to various sources of information within this article. However, while the author believes these sources to be reliable, the author provides no guarantee either expressly or implied.

Summary

Tokai Pharmaceuticals (TKAI) is a one-product biotech company with a single drug in development. Galeterone is being developed for the treatment of prostate cancer for a very specific “subgroup of a subgroup” of patients for whom existing treatments are not effective. The sole reason for justifying taking Galeterone into Phase 3 trials was an after-the-fact “retrospective subset analysis” of its Phase 2 results, which saw encouraging results in just 6 patients out of 87. The structure of Tokai’s Phase 3 trial is such that failure is virtually guaranteed. As a result, Tokai has one of the highest short interest ratios of any stock on the NASDAQ. Insider selling has been rampant ahead of the pivotal trial results in 2016.

Because of its trial design, Tokai is virtually guaranteed to fail in Phase 3 and the stock will fall to cash value, a decline of at least 60%. Tokai recently filed a massive $150 million shelf registration statement in hopes of raising money before the Phase 3 results come public. The equity offering will add near-term pressure to the stock price.

Background on shorting biotech stocks

The year 2014 could easily go down in history as “The Year of the Short Squeeze”. Many investors deliberately piled into controversial stocks for the sole reason that they were heavily shorted, banking on a short squeeze to give them an excess return. It was an unrestrained bull market and even sell-side analysts began deliberately recommending stocks which were blatantly overvalued or even downright fraudulent on the basis that the high short interest might cause them to squeeze higher.

But now it is 2015 and heavily shorted stocks have been behaving more rationally. When the negative thesis becomes well understood, these heavily shorted stocks plunge as expected.

Shares of Wayfair (NYSE:W) were among the most heavily shorted of all stocks on the NYSE. Yet a brief report from Citron research sent the stock plunging by more than 40%.

Shares of AAC Holdings (NASDAQ:AAC) had a short ratio of nearly 40% of the free float. But a report from Bleecker Street Research sent that stock plunging by as much as 50%.

Shares of Amira Nature Foods (NYSE:ANFI) plunged by 40% following a report from Prescience Point, despite having a short ratio of around 40%.

More recently, heavily shorted Straight Path Communications (NYSEMKT:STRP) plunged by more than 40% following a report from Kerrisdale Capital. This was despite the fact that the stock was heavily shorted and had just 10 million shares outstanding.

The point from these examples is that a high short interest is now indicative of what it should be: namely that a company has significant problems and is likely to see sharp declines going forward. Unlike in 2014, investors who are short these problematic names have now demonstrated that they are in no rush to cover their short positions as they wait for the inevitable decline.

On the surface, shorting biotech stocks might appear to be downright stupid. If a drug wins approval, a short seller stands to potentially lose several hundred percent (or more). If things go right, the gains are typically limited to 70-80%. Before going short, investors must strongly assess the probabilityof the decline.

As a result, when a biotech stock has a massive short interest, it is a sign that the market has very strong reasons to be ultra confident that failure will be the outcome.

When I wrote “The Ugly Truth About Ohr Pharma” (NASDAQ:OHRP), the stock was still sitting at around $10. Yet I highlighted the fact that the company’s drug had already failed in past clinical trials and should be expected to fail again. It was a true no-brainer and it attracted a huge short interest. When the drug failed (as expected), the stock cratered to around $2.00 – down by nearly 80%. Following that, I followed up with “Five Lessons from Ohr Pharma” to highlight where investors went wrong.

I made a similar case against ZIOPHARM’s (NASDAQ:ZIOP) Palifosfamide drug, which was also all but guaranteed to fail. This could easily be deduced by looking at the history and details of its clinical trials. When the stock was at $6.00, the short interest was massive with huge bets that the drug would fail. As expected, the drug failed and the share price crashed to $1.60 – down by nearly 70%. I followed up on that with “Why Retail Got Slaughtered on ZIOPHARM“. (ZIOPHARM has since been resurrected through its collaboration with Intrexon (NYSE:XON)).

