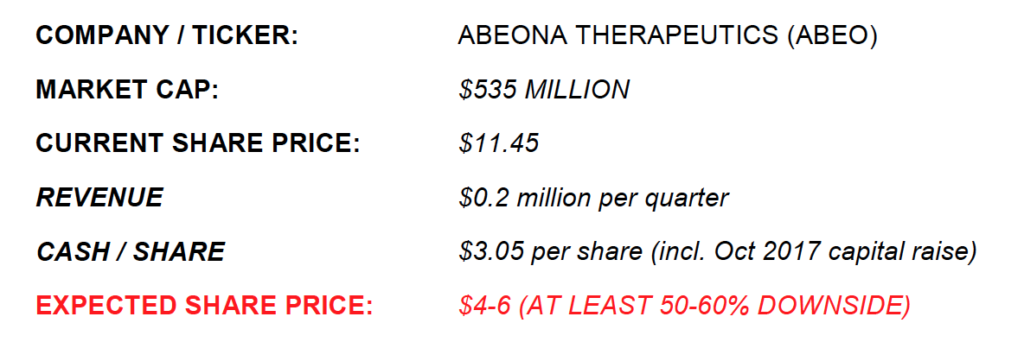

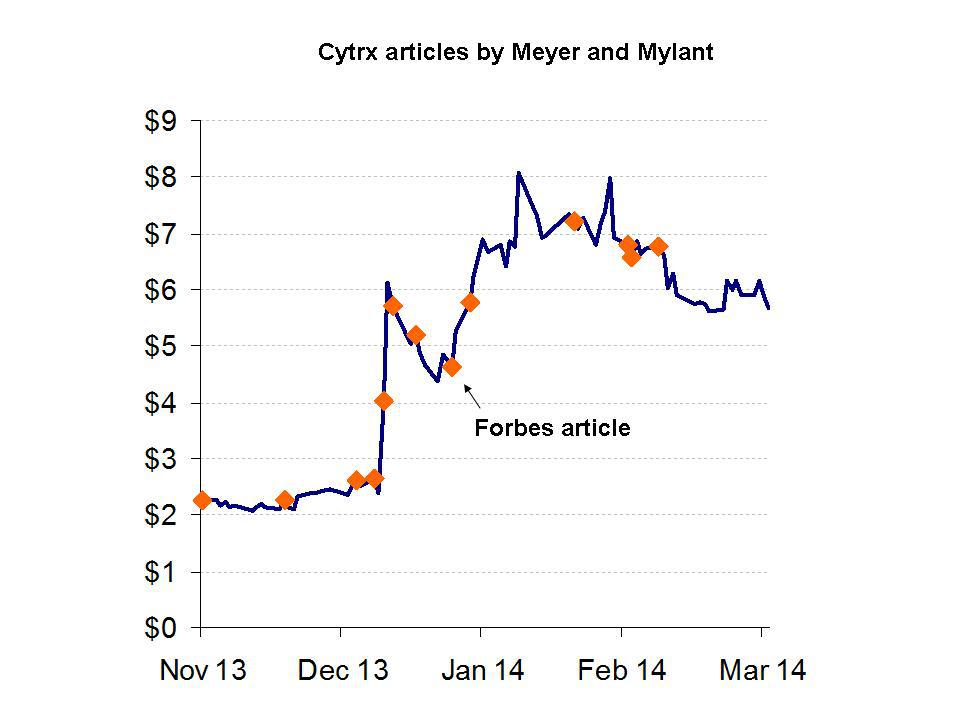

Organovo Holdings (ONVO) has doubled in the past two weeks and now sports a market cap in excess of $1 billion with a share price of $12-13. The company has 58 cents per share in cash following an equity raise at $4.50 in July. Aside from that, total assets for the company amount to just $1 million. The company currently has no products on the market, but hopes to launch a 3D liver assay in December 2014. However, detailed market analysis reveals that total market potential for this product is only a few million dollars. There are already competing 3D liver assays on the market which sell for as little as $1,750. Swiss company Insphero reveals that the market size for these assays is at most a few thousand units per year. The stock has recently doubled due to a tremendous wave of articles which suggest that Organovo is on the cusp of generating hundreds of millions of dollars in near term revenues. The stock is held 93% in retail hands and has no institutional research coverage. As investors realize that the best case if for $3-5 million in revenues over the next 3 years, the stock should be due for a meaningful correction. Meanwhile, insiders have been selling millions in stock and have filed a massive S8 registration statement by which they can award themselves 11 million more shares, valued at $130 million. Additional concerns are highlighted herein. In the near term, Organovo should be expected to drop by around 50%, returning to the $5-7 level where it was just two weeks ago.