Summary

- Omeros recently spiked on release of new Phase II drug data for OMS-721.

- The stock quickly gave up almost all of these gains once the details of this trial were better understood.

- Omeros had previously been hitting a new 52-week low of $11.93 due to the failed launch of its only commercial product, Omidria. But shares appeared to be headed lower.

- Omidria continues to fail and the share price should retrace to well below $11.00. Ultimately, the stock should settle around $6-8.

- Omeros desperately needs to raise money in the near term via an equity offering any day now. This is the near-term catalyst for a sharp decline.

This article is the opinion of the author. Nothing herein comprises a recommendation to buy or sell any security. The author is short OMER. The author may choose to transact in securities of one or more companies mentioned within this article within the next 72 hours. The author has relied upon publicly available information gathered from sources, which are believed to be reliable and has included links to various sources of information within this article. However, while the author believes these sources to be reliable, the author provides no guarantee either expressly or implied.

Company Overview

Name: Omeros Corp. (NASDAQ:OMER)

Market Cap: $734 million (fully diluted)

(includes 9.5 million shares from options and warrants)

Share price: $15.50

Avg. Volume: 2 million shares

LTM Revenues : $3 million

Cash: $51 million (as of June 30)

Total debt: $30 million

Cash burn: $34 million/6 months

Background – failed drug launches

Shorting stocks into a failed drug launch is about the closest thing there is to printing free money. Sell side analysts routinely put unrealistic sales estimates on new drugs even when there are obvious signs that the market will not accept the drug commercially. The sell side targets result in vastly overpriced stocks which inevitably correct as the poor launch results become visible over time. When companies are forced to raise cash on the back of a failed drug launch, the correction is even further accelerated.

Back in May, I highlighted a short opportunity with Keryx Biopharmaceuticals (NASDAQ:KERX). Keryx was trading at around $10 with a market cap of around $1 billion, despite generating sales for its only drug of less than $1 million. Even these paltry sales were only achievable when Keryx used overly aggressive marketing tactics, conveying an iron benefit for which its Auryxia drug was not approved. The sell side had told us to expect sales of over $20 million for the year, but by May it was clear that this was pure fantasy. Even with the stock trading at a 52-week low of around $10, the stock was a compelling short. Keryx now trades for around $6, down by nearly 40% in just 3 months. Previously, the stock had traded at over $18 due to pre-launch hype for Auryxia thanks to sell side analysts.

Another example is the failed launch of Afrezza by MannKind (NASDAQ:MNKD). MannKind is backed by billionaire Alfred Mann, which generated ample enthusiasm for the prospects of this inhaled insulin drug. Even as the failure of the launch became evident, the stock still traded as high as $7.00 as recently as June. The stock now trades for just $3.50, down 50% in 3 months.

As with Keryx and MannKind, we are about to see a similar phenomenon with Omeros Corp. But with Omeros, the situation is exacerbated by the company’s need to raise cash in the near term.

Shares of Omeros now represent a compelling short opportunity for a variety of reasons. There is also a catalyst for a near-term decline. The first issue is that the launch of its only commercial product has been an abject failure. Further revenues will not materialize in any amount remotely near to what the sell side had told us to expect. The notion of getting to $100 million is pure nonsense.

The shares recently spiked due to the release of Phase II data on a separate drug, but now they are quickly giving up all of these gains, as investors understand the tiny scope of this preliminary trial and the lack of trial design.

However, the shares currently remain elevated versus where they were prior to this data release, creating the compelling short opportunity. Much of the reason that Omeros currently trades above $6-8 is that the market believes that Omeros has an additional broad pipeline of potential drugs. It is the “multiple shots on goal” theory.

But this is mistaken. Three of these drugs have either been discontinued or are on clinical hold by the FDA. There is no value to them. The only Phase III candidate has already been licensed out and offloaded for a minimal sum. Again, there is no further value there either. And with OMS-721, we can see that the stock is already giving up all of its gains due to the weak trial design and small trial size.

Prior to the release of the recent Phase II data, Omeros was hitting new lows of $11.93. If it were not for the data driven spike, the stock appeared to have been headed steadily lower. Omeros does not currently have enough cash to even fund its trials and must raise capital in the very near term. As a result, the company needs to issue stock, which will ultimately see the stock trading at around $6-8.

Overview

Omeros Corp. has a fully diluted market cap of $734 million, despite the fact that it has only a single commercial product (Omidria) which is now suffering through a failed launch. Omidria is basically just an NSAID (Non Steroidal Anti-Inflammatory Drug) which controls pain and inflammation during cataract or lens surgeries. It also controls pupil dilation.

As of Q2, the company had just $51 million in cash vs. a 6-month cash burn of $34 million. By now we can estimate that cash is down to $30-40 million. Yet cash burn now needs to accelerate due to ongoing clinical trials. As a result, the company simply must issue equity in the near term.