More recently, shares of XOMA (NASDAQ:XOMA) plunged by 80% following the failure of its main drug. Yet a multi-year analysis of its clinical trials showed that it too was all but guaranteed to fail. As usual, the huge short interest in the name should have alerted investors that something was very wrong.

The point is that in some cases, shorting biotech stocks can be a no-brainer (and a very high probability) win. By conducting a close analysis of clinical trial details, one can get a very clear idea where problems exist. A huge short interest in the stock is a sure sign that institutions have already done this work and are happy to take a lopsided bet against the stock, hoping for returns of at least 60% based on the fact that failure is almost inevitable.

Background on Tokai

Tokai Pharmaceuticals came public in September of 2014 when anything biotech was virtually guaranteed a hot reception. The stock came public at $15.00 and quickly rose to as high as $20.00. But since that time, the stock has floundered and now trades for around $11.00.

Seeking Alpha author Stock Doctor highlighted a bull case for Tokai in an article entitled, “Tokai Pharmaceuticals: The Small Cap Biotech With The Billion Dollar Prostate Cancer Drug“. Upon publication, the stock immediately jumped by 20%.

However, since that time, the stock has declined to new lows and has become one of the most heavily shorted stocks on the Nasdaq. Insider selling has been rampant and Tokai has just filed to raise up to $150 million in an equity offering before Phase 3 results come out.

Clearly something is amiss.

The bull case for Galeterone

Galeterone is being targeted at a very specific subpopulation of prostate cancer patients who are treated specifically for “castration-resistant prostate cancer” or CRPC. Right now, there are two drugs which compete for this market. Medivation (NASDAQ:MDVN) offers Xtandi while Johnson & Johnson (NYSE:JNJ) offers Zytiga. Together, these two drugs bring in over $3 billion in annual revenues.

However, there is a problem with both drugs in that they fail to show results in a sub-subpopulation of CRPC patients with a certain truncated androgen receptor known as AR-V7.

As a result, Tokai is going after an even smaller population within this subpopulation.

In Phase 2 trials, Galeterone appeared to show effectiveness in AR-V7 patients, such that it could end up replacing Xtandi and Zytiga (but only in the subset of patients where those drugs do not work). This would create a market opportunity of perhaps $500 million to $1 billion.

That is the full extent of the bull case and it rests entirely on AR-V7.

The problems with Tokai and Galeterone

First off, it should be made clear the Tokai never even conducted a Phase 2 trial designed to test the effectiveness of Galeterone on AR-V7 patients. It also did not run a comparative trial designed to test the drug’s effectiveness versus Zytiga and Xtandi. Instead, the company merely ran a Phase 2 trial testing Galeterone for effectiveness in CRPC prostate cancer.

So how did Tokai come to focus specifically on AR-V7 patients?

Tokai began Phase 2 trials for Galeterone in December 2012, with no mention of AR-V7. The study evaluated 87 patients who were specifically classified as CRPC. The data includes 17 patients who were non-metastatic and treatment naïve (no other drugs given) and 39 patients who were metastatic and treatment naïve. It also included 26 patients who had received Zytiga and 5 who had received Xtandi.

(Source)

Tokai was set to come public in September of 2014 with a drug that was undifferentiated from two existing blockbuster drugs. The company needed something to differentiate itself.

Fortunately, there was already an article in the works in the New England Journal of Medicine highlighting the fact that both Zytiga and Xtandi had a weakness in that they were not effective in AR-V7 patients.

Ahead of its IPO, Tokai quickly began conducting after-the-fact data miningand found that there happened to be 6 patients out of these 87 patients who would be classified as AR-V7 and in whom Galeterone proved effective.

In scientific terms, this is called a “retrospective subset analysis”. In layman terms, it is called data mining and “cherry picking”.

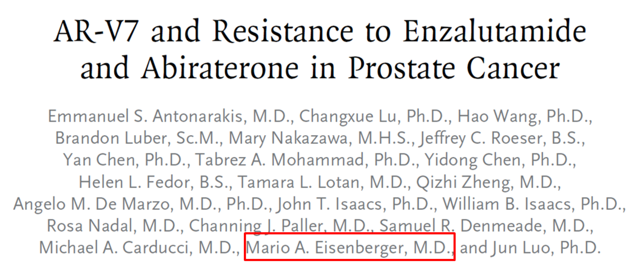

Tokai was no doubt well aware of the upcoming publication in the NEJM. Dr. Mario Eisenberger can be found as an author on the NEJM study. He also happens to be a lead contributor on the Phase 2 trial for Tokai on Galetrone.

The following image shows the contributors to the NEJM article:

(Source)

The following image shows the contributors to the Galeterone study:

(Source)

As a result, by the time Tokai filed to come public, the company had an IPO prospectus describing its strategy as one focused on the unique AR-V7 angle.

Tokai disclosed that:

In our ongoing Phase 2 clinical trial of galeterone, which we refer to as our ARMOR2 trial, we observed clinically meaningful PSA reductions in patients that were identified as having altered androgen receptors that were truncated in a retrospective subset analysis of seven such patients. Six of these patients showed clinically meaningful PSA reductions of at least 50%.

Structural problems with the Phase 3 trial

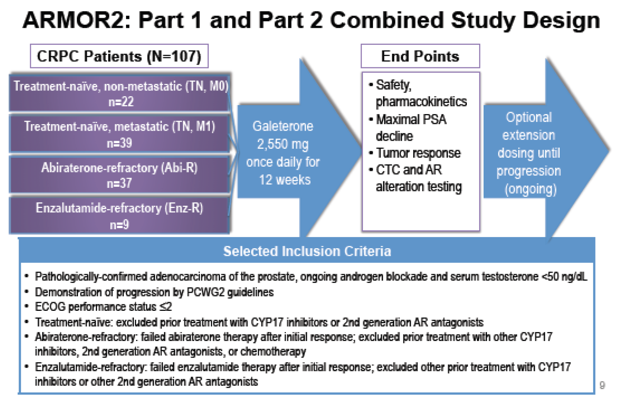

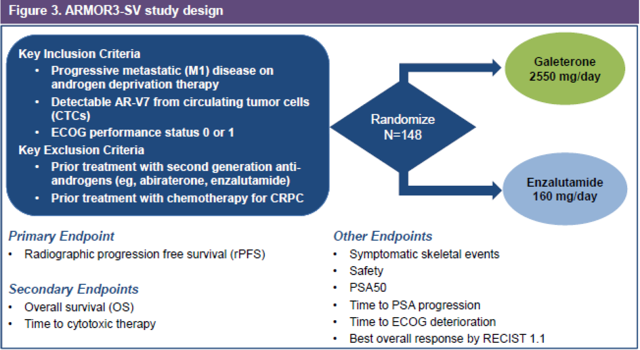

The following graphic shows the trial design for the Phase 3 trial for Galeterone.

(Source)

Because of the change in strategy, it is clear that Tokai is flying blind into its Phase 3 trial. The company plainly discloses that:

For drug and biological products, the FDA typically requires the successful completion of TWO adequate and well-controlled clinical trials to support marketing approval. In the case of galeterone, we intend to seek approval based upon the results of a SINGLE pivotal clinical trial. If the results of the trial are not robust, are subject to confounding factors, or are not adequately supported by other study endpoints, the FDA may refuse to approve galeterone based upon a single clinical trial.

But it gets worse.

Unlike the general Phase 2 trial which was evaluating Galeterone as a standalone drug, Tokai has launched a Phase 3 trial which compares it specifically to Xtandi. The company also changed its endpoint to be radiographic progression free survival (“rPFS”).