Based on the failed drug launch and the stock offering catalyst, we can expect the stock to fall by 40-50% from current levels.

The failure of Omidria to achieve meaningful sales should have come as no surprise to investors. The product is simply a combination of two existing generic drugs which can be easily compounded by any compounding pharmacy for about 1/10th the cost of what Omeros is attempting to charge.

Despite this obvious competitive problem, the sell side had very aggressive sales estimates following the company’s Omidria launch earlier this year. This is identical to what we saw with Keryx and MannKind.

The sell side estimated that Omidria sales for 2015 would come in at over $20 million, while sales in 2016 would exceed $100 million. Omidria was launched earlier this year with sales so far of around just $3 million. However, according to the recent 10-Q, these sales include at least 1 month’s worth of inventory stocking by wholesalers as opposed to end demand to be used in procedures. As a result, true sales should be estimated in the range of $1-2 million so far.

Omeros has no other viable pipeline

Management has continued to tout its pipeline outside of Omidria. This has helped to support the stock at prices over $10 for some time. However, the fact is that what it is touting does not really exist.

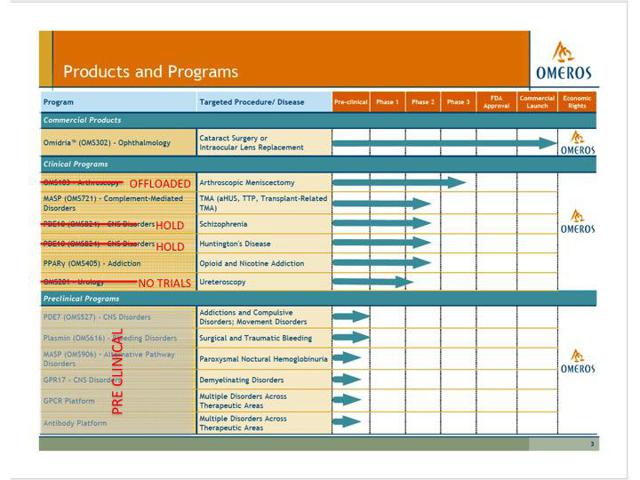

Looking at its investor presentation, Omeros does seem to have a lot of other drugs in the pipeline. However, much of this can be seen as very misleading. The chart below shows Omeros’ pipeline as per its presentation to investors. The red lines and text were added by me to illustrate where this pipeline is bogus.

The bulk of the programs that are listed by Omeros are simply pre-clinical. There have been no trials initiated and there should only be minimal (if any) value attributed to them. Some of these programs have been ongoing for as long as 7 years without even making it into clinical trials. Yet management still continues to tout them as part of its “pipeline”.

But here is the real problem. There is only one Phase III candidate listed in Omeros’ pipeline. This is for OMS-103 to be used for arthroscopy indications. That drug already failed to reach statistical significance in its primary endpoint in clinical trials. In June of 2015, Omeros basically offloaded the drug to Faragon NV for up to $10 million in milestone payments, should they ever occur. It is basically worthless.

Within the several Phase II programs, we can see from the recent 10-K (but not in the presentation to investors) that three of these programs have either been cancelled or placed on clinical hold.

OMS-824 for CNS disorders (two listings below) was placed on clinical hold by the FDA in October of 2014.

OMS-201 for urology uses is no longer in active clinical trials. These three items are, for all intents and purposes, dead. There is no value to them.

OMS-405 is for opioid and nicotine addiction. However, this is still in the recruiting stage for a Phase II trial and should not provide any value or catalyst for the stock in the near future.

That leaves us with OMS-721 which was what caused the stock to spike when the data was recently released. So let’s take a look at why the gains didn’t hold following the release of data.

Looking at the data for OMS-721

On August 14th, Omeros was hitting new lows of $11.93. The next day, Omeros released data on the mid-dose cohort for its OMS-721 and the stock quickly spiked to as high as $30.00. But now the stock has given up nearly all of those gains, trading at just $15.00. What happened?

OMS-721 is being studied for the treatment of thrombotic microangiopathies (TMAs). TMAs are a family of rare, debilitating and life-threatening disorders characterized by excessive thrombi (clots) – aggregations of platelets – in the microcirculation of the body’s organs, most commonly the kidney and brain.

The data was indeed positive, and the fact that Omeros has obtained Orphan Drug Status for OMS-721 is what led the stock to spike so high. Clearly, some might have thought this could represent another distinct revenue stream for Omeros and the Orphan status could make that meaningful.

Or perhaps not.

The reason why the stock is now plunging is that the market has become aware that the trial applied to just 5 patients and there was not even a placebo arm. More importantly, it does not appear that the drug would be competitive with the existing drug Soliris by Alexion (NASDAQ:ALXN).