As a result, the company truly has no idea what outcome to expect. It is as if the company never even conducted a Phase 2 trial at all!

From its disclosure:

Our ARMOR3-SV trial will be a randomized, open label clinical trial comparing galeterone to Xtandi in 148 metastatic CRPC treatment-naïve patients whose prostate tumors express the AR-V7 splice variant. The primary endpoint of the trial will be rPFS as determined by a blinded, independent central imaging assessment.

Once again, this is entirely different than its Phase 2 trial and gives the company no idea what to expect.

We have not conducted any clinical trials of galeterone for patients with AR-V7, comparing galeterone to a comparator drug or using a primary endpoint of rPFS. As a result, the results of the clinical trials that we have conducted may not be predictive of the outcome of our ARMOR3-SV trial.

Again, it gets worse.

As for the rPFS endpoint, the company discloses that:

we are unaware of any completed or currently ongoing pivotal trials of treatments for prostate cancer for which the sole primary endpoint to support initial FDA drug approval was rPFS. As a result, we cannot be assured as to how the FDA will interpret any rPFS data that we generate in our ARMOR3-SV trial.

But we can see that the FDA has already warned the company about the use of this endpoint:

In August 2014, we met with the FDA to discuss plans for our ARMOR3-SV trial. At this meeting, the FDA advised us that, in its view, rPFS and the use of rPFS in the metastatic CRPC context is limited by difficulties in bone scan interpretation and the complexity of the criteria used to define progression, each of which creates uncertainty as to the ability of rPFS to predict improvements in morbidity or mortality.

The FDA specifically warned Tokai:

The FDA also advised us that if we used rPFS as the sole primary endpoint, this uncertainty would need to be overcome by a statistically persuasive large relative and absolute magnitude of improvement in rPFS as well as internal consistency across secondary endpoints, including a supportive result in overall survival.

The biggest and most fundamental problem here is that the Phase 3 trial designed by Tokai is virtually guaranteed to not meet these hurdles simply due to the size of the trial alone.

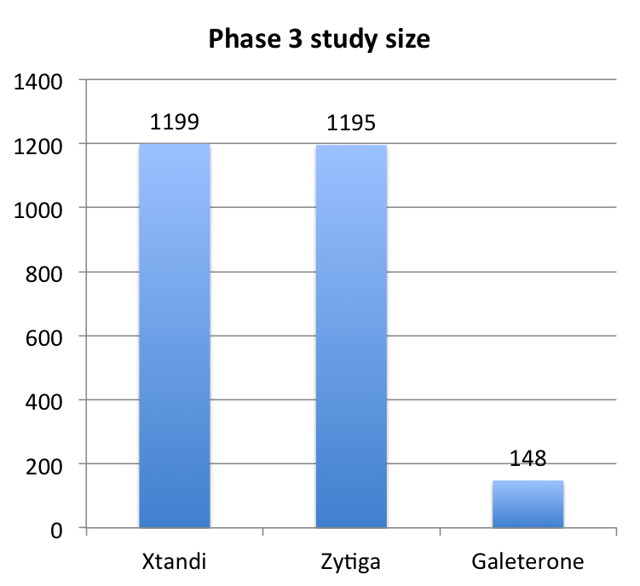

This can be seen by comparing the study size for the Galeterone trial to the trials of Xtandi and Zytiga.

(Source: Author, based on 10-K data)

The problem with cherry picking data

Wikipedia describes Cherry Picking as follows:

The term is based on the perceived process of harvesting fruit, such as cherries. The picker would be expected to only select the ripest and healthiest fruits. An observer who only sees the selected fruit may thus wrongly conclude that most, or even all, of the fruit is in such good condition. A less common type of cherry picking is to gather only fruit that is easy to harvest, ignoring quality fruit higher up the tree. This can also give a false impression of the quality of the fruit (since it’s only a sample).

Cherry picking data can be very useful in attempting to make the case for a conclusion.