From the data release,

In the mid-dose cohort, the two patients with plasma therapy-resistant aHUS demonstrated:

• 47% increase in mean platelet count, resulting in both patients having counts in the normal range

• 86% decrease in mean schistocyte count, with schistocytes disappearing in one patient

• 71% increase in mean haptoglobin with both patients reaching the normal range during treatment, one slipping slightly below normal at one week following the last dose

• 5% decrease in the mean levels of LDH, with levels in both patients remaining slightly elevated above normal range

The key concern from the above data is the fact that there was only a 5% decrease in the mean levels of LDH, with levels remaining elevated. Soliris has shown normalization of LDH levels in up to 80% of patients.

It was also noted that with the mid-dose patient with TTP, “Laboratory parameters did not show consistent improvement”. That was for one out of the five patients.

The first conclusion is that all in all there should have been nothing to get too excited about with the release of data from OMS-721. There should have been very little movement in the stock in the first place. This is why the stock is now giving up all of its gains.

KEY POINT: But the key takeaway here is that over the course of 7 years, and after spending nearly $300 million, Omeros has produced just a single approved drug… which happens to be nothing more than the combination of two existing generic drugs.

Looking at the failed launch of Omidria

Looking at the overall pipeline for Omeros, including the new data from OMS-721, it is clear that the overwhelming majority of the value of the company should be based simply on Omidria. Omidria is Omeros’ only FDA approved product and the only one which has been commercially launched.

Sell side analysts have put forth projections for Omidria sales which are as high as $100 million in 2016. This is what kept the share price elevated prior to launch at levels of $20-25.

Once we were able to get past the initial launch and see how sales actually materialized, the share price was quickly cut in half. Just a few weeks ago (prior to the recent spike), the stock was hitting new lows daily, as low as $11.93.

Omidria is simply a combination of phenylephrine and ketorolac which is injected into the eye during cataract surgery or intraocular lens replacement. The combo treatment helps to maintain pupil size, while reducing pain and inflammation.

The key thing to realize here is that both phenylephrine and ketorolac are existing generic drugs. Omidria is simply a formulation which combines the two and which was subsequently FDA approved.

Omidria did obtain Medicare pass through status for reimbursement at around $400 per vial. However, this is about 10x what it would cost a compounding pharmacy to simply mix the two medications on its own. Most ophthalmologists have ample access to compounding pharmacies.

As a result, the only real reason to use Omidria is that it is more convenient and saves the step of having the compounding pharmacy mix the drug. It is clear from the results post launch that this has not been enough of an incentive to generate meaningful revenues. It is also clear from the failed launch that this combination of two readily available generics will never be a $100 million drug. Not by a long shot. At best, we will continue to see a few million in sales from Omidria.

Similar to what we saw during the failed launches for Keryx and MannKind, the share price for Omeros is steadily grinding lower, rather than suddenly plunging. But unlike Keryx and MannKind, Omeros is in urgent need of raising money. With a minimal viable pipeline, there is very little to incentivize investors, such that the impact on the stock will be larger than usual.

The catalyst for a share price drop will be a near-term equity offering at a meaningful discount. Such an offering could be expected to happen any day now.

Conclusion

Over the past 7 years, Omeros has spent nearly $300 million on a variety of endeavors and the only thing it has to show for it is a single approved drug, Omidria, which happens to be nothing more than a combination of two existing generic drugs.

Aside from its already-launched Omidria, Omeros does not have a viable pipeline. The bulk of its programs are simply pre-clinical and not even in FDA trials. Of the ones which have reached clinical stage, 3 have either been placed on clinical hold or have been discontinued. One has already been offloaded to another company for a mere $10 million of potential milestones, should they ever occur. That leaves us with OMS-721, where the recently announced trial had just 5 patients and no placebo arm with fairly mediocre results. There should be little, if any, value attributed to OMS-721 until there is a larger Phase III trial in 2016 or 2017.

That leaves Omeros with just a single commercial product, Omidria. Omidria is FDA approved and has already been launched. But because it is simply the combination of two readily available generics, it has not generated meaningful sales post launch.

Omeros had just $51 million in cash as of June. Yet the company burned $34 million in the 6 months ended June. By now it is likely down to $30-40 million in cash. Unusual for a biotech, the company has $30 million in debt.

Against this, the company must fund a 40-person sales force as well as its ongoing clinical trials for OMS-721. It is quite clear that the company doesn’t have the cash to do this without raising equity financing in the very near term, which will add significant pressure to the share price.

With the share price spike now fading quickly, I expect that the company will issue shares very soon and that the share price will quickly head back to $11 or below. Given the failed status of Omidria, the share price will likely find a floor at around $6-8.

This is based on the assumption that Omeros raises $80 million at $12, issuing 6.7 million new shares, bringing fully diluted share count to 54.07 million. It also assumes that sales for 2015 and 2016 stabilize in the range of $10-15 million, rather than $20-100 million as per sell side estimates.

Note that Omeros excludes from its share count the 9.5 million options and warrants. (See page 8 of the recent 10-Q).