For example, within the NBA, China can point to 5 famous basketball players. They are Mengke Bateer, Sun Yue, Wang Zhizhi, Yao Ming and Yi Jianlian.

It would be very easy to produce a “retrospective subset analysis” of a small sample of NBA players which could conclude that Chinese nationals are somehow uniquely suited to be basketball stars. The analysis could be designed to show this even though Chinese nationals are the exception rather than the rule in the NBA.

This is precisely what Tokai has done with its Phase 2 data.

Testing for AR-V7 – yet another problem

Perhaps the biggest elephant in the room is the fact that there is no easy way to even test for AR-V7 in practice. There currently exists no FDA-approved test for AR-V7.

Tokai notes that:

We need to develop an analytically validated assay that sensitively detects AR-V7 in order to proceed with our planned pivotal Phase 3 clinical trial and develop and commercialize a companion diagnostic test for this assay in order to seek approval of, and commercialize, galeterone for patients with these types of truncated androgen receptors. We have entered into a collaboration with Qiagen to develop and commercialize the companion diagnostic. Clinical data obtained with the clinical trial assay in the Phase 3 trial will be used by Qiagen to support regulatory filings for the approval of the companion diagnostic for AR-V7 and by us to support our regulatory filings for approval of galeterone.

What it comes down to is that Tokai WILL be able to use a non-approved test for finding patients for its clinical trials, but that commercial use of Galeterone CANNOT proceed until there is an FDA-approved diagnostic test for AR-V7.

Insider selling and a massive S3 filing

Based on the information above, the rampant insider selling now becomes perfectly understandable.

Over the course of 2015, insiders have been selling millions in stock, all at prices below where the IPO was priced.

This includes the CEO, the CFO and the COO, as well as by partner Novartis (NYSE:NVS). Needless to say, there have been no insider purchases in 2015.

Adding to that pressure is the fact that Tokai just filed a massive $150 million S3 registration statement to raise money via an equity offering.

Tokai currently has $83 million in cash (about $4.00 per share). However, this cash will all be consumed by the Phase 3 trial. From the disclosure, we can see that the company “believes” it has enough cash on hand to fund the Phase 3 trial… but NOT enough to get to an NDA.

As a result, Tokai should be expected to launch an equity offering as soon as the S3 becomes effective, potentially in the coming days or weeks.

Conclusion

Tokai is a no-brainer short that will likely return at least 60% on the downside. The incredibly high short interest is a reflection of the fact that the drug is virtually guaranteed to fail its Phase 3 trial and it has no other products in the pipeline.

Prior to its IPO, and based on its Phase 2 trials, Tokai Pharma did not have a drug that was differentiated from Xtandi or Zytiga. It did not have a drug that would be approved.

In response to findings from the New England Journal of Medicine (and AFTER the Phase 2 had already begun), the company quickly changed its strategy to target AR-V7. The justification for this was simply a cherry picking exercise which noted effectiveness in just 6 patients out of 87.

The company dramatically changed the design of its Phase 3 trial to become a comparison between Galeterone and Xtandi. It also changed the trial design to use rPFS as its primary endpoint, despite warnings from the FDA about the shortcomings of this endpoint.

There has never been a drug approved using rPFS. Despite this, Tokai is attempting to do so with an inadequate sample size, and in a SINGLE trial rather than the TWO trials as required by the FDA.

As a result, the trial is all but guaranteed to fail. This is very similar to what we have seen with past biotech failures such as Ohr Pharma, ZIOPHARM and XOMA, among others.

Tokai should be expected to trade down to cash value per share.

However, the actual share price target on the downside is a moving target. Tokai will quickly consume all of its current cash balance in the Phase 3 trial. But the company is close to launching an equity offering to raise additional cash.

That soon-to-be-launched equity offering will be the catalyst for the first leg down in the stock of perhaps 20-30%, leading to a total decline of at least 60-70% as we get closer to trial results in 2016.